The $700 Billion Gimmick at the Center of Biden's Tax Plan

Biden's plan will raise taxes on individuals earning as little as $30,000 annually by 2027, but that's just a trick to make the overall cost of the bill look lower than it really is.

Central to President Joe Biden's plan to hike federal spending by $3.5 trillion is a promise that middle-class Americans won't face a tax increase.

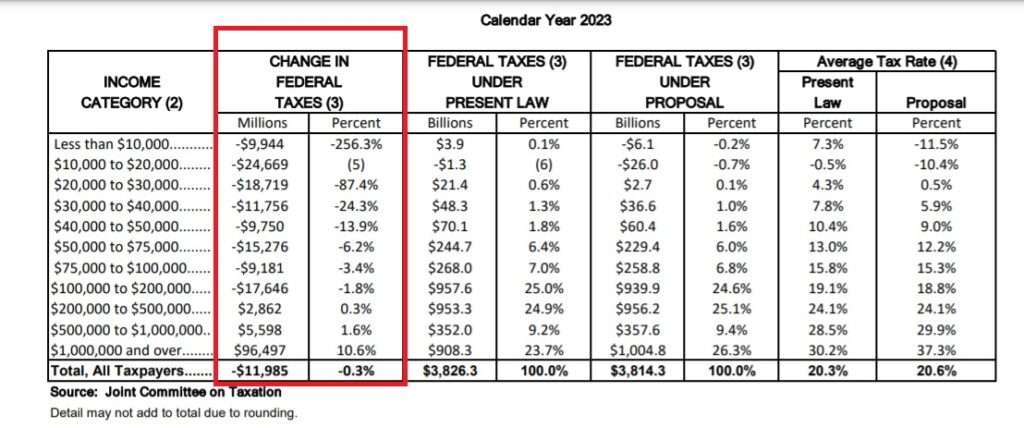

That's a claim that is looking less and less true with each passing day. The bill Congress is drafting to pay for all that new spending includes tax hikes on tobacco products, electronic cigarettes, and cryptocurrencies—taxes that will apply to the rich and poor alike. And while the bill does not raise income taxes on anyone earning less than $200,000 annually in the immediate future, Americans earning as little as $30,000 could face a tax hike by 2027 under Biden's plan, according to an analysis published Tuesday by the Joint Committee on Taxation (JCT), a nonpartisan number-crunching agency housed inside Congress.

The culprit for that future tax increase is the expanded child tax credit, which the House tax plan would extend through 2025 (the JCT's report only provides estimates for every other year, so 2027 is the first child tax credit–less year included in its analysis). More accurately, the culprit is Congress' unwillingness to address the full cost of that tax credit in this bill. By promising to raise taxes later, Democrats are able to manufacture about $700 billion in "savings" that will likely never materialize.

Let's back up a little. The new JCT report shows that taxpayers earning less than $200,000 annually would see a net tax cut in 2023 under the changes that the House Ways and Means Committee unveiled earlier this week. The House Democrats' plan would shift the tax burden toward wealthier Americans next year, largely because of how Biden's proposal relies on hiking income tax rates for high earners and raising the capital gains tax rate, which is applied to investment earnings.

