Why Did Americans Stop Caring About the National Debt?

Both parties—and the voters—are to blame for the national debt fiasco.

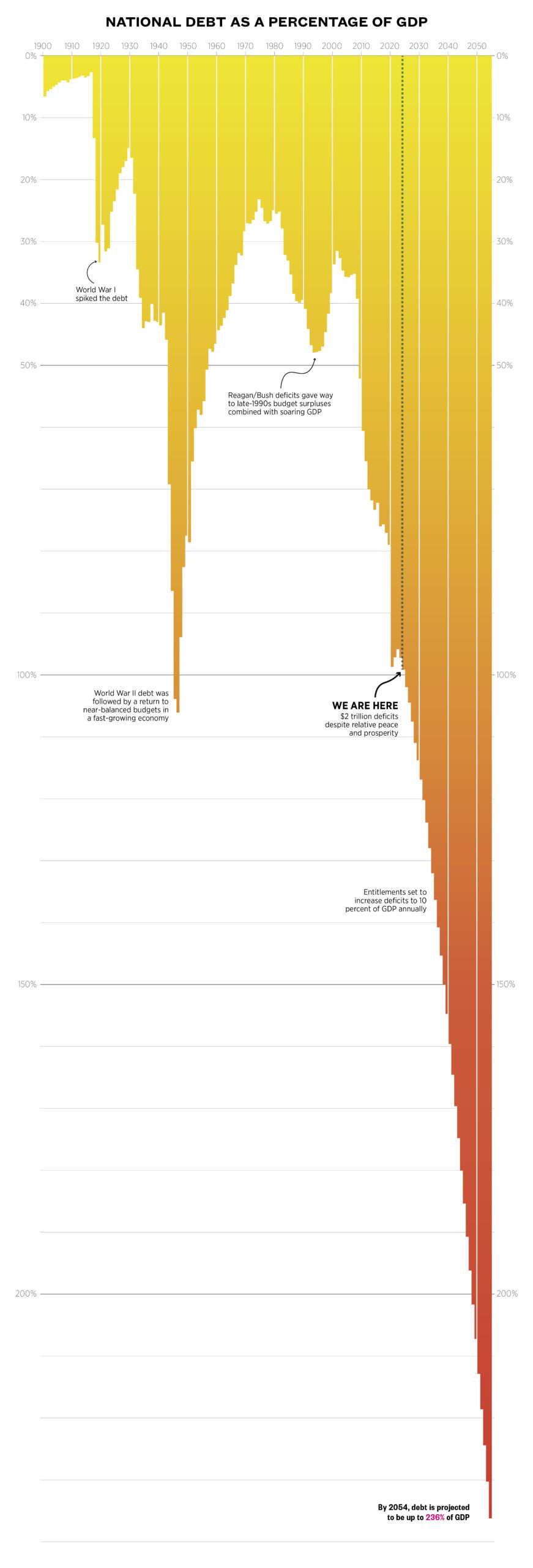

Scroll down to see how big the national debt may get over the next few decades, and then read about how we got here.

When President Joe Biden delivered his 2023 State of the Union address, Washington was drowning in a sea of red ink. The annual budget deficit was in the process of doubling from $1 trillion to $2 trillion in a single year due to some student-debt cancellation shenanigans. That year's budget deficit would become the largest share of gross domestic product (GDP) in American history outside of wars and recessions. Economists at the Congressional Budget Office (CBO) and across the political spectrum warned that continuing to ignore the escalating Social Security and Medicare shortfalls while also opposing new broad-based taxes was unsustainable and could bring a painful debt crisis.

How did the nation's highest elected officials respond to this economic challenge? Biden promised that "if anyone tries to cut Social Security [or] Medicare, I'll stop them. I'll veto it." He also accused congressional Republicans of plotting to reform these programs—prompting outraged shouts from Republicans who resented the accusation of caring about the looming insolvency of the Social Security and Medicare trust funds. When the president triumphantly taunted that such boos reveal a new bipartisan consensus to do nothing about Social Security and Medicare shortfalls, both Republicans and Democrats leaped to their feet with thunderous cheers. For good measure, both parties endorsed Biden's prohibition on any new taxes for 95 percent of families. Washington's dangerous borrowing spree would continue with enthusiastic bipartisan support.

Paradoxically, the faster government debt escalates toward an inevitable debt crisis, the less politicians and voters seem to care. In the 1980s and 1990s, more modest deficits dominated economic policy debates and prompted six major deficit reduction deals that balanced the budget from 1998 through 2001. That era is long gone. In the past eight years, President Donald Trump and then Biden enacted $12 trillion in deficit-expanding legislation even as Social Security and Medicare shortfalls drove baseline deficits higher. When even liberal economists warned politicians that the post-pandemic economy faced a modest degree of rising inflation and interest rates—and that a federal spending spree would pour gasoline on that fire—lawmakers responded by enacting the $2 trillion American Rescue Plan. When inflation and mortgage rates resultantly surged to 9.1 percent and 7.8 percent, respectively, lawmakers brazenly continued the inflationary spending spree.

Why are we no longer responding to soaring debt and its economic consequences? While there are many factors, the three most important are these: 1) We've convinced ourselves that deficits do not matter; 2) partisan politics and the collapse of lawmaking have turned deficits into a weapon to be politicized rather than a problem to be solved; and 3) few of us are willing to face the unpopular reality that this issue cannot be resolved without fundamentally reforming Social Security, Medicare, and middle-class taxes.

Debt Drivers

Few voters, or even politicians, have fully grasped how perilous Washington's fiscal outlook has become. While budget deficits have historically averaged 3 percent of GDP—ensuring the debt grows no faster than the overall economy—the deficit reached 7.5 percent of GDP last year and is projected to swell to 14 percent of GDP over three decades if current tax and spending policies are extended. If the federal debt continues to roll over into the 4.5 percent interest rate seen at recent Treasury debt auctions, then the budget deficit may surpass $4 trillion within a decade.

When a debt becomes this enormous, interest rates become a budgetary time bomb. Even if rates stay below 4 percent forever—as the CBO's projections questionably assume—projected interest costs will consume a quarter of all federal taxes within a decade and become the largest annual federal expenditure within two decades. If rates rise, each percentage point will add $35 trillion in interest over three decades—the cost of adding another Defense Department. Again, that's for each percentage point.

To many economists, the most important debt figure is the total federal debt as a share of the economy. This "debt ratio" has already leapt from 40 percent to 100 percent since 2008, and it is projected to exceed 230 percent within three decades under current policies. If interest rates gradually rise to 5 percent or even 6 percent, the debt ratio could surpass 300 percent, with interest costs consuming nearly all annual tax revenues. There would be no tax revenues left to finance any federal programs.

If this sounds unduly alarmist, consider that the economists at the University of Pennsylvania's Wharton School could not even project a functioning long-term economy on our current debt path. The economists write that their economic models "effectively crash when trying to project future macroeconomic variables under current fiscal policy. The reason is that current fiscal policy is not sustainable and forward-looking financial markets know it."

The driver of this debt is no mystery. The combination of rising health care costs and 74 million retiring baby boomers is driving annual Social Security and Medicare costs far above their payroll tax and Medicare premium revenues. These annual program shortfalls—which must be funded with general tax revenues and new borrowing—will exceed $650 billion this year on their way to $2.2 trillion annually a decade from now, when including the interest costs of their deficits. Specifically, by 2034 Social Security and Medicare will be collecting $2.6 trillion annually in revenues while costing $4.8 trillion in benefits and associated interest costs.

And that's just the beginning. Over 30 years, CBO data show Social Security and Medicare facing an annual shortfall of $124 trillion while the rest of the budget is roughly balanced. By 2054, these two programs will be contributing 11.3 percent of GDP to annual budget deficits, or the current equivalent of $3.2 trillion in annual program shortfalls (including the interest costs of their deficits). As for the rest of the budget, CBO projects that tax revenues will continue to rise, and other program spending to fall, as a share of the economy. This means the entire long-term deficit growth is driven by Social Security, Medicare, and the interest cost of their shortfalls.

