Tesla's Expensive New Cybertruck May Qualify for $7,500 in E.V. Tax Credits

According to a Treasury Department website, two of the three Cybertruck models currently offered would qualify for tax credits.

In late November, Tesla Motors delivered the first 10 Cybertrucks to customers, over four years after it was first unveiled as a concept prototype and two years after it was originally supposed to begin production. The odd, angular electric vehicle with a stainless steel exterior attempts to marry Tesla-style sports car performance with the rugged function of a pickup truck. The Wall Street Journal characterized it as "a giant, steel triangle on wheels."

Depending on options, the Cybertruck can achieve 600–845 horsepower and cost between $60,000–$100,000—clearly making it a luxury purchase and not for the shopper on a budget.

So why, then, do some models qualify for federal tax credits?

As part of President Joe Biden's pledge to transition the U.S. to greener sources of energy, the 2022 Inflation Reduction Act (IRA) established $7,500 tax credits for purchases of electric vehicles (E.V.s).

"Working families will be able to use tax credits that make electric vehicles more affordable," brags the White House's Clean Energy webpage. "Purchasing an electric vehicle (EV) can save families thousands of dollars on fuel costs over the life of their car."

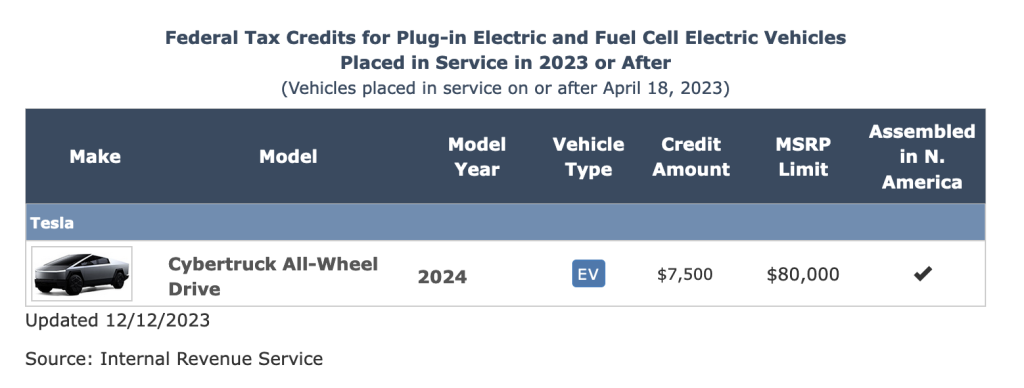

But according to FuelEconomy.gov, maintained by the U.S. Department of Energy, the Cybertruck can qualify for the tax credits as well.

The site notes that qualifying models must be assembled in North America and are limited to a retail price of $80,000, the same parameters put on any vehicles that hope to qualify. Since the Cybertruck is assembled in Tesla's Texas Gigafactory and two of its current options retail under $80,000, it could indeed qualify.

Neither the IRS nor the Department of Energy responded to Reason's requests for confirmation that the Cybertrucks would qualify, but Tesla clearly thinks so: The Cybertruck order page on the automaker's website lists "purchase price" alongside prices with "probable savings," which "assume IRA Federal Tax Credits up to $7,500 for Rear-Wheel Drive and All-Wheel Drive and est. gas savings of $3,600 over 3 years."

It's worth wondering why the Cybertruck should qualify for tax credits that are nominally intended to benefit people who want to switch to an electric vehicle and need a little help. It stands to reason that anybody both willing and able to spend around the median annual household income on a futuristic-looking luxury truck should have to cover the entire cost themselves, without any help from the American taxpayer.

Earlier this year, Biden promoted the E.V. tax credits by tweeting a photo of himself driving a GMC Hummer EV, even though no version of the Hummer EV available at the time cost less than $84,000. For the 2024 model year, GMC is planning to offer the base model EV2 starting at $79,995—$5 below the cutoff. Similarly, Tesla currently set the all-wheel-drive Cybertruck's retail price at $79,990.

Show Comments (51)