Trump Doesn't Need the Fed To Fix Housing

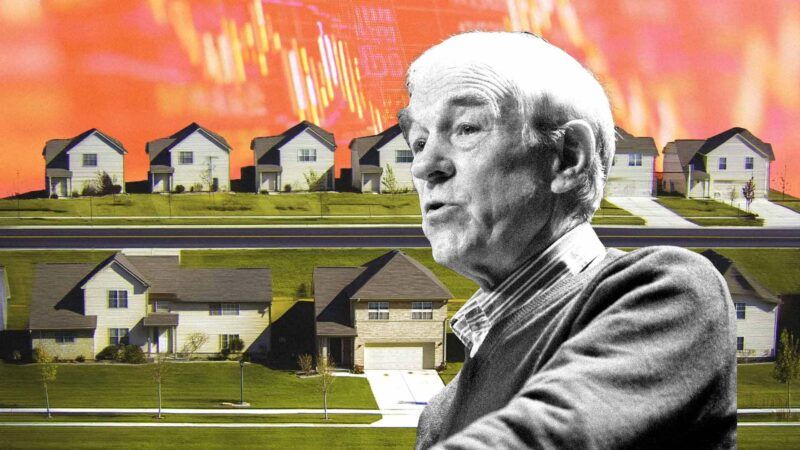

Former Rep. Ron Paul argues that slashing red tape will do more to bring down home prices than pressuring the central bank to cut interest rates.

President Donald Trump, eager for some good economic news to offset headlines about his tariff fallout, is joining the long list of presidents and other politicians pressuring the Federal Reserve to cut interest rates.

The president recently posted on Truth Social that Federal Reserve Chairman Jerome Powell is "always TOO LATE AND WRONG" and that his "termination cannot come fast enough."

Exposing the dangers of the Federal Reserve was my main motivation for getting into politics. However, I do not agree that a president should fire a Federal Reserve chair because they refuse to follow orders to cut rates faster.

Interest rates are the price of money—and government price-setting never works, whether it's done by central bankers or politicians. Artificially low interest rates are what caused the Great Depression, the housing bubble, the post-COVID surge in consumer prices, and every downturn that has occurred since Congress made the mistake of creating a central bank in 1913.

Forcing interest rates lower than their true market rate leads builders to start massive construction projects, companies to expand recklessly, and consumers to take on mortgages and debt they can't really afford. In the short term, it looks like a boom—jobs grow, markets rise, and politicians pat themselves on the back. But it's a house built on sand.

Eventually, reality sets in. The malinvestments—investments that made sense only under distorted interest rates—are exposed. Housing developments sit empty. Borrowers default. Banks tighten credit. And then the crash comes.

To fix the housing industry, Trump doesn't need to increase economic intervention—he just needs to unleash the housing market. Fortunately, he has already gotten started.

His day one executive order on "Delivering Emergency Price Relief for American Families and Defeating the Cost-of-Living Crisis" aims to slash through the tangled web of state and local regulations that choke off new housing supply. Housing and Urban Development Secretary Scott Turner and Interior Secretary Doug Burgum also announced a joint task force to build new homes on federal land.

Trump also seems to believe in letting housing markets operate efficiently so supply can rise to meet demand. His administration can help make that happen by ending the previous administration's Department of Justice (DOJ) antitrust lawsuit against the software firm RealPage, which it alleged helped landlords artificially raise rents.

In reality, this software helps property owners better understand their market rate valuations (much like Kelley Blue Book does for car owners and buyers). Yet, time and time again on the campaign trail, former President Joe Biden and former Vice President Kamala Harris falsely claimed this pricing software was driving up costs for renters—an attempt to shift blame for high prices away from the government and the Fed.

Blaming pricing software for rising rents is like blaming the thermometer for a fever. It's not landlords' and homeowners' fault that inflation under Biden's watch forced them to raise their prices.

Once Trump succeeds in achieving zoning and permitting reform, this innovative new pricing technology will help reduce home prices faster. Why? Because deregulation lowers prices, and this software provides real-time market pricing. That's why fending off this Biden-era regulatory overreach is so important. Innovation helps drive prices down.

