Biden's Student Loan Plan Could Cost Twice as Much as Projected

Unlike the Education Department's estimates, a CBO analysis considers how the new rules will encourage more students to take out loans they won't be able to pay back.

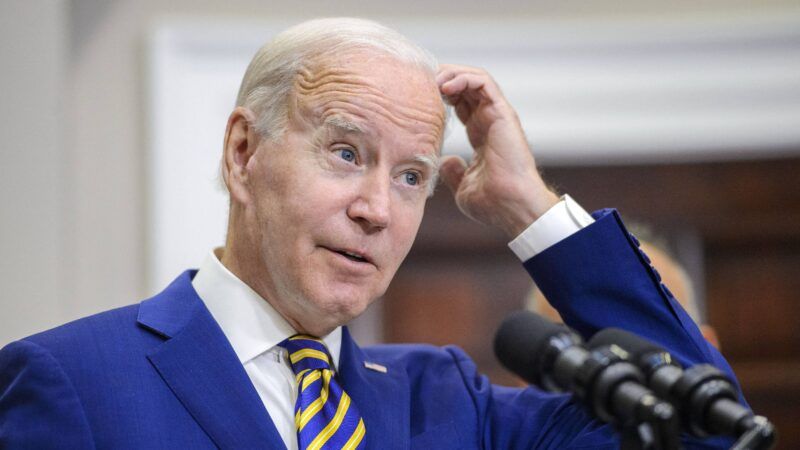

Regardless of how the U.S. Supreme Court rules on President Joe Biden's plan to forgive up to $20,000 in student loan debt for some federal borrowers, the White House is also pushing ahead with a new repayment plan that will lower what many student borrowers end up owing.

It's going to be significantly costlier than the Department of Education originally projected.

A new analysis from the Congressional Budget Office (CBO) shows that Biden's so-called income-driven repayment plan will cost at least $230 billion over 10 years—with an additional $45 billion in costs likely coming if the Supreme Court invalidates the White House's student loan forgiveness scheme. That means the final tab could be more than twice the $138 billion price tag attached to the proposal by the Department of Education, which is overseeing the program's rollout.

Under current law, federal student loan payments are capped at 10 percent of an individual's "discretionary income," which the Department of Education defines as income that exceeds 150 percent of the federal poverty guidelines. In practice, that means a single borrower with no children starts making payments on income that exceeds $20,400.

Biden wants to lower that threshold to 5 percent for undergraduate loans and impose a new limit of 10 percent for loans put toward a graduate degree. Biden's plan would also wipe away outstanding student debt after 10 years of payments for those who borrowed $12,000 or less—and a maximum payment period of 20 years no matter how much was borrowed.

But if you cap monthly payments at a lower level and also shorten the allowable repayment time, there will be a lot of loans that never get paid back in full. That cost ultimately falls on the taxpayers, and that's what the dueling estimates from the CBO and the Department of Education are all about.

The gap between the two estimates is a telling one.

The CBO points out that the Department of Education did not account for the "behavioral effects" of the new policy—in other words, it did not include estimates for how many additional students would take out loans if the repayment method was altered.

The CBO, however, did. It found that reducing what student loan borrowers will eventually have to pay back unsurprisingly caused more students to take out loans—including loans that they would be unable to pay off in full. Overall, the annual volume of student loans would increase by about 12 percent, the CBO estimated, with both undergraduate and graduate students seeking more loans.

"Students who would be expected to take out federal loans would borrow more," Leah Koestner, a CBO budget analyst concluded in a presentation on Wednesday. And "some students who would not be expected to borrow under current law would take out loans."

Biden would be continuing a now-decadeslong trend of reducing the limits on the federal government's income-driven repayment plans for student loans—and an equally long trend of those changes costing more than the Department of Education anticipates.

