Fuming About Corporate Greed Won't Fix High Gas Prices

Rebutting Democrats' gaseous words on refiners' greed.

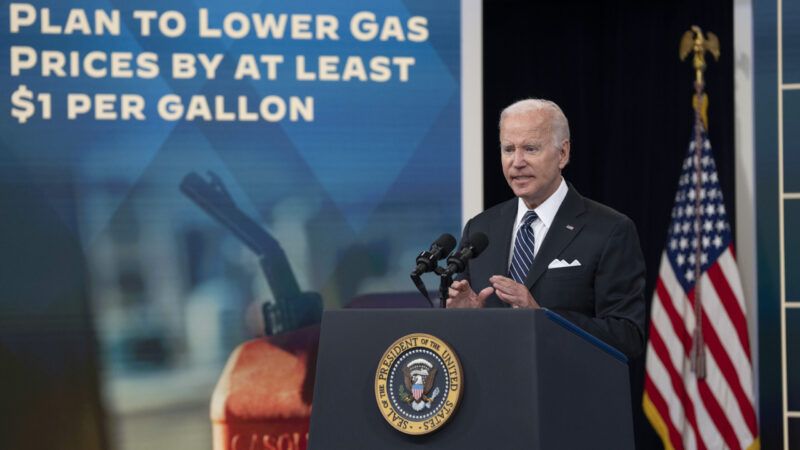

Although gasoline prices have moderated slightly, President Joe Biden and Democratic leaders continue to level their usual attacks on the nation's oil companies. They're blaming corporate "greed" for the nearly $5-a-gallon prices that drivers must endure nationally, and proposing a host of predictable government "solutions."

In a letter to oil companies last month, Biden blamed Russian despot Vladimir Putin's war on Ukraine for drying up crude oil supplies, but also said pump prices are "the result of the historically high profit margins for refining oil into gasoline, diesel, and other refined products." He instructed Energy Secretary Jennifer Granholm to convene an emergency meeting with oil executives to demand an explanation.

For their part, legislative Democrats want to launch an investigation into California's nationally high prices of around $6.50 a gallon. They're going to get to the bottom of a fictitious "mystery" gas surcharge. They bloviate and posture—and demand "accountability" from the Big Oil culprits. The only mystery is why lawmakers aren't clever enough to recognize the real culprit (check a mirror).

"Oil companies rake in record profits, while hardworking Californians struggle to pay record prices," tweeted Assembly Speaker Anthony Rendon (D–Los Angeles) in March. "Some believe the solution is to give #BigOil even more money through a gas tax holiday. We're working on a plan to provide relief that doesn't hinge on the kindness of Big Oil."

It was always foolhardy to expect much kindness from a state government that is largely responsible for California's unaffordable prices. California's Legislature and governor finally approved a modest means-adjusted gas-tax rebate—but they shrugged as new gas-tax increases went into effect last week, boosting prices another 3 cents a gallon.

Our state has the second-highest gas taxes in the nation. "Then there's the 2-cent underground storage fee, the 14-cent state sales tax, an estimated 25-cent cap-and-trade fee, and an estimated 22-cent low carbon fuel standard fee," The Sacramento Bee reported. "Gas prices also fluctuate by 10 to 15 cents when California switches to its special summer blend of gasoline."

That adds up to $1.32 to the cost of a gasoline gallon, which might offer a hint about our unaffordable prices. I'm writing from Washington, where gasoline prices are $1.50 lower than at home. Does any serious person believe Evergreen State distributors somehow are less greedy than Golden State-based ones?

The price of oil—and everything else in the private marketplace—stems from supply and demand. I just sold a four-year-old car to a dealer for more than I paid for it new. Was I being greedy—or (like everyone else) just operating within current market conditions? If you choose "greed," then I urge you to sell your home at a 20-percent discount.

In April 2020, oil companies faced a glut amid the pandemic stay-at-home slowdown. The price of crude dropped below zero. "A global oil glut sent prices so low Monday that sellers holding U.S. crude contracts paid buyers as much as $30 per barrel to take it off their hands," The Washington Post reported. Companies were storing oil offshore because they had no place to sell it.

The federal government was concerned about the price tumble. President Donald Trump tweeted (remember those days?) that he "instructed the Secretary of Energy and Secretary of the Treasury to formulate a plan which will make funds available so that these very important companies and jobs will be secured long into the future!"