Deregulation is almost always the answer. Interventionism is not. We must stop depending on central bankers to "fix" the economy with levers and dials. Every manipulated boom leads to a bust. Every time Washington intervenes, it creates distortions that punish savers, reward speculation, and ultimately hurt the very people it claims to want to help.

The real solution isn't more planning—it's more freedom. Let markets set interest rates. Let prices rise and fall. Let supply and demand work without interference. That's not just sound policy—it's sound money.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Cutting interest rates won’t lower house prices.

It could only lower house payments.

It lowers the interest paid on mortgages. The total, principal plus interest, is the *actual* price you're paying for the house.

Time preference is a thing. If you can spread the cost out over 30 years, it is effectively costing less, or at least affordable to more people because most people seem to think of everything in terms of what monthly payments they can afford. Which is actually a decent contributor to the increase in sale price of houses. If more people can get into the market, with low down payments and 30 year mortgages, prices grow up even as cost (in terms of monthly payments) goes down.

Same rationale for student loans…only a house has value. The value of a college degree has eroded since 2000 which is also when student loan debt started greatly increasing. Harvard and Yale believe student loans are dumb and they discourage them…that means student loans are dumb at every college!! So with student loans college professors and administrators get the cash and the student gets the debt and a worthless degree.

No it doesn't. It INCREASES the price you (or someone else) is willing to pay for the house. Since the house sells for the highest price that clears - lower interest rates tend to increase house prices. Further, those lower interest rates are associated with a TON of speculative demand for housing that only serves to increase the asset price.

The only situation in which lower interest rates don't lead to higher house prices is when those lower interest rates are associated with a shitty economy with no homebuyers. But even then, those lower interest rates prevented house prices from falling further.

This guy gets it.

Yup. Trump doesn't. On anything.

I’ve lived in every major southeast city prone to flooding. The oldest neighborhoods built first never flood…it’s the neighborhoods built post WW2 generally on dredged land (New Orleans, Charleston, Miami Beach all significantly man made) that flood. Houston neighborhoods built recently flood as it’s a newer city. Sprawl causes flooding because each new neighborhood is built on land that is less desirable from a flooding perspective. Galveston was supposed to be Houston but it was wiped out by a hurricane and so Houston is very new and every year people will discover their neighborhood is flood prone…don’t build on concrete slabs!! Plumbing becomes super easy with raised houses but your HVAC will continue to fail! 😉

If demand increases due to lower mortgage interest costs, with no increase in supply, then lowering the interest rate may actually increase cost of housing.

We need an interest free mortgage for single family homes that cost $200k or less. And then have municipalities and states attempt to lure residents with no property taxes for several years. So cities like St Louis and Cleveland have infrastructure for hundreds of thousands of more residents and yet people are moving to Texas and Florida that have to build new infrastructure that is making the grid less reliable and flooding more likely. The empty lots in St Louis have access to the grid and sewers and don’t flood! And nobody sends their kids to public schools anymore and so private schools will follow the money. Apparently Shedeur Sanders hasn’t attended a classroom in years and he is an A student…class is online for him.

There is a reason everyone is moving out of those places, and it’s not interest rates

Yup. And St. Louis is susceptible to flooding.

What a moronic post.

We need an interest free mortgage for single family homes that cost $200k or less.

What is the purpose? To fix house prices? Create distorted demand for housing? To get votes?

And then have municipalities and states attempt to lure residents with no property taxes for several years.

So basically the California Prop 13 approach. How's that worked out?

What is the purpose? To fix house prices? Create distorted demand for housing? To get votes?

You see, socialism is totally fine when it serves the "right people".

The draconian zoning restrictions in most of the US serve well off grifters who disproportionately vote Republican, and Trump was very clear in the 2016 campaign that he strongly supported those grifters.

The empty lots in St Louis have access to the grid and sewers and don’t flood!

Oh- and if the issue in St Louis citywide is empty lots, then that is an issue of bankruptcy and land tax NOT property tax. Jack UP land tax and eliminate tax on the building. IDK who owns the land on those empty lots but the two biggest owners of vacant properties are likely some city entity and Paul McKee (an area developer/speculator who owns 1000's of vacant properties). They are profiting by being able to sit on empty land with no annual carrying cost. It's the same business model as slumlords and malls around the US that can sit empty for years/decades without being converted into a profitable use.