It was President George W. Bush who signed into law the first income-driven repayment plan. As Reason's Mike Riggs explained in the November 2022 issue, the original plan "pegged monthly loan payments for participating borrowers to 15 percent of their adjusted gross income and forgave the remaining balance of those loans after 25 years. In 2015, Obama shortened those numbers to 10 percent and 20 years for many borrowers."

"All of these policies," Riggs wrote, "have costs that eclipsed the Education Department's projections, and that is because the Education Department sucks at projecting costs."

The CBO's projections of the long-term costs of Biden's payment plan could be wrong, of course, as all such estimates can. But to completely ignore the ways in which easing student loan payments might cause more students to take out more loans—as the Department of Education's model does—seems wildly flawed and obviously inaccurate.

The Biden administration says student loans are a debilitating cost on recent college grads, but this repayment policy will result in more students taking on more college debt—and passing the excess costs onto taxpayers. That hardly seems like a solution.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

"...the new rules will encourage more students to take out loans they won't be able to pay back."

And once again, the road to hell is paved with [dubious] good intentions, and moral hazards abound.

But of course the goal is if the government pays for everyone's education, they will have complete say over how it is administered.

My last month's online earning was $17930 just by doing an easy job obout 3 months ago and in my first month i have made $12k+ easily without any special online experience. Easiest home based online job to earn extra dollars every month just by doing work for maximum 2 to 3 hrs a day. I have joined this job aEverybody on this earth can get this job today and start making cash online by just follow details on this website........

OPEN—>>>trying the info… pprodollar09

I am making a good salary from home $6580-$7065/week , which is amazing under a year ago I was jobless in a horrible economy. I thank God every day I was blessed with these instructions and now it’s my duty to pay it forward and share it with Everyone,

🙂 AND GOOD LUCK.:)

Here is I started.……......>> http://WWW.RICHEPAY.COM

Start now earning every week more than $5,000 by doing very simple and easyhome based job online. Last month i have made $19735 by doing this online jobjust in my part time for only 2 hrs a day using my laptop. This job is justawesome and easy to do in part time. Everybody can now get this and startearning more dollars online just by follow instructions here............

.

.

Now Here ————————————->> https://Www.Coins71.Com

As usual this is a Democratic plan to transfer wealth to a key Democratic Party demographic from everyone who has a few dollars left to extract it from - either directly in income taxes or indirectly through inflation.

Mike, great work. I appreciate your work since I presently make more than $36,000 a month from one straightforward internet business! I am aware that you are now making a good living online starting sb-05 with merely $29,000, and they are simple internet operational chores.

.

.

Just click the link——————>>> http://Www.smartjobs1.com

student loan repayment is theft!

I have made $18625 last month by w0rking 0nline from home in my part time only. Everybody can now get this j0b and start making dollars 0nline just by follow details here..

🙂 AND GOOD LUCK.:)

Here is I started.……......>> http://www.apprichs.com

Biden still fails to realize that the "crippling student loan debt" is the result of skyrocketing tuition and expenses and that those are the direct result of the government's bloated subsidies.

This is a government-caused problem and doing more of the same is not going to get us out of it.

We just need to pray (to the government gods) harder.

Goddamn you're a horrible troll.

I think we might need to pray to the Gods of the Copybook Headings instead...

Biden realizes that this is politically popular, and future politicians, not him, will have to deal with the mess. What else does a politician need to know?

It is also because a large percentage of the degrees are in financially worthless subjects. A degree in woman's studies won't even get you a job at McDonald's. Same for any degree in race studies, poetry, LGBQTRSUV ( or whatever it is nowadays) or any of probably two or three dozen subjects are completely useless in obtaining employment and if the person is lucky only put them $100,000 in debt. If people want degrees in these subjects that is fine but they shouldn't be surprised when the bill comes due and they are flat broke.

My last month's online earning was $17930 just by doing an easy job obout 3 months ago and in my first month i have made $12k+ easily without any special online experience. Easiest home based online job to earn extra dollars every month just by doing work for maximum 2 to 3 hrs a day. I have joined this job aEverybody on this earth can get this job today and start making cash online by just follow details on this website........

