The New Trustbusters Are Coming for Big Tech

Left and right are joining forces under the banner of “hipster antitrust.”

Jeff Bezos "is worried about me," grinned Donald Trump back in 2016 while discussing Amazon's bald-headed billionaire. "He thinks I would go after him for antitrust, because he's got a huge antitrust problem because he's controlling so much." President Trump has continued to threaten Amazon and other tech giants with the trust-busting lash. This year, on CNBC, he informatively announced his role model: "The European Union is suing them all of the time. Well, we should be doing this. They're our companies."

You will not be surprised to hear that Fox News talker Tucker Carlson agrees with Trump. But you might blink when told that he arrived at this agreement via a lecture delivered by Professor Elizabeth Warren. The Massachusetts senator has gained traction in a crowded Democratic presidential field by announcing pre-election antitrust verdicts to bust up Amazon, Apple, Google, and Facebook—no legal proceedings required.

Carlson sprinkles conservative holy water upon Warren's Plan for Economic Patriotism, saying her "policy prescriptions make obvious sense." Warren would treat the rise of big tech firms like an exploding offshore oil rig: an emergency to be met by capping, closing, and hosing down the fiery mess. Carlson gushes that Warren "sounds like Trump at his best."

This bipartisan pot of pols and pundits is echoing a school of thought known as the "new structuralism." But you're more likely to hear its nickname: "hipster antitrust." It claims a historical hero in the late Supreme Court Justice Louis Brandeis, and its manifesto is Lina Khan's 2017 Yale Law Journal article "Amazon's Antitrust Paradox."

The antitrust hipsters fear the "winner take all" rivalry in tech platforms while romanticizing the drowsy world of "common carrier" regulation. As seen in transport and communications, this regime has had its unfortunate place in history. While imposing so-called "nondiscrimination" rules on service providers under the auspices of giving everyone equal access, the regulations widely and deeply favor incumbents and legacy technologies at the expense of upstarts and innovation.

In the hipsters' telling, regulation and antitrust are princes riding white horses to our salvation. The computer company IBM was an unrepentant oligopolist, they say, until it was put on the straight and narrow by a federal antitrust suit in 1969. That police action opened the market for Microsoft, which then started monopolizing the software business. Thankfully, the 1998 U.S. v. Microsoft suit busted that diabolical plot. If not for this victory for the Department of Justice Antitrust Division, Google would have been nipped in the bud. Alas, Google's search function then got much too popular, and now it must be disciplined. Indeed, Amazon, Google, Facebook, and Apple have all grown too big for their britches. Each needs to be split up. They would already have been, in fact, had the cop on the beat not dozed off.

This pattern-recognition exercise is a reprise of Justice Brandeis' early 20th century legal attacks on price-slashing innovators such as A&P, Safeway, Sears, Montgomery Ward, and J.C. Penney. Then, as now, each triggering offense was a daring market breakthrough that consumers flocked to embrace. Legislation procured by those who, like Brandeis, saw these commercial successes as threats did more to promote cartels than to promote competition: Oligopolies flourished under the auspices of the Interstate Commerce Commission (ICC), the Federal Communications Commission (FCC), the Civil Aeronautics Board (CAB), and the U.S. Department of Agriculture, with grim effects. Under the rule of the CAB, for example, air carrier competition was drastically reduced. In one of the "most bizarre and illuminating chapters in the history of regulation," Harvard law professor Louis Jaffe wrote in the Harvard Law Review in 1954, only 30 percent of air traffic could be sold at coach fares—and that discounting existed only because "unscheduled" airlines brazenly evaded a government ban. "The CAB is completely committed to the existing certificated carriers," Jaffe explained.

And while the ICC brought stability to railroads, it did so while creating higher average prices. The agency, which was established in 1887, was abolished in 1995 for undermining railroad and trucking efficiencies, wasting fuel, savaging the environment, killing economic growth, and waterboarding consumers. With less "public interest" and more open market rivalry, shipping costs were slashed, pollution declined, and innovation sprouted. A Brookings Institution study pegged efficiencies at $18 billion in 1996 alone, while crediting deregulation for allowing the emergence of new competitors in overnight shipping, including Federal Express.

Waves of deregulation produced protean results elsewhere, too. Legacy markets have been disrupted and powerful incumbents have fallen, with the choices available to consumers proliferating. The emergence of competitive wireless networks—granting 6 billion human beings access to global communications, 5 billion of them new phone subscribers—is itself a prime example of this liberalization. The antitrust hipsters present themselves as populists, but it is a curiously elitist form of populism that would undo the laws that allowed those mass market gains.

