Federal Government Will Borrow Another $20 Trillion in the Next Decade

Three things to know about the new Congressional Budget Office report on the growing federal deficit.

During the COVID-19 pandemic, the federal deficit surged to unprecedented, barely fathomable levels: more than $3.1 trillion in 2020 and $2.7 trillion in 2021.

The federal deficit will soon approach those huge figures once more—not due to one-time emergency spending in response to a crisis, but simply the result of the government's routine operation.

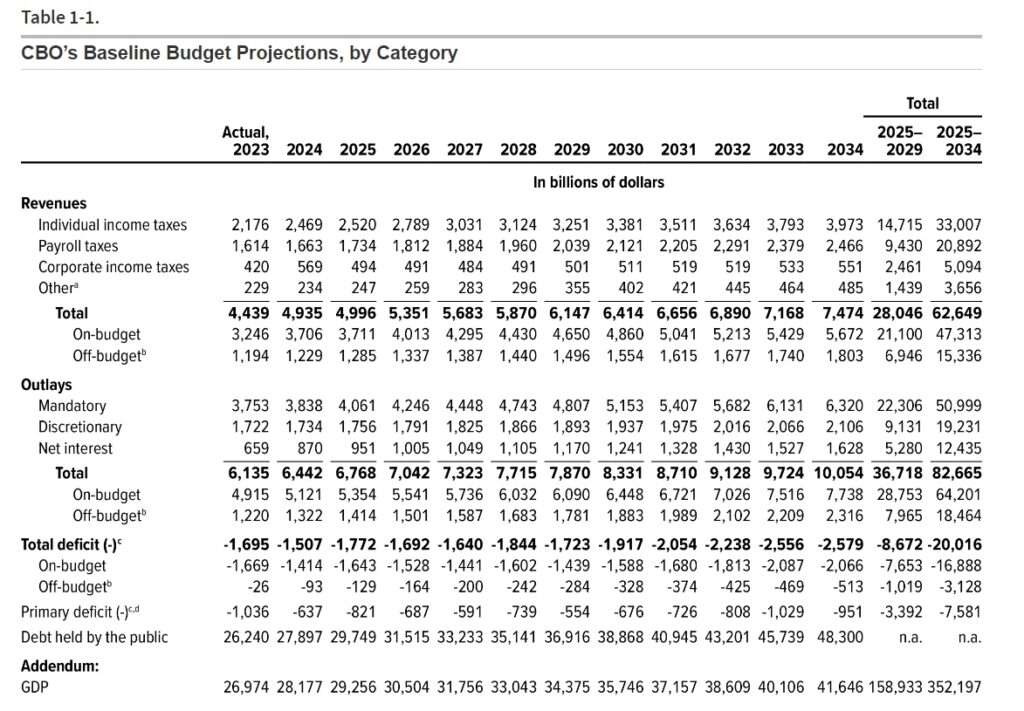

In a new semi-annual forecast released Wednesday, the Congressional Budget Office (CBO) projected that the federal government's annual budget deficit will exceed $2.5 trillion by 2034 if current policies remain in place (and assuming no further emergency spending of any kind, which seems like a stretch). The federal government is on pace to borrow more than $20 trillion over the next 10 years, the CBO estimates.

Here are three key things to know about the new CBO report. First, it demonstrates how too much borrowing in the past will affect the future.

A huge factor driving deficits over the next decade will be rising interest payments on the $34 trillion (and rapidly growing) national debt. As recently as 2021, interest costs on the debt totaled about $350 billion, but that line item is now growing thanks to higher interest rates. The CBO expects interest costs to total $860 billion this year—exceeding military spending—and to reach $1.6 trillion by 2034. At that point, more than a quarter of all federal tax revenue will be directed toward paying the interest on the debt.

"That's 3 months of your federal taxes each year that will not fund a single veteran, Social Security benefit, or highway expansion," Brian Riedl, a senior fellow at the conservative Manhattan Institute and a former Senate budget staffer, wrote on X (formerly Twitter). "What a waste."

