A Michigan Man Underpaid His Property Taxes By $8.41. The County Seized His Property, Sold It—and Kept the Profits.

A state law allows counties to effectively steal homes over unpaid taxes and keep the excess revenue for their own budgets.

An 83-year-old retired engineer in Michigan underpaid his property taxes by $8.41. In response, Oakland County seized his property, auctioned it off to settle the debt, and pocketed nearly $24,500 in excess revenue from the sale.

Under Michigan law, it was all legal. And hardly uncommon.

Uri Rafaeli, who lost his property and all the equity associated with it, is just one of thousands of people to be victimized by Michigan's uniquely aggressive property tax statute. The law, passed in 1999 in an attempt to accelerate the rehabilitation of abandoned properties, empowers county treasurers to act as debt collectors. In the process, it creates a perverse incentive by allowing treasurers' offices to retain excess revenue raised by seizing and selling properties with delinquent taxes—even when the amount owed is miniscule, and even when the homes aren't abandoned or blighted at all.

Organizations representing property owners like Rafaeli say the practice is unconstitutional, inequitable, and unreasonably harsh. They call it "home equity theft"—a process that's a close relative to the civil asset forfeiture laws that have been used by police departments to similarly deprive innocent Americans of their property without due process. They are now asking the state Supreme Court to restrict the practice.

"Michigan is currently stealing from people across the state," says Christina Martin, an attorney with the Pacific Legal Foundation, a nonprofit law firm now representing Rafaeli and other homeowners in a class-action lawsuit that will go before the Michigan Supreme Court in early November.

"Counties have been authorized to take not just what they are owed, but to take people's life savings."

A Win-Win Situation

Rafaeli's case—which has the potential to stop the predatory behavior of county treasurers across the state—began with a simple mistake.

In August 2011, Rafaeli purchased a three-bedroom, 1,500-square-foot home in the predominantly African American community of Southfield, Michigan, a lower-middle-class suburb just north of Detroit. "The investment was good to the state economy, and [at] the same time, it may produce a good rent for my retirement. A 'win-win' situation," says Rafaeli, who lived in neighboring Macomb County at the time. (He no longer lives in Michigan.)

The $60,000 purchase was recorded by the Oakland County Register of Deeds on January 6, 2012. About six months later, in June 2012, Rafaeli was notified that he had underpaid his 2011 property tax bill by $496. Rafaeli made subsequent property tax payments on time and in full—and, in January 2013, he attempted to settle the unpaid tax debt, according to court documents.

But he made a mistake in calculating the interest owed, resulting in another underpayment of $8.41.

A little more than a year later, in February 2014, Rafaeli's rental property was one of 11,000 properties put up for auction by Oakland County. It was sold for $24,500 in August of the same year—far less than what Rafaeli had paid for the property just three years earlier.

Today, real estate service Zillow, which rates the Southfield region as a "hot" market in the Detroit region, estimates the property is worth $128,000, But Rafaeli has missed out on reaping a financial reward for being an early investor in the area.

"I believed in the power of the U.S. to withstand the difficulties," says Rafaeli, "and I believed in its fairness and dignity in doing business there." Now, he says, he thinks differently.

"Punitive for Property Owners, and Profitable for the County"

In court documents, Rafaeli's attorneys estimate there have been more than 100,000 properties—along with the "entire equity in them"—that have been taken by Michigan counties since 2002. "In thousands of instances each year, the proceeds for a given property sold at auction far exceed the delinquent tax amount and are far less than a delinquent taxpayer's equity in the property," they argue. "This results in millions of dollars in surplus proceeds and equity for the counties and tax sale purchasers."

At the root of those seizures is a 1999 update to Michigan's general property tax statute. That legislation, Act 123 of 1999, gave Michigan's 83 county treasurers the authority to act as the primary agents for handing the foreclosure and auction of properties with unpaid taxes. It also expedited the process for seizing and auctioning homes that owed taxes, allowing county treasuries to sweep aside liens and other speed bumps in the tax foreclosure process.

The legislation's goals were "to encourage the rapid reuse of property, prevent the onset of blight, and improve the overall use of property" in the state, according to a 2011 University of Michigan report about the effects of Act 123 in Wayne County—where Detroit is located, and where the 1999 law has had the most devastating effects on homeowners.

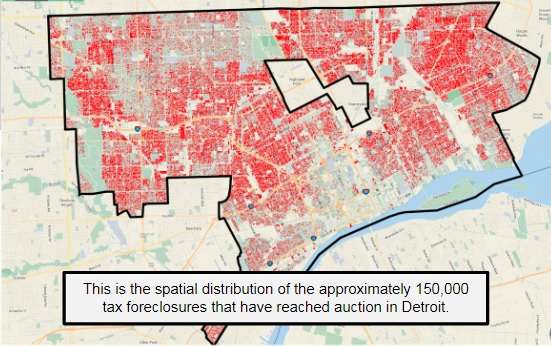

Over the past decade, more than 150,000 properties in Detroit have gone through the tax forfeiture process, according to data collected by Jerry Paffendorf, the founder of Loveland Technologies, a Detroit-based mapping firm. The process, says Paffendorf, is "punitive for property owners and profitable for the county."

Paffendorf became increasingly interested in Michigan's unique tax foreclosure rules shortly after Detroit's 2013 bankruptcy, when his company worked with an anti-blight task force to identify and photograph abandoned properties across the city. At the time, the media was fascinated with Detroit's economic collapse—one of the most memorable signs of which were the homes being auctioned for $1,000 or less.

As he began tracking the supposedly vacant homes being auctioned off by the city, Paffendorf noticed an odd trend: Lots of them weren't actually vacant.

"There was sort of an assumption that tax foreclosures were happening to abandoned buildings. You know, properties that people had left," he tells Reason. But that wasn't always the case. "We saw thousands of properties that had people living in them being auctioned."

That was happening because of the accelerated foreclosure process created by Act 123, which harshly punished any Michigander for falling behind on property tax payments. Prior to 1999, the average time between a property falling into tax delinquency and foreclosure was five to seven years, but Act 123 reduced that timeline to a little over two years. The accelerated foreclosure process caught many homeowners who fell behind on their taxes during the Great Recession.

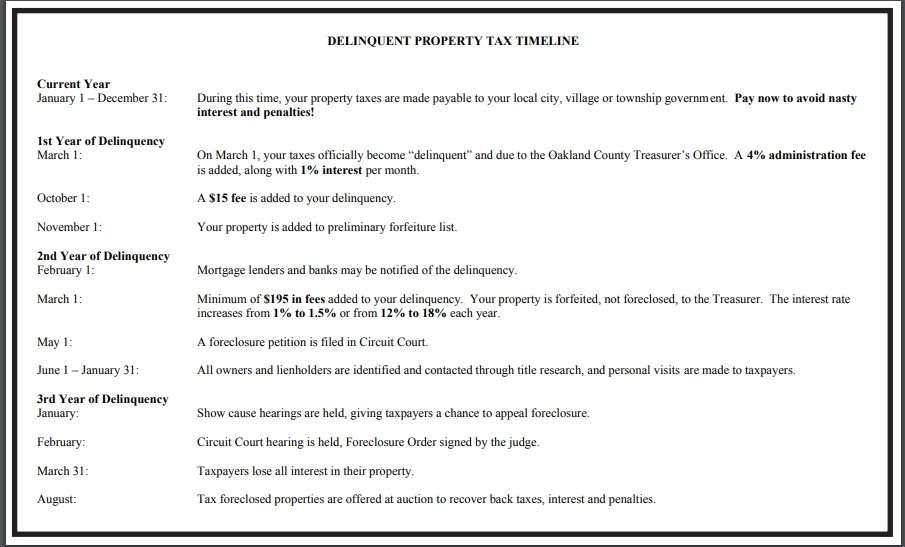

In Michigan, property taxes are due twice per year. Bills are sent in July and December, with payments due in April and November. If there are outstanding debts from the previous year, delinquent properties are turned over to the county in March the following year. The county buys the debt from municipalities—the funding comes from the county's "delinquent tax revolving fund" (DTRF)—and the county effectively becomes the debt collector for the unpaid taxes. Under state law, counties are allowed to impose a one-time 4 percent administrative fee to each delinquent property, and may charge 1 percent interest for every month the tax remains unpaid.