Antitrust was recently pushed to advance consumers' welfare. That was part of the liberalization trend. Now it's being tugged back to form a support system protecting "competitors"—guarding against low prices, escalating quality, and market rivalry.

Amazon Crime

For Khan, a legal scholar currently based at Columbia University, the problem with today's market is epitomized by the operations of one firm. Amazon "generates meager profits," electing to keep prices low while "choosing to expand at a speed and scale that is pushing it into the red," she writes. It has risen to become the world's second most valuable firm, worth about $1 trillion, because it is "at the center of e-commerce" and owns "essential infrastructure for a host of other businesses that depend upon it."

That infrastructure—a platform spanning the planet—certainly is valuable. Amazon lists more than 400 million product pages from more than 300,000 independent vendors, creating the "long tail" of niche goods and services that shoppers adore. Recode reported in 2018 that "more than 100 million items in the U.S. are now eligible for two-day shipping." Most of these are sold by companies other than Amazon, which not only hosts "rival" vendors but takes orders, ships products, and collects payments on their behalf. About half of these businesses generate over $100,000 a year.

For Khan, Amazon creates competition but also crushes competition. It is ensnared in a maze of conflicts, she says, and it routinely engages in predatory tactics—such as favoring its own listings—that steamroll pesky upstarts to protect Amazon's ruthless march to world domination. Yet Amazon's prices have been low for 25 years now. Khan doesn't deny that. In fact, it's what she complains about: The company's offerings are too good for other sellers to compete with.

There is a germ of truth in Khan's complaints about Amazon's conflicts, but she fails to see the ubiquity of conflicts in economic rivalry—and in government regulation, which can worsen outcomes for consumers and the overall economy. Hence, she interprets vertical integration—Amazon supplying an online store and then stocking some of the shelves with its own products—in a naive and counterproductive way.

Every business acquires inputs and then sells outputs. In between, some magical process creates new value. Cooperative deals between suppliers and buyers today may well erupt in rivalrous tension tomorrow. That's actually a good thing: We want to encourage shifting alliances. Customers change; technologies advance; firms learn; efficiencies evolve. Amazon hosting its retail rivals is no weirder than Costco displaying its own Kirkland champagne side-by-side with Veuve Clicquot or the Dodgers hosting the Giants in Dodger Stadium.

Antitrust scribblers may imagine Amazon squelching independent sellers and stealing their profits, but that's not the reality according to the vendors. Hundreds of thousands of third-party sellers have made Amazon "the Everything Store." From 1999 to 2018, Amazon's own share of the products it sells dropped from 97 percent to 42 percent. And even that overstates Amazon's vertical integration. Marketplace—the platform for third parties who offer goods through Amazon—now accounts for 68 percent of the platform's retail revenues.

"More buyers transacting more often on Amazon will naturally attract third-party sellers," eMarketer analyst Andrew Lipsman told TechCrunch last year. "But because third-party transactions are also more profitable, Amazon has every incentive to make the process as seamless as possible for those selling on the platform." In May 2019, Business Insider headlined the news "3rd-party sellers are thriving on Amazon."

In Khan's telling, all the economic forces move in opposite fashion. She recommends a ban on mergers and more aggressive actions to limit or scale back the platform.

Take Amazon's recent acquisition of Whole Foods for $13.7 billion. Khan blasted the combination in a June 2017 New York Times op-ed titled "Amazon Bites Off Even More Monopoly Power." The fear was that a company with 0.8 percent of U.S. grocery sales (Amazon) gobbling up a competitor with 1.7 percent (Whole Foods) would leave American shoppers powerless to resist. Walmart's 26 percent share of total grocery sales, not to mention Kroger's 10 percent or Albertson's 5 percent, would not constrain the beast. Neither would the fact that, in the year the merger went through, just 3.8 percent of U.S. groceries were sold online.

"Amazon's purchase of Whole Foods will expand its dominance and heighten conflicts of interest," Khan predicted. "By bundling services and integrating grocery stores into its logistics network, the company will be able to shut out or disfavor rival grocers and food delivery services."

Her predictions have thus far proven wrong: Amazon's rivals gained after the merger. "In the past year," the Harvard Business Review reported in April 2019, "Walmart, Kroger, Costco, and Target have driven down costs and introduced delivery capabilities in new regions, cutting into Amazon's market share." They're afraid of the online retail giant? Good.

