New York Set to Hobble 'Legal' Cannabis with Taxes and Regulations

Empire State politicians will soon wonder why the marijuana black market still thrives.

Politicians who fail to learn from their stupid decisions are doomed to repeat them, and prohibitionist policies seem to offer the toughest lessons of all. Time and again, government officials impose bans on things they don't like only to drive the public to illegal sellers. Politicians then grudgingly "legalize" the market but burden it with taxes and red tape that keep the black market thriving. New York seems ready to recreate all of the mistakes of the past with a "legal" recreational market so hobbled that it will offer uncompetitive prices to consumers and daunting barriers to vendors.

"Since June 1, the New York's Cannabis Control Board has issued 162 recreational cultivation licenses," Bloomberg Tax recently noted. "Those fortunate enough to obtain one of New York's recreational cannabis licenses will be forced to contend with a gauntlet of state and local taxes."

The analysis, prepared by three accountants, detailed a long list of sales taxes, corporate taxes, and "recently enacted adult-use cannabis taxes." Given the number of jurisdictions involved and uncertainty as to how they'll apply to businesses that won't be able to open their doors until the end of the year, at soonest, the authors declined to guess at the final tax burden. But it will be high, and compliance a guessing game with penalties awaiting those who cross the authorities. It's a good bet that many entrepreneurs accustomed to operating in the illicit market will remain underground rather than risk the costs and hassles of legal operation as envisioned by Empire State officials. After all, technical legalization hobbled by stiff taxes and regulation has already stumbled elsewhere.

"The state has taxed marijuana three separate times as it travels from farm to consumer. Many counties and cities impose their own taxes, at varying levels, on top of the state levies," The Washington Post reported this month of California's byzantine system which favors large corporate operations with the ability to navigate the rules. "California's cannabis taxes come on top of licensing fees and regulatory permits, which can cost tens of thousands of dollars annually for growers, burying those who used to work without regulation in red tape and state invoices."

That explicit prohibition is only one legal barrier driving buyers and sellers to black markets seems to be a revelation to regulators of newly sort-of-legal cannabis markets. The fact that taxes and regulations do the same had to be rediscovered in recent years by officials in California, Colorado, Oregon, and Washington, among other places. Precisely that point was made to New York officials in a 2018 impact assessment featured to this day on the website of the state's Office of Cannabis Management.

"The higher the tax rate imposed, the higher the legal market price will be," the document cautions. "In turn, a higher legal market price will have a greater price effect, which will result in users less likely to exit the unregulated market."

"Washington State initially had higher tax rates and restructured their taxation after the realization that the taxes were cost prohibitive. Colorado, Washington, and Oregon have all taken steps to reduce their marijuana tax rates," the report adds.

Intrusive and restrictive rules also matter, the 2018 New York assessment notes, as it warned against measures such as "allowing localities to ban the sale of marijuana, which will all lead to an increase of marijuana purchased on the unregulated market and will reduce the amount of tax collected." Nevertheless, regulators are busy binding the still-aborning legal marijuana trade in red tape. In the pursuit of social justice, those include preferences for those hurt in the past by prohibitionist laws.

"New York is the first to offer its initial dispensary licenses solely to entrepreneurs with marijuana convictions," according to Politico. "It's a move aimed at offering an advantage to people, disproportionately in Black and brown communities, harmed by the war on drugs."

That's a nice sentiment, but it tries to mold a market into a politically favored form rather than a natural expression of free human interactions. California offers a case study in how trying to create the market politicians want makes it accessible only to those with connections and compliance departments.

"The once-mystical heart of the nation's marijuana industry is dying, fast, strangled not by law enforcement but by the high taxes and baffling regulation that have crushed small farmers since state voters approved legalization almost six years ago," the Washington Post story mourned. "The state rules and omissions have also empowered a still-thriving black market for marijuana—once a chief target of state regulators—whose growers sell their product illegally across state borders and still fetch a lucrative price."

New York's recreational marijuana regulators are about to walk well-trodden ground paved with government forms. Their motivation is apparent from the fact that so many of those forms involve tax collection and extensions of control. Officials mouth sentiments about removing the legal burdens on those with criminal convictions for dealing in cannabis, but they're obsessed with shaping the market to meet their peculiar vision and with the money they hope to make. The 2018 impact assessment includes colorful charts predicting first-year tax revenues ranging from $248.1 million to $677.7 million depending on how people respond to that "gauntlet of state and local taxes."

And even before social justice became a priority for regulators, the 2018 impact assessment offered plentiful assurances of the alleged benefits to be had from rules regarding age limits, "adequate security at cultivation and dispensing facilities," hours of operation, tracking and reporting requirements, THC content, and more. But all such barriers will spur people already complaining about existing medical marijuana rules to stick with the illegal market.