If the property owner still owes back taxes by March 31 of the third year of delinquency—that is, two years and 31 days after the county took over the collection process—the county can foreclose and take the property to auction.

Source: Oakland County Treasurer's Office

After a property is auctioned, the county keeps the proceeds and recycles the revenue through the same DTRF used to buy the debt from municipalities in the first place.

If the county ends up with a positive balance in its DTRF, the excess funds can be channeled into the county budget.

That's how Wayne County has funneled more than $382 million in delinquent tax surpluses into its general fund budget since 2012, according to an analysis by Bridge magazine, a Michigan-based nonprofit publication.

In Oakland County, where Rafaeli's Southfield property was seized and sold in 2014, the process has been lucrative too. According to the county's most recent comprehensive annual financial report, its DTRF had $196.8 million in net assets.

The same document details plans to use the DTRF for a number of pet projects, including the construction of a new animal shelter and adoption center. The county also "anticipates the continuation of annual transfers from the DTRF to support General Fund / General Purpose operations in the amount of $3.0 million annually for FY 2019 through FY 2023"—totals that are in line with historical norms, according to the annual report.

That's hundreds of millions of dollars in private equity that have been transferred to the two counties' control—completely legally, under the terms of Act 123.

"It is simply government-sanctioned theft," says private attorney Philip Ellison. Ellison has been involved in a series of class-action lawsuits targeting nine Michigan counties' use of home equity forfeiture over the past six years, during which time, he calculates, counties in Michigan have pocketed more than $36 million in surplus equity seized from tax delinquent properties.

Ellison represents people like Donald Freed, a resident of Alma, Michigan, who had his home and 35 acres of land seized by Gratiot County, Michigan, over a $750 tax debt. The property was auctioned for more than $100,000—and, of course, the county kept the change.

The same thing happened to Romualdo and Erica Perez, a father/daughter duo who bought a four-unit apartment building and an adjacent, abandoned single-family home in Detroit in 2012. Even though they were living in New Jersey at the time, Romualdo would drive 11 hours to Detroit on weekends to fix up the properties in the hopes of eventually relocating there to be closer to other relatives. Romualdo and Erica planned to live in the house and earn a living by renting the small apartment building.

"Every bit of money we saved and every spare minute we had went to fixing the house," Erica says. "The plumbing, the electricity—everything."

But the first year they owned the property, they underpaid their property taxes by $144. County tax records show that they made full payments, on time, every subsequent year. But Wayne County never informed them of the unpaid debt, they say, because the notices were sent to the wrong address. But the county should have known the correct address for the notices because more recent property tax payments indicated the proper address, says Martin.

In 2017, the county foreclosed on their property, sold it for $108,000, and kept the excess equity beyond the $359 owed in back taxes, fees, and interest. They, too, are suing the state with the assistance of the Pacific Legal Foundation, in a case that's separate from Rafaeli's.

Making Detroit a Worse Place to Live

In addition to destroying the livelihoods of individual property owners, Act 123 has made Detroit a less attractive place to live.

"Detroit's collapsing structures and vacant lots didn't just happen," the Obama administration's special Detroit Blight Removal Task Force concluded in its 2013 report. "They are the physical result of dire economic and social forces that pulled the city apart."

The county's aggressive home equity forfeiture scheme seems to be part of the problem. Over a two year period between 2017 and 2018, volunteers working with the Quicken Loan Community Fund, a Detroit-based nonprofit connected to the mortgage company, interviewed more than 60,000 property owners who owed taxes to the city. Most were aware that they owed taxes, but did not have accurate information about the process or the potential consequences.

Worse, the survey found that aggressive use of home equity forfeiture was leaving the city with more vacant properties, not fewer. "In theory, the annual tax foreclosure auctions are intended to take properties that are neglected and not generating tax revenue, and sell them to owners who will pay taxes and put the properties to productive use," the Quicken Loans Community Fund report concluded. "In practice, most Detroit homes that have been tax foreclosed do not return to productive use. Instead, speculators who purchase cheap property at auction allow it to deteriorate without paying property taxes, leading to further depressed home values and blight."

Paffendorf, whose company was involved in the Quicken survey, says that about 80 percent of tax-foreclosed properties end up abandoned. Some are vacant because they are going through forfeiture, and some are going through forfeiture because they are vacant, he says. But regardless of which way the causation runs, it's fairly obvious that a law that was meant to return tax-delinquent abandoned properties to productive, tax-producing ones is failing to achieve that goal.

"If you sell houses with people living in them," Paffendorf tells Reason, then "you're only creating more vacant properties."

An Incentive for County Officials to Steal

The aggressive use of home equity forfeiture under Act 123 has not only failed at its stated goal of returning abandoned homes to productive use, it has created a perverse incentive for county officials to effectively steal from their constituents.

On the morning of April 1, 2014, Linda Irwin, Cass County's treasurer, emailed a county contractor to say she was "tickled pink" to have the opportunity to seize a $3.5 million lakefront property. The deadline for the property owner to settle an unpaid property tax debt had passed the day before and the county was ready to foreclose. In subsequent emails, the contractor joked with Irwin about using the property to host cookouts for county employees, according to court documents attached to a lawsuit against Cass County.

It wasn't until three weeks later that Douglas Anderson, the registered agent who was handling the property and overseeing the construction of a still-unfinished home, became aware anything was wrong. In court documents, lawyers representing Anderson and property owner Sergei Antipov allege the county failed to provide adequate notice about the unpaid property taxes. Cass County argues that it took the appropriate steps required under law, sending two certified letters to the address. Both were returned as undeliverable, likely because there was no one actually living at the address yet.

It was not until April 18, 2014, weeks after the foreclosure deadline had passed, that county officials called Anderson to tell him the property was being seized. When Anderson and Antipov offered to pay the back taxes, the county refused to accept it.

"It's a done deal," Irwin told a local newspaper in June 2014. "They've tried to send us a check for $100,000, and I've returned it. I've had my council look at it, and we've done everything right. We didn't make any mistakes. They did."

Maybe so. But the county—and the contractor, Title Check, which works with county treasurers across the state and gets to keep a portion of the proceeds from auctioned properties—does not appear to have done much to alert Antipov that he owed taxes.

Antipov's situation bears many similarities to the forfeitures that targeted the Rafaeli and Perez properties, among others. In each case, the property owners alleged that they were not given sufficient warning about their delinquent taxes. In some cases, that's because county officials were mailing notices to unfinished homes or properties without permanent residents. In others, like Rafaeli's case, the notices were delivered to tenants who failed to pass along the information to their landlord, mistakenly believing that the county would inform the landlord separately.

