Competition, Not Antitrust, Is Humbling the Tech Giants

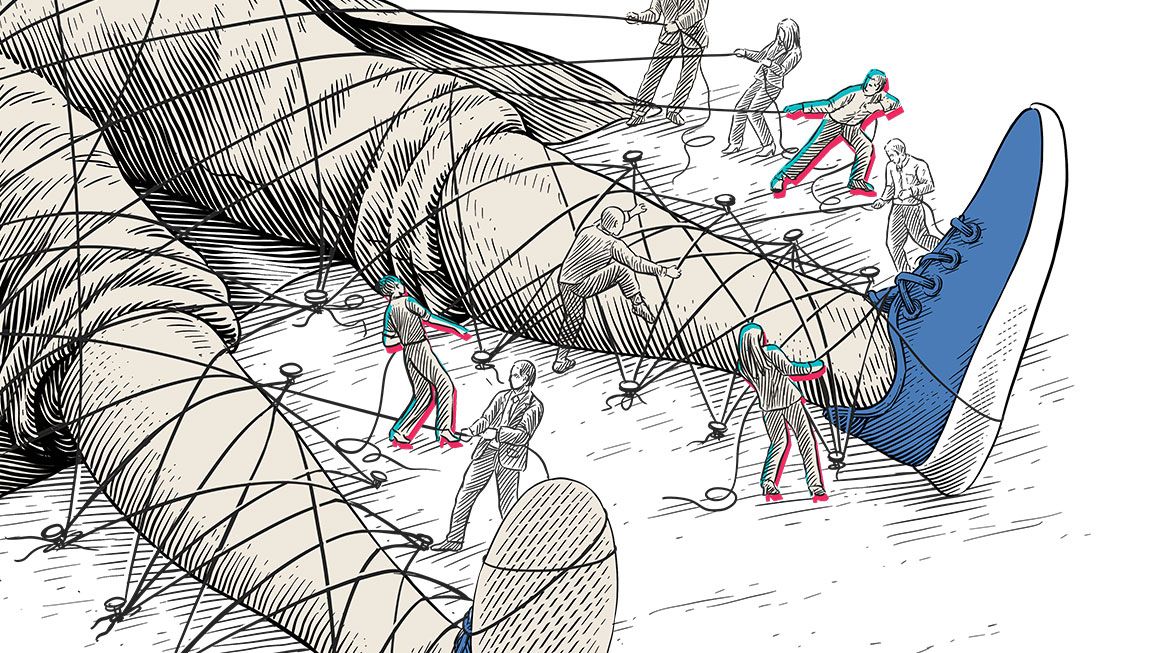

The worst of the antitrust alarmism keeps proving untrue, as tech companies believed by some to be monopolies instead lose market share.

In 2017, a 27-year-old Yale Law School student published an article arguing that the online retailer Amazon had grown so large that federal regulators should treat it as inherently suspect. Amazon, the paper said, engaged in a wide variety of harmful anticompetitive practices. The article did not merely demand far greater federal oversight of the company; it called for a complete overhaul of how regulators approach antitrust, urging more frequent, more aggressive legal action founded on a generalized antagonism toward large companies and corporate mergers.

At the time, the view was relatively novel, with few adherents in government or the academy. But today that former student, now 34, leads the Federal Trade Commission (FTC), and both the agency specifically and the Biden administration more generally are pursuing a concrete version of her antagonistic agenda.

That student was Lina Khan, and her swift ascendance from young academic with a dream to bureaucrat with real power showcases some rapid political and intellectual shifts that have taken place over the last few years. Not only did Khan take command of a major regulatory agency, but the Biden administration found plum spots for fellow antitrust revisionists such as the Columbia Law School professor Tim Wu, who became special assistant to the president for technology and competition policy, and the attorney Jonathan Kanter, who was installed in the antitrust division of the Department of Justice (DOJ). Beyond the White House, politicians on both the left and the right have embraced versions of these theories—and called for applying them to a swath of increasingly large, increasingly successful technology companies.

