The Real Inflation Risk Is Political

The short-term inflation outlook isn't as grim as it looks, but the long-term situation could be awful

As America exits the COVID-19 pandemic, demand for goods and services is surging—and triggering worries about inflation.

The consumer price index for March showed a 2.6 percent increase over the same month last year. That's the largest year-to-year increase in prices since the summer of 2018, and significantly more than the 1.4 percent year-to-year increase that was being reported just two months ago. Meanwhile, the White House Council of Economic Advisors warned this week that "measured inflation" is likely to increase over the next few months. And the price of gasoline—perhaps the most obvious signal of rising prices, at least for those of us who don't hold advanced degrees in economics—has been steadily marching upwards since the start of the year.

Should we be worrying about a return to the rampant inflation of the 1970s?

For now, the fear is probably premature, says David Beckworth, a former Treasury Department economist now affiliated with the Mercatus Center, a free market think tank at George Mason University.

"The economic indicators aren't flashing any red alerts right now," Beckworth tells Reason, "but the political economy is more worrying."

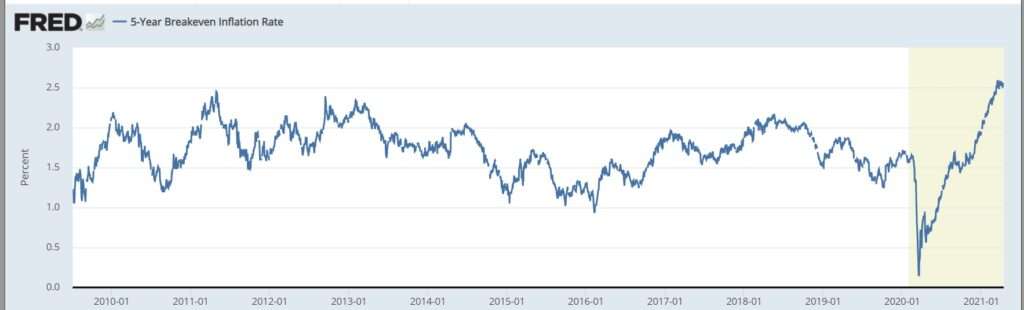

One of the best indicators of future inflation is the "breakeven inflation rate," which measures the difference in yield between bonds that are pegged to inflation and those that are not over the same period of time. The five-year breakeven inflation rate—in other words, how inflation investors are anticipating over the next five years—has been increasing, but it currently sits just slightly higher than its post–Great Recession average.

So if runaway inflation is on the horizon, investors aren't anticipating it. Even if inflation spikes in the short term, they don't appear to expect historical highs over the course of several years.

The rising CPI might not be a major cause of concern, either. It's a backward-looking economic indicator—comparing prices today to what they were a year ago—so it's capturing some of the economic weirdness that the pandemic created last spring, when prices fell as demand sank and much of the country entered lockdown.

The biggest contributor to the rising CPI in March was the surge in gasoline prices, which were up 22 percent from last year. But that says as much about last spring's drop in gas prices—due to a sudden glut of supply as many people stopped traveling and commuting—as it does about where things sit now.

For a similar example, think about the markets for airline tickets and vacation rental homes. Many Americans had travel plans cancelled last summer, and that backlogged demand will likely be unleashed in the coming months as an increasingly vaccinated population reunites with far-flung families and friends. A sudden increase in demand in markets where supply can't rapidly grow to match it is a recipe for higher prices. But that's a short-term situation that will work itself out, not a long-term increase that could wreck standards of living and retirement plans.

"We think the likeliest outlook over the next several months is for inflation to rise modestly due to the three temporary factors we discuss above, and to fade back to a lower pace thereafter as actual inflation begins to run more in line with longer-run expectations," the White House economists conclude.

That's the economic side of the inflation situation. It should provide some comfort. The political side is a different story.

"What ultimately will cause inflation to take off is a sustained increase in the growth of government spending," says Beckworth. "If we do these big spending packages and there's not an immediate increase in inflation, it enables us to be more complacent about future government spending programs."