The county officials involved in each of those lawsuits contend in court documents that they complied with the notification requirements written into state law. Although Act 123 does require that county treasurers make three attempts to contact tax delinquent property owners, attorneys representing the homeowners say more should be done.

"They don't have to sue in the normal sense," says Martin. Because the legal action—the forfeiture—is filed against the property itself, the notice required is significantly lower than what is required in other legal matters. And some counties don't include delinquent taxes on subsequent property tax bills, she says. "There is no notice on the new assessments that says 'you have not paid a prior year's bill.'"

In Cass County, officials don't appear to have done anything beyond the bare minimum. Antipov's attorneys say it would have taken a quick online search to find that the property was owned by an LLC registered in Anderson's name and with his Indiana address. Antipov, who owns a metal fabrication company in Indiana, owns another property in Cass County and would have been on the county's tax rolls (and likely known to the treasurer's office) But neither the county nor Title Check made anything other than the bare minimum effort to avoid running out the clock established by Act 123.

"This is a major asset," Irwin said in 2014. "We can sit on it and decide what to do with it, or we can move forward with an auction."

Irwin died in 2018, but Cass County is still engaged in a lawsuit over the property. The county has racked up more than $250,000 in legal fees since 2014 defending its right to seize Antipov's property, documents show. The home is still unfinished.

And while some county officials use Michigan's aggressive foreclosure law to benefit their budgets or to provide a setting for backyard barbeques, others use it in ways that are more openly designed to advance municipal self-interest.

Wayne County Treasurer Eric Sabree has also been caught on camera admitting that Wayne County and the city of Detroit will sometimes conspire to manipulate the auction process. During a 2015 appearance on "Detroit Wants To Know," a local web series, Sabree talked about how the treasurer's office will bundle properties together in order to make them more attractive to potential buyers—or perhaps less attractive, so the city of Detroit can keep certain parcels for itself.

"It's a group of properties we put together, because we cooperated with the city of Detroit…Nobody will buy this bundle, and then we can just give it to the city, and then the city will use the demolition funds to tear them down," he said. "And in the bundle, we also had some good properties, which the city then sold to fund the demolition and the management of the properties they took."

It's not only the city that benefits. In February, the Detroit Free Press and The Detroit News published a joint expose showing that Sabree's relatives purchased several homes in county-run tax foreclosure auctions. When confronted with the allegations, Sabree dismissed the rules that forbid treasurer's office employees or their family members from bidding in those auctions as "intrusive and unrealistic."

Sabree did not return requests for comment. But in July, an ethics board voted 5-1 to clear him of any wrongdoing, concluding that his wife's purchase of properties in 2011 did not violate the ethics rules because the rules were adopted in 2012. Wayne County Executive Warren Evans told the Detroit Metro Times that he was "not sure that the Board's action today did much to address" the concerns about Sabree's behavior.

In Oakland County, the suburban county north of Detroit where Rafaeli's property was seized and sold in 2014, there were 86 properties included in the county's 2019 land auction, held in October. In 2018, the county auctioned off 79 properties that had been seized due to unpaid taxes, according to a list obtained by Reason via Michigan's freedom of information law. That's down from nearly 300 properties that went to the auction block as recently as 2015 in the same county.

County Treasurer Andrew Meisner, who is a defendant in the Rafaeli lawsuit going to the Michigan Supreme Court, did not return repeated requests for comment on this story.

His office says it tries to help homeowners avoid foreclosure. In a press release issued in March 2019, Meisner said his office has "contacted hundreds of property tax owners to discuss their options to avoid foreclosure" before the April 1 property tax payment deadline. "Preventing foreclosure is in everyone's best interest," said Meisner, in the same statement. Yet the evidence clearly shows that county officials and budgets have benefited from aggressive seizures and sales.

An Unconstitutional Fine

If Rafaeli is victorious before the Michigan Supreme Court, the next step would be to enter into negotiations with Oakland County to determine a fair market value for his lost property and he would be entitled to "just compensation." And so would lots of other Michiganders. "If the Michigan Supreme Court in the Rafaeli case…rules in favor of the property owners, counties will be required to make an appropriate refund," says Ellison.

Legally, the matter is fraught. Counties seizing excess revenue above and beyond the amount necessary to settle the unpaid debts could be considered a taking—in which case it would be subjected to the Fifth Amendment, which promises that "private property [shall not] be taken for public use, without just compensation." The Michigan Constitution offers similar protections against government taking private property without compensation.

Oakland County has prevailed in lower courts by arguing that the seizure of Rafaeli's property was a forfeiture. But that argument runs into other legal problems: For one, even under the wide leeway that is afforded in asset forfeiture laws, there must be an allegation of underlying criminal activity. Not paying property taxes is a civil violation, but not a criminal one.

"Traditionally, civil forfeiture would only apply to the product of the crime or the proceeds of the crime," says Martin. Although many states and localities have stretched their use of civil asset forfeiture to include cases where no one is actually convicted of a crime—often as part of drug enforcement—the legal doctrine requires that the property seized must be "tainted with criminal activity," she says.

But if that's the way courts want to look at it, then the Eighth Amendment's prohibition against excessive fines would apply. It doesn't matter that a state law, like Act 123, might authorize such a forfeiture if it is unconstitutional.

In a landmark U.S. Supreme Court case last year, Timbs v. Indiana, the high court ruled that the excessive fines clause applies to both state and federal proceedings. In Timbs, the state of Indiana attempted to seize a $42,000 vehicle that had been used to transport illegal drugs, but the Supreme Court determined that taking the value of the vehicle—which was many times in excess of the allowable monetary fine for the crime Tyson Timbs had committed—violated the Eighth Amendment.

That might matter for the Rafaeli case. "Tax foreclosure is not the same thing as a forfeiture," Wesley Hottot, an attorney with the Institute for Justice, a nonprofit libertarian law firm, tells Reason. Hottot was the lead attorney in the Timbs case.

"But even if they were right," Hottot adds, the forfeiture in this case violated the excessive fines clause of the U.S. Constitution, he says, "because it was grossly disproportionate to the minor offenses involved."

In a brief submitted to the state Supreme Court defending Oakland County's use of home equity forfeiture against Rafaeli, the Michigan Association of County Treasurers makes several arguments in favor of the existing arrangement. The current system allows for counties to more easily? address blight, the group argues, despite evidence, like Paffendorf and Quicken found, that it has made blight worse in some places.

Elsewhere, the group's arguments seem to contradict one another. Ruling that tax foreclosure is a taking "could eliminate any incentive for property owners to pay delinquent real property taxes," the MACT argues, because the threat of punishment must exist for property owners to comply. But, later, the group argues that the seizure of an entire property to pay a smaller debt is "not intended to be punitive" and therefore does not run afoul of the Eighth Amendment's prohibition on excessive fines.

At the very least, the group's attorneys argue, the legislature—not the courts—should be responsible for fixing Act 123, because it would be able to do so "without destroying the tax collection process."

At other times, county officials have pleaded poverty. "They were on the verge of [bankruptcy] for quite a while. It was up to elected officials and administrators of local governments to take the initial steps (to collect taxes) and somehow they just didn't do it," Ray Wojtowicz, a retired Wayne County treasurer, told Bridge in 2017. It's clear that counties in Michigan now count on being able to pad their budgets with revenue from homes seized for having unpaid taxes.