Did the oil companies behave altruistically in 2020 and then greedily in 2022? Only a president or an Assembly speaker would suggest as much. People who sell stuff charge as much as the market can bear. People who buy stuff try to pay as little as possible. When prices soar, suppliers ramp up production, which ultimately leads to falling prices.

This equilibrium works wonderfully most of the time, except when the government decides to shutter the entire economy because of a pandemic. It's how the system works—and explains Americans' remarkable standard of living. The alternative is government price-setting, which distorts price signals and leads to shoppers waiting in line for potatoes and fields of unneeded, rusting tractors. (Google: Soviet Union).

We don't need an inquiry into why California has absurd gasoline prices. It's because of government intervention. The state's tax rates, regulations, and special gas formulation (which limits supplies from elsewhere) lowers supply and raises costs. California's leaders—including a certain governor who might be running for president—are proud of their efforts to drive the fossil-fuel industry out of business. Policies have consequences.

There are specific market reasons for the latest gas-price spikes (post-pandemic demand, Russia's war, etc.) but the ultimate problem stems from government policies that impede the market. The feds haven't gone as far, but they're on the same path as California. If you're looking for greed, then look at a government that's addicted to tax revenue and regulatory power.

This column was first published in The Orange County Register.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Democrats are economically retarded. Dog bites mail-man. Water, wet

I actually have made $18k within a calendar month via working easy jobs from a laptop. As I had lost my last business, I was so upset and thank God I searched this simple job achieving this I'm ready to achieve thousand of dollars just from my home. All of you can certainly join this best job and could collect extra

money online visiting this site...> https://oldprofits.blogspot.com/

Makes $440 to $780 per day on-line work which i received $21894 in one month online performing from home. I'm a daily student and work just one to a strive of hours in my spare time. everybody will do that job and online raise extra cash by simply

Open HERE:>>> https://dollarscash12.blogspot.com/

“When prices soar, suppliers ramp up production, which ultimately leads to falling prices.”

That’s what you’re selling but it isn’t what’s happening. It’s bullshit.

Prices go up, not down. It’s called inflation. The “market” corrects with recessions and depressions. It is a casino. The house always wins.

Here's an example of the Nazi shitbag's understanding of econ:

Rob Misek

March.5.2022 at 8:47 am

"The fuel price has nothing to do with supply and demand.

More people are working from home than ever before. Demand is down.Russia isn’t affecting North American supply"

It should be an obvious example of why the Nazi shitbag's comments are bullshit.

Further the Nazi shitbag has finally given up claiming that I'm Jewish and might possibly learn that those who are not Jews find his antisemitism the sign of a fucking ignoramus.

Eat shit and die, asshole

There’s another example of you not refuting anything I say.

Obviously eating shit hasn’t killed you.

I figured you would blame the Jews and tell us we have to eradicate them. Like your friends did back in the 40’s, when they murdered six million of them.

You figured wrong again fuckwit.

High gas prices are a wingnut.com myth. Inflation is a wingnut.com myth. Biden is awesome. This economy is the best ever.

#TemporarilyFillingInForButtplug

But he's back! You don't need to fill in for him any more.

#WantsTheOriginalToTakeOutTheTrash

I actually have made $18k within a calendar month via working easy jobs from a laptop. As I had lost my last business, I was so upset and thank God I searched this simple job (vsg-12) achieving this I'm ready to achieve thousand of dollars just from my home. All of you can certainly join this best job and could collect extra money on-line

visiting this site.

>>>>>>>>>> http://getjobs49.tk

The court must have granted him bail.

But raising taxes isn’t greedy.

Wanting to keep your own money is greed. Using government to steal on your behalf is the height of altruism.

They don't want to fix high gas prices. High gas prices are a core piece of their agenda.

This is either hilarious or terrifying.

High gas prices will lose them the midterms, yet they won't do any of the things that countless experts have said will lower gas prices, because CLIMATE CHANGE. If they lose the midterms, none of their agenda will pass.

So, they're either phenomenally stupid and fanatically devoted to their agenda, despite the fact that it's an obvious loser and everyone hates it (which is the hilarious part), or they don't care about elections because they have something else up their sleeve to get it done.