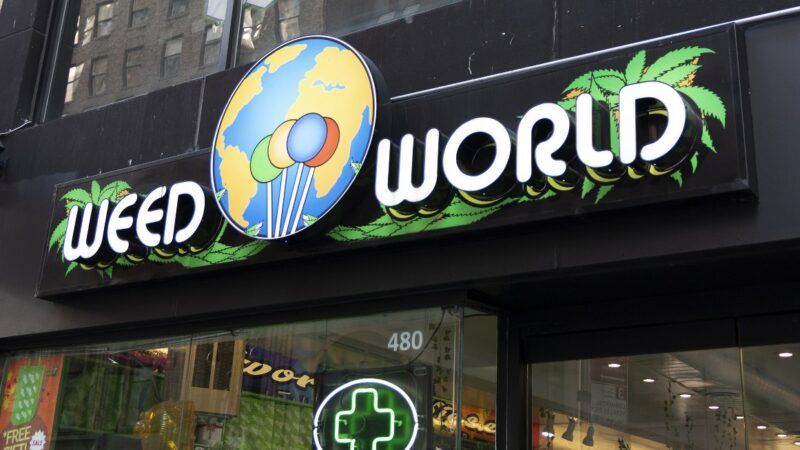

"Operators and patients have long complained of draconian regulations and taxes, which have made medical marijuana less accessible and more expensive than illicit market offerings," The New York Times reported last week about the perils facing the new recreational market. As a result, "the illicit market is thriving in New York, some of it in plain sight."

That's not to say it's all bad news. A legal market with high taxes and overly stringent regulations is still a market in which people aren't arrested and jailed. Rules can be loosened to what people will tolerate, as they have been elsewhere. But New York officials have yet to learn that markets function based on the choices of participants. The wishes of government regulators who want to use them as social-engineering tools and ATMs don't really matter. Marijuana markets will thrive so long as there are customers to be served. The question is whether they will thrive in the open under light taxes and regulations, or underground to escape the heavy hands of politicians.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Fuck Joe Biden

After being without work for 6 months, I started completing a simple online work over this website I found online, and I couldn't be happier now. (res-03) Results... After 3 months of doing this my monthly income increased by 8900 per month by working for just several hours per week...Start by following the:-

.

Instructions here:>>> https://workofferweb24.pages.dev/

thanks https://4u-review.com/beast-funnels-review/

I am creating eighty North American nation greenbacks per-hr. to finish some web services from home. I actually have not ever thought adore it would even realisable but (ati-12) my friend mate got $27k solely in four weeks simply doing this best assignment and conjointly she convinced Maine to avail. Look further details going this web-page.

.

---------->>> https://smartpay21.pages.dev

"The politicians running New York are criminals, so they will operate the marijuana industry as criminals would."

...except real criminals show a profit.

...except real criminals show a profit.

Profits will be had. But just like the markets for drugs and, more pointedly, guns of so many S. American cartels, those profits will not be shared equally.

Oh, these criminals show a profit...

to themselves. They don't care about the organization, unlike the real mafia, just themselves.

Thank God for Delta 8. I don't have street price to compare to, nor have I compared it to anything in the "regulated" market, but it seemed pretty reasonable given the stories I've heard.

the bud light of cannabis

And if Chuck Schumer has his way, any Federal marijuana legalization will look just the same, and have the same results.

This is simple to predict: pot smells, but also smells like money. If a politician senses there is money then she goes for it. Tax anything, pretend it is either not a tax at all or that it is one, but only the underserving will ever pay it.

And it will reduce the deficit.

A legal market with high taxes and overly stringent regulations is still a market in which people aren't arrested and jailed.

Maybe not for marijuana, but now jailed for failure to follow regulations and pay the proper taxes.

I would suggest that the black market is as efficient as possible, re-making it with the cost of government included in the price is necessarily going to make it less efficient.

Long time ago our Squadron shared a hangar in Florida with the DEA and Customs. One night we were sitting at the picnic table outside the hangar drinking beer. One of the Senior DEA guys was asked about the easiest way to remove the drug "problem". He'd had a few beers and said "Legalize it. That takes the big money out of it. Let it be bought the same way as alcohol, where the quality and purity is known, that takes the OD problem out of it. The problem is that there IS too much money to be made and both the people selling it and the people fighting it make campaign contributions."

ny is run by who? democrats. so why is this a surprise or even a story. this is totally expected from these morons.

Zzz...

New York must have looked at California and said "it is good, let's do that."

Economics rules all. It cannot be tamed, shaped, or regulated into something else. As the Great One says (and I may be paraphrasing) "there are no solutions, only tradeoffs"

This surprises anyone? New Jersey did virtually the same thing.

“Legalization“ was all about squeezing money out of stoners through taxes and “social equity excise fees.“ With Democrat constituencies being paid off as a bonus.

Welcome to doing business under the great State of New York.

New York Set to Hobble ̶'̶L̶e̶g̶a̶l̶'̶ ̶C̶a̶n̶n̶a̶b̶i̶s̶ All Aspects of Freedom with Taxes and Regulation

Fixed it

Seems like they have taken playbooks from California, Washington, and a few toher such states. The black market thrives in such places, as while possession of the stuff is now no longer crime, thus no stretch in the hoosegow , their fines and confiscations and taxes will all but destroy the product in pretty short order. So the underground" market will yet thrive.

Those who forget history are doomed to repeat it. So there revenue projections will be way high and they will wonder why.

This is insanity!

And that's the reason why I want to start growing cannabis myself. Well, I'd already managed to find this page that helped me learn all the basics, and I think I'll manage to grow a good harvest. At least, it's worth giving a try because seeds are not that expensive at all, especially compared to the joints.

Well written. Thank you.