Tax the LAND to cover ALL the operating costs of the infrastructure. Eliminate the property element of the tax. The certainty is that the land's true value is MUCH higher than the property tax assessor games which are always corrupt (because property is depreciable and deductible where land is not). Sell that land to whomever will pay that land tax. The only way they will be able to cover the tax is to turn the property into something valuable that generates a return - but their taxes will not go up after they do that. Still the same land.

For place like St Louis and Cleveland - where population used to be a lot higher, there are probably a ton of old rent-seeking expenses that are still being imposed on a shrinking population. Maybe muni bonds - pension plans - basically old sunk cost shit. That requires a full fledged bankruptcy to clear liabilities from new population going forward. Just clearing that eliminates the uncertainty of anyone who might want to move to those cities NOW.

There is a St Louis website that identifies the vacancy problem.

Of the 15,600 vacant lots - 8500 are owned by LRA (the St Louis muni entity that does that stuff), 7100 owned by private.

Of the 9,000 vacant buildings - 1200 are owned by LRA and 7800 owned by private. 5400 single family; 2200 duplex; 660 multi.

Basically there is a relatively easy solution to get that land back into a tax base and to make the land market in St Louis reasonably liquid so that land can be valued. Course there's probably 1000 completely corrupt solutions and those are the ones that gather interest.

The problem in St. Louis is the lack of an adequate economy which has made the city no longer fiscally viable as an independent city. Baltimore is in the same situation.

You could give away homes and it still won't reverse the population losses. In fact Baltimore for a while was selling city owned homes for $1. Helped some families but didn't reverse the city's decline.

Current St Louis population is 270,000. That is viable as a city. Similar to Plano TX or Madison WI or Lincoln NE or Reno NV or Buffalo NY. The city itself is no longer big enough for pro-sports teams - or hallucinations of what it may once have been when the city had a population of 850,000. If the city can deal with reality, it can do well going forward - and grow again.

Dealing with reality is not easy though.

St. Louis has had too much of its tax base move to the suburbs. Ditto Baltimore. The tax base of New Orleans mostly left the state. These cities no longer can afford to provide basic public services. Best would be to abolish St. Louis and Baltimore as independent cities, and merge them with the counties of the same name. Orleans Parish should merge with Jefferson Parish. Note that sunbelt cities that have been allowed to annex suburbs such as Houston and Phoenix are doing great, apart from massive suburban sprawl and traffic jams.

The problem with thr mortgage interest deduction is that lower income people don’t get to take advantage of it. So this not only levels the playing field with wealthy people putting pressure on high end prices but also levels the playing field with institutional buyers that can pay cash. Basically it will make buying a home cheaper than renting for a $200k home. A buyer could only get one interest free loan at a time and they would have to live in the house for 5 years and couldn’t rent it out…it would still be cheaper than renting to walk away from the equity if one’s career forced a move.

There should be no interest deduction on anything. That simply provides a tax incentive to leverage up and CREATE risk (and inflation). Find ways to get rid of the mortgage interest deduction for everyone rather than expand it to include everyone.

We will never get rid of the mortgage interest deduction. People need to live somewhere and I remember visiting Orlando in 2012 and I was driving around Kissimmee and school buses were dropping kids off at those old run down motels. Why should a kid be forced to live like that when there were empty houses in Orlando from the housing bust? It’s just stupid that institutional investors with cash got to buy all of the nice $150k homes that are now probably worth $500k.

The mortgage interest deduction subsidizes excess investment into housing and drives up house prices. The only reason mortgage interest deductions exist is because BUSINESS interest deductions exist. It's difficult to separate the two. Which is why I'm saying that ALL interest deductions should cease.

As for cash buyers - that is a direct consequences of subsidized interest rates from the Fed and property taxes that are too LOW in many states.

Tax preferences for capital gains reward risky behavior even more!

California's Prop 13 defunded police. However, most of the cities in the US with low violent crime rates are in California. Maybe it did work out.

Prop 13 basically eliminated local government in CA. The data doesn't show that violent crime in CA is particularly low at all. LA is similar to Dallas or Phoenix. Oakland/Stockton are higher than Chicago. SF is similar to Miami.

What Prop 13 did do was create a massive crony deal for long-time homeowners - which eliminated a ton of supply from ever coming to market. Which jacked up house prices - and distorts the housing market itself by making it less liquid - and made CA a cesspool for those squeezed out of housing.

