The 'Inflation Reduction Act' Won't Actually Reduce Inflation

But it will hike taxes, including on Americans earning less than $200,000 annually.

Complicated pieces of legislation rarely live up to the glitzy names scrawled across the first page. But even by that familiar standard, the Inflation Reduction Act of 2022 is going to disappoint anyone excited by its title.

The bill, introduced last week after a long-awaited deal was struck between Senate Majority Leader Chuck Schumer (D–N.Y.) and moderate Sen. Joe Manchin (D–W.Va.), was pitched as a way to lower costs for consumers while also reducing the federal budget deficit and spending billions on environmental initiatives meant to combat climate change.

It didn't take long for a problem to present itself.

"The impact on inflation is statistically indistinguishable from zero," concluded the Penn Wharton Budget Model (PWBM), a number-crunching policy center based at the University of Pennsylvania. In fact, if the bill's passage had any impact on inflation in the short term, it would be to increase it very slightly until 2024, according to the group's preliminary analysis, released on Friday.

Other parts of the Inflation Reduction Act would do what Manchin and Schumer claim. According to the PWBM report, the bill would reduce future deficits by a cumulative $247 billion over the next decade and would marginally reduce the national debt as a result. It would spend about $370 billion on new environmental and climate initiatives. It would pay for all that by raising taxes and by boosting IRS enforcement, in hopes of chasing down revenue that currently goes unpaid.

But again, the Inflation Reduction Act won't actually reduce inflation.

The Schumer-Manchin deal also appears to violate President Joe Biden's oft-repeated promise not to raise taxes on households earning less than $400,000 annually.

According to the Joint Committee on Taxation (JCT), a nonpartisan agency within Congress, the Inflation Reduction Act would hike taxes by about $54 billion next year. More than $16 billion of that total would come from households making less than $200,000 and another $14 billion from households earning between $200,000 and $500,000. (The JCT's brackets don't cut off at the $400,000 level used by Biden.)