OPEN—>>>trying the info… prodollar09

When I worked in restaurants there were many well-educated people who couldn't find a job in their field of study. Either they studied something completely useless, or got a Bachelorette in a field of study that is useless without a Masters. However everyone who studied a STEM field disappeared. So I chose to disappear.

sarcasmic 2 years ago

Flag Comment Mute User

About the only thing I miss about working in restaurants was access to drugs. There’s always a dishwasher slinging weed and a waiter with nose candy.

Maybe it was another reason they couldn't find employment?

Bachelorettes in useless fields of study can be fun, but they're not usually the ones you bring home to meet your parents.

Baccalaureate. Fucking autocorrect. Thanks for ignoring the substance of my post and focusing on the use of an incorrect word. I would have been shocked if you did anything else.

There is no way on earth autocorrect did that.

Dude, it was a joke.

(And don't pretend like we all didn't give John a ton of shit for his typos.)

(And don’t pretend like we all didn’t give John a ton of shit for his typos.)

... and generally without the assumption that we were disagreeing with anything else he said.

Funny that people portray(ed) John as a one-sided, insanely hyper-partisan, humorless screechbag and then sarc screams "YOU ALWAYS DO THIS! YOU'RE RUINING MY LIFE!" like a PMSing teen girl because someone found the turn of phrase she mistakenly used to be humorous without disagreeing in any way with the overall sentiment expressed.

LOMGWTFBBQ+

Education is so valuable, it should be free!

This might have some effect on grad students and older students (both of which are categories who are more likely to know what they're doing and not be in an income-based repayment plan anyway) but the bulk of problematic student debt is held by people who went to college right out of high school and didn't get past the undergrad degree: aka, folks who started taking loans at 17/18 and made poor decisions (as 17/18 year olds tend to do).

Which is to say... I find the CBO's assumption that 17/18 year olds pay that much attention to Washington a bit optimistic.

Yeah, 17-18 YOs ignore free money.

My last month's online earning was $17930 just by doing an easy job obout 3 months ago and in my first month i have made $12k+ easily without any special online experience. Easiest home based online job to earn extra dollars every month just by doing work for maximum 2 to 3 hrs a day. I have joined this job aEverybody on this earth can get this job today and start making cash online by just follow details on this website........

OPEN—>>>trying the info… prodollar09

Brevity soul wit.

The CBO isn’t saying “18 yr. olds should listen to us and borrow less money.” they’re saying “18 yrs. olds, when required to pay back less on borrowed, will borrow more.” and, despite EschreEnigma’s brain fart, the situation doesn’t apply just to 18 yr. olds.

Should this not be a dead letter? There is no more official COVID Emergency to justify the breaking of restraints on executive authority required for this to go forward.

Joe has 6 more days of “emergency powers”.

Restraints? On government? That's so quaint.

My last month's online earning was $17930 just by doing an easy job obout 3 months ago and in my first month i have made $12k+ easily without any special online experience. Easiest home based online job to earn extra dollars every month just by doing work for maximum 2 to 3 hrs a day. I have joined this job aEverybody on this earth can get this job today and start making cash online by just follow details on this website........

OPEN—>>>trying the info… prodollar09

This you backing federalized banking?

sarcasmic 3 days ago Flag Comment Mute User 1) Do you even know what arguing in good faith means? I’ll give you a clue. It means you don’t assume that everyone who disagrees with you has bad intentions. You should try it. Just once. See how it works out.

2) Learn a bit about the history of banking in this country. Free banking wasn’t great. The gold standard wasn’t great. Bank runs weren’t great. And while the system we’ve got isn’t wonderful, it’s a lot better than it was in during your imaginary heyday.

Nobody's saying it was great. The question is, do you want a background level of small failures, or occasional huge, synchronized failures? Because it's pretty obvious at this point the regulators aren't any longer actually preventing bank failures. If anything, they're promoting them by mandating that banks adopt economically foolish policies.

