New CBO Report Exposes Biden's Deficit-Reduction Misinformation

The president is trying to claim credit for falling deficits. Actually, his administration has overseen a $2.4 trillion increase in the long-term deficit.

By the time inflation comes under control sometime next year, the federal budget deficit will be ballooning once again—and on course to hit $2 trillion annually by the end of the decade.

The new economic and budgetary outlook released by the Congressional Budget Office this week forecasts steady if unspectacular economic growth for the next 10 years, falling inflation rates, and climbing budget deficits. The report projects that "the current economic expansion continues, and economic output grows rapidly over the next year." But the government continues to spend more than it collects in tax revenue, driving annual budget deficits to $1.7 trillion by 2028 and $2.3 trillion by the end of the 10-year budget window in 2032.

The number-crunching agency expects inflation to fall to 4.7 percent by the end of this year and keep tumbling to 2.7 percent by the end of 2023 (only slightly higher than the Federal Reserve's long-term goal of 2 percent). That's good news for consumers, though it suggests that relief from 40-year-high inflation rates might not arrive as soon as many would like. The bad news is that the CBO expects economic growth to fall along with inflation: from 3.1 percent this year to a mere 1.5 percent by 2024.

But the CBO's projections are best understood not as a crystal ball providing information about future growth rates and inflation. Rather, the agency's long-term projections serve as a baseline—a literal one, when it comes to measuring the impact of new legislative proposals—for measuring how Congress and the White House have influenced future budgetary trends through recent policy changes. To really understand the usefulness of the CBO's projections, then, you have to look at what the agency was projecting last year and the year before that—then compare it to what the CBO is expecting now.

That's especially important to do right now because the Biden administration is pushing a wildly misleading talking point about the falling federal budget deficit. The deficit "has gone down both years that I've been here. Period. Those are the facts," the president said earlier this month.

As I've explained at length previously, the deficit is falling from the stratospheric levels that it reached during the COVID-19 pandemic because a lot of one-time, emergency pandemic spending is coming off the books. It's tricky because Biden is correct that the deficit is likely to fall by more than $1 trillion this year—even though this year's deficit is going to be larger than the deficit was in 2019, the last pre-pandemic year.

The CBO baseline is the best way to measure how deficits have grown or shrunk over multiple years since it filters out one-time emergency spending like the COVID relief efforts.

So what does the CBO have to say about how its budget baseline has shifted during the Biden administration's first full year in office?

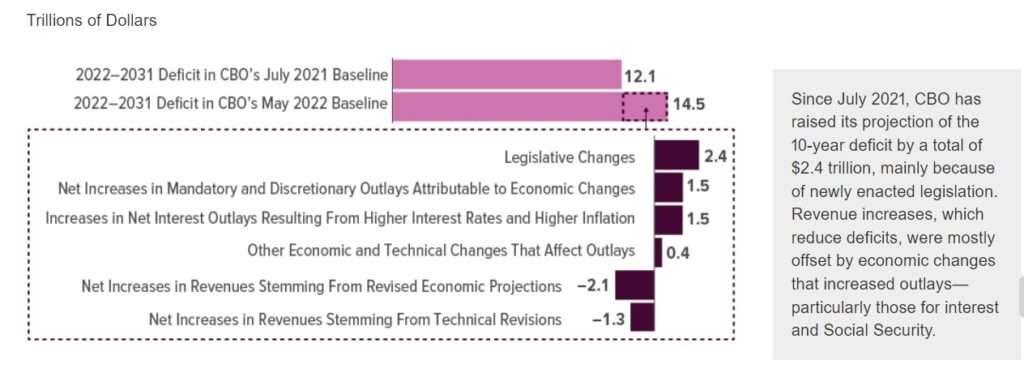

"Since July 2021, CBO has raised its projection of the 10-year deficit by a total of $2.4 trillion, mainly because of newly enacted legislation," the report reads. "Revenue increases, which reduce deficits, were mostly offset by economic changes that increased outlays—particularly those for interest and Social Security."

Those increased outlays—that is, spending—are mostly the result of the bipartisan infrastructure bill and the 2022 omnibus budget bill, which hiked spending by more than $600 billion.

In short, the deficit situation is getting worse. Even if it looks better in this particular year, the long-term trend is deteriorating thanks, largely, to interest payments on the ever-growing national debt and the increasing cost of entitlement programs.

Unlike the spiking deficit during the pandemic, the deficits projected over the next decade are unlikely to resolve themselves. The interest costs of the federal debt are creating a nasty feedback loop that drives deficits—and therefore borrowing—higher year after year, leading to more debt and higher interest payments in future years.

In fact, the CBO projects that interest payments on the national debt will triple by 2032, climbing from about $400 billion this year to more than $1.2 trillion that year. "Over the full decade, interest costs will exceed $8 trillion—comprising more than half the deficit and consuming all revenue outside of individual income and payroll taxes," notes the Committee for a Responsible Federal Budget, a nonprofit that advocates for smaller deficits.