I went to the Major Cities Chiefs Association to look at their data. The lowest homicide rate or large US cities in 2024 was San Diego, with 2.52 homicides per 100,000 population. #2 was San Jose, at 2.78. They were followed by Virginia Beach, El Paso, Mesa, Boston, Omaha, Arlington (TX), and San Francisco was #9, at 4.33. New York City wasn't in their database but it would be #10, at 4.63. Salt Lake City was #11 and Fresno was #12, at 5.50. Miami was #15, at 5.92, 28% higher than San Francisco. Los Angeles was #19, at 7.43, lower than #22 Phoenix at 8.36 or #39 Dallas at 15.05. Oakland was #47, at 19.70, lower than Chicago, #48, at 21.54. They did not report data for Stockton.

But you are 100% correct about the grifting effect of Prop 13. My brother in law pays under $1,700 in property taxes on a $700,000 house in the nicest part of Sacramento. Few if any places in the US have property tax rates so low, yet Republicans repeatedly blast California for supposedly exorbitant taxes. Those who were lucky enough to be there decades ago don't agree.

Higher interest rates create downwards pressure on real estate prices. As higher rates lower the number of potential buyers through higher mortgage payments.

Exactly, but why should low income Americans suffer because wealthy Americans bought a third home in Jackson, Wyoming or Jupiter, Florida??

It actually increases prices. Lower interest rates make payments lower. Trump is too stupid to understand this.

Is the red tape federal? Because if its not, well, Trump can't cut state regulations, can he?

The Fed is kinda the only lever he has - or at least the least disruptive one.

Just because you can do something, doesn't mean you should.

Note that I did *not* say he should.

Only that this is the least worst lever he has to do this. Most of the problem lies in the states.

Incunabulum; or even more local than that.

Primarily, but not exclusively, democrat states.

In New York and California, Democratic politicians have been trying to reduce the regulations and Republicans are all-in to prevent them from doing so.

In Republican states, the regulations are often from homeowners associations and are more draconian than any government regulation.

Noted. Just a general comment.

He could hold back highway funding in exchange for states to cut red tape - ART OF THE DEAL

Apparently you can only withhold federal funding if its to coerce something the Left wants - like 55mph speed limits and needing to be 21 to buy alcohol.

In the 2016 campaign Trump made a big deal weaponizing his opposition to relaxing such regulations. And although he hasn't been talking about this lately, his supporters are all in to support continuing them. Not even one Republican voted for the recent upzoning of New York City.

King Donald can order States and Local governments to bend to his will. However, he and most Republicans have consistently opposed removing the biggest impediment to affordable housing: Restrictive zoning laws. Curtis Sliwa is running for Mayor of New York on a platform of bringing back the overly restrictive zoning laws that were just repealed a few months ago over the opposition of every Republican on the City Council. And Republicans in New York and California have been all-in to block even the relatively modest efforts by Newsom and Hochul to increase housing supply. The Republican Party used to be the party of business; it is now the party of well-off grifters. With the support of most commenters here.

Shorter, more accurate headline:

"Trump doesn't need to fix housing."

more accurate headline

"no one can make housing affordable after the covid spending extravaganza"

Good idea but that would require Trump to work with a congress currently controlled by his own party to try to actually get legislation passed, instead of randomly signing executive orders and rage tweeting.

can't we give subprime mortgages guaranteed by the government another try

Nope, elevated CPI for 4 years peaking in July 2008 is what undermined the American consumer spending economy. The spike in home ownership rate was a symptom of a dysfunctional economy because 25 year olds with student loan debt shouldn’t own a home because they are still moving around for their careers. “Subprime lending” shouldn’t have been a problem but for the fact housing prices were in a bubble because of house flipping and speculation because business investment was relatively low and the cheap credit went to the investors of last resort—individuals taking out a $250k loan to make $30k…that’s what a job is for!!

Cutting rates while inventory is low will actually drive prices up. MAGA is so stupid

As-if the very UN-Constitutional machine (Federal Reserve) wasn't pitched and passed by Democrats.