The rivals' fortunes may still change. Who knows? Not Khan, not the Justice Department, not Amazon. Absent demonstrable harm, letting things play out produces robust competition, oodles of innovation, and even new competitors, such as Instacart, launched in 2012 by a former Amazonian. That company boasts that it delivers alcoholic beverages to your home in as little as one hour. Which is, of course, not a moment too soon.

Khan ignores these dynamics. Or rather, she actively opposes them.

Conventional wisdom holds that U.S. corporations are painfully shortsighted. It's said they scurry about with an eye to quarterly earnings while ignoring the broader horizon. It's said that this undermines the risk-taking and R&D investments that are needed to unlock better worlds. But Khan launches her 96-page essay with this quote from The New York Times: "Even as Amazon became one of the largest retailers in the country, it never seemed interested in charging enough to make a profit. Customers celebrated and the competition languished." She also quotes the biographer Ida Tarbell, who said that one of John D. Rockefeller's "most impressive characteristics [was] patience."

The Fable of the Diapers

Back in the day, Khan argues, antitrust policy would have stopped the clear and present danger of Amazon. But free market economists, mostly from the University of Chicago, have twisted the law to focus solely on "consumer welfare" as measured by "prices and outputs." And so, she says, monopolies thrive. Things that look to be amazing new efficiencies, driven by economies of scale, are a trick: Predatory tactics displace competitors, steal markets, and dominate entire industries in the long run.

The paradigmatic illustration is Amazon's acquisition nine years ago of Diapers.com. Yet a close look at her selected case study undercuts the lessons taught in Lina Khan's academy.

In short: Marc Lore and Vinit Bharara launched the online retailer Quidsi in 2005. The startup sold baby products online, and its Diapers.com website gained a toehold. In November 2010, the pair sold their company to Amazon. Khan claims that Amazon actually squished them like a bug, using its massive data intelligence capabilities to crack their strategy. By figuring out how to reduce its own diaper prices, it drove Quidsi to the financial brink and then devoured it via merger in order to eliminate a retail rival. The upstart was vanquished, the monopolist got fatter, and all potential challengers were forewarned.

Khan's story is sourced from Brad Stone's 2013 book The Everything Store. Stone reports, but Khan does not, that the story of Amazon's strategy is in dispute. This missing detail is one among many. But it turns out to be a harmless oversight, because Khan's own facts, nested in the context of competitive innovation, are indisputably hostile to her theory.

First, there was no barrier to entry. Quidsi got into the business of selling Pampers and Huggies online, which Amazon could not prevent. The newcomer then pioneered innovative methods, particularly in shipping, using boxes that fit orders exactly so as to lower costs. This welcome progress stands in stark contrast to what happens under "public utility" regimes in which "licenses of convenience and necessity" are routinely denied to upstarts. Airlines, railroads, medical services, trucking, shipping, broadcasting, telecommunications, energy—in every one of these cases, commissions have erected artificial entry barriers deterring competition. Not a single new trunk airline was approved for launch by the Civil Aeronautics Board from 1938 to 1978. With unregulated diapers sold online, two guys from New Jersey formed a firm and walked right in.

Second, the Jersey boys did a better job of cleaning up the babies' bottoms. Yes, Amazon sells competing products, and yes, it has bots that relentlessly monitor competitive offers. But by 2010, Diapers.com was outselling the ogre from Seattle by about four to one. When Lore and Bharara sold to Amazon, they received a payoff of $545 million, or about $400 million above invested capital. If Amazon is a predator trying to discourage entrants, it is going to need some powerful corporate messaging to overcome the language its cash is speaking.

Third, founder Marc Lore didn't lose his entrepreneurial bent. In 2014, he founded Jet.com, an online retailer and direct rival to Amazon. In 2016, he sold that start-up for $3.3 billion to Walmart. Lore—a billionaire who bought a $43 million flat in one of New York City's finest buildings in 2018—now heads the brick-and-mortar retailer's eCommerce division. If this is what Amazon's economic brutality looks like, quick—let's crowdfund AdultDiapers.com and get pummeled.

Fourth, the gains for consumers were not just temporary. Khan says Amazon immediately ceased its price discounts on products sold by Diapers.com after absorbing the site. But hers is a vague and selective presentation; suffice it to say that the evidence would not be admissible in a court of law. I do not have a dataset as extensive as Amazon's, but online prices for many brands over time can be found on Google. Huggies, Snuggles, Pampers, Luvs, and Seventh Generations were about 18 percent cheaper in online stores (free delivery with minimum purchase!) in 2019 than they were in mid-2010. Mommies and daddies clicked away—and won. No predatory exclusion, no monopoly, no price hikes to recoup the investment. Just good, clean, bottom-up consumer welfare.

