The $700 Billion Gimmick at the Center of Biden's Tax Plan

Biden's plan will raise taxes on individuals earning as little as $30,000 annually by 2027, but that's just a trick to make the overall cost of the bill look lower than it really is.

Central to President Joe Biden's plan to hike federal spending by $3.5 trillion is a promise that middle-class Americans won't face a tax increase.

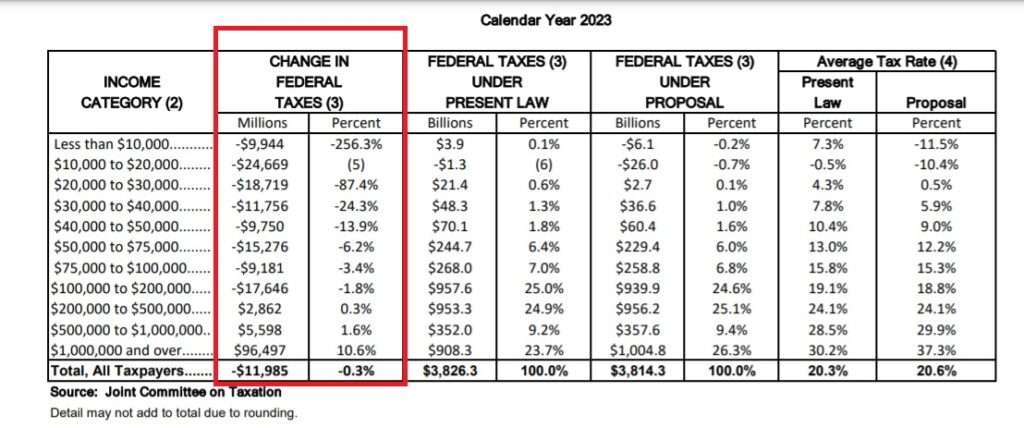

That's a claim that is looking less and less true with each passing day. The bill Congress is drafting to pay for all that new spending includes tax hikes on tobacco products, electronic cigarettes, and cryptocurrencies—taxes that will apply to the rich and poor alike. And while the bill does not raise income taxes on anyone earning less than $200,000 annually in the immediate future, Americans earning as little as $30,000 could face a tax hike by 2027 under Biden's plan, according to an analysis published Tuesday by the Joint Committee on Taxation (JCT), a nonpartisan number-crunching agency housed inside Congress.

The culprit for that future tax increase is the expanded child tax credit, which the House tax plan would extend through 2025 (the JCT's report only provides estimates for every other year, so 2027 is the first child tax credit–less year included in its analysis). More accurately, the culprit is Congress' unwillingness to address the full cost of that tax credit in this bill. By promising to raise taxes later, Democrats are able to manufacture about $700 billion in "savings" that will likely never materialize.

Let's back up a little. The new JCT report shows that taxpayers earning less than $200,000 annually would see a net tax cut in 2023 under the changes that the House Ways and Means Committee unveiled earlier this week. The House Democrats' plan would shift the tax burden toward wealthier Americans next year, largely because of how Biden's proposal relies on hiking income tax rates for high earners and raising the capital gains tax rate, which is applied to investment earnings.