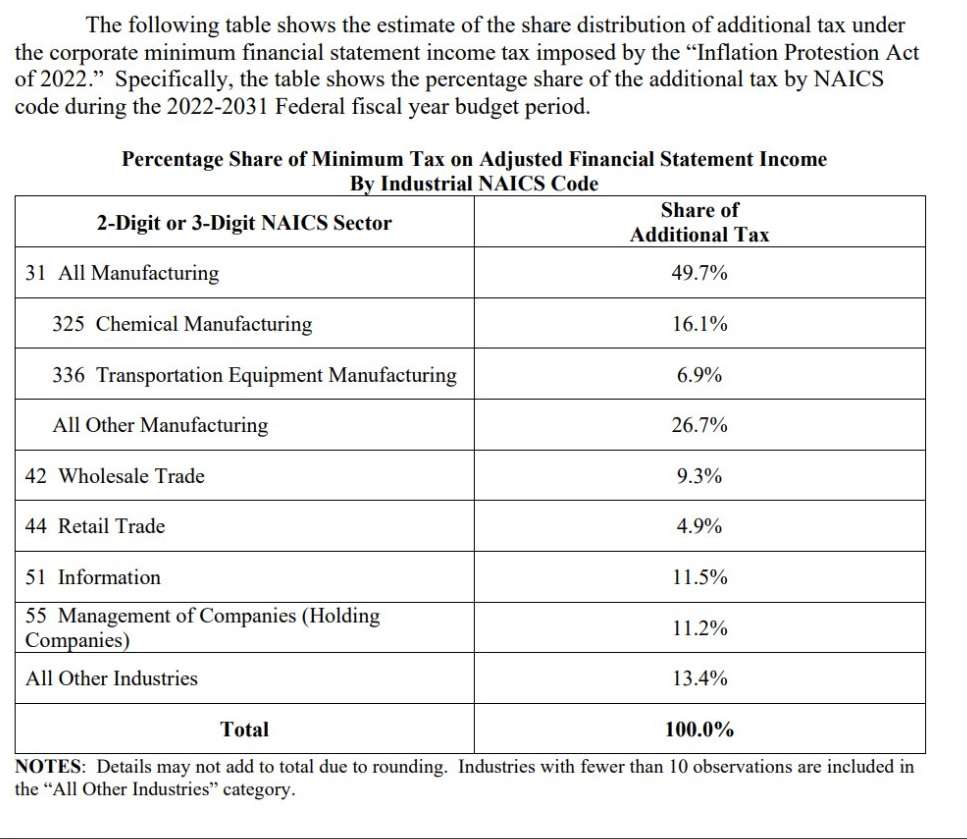

Meanwhile, other provisions in the Inflation Reduction Act would sit uncomfortably beside Congress' other major initiatives this year. Just last week, the Senate voted to hand $66 billion in new subsidies to computer chip manufacturers as part of an overall effort to boost domestic manufacturing of high-end electronics. But the corporate tax increases included in the Inflation Reduction Act would fall most heavily on the manufacturing sector, according to the JCT.

As a result, senator voting for both bills would effectively be voting to hike taxes on the very industries they just voted to subsidize. So much for improving American manufacturers' competitiveness!

Passing contradictory and counterproductive pieces of legislation would be nothing new for Congress, of course. So the biggest political problem for the Inflation Reduction Act remains the disconnect between the bill's premise and the impact (or lack thereof) that it would have on inflation.

Manchin is certainly trying to sell it. "This is all about fighting inflation," the senator said during an appearance yesterday on ABC's The Week. "Inflation is just absolutely destroying families across West Virginia and across America."

Manchin's right that Americans are struggling to deal with high costs. But it's not clear how raising their taxes will help with that.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

What!? Next you are going to tell me the Affordable care act didn't make healthcare affordable.

The ACA made it so that my employer could not longer afford to offer our 'Cadillac' style plan at no cost to their employees, as they would have been taxed and penalized too harshly for offering too good of health benefits.

Instead, we got less coverage with higher deductibles that we now have to pay for ourselves (part of it anyway).

This looks like Russian disinformation, the kind that will soon be illegal to spread.

The Dry Cleaners called, they said your brain is ready.

They had some problems with the rinse cycle due to the amount of leftover soap from your previous brainwashing sessions.

-

You are either a tool or a fool.

I made $30k in just 5 weeks working part-time right from my apartment. When I lost my last business I got tired right away and luckily I found this job online and with that I am able to start reaping lots right through my house. Anyone can achieve this top level career and make more money online by:-

.

Reading this article:>> https://oldprofits.blogspot.com

The ACA made it so that my employer could not longer afford to offer our 'Cadillac' style plan at no cost to their employees, as they would have been taxed and penalized too harshly for offering too good of health benefits.

The exact same thing happened where I worked.

Almost like that was the plan all along…

The ACA allowed those wanting to retire but had a younger spouse not yet old enough for Medicare to not have to wait or pay the cost for insurance for their spouse. They simply apply for the ACA giving their Social Security as income and get insurance a lot cheaper. The ACA does not ask for investments or 401k only income so a retired person could have millions in a 401k and still be eligible. Considering this is not something widely revealed it most likely was intentional. You certainly can't get any other government benefits without listing your worth. Retirees that take advantage of it certainly don't advertise it afraid it will be changed.

That has absolutely nothing to do with so many people losing their insurance because the government decided it was too generous.

Or that the PATRIOT Act wasn't about patriotism.

American healthcare is unaffordable because it's privatized. Profit-sucking parasitic middlemen are catered to instead of patients. Libertarians applaud this system and want more

LOL

This dumbass really wants Daddy Gov MORE involved in its healthcare!

Sadly he's going to get it and by the time he realizes what's happened it will be too late.

Which dumb motherfucker is this sock for?

When did American healthcare become unaffordable? If that was true the 99% with insurance would not have it. That is like saying homes are unaffordable. Like everything else you have to work for what you want. The government getting involved did more harm than good. The ACA subsidizes premiums, but the co-pays and deductibles are beyond the reach of many people on it. There are families on the ACA that are forced to go to emergency rooms claiming no insurance to get treatment when they can't afford the co-pay or deductible.

Medical care in the USA is vastly more expensive than it would be without government impeding competition and imposing insane regulations to drive costs up. It wasn't always this way.

https://fee.org/articles/lodge-doctors-and-the-poor/

First time I learned what a "certificate of need" is, I just about blew my stack.

-jcr

As someone who comes from a socialist country, I can tell you that this is baloney. The most expensive and lowest quality health care is the government owned one. There are long waiting lists, shortage of good doctors and rampant corruption. I've got my first practical lesson in corruption when I was 11 years old and got pneumonia. My father gave the head nurse 100 German marks, once popular "adlers", and a bottle of Hennessy, and I was transferred to the doctor of his choice and got a 2 beds room instead of 4 or 6 beds room.

