An $86 Billion Moral Hazard

Nestled in the $1.9 trillion emergency spending bill passed in March was a bailout for unions' private pension funds.

The $1.9 trillion emergency spending bill Congress passed in early March was full of items that had little to do with the COVID-19 pandemic, the ostensible justification for the package. Perhaps the most indefensible provision was an $86 billion bailout for unions' private pension funds. This unprecedented handout could pave the way for a much more expensive bailout of public-sector pensions.

The American Rescue Plan Act creates a new federal grant program to support multiemployer pension funds. There are more than 1,400 of these retirement plans, which are jointly funded by unions and the private companies that contract with them through collective bargaining agreements. All told, this arrangement serves more than 10 million current and retired workers. Most of the funds are doing fine, but 124 of them are in "critical" financial condition, according to the Pension Benefit Guaranty Corporation (PBGC), a federal entity created in the 1970s as a financial guarantor for multiemployer pension plans, which is itself on pace to be insolvent by 2027.

Unlike COVID-19, this crisis didn't suddenly pop into existence. Democrats in Congress have been seeking federal aid for these retirement plans for years, while Republicans have been pushing for reforms in exchange for new loan or grant programs to prop up the pension system. The American Rescue Plan granted aid with no strings attached.

"It's a very expensive way to not solve a problem," says Gordon Gray, director of fiscal policy for the American Action Forum, a free market think tank. While the troubled multiemployer pension funds now have enough cash to pay full benefits through 2051, he says, "congressional Democrats have decided to forgo a lasting solution to the challenge and simply write these plans a check to cover their costs for the next 30 years."

Anyone who has followed the slow-burning public-sector pension crisis will recognize the fundamental problem plaguing the multiemployer pension funds. Both systems overestimate future investment returns even as they underperform their past projections.

A 2017 study by the Government Accountability Office found that the Central States Pension Fund, one of the largest and most deeply indebted private multiemployer funds, would have 91 percent of the assets necessary to cover future costs if it had achieved its target annual financial return of 7.4 percent every year since 2000. Instead, the fund has earned an average of less than 5 percent annually and was on pace to run out of money by 2025.

Democrats who championed this year's bailout, such as Sen. Sherrod Brown (D–Ohio), say federal funding is necessary to prevent painful cuts to retirees' income. Brown is right that workers are not to blame for the pension funds' fiscal problems. But a federal bailout won't encourage troubled plans like Central States, which provides retirement benefits for truck drivers, to invest more wisely.

The American Rescue Plan "is likely to breed what economists call 'moral hazard' as plan managers and sponsors realize there are no consequences to underfunding and overpromising," Sen. Chuck Grassley (R–Iowa), former chairman of the Senate Finance Committee, said on March 5 during the Senate's floor debate over the bill. A "no-strings bailout" of the pension funds, he added, means "the American taxpayer will be left footing the bill for a private-sector retirement system."

Grassley, who had been working with Senate Democrats on a rescue plan for the multiemployer pensions, proposed amending the bailout to include stricter capitalization rules and more oversight by the PBGC. Grassley's amendment was defeated in a party-line vote. The American Rescue Act passed both chambers of Congress without a single Republican vote for it.

That moral hazard also could manifest in other ways. Critics of the bailout worry that congressional Democrats are telegraphing their intent to put federal taxpayers on the hook for underfunded public-sector pension plans. "If politicians will bail out truckers' and coal miners' pensions, why would they turn away from teachers and firefighters?" asked Andrew Biggs, a resident scholar at the conservative American Enterprise Institute, in a Wall Street Journal op-ed.

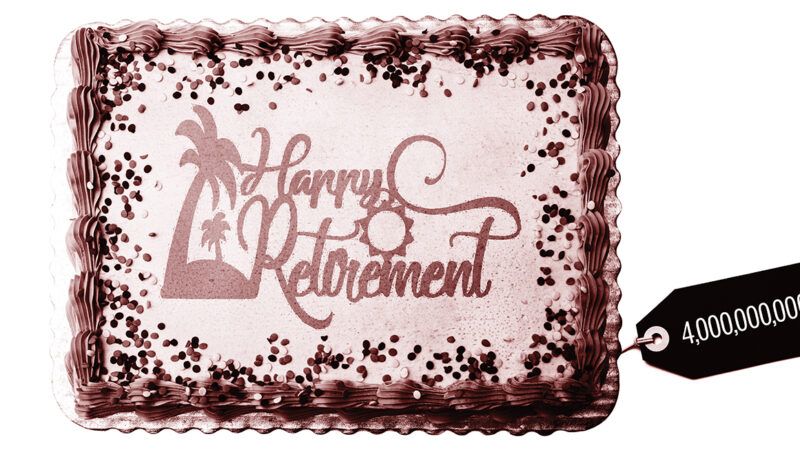

The price tag of such an effort would make this year's pension bailout look small by comparison. America's various state and city pension plans are an estimated $4 trillion in the red.

Show Comments (27)