My guess is, there will be a sunk Navy ship and a few hundred dead American sailors and we'll be at war by October. They are just evil enough to do that because they think it's going to save their agenda.

I just want them to stop beating around the bush and call it The Green Leap Forward.

Stealing it

They can get away with this nonsense because in my estimation, 98% of Americans have no clue about the Great Leap Forward or the Cultural Revolution and its effects.

My guess is, there will be a sunk Navy ship and a few hundred dead American sailors and we'll be at war by October. They are just evil enough to do that because they think it's going to save their agenda.

Weren't you the one just in the previous discussion complaining about 'absurd hyperbole'?

It’s not absurd.

Not really all that hyperbolic either.

Remember the Maine!

Beat me to it.

"... reason we are fighting is William Randolf Heart's profits"

Biden, or more likely has primary puppeteer Ron Klain, has proven easily capable of such an action.

https://www.zerohedge.com/geopolitical/what-council-inclusive-capitalism

This mission statement is rather familiar, as it echoes the goals of the WEF and its concept of the “Shared Economy”: A system in which you will own nothing, have no privacy, borrow everything, be completely reliant on the government for your survival and you will “like it.”

In other words, the purpose of “inclusive capitalism” is to con the masses into accepting a rebranded version of communism. The promise will be that you won’t have to worry anymore about your economic future, but the cost will be your freedom.

So much easier to kick the leftists out.

They don't want to fix high gas prices. High gas prices are a core piece of their agenda.

Well, somewhat.

It is a tension between their environmental goals and their populist/strategic objectives.

Sure a lot of them would like high gas prices because that means less demand for gas and then the planet gets healed (or something). But if gas prices are too high, then it can motivate voters to vote against them out of anger.

Higher prices on something you can hardly do without causes little demand destruction.

You mean there is no way to save on gas? Can't combine trips? Can't stay home instead of taking a road trip? Can't buy a more efficient car?

Wow man, that really sucks.

Have you seen car prices lately? They’re way up from just a few years ago. Interest rates for auto loans are also up. So if someone is struggling with higher gas prices, along with higher prices for everything else, I doubt that a new car that costs lots more money is going to be the thing that fixes their budget.

Actually I have. Bought a car in January.

That Big Wheel you fished out of a dumpster?

I think many of those things are being done by people. Store brand foods are outselling the big name brands and people are eating out more than ever. Maybe your friends flying everywhere by private jet could start flying American Airlines-hahaha

Rushes to defend the left but don't call him a leftist.

How Jesse's Brain Works:

Refusal to support the Team Red narrative of the Left = Complete support for the Left

How Jeff's hypocrisy works. Calls everyone team red but cries like a bitch for everyone accurately calling him a leftist.

Except he's right. You cry like a bitch and scream "Leftist!" when anyone says boo about Republicans. You're a fucking sycophant.

LyingJeffy is rarely right about anything. Lyingjeffy goes out of his way to defend almost every single thing the left does. Your criticism of Jesse in this case is utter bullshit, since he is correct. Stop defending the blatantly partisan Jeffy and maybe you'd get a bit less grief.

This is what I agreed with.

How Jesse's Brain Works:

Refusal to support the Team Red narrative of the Left = Complete support for the Left

You telling me jeff's observation is incorrect? From what I've seen any and all criticism of the right is met with "YOU'RE A LEFT-HANDED LEFTY LEFTIST WHO VOTED FOR BIDEN AAAUUUGHH!" from JesseAz.

Fucking tags have to be on every line now. Dang it.

How Jesse's Brain Works:

Refusal to support the Team Red narrative of the Left = Complete support for the Left

There.

We all know you’re in love with Jesse.

Soldiermedic is just mad that I called out his obviously ridiculous pants-wetting over the Disinformation Governance Board. Don't forget that Soldiermedic was the one who credulously claimed that because of the DGB, the FBI was going to be kicking in conservatives' doors at 3am and dragging them to the gulags just for posting some shitty meme on Facebook. So evidently the rule is, if soldiermedic is going through one of his manic/drunk phases, you have to coddle him.

Yeah, you’re all in for a federal organization that will end up controlling a lot of public speech. That’s not a leftist position at all.

