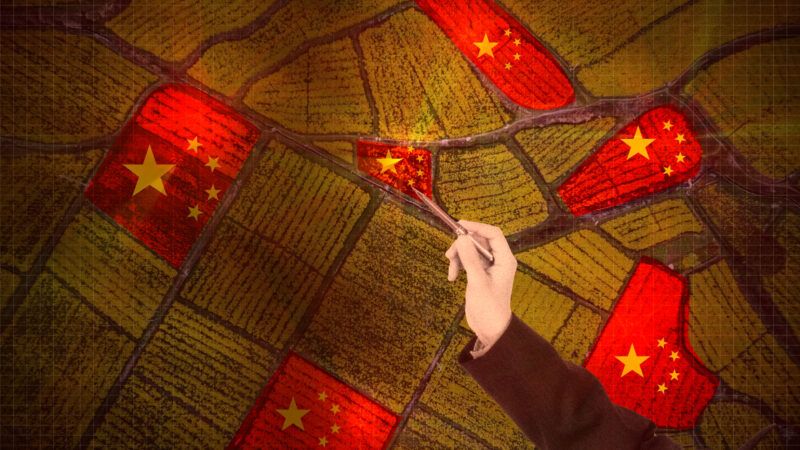

China's Purchases of U.S. Land Stoke Bipartisan Panic, Just Like Japan's Did In the 1980s

People panicked in the 1980s that Japan's economic largesse posed a grave threat to American interests. Then the market reined it in.

"Buy land," says the old investment axiom. "They're not making any more of it." And yet, depending on which country you come from, some U.S. lawmakers would deny you the right.

Between 2009 and 2016, China's global expenditures on agricultural land increased more than tenfold, according to data cited by the U.S. Department of Agriculture (USDA). Increasingly, both Republicans and Democrats agree this is a serious problem requiring a legislative solution.

Texas state Sen. Lois Kolkhorst (R–Brenham) introduced a bill that would bar any "citizen of China, Iran, North Korea, or Russia" from buying property in the state. While Kolkhorst said the bill would not apply to American citizens or lawful permanent residents, the bill's text made no such distinction. (She later modified the bill to make an exception for U.S. citizens and permanent residents and to exempt home purchases.) Gov. Greg Abbott indicated he would sign the bill if passed.

In January, Florida Gov. Ron DeSantis said he was also considering a ban on Chinese investors or companies purchasing property in the state.

Kolkhorst, Abbott, and DeSantis are all Republicans, but this issue has support across the aisle: While running for governor of Georgia in 2022 against incumbent Brian Kemp, Democrat Stacey Abrams told Fox News that Kemp was "placing farmland in the state of Georgia in the hands of, basically, a nation that has proven itself to be a national security threat," referencing China. Abrams dinged Kemp for a state-funded website that encouraged Chinese investment in Georgia.

In January, Sens. Jon Tester (D–Mont.) and Mike Rounds (R–S.D.) introduced a bill, the Promoting Agriculture Safeguards and Security (PASS) Act, "aimed at preventing China, Russia, Iran and North Korea from investing in, purchasing, leasing or otherwise acquiring U.S. farmland." Reps. Elise Stefanik (R–N.Y.) and Rick Crawford (R–Ark.) introduced a bill of the same name last year.

The Committee on Foreign Investment in the United States (CFIUS), an interagency assemblage, reviews certain foreign purchases of U.S. properties and has the power to block any it disapproves of. The PASS Act would add the secretaries of the Department of Agriculture and the Department of Health and Human Services to the CFIUS in order to approve or deny agricultural purchases.

Tester said he would not "let our foreign adversaries weaken our national security by buying up American farmland," with Rounds adding that the bill would ensure that "American interests are protected by blacklisting foreign adversaries from purchasing land or businesses involved in agriculture." (Representatives in Tester's and Rounds' offices did not respond to Reason's requests for comment on why Chinese purchases of agricultural land constituted national security risks.)

But the bills are driven by an overblown panic.

For one thing, despite the recent ramp-up, China's share of American land is quite small. In 2021, the USDA's Farm Service Agency reported that foreign investors own around 40 million acres, which constitutes just over 3 percent of all privately held agricultural land. Of all foreign-owned land in the U.S., China's share comprised around 384,000 acres—0.9 percent of the total. In fact, on the list of countries that own the largest shares of American agricultural land, China's portion is consigned to "Other." (Critics note that the USDA's numbers are incomplete and reporting is not universal.)