Finally, Khan makes a major concession when she argues (uncompellingly) that prices rose after the Amazon-Quidsi merger. Throughout her critique of modern antitrust, she complains about the fact that the law focuses "primarily on price and output effects as metrics of competition." But there's a good reason for that, and courts ought to be encouraged to do more of it. These are the indices that impact customers and distinguish efficient rivalry from predatory conduct. Under the latter, prices fall, but only temporarily, and the price increases that come after wipe out the benefits for customers.

So Khan was right to consider Pampers prices as a metric of consumer impact. Alas, she makes no serious commitment to this approach. If she did, she would have to demand that regulatory measures advance their stated purpose and that they do not sabotage the constituency being offered protection. Attacking low prices with antitrust rules that retard innovation and freeze technologies does exactly that.

Even more problematic: As I witnessed up close while testifying as an economic expert retained by the winning side in a class-action suit against a firm found to have engaged in predation, judges can be lost when it comes to what remedies to administer.

"For much of its history," write scholars Joshua Wright, Elyse Dorsey, Jonathan Klick, and Jan M. Rybnicek, "antitrust has done more harm than good." Rulings that block pro-competitive conduct may "have resounding chilling effects…likely to discourage other firms from engaging in similarly beneficial conduct." Leaving an overly dominant firm intact, on the other hand, often creates less social risk, because it generates its own offset: The profits earned by the miscreant announce opportunities for others.

Khan falls into this trap when she offers Quidsi as the quintessential upstart entrant but fails to mention its empirical reality. Or, for that matter, its inspiration: Amazon. Lore and Bharara idolized the online giant. They privately referred to Jeff Bezos as "sensei" and wanted to be him. And their decision to get into the game was funded by, among others, Accel Partners, a company flush with early-stage windfalls from Facebook. All these monopolies, so many startups.

Brandeis' Folly

The antitrust hipsters' lodestar, Louis Brandeis, championed local enterprises—"the small dealers and worthy men," as his Supreme Court predecessor Rufus Peckham called them—that found themselves fighting the emerging national chains. To Brandeis, the big retailers' low prices were a bug, not a feature. In 1915, the future justice amazed Rep. Alben Barkley (D–Ky.) by testifying that volume discounts were "fraught with very great evil" and should be banned. "Knowing the quantity discounts were as old as business itself," wrote Thomas McCraw in his Pulitzer Prize–winning Prophets of Regulation (1984), Barkley "could not believe he had heard Brandeis correctly." He had.

In this way of thinking, the efficiencies of the Industrial Revolution were a problem we needed government to counter. Brandeis condemned the consumer as "servile, self-indulgent, indolent, ignorant," because she would blithely shop for lower prices and higher quality without concern for the social ramifications. It was an unambiguous loss, he believed, for A&P to displace the local grocer and for Sears, Roebuck and Co. to out-compete the town dry goods shop. Brandeis supported cartels to raise prices and protect inefficient producers. He rejected the interests of the "supine" customer, who "deserves to suffer" for patronizing vendors based on cost and convenience. As McCraw put it, Brandeis attacked consumer welfare as an objective because "consumers had betrayed him: They had refused to follow his precepts." Instead, they were eagerly buying "the endless stream of goods that flowed" from the large, integrated businesses that "Brandeis so detested."

Brandeis' view nonetheless gained traction. In 1962, the Supreme Court blocked Brown Shoe (a company producing 4 percent of U.S. footwear) from merging with Kinney's (a company retailing 1.2 percent). The antitrust enforcers then put the kibosh on Vons-Shopping Bag in 1966, saving America from a supermarket behemoth that would have dominated the Los Angeles retail grocery market by cornering—as the third-largest local seller—7.5 percent of sales. That, the high court said, indicated a "threatening trend toward concentration." One wonders what the justices were drinking, but that may have been answered a few days later, when the Court upheld the Department of Justice's move to stop a Pabst-Blatz merger as well.

Just to be clear: If the beer market were being monopolized, I would be the first to buy a case for the legal beagle filing suit. But here I'm not even opening a tab. As the Supreme Court explained: "In 1958, the year of the merger, Pabst was the tenth largest brewer in the Nation and Blatz ranked eighteenth. The merger would have made Pabst the Nation's fifth largest brewer with 4.49% of the industry's total sales. By 1961, three years after the merger, Pabst had increased its share of the beer market to 5.83% and had become the third-largest brewer in the country." The Court ominously noted that their combined shares totaled 23.95 percent of the all-important Wisconsin beer market, raising the prospect of an "incipient" monopoly.