Second, American health care is not market based. In market based systems, the customer makes the decision based on price and quality. When I need some blood works done, I couldn't even ask for a price. My HMO tells me that I have to fill my prescription at Walgreen. I cannot look for a cheaper alternative. That's not a market health care, that is a system of government sustained local monopolies, crony capitalism at its best. On the plus side, UNH and JNJ stocks are doing great.

Swiss health system IS market based and is much better and cheaper than American. Markets are more efficient than governments. Always.

Sen. Joe Manchin turns out to be a lying weasel.

Oh, yeah; (D)

Lying weasel just as easily applies to many Rs.

Yep, both sides are full of it.

There is some difference in type of BS for the two parties. The GOP bullshit is too old-fashioned for the younguns, who fall for the new-fangled woke shit from the left instead.

>>"Inflation is just absolutely destroying families across West Virginia and across America."

is like Mike Judge complaining o/b/o the A.L. East ... but real.

Aaron Judge lol where the fuck was my brain with Mike Judge?

The new Beavis and Butt-Head series is coming out this week? The new movie wasn't half bad.

yes I am armed with someone else's login and am excited for both

There is no inflation. There is no recession. The Biden economy is perfect. 1 / 6 is 9 / 11. Trump is going to prison. Liz Cheney is a hero. I'm a liberal capitalist.

#TemporarilyFillingInForButtplug

At this point in life, I am honestly astonished that so many in the media and in society still think that any spending and taxing bill generated in Congress has anything close to the effect that the drafters claim.

Over and over again we get bills that are claimed to do one thing and result in so many other things. Yet, we just keep going along with it like a good little electorate.

Yes. A columnist in today's cage liner admits that "in hindsight " the pandemic cash giveaways triggered today's inflation. Really, hindsight? No one paid any mind to those icky conservative and libertarian economists who predicted this at the time.

It's bullshit anyway.

The 1% of spending they gave directly to the people didn't cause our massive inflation.

Well, they're sort of correct. It was pandemic cash giveaways that triggered inflation, but the vast vast vast vast vast majority of those giveaways were to the politically connected, not to Main Street. They gave us enough so we'd sit down and shut up while they raided the treasury -- again.

No one paid any mind to those icky conservative and libertarian economists who predicted this at the time.

Rand Paul was the first US Senator to get COVID and it happened coincidentally the week they passed the first bill.

First one who got it, knew he got it, and said so. Don't forget that COVID is asymptomatic in a hell of a lot of people.

-jcr

There should be some kind of version of Betteridge's law, for statute titles. "Any bill which claims to reduce something will actually increase it."

Corporations will pay a minimum 15% on profits? The prog meme is that big corporations pay "nothing "right now. How is that possible, unless the corporation has a LOSS under provisions of the tax code?

If a corporation is currently profitable, isn't it already paying taxes? I don't remember the corp. tax code exactly, but the marginally profitable corporations that make a small profit and pay less than 15% tend to be very small companies where a new minimum 15% tax is likely to impact their investment in new equipment, wage and benefits for employees, and ability to compete.

The theory is that by reinvesting profits back into the company, they are cheating on their taxes. Of course, if we forbid reinvestment, they will just grow less competitive. But you got to break a few eggs, amiright?

Breaking the eggs is the whole point

As Orwell said “where’s the omelette?”

People tend to conflate reported profits of publicly traded companies with their responsibilities under the tax code. These are very, very different things.

GAAP income and taxable income are two wildly different animals.

And, I hate when the elected officials who wrote the tax law complain of "loopholes" which are simply businesses complying with the law as it is written.

Is the mortgage interest deduction a loophole?

Corporations Don't Pay Taxes because any tax bill they receive becomes a Cost of Doing Business on the Balance Sheet and gets passed along to the customer in the form of higher prices.

The net effect on the consumer of a 15% Corporate Income Tax is for prices to rise to cover the costs ~and~ for there to be fewer products available in the marketplace as the no longer economically viable products are eliminated.

MMT says they need to do exactly what they are planning. Tax the fk out of the middle class to pull money back out of the economy. It was in the playbook the entire time.