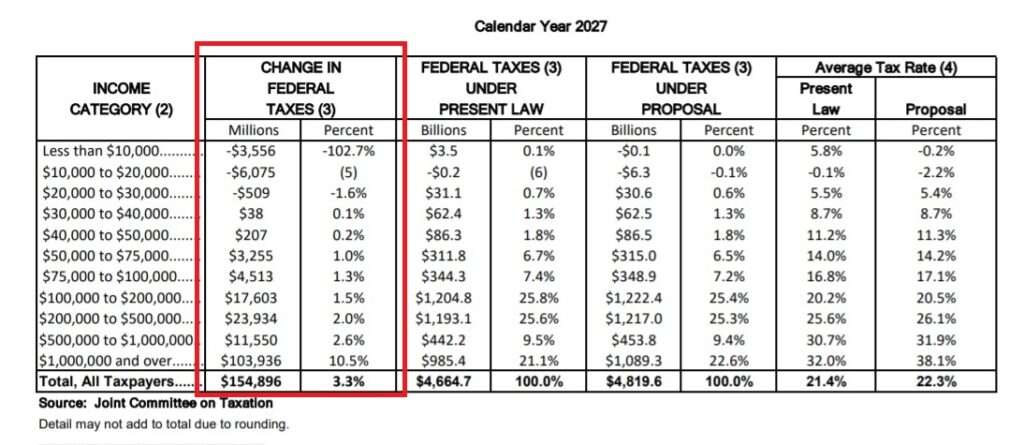

Skip ahead to 2027, however, and things look quite a bit different. By then, the changes House Democrats are now proposing would result in higher taxes for nearly all taxpayers—even those making as little as $30,000 per year. Middle-class Americans earning between $50,000 and $100,000 would owe, on average, several hundred dollars in additional taxes, according to the National Taxpayers Union Foundation's breakdown of the JCT's analysis.

That sudden shift in the tax burden is caused by the expiration of the newly expanded child tax credit. As part of the COVID-19 relief bill passed in March, Congress approved a one-year increase in the child tax credit from $2,000 per child annually to $3,600 per child under the age of 6 and $3,000 for those ages 6 to 17—delivered as monthly payments of $300 per child under age 6 and $250 for older kids. In the reconciliation bill, Democrats are proposing to maintain the expanded tax credit through 2025.

Why 2025? Because the tax credit—which isn't really a tax credit at all, but rather a direct subsidy since it is paid out even if recipients have no income and owe no federal taxes—is expensive. The Committee for a Responsible Federal Budget estimates that the child tax credit will cost about $110 billion annually, and extending the tax credit through 2025 will cost $450 billion. Making it permanent would cost $1.1 trillion over the next 10 years.

Those amounts could make a big difference in the ultimate fate of Biden's plan. Democrats need to use the reconciliation process to bypass the filibuster in the Senate, but the rules governing the reconciliation process forbid legislation that expands the federal budget deficit over the next decade. That means every dollar of new spending has to be offset somehow. And $1.1 trillion is a lot more than $450 billion.

Most Democrats would probably love to extend the expanded child tax credit permanently. At least a few Republicans would probably agree to that too. But by setting the expanded tax credit to expire four years from now, Democrats are able to ignore roughly $700 billion in future costs that have to be offset in order to use the reconciliation process.

"Democrats have no intention of taking away the child credit expansion after 2025—it is both popular and central to their poverty-reduction strategy," says Brian Riedl, a senior fellow at the Manhattan Institute, a conservative think tank, and former Senate Republican staffer. "But sunsetting the policy after 2025 in this bill provides $700 billion in fake savings over the decade, as future Congresses will surely extend the policy."

In other words, it's a gimmick. A gimmick that, yes, Republicans have also used when trying to route major tax policy changes through the reconciliation system, but a gimmick nonetheless.

As a result of that gimmick, the JCT's estimates for fiscal year 2027 do not include the child tax credit. And that's why it looks like taxes will go up for a lot of middle-income families a few years from now.

This sets up a clever game. Democrats will be able to wave away objections about those future tax increases because of course Congress will extend the child tax credit beyond 2025…eventually. But they don't have to account for the future cost of that inevitable extension in the bill they want to pass within the next few weeks.

Compared to what experts say are the other likely long-term consequences of passing this $3.5 trillion reconciliation bill—including slower economic growth, more debt, and lower wages—the gimmickry involved in gaming the reconciliation process over the child tax credit is relatively small potatoes. But make no mistake: The child tax credit is adding to the future size of government, even if that amount doesn't show up on a balance sheet past 2025 yet.

These cynical maneuvers are one of the main reasons why it is so hard for Congress to get its hands around America's long-term debt problem. Lawmakers are quite literally crafting legislation not in pursuit of the best policy, but in order to avoid the very barriers that have been put in place, within the reconciliation process, to limit deficit spending.

Gaming the system is no way to produce the best outcomes—and that's especially true for today's kids, ostensibly the beneficiaries of this policy, who are going to have to pay for it in the long run.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Fuck Biden the liar.