The new antitrust movements went by many names: "new structuralism," "neo-Brandeisianism," or, among critics, "hipster antitrust." Their rise coincided with a slew of legal actions and investigations against Big Tech companies, such as Facebook, Microsoft, and Amazon—including, in June, a major lawsuit accusing the latter of tricking people into enrolling in its Prime subscription service and deliberately making the cancellation process difficult.

What had started as a boutique intellectual movement built on law school journal articles had quickly become an influential component of the national policy-making apparatus.

But then something happened: Even as the new antitrust movement gained power—and flexed it—its efforts flailed. Public support fizzled or failed to appear entirely, and the movement's fundamental premises have fallen apart, wrecked by dynamism, jurisprudence, and political expediency. Meanwhile, the worst of the antitrust alarmism keeps proving untrue, as tech companies believed by some to be unassailable "monopolies" instead lose users, market share, and prestige.

If the past half decade has seen a war over the future of antitrust law, it's too soon for any side to declare victory. But there are signs of hope that we will emerge with a form of antitrust that is more market-friendly and consumer-focused, less open to use—and abuse—by central planners who want to pick winners and losers in the economy and regulate even the most minute facets of business operations and commerce.

From Consumer Welfare to Big Is Bad

To understand the rise of Khan and her fellow travelers, it's useful to understand the two schools of thought that have dominated antitrust policy and politics since the late 1800s.

Starting in the Progressive Era, antitrust law was often used as a tool for attacking businesses that got too big. Policy tended to follow Supreme Court Justice Louis D. Brandeis' maxim that corporate bigness was a "curse." He believed that in order to protect competition, there must "be regulation of competition," with government stepping in to stop big companies from successfully thwarting smaller competitors.

This view of antitrust held through the 1960s. Then came a new approach spearheaded by the legal scholar Robert Bork and economists at the University of Chicago. They argued that anti-competitive behavior shouldn't simply mean things businesses do that harm some nebulous idea of competition or that make things harder for specific competitors. Instead, we should consider whether consumers were negatively affected. Essentially, they held that maximizing customer welfare should be the lodestar of antitrust law enforcement. This became known as the consumer welfare standard, and since the 1980s it's been the dominant theory of antitrust law.

But not everyone was happy with the transition. A group of lawyers, academics, and activists who self-identified as neo-Brandeisians or new structuralists argued for moving away from the consumer welfare standard in favor of a framework that gave the government more leeway to intervene.

Khan's 2017 Yale Law Journal article, "Amazon's Antitrust Paradox," was a foundational text for this cohort. Khan's essay argued that Amazon's "sheer scale and breadth" made it a ripe target for antitrust law enforcement if only we would change the way we've been thinking about antitrust law. "The current framework in antitrust—specifically its equating competition with 'consumer welfare,' typically measured through short-term effects on price and output—fails to capture the architecture of market power in the twenty-first century marketplace," wrote Khan, warning that this framework hid "the potential harms to competition posed by Amazon's dominance." Khan wanted a return to economic structuralism, which she described as resting "on the idea that concentrated market structures promote anticompetitive forms of conduct."

"With a single scholarly article, Lina Khan, 29, has reframed decades of monopoly law," The New York Times' David Streitfeld reported in 2018. The Financial Times' Rana Foroohar called her a "legal wunderkind" out to take on "the monopolies hiding in plain sight."

A year after Khan's article, Tim Wu published The Curse of Bigness, a book outlining the vision for "a post-consumer welfare" worldview, in which a company enjoying strong market share was de facto suspect.

In contrast to the Chicago school, which thought scale could be evidence that a company provides an efficient service that customers value, the neo-Brandeisians saw popularity and size as signs a company is probably engaging in processes that suppress competition in a way that should be barred. Wu called for fewer merger approvals, more forced breakups of big companies, and an FTC mandate to automatically investigate companies if they've held a dominant market position for a decade.

In 2021, both Khan and Wu were elevated to prominent positions in the federal government. Wu held his post until early 2023. Khan, the youngest person ever to be appointed FTC chair, is still launching high-profile actions against big companies and major mergers.