Baby boomer retirements, health care costs, and rising interest rates combine to create what Bill Clinton's former White House chief of staff, Erskine Bowles, in 2012 called "the most predictable economic crisis in history." As far back as the 1990s, experts warned that surging retirements in the 2010s and 2020s would push Social Security and Medicare costs dangerously far above their more-steady payroll tax revenues. Yet attempts in the 1990s and early 2000s to gradually phase in reforms while the boomers were still young enough to adjust to them went nowhere. Consequently, stabilizing the debt will now entail deeper and more drastic Social Security and Medicare reforms—as well as increases in middle-class taxes—that can no longer exempt current and near retirees.

We cannot grandfather out of reform the 74 million boomers whose costs are driving the $124 trillion shortfall. Nor can we tweak our way out of this. If the system is to be kept afloat, Social Security's eligibility age must rise, its benefit growth formulas must be significantly curtailed for above-average earners, and its taxes may need to rise too. Medicare premiums must steeply rise for above-average earners, and its elevated costs addressed either with a new choice- and competition-based premium support system or with ambitious price and payment reforms to scale back costly procedures.

Washington will not even discuss this.

Deficits Do Matter

Younger voters may not grasp how much deficit concerns dominated economic policy debates from 1982 through the end of the century. As deficits widened under President Ronald Reagan, due to tax cuts and military spending, deficit reduction became a top voter priority, driven by concerns of elevated interest rates, sluggish economic growth, and foreign debt ownership. These deficit concerns—colored by a modest recession—helped elect President Bill Clinton in 1992. In The Agenda, Bob Woodward detailed the Clinton White House's monomaniacal focus on budget deficits, interest rates, and the bond market when pushing its 1993 tax hike bill. Even with the debt roughly stable as a share of the economy, both parties demanded aggressive deficit reduction to cut interest rates, spur investment, and encourage economic growth.

After six major deficit reduction deals and a temporary revenue surge finally brought balanced budgets from 1998 through 2001, triumphant lawmakers shifted the debate to how to spend $5 trillion in projected (and, in retrospect, fake) 10-year surpluses. Even as a sluggish economy eliminated those surpluses, Washington's appetite for replacing austerity with tax cuts, war spending, and new entitlements could not be stopped. Vice President Dick Cheney famously declared "deficits don't matter"—and when Great Recession stimulus spending brought the first trillion-dollar deficits without any immediately apparent danger, all of Washington wanted to join the party. Low interest rates made federal borrowing cheap, and the 2016 and 2020 presidential campaigns saw Sen. Bernie Sanders (I–Vt.) propose between $60 trillion and $97 trillion in new spending over a decade. Then Presidents Trump and Biden enacted $12 trillion in deficit-financed legislation in just eight years.

Progressives even invented an absurd justification for enormous deficits. Modern Monetary Theory (MMT) inexplicably claimed that Scandinavian-size spending could be financed by radically expanding the money supply without significant inflation. The 72 leading economists on the left and right responding to an expert survey unanimously rejected the MMT's ahistorical and nonsensical claims. The MMT's real purpose was to concoct an economic justification for progressives' longstanding desire to drastically expand government unconstrained from the limits of plausible taxation.

In hindsight, the economy managed the post-2000 debt surge because the initial 32 percent of GDP debt level provided some fiscal space for additional borrowing. Furthermore, the sluggish economy, an accommodating Federal Reserve, and a global savings glut drove a historic interest rate decline that made debt more affordable for families, businesses, and the federal budget.

That free-lunch era is now over. The federal debt exceeds 100 percent of GDP and is set to double or even triple over a few decades. These debt levels are rendered even more unaffordable by rising interest rates, as the structural factors that long reduced rates begin to reverse. Consensus economic analysis suggests that the debt surge itself will elevate interest rates by as much as three percentage points.

Unfortunately, American politics has not caught up to this new economic reality—which brings us to one of the biggest barriers to reform.

Partisan Politics and the Collapse of Lawmaking

Washington was not always as hyperpartisan and dysfunctional as it is today. In 2019, I analyzed the 14 leading "grand deal" deficit negotiations from 1983 through 2019 to learn why six negotiations successfully enacted legislation and eight failed. The most important cause of the recent failures, I found, has been Congress itself.

Up through the mid-1990s, Republicans and Democrats—despite public bickering—often collaborated well behind the scenes. During the 1983 Social Security negotiations to avert a looming trust-fund insolvency, Reagan and House Speaker Tip O'Neill (D–Mass.) pledged not to attack each other's approaches in public. President George H.W. Bush and congressional Democrats trusted each other in the 1990 budget deal negotiations that brought new spending controls and tax increases. Even the 1997 balanced budget agreement between Clinton and House Speaker Newt Gingrich (R–Ga.), coming two years after a rancorous government shutdown, was a model of healthy, trustworthy, bipartisan negotiations.

This bipartisan era ended abruptly in January 1998, when the Clinton-Lewinsky scandal broke. Clinton and Gingrich canceled a bipartisan fix to Social Security that was set to be announced just days later. Deficit concerns did not return until 2009, and by then Washington was far more polarized.

Rather than stay in D.C. during the legislative session and build bipartisan relationships—which voters once rewarded—lawmakers now fly into Washington on Monday evening, attack the other party in press releases and floor speeches, and then fly out on Thursday afternoon. The media landscape has become fragmented, partisan, paranoid, and obsessed with narratives of betrayal. Gerrymandered House districts leave members more fearful of primary challenges from true-believing partisans than of losing swing voters in the general election. Most congressional policy making has been removed from relatively bipartisan congressional committees and centralized in the Capitol offices of the House and Senate party leaders.

The result is 24/7 partisan warfare, with individual issues seen as little more than interchangeable weapons in the day's communication wars. For the past two years, Republicans and Democrats savaged each other over inflation—the voters' top issue—without either side bothering to offer serious legislation to solve the problem. (The cynically named "Inflation Reduction Act" had little to do with combating inflation.) In this environment, neither party dares to push politically risky entitlement reforms or broad-based taxes. Just ask former House Speaker Paul Ryan (R–Wisc.), whose earlier efforts earned him bipartisan hatred from voters and an attack ad portraying him murdering a senior citizen.

Even if the parties could trust each other to negotiate a good-faith deficit deal, their own purity-test voters would accuse them of surrendering to the other side. So Republicans and Democrats just point fingers at each other. Deficits are not a problem to be solved, but instead another weapon in the partisan communications war.

No More Easy Solutions

In the 1980s and '90s, lawmakers could tweak their way to deficit reduction. Nearly half of federal spending was discretionary, and the Cold War victory brought vast military savings that minimized the need for austerity elsewhere. A late-1990s revenue bubble was enough to bump the deficit into surplus for four years. The political payoff of a balanced budget was worth these modest reforms.

Today's deficits of $2 trillion—headed toward $3 trillion or even $4 trillion—cannot be tweaked away. Balancing the budget is virtually impossible, and even stabilizing the long-term debt at today's 100 percent of GDP requires wildly unpopular changes to Social Security and Medicare (and will likely take broad-based taxes). Other reforms are necessary but far from sufficient.

Yet Washington refuses to confront this budget math, relying instead on publicity stunts. Voters search for "one cool trick" that would quickly and painlessly balance the budget if only the out-of-touch politicians would listen.

Start with Republicans. The GOP canon begins by asserting that deficits are always driven by Democratic spending. This narrative is flatly contradicted by Presidents George W. Bush and Trump, both of whom expanded federal spending by trillions of dollars while enacting trillion-dollar tax cuts. The last time Republicans controlled both the White House and Congress, in 2017 and 2018, they immediately cut taxes by $1.5 trillion, expanded discretionary spending by 13 percent in one year, and rejected all entitlement savings.

"But those tax cuts paid for themselves," Republicans retort, which incorrectly assumes that pre-cut tax rates are always above the Laffer Curve's revenue-maximizing rate. This math also requires that every tax cut dollar adds at least $5 in economic output, taxed at an average 20 percent rate to recover that lost revenue dollar. While tax cutters will point to rising tax revenues as evidence of "free" tax cuts, even a stable tax code will produce rising revenues due to inflation, population growth, rising real wages, and business profits. Despite the many positive attributes of GOP tax cuts, they undeniably resulted in lower tax revenues than otherwise.