The burden of aggressive property tax enforcement, meanwhile, falls heaviest on poor communities. Wealthier homeowners have easier access to the legal and accounting assistance necessary to avoid underpayments or to quickly address any problems. Once property is seized, there's no guarantee of due process or even a court hearing. Homeowners don't even have access to public defenders; those are allocated only in criminal cases.

In some counties, Act 123 has "created this incredibly unhealthy incentive where the county isn't just satisfied when they make enough to cover what they would have made in taxes," says Paffendorf. "They are relying on these surpluses from people who are in debt."

University of Massachusetts law professor Ralph Clifford has spent years studying home equity forfeitures in Massachusetts. The state has a less aggressive foreclosure law, but similarly allows municipalities to pocket excess revenue when tax delinquent foreclosures occur. His research shows that an estimated $56 million is appropriated from Massachusetts taxpayers every year. After reviewing all such seizures—known as "tax deed" actions, under Massachusetts state law—that took place between August 2013 and July 2014, Clifford found that towns in the state collected $42.87 for every dollar in taxes owed. His analysis includes one instance in which a property assessed for a value of $24,000 was taken to cover a $26 tax bill.

"As far as I can tell," he told Reason, "it's all just blatantly unconstitutional."

Reforming the System

"We'd had these situations for decades, where people have lost their entire homes over a few hundred dollars of unpaid property taxes," Montana state Sen. Tom Jacobson (D–Great Falls) tells Reason. "They would lose their entire homes. Forty years. All that equity. Over a few hundred bucks."

Shortly after his election to the state legislature in 2012, he introduced a bill to require that property owners be compensated for what is taken—minus the debt owed and any interest.

But Jacobson says he was surprised by the level of opposition he witnessed. Lobbyists for counties (which handle property taxes in Montana, like in Michigan) said the bill would hurt their budgets.

He reintroduced the bill during the 2015 and 2017 sessions—Montana lawmakers meet for a formal session only once every two years, though they have an interim session in off years where much of the groundwork is laid, though no votes are taken. By the third time though the process, lawmakers agreed to add additional notification requirements before a property could be seized.

This year, the state legislature passed, and Gov. Steve Bullock signed, a bill giving property owners the right to the remainder of the equity in their homes after the tax debt is settled. The bill also requires that properties cannot be sold for less than 50 percent of their assessed value—an important caveat that should prevent some of what has occurred in Michigan.

The reforms also flip the counties' incentives. Instead of being able to profit off delinquent taxes, says Jacobson, officials will now have an incentive to make sure the taxes are paid up front and on time—or they'll have an incentive to help taxpayers find ways to meet their obligations.

A Penalty More than 8,000 Times the Underlying Debt

Which means there will be more people like Uri Rafeali, who lost a home over an $8.41 mistake. His property, bought as an investment, is valued at an estimated $136,000. The penalty imposed by Oakland County was more than 8,000 percent greater than the underlying debt.

But today, while the legal battle over its fate plays out, the house sits empty. It generates no tax revenue for the city or county. It earns no money for Rafaeli or his wife in their retirement.

"The Constitution was written to prevent the government from violating a right that preexists the Constitution," says Martin. "If this can happen to multimillionaires and to the poor, to the elderly….If this can happen to Mr. Rafaeli, it can happen to anyone."

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Now is a good time to be laying the groundwork for banning this sort of robbery. Particularly if you don't live in a jurisdiction where this is currently a problem, you should be pointing to these examples and pressuring your state legislators to forbid their cities from behaving this way. It will be easier before their budgets depend on this. Given the current situation with state and federal finances, they'll be trying to take everything that's not nailed down (and then the nails) in another ten to fifteen years.

On the federal level...WHY? You see, "The Federal Government, with the cooperation of the Federal Reserve, has the inherent power to create money--almost any amount of it." ~ The National Debt, Federal Reserve Bank of Philadelphia, p. 8

ALMOST? Why only ALMOST? What keeps them from printing ALL they want? You? Me? Your dog? A full moon?

"What keeps them from printing ALL they want?"

Two words: Wiemar Republic.

On a more immediate level, availability of the special paper and inks used in printing currency, physical limits on the production capacity at Treasury printing facilities

Do you morons know ANYTHING about how money is created?

Money is created - out of thin air - when banks make loans. Period. Sometimes the borrower is govt. More often it is not. THAT is the limit on money creation - the interest various parties have in borrowing and the interest other parties have in creating money to extend that group credit.

And for all the yapping that people make re the govt role in that borrowing - I have yet to find more than a handful who will actually focus on reducing govt spending if they are presented instead with the opportunity to have a tax cut with more borrowing.

Lol. No.

Correct. Every dollar is borrowed into existence. Now, back to the story..........

“Tickled pink”......... We sure do have a lot of government parasites to pay for. It’s no wonder you are so resentful of “tax cuts for the rich”. It all makes sense now.

Haha.

Loans do create deposits. My spending is somebody else's income. Loans create money - and paying off loans destroys money. Crazy stuff, isn't it? The Fed can create money too - out of thin air. They "printed" money (electronic entries) which they used to buy Treasuries and mortgage backed securities - that is how "quantative easing" was carried out. That whole exercise was basically a giant asset swap. The Fed got bonds and the banks got reserves. That's the main reason QE didn't cause hyperinflation.

I'm surprised you're getting shit for this comment on a supposedly libertarian forum. The fact is, money can be created out of thin air BY ANYBODY. Money is nothing more than a potentially enforceable promise of future work to be done in exchange for something today. Its a stand-in for debt. An IOU. If I promise to mow your lawn next week if you let me bang your wife today, guess what?? If you agree, then we just created money out of thin air! You can now take my promise to mow your lawn next week and trade it to Vinny "Four Fingers" del Vecchio in exchange for banging HIS wife, and you've converted my "potentially enforceable" promise of future work into hard currency.

*In this scenario, Vinny is the government, and you are the bank.

About time the local governments started to emulate private equity firms. So, to who do the profits go, isn't any good to distribute them to the employees? Hmm. Ok. Got it. These monies need to go to the people holding the most wealth in the county.

Yeah. The new and American Way. Profit to the top! On the local level!!!

Do you believe you sound clever?

It looks very much like all of these counties need to have a federal RICO charge thrown at them.

Anytime is a good time to be abolishing the political paradigm that primarily uses the initiation of violence, threats, and fraud. It's the only paradigm used worldwide now and in the past. It has never worked and the proof is in the fact that its ultimate expression, its "health" is war.

I would support replacement with a voluntary paradigm based on reason, rights, and choice. Or we could just keep the chaotic mess we have and hope for a better result without any fundamental change in the politics. We could focus on goals and ignore the results obtained or blame the people given power, anything to avoid taking responsibility for our failure to self-govern. That hasn't worked in 10,000 years, but it works good for the ruling elite.

For fuck's sake. Shorten the damn article. No one who isn't already convinced that property taxes are bullshit is going to read this.

Hey, property taxes keep degenerates out of my neighborhood or at least those that keep their degeneracy behind closed doors like myself. That road thing too.

I'm fishing for positives...

Property taxes could be one of the less worse ways to do taxation if it were based simply on a straight, simple valuation of the land. But I'm still pretty uncomfortable with them as they are basically a way that governments claim and make you pay rent on your own property. I don't like the idea that you can't own land without also having money to keep the tax man from taking it from you.