The movement away from the consumer welfare standard started in academia. But under President Joe Biden, it permeated the political sphere.

From Academia to the White House

This shift dovetailed with the burgeoning, bipartisan interest in casting Big Tech companies as social and political enemies, providing a theoretical basis for taking on businesses that weren't obviously engaging in unlawful practices.

Big Tech companies such as Alphabet (formerly Google), Meta (formerly Facebook), X (formerly Twitter), and Amazon (which is still Amazon) aren't engaging in the classic "restraints of trade" prohibited by the Sherman Antitrust Act of 1890 and deemed inherently unreasonable by the courts, such as direct agreements among competitors to fix prices, divide markets, or rig bids for business contracts. Nor are they monopolies in the traditional sense—there are plenty of places to post pictures online, shop for books and household items, and so forth. There's scant evidence they're engaging in the outright "deceptive acts or practices" the FTC has the authority to challenge. Besides, they kept prices for consumers low or even free, making it hard to argue against them under the consumer welfare standard.

Using antitrust law to break up or sanction such companies seems like it should be a dead end. But the neo-Brandeisian view, in which bigness is a curse to be checked by federal power, offers a handy justification for doing so. It's no wonder many people with an anti-tech agenda embraced it.

And how they embraced it. For a few years, using antitrust law to regulate, break up, and punish Big Tech companies was an idea you couldn't escape.

Federal lawmakers put forth a flurry of bills banning normal business practices by Big Tech platforms and imagining burdensome new rules they should have to follow. Senators from Elizabeth Warren (D–Mass.) to Josh Hawley (R–Mo.) called for cutting technology companies down to size. Congress hauled tech leaders before the antitrust subcommittee and demanded reams of documents, part of a long investigation into "online platforms and market power."

The DOJ sued Google, and the FTC sued Facebook. And state attorneys general, both Republican and Democratic, joined these federal lawsuits or launched their own probes and complaints.

In 2021, Biden issued an executive order on promoting competition, warning that corporate consolidation had produced "dangerous trends" and promising far more vigorous antitrust enforcement. Big companies—especially those looking to grow via mergers—were put on notice. But for a variety of reasons, all this antitrust action hasn't had all that much real-world impact.

The Courts Called Their Bluff

The core of the Biden administration's approach to antitrust has been a series of high-profile, high-stakes legal challenges against the biggest players in tech. Some of these suits seem to be inspired by colloquial, politically charged perceptions of what are actually complex legal concepts—the idea, for example, that many large tech companies are "monopolies." The courts haven't reacted well when agencies twist language and legal concepts this way.

In late 2020, for example, the FTC filed a suit accusing Facebook of illegally maintaining a monopoly in "personal social networking services." In June 2021, the U.S. District Court for the District of Columbia held that the commission failed "to plausibly establish…that Facebook has monopoly power" in that market. The court dismissed the FTC's complaint, along with a complaint filed by 48 states and territories objecting to Facebook's 2012 acquisition of Instagram and 2014 acquisition of WhatsApp.

The decision left the FTC open to file an amended complaint—which the agency did, in 2022—but did not leave the states with that option. The states appealed, but the U.S. Court of Appeals for the D.C. Circuit rebuffed them, saying they had waited too long to challenge the acquisitions.

In July 2022, the FTC sued to stop Meta from acquiring the virtual reality fitness company called Within. The agency argued that by failing to develop an entirely new virtual reality fitness app, Meta was depriving consumers of choices and "dampening…competitive rivalry." A federal court rejected this bizarre argument, declining to block the acquisition.

In July 2023, the U.S. District Court for the Northern District of California denied the FTC's request to halt Microsoft, which makes the gaming console Xbox, from a planned $69 billion acquisition of Activision Blizzard, which makes the Call of Duty franchise and other popular video games. "The FTC has not shown it is likely to succeed on its assertion" that Microsoft's "ownership of Activision content will substantially lessen competition in the video game library subscription and cloud gaming markets," wrote Judge Jacqueline Scott Corley.