Nobody ever said they prevent bank failures. The best they can do is stop runs by freezing withdrawals, insure deposits, and do stress tests based upon past failures. But they can't predict the future. No one ever said they could.

As I stated in the prior discussion...

Banking failures were more often but smaller and more localized prior to the 1910s. The federalization of banking was an attempt to undo frequent banking failures. For a time failures were seemingly less frequent, but the failures were deeper and took much longer to recover from.

Largely this was due to subsidization of the failures through reallocation of assets. But what we've started to see is as government has more control, reallocation of assets of a failure is less and less beneficial. Instead of the market handling reallocation, government picks and chooses. And if the last half century has shown, the failures are becoming as frequent as prior to the federalization.

So we no longer see any benefit. But now instead of banks subsidizing banks, taxpayers subsidize banks which removes the process even further away from proper reallocation of resources.

Federalizaiton of banking has been terrible on every front.

There’s also this (of course Reuters agrees with Climate mandates):

https://www.reuters.com/article/bc-finreg-fed-policy-mandates-climate-ch-idUSKBN2KD23A

Green startup loans from permanent residency visas- what could go wrong? I lurk on an Asian thread. Shareholders honestly believed they would be bailed out.

> The gold standard wasn’t great.

Compared to what we have now it was.

Do some research. There were pros and cons.

Provide an argument. Problem is you most likely can't.

Well folks, we can't fix this. It ain't gonna change. So what can we do? Encourage those we know who are going to college to study something that will get them a job, or to skip it entirely and get a trade. Or maybe get a trade to pay for college. C'mon libertarians, preach personal responsibility.

I doubt he's concerned about it.

"Après Biden, le déluge." pretty much sums up this administration's attitude concerning long term effects.

Of course it will cost more than predicted. Every government program ever always costs more than predicted.

Do you really expect anyone to believe a democrat would lie about the true cost of a government program?

Clearly fake news.

My last month's online earning was $17930 just by doing an easy job obout 3 months ago and in my first month i have made $12k+ easily without any special online experience. Easiest home based online job to earn extra dollars every month just by doing work for maximum 2 to 3 hrs a day. I have joined this job aEverybody on this earth can get this job today and start making cash online by just follow details on this website........

OPEN—>>>trying the info… prodollar09

Democrats believe Democrat politicians and Republicans believe Republican politicians. Wise people believe neither.

Wise people believe neither.

Sarc, OTOH, believes libertarians don't lie to libertarians, scientists don't lie to other scientists, businessmen don't lie to other businessmen, religious leaders don't ever deceive their flock, and that everybody buys his bullshit.

I'm sure the girls swooned over that comment.

Except you defend democrats all the time.

Wow, who could have seen that coming? Well everyone but Potato Joe!

"All of these policies have costs that eclipsed the Education Department's projections, and that is because the Education Department sucks at projecting costs."

That is way too smug. The Education Department’s projections are wrong because there are no consequences to being wrong. Instead, individuals are rewarded for saying what their bosses wants to hear.

What's a few hundred billion dollars when you can create Democratic voters for life, and continue to expand a key part of the Marxist propaganda system?

+1000000 Well Said.

People forget how much Nazi-Propaganda comes from Commie-Education.

I’m amazed that kids are on the hook at 9% interest rates for an education that is pretty much mandatory. While the provosts and Deans hang out with politicians and tell the kids they are on their side. Don’t know how they sleep knowing the debt they created.

I'm sure this is a problem caused by the government, and if we do the same, we won't get rid of it. We must strive to support young people. After all, the learning process is quite complex and the program is intense. This is hard to deal with on your own. Especially when it comes to writing an essay. Therefore, the best way out of the situation is to use online services where professional writers can write my essay WriteMyEssayOnline and do it quickly and efficiently. I have been using such services for quite a long time and have never regretted my choice.