Actually the first central bank in the US was chartered in 1791, by Federalists, many of whom had been the WRITERS of the Constitution, including President Washington and Treasury Secretary Hamilton. The second one was chartered in 1816, with the approval of President Madison, from the Democratic Republican Party, who is literally called the Father of the Constitution.

I have just completely debunked the "Fed is unconstitutional" meme. You have been owned.

the First Bank of the United States (Alexander Hamilton pitched) was not solely responsible for the country's supply of bank notes. It was responsible for only 20% of the currency supply; state banks accounted for the rest.

Several founding fathers bitterly opposed the bank. Thomas Jefferson saw it as an engine for speculation, financial manipulation, and corruption.[3] In 1811 its twenty-year charter expired and was not renewed by Congress.

Congress to modify its powers, giving it the ability to both create money, as the 1913 Act intended, and destroy money, as a central bank could.

During the 1920s, the Federal Reserve experimented with a number of approaches, alternatively creating and then destroying money which, in the eyes of Milton Friedman, helped create the late-1920s stock market bubble and the Great Depression

https://en.wikipedia.org/wiki/History_of_central_banking_in_the_United_States

About the only thing you debunked was Alexander Hamilton ever being a USA patriotic founding father which most everyone already knows.

Jefferson opposed the First Bank. True. It was inconsistent with his vision of the US being an agrarian society dominated by elitist oligarchs like himself.

Madison was President when the Charter expired. He then tried to fight a war without it. He had to resort to printing money and levying property taxes to pay for it. Inflation was rampant and he realized that only a central bank could control it. Hence, he signed the Second Bank of the United States into law. Note that some of the opposition was from slaveowners who worried that a modern banking system would lead to the end of their Peculiar Institution. It was also opposed by the state banks who with Andrew Jackson forced the Second Bank's Charter to expire, and it was precisely the irresponsibility of Jackson and the state banks that led directly to the Panic of 1837, mentioned in my earlier comment.

Central banks make mistakes. Lack of a central bank makes economic chaos.

LOL... As-if there hasn't been any economic chaos since 1913 huh??? Like the worst 'Greatest' Depression the USA has ever experienced and the worst debt too. /s

You don't think Central-Banking causes elitist oligarchs?

I'd say elitist oligarchs are literally a remnant of central-banking.

This isn't Economics 101 it is high school economics, which MAGA flunked.

I wonder how many Ron Paul staffers it took to write this piece under his byline.

What are you talking about? Ron Paul is still very active.

Lucky for us that is true.

ALL Presidents and ALL of Congress shouldn't be Gov-Gun demanding an interest rate.

This is not *JUST* a Trump issue so stop pretending like everything is.

This is a Democrats issue. Democrats pitched, passed and put into effect the Federal Reserve Act. Caused the Great Depression doing it.

Nonsense. The Smoot-Hawley tariff turned a modest recession into the Great Depression. The Fed was powerless to overturn the tariffs.

Smoot Hawley tariff simply accelerated the reduced trade that was going to happen anyway. The Great Depression was NEVER going to be a mere recession because it was a FINANCIAL crisis. Recessions are basically inventory/production problems and they eventually self-correct which is why they are 'mild'. Financial crises do NOT self-correct. They lead to bank runs and debt deflation and the end of monetary systems and all sorts of other problems.

That said - the Federal Reserve did not really cause the financial crisis that led to the Great Depression. Really - the Brits did. They tried to get back on the gold standard in 1926 after WW1 had embedded too much currency depreciation in the pound. The Fed tried to support the Brits - and in so doing created margin bubbles in the stock market and real estate speculation/bubbles in Florida and the areas that later became Dust Bowl, and excess debt-fueled consumption with the flappers/etc, and excess corporate buildout of the utilities/electricity bubble

"The Fed tried to support the Brits" ... Subsidizing!?

The person who put the UK back on the gold standard was Winston Churchill. He would later say that it was the worst thing he ever did.

But had the UK and US followed his policies on trade, there would have been no Great Depression. The financial crisis would have been weathered but international trade died, making it impossible for the inventory/production problems in both the UK and US to self-correct. Economists begged and pleaded for Hoover to veto the Smoot Hawley bill but Hoover had the America First ideology even though the term hadn't been coined yet. (And indeed Hoover would be one of the loudest America First proponents in 1941.)

Funny. You don't think Tariff's existed before the Federal Reserve Act 1913? It's power is literally written into the US Constitution of 1787.