On the spending side, Republican voters are quick to claim that a $2 trillion deficit can be mostly eliminated by cutting foreign aid (just 1 percent of federal spending) or the classic "waste, fraud, and abuse," as if such a line-item exists in the federal budget to be zeroed out. Some Republicans like to talk about eviscerating social spending, but that rhetoric tends to fall apart when you calculate how much of that spending you'd need to cut to meet the GOP's balanced-budget targets: You'd need to eliminate all funding for veterans' benefits, child credit payments, the earned income tax credit, school lunches, disability benefits, K-12 schooling, health research, unemployment benefits, food stamps, homeland security, infrastructure, embassy security, federal prisons, border security, and much more. There is not much Republican appetite for that. (And no, immigration does not significantly widen federal budget deficits, although it can raise state and local government costs.)

GOP leaders also rely on gimmicks. Trump absurdly promises to pay off the $27 trillion federal debt with oil and gas revenues. One recent Republican presidential candidate, Vivek Ramaswamy, promised to grow the economy to a balanced budget. That lazy contention not only requires nearly impossible growth rates; it fails to acknowledge that faster economic growth also raises Social Security and Medicare costs and interest rates on the federal debt.

Without a consensus around a serious deficit reduction agenda, many Republicans rely instead on gimmicks and publicity stunts. So-called government shutdowns affect less than a tenth of federal spending, eviscerate many of the most popular programs, and guarantee an intense voter backlash. Similarly, debt limit showdowns offend voters as a crude way of eliminating an undetermined quarter of federal spending, defaulting on federal contract payments, and potentially defaulting on the debt with devastating economic consequences. They never succeed.

Another Republican gimmick is simply to demand a balanced budget amendment, or easy-sounding spending caps such as the "Penny Plan," without specifying how to meet their impossibly tight savings targets. Empty lawmaker pledges to quickly balance the budget while also extending the 2017 tax cuts and protecting key spending priorities—a mathematical and political impossibility—are meant to distract conservative voters from their runaway spending. Talk like Barry Goldwater; spend like LBJ.

So George W. Bush signed legislation collectively adding $6.9 trillion in debt, while Trump signed $7.8 trillion in just four years. The House GOP's balanced budget plan consists nearly entirely of gimmicks. Lawmakers engage in symbolic fights over small slivers of discretionary social spending while entitlement costs skyrocket. Freedom Caucus lawmakers give angry press conferences demanding colossal spending cuts without bothering to lay out any specific savings blueprint to meet their demands—or doing the necessary outreach, negotiating, and coalition building to win over skeptical lawmakers. It's all just a show; performative outrage for gullible voters.

Democrats have also built their own bubble of misinformation and excuses. The most basic progressive narrative claims that deficits do not matter and are merely a green-eyeshade scheme to serve the wealthy over the people. These progressives offer no answer for who will lend Washington at least $120 trillion over 30 years, or how such debt will affect the economy. The MMT enthusiasts call for financing such deficits with new money creation and then pretend hyperinflation would not result. "Zombie Keynesians" assert that trillions of dollars in deficit spending is needed to keep the economy afloat, and that even slowing the growth of spending would bring recession, mass poverty, and social collapse. (Real Keynesians acknowledge that recessionary stimulus also requires offsetting austerity during economic expansions.)

Liberal Democrats suddenly become anti-deficit when hammering Republicans. Flipping the GOP argument, they assert that Republicans drive the debt because deficits expanded during recent Republican presidencies and declined under Democrats. Yet such arguments measure only the first and last years of each presidency, which are often heavily affected by one- to two-year fiscal anomalies outside of presidential control, such as the 2000 revenue bubble, the 2008 housing crash, and the 2020 global pandemic. In fact, the partisan effect on deficits disappears if you measure deficits across entire presidencies, control for factors that are inherited or outside presidential control, and incorporate the partisan makeup of Congress passing the budget bills. Unfortunately, these standard economic and statistical cleanups do not fit in a meme.

Perhaps the most persistent Democratic myth is that tax cuts for the wealthy caused today's deficits and that taxing the rich can eliminate the problem. The math just doesn't back this up. Annual federal budgets since 2000 have fallen from a 2.3 percent of GDP budget surplus to a 7.5 percent of GDP deficit. That 9.8 percent decline results from annual spending jumping 6.3 percent of GDP; the bursting of the 2000 revenue bubble, which reduced revenues by 1.5 percent of GDP; and tax cuts, costing 2 percent of GDP. Approximately 70 percent of the 2001 and 2017 tax cut costs (and subsequent extensions) went to earners in the middle and lower classes. Out of that 9.8 percent of GDP fiscal decline, that leaves just 0.6 percent that can be attributed to "tax cuts for the rich."

So how do critics claim that "tax cuts for the rich" drive deficits? By including all tax cuts even for the nonwealthy. Or simply giving a free pass to the 5.5 percent of GDP entitlement spending hike since 2000 and then blaming tax revenues for not keeping up.

In its more extreme form, this fiscal fallacy insists that simply taxing the rich can not only close between $120 trillion and $150 trillion (depending on current policy extensions) in total budget deficits over three decades, but also finance a full Nordic social democracy. The first problem with this claim is mathematical. Even seizing every dollar of wealth from America's 800 billionaires—every home, yacht, business, and investment—would merely fund the federal government for nine months. And then the money would be gone. So would your 401(k), given that most of this wealth would be seized from the stock market. Not even the Sanders fantasyland tax agenda of a 77 percent estate tax, 8 percent wealth tax, and huge corporate, income, and investment taxes could finance Washington's current spending promises, much less his enormous new spending agenda. There simply are not enough millionaires, billionaires, and undertaxed corporations to close a minimum $120 trillion shortfall or finance a generous social democracy for 330 million Americans.

The second problem is economic. Only so many upper-income taxes can be layered on top of each other before surpassing their revenue-maximizing rates. At most, 1 percent to 2 percent of GDP in new taxes could be raised from high earners and corporations before their tax rates reach revenue-maximizing levels and the economy begins to capsize.

The final problem is political. Even a unified, unconstrained Democratic government in 2021 and 2022 limited its tax-the-rich reach to a modest and exception-stuffed corporate minimum tax and some IRS funding. It turns out that a lot of high earners and corporations are located in California and New York, where they help elect Democratic congressional leaders, who are not eager to bury them in a socialist tax revolution.

Progressive lawmakers exaggerate tax-the-rich savings by recycling the same few tax proposals to pay for countless spending proposals. Liberals lionize the 91 percent income tax rates of the 1950s, without doing the basic research to discover that: 1) Virtually no one in those days actually paid marginal tax rates over 50 percent; 2) those high earners paid lower effective rates than today; and therefore 3) the high tax rates of the 1950s to 1970s collected a smaller share of GDP in revenues than the post-1980 era of significantly lower tax rates. And when tax-the-rich progressives call for matching Europe's higher tax revenues, they ignore the fact that virtually all of Europe's revenue advantage results from broad-based value-added and payroll taxes, not additional upper-income taxes. Taxing the rich should be on the table—as should all savings policies—but cannot close more than a modest fraction of the shortfalls.

Democrats offer other dubious easy solutions to deficits. The popular target of Pentagon spending has already fallen from 6 percent to 3 percent of GDP since the 1980s and is projected to continue declining to 2.5 percent, which is not far above NATO's 2 percent target. Moreover, congressional calls to dramatically slash military spending have not been backed up by specific proposals, because even progressive lawmakers cannot figure out how to meet their savings targets.

Similarly, Medicare for All is more of a talking point than a serious savings proposal. Bills from Sanders and Rep. Pramila Jayapal (D–Wash.) promise nearly impossible efficiency savings yet fail to specify any new provider payment system to achieve them. Instead, the bills lamely assign someone else to figure out how to make it all work. Meanwhile, economists estimate that any modest efficiency savings would be spent on expanded benefits, leaving national health expenditures largely unchanged. Additionally, no one has yet designed a "Medicare for All" tax large enough to replace the $3 trillion in annual private health spending that would be nationalized. Most crucially, none of these proposals would affect Medicare's projected $87 trillion three-decade shortfall, because, obviously, old-age Medicare already pays Medicare for All's lower provider rates.

Some myths are bipartisan, such as claiming that Social Security and Medicare cannot legally run deficits, that most seniors are impoverished, and that retirees collect only as much as they paid into the systems. In reality, those two programs will run a combined deficit of $650 billion this year, senior incomes have soared four times as fast as worker incomes since 1980, and most retirees receive Social Security and especially Medicare benefits substantially exceeding their lifetime contributions.