^

This is what you voted for eric

Why is it a bad thing, in the abstract, if people earning less than $200k pay additional taxes? Shouldn't additional tax burdens be shared among all people, regardless of income?

I would make it law that no matter the deductions all people earning income cannot be refunded more than they paid in, and may not recover all they paid in, i.e. they can get a refund up to 99% or something. This would actually hurt me, as we generally get more back then we pay in (usually because we file business taxes as personal income and we've generally ran the ranch at a loss, since we're just starting off).

You must mean something like the Alternative Minimum Tax scheme?

The 'Inflation Reduction Act' Won't Actually Reduce Inflation

WHAAAAAAAAAAA?????

Seriously though. My shocked face in in the shop getting a new layer of *gasp* applied. I need you to lay off these headlines for a while.

The Schumer-Manchin deal also appears to violate President Joe Biden's oft-repeated promise not to raise taxes on households earning less than $400,000 annually.

Read his lips?

Much like when McCain looked Putin in the eyes and saw a K, G and B, if you look into Biden's eyes you'll see two Cs and a P.

I did read his lips. I have no idea what "afkjaw lasd'b pj oasdhfhakljdba vclks iasd uiebajdn" means.

Biden lied? Who would have seen this from a man who lied about getting three degrees, graduating at the top of his class, and committed plagiarism?

"Mostly Honest"

Biden didn’t lie. It was fucking transparent from the get go that any increase in taxes was going to not just hit the 1%.

Anyone that voted for the Democrats either knew and didn’t care or are just too fucking stupid to barely walk and breathe simultaneously.

This is exactly what Boehm, and Reason, campaigned for.

Why don't you repeat exactly what is so terrible about this bill in your own words.

It raises both taxes and prices while we're in a recession. It's stupid in almost every conceivable way.

Spending money we don't have. New taxes that will make our companies less competitive, and will likely lead to higher prices and or lay offs for consumers, government energy programs that copy what failed in Germany, while raising utility rates to among the highest in the developed world and have required them to reopen coal powered plants because their green fantasies have been failures. Government directing and controlling the economy (actual fascism in other words). Should I go on?

Tony thinks all of those things are swell.

Tony isn’t a very good person.

Don't be Tony

We have as much money as the government wants to create. That's one of the great things about money.

"Less competitive" is a nice euphemism for "getting less free money from the American public." You want to set all tax rates to zero? Wouldn't it make us all more competitive, apart from the fact that we'd not have a government anymore?

Any rational person should think that any investment in reducing the impact of global warming is a good idea. This bill, written by a coal state senator, is good but hardly adequate.

The government controlling the economy is not the definition of fascism. All governments everywhere control the economy. They make it possible for sophisticated economies to exist. This is not me worshiping government, this is a statement of fact about the universe.

We have as much money as the government wants to create. That's one of the great things about money.

Yeah, look at how it worked out for Zimbabwe.

You fucking moron.

-jcr

In fact I do look at how poorly it worked for Zimbabwe. It's called data.

You'll be relieved to know that runaway currency inflation is not in the realm of likely, approaching impossible, in our scenario.

Here's a thought. Why don't you repeat exactly what is so good about this bill in your own words?

The worst thing by far is this is Joe "big guy" Biden's bill. Regardless of what is being advertised his track record would or at least should convince anyone passing it is a terrifying idea. The truth is there is nothing he has done so far that hasn't resulted in having a disastrous conclusion in the eyes of the people even though it is all part of the vision. What is happening now is what he campaigned on and this bill doubles down on it. If you like high gas prices wait until this tax kicks in for oil and gas companies and they raise the price even higher. If you like the price of groceries wait until the regulations and taxes kick in for farmers and prices get even higher. The government taxing some and subsidizing others is never a good idea. The government controlling what the people can afford and what they can't, will end badly.

The Democrats are simply counting on Americans to be as stupid as the party thinks they are.

If spending $370 Billion today will save us $247 Billion over the next ten years, why not spend $370 Trillion today and save $247 Trillion over the next ten years? That way we can eliminate the debt and send everyone a big rebate check.

"The 'Inflation Reduction Act' Won't Actually Reduce Inflation"

This is my shocked face: =O

My understanding is that Krysten Sinema is pretty strngly opposed to the idea that the far left likes to call "closing the carried interest loopphole" and so far has refused to commit to supporting this.