Justice William O. Douglas attached a 1966 Washington Post column, written by humorist Art Buchwald, as an appendix to his concurring opinion in the Pabst case. Buchwald's piece considered a future (1978) merger case involving the last two companies in America—Samson, controlling all corporate assets west of the Mississippi, and Delilah, owning everything to the east. The essay had the Court finding no competitive issue. An excellent analogy for Pabst-Blatz: After those two companies assume control of all but 94.17 percent of U.S. beer production, what's left?

Beware the Big Fix

Antitrust hipsters present the free market economists of the University of Chicago as their historical villains. Yet these scholars began their journey not far from Brandeis. The late Nobel laureate George Stigler started as a "bust 'em up" guy: In 1952 he wrote an article in Fortune stating the "case against Big Business" and calling for the dissolution of General Motors. But through observation and analysis, Stigler's view progressed until he arrived at an antitrust policy that gave dynamic forces their due and put consumer interests at the center. He came to see government institutions as imperfect, and he posited in a 1971 paper the theory of "regulatory capture," whereby "regulation is acquired by the industry and is designed and operated primarily for its benefit."

Khan claims that ideological motives explain this "effort to idealize competitive markets and assume that nonintervention was almost always superior to interference." Yet a deep and cutting critique of regulation preceded the new Chicago School approach. In 1952, Harvard's Samuel P. Huntington wrote in the Yale Law Journal that the "attitude of the railroads towards the [Interstate Commerce] Commission since 1935 can only be described as one of satisfaction, approbation, and confidence." Huntington called for abolishing the agency, saying it had lost "its objectivity and impartiality by becoming dependent upon the support of a single, narrow interest group": the railroads.

Jaffe, writing in that 1954 Harvard Law Review article, similarly acknowledged that most regulators had underperformed. Drawing on the extensive writings of former Harvard Law School Dean James Landis, Jaffe noted that administrative supervision of industry was the dream of the Progressive Era and then of the New Deal. But the "planning thesis took almost no account of the character and psychology of our administrators" and "gave too little weight to the dynamism of the industrial system."

Cleaning up the regulatory mess fell, in part, to a Cornell economist: the late Alfred Kahn, an earnest New Dealer for all of his days. Appointed by President Jimmy Carter to head the Civil Aeronautics Board in 1977, Kahn intended to reform the agency. But he found that greater price competition, not to mention service innovation, could not be realized within the model he inherited. Kahn discovered deregulation not by imbibing Chicago School Kool-Aid but through fealty to the public's actual interests. It was because he took his fiduciary obligations seriously that he sought to overturn the "common carrier" approach of the 1938 Air Carriers Act, ultimately ending the agency via bipartisan congressional reform.

Kahn's early scholarly work channeled Thorsten Veblen, who was as critical of consumers' choices as Brandeis was. Yet Kahn studied on. He came to see "that society's choices are always between or among imperfect systems" but that markets generated a dynamism, giving them an edge: "Wherever it seems likely to be effective, even very imperfect competition is preferable to regulation." Paring back controls over air routes and fares has resulted in consumer gains conservatively estimated by the Brookings Institution at $10 billion annually.

No, air travel is not perfect. Yes, I've flown United. But it's all relative. The Civil Aeronautics Board was a comparative disaster for efficiency, innovation, and customers—particularly the low- and middle-income Americans, then earthbound, who now dot the sky.

Policy makers gave the "common carrier" theory of regulation a marathon test drive following the 1934 Communications Act. The FCC, under its "public interest, convenience, or necessity" standard, enhanced Ma Bell's market power. That was, literally and practically, "network neutrality"—the same philosophy endorsed by Lina Khan as a promising pathway for regulating tech giants today.

How did it work out? In 1974, the U.S. Justice Department filed a massive antitrust suit against the company. Settled in 1982, it dissolved the giant into seven "Baby Bells" and an independent AT&T Long Lines.

The reason for the lawsuit was that AT&T, a "common carrier," was preventing competition by using antidiscrimination rules enforced by the Federal Communications Commission. "The FCC was trying to block MCI from competing in ordinary long-distance services when the AT&T case was filed by the Department of Justice in 1974," explained Robert Crandall and Cliff Winston of the Brookings Institution in a 2003 Journal of Economic Perspectives article. "Thus, antitrust policy did not triumph in this case over restrictive practices by a monopolist to block competition, but instead it overcame anticompetitive policies by a federal regulatory agency."