Another myth is that the Social Security trust fund contains real resources to pay benefits—or would have if politicians had not "raided it" for other spending. Some claim that long-term Social Security and Medicare projections are just guesses, even though their retirees already exist with benefit formulas set in law; or that we can shield everyone over age 50 from reform, even though that window closed 20 years ago.

The media often encourage fake solutions and deficit denial. Bloomberg has hyped the mathematically impossible free-lunch fantasy that billionaire taxes can fix Social Security. Not surprisingly, it proved popular. Leading media organizations criticize runaway deficits but then respond to even modest proposed spending cuts with apocalyptic coverage of families who supposedly will be driven into destitution if their Social Security benefits grow at a slightly reduced rate or their Medicare co-pays rise by a few dollars.

Back to Reality

Our fiscal lies and myths reflect motivated reasoning because we refuse to confront the inevitable tradeoffs for Social Security, Medicare, and middle-class taxes. I have briefed dozens of lawmakers and some top presidential candidates. They are aware that the untenable fiscal situation is heading toward a painful reckoning. But most simply refuse to discuss it publicly—and some even demagogue political opponents who try to address it—because they admit that the brutal politics of deficit reduction leave them no choice.

And for that, the voters are to blame. We oppose real deficit reforms in favor of "one cool trick" gimmicks. We make self-righteous fiscal demands that are incoherent, contradictory, and reckless, such as simultaneously calling for a balanced budget, higher spending, and no more taxes. We vote for Santa Claus candidates of both parties who promise a free lunch and reject candidates who acknowledge fiscal tradeoffs. We blame the other party for deficits and savage any politician who dares to propose real reforms. Ultimately, we are the reason that admittedly craven politicians won't risk addressing our looming fiscal insolvency. And we will eventually pay the price.

It's time for voters and politicians to confront some inconvenient truths. Washington has promised substantially more spending than the economy and tax system will be able to deliver. There is no easy solution that everyone missed or that politicians are hiding from you. Washington cannot continue its current course toward a debt of 200 percent or even 300 percent of the economy. The financial markets will surely not be able to lend us between $120 trillion and $150 trillion over three decades at interest rates of just 2 percent or 3 percent. We do not know precisely when the financial markets will tap out and demand unaffordable interest rates, creating a vicious circle of rising debt and interest rates. But that day will almost certainly arrive unless Congress acts.

Here's the painful reality for Republicans: You cannot stabilize the long-term debt with tax revenues remaining at 18 percent of GDP. Federal spending is headed toward 32 percent of GDP, due to 74 million baby boomers retiring into Social Security and Medicare, rising health care costs, and debt interest expenses. You can't simply cancel those costs. Nor can you more aggressively eviscerate popular programs just to honor a pledge to spare millionaires, billionaires, and corporations from one dollar in new taxes. Everyone must contribute. The most ambitious-yet-plausible conservative reforms would limit long-term spending to 23 percent of GDP, which in turn requires revenues of 20 percent to stabilize the debt. This means ambitious reforms to Social Security, Medicare, and defense, as well as new taxes. Every year of delay leaves the debt larger, interest costs higher, and aging boomers less able to absorb reforms—forcing a more tax-heavy eventual solution. Seek a compromise now, not later.

Here's the painful reality for Democrats: You cannot chase spending heading to 32 percent of GDP with taxes. Even maximizing every tax-the-rich policy is not close to enough. Nor could deep military cuts or Medicare for All make a major dent in deficits heading toward 14 percent of GDP. Furthermore, middle-class families will not accept their taxes doubling merely to ensure that wealthier baby boomer retirees can continue to collect Social Security and Medicare benefits far exceeding their lifetime contributions. Nor is it "progressive" to squeeze every remaining progressive funding priority and soak up all plausible upper-income taxes simply to subsidize often-wealthy seniors.

And the reality for both parties: You need each other. You need to put all spending and taxes on the table to achieve the required savings, and you need each other to provide the necessary political cover. No party is strong enough to muscle through a partisan, one-sided austerity solution and then survive the brutal partisan onslaught that follows. The political model is the 1983 Social Security reforms, where both parties held hands, jumped together, and were overwhelmingly reelected.

The most important reform variable is the voters. Lawmakers will not act as long as they fear that even discussing deficit-reduction proposals will provoke a furious backlash. For decades, we've been warned that a debt crisis is coming after the boomers retire. With budget deficits exceeding $2 trillion and likely surging past $3 trillion within a decade, does anyone care to stop it?

This article originally appeared in print under the headline "The Debt Lies We Tell Ourselves."

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Donald Trump has The Final Solution… A repudiation of, or default on, the national debt! BankTrumpcy has worked for Him; Why not for us?

https://www.thebulwark.com/p/why-trump-wants-u-s-to-default-on-debt

Why Trump Wants U.S. to Default on Debt

BUTT… He blathers out of both sides of His Mouth actually…

https://www.cnn.com/2016/05/09/politics/donald-trump-national-debt-strategy/index.html

Trump: U.S. will never default ‘because you print the money’

https://www.nytimes.com/2016/05/07/us/politics/donald-trumps-idea-to-cut-national-debt-get-creditors-to-accept-less.html

Donald Trump’s Idea to Cut National Debt: Get Creditors to Accept Less

WHOA, twat will THAT do to the "full faith and credit" of the USA fed, and peoples' willingness to buy more bonds?

CNN, the NYT and The Bulwark. It’s a Nevertrumper hat-trick.

So Trump never said twat He said? Is THAT shit? Have You PervFectly been personally monitoring every absurd word Trump hath spoken, during His Entire Life?

Twinsies!

SQRL, Jeff, or Sarc? Who was just taken down by the Secret Service?

Funny how one side proposes actual solutions, is blasted as evil by the other side and their propagandists until they stop trying and this retard comes up with "both sides". Fuck off with that crap.

WHICH side proposes actual solutions!?!?!? And WHAT are these “solutions”? READ my above posts to see that shit is NOT The Donald that is proposing them!!!

(The Donald and "Team R" supposed solution is largely the EXACT same as the Demon-Crap "solution"... Blame the other team!!! Fool the voters!!! The latter part IS actually "working"! At getting votes, at least...)

Republican-side whos actual platform proposes the USA actually obey the US Constitution (the very definition of a USA).

And if you can't see one side doing a far better job than the other on that you've got a major case of TDS. Which everyone but you already knows.

The below proposals are actually obeying the US Constitution?

Donald Trump has The Final Solution… A repudiation of, or default on, the national debt! BankTrumpcy has worked for Him; Why not for us?

https://www.thebulwark.com/p/why-trump-wants-u-s-to-default-on-debt

Why Trump Wants U.S. to Default on Debt

BUTT… He blathers out of both sides of His Mouth actually…

https://www.cnn.com/2016/05/09/politics/donald-trump-national-debt-strategy/index.html

Trump: U.S. will never default ‘because you print the money’

https://www.nytimes.com/2016/05/07/us/politics/donald-trumps-idea-to-cut-national-debt-get-creditors-to-accept-less.html

Donald Trump’s Idea to Cut National Debt: Get Creditors to Accept Less

I know that even though you are functionally retarded, even you know that the NYT is grossly misrepresenting here.

TDS firsthand. What a treat.

Care to make a point beyond your own Obsessive Compulsive Disorder on Trump?

WHICH side proposes actual solutions!?!?!?

The Modern Monetary Theorists who control the Democratic party.

Half the country has a negative federal tax rate. They don’t have to pay the debt so they don’t care about it.

A big portion recieve direct funds from the debt, they don’t care about it.

Keynes was pushed as the debt not mattering, and democrats don’t care about it.

Democrats have implemented federal groups like the STL Fed to lie about it, and propaganda works. Or things like Obama closing open air monuments over a 1% spending reduction. Creating a state dependency om federal dollars. Debt is part of the Democrats platform.

Media has helped democrats demonize anyone who wants to cut debt as pushing austerity and wanting to kill grandma. So they don’t want to kill grandma.

Lastly the marxist groups advocate and desire a collapse of the country so they openly advocate for the destruction advertising a great reset. This has been discussed in the comments here for decades but is largely ignored or even supported by media and journalists.

"openly advocate for the destruction"

Indeed. Well Said +10000000.

The only logical solution is to destroy the Marxists. Much as one would deal with a rabid animal. There is no saving them. There is only saving us.

Time to end Marxism in America.