That should be a sobering assessment for America's political leaders, particularly because those costs are largely baked into future budgets already. It's time to pay the piper for years of accumulated deficits and fiscal nonchalance, and the price is a steep one.

But Biden is trying to claim credit for falling deficits as a way to justify even more government spending. The CBO's new projections—and the upward trend in the agency's baseline over the past 12 months—ought to put an end to those phony claims.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

But I had a Diet Coke with my meal specifically so I could have a double portion of chocolate cake for dessert. If you're saying I can't have a double portion of chocolate cake, I might as well have had a regular Coke.

Defining decency down. Brandon is not a decent human being

I’ve made so far this year and I’m a full time student. I’m using an online business opportunity I heard about and I’ve made such great money. (res28) It’s really user friendly and I’m just so happy that I found out about it. Here’s what I do.

.

For more details visit:>>>> https://brilliantfuture01.blogspot.com/

This is a masterclass in how the media reports things that aren't actually things:

Front page, above the fold.

It’s important news.

Weren't the 'guerilla gardeners' the ones who threw a bunch of cardboard down, rubbed some topsoil on it, and expected the Bonnies Plants veggies they looted from Home Depot to grow in it, only to watch them die?

That sounds like the kind of farming prowess I expect from progressive urbanites.

If nobody has food, it's still equity.

Don't we just call that Communism.

Yes, literally, yes.

Trying to beat the Chron; top of the front page was:

"Protests in wake of shooting"

They found three or four groups who simply do not understand A2.

According to butplug, SleepyJoe is some kind of financial genius.

Rig count is up and Warren Buffett is getting richer. That means the economy is great.

#TemporarilyFillingInForButtplug

For the elites like you and ButtPlug it is. How about the rest of us serfs?

While the United State's long term debt may have increased under the Biden administration, the important thing is that civility has returned to American politics and we no longer pursue a Neo-isolationist, "America First" foreign policy. I'm sure most of the Reason staff agree with me that a Biden vote in 2020 and 2024 is the morally correct decision.

No mean tweets.

They may have to do it strategically, but they will do it again.

For fuck sakes, what do you think the goal was when 100% of the Democratic field declared, in front of the nation, that the world's population would be entitled to free, taxpayer funded healthcare so long as they were able to make an end-zone dive into the confines of our social construct? What is it-- exactly-- that you think is going on here?

Wrong thread.

May as well use this to say Fuck Joe Biden.

Fuck Joe Biden

Yet relevant

"The number-crunching agency expects inflation to fall to 4.7 percent by the end of this year and keep tumbling to 2.7 percent by the end of 2023"

Looks like the CBO is expecting the Democrats to lose big in November mid-terms, too.

It’s the only solution.

Obviously TFG's fault.

New CBO Report Exposes Biden's Deficit-Reduction Misinformation

If only there were a government agency to deal with such misinformation...

Consider this:

https://www.youtube.com/watch?v=bfNamRmje-s&list=TLPQMjcwNTIwMjL9PRulNU70QA&index=3

HSBC's Stuart Kirk tells FT investors need not worry about climate risk

I’m betting any climate investment from significant financial players is based on demand guaranteed through regulation and major incentives from government. As opposed to real market demand.

"By the time inflation comes under control sometime next year"

I'm curious, how will this happen? Even if GOP sweeps the midterm, most of the party won't be on board for austerity measures. Some might pivot back to free trade, which will help.

When was the last time raging inflation was deflated (so to speak) significantly? If another recession hits, another stimulus check is all but inevitable. The amount MIGHT be less under GOP control. And the war in Ukraine in continue to put a crimp on fuel and grain supply. Covid shutdowns remain like he sword of Damocles.

We played a lot of stupid games during covid, and we're starting to win stupid prizes. The last two mass shooters were radicalized during shutdowns. All those 5th and 6th graders who missed out on school will be 9th and 10th graders pretty soon, and they might be the next lost generation. New police recruits will dry out in the future, endangering many minorities in crap parts of the country.

At the start of the inflation, they were saying it would be down to 2.5% by now because it was transitory.

They have no idea.

Whether the next quarter is negative or not, the current stagflation is absolutely unsustainable. Right now, real growth is around -8%. What is the likelihood of GDP growth outpacing inflation anytime in the next 2 years? Maybe I'm too much of a pessimist, but it seems that sustained sub-inflation growth will make the situation significantly worse, not temper and catch itself.

If food prices redouble be for the next presidential election, the democrats may not have to worry about elections. They just won’t be around anymore.

Someone, light the Buttplug Signal!

Here ya go:

turd lies; it’s all he ever does. turd is a kiddie diddler, and a pathological liar, entirely too stupid to remember which lies he posted even minutes ago, and also too stupid to understand we all know he’s a liar.

If anything he posts isn’t a lie, it’s totally accidental.

turd lies; it’s what he does. turd is a lying pile of lefty shit.

B-

Joe needs to be kept away from ALL live mics. Mainly because he doesn’t know what he is talking about. And, at best, he thinks Americans are stupid enough to believe what he is saying.