In August, the U.S. District Court for the District of Columbia narrowed the scope of a joint Justice Department and state case against Google, suggesting that some of the suit's allegations rested on "opinion and speculation."

Courts have also rejected other antitrust actions brought by the Biden administration, including an attempt to block U.S. Sugar's acquisition of Imperial Sugar and the merger of UnitedHealth Group and health I.T. company Change Healthcare.

The Biden administration's biggest antitrust success so far* has been stopping book publisher Penguin Random House from acquiring rival publisher Simon & Schuster, which the government argued would harm blockbuster authors like Stephen King and others who earn more than $250,000 in advances.

There are still a number of antitrust actions and investigations pending against tech companies—for instance, two DOJ suits against Google (one filed in 2020 that's concerned with search and search advertising, one filed in 2023 that homes in on Google's digital advertising tech). The FTC's amended case against Meta is still ongoing, as is a case involving the agency's attempt to undo DNA sequencing provider Illumina's acquisition of multicancer early detection test-maker Grail. In July, the agency informed OpenAI, the company behind the ChatGPT artificial intelligence chatbot, that the FTC is investigating whether it "engaged in unfair or deceptive privacy or data security practices" or practices that caused consumers harm, "including reputational harm."

These cases could yet turn out badly for tech businesses. But the rulings we've seen so far suggest that courts aren't about to simply set aside decades of antitrust custom and precedent because some people in power want to see tech companies broken up.

The Alarmists Were Wrong

One of the chief arguments of Khan's 2017 law review article was that consumer welfare–focused antitrust policy was too oriented toward the short term. "Antitrust law," she complained, "now assesses competition largely with an eye to the short-term interests of consumers, not producers or the health of the market as a whole."

But in "Doomsday Mergers: A Retrospective Study of False Alarms"—a white paper published in March 2023 by the International Center for Law & Economics, a group that tends to be skeptical toward the Khan/Wu approach to antitrust—the economists Brian C. Albrecht, Dirk Auer, Eric Fruits, and Geoffrey A. Manne look at several deals that neo-Brandeisians demanded be blocked—forecasting dire consequences should they be permitted—and show that these dire results have failed to pan out. The paper argues instead for antitrust enforcement that "focuses on tangible and short-term metrics, rather than hypothetical doomsday scenarios that are notoriously hard to predict."

In 2017, for example, Amazon announced that it would purchase the grocery chain Whole Foods for approximately $13.7 billion. In response, Khan, then still in grad school, published an op-ed in The New York Times predicting disastrous results for competitors. By "bundling services and integrating grocery stores into its logistics network, [Amazon] will be able to shut out or disfavor rival grocers and food delivery services," she wrote.

In fact, in the years since Amazon's merger, multiple large retailers have grown faster or performed better in the stock market; direct competitors in the online grocery sales sphere have grown significantly. Meanwhile, Whole Foods and Amazon only control a small percentage of the grocery market. Similarly, the quartet of economists report, Google's acquisition of Fitbit was expected to "reinforce Google's position in the ad industry and prevent new entry; harm user privacy by enabling Google to integrate Fitbit health data into its other ad services (or sell this data to health insurers); and crush burgeoning rivals in the wearable-device industry." Instead, "the exact opposite has occurred: Google's share of the online-advertising industry has declined, as has Fitbit's position in the wearable-devices segment. Likewise, Google does not use data from Fitbit in its advertising platform; not even in the United States, where it remains free to do so."

The Dynamism Factor

The neo-Brandeisians also argued that the tech titans of the 2010s were so big that they were effectively immune to competition and could only be dislodged by government power. In The Curse of Bigness, Wu worried that a few Big Tech companies were so firmly entrenched that by the late 2010s, "a next new thing" was not possible. In 2018, he told Vox he wanted to break up Facebook "because they face no serious competition" and had the power to squelch or consume competitors by buying them out. "Nobody is going to start in the shadow of Facebook and get anywhere," he said.

