A Taxpocalypse of Rising Rates Is Coming For Americans if Congress Doesn't Act

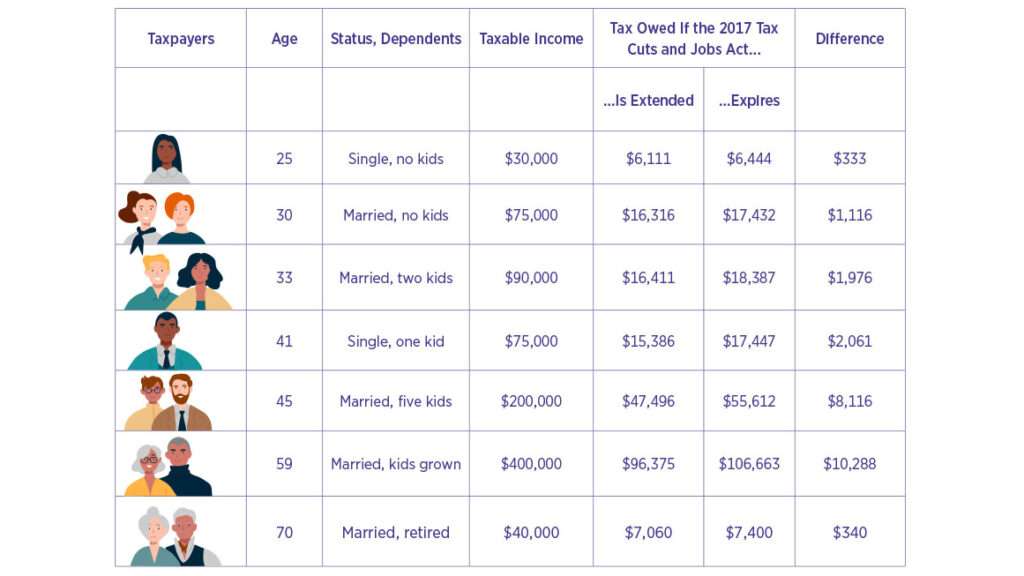

Here's how expiring tax cuts could affect you.

When the new session of Congress opens on January 3, the clock will already be ticking toward the most important set of fiscal decisions lawmakers will make this decade.

Decisions made through the end of 2025 will determine the fate of literally trillions of Americans' dollars. Will they remain in wallets, bank accounts, and retirement portfolios, or will they flow to the U.S. Treasury to fund wars and welfare?

This "fiscal cliff" is eight years in the making. The 2017 Tax Cuts and Jobs Act (TCJA) revamped both the federal corporate and individual income tax codes. But while the new, lower, corporate income tax rate (and associated changes) were made permanent, many changes to the individual tax code were temporary. That includes the higher standard deduction, expanded child tax credit, and the lower tax rates that have allowed nearly all taxpayers to keep more of their own money these past several years.

Unless those provisions are extended or made permanent by the end of 2025, the higher pre-TCJA policies will automatically return. That would mean higher taxes for nearly all taxpaying Americans.

Of these complex and interconnected issues, those individual income tax rates are the most pressing for Congress to solve. Under the TCJA, the top marginal rate was reduced from 39.6 percent to 37 percent—with rates for other tax brackets falling similarly.

Donald Trump's victory and the Republican takeover of the U.S. Senate (the U.S.House majority was undecided when this issuewent to press) will undeniably shape the negotiations. But neither party made the approaching fiscal cliff a major issue during the run-up to the election, and there is not a unified position on either side of the aisle. Many Republicans and Democrats are on the record as supporting an extension of the lower TCJA rates for most taxpayers, but there are those who disagree. Sen. Elizabeth Warren (D–Mass.), for example, has called for Democrats to allow the TCJA to expire in full. Meanwhile, some figures on the so-called New Right have suggested that Republicans should allow the individual tax cuts to expire and should partially undo the corporate tax changes made in 2017 to hike taxes on businesses.

Fiscal realities may bite too. When the TCJA passed, analysts projected that it would add to the budget deficit and national debt—and it did. But those problems were more easily waved away when the country was running significantly smaller annual deficits and the debt-to-GDP ratio wasn't reaching levels unseen since the height of World War II.