Yes, and add to that the fact that a large part of this 'debt' goes straight into the pockets of the electorate and you can easily see why they don't care about said debt. To them, it isn't debt it's income.

It's well fucking known this is the major downside of Democratic nations, and it's been a critique for literally thousands of years now, so to act surprised is to be wholly ignorant of just about anything that actually matters.

And the bill for the debt will go to people who can't vote yet. Neat trick for a democracy....

Except Keynes said the government should run a deficit when the economy is struggling, and a surplus when the economy is strong. They always seem to forget the surplus part. When the economy is surging, the government spends even more, because there is no need for austerity. And when the economy is weak, they say now is not the time to try austerity.

Spend, really SPEND MORE, is the only mandate they have.

Except Keynes said the government should run a deficit when the economy is struggling, and a surplus when the economy is strong.

And the Republican mantra has always been the need to lower tax rates (running a deficit since they won't cut spending) when the economy is struggling, but then they want to "give back" to the people by lowering tax rates when times are good (again running a deficit because they won't cut spending). They justify all of that with Laffer Curve, supply-side nonsense that never reflects reality.

The question still remains: How do we get politicians to act on intelligently crafted policy instead of economic fantasies?

All tax cuts are good.

Fuck you, cut spending.

Tax revenues go up after tax cuts. If they froze spending increases, not even a cut, deficit would drop to zero in around a decade.

Funny how you morons always miss that part.

Tax revenues go up after tax cuts. If they froze spending increases, not even a cut, deficit would drop to zero in around a decade.

Funny how you always miss that an assertion like that requires evidence. Of course, if you're saying that a tax cut coinciding with a growing economy can still produce an increase in revenue despite the rate cut, sure. That has happened. But try proving the supply-side/Laffer Curve argument that cutting taxes essentially pays for itself with the stimulating effect of the lower tax rates.

Youre referring to what he actually said. Not how Dems interpet him.

Then there’s the fact that after events like the 2008 bailout, those on the right don’t trust the federal stage Republican politicians to keep their austerity promises the moment they cause problems for them or their banker and real estate buddies.

Addendum- And how the old establishment pubs treated the Tea Party.

I thought TARP was terrible. But at least it ended deficit neutral because they forced the repayments.

Keynsian economics needs to be tossed into a dumpster and burned along with keynes himself.

Half the country has a negative federal tax rate.

Not when you include payroll taxes, gas taxes, and others.

See Table 1 here from The Tax Foundation.

It estimates the total federal tax burden per household in the lowest quintile to be $1248 in 2019. Add in state and local taxes, and people living in poverty are still paying thousands a year in taxes. They might also get benefits from the government in excess of that, from food stamps, Medicaid, welfare, and so on, but they still pay the same sales tax as everyone else, gas taxes when they fill up a car (if they have one), and more.

State federal taxes. Include state and local taxes. Yeap. Youre fuckjng retarded.

We already know all your retarded talking points. Should we add in the state and local spending as well dumbass?

oure fuckjng retarded.

And you, apparently, don't proofread.

What is your point? Besides ranting about how you think the bottom half is not paying enough federal taxes (which, as I pointed out, is not negative when all federal taxes are included for all but the poorest people). I referenced state and local taxes at the end of my response to point out that people are still paying some taxes regardless of their income level. The idea that there are millions of people sitting on their asses letting the government take care of them is just in the imaginations of people that don't like paying taxes themselves.

The collapse is inevitable.

Why bother?

This perhaps expresses why this country continues into increasing debt, people have given up. No politician will seriously take on the issue because of the danger of losing one's position. So where do you go if the people you elect will not address the problem?

I wouldn't say people have given up. They were sold the idea that [WE] gangs could legally/legitimately go out and STEAL and ENSLAVE and it was a-okay.

They were sold their own destruction by the Democrat Party that [Na]tional So[zi]al[ism] would make all their ?free? pony-ride dreams come true.

Yeap. Not a single politician.

https://www.cbpp.org/research/federal-budget/trumps-2021-budget-would-cut-16-trillion-from-low-income-programs

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5468112/

https://www.nbcnews.com/politics/donald-trump/trump-floats-cutting-retirement-spending-drawing-quick-pushback-biden-rcna142776

https://rollcall.com/2021/01/12/white-house-readying-last-minute-27b-spending-cuts-plan/

https://www.forbes.com/sites/joshuacohen/2024/03/12/former-president-trumps-history-of-proposing-cuts-in-medicare-spending/amp/

https://apnews.com/article/donald-trump-ap-top-news-elections-politics-election-2020-32b2fd53ef9a547c8ca7a920c2ee7c43

Trump would be a lot better than Biden/Harris/Newsom/Whitmer/TBD, but he’s not exactly the poster child for fiscal austerity.

Rand Paul had a reasonable plan to balance the budget back in 2016. Republican voters mostly ignored him in the primaries.

Gary Johnson had a reasonable plan to balance the budget in 2016 as well. American voters mostly ignored him in the general election, because they hated Trump or Clinton so much.

Neither plan would be effective now, because federal spending increased by 50% in just 5 years.

If we ignore congress and their role, then no, there is no model that will satiate you.

And with the Impoundment Act, there is very little a president can do in isolation.

That's exactly right. It's not that people don't care; they just realize that nothing is going to be done about it. Time to buckle in for the collapse. At my age, I'm hoping to die of natural causes before it happens.

Not only that, but "collapse" ain't so terrible. It just means a lot of wealth people thought they had doesn't exist. The real assets and real income potential continue.

If you survive.

"Why are we no longer responding to soaring debt and its economic consequences? While there are many factors" ... blah, blah, blah ...

the most important factor is:

A USA conquered and consumed by [Na]tional So[zi]alist mentalities.

‘Social’-ist Security in the USA ….. Common people; what the F did you think was going to be the result of that???? Not like history doesn’t tell us that over and over and over again yet people just keep falling for it out of their own ignorance, greed and stupidity.

You can’t start [WE] identity-gang building for ‘armed-theft’ and expect to maintain a civil, peaceful, prosperous and free society. ‘Guns’ don’t make sh*t. Their *ONLY* human asset for all members of a nation is to ensure Liberty and Justice for all.

I can’t imagine that anyone read all that.

Did he include the automatic benefit cuts in social security when it depletes the imaginary trust fund? I have no doubt that politicians will lean heavily into that.

Does medicare have similar provisions?

Medicare is a lot easier to cut without saying you are cutting it. People notice immediately if their pension is cut, and almost as fast if they don't keep up with inflation.

Medicare pays doctors and hospitals, not patients. Pay 10% less to them, and they look like the greedy bad guys for telling patients to make up the difference or refusing to cover certain procedures.

It's the third party problem all over again.

Medicare is not easy to cut due to the benefits. Joe is even trying to expand the totality fo what is covered. Likewise hospitals and providers already cost shift underpayment to private plans. Medicare pays about 92% of the cost making insured coverage cost around 120% of costs.

Cuts there just get taken up with the costs of government mandated private insurance.

For those cuts to be realized government has to get out of the medical industry completely.

government has to get out of the medical industry completely.

Not a chance in Hell of that happening.

But it's the only chance of surviving the mess.

Once upon a time before 'government' healthcare doctors came to the door for the prize of a pizza. Only 'government' and its 'Guns' can manage to STEAL 100-Times what actual free-market value is worth.

Cutting SS benefits will be a non-starter politically. Old people vote. The government will just borrow more to keep them at the existing levels.

I sure didn’t read even half of it. And having seen these sorts of articles my entire adult life, didn’t need to read it.

Why Did Americans Stop Caring About the National Debt?

Because we successfully managed to eliminate all the pain associated with carrying it. Without pain there is no motivation to act to change what is causing it. When the pain happens, it may well be too late but before then it will be too early.

National Debt as a % of GDP

Aah. The perpetually useless measure. Public/govt debt as a % of GDP may have been a useful measure when govt debt was distributed through the post office to individual citizens via savings bonds. But now the broker-dealers who buy all the debt (and distribute it on) are also the entities issuing mortgages, writing derivatives, financing global trade, selling corporate debt for equity buybacks and mergers, etc. Those companies have a very specific view of govt debt and that is the ONLY view that matters. Govt debt is a small portion of total debt to GDP. Total debt is over 700% currently.