All taxation is, at base, a burden on the economy and a form of theft. Government, like fire, is necessary, but should be no bigger than needed, a lesson that Progressives are determined to ignore. The result of letting the government grow unchecked is rapacious taxation.

Property tax is a wealth tax. Now I'm wondering if Warren's wealth tax exempts physical structures, vacation homes, rentals and land? That makes it a federal property tax.

"But I’m still pretty uncomfortable with them as they are basically a way that governments claim and make you pay rent on your own property." First Plank: COMMUNIST MANIFESTO Abolition of property in land and the application of all rents of land to public purposes. (Zoning - Model ordinances proposed by Secretary of Commerce Herbert Hoover widely adopted. Supreme Court ruled "zoning" to be "constitutional" in 1921. Private owners of property required to get permission from government relative to the use of their property. Federally owned lands are leased for grazing, mining, timber usages, the fees being paid into the U.S. Treasury.)

Those are potential problems with a land tax or even a property tax. But the bigger problem - which isn't even mentioned here - is that when mortgages are split into pieces and collateralized and sold off, the record of who owns what now is recorded electronically with MERS - and MERS has been sloppy at best in recording those with the state/county clerks who have to assess who owns what and where to send the notices for the property tax.

IDK whether these individuals in this story are just small fry free-and-clear owners who are now caught in a bureaucratic/corporate system that now has a working assumption that all land is now actually owned by mortgage lenders who securitize their loans globally - or whether they took out mortgages from lenders who aren't part of MERS - or what. But this MERS crap was a huge reason the foreclosure system broke down in the aftermath of 2008 when it was banks doing the foreclosing.

And since 'mortgage' is only mentioned once - in passing - in this article re something that is very significant in land ownership nowadays, I suspect this is also really sloppy agenda-driven reporting.

Property taxes make sense only as a mechanism to fund municipal expenses related to real estate and structures: flood and other run-off mitigation, some other infrastructure, perhaps water and sewer service, etc.

Expenses related to services for people, like education, recreation, and (gulp) health should be funded by taxes assessed on people, not property.

Not wholly true - unless you think that landowners should receive all the benefit of increased home prices that are due to things like muni-spending on nearby schools, parks, hospitals, etc.

And if you think that, then you have created the ultimate feudal free lunch.

In New Jersey, New York property taxes are kickbacks to teacher's unions and unions in general for votes. What you end up with is emigration states, and finally, the wealthy will leave and then tank the economies.

How do property taxes keep degenerates out of ANY neighborhood?

If they rent the land "owner" simply passes them on to the tenant in the rent due. Property taxes ARE rent. At least the way they are implemented. They fit the 1st Plank of the Communist manifesto to the TEE!

Property taxes are passed on. Land taxes can't be passed on.

The most extreme example would be two parking lots right next to a skyscraper. A land tax system would ceteris paribus assess the same tax on all three. Parking lot A owner might try to pass that tax on to parking fees. But if parking lot B owner decides to add a couple levels of parking spaces to double the number of spaces, their land taxes don't increase. So each park space is charged half of what the unimproved park lot charges for that space. So the first lot loses customers and either has to eat the land taxes hisself or find a higher value use for the land.

Since the land tax is assessed on the land not the improvement, it also means there is no tax on the capital/labor that creates that improvement - which lowers the cost of those improvements and that lower cost is passed on to the tenants of that improvement. Where a property tax OTOH DOES tax those improvements (thus disincentivizing the improvement by raising its cost) and in so doing undertaxes the land (thus incentivizing dog-in-the-manger speculation exemplified by two parking lots right next to a huge skyscraper).

Well, put up or shut up. Democrats in California and New York should run on land value taxes.

DeRps are completely captured. They ain't gonna do anything. Libertarians or some other third party - esp the Rent is Too Damn High Party - should absolutely do that

Just the easy look at NYC - which has lower prop tax rates than NY state. The land alone in that city was worth $2.5 trillion about a decade ago. Not the property - the land. Prob closer to $5 trillion now.

The city spends about $82 billion/year now. It currently raises about $24 billion in prop taxes, $21 billion sucking off a fed/state teat, and $37 billion in income/sales/etc.

If it had the same prop tax rate as NH or TX (roughly 2%/year) - but focused entirely on the land - it could basically fund its current spending while eliminating all other taxes and dependence on other grants/teats. And even assuming no one can figure out how to cut what is prob $10-20 billion in wastefraudabuse spending (or excess spending in all categories cuz NYC cost-of-living), the follow-on effects of that sort of tax switch would be huge. Currently, 22% of NY land is streets, 10% is vacant, 6% is govt owned, 16% is recreation/etc, and 23% is 1/2 family. Massively underutilized land for a major global city - ie speculation borrowing - which directly affects high housing prices, welfare payments at the low end of wage scale, inability to open businesses if they depend on lower pay levels, etc.

But you can bet Wall St and the We'lltakecareofyouforever bureaucrats would shit a ton of bricks.

tl;dr - I have an 8-second attention spa.....oh, look! A squirrel!

Squirrel! Squirrel!!

It's an actual article for the magazine. Sort of what their job is to produce.

Property taxes may be bullshit, but why didn't the morons pay what they agreed to pay? I pay my own taxes, it isn't difficult. Even Obama could do it.

Having said that, no one should have sympathy for Detroit. They have been ignoring their their financial responsibilities, as citizens and a city, for 50-60 years.

They get the city they deserve created by the government they elected.

They weren't notified that they owed the tax. Either the notices were sent to the wrong address or to unfinished houses. And I really can't imagine why the next year's assessment wouldn't include the unpaid amount from the previous year. That seems like conspiracy to me. It should be enough on it's own to invalidate the process.

It is not so provably conspiracy as much as it is obviously the government ACTING IN BAD FAITH. Which, (like withholding exculpatory evidence and other nefarious practices) is USUALLY forbidden, but this law about expedient collection of property taxes actually INCENTIVIZES, PROTECTS, AND REWARDS government officials using pretexts, self-interest, and employing lofty appeals to the asserted "good" that will result from the outright annulling of a citizen's right to due process and justice.

They voted for their state govt Democrats, though, didn't they? Suckers!

Yes, every single person voted the same way, and so they deserve this.

Shove your collectivist bullshit up your ass.

Those 80-odd victims who are now sleeping under bridges will read it. The Detroit LP needs to get them to vote libertarian once they have cardboard boxes they can put down as addresses on their voter registration cards.

+1,000!!!!

This is vastly superior reporting to Reason's usual content.

Sorry if painting a clear picture of the state's abuses makes for a long list.

So.

Corruption on a grand scale.

Relatives profiting from officials actions.

A cozy relationship between a government and a contractor.

(no info on whose cousin owns the firm?)

All under democrats.

Moral. Don't live in Detroit. Don't vote for democrats.

On the one hand, you say if you pay the taxes on time, you should be fine. On the other hand, that's some next level graft and "FYTW, citizen". If it wasn't Detroit I'd ask why that hasn't come in elections for treasurer etc.

This isn’t just a Detroit thing. As reported in the article, equity theft has also happened in the little town of ALMA, MI. The City of ALMA made over 100k on a $750 tax debt. Why is ALMA or any city entitled to any more than what was owed to them? Because an unconstitutional statute allows it? It’s theft by government no matter how you look at it. It’s abuse of power. It’s exactly what our forefathers fled from. Fuck what the Michigan Legislature authorizes and fuck the county treasurers who use the law to steal and pad their budgets. It’s wrong. Plain and simple.

