Fuming About Corporate Greed Won't Fix High Gas Prices

Rebutting Democrats' gaseous words on refiners' greed.

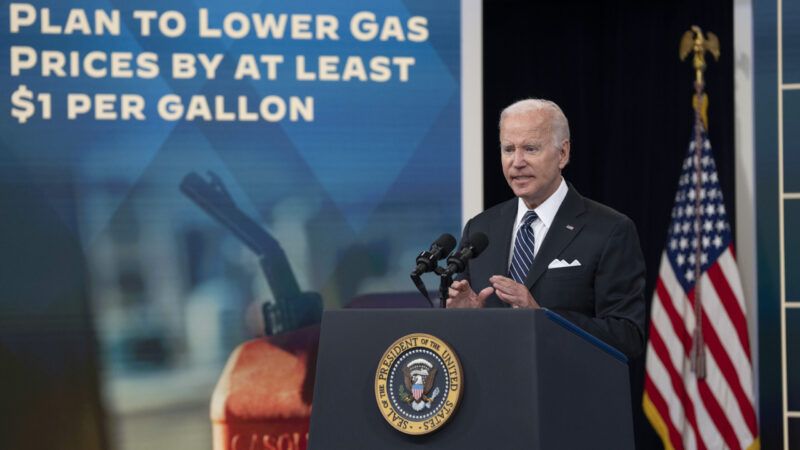

Although gasoline prices have moderated slightly, President Joe Biden and Democratic leaders continue to level their usual attacks on the nation's oil companies. They're blaming corporate "greed" for the nearly $5-a-gallon prices that drivers must endure nationally, and proposing a host of predictable government "solutions."

In a letter to oil companies last month, Biden blamed Russian despot Vladimir Putin's war on Ukraine for drying up crude oil supplies, but also said pump prices are "the result of the historically high profit margins for refining oil into gasoline, diesel, and other refined products." He instructed Energy Secretary Jennifer Granholm to convene an emergency meeting with oil executives to demand an explanation.

For their part, legislative Democrats want to launch an investigation into California's nationally high prices of around $6.50 a gallon. They're going to get to the bottom of a fictitious "mystery" gas surcharge. They bloviate and posture—and demand "accountability" from the Big Oil culprits. The only mystery is why lawmakers aren't clever enough to recognize the real culprit (check a mirror).

"Oil companies rake in record profits, while hardworking Californians struggle to pay record prices," tweeted Assembly Speaker Anthony Rendon (D–Los Angeles) in March. "Some believe the solution is to give #BigOil even more money through a gas tax holiday. We're working on a plan to provide relief that doesn't hinge on the kindness of Big Oil."

It was always foolhardy to expect much kindness from a state government that is largely responsible for California's unaffordable prices. California's Legislature and governor finally approved a modest means-adjusted gas-tax rebate—but they shrugged as new gas-tax increases went into effect last week, boosting prices another 3 cents a gallon.

Our state has the second-highest gas taxes in the nation. "Then there's the 2-cent underground storage fee, the 14-cent state sales tax, an estimated 25-cent cap-and-trade fee, and an estimated 22-cent low carbon fuel standard fee," The Sacramento Bee reported. "Gas prices also fluctuate by 10 to 15 cents when California switches to its special summer blend of gasoline."

That adds up to $1.32 to the cost of a gasoline gallon, which might offer a hint about our unaffordable prices. I'm writing from Washington, where gasoline prices are $1.50 lower than at home. Does any serious person believe Evergreen State distributors somehow are less greedy than Golden State-based ones?

The price of oil—and everything else in the private marketplace—stems from supply and demand. I just sold a four-year-old car to a dealer for more than I paid for it new. Was I being greedy—or (like everyone else) just operating within current market conditions? If you choose "greed," then I urge you to sell your home at a 20-percent discount.

In April 2020, oil companies faced a glut amid the pandemic stay-at-home slowdown. The price of crude dropped below zero. "A global oil glut sent prices so low Monday that sellers holding U.S. crude contracts paid buyers as much as $30 per barrel to take it off their hands," The Washington Post reported. Companies were storing oil offshore because they had no place to sell it.

The federal government was concerned about the price tumble. President Donald Trump tweeted (remember those days?) that he "instructed the Secretary of Energy and Secretary of the Treasury to formulate a plan which will make funds available so that these very important companies and jobs will be secured long into the future!"

Did the oil companies behave altruistically in 2020 and then greedily in 2022? Only a president or an Assembly speaker would suggest as much. People who sell stuff charge as much as the market can bear. People who buy stuff try to pay as little as possible. When prices soar, suppliers ramp up production, which ultimately leads to falling prices.

This equilibrium works wonderfully most of the time, except when the government decides to shutter the entire economy because of a pandemic. It's how the system works—and explains Americans' remarkable standard of living. The alternative is government price-setting, which distorts price signals and leads to shoppers waiting in line for potatoes and fields of unneeded, rusting tractors. (Google: Soviet Union).

We don't need an inquiry into why California has absurd gasoline prices. It's because of government intervention. The state's tax rates, regulations, and special gas formulation (which limits supplies from elsewhere) lowers supply and raises costs. California's leaders—including a certain governor who might be running for president—are proud of their efforts to drive the fossil-fuel industry out of business. Policies have consequences.

There are specific market reasons for the latest gas-price spikes (post-pandemic demand, Russia's war, etc.) but the ultimate problem stems from government policies that impede the market. The feds haven't gone as far, but they're on the same path as California. If you're looking for greed, then look at a government that's addicted to tax revenue and regulatory power.

This column was first published in The Orange County Register.

Show Comments (109)