The federal government pumped $1.9 trillion into the economy in March. While that was a one-time infusion of newly printed money, the Biden administration is also proposing permanent increases to the baseline federal budget and pushing for a $2.3 trillion infrastructure package that is likely to be at least partly financed with deficit spending.

Even without those spending increases, deficits are set to grow in coming years, largely because of entitlement programs like Social Security and Medicare that run on autopilot.

And all that is happening at a time when both major parties have abandoned any pretense of concern about overspending. The alarm bell of a rising CPI might be the only real check on the political incentives that keep the cost of government growing—and pave the way for more substantial inflation down the road. And the alarm bell isn't ringing. Yet.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

CPI increases per se don’t matter. If prices rise because of changes in demand or supply that’s not something to worry about. That’s the economic system working. It’s when prices rise due to increases in the money supply that we should start worrying. THAT’S the problem lurking in the political system.

The CPI is crap. Only need to look at one part of the 'basket of goods' - housing - to quickly realize what crap it is.

The part I love the most is the concept of "core inflation".

They take OUT the two things EVERYONE HAS to buy, food and energy.

Meanwhile they have stopped reporting M1 and M2 weekly and are now only updating it monthly.

If we bought more TVs we could drive down inflation!

Single Mom With 4 Kids Lost Her Job But Was Able To Stay On Top By Banking Continuously $1500 Per Week With An Online Work She Found Over The Internet. Check The Details HERE…. Visit Here

Time to invest in lubricant to ease through the next few years without too much damage.

Like Lucas' Gun Oil?

Definite maybe.

There was once a libertarian magazine that would have expounded on the reason inflation increased in the 1970s and why pumping up the dollars would cause it to happen again instead of taking the administration's line.

But sure keep the dollars coming, because more dollars chasing fewer products is a good thing.

Yep.

As a devout Ron Pauler, though, I've been protecting myself by betting against the dollar for years. I suggest everybody do the same.

"...both major parties have abandoned any pretense of concern about overspending."

https://www.businessinsider.com/modern-monetary-theory-mmt-explained-aoc-2019-3

Whether they admit it or not, seems just about everyone in government is on board with this.

So what’s the play? How to profit from this ?

Buy Reason writers for what they are worth, and sell them for what they think they are worth?

Figure out how to get the Fed to give you the new money first.

Climate bans: gas powered vehicles, natural gas heating (home energy systems), gas hyperinflation, private transportation hyperinflation. Climate mandates: solar /wind electric - with overnight rate hyperinflation and rolling blackout rationing between blue states (sorry fans of overnight or cloudy day A/C , heat, private transportation). Buy whatever Pelosi is buying. Her husband bought options in Tesla the day b4 Biden’s EO on electric vehicles.

Bet against the dollar. Buy bitcoin. Buy land. If you have nothing at all, run up your credit cards.

This may be different in that the slowdown was purely regulatory, and while policy is pumping out the dollars, the reopening economy (with or without 'approval') is also going to be pumping in goods and services.

Of course, in the long run, it will be fine because the fascists say so.

"The short-term inflation outlook isn't as grim as it looks, but the long-term situation could be awful"

Yeah, and that might matter if anybody had the slightest idea or warning of when we go from short term to long term.

As it is, it's a case of, "It's not the fall that kills you, it's the landing."

And we're falling through fog.

Like the guy who fell off the Empire State Building?

He was heard to say as he passed the third floor on the way down "So far, so good".

In addition to all of those new dollars floating around here's how I'm seeing inflation. It comes in the reduction in size of everyday products, with no commensurate price decrease. A couple of weeks ago I bought a box of Reynolds aluminum wrap. The large size used to come in 250 feet rolls. Now it's 225 feet, a 9% decrease in volume, same price. About a year ago the toothpaste I buy went from 6.4 ounces to 5.7 ounces, more than 10% decrease in volume, same price. The previous time I bought a McCormick's steak season it was in a 14 ounce container. Now it's 11 ounces. And they slapped a big red sticker on it saying it's more than 3 times their 3 ounce container, hoping most people won't notice. A couple of years ago Charmin TP went from 307 sheets to 286 sheets, now it is even less.