"It is simply government-sanctioned theft," says private attorney Philip Ellison.

It's not just "government-sanctioned" when it's the government doing it. Asset forfeiture like this should be an obvious violation of the Eighth Amendment excessive fines clause and a good argument for doing cruel and unusual things to lawyers who argue bullshit about the finer points of civil vs. criminal law when the government is involved.

But I must say, I had to scroll back up to see who wrote this piece - I assumed it was Sullum because this is a very fine piece of reporting. Kudos to Boehm.

A lot of good reporters here when they aren't in the throes of TDS.

Even with the wonders of modern industry, there simply isn't enough rope in the world. Where's a planet-killing meteor when you need one?

On a related note, does anyone know a good cardiologist?

No, but I have a good rope guy.

Does your rope guy also deal in piano wire?

Whatever happened to the woodchipper fad?

Inventory too cumbersome.

Hemp is cheap again

Michigan is basically a third world country.

The cities anyway. I think the agricultural areas do alright.

I have a small window into the rural areas of Michigan - a portfolio of companies I lend to out there for retail fiber projects. I understand that this is a limited window, but I have noticed that the average financial performance of my rural Michigan portfolio is notably lower than the rural areas of surrounding states.

In the lending world, its generally known that Michigan is a risky state... that being said, there are some northern areas of Michigan that have shown decent average household income growth, so maybe there's hope. I'm obviously being a little hyperbolic with my third world comment. I'm feeling hyperbolic today.

Sounds like you probably know better than I do.

The activity of the governments in Michigan is one reason they no longer teach about the American Revolution in schools. The conduct by the various governments in Michigan is far worse than anything George III did to motivate George Washington and many others to start the American Revolution. I am surprised that Michigan has so far escaped the same result. Must be that George III did not have as strong a grip on the colonies as the Michigan governments have on the property owners of Michigan.

When a political party panders to unions for votes, it becomes a ticking time bomb. The productive move and unions are left to pay the tax bills. I find it hilarious that the California teacher's unions press for exemption of income taxes. Hell, Bernie will exempt unions from his medicare for all plan...thats how the left rolls.

Ann Arbor has been booming for quite a while. The Grand Rapids-Grand Haven-Holland area is solid. Traverse City has done well, too (the tourist industry in that region is a big business). But the older industrial cities (Flint, Saginaw, Pontiac, Benton Harbor) have continued to struggle for sure.

They’re fine to visit, and probably fine for people who don’t know what they’re missing. But grey skies and cultural smothering get old pretty quick.

Grey skies... Grey water...

Excessive taxation was one trigger for the suburban flight from Detroit in the 1950's. It's a damn shame Detroit is holding firm and even Oakland County is now stepping up the tax game.

Michigan, as a whole, does nothing to influence people to move there. I might move back but only to be closer to family.

I've known people from the Upper Peninsula and were happy there and plan to eventually move back. As long as you stay out of the Dem-dominated areas like Detroit, Dearborn, Flint, Ann Arbor, etc., the communities tend to be higher-trust and less dysfunctional.

Remember this the next time some wanker tells you that taxes are the price we pay to live in a civilized society. Plainly the definition of "civilized" is "where the thieves are better organized".

aggressive use of home equity forfeiture was leaving the city with more vacant properties, not fewer.

Inconceivable!

Nobody in their right mind should want to own real property in Michigan. The practice reported in this article is far worse than anything King George III was doing prior to the American Revolution. We went to war against him. How does Michigan escape the same result? (So far)

Because the elites (enough of them anyway) wanted to fight King George III and don't want to fight today's governments.

WOW! I can read the headlines that are going to be coming to Michigan soon. 83 year old man walks into property tax office and shoots everyone there before police arrive and kill him. Actually since the founding fathers started shooting British over a 3% tax...I wonder what THEY would be thinking if they were alive and saw this kind of insanity going on? BTW...PROPERTY TAXES are RENT. They are the FIRST PLANK OF THE COMMUNIST MANIFESTO!

Whatever happened to garnishing wages? These people are defaulting on their mortgages, so obviously they have wages. And why can the city just mail notices to the wrong address and this counts as giving the taxpayer sufficient warning? Shouldn't they at least be required to send registered mail or some other method that provides feedback that the taxpayer actually received the notice?

Do you read? Not mortgages, tax default. And an 83 yr old. Can you garnish social security? And why would they want to when they can steal $100k instead?

Mr. Boehm....This was a good article. A major step upward from the Never Trump Trash you usually write.

Can't fucking believe this has not been litigated already. MI is about to get their ass handed to them. As far as Southfield goes, it is what I call: Meh. No great shakes.

Dearborn however, has turned into a third world shithole.

If reining in this practice would “impact the budgets” of the counties, then the counties are clearly trying to do too goddamned much. Also, this is clearly heading for a Supreme Court case, either as ‘takings’ or as ‘fines’, and from the way the court has been lately, the counties involved are going to have to cough up HUGE amounts of money. If I were one of the government stooges involved, I wouldn’t be arguing. I would be headed somewhere with no extradition treaty.

"Impact the budgets" is likely bureaucratese for "sending out pension checks".

Ding ding ding!!!! You win.

I would check to see who is buying these properties for ridiculously low prices to make sure no one that works for Michigan county governments, or anyone related to persons in government, is using the government to seize these properties so they can buy at auction for personal gain. We already know government is corrupt and some will use it's power for their benefit.

Democrats. Feh.

This is one case where I am reluctant to assume that Democrats are wholly responsible. This is local government; the kind of goobers who rand for Class President (or worse; Class Secretary) in High School but lacked the smarts and charisma to get higher than county level. There's an awful lot of those, they belong to whatever Party they think will serve their petty ambitions, and they're harder to get rid of than mold.

Mind you, my gut reflex is to assume they are Democrats, but I suspect they aren't. This is the kind of thing government DOES. It gets worse when it isn't representative or hemmed in by a Constitution, but this is just how Government behaves when left to its own devices for too long.

Asshattery is a bipartisan trait.

Congratulations, picked up by Drudge. Maybe some people will read this, and not like what they see.

And they wonder why people don’t trust politicians. Sharpen the pitch forks.

taking away homes is terrible plan if the wish is to have taxpayers paying home taxes

Property taxes are extorted at the point of a gun, like income taxes. Both property and income taxes should be banned in the United States and replaced with voluntary taxes. Voluntary taxes include sales taxes and government fees. You only pay taxes if you voluntarily chose to buy or use something, and every citizen supports the cost of government, reducing the demand for government spending to keep sales tax rates low.

If only Americans could choose to live in different areas, with distinct legal charters and variations in social and political agenda...

Wait:

"A 'win-win' situation," says Rafaeli, who lived in neighboring Macomb County at the time. (He no longer lives in Michigan.)"

"Act 123 has made Detroit a less attractive place to live. "

That's difficult to do.

New Jersey looks good by comparison.

GOVT: "We're selling your home to collect the sum you owe us. That plus a little interest."

MAFIA: [contemplating the situation] "Holy crap, that is so unconscionable!"

Government is the mafia that we all do together.

somebody teach them to start w/fingers, not dwellings

The philosopher St. Augustine once wrote, "What is a state without justice but a band of robbers?"