Thank you; Fuck Biden

I made over $700 per day using my mobile in part time. I recently got my 5th paycheck of $19632 and all i was doing is to copy and paste work online. this home work makes me able to generate more cash daily easily. simple to do work and regular income from this are just superb. Here what i am doing. Try now.........

Click & Chang your Life ............... VISIT HERE

Start making money this time… Spend more time with your family & relatives by doing jobs that only require you to have a computer and an internet K access and you can have that at your home. Hax Start bringing up to $65,000 to $70,000 a month. I’ve started this job and earn a handsome income and now I am exchanging it with you, so you can do it too.

Here is I started.…………… VISIT HERE

Sarah getting Paid up to $18953 in the week, working on-line at home. I’m full time Student. I shocked when my sister’s told me about her check that was $97k. It’s very easy to do.QEd everybody will get this job. Go to home media tab for additional details……

So I started……… READ MORE

Indeed. When has that idiot ever been held accountable for anything in his life? He’s just a gasbag career politician who would have been in way over his head on the best day of his life. And he is far, far from that.

Democrats were ignorant idiots to vote for this senile fool.

I am making a good salary online from home.I’ve made 97,999 dollar’s so for last 5 months working online and I’m a full time student.EFg I’m using an online business opportunity I’m just so happy that I found out about it.

For more detail ................ VISIT HERE

I made over $700 per day using my mobile in part time. I recently got my 5th paycheck of $19632 and all i was doing is to copy and paste work online. this home work makes me able to generate more cash daily easily.GBn simple to do work and regular income from this are just superb. Here what i am doing.

Try now.............. Pays24

"Biden's plan will raise taxes on individuals earning as little as $30,000 annually"

Fact check: False.

Joe said he would not raise taxes on anyone making less than $400,000. Period.

Biden is always correct. To think some folks were worried the Taliban would take over Afghanistan.

And his boss said if you like your doctor, you can keep your doctor. Period.

Joe said he would not raise taxes on anyone making less than $400,000. Period.

Which I have complete faith is true. The only caveat is that, with the way things are going, we'll all be making about $400,000 an hour in a few years but that still won't be near enough money to buy a loaf of bread.

Yeah 400K will be like 100K is now.

I visited what used to be a low cost Midwestern state recently, and all I heard on the radio were ads looking for workers. 14 bucks an hour to start in fast food or custodial work. 17 bucks an hour for light no-skill manufacturing, with double pay (not time and a half) for overtime. And every job had a signing bonus, from 1 to 5K.

Just drove from NM to NY taking blue highways, enjoying the country. Donut shops, gas stations, large industry factories, shipping companies, assembly plants all have signs out “now hiring”. Walmart had a bill board for $20.85/he and radio ads for drivers at $87k/ year.

Elections have consequences. For example Newsom sounds like he's gonna bring the hammer down even more. Congrats to those voting democrat you get what you deserve.

And they want it, good and hard.

They are all bottoms.

Under Biden's tax plan, low income voters and billionaires make out like bandits in the short run, and those are the people supporting him. They don't care about the long run.

So, the problem isn't that somehow politicians are not delivering to people what they want, it's that democracy unfettered by basic liberties leads to the destruction of the economy and the country in the long term.

I'm not as concerned about the 700 billion dollar gimmick as I am about the multi-trillion dollar lie at the heart of Biden's plans.

There will either have to be austerity in the future, or the complete devaluation of the dollar. I think we see which one we are headed to currently.

Average home price is now near $400k? But inflation is only 5.4% Sure thing...

The democrats should be overthrown and the traitors put down. Then we can work on saving this country.

It won’t be easy. The left has nearly destroyed this country.

And the Democratic base doesn't care: they are welfare recipients, kids without a future, seniors who didn't save for retirement, single moms, the desperately poor. All they care about is government handouts, the more the better.

And they NYT's resident Nobel Prize winning economist will be there to warn of the dangers of austerity, even though it's never been tried.

And the Fed will keep postponing "the taper" and keep loading up on Treasuries and mortgage backed securities to keep the stock market afloat.