This thing is far from a done deal, whatever you might be reading

Maybe it is time for her to save the Democrats from thier own stupidity?

Respectfully disagree. A consumer that makes a longterm investment purchasing a hybrid or all-electric vehicle reduces oil inflation for the lifetime of the vehicle (usually 5-10 years). If that consumer also owns an all-electric lawnmower (replacing a high pollution mower) that consumer drastically reduces oil inflation. Other clean energy tax credits also reduce oil inflation.

This bill also reduces prescription drug inflation, rising much faster than wage inflation for most Americans.

Most working class Americans and small corporations pay a tax rate from about 21% to 30% (or more). This bill is merely a minimum 15% tax rate for corporations grossing over $1 billion in revenue. It does not raise taxes on anyone making under $400,000. Regular citizens pay much higher rates.

And where do those magic electrons come from? Or the additional $10-20k for these vehicles running on those magic electrons? Or the rare earths necessary for the batteries? Etc.

And I don’t know where you got your tax rates, but it clearly wasn’t the IRS.

A consumer that makes a longterm investment purchasing a hybrid or all-electric vehicle reduces oil inflation for the lifetime of the vehicle (usually 5-10 years). If that consumer also owns an all-electric lawnmower (replacing a high pollution mower) that consumer drastically reduces oil inflation. Other clean energy tax credits also reduce oil inflation.

While increasing demands for other forms of energy, whose prices will go up.

This bill also reduces prescription drug inflation

It may claim to, but it won't.

It does not raise taxes on anyone making under $400,000.

That's what the army of new auditors is for. How else do you think Joe intends to make good on his promise to raise three-quarters of a trillion dollars without raising anyone's tax rates?

Word Salad.

You only see one side of the ledger, and have conveniently overlooked all the costs that the green movement routinely and deliberately ignores to make their fantasy seem like a viable reality.

Without oil and gas for energy you have no green energy. It takes energy to manufacture and transport what is necessary to produce green energy products. Making oil and gas more expensive is also making green energy products more expensive. It also makes charging EVs more expensive. Buying electric puts more demand for energy which is oil and gas and increases inflation. Demand is part of the equation of inflation.

By the way, make no mistake whatsoever about this fact: if Sinema does end up caving and the equity firms end up getting hit with the higher tax rate, it is NOT the billionaires who are going to get slammed the hardest. Almost all of that is going to be passed right along to the working schmucks like you and me who have 401ks, Roth IRAs, mutual funds, etc in the form of higher fees.

Almost all of that is going to be passed right along to the working schmucks like you and me who have 401ks, Roth IRAs, mutual funds, etc in the form of higher fees.

^

Bill Gates and Warren Buffett are not "the 1%."

No, they are the top level of the One Tenth of 1%.

The Schumer-Manchin deal also appears to violate President Joe Biden's oft-repeated promise not to raise taxes on households earning less than $400,000 annually.

That's why Biden will surely veto it, right? RIGHT?!

Real fiscal-conservatives should love this bill. This is best deficit-reduction bill since Bill Clinton handed a balanced-budget to George W. Bush.

For the past 40 years almost all expenses have inflated except wages for working class Americans. Most wages have deflated based on annual inflation rates. Most working class Americans pay higher tax rates than this bill taxes corporations grossing over $1 billion annually. This only creates a minimum 15% tax on the richest corporations - less than most of us pay.

And this bill will fix that because it’s in the title?

Without a doubt. cointelpro must be a new joe friday sock. Same level of stupid.

silly rabbit... corporations don't pay taxes. they pass on costs.

You got a 401k? Or a Roth IRA? Mutual funds? Or are you in a one of the many big unions that has their pensions and retirement funds invested in a big equity firm, as most do (as do many municipalities around the country by the way)?

If you answered "Yes" to any of the above, then you're going to be the one who pays the bulk of the higher tax, in the form of bigger fees. It's just going to be yet another inflated cost among many. For you.

You far lefties never, ever think these things through to their obvious, logical conclusion. I do. That's the biggest reason why I'm here, to teach you fools how the real world actually works.

I think that you missed a key point - the 15% tax wouldn’t be on profits, but on revenue. A company may lose its shirt one year, with mountains of red ink, but if it’s sales are high enough, it still pays the tax. Imagine that the company had $2 billion in revenue, and $3 billion in expenses. Under the current law, there would be a $1 billion loss that could be carried forward to cover future profits. But under this bill, the loss isn’t $1 billion, but $1.3 billion, with the 15% surtax.

the 15% tax wouldn’t be on profits, but on revenue.