The Fed has been powerless to stop anything. In Fact; I'd say all they've done is helped bankrupt the nation and made $ useless (made everything worse).

Ron Paul disagrees with Trump. Mises Caucus hardest hit. Full story at eleven.

Ron Paul is the girl-bullying republican who once infiltrated the LP and, by association, convinced many women voters we wanted to help the GOP endanger them via involuntary servitude of reproduction. This is the exact same thing the Jesus Caucus just repeated in order to drive our votes to zero before the next mid-terms. Why is Reason platforming this national socialist when his own party doesn't? Have we not enough Comstockist zealots in the commentariat?

Thems fightin' werds.

LIBtardator; NO one asked you anything.

Yes, but the girls really love it that way.

does anyone know how to translate this libshitois?

California: You can take my onerous byzantine housing regulations from my cold dead hands.

Actually Newsom is trying to relax them, and is being opposed by essentially every Republican in the state, and a few Democrats as well.

every Republican in the state ... what's that 5?

Republicans hold LOTS of local offices and they are defying state law. Nothing new there; Trump defies federal law. They need to defend their grifting voters.

Uncle Ron always makes sense. Every time including this one.

X and Y medicine will both help with your sickness, esp X "Okay , thanks, then I won't take Y" GODDAM STUPID ....okay regulations are worse, I've posted that often , even yesterday, but what does that have to do with doing everything that helps bring down prices. Just goddam stupid of Ron Paul to say

As many have noted above, lower interest rates don't lower house prices. Likely quite the opposite.

"Congress made the mistake of creating a central bank in 1913. "

I stopped reading after this junk history statement. The US had suffered disastrous financial panics in 1837, 1857, 1873, 1893, and 1907, largely because there was no central bank to take action to ameliorate the excesses of the oligarchs. 1873 resulted in a depression that lasted to the end of the decade. For the last two, J. P. Morgan acted as a Central Banker and prevented the disaster from having a long term effect. There was another panic in 1914, after the Federal Reserve System had been enacted but before it was up and running. J. P. Morgan was dead, but the brilliant Treasury Secretary William G. McAdoo, a railroad executive, closed the New York Stock Exchange for four months and printed massive amounts of paper money to ameliorate the crisis caused by the beginning of World War II as Europe was dumping every US asset they had to fund the war. This prevented a Great Depression. McAdoo was Woodrow Wilson's son in law but not all Presidential sons in law are idiots.

You need a central banker. And you don't want it to be an oligarch like Morgan. Most of today's oligarchs are FAR greedier than Morgan and would screw the country in order to protect their own assets. Morgan was no saint but he did care about the country.

Everyone get in-line for the 'charliehall' paper dollar! /s

He promises 'his' central-bank notes work especially when he prints them for himself!

If Congress had members like Dr No, there would be such a debt problem. Congress loves giving stuff away that future generations will be on the hook for. Dr Paul understands economics. Few in Congress do.

Cutting red tape does reduce housing costs, but if housing costs still remain unaffordable for large segments of our population what does this really accomplish? The free market alone will never meet US affordable housing needs -- not in my lifetime and not even in my young grand children's lifetimes. There must be government subsidies in one form or another. The market alone did not build post-WWII housing. It did so in partnership with government on the financing side for owner-occupied housing; and with even more direct government subsidies on the rental side. Cutting red tape for housing people can't afford to occupy wastes everyone's time. It reminds me of the 1980's commercial real estate building boom when hundreds of US buildings sat empty because no one bothered to do market studies to see whether anyone would rent them. The market caused dozens of financial institutions which financed them to fail, and my law practice to thrive.

"The free market alone will never meet US affordable housing needs"

100% complete BS.

It did in the past and it did it quite well.

Cost of a House in 1910 $2500.

"A competent accountant could expect to earn $2000 per year, A dentist $2,500 per year, a veterinarian between $1,500 and $4,000 per year,and a mechanical engineer about $5,000."

The only thing that F'Ed up affordable housing was your (Gov-Guns) of THEFT.

Let me spell just how stupid you are out to you. If you owned a store and 90% of your clientele STOLE stuff what would the price of your $1 item have to be to survive?

That's right dumb*ss.... 10-TIMES what it should cost.