But since 2018, Facebook has shed users and embarked on failed expansions. Data published by Edison Research in early 2019 showed the platform had lost an estimated 15 million U.S. users since 2017, with the biggest losses occurring among young people. In 2019, just 62 percent of 12- to 34-year-olds used Facebook, down from 79 percent in 2017. Facebook revealed in February 2022 that it was also shedding users globally.

Meanwhile, new competitors in the social media realm have started gaining traction. None of these platforms may have the do-everything functionality and be-everywhere ubiquity of Facebook—but that's exactly what antitrust crusaders shouldn't want, anyway. We don't need another Facebook to compete directly with Facebook; better that many different platforms attract different niches and serve different functions. And that's what we've been getting. Markets, especially in innovative sectors like tech, adapt and evolve in unexpected ways.

TikTok has seen the most dramatic rise, skyrocketing from 11.3 million active U.S. users in 2018 to 150 million in 2023. But there have been other notable new entrants, including Substack, which fills a hole left by the downgrading of news content on Facebook. (With the launch of its Notes feature, Substack is also gunning directly for Twitter.) BeReal became popular with Gen Z as an alternative to Facebook-owned Instagram. Twitch has taken a lot of the popular video game streaming market away from YouTube. In July 2023, Instagram launched a Twitter competitor, dubbed Threads.

Quite a few platforms have been competing to peel users away from Twitter, which was once assumed to have a lock on a certain segment of the chattering classes. The company's takeover by Elon Musk and some of the changes Musk implemented sent many journalists, scholars, and celebrities running, or at least trying out new alternatives, including Bluesky, Substack Notes, and Mastodon. Meanwhile, former President Donald Trump's Truth Social serves as an alternative for right-leaning Twitter users. Twitter may still reign among the microblogging platforms, but its status feels much less secure than it did a year or so ago.

Even Google has felt the squeeze of competition, as artificial intelligence tools such as ChatGPT disrupt search. Google also faces issues with ad sales, as does Facebook. Last year, the two powerhouses' combined share of the digital ad sales market dropped below 50 percent for the first time since 2014, according to a Wall Street Journal analysis. The drop comes as TikTok, streaming services, and e-commerce sites become more attractive to advertisers. "Meta and other social-media companies including Snap Inc. also suffered from Apple Inc.'s 2021 decision to require apps on its devices to ask users if they wanted to be tracked," reported the Journal.

The incumbents' attempts to stay relevant have been far from universally successful. Facebook's 2012 purchase of Instagram paid off, but the company's more recent gamble on virtual reality—the metaverse—seems to be flailing. It has failed to captivate consumers or businesses, and there are now signs that Meta is quietly turning its attention elsewhere.

As major tech platforms shed users and subscribers, yearslong hiring sprees and expansions have been crashing to a halt too. In early 2023, Alphabet let go of about 12,000 workers and Microsoft about 10,000. Spotify laid off hundreds of employees in the first half of the year. And Amazon announced that it was cutting a whopping 18,000 positions, about 5 percent of its corporate work force. This followed fall 2022 layoffs from Meta, which let go around 13 percent of its staff, and Twitter, which got rid of nearly half its work force amid the Elon Musk ownership transition. Layoffs can be seen across the tech industry, hitting computer companies, virtual meeting services, social media platforms, video streaming sites, real estate apps, ride-sharing companies, and e-commerce.

No One Cared?

In 2021, Wu told The New Yorker that the Biden administration was embracing efforts "to bring back antitrust as a popular movement." Those efforts don't seem to have fared well either. Surveys show a lot of Americans like Big Tech companies as they are.

For instance, a 2021 survey by The Harris Poll and the Center for American Political Studies at Harvard University found Amazon's favorability ranked higher than all but one of 18 institutions or groups, including police, the DOJ, the FBI, and the Supreme Court.

A 2020 survey from The Verge also showed high favorability ratings for Amazon (91 percent), along with Google (90 percent), YouTube (90 percent), Microsoft (89 percent), Netflix (89 percent), Apple (81 percent), and even social media platforms (which tend to get more mixed reviews across surveys). Some 72 percent of respondents viewed Instagram favorably, 71 percent viewed Facebook favorably, and 61 percent viewed Twitter favorably.