A full extension of the TCJA would add another $4.6 trillion to the deficit over the next 10 years, the Congressional Budget Office projects. When the economic benefits of lower taxes are taken into account, the extension would still reduce revenue by $3.5 trillion, according to an estimate by the Tax Foundation, a right-leaning think tank. With current deficits already approaching $2 trillion annually, lawmakers must now face the disconnect between how much government Americans are getting vs. how much they are paying for.

Ideally, Congress would offset the continued tax cuts with spending reductions. In reality, that's borderline impossible, since much of the expected spending growth over the next decade is for entitlement programs running on autopilot and mandatory interest payments on the debt that's already accumulated.

If spending cuts don't happen and the appetite for more borrowing is limited, then taxes simply must increase. But who should shoulder that burden?

The individual tax rates and brackets are only a part of that arithmetic. Lawmakers will also have to decide whether to retain the TCJA's cap on the state and local income tax deduction. Removing that would benefit wealthy taxpayers in high-tax locales like New York and California while adding to the deficit. The elimination of that tax credit, on the other hand, could net $2 billion in revenue over 10 years.

Similarly, they must decide how to handle the child tax credit, which was made more generous by the TCJA. Simply extending the child tax credit in its current form would cost an estimated $600 billion over a decade. Lawmakers on both sides of the aisle want to expand it again, but providing a greater benefit to families means requiring others to pay more (or adding yet more to the deficit).

It would have been useful to have the 2024 election season focused on candidates' tax and spending proposals so voters would be more keenly aware of the coming fiscal cliff and the difficult tradeoffs necessary to navigate it. That didn't happen, but there are at least a few broad, competing visions being sketched out by tax-focused think tanks.

On the left, the Center on Budget and Policy Priorities (CBPP) stresses that high-income earners should see their tax rates revert to the pre-TCJA levels. Allowing the lower rates to expire for taxpayers earning over $400,000 annually would avoid more than 40 percent of the full cost of extending TCJA's policies, according to the group's calculations. The CBPP is also pushing for raising the corporate income tax to offset the maintenance of lower personal income tax rates.

The Tax Foundation, meanwhile, warns against using higher taxes on corporations or wealthy individuals as a tool to "pay for tax breaks for some at the expense of economic growth for all." The group is also skeptical of plans to use tariff revenue to offset tax breaks, since those tariffs would create a variety of economic harms—and would end up being paid by Americans anyway.

Optimistically, one might view this fiscal cliff as an opportunity for Congress to bring deficits under control and restructure Americans' fiscal relationship with the federal government. But it is also a messy tangle of overlapping political and policy intentions, one that would be difficult to solve even in an era when Congress was less fractured and more serious about policymaking.

This article originally appeared in print under the headline "Taxpocalypse."

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Fortunately, extension of TCJA income tax rates is job 1 or 2 of Pres Trump and the Congress. Not too concerned about that, Boehm.

Slow day today?

I'm eager to see who gets to cover the Biden pardon and what angle they take. Seeing Gillespie's tweets, I'd guess they'll probably lean towards saying Hunter should never have been charged anyway.

Just shows how Nick isn't a true libertarian. If he was he'd be demanding that Hunter spend the rest of his life in prison because true libertarians hate Democrats and have no principles.

Did it occur to you that it would be because he committed actual normal crimes? Not even the novel variety you support against your enemies?

Amazing you'll even defend an 11 year pardon for known and unknown crimes for a Democrat. Not a single criticism to be had from you. Perfectly normal for dems to not be responsible for actual crimes.

I see you're still rehearsing rebuttals to arguments no one made as you drive to your do-nothing government contractor job where you suck on the taxpayer teat while commenting on Reason all day about how much you hate foreigners on welfare.

Poor sarc. So much “you” in that post.

So much wrong in that post too. He defends his actions with blatant lies lol.

Without lies and projective insults, what else is left for him? And all this just for head pats from Pedo Jeffy.

I'm sorry. Can you point out you criticizing this pardon?

You're still trying to guess what I do which is fucking hilarious. After you keep twlling fake stories of your jobs in government buildings lol.

I don't charge anything to government dumb dumb. But your welfare spending did. Lol.