There is no secret formula that produces enormous gains from blockbuster innovation without the disruption of old markets and obsolete business models. The "Great Enrichment" that economist Deirdre McCloskey describes—an approximately 30-fold increase in capitalist country incomes between 1800 and 2000, which upended the economic flatline of history—was and is a rough-and-tumble process. That's why Joseph Schumpeter dubbed it "creative destruction."

There are good reasons to be wary of large organizations of any stripe, including giant tech platforms. But far more dangerous—to consumers, workers, and the economy as a whole—are hipster antitrust promises of a magical fix.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

"You will not be surprised to hear that Fox News talker Tucker Carlson agrees with Trump. But you might blink when told that he arrived at this agreement via a lecture delivered by Professor Elizabeth Warren."

No I am not, because this is a prime example of where most of the "independent" middle lands politically rather than on some vague libertarianism. I do not like it, but this is the actual shape of the political terrain.

The thing is, the anti-monopoly crowd has a point. Where they get it wrong is failing to understand how government encourages monopolies in the first place, and how government itself can be a monopoly (zero competition, crap service, everything overpriced and of terrible quality).

"how government itself can be a monopoly (zero competition, crap service, everything overpriced and of terrible quality)."

They know this. They just don't care as long as they are the ones wielding the power.

This^

These companies got into bed with government over domestic spying on Americans and it benefited their bottom line.

Americans are to blame for allowing government to do this and for allowing companies to end-run the Constitutional protections because THEY ARE NOT GOVERNMENT.

The situation we are currently in is largely a direct result of the CDA of 1996. Media consolidations started shortly thereafter. It's not just a Section 230 problem, the whole damned thing practically guaranteed us an oligopoly. Which we now have, and having climbed the ladder is largely seeking to remove the bottom rungs.

You are correct Inigo Montoya that government does assist these corporations in becoming monopolies.

Honestly, companies that assist in the domestic spying of Americans get protection from the feds. AT&T, Verizon, Facebook, Amazon, Microsoft, Apple, Cisco Systems....

Thank You For This..

So these companies went out of their way to insult the political right, who should have been their natural allies, and throw in with the left, who were going to hate them for being successful no matter how loudly they sang from the hymnal. Now they’re surprised they have no friends anywhere.

Yeah, not much sympathy here. Let ‘em burn. Not my problem.

Nemo nails it. The big techs could have stuck to the old fashioned business principle of taking people's money without regard to their politics. Instead they went out of their way to insult a third to a half of their potential customers. Unlike the so-called robber barons who fucked people over to make more money, the current crop of moghuls fuck people over for the mere fun of it and probably lose revenue by doing so.

That circles around to company executives stealing from stock holders with this SJW bullshit and there is really nothing a stock holder can do about it, except sell their current stock holdings (after losing money of course).

Stock holders absolutely have a claim if they hold stock and THEN a company does some SJW shit and loses money. If some person buys stock AFTER the SJW event, you should have known what you are getting into.

Since Delaware is a very common state for Incorporation, here are a list of types of Corporations which include Public Benefit Corporations ("The specific public benefit purpose of the corporation is to ______"), Stock Corporation ("The purpose of the corporation is to engage in any lawful act or activity for which corporations may be organized under the General Corporation Law of Delaware")....

Delaware new Entities

Any of them Ol' Ebola Joe's crooked companies?

This bipartisan pot of pols

I think I see what you did there

Mao sentiments exactly! Amin, I’m still glad you pointed it out.

All this analysis of the situation is horseshit. It's a simple principle as old as Cain and Abel - you got shit, we want it, hand it over. Look at the recent opioid settlements that are pure thievery on the level of asset forfeiture. Bernie wants the oil companies treated the same way and there's tons of people looking at guns, alcohol, sugar, fast food, video games - you name it, there's a group pushing to sue the shit out of some evil industry and take all their money. There's no rule of law any more, only the law of the jungle and you'd better grab what you can while the grabbing's good.

Rule of law has been displaced, henceforth Jefferson advising that government needs reformed by the people every now & again.

While pretending to support a free market, @Reason has consistently supported coercive monopoly states (limited or not)

I remember a recent article by Gillespie claiming all libertarians supported that concept.

Betcha can't link to any such article.

Waiting for the pro government posts screeching the virtues of interventionism.

The problem we have is largely due to government intervention.

How do we undo that without making changes to existing government behavior?

Speaking of which, why the Fuck is Reason trying to install Widevine in my browser?