In addition, some evidence suggests Americans are still quite wary of heavy-handed interference in business by the government—at least under most circumstances—and/or think there are better things for lawmakers to be focusing on.

For instance, a July 2022 poll from the U.S. Chamber of Commerce and AXIS Research found just 1 percent of respondents said "regulating technology companies" was the most important thing for Congress to do. If they were going to regulate, breaking up Big Tech was low on people's priority list: Just 4 percent prioritized "breaking up large tech companies into smaller ones" and 3 percent "limiting large technology companies from growing further."

The same poll asked people how valuable various tech tools were in their daily lives, with a lot of the examples drawn from things that could be banned or penalized under congressional antitrust proposals. About 69 percent said Amazon Basics products were valuable, 57 percent said having apps pre-installed on their phones was valuable, and 65 percent said social media apps such as Facebook, Snapchat, and TikTok were valuable. About 70 percent opposed plans to limit companies' "ability to feature their own products on their sites or applications."

Likewise, a 2022 survey from the Pew Research Center found only 44 percent of Americans were supportive of more regulation for major tech companies. Among both Republicans and Democrats, support for more regulation had dropped significantly since 2021, despite increasing political rhetoric about the alleged need to regulate these companies.

Mass support for using antitrust law against tech companies hasn't really materialized. Part of that may just be that the subject is a little wonky and far removed from daily life. But politicians might also just be out of touch. Their demonization of tech platforms across the board doesn't seem to jibe with popular sentiment, and their outrage over particular offerings (like Google Maps popping up when you run a Google search for a business, or Amazon offering low-cost Amazon brand products) runs completely counter to how many consumers feel about those things.

There certainly are some circumstances that can get Americans over their skepticism about regulation. The most tried and true of these: protecting children. So politicians and activists have seized on that when trying to pass new regulations for social media and other tech companies. A barrage of bills—in Congress and statehouses—takes aim at tech companies under the auspices of stopping harms against kids and teens. These proposals range from requiring social media platforms to verify user ages to allowing civil suits against sites that fail to prevent all sorts of harms to outright bans on apps such as TikTok.

There are fewer bills and lawsuits premised on the idea that tech companies are breaking antitrust laws and more suits predicated on the notion they are harming minors' mental health. Sen. Josh Hawley has gone from arguing that Facebook "should be broken up" to proposing a ban on people under age 16 signing up for social media. The House has gone from hearings on "the dominance of Amazon, Apple, Facebook, and Google" to a March 2023 hearing on how Congress can "protect children from online harms" associated with TikTok.

Using antitrust law as a cudgel against tech companies may not have gone as planned, but anti-tech politicians have a host of weapons in their arsenal. Some antitrust crusaders really believed in the cause, but others were simply seizing on a handy tool for their broader reactionary goals. There's dynamism in moral panics too.

The Consumer Welfare Standard Returns

Despite setbacks, Khan and others in the Biden administration likely won't stop trying to expand antitrust enforcement power.

"They're very determined in this agenda," says Ashley Baker, director of public policy at the constitutionalist nonprofit Committee for Justice. "Whether it's just they're too naive to realize when they should stop or they're just really bent on driving this, it doesn't look like they're slowing down."

Over the summer, the FTC and DOJ jointly released a draft update of corporate merger guidelines, which Khan said were designed to "reflect the realities of how firms do business in the modern economy." In response, Geoffrey Manne, in his capacity as president of the International Center for Law & Economics, argued that "the overbroad guidelines are clearly designed to deter merger activity as a whole, regardless of the risk posed to competition." Baker called them "really more of an anti-merger manifesto."