Extra amusing as it was 7am here. Still can't figure out time zones huh?

I eagerly await your "Trump did it first with Sheriff Arpaio" anti-excuse for Biden pardoning his son.

It will be celebrated by Jacob Sullum. I won't be reading it.

Yes, JS;dr as always.

Trump pardoned his son-in-law’s father, Charles Kushner, for tax evasion and other crimes.

Let He who is without sin, cast the first stone!

Republicans did shit first, so shit is OK for Demon-Craps to do shit!

https://fortune.com/2024/11/30/trump-charles-kushner-pardon-jared-ivanka-us-ambassador-france/ Pardoned criminals for high political orifices; THAT'S the way ye do shit!!!!

I fund it amusing that Boehm will call even Joe's tariffs the Trump tariffs, but he won't call these Trump tax cuts.

Because trumps tax cuts didn't help anyone other than the richest americans

You mean the people with jobs?

people with jobs are the richest Americans? now that is rich, it's those f*ckers who live off trusts, investments and interest etc. THOSE people get the most help, not the family making 100K.

You are a fucking moron

Your sarcasm meter is broken

It appears to be. Blame the tryptophan. Apologies.

I'm confused. I've been browbeat by Democrats that Trumps tax cuts only helped the rich but now I'm finding out they helped everyone? Wow, Democrats lied?

And what about the deficit?

You must've missed the boat then. But somehow the tax cuts for the rich never run out but the regular worker, it DOES! imagine that.

"The group is also skeptical of plans to use tariff revenue to offset tax breaks, since those tariffs would create a variety of economic harms—and would end up being paid by Americans anyway."

Twat do you mean? The Trumpanzees have FIRMLY ASSured me that evil ferriners pay tariffs!!!

Who wrote this drivel?

Of course the tax cuts are going to be extended/made permanent.

That is a key component of Trumps policy.

As stated in the table, Trumps’ tax cut benefit every American of every economic level.

Hopefully Elon Musk and DOGE will lower the spending side of the equation

While the Trump tax cuts were not a primary issue for some in the election it was important to me. The Democrats distinguished themselves by demanding the cuts expire and there is good reason to believe that had they retained power they would have. Just another good reason to vote Trump.

And painfully obvious why Reason didn't make this a major drumbeat issue BEFORE the election.

The democrats would have offered some bullshit tax credit program or something similar to soften the blow with their base. Likely sneaking in billions for illegals in the process.

If the 2017 TCJA expires, I will make about $40k more a year.

The good news is that even if they do renew the tax cuts, all indications are that they will not preserve the SALT Deduction Cap, which is hilarious given how ardent Trump's policy wonks were that they were necessary. Of course, now the tent has gotten bigger and Trump wants his Silicon Valley bros to open their pocket books.

Are you a tax preparer by trade? That's about the only way anyone will "make" more money if the TCJA expires.

Or are you trying to say that you'll get to keep more of your own money? The only way that could be true is if you are both a high income earner and you voluntarily choose to live in a tax hell like New York. In that scenario, I have no sympathy for you. By asking to reduce the SALT deduction cap, you are demanding that poorer people in less tax-greedy jurisdictions use their federal tax dollars to subsidize your choice to live in a jurisdiction that (at least in theory) provides you more services for your higher local taxes. That's greedy and unjust.

The correct SALT deduction cap is $0. Your federal tax obligation should be independent of your choice of where to live (and how much tax to pay as a result of that decision). The mortgage deduction should also be $0 but at least there's a plausible social policy that we might want to encourage home ownership. There is no plausible social policy that says we should encourage people to live in high-tax areas.

"By asking to reduce the SALT deduction cap, you are demanding that poorer people in less tax-greedy jurisdictions use their federal tax dollars to subsidize your choice to live in a jurisdiction that (at least in theory) provides you more services for your higher local taxes."

Oh fuck off with your "Subsidizing" bullshit. NOT taking money is not a subsidy, you fucking idiot. There was once a time when "conservatives" actually had the integrity to bemoan double taxation and progressive attempts to define not taking as giving and not giving as taking. My how times have changed.