"Skip ahead to 2027, however, and things look quite a bit different. By then, the changes House Democrats are now proposing would result in higher taxes for nearly all taxpayers—even those making as little as $30,000 per year."

Someone else's election, someone else's problem.

https://www.youtube.com/watch?v=ngKT3MIfwpo

That's all I got.

How is it increase to people with kids and lower income? They are getting 250-300 month if they put that away (sort of joking) then they have enough to cover plus some for when it increases.

250-300 they didn't have and I won't get.

This article has a gimmick of its own. What is the "increase" in middle class taxes? They don't say. It's just that the decrease in taxes goes away. This is immaterial to anyone deciding on a political party. Obviously, when the tx credits are slated to go away we know which party will fight to keep them and which will not. Also, we know that if the democrats had a choice they would keep low taxes on the middle class and shift it to the rich. But sure, Reason found a gimmick. Now we can all go back to hate

This free lunch policy may be popular, but it is doomed for economic ruin. The ship is being pulled by a shrinking pool of taxpayers. Consumption is permanently out of balance with production. Democrat policies propose a free lunch in which a growing army of voters receive government benefits without the need to produce. The magic holding the economy under this free lunch policy is the strong currency and a strong work ethic. The work ethic is sharply changing at the entry level. Many realize that government benefits plus perhaps under the table work are much more attractive than entry level work. A wage-price spiral has begun with large wage increases to entry level workers that will propagate throughout the economy. The next 6 to 12 months will see demands for much higher compensation from workers above entry level. Shortages of goods and services will increase, especially housing shortages. The housing industry cannot keep up with demand in many urban areas. Huge increases in immigration will spur even more housing shortages.

It is. But why would most Democratic voters care? They have nothing invested in the country and don't see a good long term future for themselves anyway.

If they get a short term windfall, that's all they care about. If people who are successful lose it all and/or the US just turns into a socialist country, they will be cheering.

Great information thanks for sharing

Interestingly, at a 4% persistent annual inflation rate, these 30,000 dollars will be worth around $24,650 in today purchasing power value...This should help boost Big Pharma/Big Tech/Cryptos common stock values, so everything balances out.

The real problem is that we don't have a fiscally responsible party any more. Nor are politicians held to account when they fail to be fiscally responsible.

The Republicans have supply side economics and the Laffer curve as the basis of their bullshit. Democrats have the idea that inflation isn't connected to federal spending and that poverty can be eliminated. Both of them are full of shit and mire us further and further in debt.

Tax cuts that pay for themselves are a figment of economic imagination. Inflation being unconnected to spending is a figment of economic imagination. The only way we get out of this mess is if both parties acknowledge the failure of their economic frame works and start from scratch.

The core national priorities (like infrastructure, defense, innovation, markets with a vibrant small- and medium-sized business community, a fair criminal justice system, etc.) need to be identified and prioritized. Then the next "level", still comprised of things that have widespread support across party lines. Then the last "level", where the priorities of the present administration would be.

Separating the ongoing priorities of the nation from partisan priorities will protect core "general welfare" funding from being plundered for partisan purposes. It would also shrink the pool of budget money available for slight-of-hand bullshit like supply-side economics and "deficits don't matter" spending that are implemented using reconciliation.

A balanced budget amendment would be the best thing, but both parties are so addicted to the deficit trough that it would take a Herculean effort that included tax-and-spenders uniting with austerity proponents to restrict the amount of budget that is free to use. I just don't see that happening.

Let's see:

Supply-side economics is a macroeconomic theory that postulates economic growth can be most effectively fostered by lowering taxes, decreasing regulation, and allowing free trade

The Laffer curve assumes that no tax revenue is raised at the extreme tax rates of 0% and 100%, and that there is a tax rate between 0% and 100% that maximizes government tax revenue.

The problem is that the country is filled with idiots like you who deny such basic economic truths.

No, it wouldn't. Balancing the budget doesn't solve our problems. Our problems are caused by excessive government spending and regulation, not by deficits.

To nitpick a little, isn't the interest cost on that deficit by definition "excessive government spending?" I mean, paying to service a loan is a cost.