In February 2022, Chinese company Fufeng Group Ltd. purchased 370 acres near Grand Forks, North Dakota, with the intent to build a $700 million corn-milling facility. But given that the land was less than 15 miles from Grand Forks Air Force Base, the deal raised suspicions among politicians and government officials. According to Sen. John Hoeven (R–N.D.), the base's aerospace activities "will form the backbone of U.S. military communications across the globe."

In a January letter to Hoeven, Andrew Hunter, an assistant secretary for the Air Force, stipulated that the mill "presents a significant threat to national security with both near- and long-term risks of significant impacts to our operations in the area," though he did not give any specifics. Rep. Dusty Johnson (R–S.D.) said a nearby mill could "intercept sensitive U.S. military communications."

In July 2022, 19 Republican House members wrote a letter to Secretary of Agriculture Tom Vilsack asking for action against Chinese purchases of agricultural land, citing the country's status as a "global rival" and previous cases of Chinese nationals attempting to "steal U.S. seed DNA information."

For its part, China has struggled in recent months to feed its 1.4 billion people. In August, the Chinese government warned that record heats and a monthslong drought posed a "severe threat" to the autumn harvest. In that context, it makes sense that Chinese companies would invest in arable land in another country.

Regarding an outright ban like the PASS Act, Stewart Baker, host of the Cyberlaw podcast and a former Department of Homeland Security official who was in charge of the department's participation in the CFIUS, tells Reason, "I'm pretty skeptical that we need to do that." A desire to ban foreign investment is "a surprisingly familiar inclination all around the world," Baker says, as there's "something particularly atavistic about [someone] controlling your food supply," perhaps engendered by farmers upset to be outbid by an unfamiliar foreign investor.

Baker concedes that the proximity of the Grand Forks mill to the air base could allow a malign actor to intercept communications and that it has happened before, but "you probably don't have to buy a farm to do that." Similarly, Chinese nationals have indeed stolen agribusiness trade secrets, but that hardly constitutes a national security threat.

The outsize concern over foreign investors is not unique: A generation ago, Japan was the economic boogeyman that threatened to supplant America's superiority and buy up our land in the process. In the mid-1980s, Japan—flush with cash and experiencing red-hot real estate and financial sectors—invested heavily in foreign markets. To many Americans' consternation, this included major purchases of high-profile U.S. landmarks, like Columbia Pictures, Rockefeller Center, and California's Pebble Beach golf resort.

In both fiction and nonfiction alike, writers depicted Japan—sometimes in reductive or racist terms—as militant and devious, singularly focused on world economic domination, possibly as revenge for its defeat in World War II. The novelist Michael Crichton accused Japan of trying to turn the U.S. into its "economic colony."

And yet within a few years, the bubble burst. Japan's stock index fell 60 percent, real estate prices fell 30 percent, and bankruptcies spiked into the billions of dollars per year. Rockefeller Center and Pebble Beach were sold, the latter for a 40 percent loss. Rather than an invincible economic juggernaut, Japan entered into a "lost decade," a yearslong period of economic stagnation.

China may indeed have designs on stealing American security or trade secrets, but those concerns can be mitigated without an outright ban on property ownership. Not to mention, any further efforts to restrict such purchases constitute an encroachment on the rights of Americans to sell their own property in a transaction they deem to be mutually beneficial.

Gary Bridgeford sold land to Fufeng for $2.6 million, one of three property owners to do so. "People hear the China stuff and there's concern," he told CNBC. "But everyone has a phone in their pocket that was probably made in China. Where do you draw the line?"

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

The 'norm' worldwide is to restrict land purchases by foreigners. Just go try to purchase some land in other countries and see how that works out.

I’m paid $185 per hour to complete the task using an Apple laptop. I absolutely didn’t think it was conceivable, but my dependable buddy convinced me to give this straightforward an03 chance a go after she made $26,547 in just 4 weeks working on it. Visit the following page to find out additional

.

.

instructions—————————>>> http://Www.jobsrevenue.com

My understanding is that only someone more evil than Hitler would offer to buy Greenland.

Americans don’t generally know how the rest of the world works.

To be fair, that's because they don't care about the rest of the world.

But true.

I know an Italian citizen. Because he does not live in Italy more than 6 months he can not legally own a car in Italy.

Japan is and was an economic competitor. China is an adversary.

Additionally, China is not operating with a currency that floats on the free market. The Yuan is tightly controlled and only allowed to trade within a certain range.

As a result the true value of the money they're spending relative to other international currencies (specifically the USD) does not change to meet economic conditions.