You carry a river full of water for Biden and the DNC. THST is why you’re a leftist. Just admit what you are.

Please get this through your brain:

I don't support the DGB.

I also don't agree with the characterization that it was going to be literal MINITRUE.

Get it?

Yet you expend endless time and energy defending them? Sure, we believe you.

I mean, how you continue to deny their plans backed by ESG and new green deal despite watching food and economic collapse in Sri Lanka and Ghana, two countries paid to go green and utilize far left eco policy in farming which has lead to massive food insecurity. Then you have the Dutch farmers protesting the same shit for a 30% reduction in exportable meat by 28.

Yet you still can't criticize the left.

Jesse, do you honestly give a shit about the people of Sri Lanka or Ghana? Do you really? Seems to me, they only become relevant in your mind when something bad happens to them and you can blame their troubles on the Left. But in every other situation, they are just shithole people from shithole countries that may be safely ignored. Heaven forfend that some of them might want to immigrate here - we can't have that! Why don't they stay put and fix their own damaged country, amirite?

The people of Sri Lanka in particular have been through a great many crises in their recent history and I don't recall ever hearing you raising a finger of concern for anything that they have gone through. So spare us your crocodile tears.

Yes. I do jeff. I feel badly for anybody who has their life disrupted by failed leftist policies. We have 200 years of their failed policies throughout different trials but the assholes continue to persist. Assholes like you. Often through graft and corruption.

And once again you are too fucking ignorant or too much a liar to understand my arguments on immigration despite me being clear and consistent. Open borders for welfare states are community suicide. Get rid of the welfare state and I'll be all for the open borders.

But you're too stupid to understand that.

Open borders for welfare states are community suicide. Get rid of the welfare state and I'll be all for the open borders.

Amazing. You said something that makes sense without being an antagonistic piece of shit.

But you're too stupid to understand that.

Whoops! Spoke too soon.

Yes. I do jeff. I feel badly for anybody who has their life disrupted by failed leftist policies.

thanks for proving my point - you only give a shit when you can blame it on the left. They aren't people, they are only pawns in your war on The Left.

Open borders for welfare states are community suicide.

"Sure, I'll support open borders,

when pigs flywhen the welfare state is abolished!"And even if I was to take your request seriously, and not as a duplicitous impossible demand, you continually refuse to acknowledge that immigrants consume a tiny fraction of the welfare state - if all immigrants, legal or illegal, were deported tomorrow, the welfare state would still be about as big as it is today. And yet you scapegoat them as being a significant drain on the welfare state.

And of course you are so serious about abolishing the welfare state that you continue to shill for one of the major parties that fully embraces the welfare state. Huh.

And I note that you are more concerned about the community than about the individual liberties of those involved. How very communist of you.

Can you name a "right wing" country, one that is for free markets and individual liberty that is a shithole?

Fuck your outrage Jeffy. You would see every one of those people starve rather than have them turn away from the left and be free.

You would see every one of those people starve rather than set foot on American soil.

That isn’t a realistic scenario. Mine is. And you’re deflecting again. The people of Ghana are facing likely starvation because of your fellow travelers. This is preferable to you as opposed to them turning away form socialism.

Just admit it.

That isn’t a realistic scenario.

Sure it is. People have the ability to travel here all the time.

The people of Ghana are facing likely starvation because of your fellow travelers.

The people of Ghana are suffering for a VERY LARGE number of reasons, some of which are bad left-wing policies. And you only pretend to care about them because you think their problems are due to The Left and can wave their bloody shirts around as victims of the people that you hate. In any other context you wouldn't give a shit. Look at how you all treat Honduras or El Salvador or Haiti. Not an ounce of compassion for the people there, no crocodile tears about "oh those poor people, if they only turned away from left-wing policies". Nope, it is entirely "they're shithole people who need to fix their own broken country so fuck 'em and send 'em all back".

Quite frankly I doubt you would even know what continent Ghana was on if it wasn't for some right-wing website bringing their plight to your attention in a story framed to blame the villainous left for their predicament.

No, they’re primarily suffering because they’ve adopted socialist policies and incorporated all this ‘Green’ bullshit too. The current result was obvious well ahead of time to anyone who understands economics (not filtered through prog theory) and can read a balance sheet.