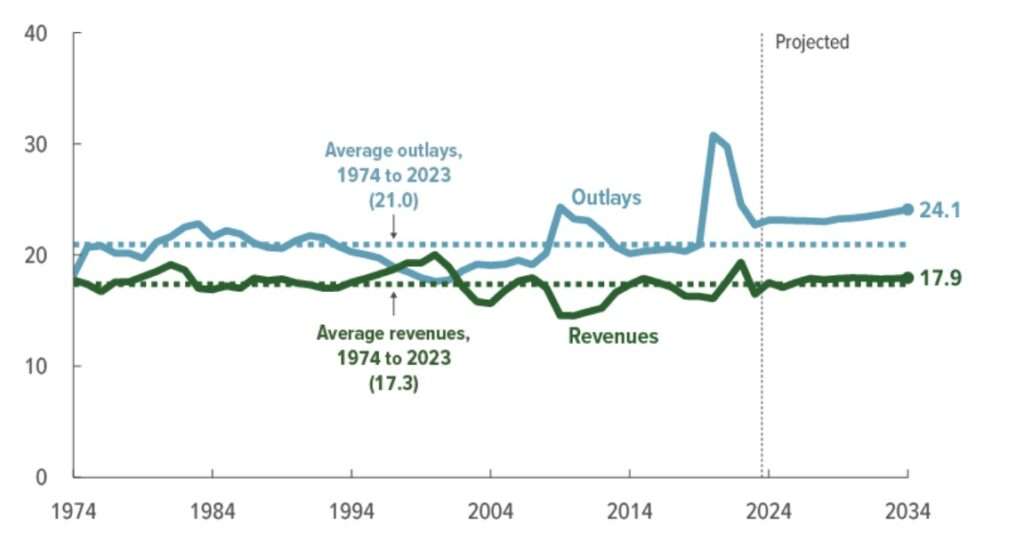

Second, the CBO projections make clear that the federal government has a spending problem, not a revenue problem.

A budget deficit is the gap between how much the government collects in tax revenue and how much it spends during a single year. When deficits are expected to grow over a period of years, that means spending is rising faster than expected revenue, or revenue is falling relative to planned spending, or both. In the federal budget, it is clearly the former.

Measured as a share of the economy as a whole, federal tax revenue has historically averaged about 17.3 percent. This year, the CBO expects about 17.5 percent of America's gross domestic product (GDP) to be vacuumed up by the federal government, and over the next 10 years tax collections will average about 17.8 percent of GDP. That's slightly above average, but the problem is that federal spending is expected to grow much faster—and into territory well outside of historical norms.

Finally, we should remember that the actual fiscal situation is likely to be worse than what the CBO is projecting—despite what the White House is saying.

The Biden administration greeted the CBO's new projections as an encouraging sign, pointing out that the estimates show a slightly lower deficit for this year than the CBO had previously expected.

But it is important to keep in mind that the CBO's projections look exclusively at current policies and therefore assume that, among other things, the Trump tax cuts will not be extended beyond their planned expiration in 2025. It also does not account for the possibility of another major emergency, or even a relatively mild recession. "The primary deficits in CBO's projections are especially large given the relatively low unemployment rates that the agency is forecasting," the CBO notes.

As Riedl highlighted on X, a more realistic alternative scenario in which the tax cuts are extended and discretionary spending caps are not maintained results in deficits that will exceed $3 trillion by 2030.

In short: Those pandemic-era deficits won't look like outliers for very long.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

But Bidenflation will raise GDP by $50 trillion. What's the problem, Mr Reluctant? You're getting what you voted for.

Not to mention the GDP boost from all the asylum seekers.

"the CBO projections make clear that the federal government has a spending problem, not a revenue problem."

Nope! Whether something is "clear" depends not upon how much clarity has been provided but, rather, upon how much clarity has been perceived. It is virtually impossible to claim that this obviousness has been perceived by any official currently occupying a position anywhere inside the District of Columbia.

They know. They just don't care. They are incentivized to give the people what they want, good and hard. The people want the government to pay for retirement and medical expenses for old people, and they don't care if the money adds to the debt. So that's what we get.

Maybe the Supreme Court shouldn't have allowed [Na]tional So[zi]al[ism] to creep into the USA in the first place. There is a Supreme Law that was suppose to stop all this.

They tried and FDR threatened to keep expanding the court until he got what he wanted. Had they pushed the issue the Supreme Court would currently have 9 or 11 justices, and he'd still have gotten his New Deal.

"There is a Supreme Law that was suppose to stop all this."

Better dead than red?

No one will really understand politics until they understand that politicians are not trying to solve our problems. They are trying to solve their own problems - of which getting elected and re-elected are number one and number two. Whatever is number three is far behind.