Which makes it a sales tax, paid by the customers.

-jcr

What's the biggest oxymoron in the military? Military Intelligence. Fuck Cointel, they never get shit correct, and I see you're holding up that tradition.

Hahahahahahahahahaha

Oh, and fuck you, cut spending.

Fuck Joe Biden.

99 days.

I'm sorry you are so partisan, propaganda-addled, and online that you are made actually miserable when the other team wins elections, even if you can't point to anything substantial they've done to hurt anyone. Very very sorry.

Says the guy who spent the Trump years literally wailing and screaming.

If Trump wasn't bad then Biden's a fucking genius and saint.

How many hundreds of thousands of Americans does a Republican president have to kill before he becomes worthy of criticism?

What’s hilarious about this metric is more people died under Biden even with the vaccine widely available. Oopsies

What makes you a total fucking clown is the only things Trump could have done would have been no shit tyrannical and authoritarian. The very things you fucking idiots continually accused him of being for 4 years.

He could have not been the core cult figure of the national anti-vaccine conspiracy theory.

Sure would be a shame if he promoted the vaccine and told all of his followers and anywhere he did a rally to go get the damn thing. Oh wait….

Nobody said he chose to be the king of the many, many antivax nutsoups who populate this board. Of course his first play was to take credit. He's not that complicated. They'll study his psychological pathology in kindergarten.

You get your bread nutbuttered by the loons you need, not the loons you want.

You’re so pathetic.

How about when the other team wins we all get fucked, that's why we're pissed off.

But you don't. You just feel that way.

Shit, my portfolio survived Bush and Trump. Yeah, it would be about 5 times larger if the other guy had gotten elected, but since we were all in the same boat, it's all relative.

No shit. Next you're going to tell me West Virginians are gullible.

“ The Schumer-Manchin deal also appears to violate President Joe Biden's oft-repeated promise not to raise taxes on households earning less than $400,000 annually.”

They’re going to adjust the threshold for inflation, right?

Right?

I'll give you credit where it's due: I got wasted last night so you beat me to the punch this time, Reason. To be fair, I figured I had another week or two before you touched the subject. To give you MORE credit where it's due, you even came to the correct conclusion! Well done!

https://simulationcommander.substack.com/p/did-the-ministry-of-truth-name-the

Schumer, Manchin and most other politicians would like us all to forget that CORPORATIONS DO NOT PAY TAXES. They just collect taxes from their customers and pass the proceeds to the government. It's another shell game.

I don't pay taxes either. It's all passed on to my cats, who long for Fancy Feast but must make do with the dry stuff.

Anytime the phrase "Climate Change" is muttered by politicians the correct agenda is Federal (National) Socialism (i.e. Nazism).

And they will stick whatever title on the bill the people will knee-jerk for to GROW their Nazi-Regime.

If Biden or anyone in the Biden administration says something you can COUNT ON THE OPPOSITE BEING THE TRUTH! They are TOTALLY INCAPABLE of telling the TRUTH! Of course Old Joe has been a complete LIAR his whole life, so why would anyone think that would change when he is President! He has never known the TRUTH about ANYTHING!

The Inflation Reduction Act is similar to treating diabetes with intravenous Mountain Dew (h/t Kevin D. Williamson).

It's not actually about addressing inflation. Joe Manchin just thinks West Virginians are stupid.

He’s not wrong.

Biden passes an infrastructure bill then raises taxes on the companies building the infrastructure which increases the price or reduces the building. He subsidizes green energy then raises taxes and gets the subsidy back in taxes increasing the price of green energy. He reduces production of oil and gas then taxes the companies which will increase the high prices even more. This all may make sense to Biden and even those stupid enough to vote for him may try to justify it but anyone being honest knows something is off.

"The 'Inflation Reduction Act' Won't Actually Reduce Inflation'

It was never meant too. It is just rebranding of the Democrat's wish list the "New Green Deal" that was rejected as to expensive that it would cause major inflation.

Awesome post. I am a normal visitor of your blog and appreciate you taking the time to maintain the excellent site. I’ll be a frequent visitor for a long time. golf usa