Just because there is a law that seemingly allows this state-enacted robbery, that doesn't really make it right or even truly legal.

Ah yes, good ol' Democratic Michigan...

TL;DR. This isn't The Atlantic.

Does the article mention the 8th Amendment anywhere?

Yes. And the Timbs case.

from a google search:

"The Eighth Amendment , or Amendment VIII of the United States Constitution, is the section of the Bill of Rights that states that punishments must be fair, cannot be cruel, and that fines that are extraordinarily large cannot be set. "

The Obamacare lawyers laugh at anyone who uses a static definition of fines and taxes.

I learned about this a few years ago and it horrified me that I would never truly own my land.

So I started playing along, and have made about $500k in last 2 years buying tax liens, foreclosing and flipping to a higher and better use.

I've realized what I think other smart people have, you can't really make an ideal world, you can just learn enough to outrun your neighbors while running away from the bear.

'When confronted with the allegations, Sabree dismissed the rules that forbid treasurer's office employees or their family members from bidding in those auctions as "intrusive and unrealistic."' Unlike a law which steals a $136k house.

Keep in mind that “Mr. $8.51” is 83 years old. My dad is 79 and can’t remember how to tie his shoes. The wisdom of Mr. $8.51 really isn’t the issue. The issue is government-sanctioned theft. People work hard most of their lives to build equity. Should the government be able to steal that equity based on a tax debt that is a nominal fraction of it? Do you think Mr. $8.51, an individual, cares if the county, a government entity, makes money on every home it seizes? Obviously, you profit from government-sanctioned theft, which explains your lack of sympathy for Mr. $8.51 and others like him.

A few notes from someone that buys and sells tax foreclosed properties on a small scale and that attends/watches 15-20 county sales a year:

Michigan's counties have been using delinquent tax funds to balance budgets long before the new law.

This article is generally correct though as usual the most extreme examples are used to make the point the author wants to make.

Keep in mind that for every "killing" the County Treasurer makes they lose money on 10 or more. MOST of the "homes" in the sales I see are literal wrecks and empty.

Title Check is whacked pretty good in this article, did the author try to talk to them? They DO try to get in touch with the owners and are pretty open and transparent about what they're doing. They visit each property and post it BEFORE it's forfeited. You can see all the sale results online at tax-sale.info and they stream all the auctions on Youtube. There are years of sales available to watch if you really want to know the process. Keep in mind they do the majority of counties in MI but not all of them.

At least in rural areas the County Treasurers DO generally work to notify owners AND make owners aware of options available to help them avoid foreclosure.

A simple question for "Mr $8.41" would be "Why didn't you just PAY the bill as presented?" ALL tax bills arrive with the amount due "if paid before". Would any of you risk a $60,000 property by calculating your own interest and then NEVER following up to see if you were square with the county? Stupid is a bad excuse.

Over the last 5 years I've bought and sold 20-25 parcels (all vacant land - I don't want to get into rehabbing) so I know the process pretty well.

I've sat in wonderment at times as the county made a "killing" but when you start adding up the expenses overall it's not as wonderful and profitable as it sounds.

What states? I do Colorado.

Keep in mind that “Mr. $8.51” is 83 years old. My dad is 79 and can’t remember how to tie his shoes. The wisdom of Mr. $8.51 really isn’t the issue. The issue is government-sanctioned theft. People work hard most of their lives to build equity. Should the government be able to steal that equity based on a tax debt that is a nominal fraction of it? Do you think Mr. $8.51, an individual, cares if the county, a government entity, makes money on every home it seizes? Obviously, you profit from government-sanctioned theft, which explains your lack of sympathy for Mr. $8.51 and others like him.

Ah, the pimp is here to tell us how good his bitches have it.

Don't take this personally, Jolly, but get cancer and die.

You seem like a nice person.

Keep in mind that for every “killing” the County Treasurer makes they lose money on 10 or more. MOST of the “homes” in the sales I see are literal wrecks and empty.

If the value of the property is not enough even to cover a few of years of back taxes (as happens sometimes in Detroit), you know what that means? It means that the annual tax bill (and the assessment it was based on) were absurdly, insanely, criminally high. Even in high-tax rate Detroit, annual property taxes are supposed to be 3.5% of market value. But Detroit dragged its feet for many, many years in reassessing property, continuing to base tax bills on old assessments that were nothing close to the actual bankruptcy-era values of the houses (e.g. valuing a house that would sell for $10-15K as if it were still worth $85K).

But even if the county can't sell a property for enough to cover the back taxes, that in NO WAY excuses them pocketing the excess (e.g. keeping $99K of the $100K sale price after foreclosing on a $1K unpaid bill). There is simply no excuse for not returning the excess to the owner.

But, if I put a lien on a house because I didn't get paid as a subcontractor, I get to foreclose on the house and keep all of the proceeds for my self, don't I?

Oh, wait... no, I don't.

But the banks do! Those evil greedy corporations hold mortgage liens, and if you don't pay, they'll take your house.... and if you owe $120k and they are able to sell it for $300k, they just get to keep all the excess....

Oh wait.... no they don't.

I like the way the government just writes themselves any power they'd like. "But it is all legal!" (because we wrote a law making it legal)

I blame us. We allow this crap because we keep voting for people who won't change it. In fact, we keep voting for people who make it worse.

"I blame us. We allow this crap because we keep voting for people who won’t change it."

I don't blame myself, I blame other people. I don't allow it. I vote for people who absolutely would change this crap in a heartbeat...but they don't win. So I don't blame 'us', I blame other people. Some of them are my friends and family and I still love 'em. But boy do they suck at economics and politics.

This exists because people are lazy.

People forget and the politicians are not destroyed. (Any same voting base would make sure such people never held public office ever again.)

If you want to know why this happens, but a mirror.

The State of Michigan is obviously in business to destroy its citizens. Those who can should leave Michigan to save themselves.

.

Michigan Property Taxes...

The legislature shall provide for the UNIFORM general ad valorem taxation...

Every tax other than the general ad valorem property tax shall be UNIFORM upon the class or classes on which it operates.

The Supreme Law of the Land held that all Duties, Imposts and Excises shall be UNIFORM throughout the United States.

Direct Taxes shall be divided, shared and levied among the states.

Michigan agreed to the terms.

An individual working for nothing other than compensation and acquiring property domestically for personal use, is not Directly subject to Duties, Imposts and Excises.

FreeMyPeopleNow.com

.

Your reference to the US Constitution is rather inapt, since this isn't a federal tax.

This is theft, pure and simple. We have been warned time and time again, if we give the government too much power that they would abuse it. Classic example of government over reach, right here. We have to vote out these politicians who endorse things like this, they will keep on doing it, and much more if we give them the chance, if we don't get rid of them.

Do you want Killdozers? Cause this shit is how you get Killdozers. 83-year-old engineer, probably has already made peace with his mortality and knows quite a bit about how to make stuff.

"The State is an institution run by gangs of murderers, plunderers and thieves, surrounded by willing executioners, propagandists, sycophants, crooks, liars, clowns, charlatans, dupes and useful idiots – an institution that dirties and taints everything it touches." -Hans-Hermann Hoppe

"A Michigan Man Underpaid His Property Taxes By $8.41. The County Seized His Property, Sold It—and Kept the Profits."

I don't know why everyone is whining, sniveling and crying about this.

No one has the right to property but The State, and profits are intrinsically evil and should be the exclusive possession of our wonderful oppressors ruling over us.