To the degree that we, as citizens responsible for govt debt, want to govern the decisions to issue new govt debt – we should be focusing more on the marginal productivity of debt. How much incremental debt in a particular year is being used to create how much incremental GDP (as a measure of total productivity)?

Back in the 40’s when govt debt was about the same % of GDP as now but non-govt debt was almost non-existent – one dollar of debt created a bit less than a dollar of new income. That is an environment where issuing debt is hugely productive – encouraging it via tax deduction or issuing directly. Today one dollar of new debt creates less than 10c of new income. That is unproductive (unless the public policy goal is to subsidize the FIRE sector). Debt should be discouraged now – both govt and private (though the size of those icebergs indicates that private debt should be the main focus (via eliminating tax deductions).

Because we successfully managed to eliminate all the pain associated with carrying it.

Examples please.

Many of them are above. Govt debt is the 'risk-free asset' at the base of the entire financial sector. They cannot grow (increase their own debt) without demanding more govt debt as reserve/collateral. It also provides a secondary market for govt debt.

The SS trust fund jacked up demand for govt debt for most of the last 40 years as those increased FICA tax revenues could not be used anywhere else and spending control was eliminated since that debt HAD to be issued.

Even the little stuff of eliminating the post office and savings bonds as a way of issuing/distributing debt. Wouldn't have made a big difference but it did eliminate any buy-and-hold (non-market) demand and any alternative channel to the market maker NY Fed operations

Reserve currency status requires permanent trade deficit (= currency surplus by simple bookkeeping) which in turn kills manufacturing/exports and subsidizes FIRE sector. Making that friction-free was the main impetus behind the 'free trade' post-GATT stuff. Friction free means that multinationals can treat global supply chains as just different accounting entities - while small companies get blindsided. The combo increased foreign demand for dollar-denominated bonds - and perversely the incentive for 3rd world to issue their own debt in dollars. Any trade in dollars is gonna be based on US govt debt.

These were not decisions specifically made for the purpose of reducing pain associated with carrying debt. But that was their effect.

Hell - for more than a decade post 2008, we bailed out the banks in order to save them to issue more mortgages. At zero interest rate - we added $13 trillion of debt and assumed it would cost zero - forever.

I'll add federal monetary policy as another topic youre clueless about.

So, as usual, you can't refute him and follow up with a useless comment. Never change.

After six major deficit reduction deals and a temporary revenue surge finally brought balanced budgets from 1998 through 2001, triumphant lawmakers shifted the debate to how to spend $5 trillion in projected (and, in retrospect, fake) 10-year surpluses.

Telling how since the 80s only two presidents have actively sought fiscal sanity and they were both Dems - Clinton and Obama.

Give Obama credit for turning a $1.3 trillion deficit into one less than $500 billion until Fatass Donnie blew it up again even before Covid.

(Boehner gets an assist)

You are a pedophile.

US Deficit per year

2008 $459 Bush

2009 $1,413 Obama

Give Obama credit for turning a $459B deficit into $1.4T

Then give a full-majority [R] congress credit for getting it back to $500B.

There. Fixed that for you so you didn’t sound like such a raging partisan-shill complete idiot.

Oh; Almost forgot....

And give Trump credit for keeping that deficit under $1T until a [D] House majority blew it up again to $3T and DOUBLE-DIPPED ~$3T with Biden and went on and kept it OVER $1.4T consistently.

Quit making shit up, Jesse.

CBO called it while Dubya was still president

https://www.nbcnews.com/id/wbna28539403

Jan. 7, 2009, 9:25 AM EST / Source: The Associated Press

The federal budget deficit will hit an unparalleled $1.2 trillion for the 2009 budget year and the U.S. economy will likely contract by more than 2 percent, according to a new Congressional Budget Office report.

Jan 7, 2009, numbnuts.

Obama signed FY09 you retarded lying fuck. Reid and Pelosi wrote it, Bush refused to sign it.

https://www.reuters.com/article/us-usa-budget/congress-sends-last-2009-spending-bill-to-obama-idUSN1054411920090311/

https://www.nytimes.com/2009/03/12/us/politics/12earmarks.html

The deficit was ALREADY going to be $1.2 trillion by the time he was sworn in, moron.

Source - CBO.

Definitive.

The Bushpigs didn't even put Iraq war spending in the budget. They were worse than it looks now.

Stop lying Kiddie Raper. The democrats have always fought to bankrupt America. They have always fought for higher deficits.

Because of congressional bills written by who you dem defending retard?

The Bushpigs didn’t even put Iraq war spending in the budget.

Buttplug swears he's not a "Bushpig", but he'll shill for Biden, the Iraq war's biggest Dem supporter, speak lovingly of the Cheney's, Romney and McCain, and eagerly quote neocons like Kristol and Frum.

Meanwhile, the only president since, who at the time spoke out publicly against the Iraq war and campaigned on a platform against it, is who Buttplug is trying to attack with Iraq,

Pluggo was always a Bush-tier warmonger.

Obama was the only POTUS who consistently disavowed the Iraq War.

Fatass Donnie supported it in the beginning. Heard him on Stern.

Yeah. Obama was anti war. Ask Afghanistan, yemen, syria… lol.

Amazing politician whose first comments on it were 2008. So stunning and brave to talk against a war many were against.

He even kept the Iraq war going until 2015 lol.

Im the og ML! You're like Vermont maple syrup.

Your Obama lie has been refuted hundreds of times here shrike. He used the return payments from TARP as revenue, he signed FY09, he implemented ACA and medicaid expansion which is a huge driver of current deficits.

But youre not a Democrat.

You didn't refute the CBO, you ignoramus.

The ACA didn't even pass for two years. Your two Team Red guys were terrible on deficits (so is Joe).

Clinton and Obama cut deficits.

Did Bush sign FY09? Who wrote FY09? Who signed FY09?

No. Reid and Pelosi. Obama.

Youre such a lying leftist piece of shit.

CBO does projections on revenue and proposed spending bills. Your cite is literally stating what the proposed DEMOCRAT spending was as being estimated for the deficit. With Obama telling people he old sign it.

Youre such a moron shrike. Lol.

You don't know the difference between "budget" and "actual".

I will try again. Who wrote the budget? Who signed it?

God damn youre fucking retarded.

CBO predicts MASSIVE deficits because Democrats won the election.

Nobody but you is trying to refute the CBO ignoramus.

And again Obama didn't cut deficits AT-ALL. Even if you wanted to pretend Obama gets all the credit for what a full [R] congress did the only deficit cutting that happened HE DID.

You're trying to sell the idea that Obama MASSIVE 1st year deficit is all Republicans fault (where ironically not a single [R] majority in anything but a [D]-trifecta) but his [R] loaded congress correction was somehow his 'good'.

You wouldn't sound nearly so stupid if you stuck with just Clinton on the numbers. Course Clinton had a fully loaded [R] congress as well short his very 1st year which was also the very worst year.

Obama even shut down monuments refusing to cut. Every budget he proposed to Congress was 1T more than they signed.

Shrike is a fucking retard.

The core problem is fiat money. Real money, gold and silver, cannot be printed at will, and borrowing is a lot more obvious and hard to do.

STOP PRINTING MONEY.

If you want pathetic "not my fault" answers, I've got some of them too.

The numbers are overwhelming. Someone who owes $1000 credit card debt and is only paying it down at $50/month may feel like the debt is terrible, but he can see the end in two years, and he can understand skipping one movie or restaurant dinner a month to speed it up. Someone owing $50,000 or even $10,000 in credit card debt sees no way out, and gives up. It's a very human reaction, no matter how stupid it is. Bankruptcy seems like a pretty good deal, all things considered. It's especially so when the debt was not from just buying too much luxury, but from a real emergency, like a dead car or hospital bills. Or bailing out banks, overseas military "help", the homeless "crisis", the climate "crisis", all these existential threats.

And targeted benefits which no one is interested in giving up when they see so many other people keeping theirs, and distributed taxes paying for them.

If Congress were "printing" the money they wouldn't need to borrow it and there would be no debt.

Anytime someone bleats out MONEY PRINTER GO BRRRR! I know that person is an economic ignoramus.

Fucking idiot. You don't even know how they print the money they loan out.