And people ‘traveling here all the time’ isn’t what we ‘re talking about. It’s the mass absorption of echo ic refugees when we’re behind broke. But all you care about is open borders, at any cost.

Notice how he deflects to avoid having to condemn the left?

This is such a bad faith argument, Jeff. Accusing someone of not caring about certain people to deflect from the substance of what was actually raised. So gross.

I am not going to fall for Jesse's trick to use the poor people of Sri Lanka and Ghana as props in his little tirade. His 'concern' is completely fake.

If they asked to come to this country, Jesse would say 'fuck you' and send them away.

If they asked for foreign aid, Jesse would say 'fuck you' and send them away.

So I"m not going to let Jesse get away with his little emotional manipulation stunt.

So Jesse is bad because the voices in your head say that he wouldn’t lift a finger to hell them. Which in your mind consists of relocating their population here and/or buying all their food. Which is required because your fellow travelers got them to go along with your horrible leftist policies. Which you won’t address.

That about cover it?

Jesse, like yourself, is a disingenuous asshole who doesn't give a shit about Ghana or Sri Lanka or any foreigner really, unless he can use them as props to blame his enemies.

Bullshit. Your kind are the ones who use them as props. That’s why they’re win the mess they are now. There will be thousands more deaths on the heads of you and your fellow travelers.

Holy fuck, are you retarded, Jeff.

No one has to “honestly give a shit about the people of Sri Lanka or Ghana” to note that they are getting fucked for going along with the eco assholes and their noble plan to save the planet.

Let em all come here though, cuz that’s the correct response to a completely preventable crisis caused by the policies of the eco assholes, right? And if you disagree you’re a bad person?

Fuck off.

How else are they going to shift dollars to their EV building union overlords?

Slow Joe even went so far during his campaign that one of his agendas was to shut down drilling and government lands to further exploration.

This was all part of the greenies agenda.

Correct. Buttergeirger guy was just on a talk show crowing about how high gas prices are going to force the conversion to green EV cars faster than ever. Of course, we can't afford to buy hamburger or pay rent but look at this shiny thing over there! He also was claiming that EV prices were going to go down because of "subsidies". Paying off union buddies at the big three to make something no-one wants because for half the year north of Maryland/Kansas they don't work worth a squat. How are these unicorns going to get electricity when all the power plants are shut down and there are rolling brownouts now? See the Ken Doll in CA just ask people to not charge their cars during the day because of this? You can go to work but not get home

A Market distorting, quick fix political solution to the previous market distorting, quick fix political solution.

You can practically set your watch to the stages of socialist policy failures if you let them take their course.

It’s almost like it’s on purpose…

Never mind the fact that many of these nature cultists/ social levelers have been calling for higher gas prices all along.

Mr president, how much longer will Americans suffer with high gas prices?

Biden: “ As long as it takes”.

Necessary for the new liberal world order.

They GOP should play that on a loop the next two years.

They would, but they’re incredibly stupid.

Author and budget hawk Martin Gross described the GOP as “dead from the neck up”, and the democrats as “Marxist traitors”. He was correct on both fronts.

"You can practically set your watch to the stages of socialist policy failures if you let them take their course."

+100000000000000; All of them UN-Constitutional and treasonous to the USA.

The pattern is: government policy causes a crisis.

The government publicly and violently searches for culprits, aided by the MSM, and names the wrong parties--usually in the private sector.

The government then rolls out a massive new law and its regulatory children to "fix" the problem as they defined it. The new law doesn't solve the real problem, costs a lot, and has massive unintended consequences, including setting the stage for the next crisis, which will be bigger and more damaging.

Memory of the past crisis fades and everybody reluctantly adjusts to the massive new regulatory overhead.

A new crisis occurs.

The government publicly and violently searches for the culprits, aided by the MSM--looking exclusively in the business community...and so it goes.