Besides, our country's spending is completely independent from its revenues, so whether the country collects more or less revenue from me, people who do not hit the SALT deduction cap will be paying the same amount, and we will still hit a deficit. They aren't SUBSIDIZING me, because they don't pay shit to me. In fact, I subsidize them, along with all the other people in my income gap that fund upwards of 50% of the revenue collected by this country.

"The correct SALT deduction cap is $0."

Then you are a moron. Income Taxes have NEVER taxed income that a person never actually earned. Your idiotic constructions are like claiming that "correct deduction for business expenses is zero".

I have paid this additional tax on my taxes for the past 7 years without real complaint- and in fact I wasn't complaining above, just noting a fact.

What is delicious to me is ostensible fiscal conservatives who immediately start spouting Progressive talking points about deductions being a subsidy because it gores the Ox of people they disdain.

I can see the argument that our federal tax burden is separate from our state tax burden and therefore we shouldn’t get a federal tax break for state taxes (it’s not like most people are itemizing to the point they can claw back some of their sales taxes).

But I get your point if you never even saw that income in the first place.

Yet another reason that income taxes are the most immoral taxes ever invented.

"I can see the argument that our federal tax burden is separate from our state tax burden and therefore we shouldn’t get a federal tax break for state taxes (it’s not like most people are itemizing to the point they can claw back some of their sales taxes)."

1) Sure, but it is a novel argument that is only being made by people because it is goring the ox of people they disdain. Since the original income-taxes were instituted, it was widely recognized that taxes were expenses that reduced your income, just as self-employment business expenses, rental property expenses lowered your income.

2) Even your statement undermines its premise. As you acknowledge, most people take the "Standard Deduction" which is a shorthand way of saying, "The government acknowledges that you have basic expenses that would deduct from income if you accounted like a business." It is an ASSUMPTION that taxes, and basic living expenses are costs against your gross income. Unless you are willing to say, "The correct deduction from Income Taxes is 0" you are already conceding this point, and merely haggling price and whose ox to gore.

3) And that is what annoys me the most- people like Rossami, who I tend to see arguing on principle a lot, have just thrown away those principles the second they see them resulting in outcomes they don't like. To be clear, nothing I am doing is "Subsidized". When the State takes my dollar, I never see it. I never earned it, any more than if (as a business) I paid a permit fee, or an employee's wages. That the Federal government comes in after and says I owe another $0.38 for every dollar confiscated by the State is an egregious change in tax laws that goes against all taxing principles.

I will also note that all the people who claimed that capping SALT deductions would force high-tax states to change their ways were 100% wrong. So even the pragmatic (but unprincipled) moralizing that this would "incentivize good behavior" turned out to be false.

Instead, what has happened is that the ultra rich have lobbied for and received special tax shelters that truly are subsidies for their money. While these subsidies are largely out of reach for the "Working Rich" (Doctors, Lawyers, high income earners), they are great for people in finance, and their money managers and botique Family Offices. These people now setup land trusts, solar concern swaps, and environmental credit trades- paying in large $250,000 chunks of cash in December, and getting a $275,000 refund from the government in the following year.

But this is always what happens when you stop seeing the Tax code as a way of raising revenue, and instead see it as a way to encourage your shibboleths and punish your enemies. The parasites get their graft, hidden in plain sight.

I will also note that all the people who claimed that capping SALT deductions would force high-tax states to change their ways were 100% wrong.

Seems worth noting that we now know that nothing can stop localities from bleeding their constituents dry, even when those people now realize exactly how high those taxes really are. They are going to vote for more of that, and damn the deficit spending consequences down the road. Nothing new there of course, it's just one more example.

Instead, what has happened is that the ultra rich have lobbied for and received special tax shelters that truly are subsidies for their money.

Question: Do you think that changes to the SALT deduction is going to change those havens or do away with them now that they exist?

Sub-Question: Didn't the 'ultra rich' do this regardless of the SALT deduction? Why would they not lobby for the creation of such freebies regardless of SALT deductions?

Maybe it was a response to the deduction itself, I honestly don't know, but it seems unlikely that any of that will go away regardless of what is done with SALT deductions going forward.

I do think that encouraging localities to increase taxes because it 'doesn't affect their constituents' is going to come home to roost, eventually, but I suppose that is for them to deal with when it happens. They are the very one's who will suffer when/if it happens.