Some of the 13 guidelines include items clearly aimed at the kinds of activity the FTC targeted in recent cases. For instance, they say "mergers should not eliminate a potential entrant in a concentrated market"—that is, any tech firm that could create its own version of a technology shouldn't be allowed to purchase a company that makes an existing version. (This is the weird argument the FTC used to try and block Meta from buying a virtual reality fitness app.) Other guidelines are so broad they could be used to justify thwarting almost any merger. For instance, mergers shouldn't "entrench or extend a dominant position," "further a trend toward concentration," or "otherwise substantially lessen competition."

Importantly, however, the guidelines aren't legally binding. Rather, the FTC has relied "on reputational capital with the judiciary" to give them some weight in court, Baker says. "And that system worked pretty well…because they've actually been pretty good guidelines and…been consistent in their application for the most part since 1968." But "when you have a highly politicized agency,…judges will probably look at that with not much credibility," she suggests.

This isn't the only way Khan's FTC is burning goodwill and credibility. Khan has been mired in potential ethics issues, including ignoring a recommendation from the FTC's top ethics official that she recuse herself from proceedings related to Meta and Within and misrepresenting this at a House hearing.

Meanwhile, the agency keeps cranking along with its aggressive pursuit of tech companies. In June, the FTC brought an antitrust action against Amazon, accusing it of violating the Federal Trade Commission Act and the Restore Online Shoppers' Confidence Act.

The Amazon suit is absurd in many ways, including its insistence that it's too "complex and confusing" to require a minimum of six clicks to complete the Prime cancellation process—one fewer click, mind you, than it takes to submit a comment to the FTC about its Amazon suit.

In a press release, the FTC accused Amazon of having "knowingly duped millions of consumers into unknowingly enrolling in Amazon Prime." But in the agency's complaint, this supposed trickery is revealed to be mostly commonplace business practices, such as auto-charging customers for a Prime membership after their free trial ends—a situation clearly spelled out in the trial solicitation's terms. Amazon even makes it easy for customers to be refunded one month's automatic charge if they forget to cancel right away, yet the FTC complains that someone "who discovered Prime charges after a few months could not obtain a full refund online." The FTC also objects to a number of mundane marketing tactics, such as making customers accept or decline a free Prime trial before completing a purchase.

The FTC may well lose this suit. But even these losses can reverberate, negatively affecting not just the companies forced to defend against them but the wider business community. Khan has indicated that she doesn't mind losing lawsuits as part of a larger, longer-term effort. She said last year that she doesn't believe "success is marked by a 100 percent court record" and "if the antitrust agencies look at the market and think that there's a law violation and the current law might make it difficult to reach, there's a huge benefit to still trying, especially with some of the bigger companies, some of the more high-profile cases."

Carl Szabo, vice president and general counsel of the tech industry association NetChoice, says that can send "a chilling message" to other businesses who fear expensive, time-consuming legal battles. "You have government officials in the executive branch who don't like the way the laws are written and are trying to literally rewrite the laws as they want to see it, not as it should be applied," he says.

It's likely the FTC will continue to pursue sweeping legal attacks based on the big-is-bad theory of antitrust. Reports over the summer suggested the agency was in the final stages of preparing a massive new lawsuit against Amazon.

But for now, the agency's suits are reverting to more familiar, more traditional arguments.

In the June suit, it doesn't claim Amazon's size hurts competitors. It doesn't attempt to stop another acquisition. It doesn't argue against Amazon's entry into a new product line. It doesn't assert that its self-preferencing store-brand products could hurt other retailers. Its beef is with the way the company advertises and operates its Prime subscription service, which the FTC says is too confusing for consumers.

Whatever merit does or doesn't exist in the FTC's argument here, it undeniably focuses on consumer welfare. The FTC's complaint accuses Amazon of unfair practices "likely to cause substantial injury to consumers." It aims not to protect Amazon competitors or competition writ large, but Amazon customers' pocketbooks.

Even the neo-Brandeisians are back to arguing about pricing and consumer harms.

The new antitrust movement has grown decidedly bigger and more powerful under Biden. But in the marketplace of ideas, it seems to be losing out to a more successful competitor.

*CORRECTION: The original version of this article attributed the action against publishers to the wrong government agency.

Show Comments (37)