Thomas Sowell

They know. No-one has the stones to do anything about it. Both sides want to keep power.

Also Democrats/Evil believe all money belongs to government so they want tax to be 99%

GOP/Stupid party - since the media is against them and low info voters want free stuff. Will talk a good talk but do absolutely nothing

So, this CBO report gets filed under which category:

1. Lies

2. Damned Lies

3. Statistics

4. Wishful thinking

5) well meaning but total useless

6. Burn after reading

7. Burn before reading, the voters don't care.

10 years? You mean 4 or 5.

Yeah, only 20T seems really optimistic to me based on the last several years.

It's certainly not the first time Democrats thought they could spend their way out of debt (ref: The Great Depression, The Great Recession, Bideninflation).

"Federal Government Will Borrow Another $20 Trillion in the Next Decade."

So what?

Just print more money.

That's what the Soviet Union did for decades, and nothing bad happened to them.

As did the German National Socialists.

Something about 'Socialist' always playing with funny-money.

At that point, more than a quarter of all federal tax revenue will be directed toward paying the interest on the debt.

An interesting history. Money has always been based on credit and debt. The entire known history of early writing, religion, math, was records of money/debt/credit transactions. The debt now can't be paid so it won't be paid. The only question is will we understand what 'jubilee' used to mean - before the SHTF with a creditor/debtor civil war.

Your very second sentence is a lie. Where do you dream this shit up? Gold and silver and other precious metals are neither credit nor debt.

It isn't made up. Coins didn't even come into existence until maybe 700 BC. Hammurabi's code is 1000+ years before and most of it is about debts and debt forgiveness and conflicts about debt. The earliest clay tablets/tokens (roughly 9000 BC - like right back to the beginning of agriculture and domesticated animals) are about accounting obligations. Obligations when quantified equals debt. Arithmetic and cuneiform were invented as a way to streamline the communication of those debts. Religious scribes and firing that clay were a way of ensuring everyone was honest over time. Astronomy and calendars were the way to determine seasons (like harvest) when those debts would be repaid and what the proto-'interest cost' would be.

Tally sticks and bones date back even earlier (30,000? BC) but not enough have been discovered in one place to know what they mean. But I doubt they were playing Sudoku.

Gift economies (obligations that aren't quantified) and debt LONG predate any evidence of barter. Indeed barter is pretty ludicrous as a foundation of money because it requires that the stuff is all produced at the same time and then exchanged. When time has always been the foundation of obligation even in a family/kin structure.

Wild stuff here, Smith slamming Bidenflation and millions for migrants, at the expense of black and Hispanic working class people, homeless born and raised here legally. Classic east coast rant on inflation, honorable mention of the magic money printer.

https://www.breitbart.com/sports/2024/02/08/watch-espns-stephen-a-smith-furious-biden-believes-trump-verge-getting-reelected/

Didn't Stephen A go off on crime/killings in Chicago. That the black community needs to step up and be better.

It was years ago so I'm old and can't remember

People mocked the "Million Man March" back in the day, but crime went down afterward. Now it's been going up steadily since 2019.

The level of government spending is quite simply obscene.

We need an American Javier Milei that actually slashes the government, instead just flapping their "Orange Lips" and not cutting spending like Trump or just blaming the "Orange Man" while driving spending that make Trump look like a fiscal hawk like Biden does.

Trump and Biden are both pathetic non-choices the uni-party wants us to vote for. One is an narcissistic orange turd and the other is a old senile corrupt turd and while the narcissistic orange turd is better than the old senile corrupt turd, both are still turds none the less.

Argentina didn’t get Milei until their government cranked inflation up over 140%.

So give Congress another 5 years or so, and we’ll get a libertarian reform candidate too.

Can we all agree that no matter who wins, spending will not be cut?

Trump said "hey, I won't be around when the bill goes due"

Biden said " Ice Cream"

Neither party cares because it's the future's problem.

Not if voters stop electing Democrats and Republicans.

Ever heard of compounding interest? No, it will be another $40 trillion to $50 trillion borrowed in the next decade, or until the entire U.S. federal financial system collapses, whichever comes first.

As usual, Republicans become alarmed about spending when it's not their spending.

When it's illegal (UN-Constitutional) spending.

It will help to boost the economy or not!

https://cricketleague.co.in/ipl-cricket-match-id/