Don't even talk about lumber which has doubled or tripled in price in a year.

This is how inflation will sneak into our wallets.

Precisely: The actual quantities have been dropping for most of a decade now.

The government has a very strong incentive to lie about the inflation rate, because so much is pegged to it, it enables them to cut here, and increase there, without owning up to it.

Exactly. The people who say there's no inflation don't go shopping. Inflation is everywhere but in government statistics.

Unless you own Bitcoin.

There's no ceiling to bitcoin because there's no floor for the dollar.

Oh no, Eric is writing on economics again. Please make him stop.

Like he gets anything else correct.

Eric...Bitcoin..end of argument..the last covid vote buying was financed ONLY by the Fed printing money...and with the geopolitical situation we can't offshore our inflation anymore to China..

The root of this is the idiotic astrology called "Keynsian" economics..savings are good..deflation is good...even Keynes knew this theories were BS..he just had to figure out a way to keep the unions happy after WW1 and allow the British govt to not have to devalue their currency after printing/inflating their money supply to pay for a stupid war..

Inflation is here and it will get worse..bank on it..ha ha

Lot more bitcoiners recently than I remember even just a year or so ago. People are waking up.

The fed controls the money supply through the banks and their lending.

I thought trickle down economics just didn’t work.

No - the Fed influences - usually to a small extent - the money supply. When it comes to bank lending (the major source of money supply growth), banks are capital constrained - not reserve constrained. Bank lending is a spread game and banks want to make profitable loans. The Fed driving down interest rates mostly motivated borrowers with excellent credit ratings to take out loans or refinance - it hasn't done much to stimulate new lending. It's also worth noting that most of the money the Fed has been creating out of thin air to buy Treasurys has ended up in the central bank reserve system. Banks don't lend reserves - except to other banks. When you read an economist suggesting that all that money in reserves will cause inflation when banks start lending it out - that's a clue that that particular economist doesn't know what they're talking about.

While what you write is true, isn’t the largest borrower the U.S. Federal government, not those banks you mention? Unlike banks, the Feds aren’t looking to lend their borrowed money out to make a profit, they are just giving it away by the hundreds of billions.

Inflation is already here. A bottle of Brags amino soy sauce was about $ 3.79 just over a year ago at my local grocery chain. The other day it was $5.99. Fuel that was $3.19 per gallon 5 months ago is now $4.09. The organic fertilizer I use on my farm was $2.63 per unit, it is now $2.78. But then I live in the Marxist state of Kalifornia.

Priced lumber lately?

Real estate?

Checked the current S&P 500 PE Ratio, Price to Book, Price to Sales, or Shiller PE Ratio against their historical values? Nice graphs on these trends here: a href=“https://multpl.com/“

Some commodity prices that have sharp upticks in the last 12 months: copper, corn, soybeans, wheat, oats, and sugar.

It’s been a while since I shopped for a used piston plane, but it seems prices there have gone up quite a bit in the last couple years. For example, I can’t find any Piper Cherokee 140s with asking price under $35k - used to be a fair number of them under that price point. Or maybe it has been more years than I remember since I last pondered buying a plane.

Try https://www.multpl.com/s-p-500-pe-ratio

Needed to buy a few boards for some scaffolding the other day. Went down to the big box, ended up buying pressure treated because it was cheaper.

I suspect the only thing keeping others from doing the same is that the stuff weighs a fucking ton until it dries.

That's another example of hidden inflation: They used to sell it already dry!

People here don't seem to understand the difference between inflation and rising prices due to supply and demand. Hm. I thought inflation was the perpetual threat to our existence that (surprise, surprise) required us to cut public spending. You think you guys would know what you were talking about.

The monetary people and Congress have been trying, and barely succeeding, to create inflation for a year. The problem has not been an overheated economy, in case you didn't notice the pandemic and mass unemployment.