You would think the peasants would've learn the important lessons of Marx, Lenin, Stalin, Mao, Castro and other enlightened leaders have provided for them to recognize these self evident truths.

The state justifies property taxation through its role as the jurisdictional authority over land titles.

In this way, so-called "private" property does the exact opposite of what it says (like other Orwellian named laws like the Patriot Act) and actually authorizes the state to confiscate by decree. After all, you don't own the land - you "own" the title, and the state controls everything its titles represent. And what it gives, it can take away.

This is why libsocs favor personal property, by which we mean justly acquired property determined by use and occupancy, that cannot be seized. In order to end state seizure of personal assets, one must abolish the legal framework that authorizes it. That framework is private property.

#marketsnotcapitalism

This particular form of asset forfeiture, like throwing hemp seeds over the fence then confiscating the property as a grow house after it rains, is just as good for debasing mortgage-backed securities and related derivative paper. It is essentially what transpired to trigger the Bush Jr. faith-based prohibitionist crash of 2008, and not much different from the mechanism behind the 1987 and 1929 crashes. Prohibition and the Crash did not coincide by coincidence.

He probably didn't have $8 left for taxes after ponying up $4,000 for Michigan's insane auto insurance premiums. Pure Michigan!

Michigan, my life long home. Staunchly Democrat my entire life. Much like Wisconsin. Minnesota and Illinois the "real" people dwell outside the Democrat strongholds, but the Detroit tail wags the Michigan dog. Oddly (or not so much) conditions like this exist primarily in Blue states.

There is a second level to this theft. The people who are buying the properties at auction are quite likely plugged in to the system. You don't buy a $130k property for $24k very often. Foreclosures might go for well below market value if there is a significant problem, they are not well advertised or if the window for purchase is extremely short. But in general, you aren't getting 90% discounts very often.

I have a relative who has bought a few distressed properties at auction - including one for a dollar. But they always come with caveats. The one he got for a dollar cost him $12k to clean up the condemned buildings. He still turned an $18k profit.... but that's also because he was able to do the work himself.

This whole thing is like the automobile seizures... The government is corrupt, and there is a corrupt set of buyers involved as well.

The video of the auctions is on youtube perhaps you can spot the corrupt buyers?

I think we can all spot the dickheads. I'm looking at you, Jelly.

The article in fact mentions the wife of one treasurer doing this.

Somebody needs to start administering beatings to these bureaucrats. Dispacling an elderly person for monetary gain under color of law to boot...Disgusting, and definitely deserving of a bucket of tar and some chicken feathers.

I favor a Killdozer, myself.

Somebody needs to start administering beatings to these bureaucrats. Displacing an elderly person for monetary gain under color of law to boot…Disgusting, and definitely deserving of a bucket of tar and some chicken feathers.

Reading accounts like this is destroying my idealism about government. I had always believed that government was out to protect its citizens but over the years I am coming more to the conclusion that government is just another shyster out to bilk its victims out of what little victim has. I would like to see if there is not some cooperation between these government officials and those who benefit from such actions as this. I would not be surprised that there is a financial connection even though it goes through several cutouts to throw the investigators off tract.

Did you just realize this? Our founders wanted limited small government.

The first President of the United States said: “Government is not reason, it is not eloquence,—it is force! Like fire, it is a dangerous servant, and a fearful master; never for a moment should it be left to irresponsible action.”

"Government" is not one monolithic entity out to get you or out to protect you. County government doesn't typically get as much scrutiny as state or federal or even municipal levels, so if you don't get good people in there, very few are going to hold them accountable. Some government officials are incompetent, some are corrupt, and some do the best they can.

"Which means there will be more people like Uri Rafeali, who lost a home over an $8.41 mistake. His property, bought as an investment, is valued at an estimated $136,000. The penalty imposed by Oakland County was more than 8,000 percent greater than the underlying debt. "

How is it 8,000 percent? 136k divided by 8.41 is over 16,171 times the amount he owed.

They didn't say it was 8000%, they said it was "over" 8000%. Which it is.

I mean, it's also over a million percent, but the statement was technically correct.

What do you expect from a failed liberal state but a predatory broke government squeezing its citizens and stealing their property.

Its pretty obvious when the tax assessor conveniently doesn't send minor tax bills from delinquent property to the correct address but sends property tax bills that are current to the correct address. This is what you get from your criminal failed democrat state government. What's next? Mass rolling power outages? Oh wait! That's the other liberal Venezuela California.

No law should be enacted that incentivizes, protects, and rewards government employees ACTING IN BAD FAITH in collecting taxes or otherwise dealing with law abiding citizens.

They need to look at who in the local government was involved on the sale and who ended up buying the property at the stolen property price. I bet its not too far from those involved.

The article covered that.

And I bet the problem can be fixed with 9 yards of hempen rope and a lamppost. The rest will get the message from the erected sign.

Great Pot

http://www.malagasy.co.uk/

Revolutions have started over less.

But dear god. That article was WAY too long.

Totally. "It violates the NAP." would have sufficed.

I like the complete treatment.

We can have updates now that are quicker. This is how it should be done, in my opinion. Full sized, in-depth articles that really flesh out the issues.

Everything has its value.

http://worldssmallestleague.co.uk/

A government that can give you anything, can take everything.

The vehicle in Timbs had nothing to do with the drugs that the government ordered him to sell to the government, and then convicted him of selling.

It was simply a piece of property a third party thought it would like to seize on behalf of the government and get a cut of.

When questioned, the thieves said "We didn't steal that property, the county did".

The property was worth $128,000.00 but the government only got $24,000.00.

Is that typical for fenced stolen property?

Excellent point, wrapped in excellent snark!

Great article, Eric. This is exactly what I expect from Reason! More please!

This is all neat and everything, but not one person in this article questions whether property taxes themselves are constitutional. Under the current arrangement, no one ever really owns his property. He just rents it forever from the government, which will assert its right to retake it if he doesn't pay up. Fuck that.

Isn't this exactly what the 2nd amendment and the milita is all about? I doubt this would have happened if we had a fully functioning milita. Instead we have Blue ISIS that instead of protecting our rights is one of the main violators of our God given rights.

Does anybody know the Pacific Legal Foundation's track record in these sorts of cases? I'm somewhat surprised not to see Institute for Justice's name on this case -- they bitch-slap smug tyrants like this with satisfying inevitability.

There are no necessary evils in government. Its evils exist only in its abuses.

Andrew Jackson

In comparison, if a bank forecloses on your house or car, it is generally not allowed to keep any proceeds beyond the amount of debt owed.

Sounds like something they would do in Cally. As governments grow more desperate for funds to pay for underfunded pensions, the hunt for taxes will go off the map. Another reason why government never works for the people it is supposed to serve, but only for the thieves that work inside of it.

If they did this to me there’d be another tragic mass shooting at the Oakland County office. I’m already homeless, so wtf, might as well let the state put me up at their expense.

I disagree with the term "property owner" used to describe the name on the deed. Ownership requires ultimate control. Ultimate control is with govt., therefore govt. owns all property. Since govt. consists of temporary owners (term limits, election) and bureaucrats with mixed values, management is chaotic, e.g., tragedy of the commons.

Govt. gets its authority from the majority, which forces that political power on all, violating rights. Therefore, no moral/practical govt. exists, although everything govt. does is legal because it defines "legal".