'Free minds and free markets' my ass.

Enforcing court action against fraudulent advertising, violations of ToS, and unfair business practices is Libertarianism's support of Rule of Law.

Amazon is conspiring with the federal government to spy on Americans without warrants, so I don't really have any sympathy for companies that do that. They live by the sword and will die by the sword (as crony capitalism is a double edged sword).

True, cronyism deserves no sympathy

Neither pro nor con for government intervention. The big tech companies started dicking around in a large way with politics, so politics is dicking back.

What did Alphabet and its "muh free markutz" defenders expect when google decided to put its playpen full of SJWs to work swinging a presidential election?

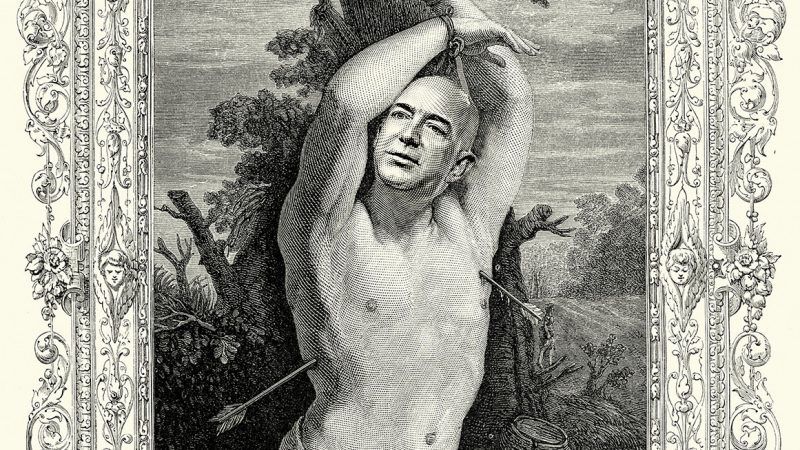

Was that painting of Jeff Bezos in one of Jeffrey Epstein’s mansions?

The Court ominously noted that their combined shares totaled 23.95 percent of the all-important Wisconsin beer market

To be fair, Pabst Blatz probably still has 23% of the Wisconsin beer market, but New Glarus is making some inroads.

Amazon sends shut right to your door. No shop involved.

If that doesn’t scare the bejesus out of you, you’re fucking crazy. The world is a terrifying place. Thank god someone gets it.

“ Carlson gushes that Warren "sounds like Trump at his best."

Well there you have it,

Carlson the conservative oracle so succinctly merges the authoritarians from both sides.

Jesus Christ! I didn't need to see penis-head Bezos depicted as Jesus Christ. Very subtle anal-ogy, I hate artistic symbolism that hits me on the skull like a 2 x 4.

There should never have been an antitrust suit against Microsoft. And the one we had accomplished nothing.

However, Microsoft did have some business practices that definitely skirted the lines of ethics and legality. They just weren't antitrust related. For example, the practice of popping up an error message if it detected DR DOS (when there were zero compatibility issues). Also, exclusivity agreements with computer manufacturers. And don't forget their license violation with Java, which they rightfully lost. I'm not a fan of copyrights, but one can't demand rigid licenses on its customers and then go turn around and ignore Sun's licenses.

The bundling of Internet Exploder wasn't a problem, as both Apple OS and IBM OS/2 provided "free" browsers with their operating environments. But that was what the whole antitrust focused on. Years and years of government action against Microsoft with nothing accomplished. Interet Exploder is still bundled with Windows, but no one cares because the market gave us Firefox, Chrome, and Safari. The biggest selling OS today is not Windows, but Linux in the form of Android on smartphones. Microsoft failed utterly to crack into the phone market even after getting one of their own moles (Elop) into Nokia.

A dearly departed friend, Giles, had a knack for coming up with conspiracy theories just plausible enough to not be dismissed out of hand. None of this "WW II bomber found on moon" crap.

You may remember the laughable video at that trial, claimed by Microsoft to be a single straight video, showing that they did (or did not) do something trivially vital to their case. Bil Gates swore to this on the witness stand. Then it was shown how icons appeared and disappeared, how the clock jumped around, and Microsoft admitted it was actually edited and multiple takes and so on.

There were also some shenanigans involving the judge giving a speech about the trial, and other evidence not holding up. Quite the circus.

Giles' theory was that Bill Gates was trying to throw the trial so that the government would split them up and fuck them up, so that when Y2K rolled around and made a mess, they could blame it on the Government splitting them up and distracting them from the more urgent Y2K problem.