A few years back you posted kiddy porn to this site, and your initial handle was banned. The link below details all the evidence surrounding that ban. A decent person would honor that ban and stay away from Reason. Instead you keep showing up, acting as if all people should just be ok with a kiddy-porn-posting asshole hanging around. Since I cannot get you to stay away, the only thing I can do is post this boilerplate.

https://reason.com/2022/08/06/biden-comforts-the-comfortable/?comments=true#comment-9635836

"Fucking idiot. You don’t even know how they print the money they loan out."

Buttplug actually once tried to claim that fluctuations in precious metals were evidence that inflation was going down.

He has also claimed he made $400 K trading.

I don’t even think it was trading. Didn’t he claim to “forget” about an account with 1k in it and by the time he checked on it again sleepy joes supercharged economy blew it up to 400k with zero effort?

Sounds reasonable.

Yeap. Thats what the act blue retard said.

That was AmSoc, you degenerate liar.

I thought he made that in interest of of 300$ in grandmas birthday cards and couch change.

https://www.cnn.com/2016/05/09/politics/donald-trump-national-debt-strategy/index.html

Trump: U.S. will never default ‘because you print the money’

Yes, the King of Debt is an economic ignoramus.

In theory Fatass could make good his promise to ambush the Fed and do that though. I mean he wants to be dictator.

"Asked specifically about Trump’s remark that the U.S. will never default on its debt because it can always print more money, Norquist said: “Well, that’s just stating a fact. It’s what the United States government has been doing for quite a number of years is printing more money.”

CNN deliberately misrepresented Trump's statement, and you two clowns bought it.

This is what happens when you're too stupid to read an article past the lede.

Taxation via MASSIVE inflation, Moose-Mammary! Did Trump point THAT out?

Moose-Mammary-NecrophiliaFarter-Fuhrer says shit's OK to do shit if shit is twat we've ALWAYS been doing... A flavor of twataboutshitism... LOOK ovary there at twat THEY are doing!!!! THEY put their grubby little mitts in the cookie jar FIRST!!!!

Butt, whatabout that them thar whatabouts? Whatabout Hillary? Whatabout OJ Simpson?

How many brain cells does it take to run a socio-political simulation on the following:

Judge and Jury: “Murderer, we find you guilty of murder! 20 years in the hoosegow for YOU! Now OFF with ye!”

Murderer: “But OJ Simpson got off for murder, why not me? We’re all equal, and need to be treated likewise-equal!”

Judge and Jury: “Oh, yes, sure, we forgot about that! You’re free to go! Have a good life, and try not to murder too many MORE people, please! Goodbye!”

Now WHERE does this line of thinking and acting lead to? Think REALLY-REALLY HARD now, please! What ABOUT OJ Simpson, now? Can we make progress towards peace & justice in this fashion?

(Ass for me, I think we should have PUT THE SQUEEZE on OJ!)

Answer one simple question: How does the federal government increase the money supply except by printing it?

Or are you trying to pretend you're clever by claiming that "printing money" is shorthand for "creating money out of thin air by adding it to computer accounts"?

You are a pedophile.

Don't confuse the Federal Reserve with Congress.

The Fed loans to the Treasury. Dollars or gold - doesn't matter. Your "remedy" is simpleton-think.

Your distinction has no difference.

You are a pedophile. Guess you don't understand which differences matter and which are merely cosmetic.

How does the federal create currency you retarded fuck?

Perfectly shown by the student loans conversation. Where even people making 150k a year refuse to pay them back and ask for forgiveness.

STOP PRINTING MONEY.

Or at the least, abolish the Fed and start following the Constitution by issuing money directly from the Treasury. The compound interest trap of using Federal Reserve "dollars" for money makes it impossible to ever retire the debt.

Your trust in Congress is naive. Congress should never be trusted.

Should an Independent Fed board be trusted? At least they can't vote themselves or their constituents payola.

The Treasury is part of the executive branch, not the legislative.

Even worse.

Trump would be larding up all his donors.

Lol. "Independent"

Fuck off.

Similarly, Medicare for All is more of a talking point than a serious savings proposal. Bills from Sanders and Rep. Pramila Jayapal (D–Wash.) promise nearly impossible efficiency savings yet fail to specify any new provider payment system to achieve them.

Thankfully Biden killed off this monstrosity once and for all. The progs don't even piss and moan about it now.

You are a pedophile.

Said the Denny Hastert conservative.

Said the non-denial.

Said the Anthony Weiner / Jeffrey Epstein / Bill Clinton Democrat.

You are trash

I mean he literally campaigns on expanding medicaid. So just a different flavor. Lol.

https://www.whitehouse.gov/briefing-room/statements-releases/2023/12/01/statement-from-president-joe-biden-on-north-carolinas-implementation-of-medicaid-expansion/

Medicare for None would save a lot more money.

Keep Medicaid, for the people who are truly needy.

Jan 6 = 9/11

Wait, shouldn't at least one person have died?

One person did die.

2 were killed by cops. East tunnel women beaten then they blamed an Adderall overdose.

Obviously, the problem is not enough DEI initiatives in our major institutions.

Anyone complaining about the debt is a racist anyway because quantitative emphasis is a symptom of white supremacy.

(sarcasm.... because who the hell can tell anymore)

Arithmetic is white supremacy.

In all seriousness, this is the root of the problem… an erosion of cultural values.

The Smithsonian exhibit that labeled basic common sense traits such as logical reasoning and hard work as features of “whiteness” (and, by extension, white supremacy) is an extreme example. The entire concept is asinine, but there are a lot of people out there that take that shit serious and as gospel.

Even on the more mundane side though, concepts like delayed gratification and merit have become nearly obsolete. Voters simply don’t care about or can’t grasp the reasoning behind the need for fiscal sanity.

Politics ain’t gonna fix it, but it will certainly make it worse.

And at the rotten core of the post-modern DEI root is the concept that a person's feelings are more important than facts, or actually that feelings ARE facts.

So if a nitwit like AOC feels something hard enough, it must be true. And similar nitwits in the captive media spread and reinforce that "truth".

The pervasiveness of leftist ideology definitely exacerbates the issue, but it goes well beyond that. There's absolutely no stigma associated with debt even on a personal level. Credit cards, student loans, car notes... it's almost a point of pride to owe a lot of money. People just don't give a shit anymore.

Can you link to that Smithsonian exhibit?

This is why you're retarded. So intellectually lazy. 5 seconds to find.

https://www.newsweek.com/smithsonian-race-guidelines-rational-thinking-hard-work-are-white-values-1518333

https://reason.com/volokh/2020/07/22/its-getting-harder-and-harder-to-distinguish-satire-from-earnest-wokeness/

Volokh did a blurb on it a while back.

Thanks

Looking at it. Those are clearly cultural values (not universal one) and place-specific. I lived in multiple countries where those values are alien. Which means that immigrants would have to learn them.

I think it is silly as hell to attribute them to 'race' or to pretend that the values exclude non-white Americans. But it doesn't surprise me that hustlers will do exactly that. Virtually all other non-white Americans will understand that these values are how the US works.

And white Americans should get a lot less defensive about this

WTF?

Not get defensive about universal core values that underly our free and prosperous society--even for non-whites? Let's see what you seem so unconcerned about:

Individual rights

The importance of family, especially with two parents

Actual science, i.e. objectivity, math, and logic

Work ethic

Using time and schedules

Property rights

Healthy competition

Making decisions and taking actions

Written communication

Politeness(!!!)

Those are NOT universal core values. They are place-specific cultural values. Here's a country comparison chart for six factors (power distance, individualism, motivation toward achievement/success, risk avoidance, long-term orientation, indulgence) - which are related to the specific values you selected. This company consults with managers who are running businesses in foreign countries - who are managing locals in an environment that is foreign to the manager. I picked four countries at semi-random (Brazil, Egypt, Japan, US) so you can see a difference.

If you ever live overseas you will immediately understand this. If you only live in the US, then of course you will see all US-specific values as universal because that's all you're ever seen. Americans in particular are not very good at recognizing cultural differences because, in the last 30 years or so, the world speaks English more than we speak any other language. So they adapt to us rather than us to them.

"And white Americans should get a lot less defensive about this"

Most of the reactions I've seen to this have been more of bewilderment or ridicule, and those getting what I'd describe as defensive about it tend to not be white (understandably so).

"If the system is to be kept afloat, Social Security's eligibility age must rise, its benefit growth formulas must be significantly curtailed for above-average earners, and its taxes may need to rise too."