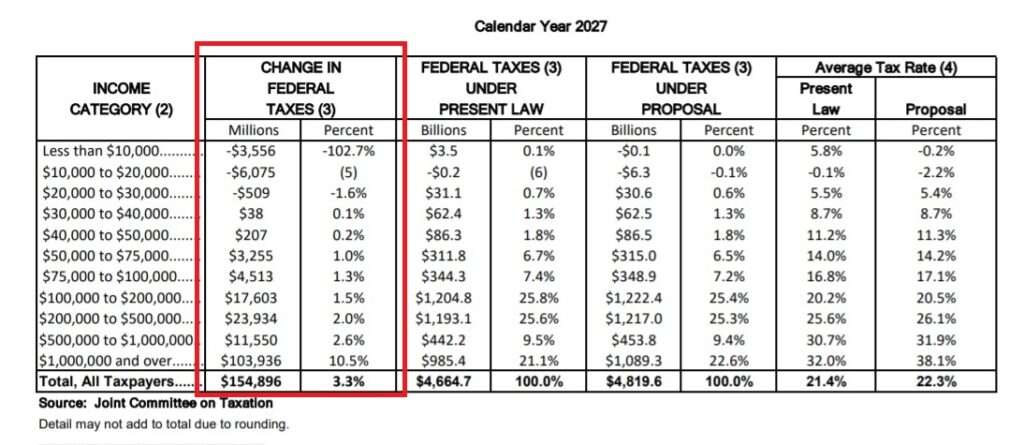

Skip ahead to 2027, however, and things look quite a bit different. By then, the changes House Democrats are now proposing would result in higher taxes for nearly all taxpayers—even those making as little as $30,000 per year. Middle-class Americans earning between $50,000 and $100,000 would owe, on average, several hundred dollars in additional taxes, according to the National Taxpayers Union Foundation's breakdown of the JCT's analysis.

That sudden shift in the tax burden is caused by the expiration of the newly expanded child tax credit. As part of the COVID-19 relief bill passed in March, Congress approved a one-year increase in the child tax credit from $2,000 per child annually to $3,600 per child under the age of 6 and $3,000 for those ages 6 to 17—delivered as monthly payments of $300 per child under age 6 and $250 for older kids. In the reconciliation bill, Democrats are proposing to maintain the expanded tax credit through 2025.

Why 2025? Because the tax credit—which isn't really a tax credit at all, but rather a direct subsidy since it is paid out even if recipients have no income and owe no federal taxes—is expensive. The Committee for a Responsible Federal Budget estimates that the child tax credit will cost about $110 billion annually, and extending the tax credit through 2025 will cost $450 billion. Making it permanent would cost $1.1 trillion over the next 10 years.

Those amounts could make a big difference in the ultimate fate of Biden's plan. Democrats need to use the reconciliation process to bypass the filibuster in the Senate, but the rules governing the reconciliation process forbid legislation that expands the federal budget deficit over the next decade. That means every dollar of new spending has to be offset somehow. And $1.1 trillion is a lot more than $450 billion.

Most Democrats would probably love to extend the expanded child tax credit permanently. At least a few Republicans would probably agree to that too. But by setting the expanded tax credit to expire four years from now, Democrats are able to ignore roughly $700 billion in future costs that have to be offset in order to use the reconciliation process.

"Democrats have no intention of taking away the child credit expansion after 2025—it is both popular and central to their poverty-reduction strategy," says Brian Riedl, a senior fellow at the Manhattan Institute, a conservative think tank, and former Senate Republican staffer. "But sunsetting the policy after 2025 in this bill provides $700 billion in fake savings over the decade, as future Congresses will surely extend the policy."

In other words, it's a gimmick. A gimmick that, yes, Republicans have also used when trying to route major tax policy changes through the reconciliation system, but a gimmick nonetheless.

As a result of that gimmick, the JCT's estimates for fiscal year 2027 do not include the child tax credit. And that's why it looks like taxes will go up for a lot of middle-income families a few years from now.

This sets up a clever game. Democrats will be able to wave away objections about those future tax increases because of course Congress will extend the child tax credit beyond 2025…eventually. But they don't have to account for the future cost of that inevitable extension in the bill they want to pass within the next few weeks.

Compared to what experts say are the other likely long-term consequences of passing this $3.5 trillion reconciliation bill—including slower economic growth, more debt, and lower wages—the gimmickry involved in gaming the reconciliation process over the child tax credit is relatively small potatoes. But make no mistake: The child tax credit is adding to the future size of government, even if that amount doesn't show up on a balance sheet past 2025 yet.

These cynical maneuvers are one of the main reasons why it is so hard for Congress to get its hands around America's long-term debt problem. Lawmakers are quite literally crafting legislation not in pursuit of the best policy, but in order to avoid the very barriers that have been put in place, within the reconciliation process, to limit deficit spending.

Gaming the system is no way to produce the best outcomes—and that's especially true for today's kids, ostensibly the beneficiaries of this policy, who are going to have to pay for it in the long run.

Show Comments (57)