The health of the economy, much like the state of race relations, crime statistics, Covid casualties, etc are exactly what the Democrats say it is at any particular time. Any suggestion otherwise will be dangerous, suppressed misinformation. And people will buy it as long as the free shit keeps flowing.

Up until the entire shithouse goes up in flames, which will then be followed by the greatest scapegoating ever seen in this country. Which, unfortunately, will come too late and serve no purpose, except to make the people even more at each other’s throats.

Just get rid of the democrats. That’s the only discussion worth having. Anything else is useless bullshit and hand wringing. It’s like everyone is constantly bitching about the thug wrecking and robbing your home. Instead of just shooting him.

And by democrats; The Nazi's (supporting National Socialism).

At the very least take away their Gov-Guns. It baffles me there is no accountability for treasonous congressmen/presidents. The judiciary department was never suppose to let this happen but they all looked aside while the USA was invaded by Nazi's.

Republicans don't deficit spend? I mean, let's be honest, they are as guilty as the democrats.

As guilty; 660B versus 6T? Yeah; right...... Let's not anyone forget about that measly 660B when we've got 6T on our hands.

"Why isn't it a 'lie' when Joe Biden says something false or dishonest?"

[...]

"...I was watching CNN the other morning and they aired one story after another bashing their favorite villain, Donald Trump. They can blame Trump for his long-distance relationship with the truth; fair enough. But they can't blame him for Joe Biden's lies - which, of course, to many liberal journalists are simply honest mistakes."

https://www.msn.com/en-us/news/politics/why-isn-t-it-a-lie-when-joe-biden-says-something-false-or-dishonest/ar-AAOvToD?ocid=msedgntp

The answer is obvious to anyone not afflicted with a raging case of TDS: The writers are dishonest pieces of lefty shit.

To be fair, Biden really just reads what's on his teleprompter like a speech synthesizer; it's doubtful he is mentally capable of lying anymore.

MMT is a hell of drug. Once you buy into deficits don’t matter you’ll never stop chasing the dragon. All you have to do is pass the damn bill. We can always print more money. /s

Not really. It's descriptive on this count. The US government acts as if deficits don't matter, they don't seem to matter, thus people setting their hair on fire about them have their explaining to do.

The main point is essentially an appeal to physics. The true limit on the economy is determined by economic capacity. Whether the private or public sector distributes it a choice.

You know that toilet paper that looks like money? Soon it will be worthy more than the money that's printed on it.

Gimmick = Lie

Well if the government is going to give everyone free everything, someone's got to pay for it.

The price tag is a fiction, not least because any given Congress can change things in the next 10 years. Right now, remarkably, the price tag is serving as a bragging point for progressives in addition to serving as the usual scare story for Koch brother cucks.

I don't know what you expected to happen once one of the human sinkholes of wealth flew an actual penis into almost space. Heads have been detached for lesser extravagances.

Work Harder SLAVES! The [WE] mob needs more ?free? shit!

Survivor tax

That's a real good question. The money runs out sooner rather than later, unless you deflate its value. But that same inflation raises the cost of new debt, and the cost of rolling over the old debt that your budget doesn't have room to pay off. The FDR trick of devaluing gold is done.

I really do wonder about this. It can't go on forever. But it seemingly can't stop either. Something's going to give, and my bet is on reality winning out and everybody else losing.

Biden's not rearranging the deck chairs on a sinking ship.

He's drilling more holes in the bottom so steerage sinks first.

My wife tells how they would make samogon, Russian moonshine to pay for work on their home etc. during the soviet union days.

The Petro Dollar is in the rear view mirror and reserve currency is limping down the shoulder on 3 flats. Nobody will be buying dollars in 10 years.

Democrats deserve endless agony for what they have done. Not the rest of us. So it’s up to the rest of us to make the democrats pay the tab they’ve run up.

When I was a kid, we were poor as shit. Now I run my own company and a small farm. That aside I never forgot what is was like to go without food, even though I have invested in many tangible assets( gold, silver, art, real estate ) I have enough sense to realize that you can,t eat any of those things. When the food supply falls apart food becomes the new currency, and so do vices.

Exactly. Nothing gets fixed while there is a progressive movement.