Meanwhile, in Washington State:

1) State’s new tax on CO2 emissions is projected to add 46 cents per gallon to 2023 gas prices

2) An increase of 56 cents per gallon is projected for 2023 diesel prices

3)By 2030, the new tax is expected to add 80 cents per gallon of gas

4) By 2030, the new tax is projected to add 97 cents per gallon of diesel

5) Current state gas tax is 49.4 cents per gallon, so the new tax is projected to nearly double taxes on gasoline paid by Washington residents

6) Fiscal note on the cap-and-trade bill projected a $20.60 cost per metric ton of carbon emissions, a fraction of what the state Department of Ecology now predicts

7) Environmental activists seek to remove protections from the cap-and-trade bill for energy-intensive, trade-exposed industries (EITE)

Through 2026, EITEs are exempt from the tax on CO2 emissions. Starting in 2027, 97% of their emissions would be exempt. Denying exemption timeline could mean business failure and reliance on Chinese alternatives that pay little and cause environmental and human rights harm

When Biden is deposed, WA should be put under martial law until the left here can be dealt with.

Time for regime change in Washington state.

It may be too late. They've gone full on Marxist stupid.

Then we can say we are……. provoked.

This is why Freight companies on land are closing terminals on the West Coast. It is also why Maersk, COSCO, Mitsui Osaka and other shipping companies are shifting from West Coast ports to Gulf and East Coast Ports. I hope no-one missed all the dredging and infrastructure work that has been done in Houston, Biloxi, Wilmington, NY/NJ, Savannah, Baltimore, Jacksonville etc. It is also why Mexico is planning a huge new port in Monterrey with a rail line straight to Kansas City. Also in the planning is a 2cd Canal roughly following the original route across Nicaragua to accommodate the larger new class of container ships. Don't forget the estimated 60,000 trucks Cali is about to force off the road due to State EPA mandates and Worker rules.

The oil and gas markets are highly competitive. Complaints about "corporate greed" are idiotic.

Benedict Arnold the most infamous traitor of America until current times. We now have someone in our highest office who hates the American people, attacks American employment, attacks out energy sources, threatening our food chains, trying to bankrupt our economy with socialist idealism, and really has sold his soul to all foreign powers. Mr. President what do you think how the Biden name will be remembered in history? Our great border protector? Loved by all Americans? That bust you have in your office of John Kennedy who said "ask not what your country can do for you but what you can do for your country" Put it away please you do another disservice to our Country, memories and you own fake put on demeanor. Your policies do not represent Democrat or Republican or any American values. The Biden family will be forever known as the family who enriched themselves at the expense of the American Tax payor. That's how 78 million plus American voters will remember not only you but also your entire family.

When the government vows to put you out of business by 2030 or 2050 (depending if you believe the Democrats or the Republicans), who's going to be stupid enough to invest in expensive infrastructure to increase availability? Biden claims to be doing everything he can to reduce the price of oil when he campaigned specifically on the issue of making oil too expensive to afford. Sure, he's an economic illiterate that doesn't realize these two aims are in opposition, just as he doesn't realize that massively increased spending is not the way to fight inflation, but Jesus Christ, is there nobody at all in his administration that can explain to him how this works? Is everybody just as economically illiterate as he is?

They don't care, because they'll be the ones shoveling money out the door to their buddies.

Come on man, they are doing it to save us from that existential threat of climate change. We would be boiling like frogs in the next 964 days if we don't end the use of oil now. Just look outside and see the bad weather. Now it is the worst and Getty worse all the time

Joe Biden's upcoming appearances will feature warnings on:

a. dangers of children having access to crack

b. dangers of spouses being white supremacists peddling stereotypes of Hispanics being like food

c. upward trends of elderly politicians demonstrating signs of cognitive impairment and memory loss

d. how to tank a thriving economy

e. steps to transition a democracy into a totalitarian state

f. how to win Big Tech to your side to sway an election in your favor

g. notes on losing a son to death and having his widow get manipulated by a sibling of the dead son

h. tips on how to read a teleprompter

oh the memes these asswipes have given America for decades are priceless

FJB and his breakfast taco loving worthless EdD wife

You forgot warnings about ten year old girls being forced to shower with their pedo dad.

Over half my gasoline price is state and federal taxes. Biden and "fight inflation" by cutting Federal gas taxes. And since all tax cuts need to be combined with a spending cut, he should simultaneously slash Federal subsidies to the petroleum industry.

Smaller government doesn't fix every problem, but damn it sure solves most of them!

You were corrected on your first sentence yesterday. You and Jeff never seem to educate yourselves.

You can't fix stupid, especially when it is intentional.

This isn't true, you stupid faggot.