Or we could just let the social security system pay out only what it is able to after 2034. IOW, take the approximate 20% reduction in payouts that will be required in 2034 and leave the rest alone. There is no need to force some people to work longer or to

refashion SS into a welfare program. The amount of the reduction needed in 2034 could be ameliorated by trimming the cost of living increases in the years leading to 2034, so that by 2034 a smaller reduction would be necessary.

It does no good to create more BS, just meet the challenge head on.

That's a band-aid. Abolish Social Security and replace it with a means-tested welfare program for the elderly. We can't afford to keep sending SS checks to affluent people who would barely miss them.

If we’re going to cheat the people who paid in for decades then we need a punitive tax in those who voted democrat, as punishment.

Disagree. People would still plan to retire broke for the free money.

You'd still be incentivizing people not being responsible for their own lives.

That's ridiculous. People would still have a great incentive to be able to live better in retirement than they would be able to on the "free money" alone. No one wants to be poor in their old age just because it's easier.

Are you talking about the same people and the same incentive to work both smarter and harder NOW, for a better life? Or do you expect grifter idiots to think about there far future more rationally than their present day?

No, I don't expect "grifter idiots" to plan for the future, nor do I think they're a large portion of the population, nor would their behavior be affected by their old age pension coming from a means-tested welfare program rather than Social Security.

As seen by the average retirement account being under 50k lol.

Have you ever met people? Do you know what the current outstanding credit card debt is?

And switching from Social Security to a means-tested welfare system for the elderly would have no effect on any of that. It would just end sending SS checks to affluent people who would be fine without them.

And instantly kill broad support for SS. Most people are NOT ready for another federal wealth redistribution plan.

Are you serious? The U.S. is the most easily gamed cash equivalent welfare state in the world. If all the public housing favelas are Yes In My Backyard then standards of living, at the margins, are negligible. This is why Britian is a fucking leftist disaster zone.

Gibberish.

There are already means tested welfare programs. No need for a new one just for old people.

Shut down the SS Ponzi scheme, sell off any remaining SSA assets, and distribute the proceeds to the victims in proportion to what they paid in. If it's 5 or 10 cents on the dollar, at least it's something, and the scam would finally end, freeing people up to invest their own money in more lucrative private investments, or to spend it when they are young and struggling, instead of forking it over to wealthier retired people living at leisure.

There are already means tested welfare programs.

No, there's not. General relief payments for people without dependents disappeared decades ago. Even then, the payments were very small—not enough to survive on.

Every single state has programs that places elderly people under the care of the state. You don't get the most luxurious accommodations, but you're not tossed onto the street either.

Bullshit.

The only way to reduce the debt is new spending!

I have not suggested any new spending.

Just more wealth transfers.

Nope. I'm suggesting LESS wealth transfer.

You’re sort of right. Some of the democrat states throw the elderly out in the street in favor of housing illegals. They just did that to at least one elderly disabled vet in NY.

Please link to the program in just one state, any state - - - - - - -

He's probably referring to Medicaid paying for skilled nursing home care for the indigent, which has nothing to do with age.

https://www.aarp.org/aarp-foundation/our-work/income/public-benefits-guide-senior-assistance/

Has every state listing in there.

Good. You spend the next couple of days reading 50 PDFs and post your summary on Tuesday.

It is not a band-aid to live within our means. It is how we avoid the very problem the OP wrote about.

When means testing, will you consider whether a person is able to work? How much one has saved?

"From Each According to His Abilities, to Each According to His Needs” is Marxist tripe. It is not the basis for a sound economy as it encourages "need" and discourages working to ones abilities.

Think. Where are we now? You're speaking as if we're starting from Libertopia and I'm proposing a welfare program. I'm suggesting what would be better than where we are now with the current Social Security system.

Where are we now? We are living in the supposed Great Society. But it ain't that great, and in fact it will bleed us dry. Your solution to create more welfare is exactly the wrong approach and is impractical to boot. You're acting as though it is 1964, the USA is riding high, and we can (supposedly) afford more welfare.

Good luck convincing a large portion of the population to give up their benefits so that a few will continue to receive full payouts. It would be a far easier sell, and more equitable, to give certain percent reduction across the board so that the system survives.

"The reason is that current fiscal policy is not sustainable and forward-looking financial markets know it."

Yet lenders continue to lend, presumably with the expectation of being repaid, with interest. What do they know that we don't?

As to why Americans aren't concerned about the debt, well the crisis lies ahead in the future. When the future comes, either a bout of hyperinflation or default will erase the debt. Haven't these always been the time honored solutions to dealing with unmanageable debt?

The lenders (the people buying Treasuries) know that the government will simply raise taxes (or borrow more) to keep paying the interest on the Treasuries.

The smart money will start to avoid long term treasuries and move to shorter maturities, so they aren't left holding the bag when hyperinflation runs amok.

Printing money is not the only way to increase the money supply.

Take a simplified case. A bank simultaneously lends B the money to buy A’s house while the proceeds of the sale are placed in A’s checking account. The money supply – M1/M2 – has increased by the size of the sale proceeds. In practice of course the bank has to get the money from somewhere first, but that can be achieved by reducing reserve requirements – which is not printing money.

You could, of course, expand immigration of children and younger workers to counter the retirement demographic time bomb, but it's too sensible a proposition to be countenanced.

Think of the economic growth, reduced crime rates, and food trucks that would lead to....

SRG2 comes out in favor of child labor.

Nope. Children get educated, then as adults enter the workforce.

After we've gone to great expense to raise and educate them. While we have historically low labor participation rates in this country. Fucking brilliant.

Why do we have low labour participation rates? And what is the participation rate for younger workers and immigrants?

And, finally, what is the net revenue benefit fo the Feds of the average individual worker?

Get back to us when you've looked all that up.

So don't fix the pyramid scheme, just find new suckers to swell the bottom?

And child labor? Really?

Where did I say anything about child labour?

And a rejigged social security wouldn't necessarily be a pyramid scheme - particularly when combined with increasing tax revenue.

And if someone proposed that we could let in immigrants provided they paid some large fee, I doubt your opposition to it would be the unfairness to the immigrants.

Opening immigration slots only to the highest bidders might have some merit.

Most of them are already paying as much as $10,000 to the cartels to smuggle them in. We might as well be getting that money.

The opening bids need to be more than $10,000

That wouldn't even cover the payments currently going to illegals.

If you can afford to bid, you don’t get assistance.

Cuz means testing is popular here, right?

Weird as immigrants here legally have higher rates of welfare and assistance than citizens. So your proposal is to increase government spending to higher levels than the current population. Good work shrike. Youre a moron. This is true of Europe as well.

Still not shrike, you lying cunt.

Weird as immigrants here legally have higher rates of welfare and assistance than citizens.

That may or may not be true -- it's not impossible that you're accidentally telling the truth - but it's not the correct point. The point is the overall economic benefit of immigration. If the economic benefits of immigration significantly outweigh the costs of some immigrants being on welfare, etc. then that the rate is higher than for citizens doesn't matter.

https://www.bushcenter.org/catalyst/north-american-century/benefits-of-immigration-outweigh-costs

Now you're either too stupid to realise this, or you know it to be true but are anti-immigration or don't want to concede the point (or both, of course).

The "percentage of GDP" stat is misleading, because government spending is included in GDP! (GDP = C + I + G + NX), where C = consumption, I = investment, G = government spending, and NX = net exports. If Congress spends more, GDP goes... up? When you borrow more, your income doesn't go up.

With GDP at 27 trillion, government spending at 7 trillion, and the national debt at 35 trillion, the debt to productive economy (GDP - G) ratio is 175%.

And that's the wrong way to look at it anyway. The whole productive economy doesn't belong to the government. We should be looking at debt to government tax revenues. With the debt at 35 trillion and government tax revenues at 4.4 trillion, the debt to revenue ratio is 795%. If your credit card balances were 8 times your income, you'd be in serious financial trouble. Unless you ran a counterfeiting operation on the side....

It's none of those reasons. It's because people sensibly understand that problems that are so big as to be intractable should be given a lower priority, while smaller problems are addressed first. That's how most people approach their own lives.

In this case they see that nothing that's on the table would significantly ameliorate the debt problem. Therefore try to take care first of little issues that could be significantly affected, and wait to deal with the debt until a handle appears that could cut it by more than 0.2%. Things have to get severe enough to require a Milei-scale solution before a Milei approach is considered.