I was in favor of getting rid of the SALT deductions at the time, but lately I tend to agree with the notion that taxing income that the individual never saw because of their greedy locality is probably not a fair proposition. Trying to get states and cities to reduce their taxation by this method was a poor and probably unwise decision, which is hopefully the reason why Trump doesn't seem inclined to push for it's continuation.

"The correct deduction from Income Taxes is 0" you are already conceding this point, and merely haggling price and whose ox to gore.

If we are honest, the proper deduction from income taxes should be zero. The fact it isn't is merely advanced social engineering and a tacit admission that the tax code, despite it's incredible complexity, is still shit.

Can’t we just agree to come together and wipe out the democrats? Then we can actually fix things.

Taking money from me but not taking it from you is a "subsidy" in every meaningful way. You're getting something (federal services) for less money than me and for no good social policy reason. Fuck off yourself. You choose to live in a tax hell. If you don't like it, move.

And no, it's not "double taxation". It's regular taxation by two different jurisdictions for two different purposes. That taxation may be unjust but there's no moral reason to make it even more unjust by making other people pay your share of the federal burden.

Aside from Overt’s accurate point that not taking money is not a subsidy, your argument falls apart anyway based on your theory that people in high tax states get more services. Everyone with a brain knows that isn’t true. The extra tax revenue versus other states is either wasted on projects like bullet trains to nowhere or goes to low income residents as entitlements. So these deductions are akin to medical deductions - expenses you don’t control that provide you no value (versus not having the incident that gave rise to the expense).

My argument stands. Presumably, Overt is a rational person making that choice intentionally. Therefore, presumably Overt gets value, even if only indirectly from that choice. Maybe he thinks bullet trains and ever greater subsidies to the poor are a good idea. Those are valid social choices for Overt (and the rest of his jurisdiction) to elect state and local politicians to make. I choose to live in a jurisdiction that (mostly) doesn't waste that money. Why should Overt get a discount on his federal tax obligation for the money he lets his local politicians spend (whether wisely or not)?

I just can’t help but think the real takeaway here is that the democrats must be eliminated.

Ideally, Congress would offset the continued tax cuts with spending reductions. In reality, that's borderline impossible

"not going to happen" is different from "impossible".

Whatever fiscal disaster awaits us, we probably deserve worse.

"Whatchoo mean 'we' white man?"

I don’t. Democrats and RINOs do. So let’s make them burn for it.

Gee, just think if there was no income tax, a minimal IRS and a sales tax instead.

Oh, wait.

That makes sense.

What was I thinking?

“When the TCJA passed, analysts projected that it would add to the budget deficit and national debt—and it did.”

Except it didn’t, you illiterate baboon.

https://www.thebalancemoney.com/current-u-s-federal-government-tax-revenue-3305762

Don’t be a shrike, Eric.

Oh, and fuck you, cut spending.

Where?

I know, right? Government’s barely funding itself as it is. We don’t even have subsidized suicide and laundry services, yet.

Income tax should be 0%

Does anyone at Reason ever go back and check if tax payments by people in the chart they posted ever materialize when the temporary caps expire? Personal income tax revenues as a percent of GDP have never actually changed significantly since 1956 regardless of the actual tax rates or exemption changes.

Happily, I'm very close to pulling the pin and going a year or two on accumulated cash (basically $0 income), and then minimal income for several more years (selling to pay expenses only). And then I'll hopefully get to suck some of that government Social Security money up for as long as it lasts.

IRS be like "Wait, we were getting 6 figures in taxes from this guy for years, and now we're getting $0? WTF?"

The 2017 TCJA was unnecessary and a failure and there is no reason to extend the tax cut. Extending it only defers taxes from people like me to my children. Let it end. In fact, I suggest that there be a compromise of letting the TCJA end and cutting some spending in return. NOt likely to happen but a good idea none the less.

Zero-Tax for importers was MORE unnecessary and a failure.

That with a topping of MORE taxes is what destroyed USA manufacturing.

Printing another $3.5 trillion will take money from Americans through inflation.

So why did you cheer on tripling the debt the entire time it was happening?