Genius!

Here's to you, Giles. May you be dreaming up new conspiracy theories for ever more.

As I recent new parent I can say that being able to buy diapers online is awesome, especially during that first winter when everyone is constantly sleep-deprived, fever-ridden and projectile vomiting. I honestly didn't care what the price was. Not having to drive to a store was worth it.

Cloth diapers. Just saying. You have a choice of dumping used pampers into the landfill, or flushing detergents down the river to the sea. The benefit to the cloth is that after baby learns to clean up his own shit, you have some nice cotton rags that have been washed so many times that they're the world's best polishing rags.

So anyone still polish their cars any more? Does no one know of the magic of used cotton diapers?

What we are seeing behaviorally with Big Tech is a decided lack of civic responsibility. I use the term 'civic responsibility' but this term really does not encompass it.

Social media is enabling and accelerating the destruction of the fabric of society. The only saving grace to Twitter is that only ~10% of Americans actually use it. Twitter usage seems to destroy good deportment. Facebook is a wrecking ball to personal privacy, and quite honestly, some of their actions with releasing member data is just criminal. Google and YouTube are no better.

It used to be that the question to ask: Should we do this?

That has now morphed into: Can we get away with doing this?

The difference between the two questions aptly demonstrates the problem we have with Big Tech, currently. The answer ultimately lies in section 230, but it seems like a 'Gordian Knot' to figure out a way to amend section 230 in a way that would pass constitutional muster.

One thing I do know: I am very uncomfortable with viewpoint discrimination by Big Tech; meaning any viewpoint (even those I find completely odious and venal).

The answer ultimately lies in section 230, but it seems like a ‘Gordian Knot’ to figure out a way to amend section 230 in a way that would pass constitutional muster.

There can be no amending it. On it's face it is a violation of the Constitution and should've been struck down like the rest of the CDA. It's like asking how do we solve the problem of what color to paint an invisible pink unicorn so that it's no longer pink but also invisible? Check your precepts. The problem is the continued pretending that such a thing exists in any meaningful way.

Clingers wonder why certain companies dominate the tech industry, and why those companies do not flatter clingers' positions and thinking. 'Why are all of these successful companies so hostile to intolerance, ignorance, and backwardness?'

Clingers wonder why our strongest schools are part of the liberal-libertarian mainstream, and why conservative-controlled campuses are such fourth-rate yahoo factories. 'Why are the Harvards, Berkeleys, and Penns all so damned liberal, and why do we have to settle for Hillsdale, Liberty, and Ouachita Baptist? Why must the the elitist schools be so hostile to intolerance, ignorance, superstition, and backwardness?'

Clingers wonder why our strongest, modern, educated communities are operated in the liberal-libertarian mainstream, and why the communities controlled by Republicans tend to be such desolate, can't-keep-up backwaters. 'Why do San Francisco, New York, Chicago, and Philadelphia always vote for Democrats, and why are the places that favor Republicans losing all of their talented, ambitious, reasoning young people? Why are our population centers so hostile to backwardness, ignorance, superstition, and bigotry?'

So far as I can tell, the only thing stopping conservatives from creating strong conservative schools, companies, and communities is right-wingers' preference for backwardness, ignorance, intolerance, and superstition.

The market is speaking, vividly, but conservatives dislike the verdict.

Liberty and Bob Jones are trash, but Hillsdale is still pretty decent.

The reason most universities are predominantly leftist is because they're insular environments with tenure. The perfect medium for left wing nutjobs to thrive. Make the right motions for a few years until you get tenure then you can kick back and gripe about conservatives for the rest of your career.

Heck, it extends down to the undergrad level. At my university there was this leftist who had been a senior for around ten years, avoiding graduation, just so he could keep running an on-campus vegan sprout-and-tofu cafe with university/government funding. Others like him at at the campus radio station and a couple of the papers, but none as extreme.

Bezos as St. Sebastian? Geez. That's some great ayahuasca you're snorting. The irony here is that the trustbusters are coming after big tech because nobody trusts big tech, and big tech did that to themselves.

This comment not approved by Silicon Valley brain slugs.

The left hates them because they won't censor the right, and the right hates them because they won't censor the left. The only people getting "censored" are the extremist nutbags like Jones.

Hell, Prager has a complete YouTube channel dedicated to bitching about YouTube blocking his speech.

Watching all the techies explain to congress how the algorithm meant no one at their companies was picking and choosing viewpoints was like trying to teach pigs to sing.

The big Tech companies are cash cows, and that's why the state AG's are going after them.