Then gas must be really cheap where you're at, being that the federal gas tax is $0.18/gallon and the average state gas tax is $0.30/gallon.

Please tell us about the spending on the subZidiEs

State is the big hitter in PA but yes it would help but not cut it in half.

"...he should simultaneously slash Federal subsidies to the petroleum industry..."

TDS-addled asshole Brandyshit thinks there *are* subsidies.

That was all economic and factual gibberish. Also, the petroleum industry isn’t subsidized. Stop with your leftist talking points.

You are a worthless, attention seeking, lying pigfucker.

Time to start doling out consequences.

Start with pathological liars at the bottom, like collectivistjeff and brandybuck, then work our way up.

Tell us your murder list. C'mon, Nardz. You can do it. Everyone knows you have one.

You won’t be on it. Alcohol already has dibs on you.

Every day Joey B says dumb stuff and his stupid sheep followers just nod.

Corporations are greedy. Their shareholders demand it. It's called the profit motive. The price of gas is controlled by the market.

So just now oil corporations that have been around for 100 years figured out they can price gouge with impunity, that is without competition undercutting them.

They didn't know thsi even 2 years ago somehow.

Just idiots!

But oil companies will always screw The People unless constrained by caring government. Now, who was in charge two years ago?

Hmm. Why does "greed" only apply to dollars and corporate execs, and not to power and politicians?

Weird because corporations can't make you buy anything. But government can use force.

Idiot rages that oil futures prices are dropping while prices at the pump aren't. Doesn't realize that futures are exactly that, things received in the future, not today. The price of oil at the first of next month has largely nothing to do with prices of gasoline today that's taken a month or more to process and reach the pump.

An honest investigation performed by the government would declare something like this " We have discovered the culprit for high prices and the culprit is us the government".

In an ideal work there would be no subsidies for gas, solar, nuclear, wind natural gas, coal or any other energy source. Minimal or no taxes on any energy source. Limited funding or grants to develop new energy sources.

The market left alone from centralized control is in a much better position to deliver the best energy source under the current situation and with current considerations. Overtime there will be market reevaluations which may change what is better.

There are far to many considerations for any centralized control to manage, but the market which is comprised of billions of people has the capacity to look at these considerations. One consideration is that what is the best for one region will not be what is best for another.

In a true market outside of centralized control, this is fine and achievable where both regions use what is best for them. With centralized control you get a focus on a few considerations ignoring the rest, then force is used to mandate whatever the centralized power demands.

Centralized control disregards reality unless there is enough resistance threatens their power.

Governments have a tendency to grow exponentially.

Politicians have a tendency to become corrupted the longer they hold power.

Companies have a tendency seek protection against their competitors by currying favor with government as they get larger.

Centralized control in a capitalist system fosters a blending of private-state economy which is a complete distortion of the market. The centralized control government with a private-state economy pretends to be free market, however is not even close. Instead it is a hidden system of payoffs and favors for the elites in power.

California is one example. I doubt that elected officials investigating the higher prices of gas in California will be honest. Rather they are in search of a scapegoat to deflect the ire of the masses that threaten their power.

Joe Biden openly declared his hostility to the oil and LNG companies. He openly stated he wanted to shut them down.

So now after closing all oil and LNG exploration on government lands as well as offshore drilling, shutting down the keystone XL pipeline that threw over 50,000 men out of a job and now after having plunged the country into a recession and possible depression, the demented old man wants to blame the oil companies or Putin for high gas and diesel prices.

This proves he and his administration are totally clueless about economics and the petroleum industry. Then again, Biden has been clueless all his life anyway.

During the trump administration one week, gas was down to $1.18/gal at the pump.

Now truckers and farmers can't afford to buy diesel to run their equipment. Fertilizer is rationed or non available. People have to decide whether to buy gas for their car or put food on the table.

Biden is kaput! The dems are now looking for a way to rid themselves of this troublesome pratt.

The only positive is to watch the dems take a stout beating next November and the republicans take control of both houses in January.

The the fun begins

So long Nancy

Impeach and remove cackling kamala

Impeach and remove dementia Joe

A thorough cleansing of the White house

Impeach fauci

Impeach Garland

defund the FBI

The Biden Administration Not Accepting Their Own Policies Are The Cause of High Gas Prices Won't Fix High Gas Prices