Want more money to buy land in the us? Just print more remnibi and go for it!

Any other currency in a country that has had years of 25% economic growth would have seen ridiculous inflation and concurrent change in international valuation. Japan's Yen suffered when the economy went into stagflation and Japanese who paid too much for property got hurt. That'll never happen for Chinese while the Yuan is not freely traded.

Additionally, China is not operating with a currency that floats on the free market. The Yuan is tightly controlled and only allowed to trade within a certain range.

True of CNY, not technically true of CNH

I would expect most US real estate transactions would be priced and conducted in USD.

Not just an adversary. An existential threat to humanity and freedom worldwide.

I simply have been making $20k monthly on social media only for few hours daily.every person will try for this activity. American company is giving us a awesome opportunity for being profitable. i am a university student and working with my laptop for being profitable at home.you may take a look at my aspect of interest .simply click on in this link and vist tabs( home, Media, Tech ) for extra data thank you

SITE. ——>>> WORK AT HOME

Good or bad, just know that more competition for U.S. lands drives up the cost for citizens. Just like more immigration drives up the cost of housing for citizens.

That can't be true. I read here that unlimited immigration is a great thing, makes the US better, and there are no downsides.

It's not necessarily a problem if, for example, the U.S. was relatively free when it comes to things like building homes. Given the fact that there appears to be a shortage of those in the U.S., at least in places like California, it does benefit us to ask the question if it's a 'good' thing overall for the average home buying citizen.

California buyers are already pricing people out of homes in places like Colorado or even Texas, and those are U.S. citizens.

American/Non-Chinese citizens/entities can’t buy Chinese land and Chinese entities (virtually guaranteed to be beholden to the CCP) can buy American land but the real problem is we don’t support free trade hard enough.

1.4 billion people is a drop in the bucket.

For its part, China has struggled in recent months to feed its 1.4 billion people. In August, the Chinese government warned that record heats and a monthslong drought posed a "severe threat" to the autumn harvest. In that context, it makes sense that Chinese companies would invest in arable land in another country.

I've got a pretty deep voice and I can't generate the low, stupified "Huh?" necessary to do this statement justice.

I am now making $19k or more every month from home by doing very simple and easy job online from home. I have received exactly $20845 last month from this home job. Join now this job and start making cash online by

Follow instruction on website Here…………….>>> http://www.jobsrevenue.com

Similarly, Chinese nationals have indeed stolen agribusiness trade secrets, but that hardly constitutes a national security threat.

Holy Shit!

"Sure, it may be just a little Chinese gain of function research, but what's the big deal?" - Joe Lancaster

WTHF?

(She later modified the bill to make an exception for U.S. citizens and permanent residents and to exempt home purchases.)

So, then, we're clear. You're unequivocally advocating not on behalf of Chinese immigrants or Chinese Americans or Americans of Chinese descent or anything like that. You're straight up advocating on behalf of the CCP.

Get fucked Lancaster.

I think it was probably included as evidence of just how incredibly ignorant the legislator is. Changing the language--after the backlash--doesn't really change that.

2023 China is 1980s Japan. Good lord.

Surprisingly, Japanese investors were unable to take their trophy properties back to Japan. I suspect the same will happen to Chinese investors.

Leaving this here without comment

Now do Hawaii, with emphasis on lava zones.

You can't trust the CCP period.

What about the CCP question mark?

I am now making $19k or more every month from home by doing very simple and easy job online from home. I have received exactly $20845 last month from this home job. Join now this job and start making cash online by

Follow instruction on website Here…………….>>> http://www.jobsrevenue.com

Don't panic when foreign nations start buying the USA?

What is this more dope for the UN-conscious?

Reasons #1 headlines....

1) Invasion is great.

2) Putting the USA up for sale is great.

How about Reason just MOVE their *sses to where it is they want all this foreign influence on them?

Japan is a capitalist country under US occupation; concerns were purely economic.

China is a hostile foreign military power and communist country intent on destroying US power and subjugating the US. Concern is quite justified.

Next thing we know, they'll be instituting sharia law throughout the USA!

What idiotic logic - how much of China's agriculture land do American companies own: ZERO...

For one thing, despite the recent ramp-up, China's share of American land is quite small. In 2021, the USDA's Farm Service Agency reported that foreign investors own around 40 million acres, which constitutes just over 3 percent of all privately held agricultural land.

We could literally be in a shooting war with China over Taiwan in the next few years....conversely, Japan is one of our strongest allies

Kinda a big difference...

Comparing land ownership between China and Japan is a stretch.