They’d have to understand what he mumbles incoherently before they can believe.

Projection.... It's the left-wings biggest character strength.

1) BLAME everything they are going to do on others.

2) DO exactly what they've been blaming everyone else for doing.

And while no-one is actually doing what they're BLAMING the world for; all the bobble head leftards just keep nodding without a F'en clue...

Point & Case

1) BLAME spending; then pitch endless spending bills

2) BLAME a racist society; then pass racist legislation

3) BLAME greedy corporation; then subsidize the living tar out of them (green-energy/musk?)

etc, etc, etc, etc............... Endlessly.....

And all the easily manipulated emotional without a penny of a bran just keep following the wolf like a pack of sheep.

Oh geez; How did I miss my favorite Point & Case.....

4) BLAME the right for being Nazi's; while outright supporting National Socialist (syn; Nazism) --- Yeah; they really are that stupid.

The problem with the current administration is that they can't contain their fuckery. Having the media on your team only works if you can keep reality from smashing into the faces of the voters.

There's no question in my mind whatsoever that the Treasury Department is playing games with the numbers, big time, even though we're not up against the debt ceiling yet. It's completely impossible for the deficit to have gone from where it was to near zero overnight, in the blink of an eye, especially the way this asshole in office spends money.

We're going to be lied to by our government at basically every level over the next few months on a scale we've never been lied to before. Probably 90-95 percent of government employees voted for this all-time shitty president, and they're VERY desperate and highly motivated to try to trick people into believing that he's not the complete and total disaster most people know he is.

The number-crunching agency expects inflation to fall to 4.7 percent by the end of this year and keep tumbling to 2.7 percent by the end of 2023 (only slightly higher than the Federal Reserve's long-term goal of 2 percent). That's good news for consumers, though it suggests that relief from 40-year-high inflation rates might not arrive as soon as many would like. The bad news is that the CBO expects economic growth to fall along with inflation: from 3.1 percent this year to a mere 1.5 percent by 2024.

Does anyone believe that inflation currently at ~9% will fall to ~5% by the end of the year....in just 6 months? Boehm the Birdbrain might believe that.

I fear inflation is going to be much more persistent than we think. I cannot see any historical instance in American history where 'high' inflation (>6%) was ever tamed in less than 5 years. Here is what I see.

In 1916, inflation shot up from 3% to 13%. Inflation did not come back down until 1921 (a pandemic shut everything down, sound familiar?).

In 1941, inflation increased from 2% to 14%. Over the next ten years, inflation was a rollercoaster and did not stabilize until 1951, 10 years later.

In 1973, inflation rose from 4% to 9%. Inflation was not tamed until 1983.

The historical evidence is just not there for what the CBO is saying, and what Boehm the Birdbrain is parroting. Inflation tends to persist and is very, very difficult to contain. It will take more time than we think.

The only way I can see it is if consumer spending absolutely crashes. We're seeing crumbling spending now, but it would have to crumble well into single digits to just account for the shortages. We're in a recession whether the official numbers say so or not. Even the rosiest GDP forecasts don't sniff the inflation rate. Stagflation is wonderful, isn't it.

They claim inflation is falling right now, which is pretty hard to believe indeed given that gas is up around 10% this month.

As I said above, every fed department and agency is going to be lying to us over the next few months to an extent they've never lied to us before, as they reach maximum desperation to protect Biden and their beloved democratic party.

M i s i n f o r m a t i o n

14 letters, 5 syllables

L i e

3 letters, 1 syllable.

saving the climate with fewer pixels, priceless.

New CBO Report Exposes Biden's Deficit-Reduction LIES

Reason had no problem calling the last president a liar, yet most of the lies were about him as we have seen the hoaxes exposed and the lies retracted by the media that started the lie.

Reason's unmitigated hate for Trump and support for Biden has made them use verbal gymnastics to not call Biden what he is, a liar.

Couldn't help but notice this article's URL calls them "Lies", not "Misinformation".

Slow Death: 2%

“Inflation is taxation without legislation.” -Milton Friedman

Many an economist will tell you that the fastest way to kill a successful economy is via inflation. Whence came this magical 2%? In 20 years, the government will have robbed you of half your money, especially at interest-rates near zero. Any inflation is legalized theft by government.

From the novel, Retribution Fever:

“Nobody ever went broke underestimating the intelligence of the American public.” -H. L. Mencken

Perhaps, Mencken had been right. The U.S. government, however, was dedicating itself to proving him wrong. It was going broke by not giving the suckers an even break.

Via the legalized theft of inflation, even after receiving interest on their deposits most savers had been losing 1% to 2% of their savings per year every year to their respective governmental bandits partly as a consequence of taxes on their “phantom-incomes”. In nominal terms, their banking accounts may have increased. In real terms, they decreased.

Then, some governments discarded their disguises to reveal themselves as that which they really were — outright thieves. They did so by instituting so-called negative interest-rates on savings.