The neat thing about a government with a functioning central bank is that it can take money out of circulation as fast as it can add it, thus preventing runaway inflation. Once again, bad fed chairs of the past sully the good name of fed chairs of the present.

The United States money supply metrics M0, M1, and M2 were in January 2020 at roughly $3,400B, $4,000B, and $15,500B respectively. By January 2021 those had grown to roughly $5,400B, $18,400B, and $19,000B respectively. An increase of 59%, 360%, and 19% respectively. These are huge jumps in the last year as an shown by reviewing the multi-year graphs in the quoted source. (Source: https://tradingeconomics.com/united-states/money-supply-m0) A historically large amount of money is being dumped into circulation.

Yep. We double the money supply every 11 years, and that trend is accelerating.

How many dollars will they need to print in 2030 to paper over the huge holes in the economy?

Yet they can barely keep inflation at 2%.

Pulling bills out of circulation doesn't do much, most money is digital. And they can't just pull that money out of the economy. It's bound up in loan terms with fixed durations.

Pumping money into the economy is easy. Lower the base rate. Loan money to banks to fuel the lending spree that results. Pulling it out is impossible, because contractual obligations tie your hands.

The only way for the federal government to pull extra money out of the economy 'quickly' is to run a surplus, and "burn" that surplus without spending it. (Don't bank it for later. Delete it from the system and pretend it never existed). I'm not holding my breath that will ever happen.

lmao.. I have to laugh at how lefties love to talk about USD as if it was monopoly money that was entirely unrelated to produce or human labor. So if those USD's you speak so *freely* of stop representing produce or labor what will you use it for? Toilet paper?

The Fed doesn't quite have the precise control you describe, but you make a good point about the difference between inflation (which I presume you define as too much money chasing too few goods) and normal price increases due to supply issues, which is what has been happening recently. There's not a rush of too much money chasing too few goods. Housing prices might be reflecting some of that, but we're not seeing the over-leveraging or bad loans dominating house purchases now - there are in fact a lot of cash buyers in many "hot" markets. The Fed has been trying to nudge inflation to 2% for more than a decade - and they have mostly failed. Too many people believe the Fed has powers over inflation, employment, and economic growth that history has shown many times not to be true.

Well, quite an interesting article. The rise of inflation is quite scary. In this world of rising inflation, the cost of business also increases. Thus, if you are looking for cheap websites for your business, do visit:

https://webocity.in/

Went to the bank last week in Kalifornia's 2nd largest city and was told they were out of $100 bills. I asked if other branches might have them and they replied that their branch was likely typical. I'm too stupid to draw any conclusions from this but I know it is not a good thing

After everyone gets done stating their "professional" opinion on how 'fiat' printed money (i.e. transfer/theft of labor and resources/slavery) has to happen in x,y or z fashion.

Then can we talk about how the USA survived for 140-years on gold and silver which cannot be 'fiat' printed and the first exit of that standard with Democratic central "SLAVERY" planning of the Federal Reserve Act threw everyone into the Great Depression?

In just the last few months, bread has gone up 10% and milk has gone up 25%. I don't remember prices of either of those dropping last year this time and those are major increases in the price of staples.

I was looking at trucks just over a year ago and trying to decide which one I was going to purchase this year. The Trucks I considered are now very hard to find and 20 to 30 thousand more and even more amazing low mileage used trucks are even worse. Everything is more expensive compared to last year so I guess that is short term inflation. I would not expect to see prices decline in the long term so with the economical genus we have in the White House now it certainly doesn't look good for the future. Minimum wage will have to be increased to 15.00 but will not buy as much as 10.00. Well at least many people did receive their 1,400.00 bribe so I hope it was worth it.

JOB FOR USA Making money online more than 15$ just by doing simple work from home. I have received $18376 last month. Its an easy and simple job to do and its earnings are much better than regular office job and even a little child can do this and earns money. Everybody must try this job by just use the info

on this page.....VISIT HERE