Trump's Washing Machine Tariffs Cleaned Out Consumers

A new report finds the tariffs raised $82 million for the U.S. Treasury but ended up increasing costs for consumers by about $1.2 billion.

President Donald Trump's tariffs on washing machines resulted in consumers paying an extra 12 percent, on average, to buy a new dryer last year, new data show.

Yes, you read that correctly. Tariffs on imported washing machines ended up increasing not only the retail price of washing machines but dryers too—despite the fact that dryers were not subject to the new import taxes imposed by the Trump administration in January 2018. Research from a trio of economists at the University of Chicago and the Federal Reserve show that retailers made the decision to hike the price of both washing machines and dryers (since they are frequently bought together) after the tariffs took effect.

All told, those tariffs raised about $82 million for the U.S. Treasury but ended up increasing costs for consumers by about $1.2 billion during 2018 economists Aaron Flaaen, Ali Hortacsu, and Felix Tintelnot conclude. Although the trade policy did cause some manufacturers to shift production from overseas to the United States in an effort to avoid the new tariffs, the 1,800 jobs created by Trump's washing machine tariffs cost consumers an estimated $820,000 per job.

The new working paper provides yet more evidence that consumers, not Chinese-based companies as the president has often claimed, are paying the costs of tariffs. The increase in retail prices for dryers also demonstrates how some businesses have taken advantage of the Trump administration's trade policy to soak consumers a second time.

"Given that many consumers buy these goods in a bundle, the price increases were partially hidden by raising the price of dryers," Tintelnot told The New York Times. "That's very clearly visible."

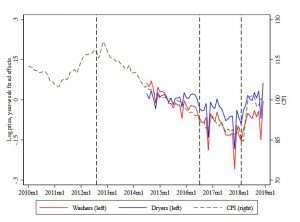

Indeed, the price of both washers and dryers spiked in the months after the Trump administration tariffs took effect, ending what had been a years-long decline in retail prices for both appliances.

Similarly, American washing machine manufacturers—which are not subject to tariffs, obviously—decided to hike their prices after the tariffs increased prices on foreign-made washers, the economists found.

"Companies that largely sell imported washers, like Samsung and LG, raised prices to compensate for the tariff costs they had to pay. But domestic manufacturers, like Whirlpool, increased prices, too, largely because they could," writes the Times' Jim Tankersley. "There aren't a lot of upstart domestic producers of laundry equipment that could undercut Whirlpool on price if the company decided to capture more profits by raising prices at the same time its competitors were forced to do so."

When the Trump administration imposed tariffs on imported steel last year, the same thing happened: American companies raised their own prices. There are other similarities too. For example, a December 2018 report by the Economic Policy Institute (EPI), a union-backed think tank, found that Trump's aluminum tariffs had created about 300 jobs at American aluminum manufacturers—at a cost of about $2.3 million each.

The numbers change but the bottom line remains the same: Tariffs are taking consumers to the cleaners, and promised benefits are getting washed away by the costs.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

I am not a big fan of tariffs in the first place. Having said that, I can't see the details of the graph such as the axis labels on either the horizontal or vertical axes. All I see is a graph that goes up for a bit, smoothly drops down for a while then very noisily comes up for a short time compared to the overall scale of the graph. Based on what the author provided, I can't say if he is full of shit or not.

You might want to check into a better browser. While I also initially saw just a small and difficult-to-read chart, I could easily zoom into it enough to read the detail.

Left vertical label = "Log price, year-week fixed effects" and marked from -.3 to +.3

Right vertical label = "CPI" and marked from 70 to 130

Horizontal labels = 2010m1 thru 2019m1

Legend = red line Washers (left), blue line Dryers (left), dashed line CPI (right)

More important, even at standard resolution, I can easily read the caption which says "Source: The Production, Relocation, and Price Effects of US Trade Policy: The Case of Washing Machines Aaron Flaaen, Ali Hortacsu and Felix Tintelnot"

a search for which takes me to this paper. Unfortunately, that paper is paywalled - which is the real problem for those of us who want to evaluate whether the article actually tells us anything trustworthy.

I appreciate your input. I did try zooming and even though the text was larger, it was blurred.

Anyway, with your input, I still have a lot of questions about this data. We only have CPI data going back before mid 2014. There are huge downward spikes (it appears at Christmas time), and it looks like washer/dryers prices scale with CPI. What does that have to say about the tariff?

What browser do I use to make 300x222 heavily artifacted jpegs look good?

All told, those tariffs raised about $82 million for the U.S. Treasury but ended up increasing costs for consumers by about $1.2 billion during 2018

I smell a subsidy coming...

One measure of the wealth of a community or country, is how long the money stays in the community. Tariffs are one way to impose that, so measuring how much the tariff costs members of the community ought include the benefit of the money staying in country. For example, in the 1960s black communities were wealthier as citizens built more business and so the community retained money that would otherwise be spent outside.

Tariffs go to the government. Are you suggesting that giving our money to the government is good for the community? Tax our way to wealth!!

I believe he's talking about the very real fact that if you keep the money in the US it swirls around more, and creates additional jobs. That 1800 figure may be a direct number... But how many jobs were created by the suppliers to Whirlpool and whoever else? Probably as many or more than at Whirlpool. Likewise all those workers are now buying lattes, cars, etc etc etc as well.

Money recirculates, and so an analysis done like this one is is intentionally distorting the actual pros and cons. We definitely have retained more money in the USA overall, whatever the distribution of said money. It may well be that we're still in the red from this overall in terms of consumer spending... But you'd never know it from intentionally distorted analysis like this. Agendas will make people do funny things.

The problem is the foreign companies simply pass the cost of the tariff on to the consumer, and if those consumers didn't pay 12% more for their washers to cover the tariff they would also be spending that money on lattes, cars, etc, etc, etc. So its really a wash as far as keeping money in the US

Incorrect reading of how capital flows work... As usual, since it is required to buy 110% into classical free trade theory.

WHO owns the capital matters. This is always ignored because it messes up the idea of free trade theory in a modern, fiat currency filled world.

If $1 billion more in money is spent on Samsung products instead of Whirlpool without tariffs, that means Samsung has $1 billion. They will NOT be buying lattes. Their employees will be in Korea, or elsewhere. They may buy US skyscrapers, or sell the dollars to someone else to buy treasuries, etc, but they're not consumer spenders in the USA.

If we jack tariffs 12% and it shifts $1 billion back to US based companies like Whirlpool, perhaps prices HAVE gone up $120 million... But for that we're retained the other $880 million in the USA, which will ultimately all filter through to consumers as wages or increases in asset values.

I'm not saying free trade theory is wrong ON A GLOBAL LEVEL. I think classic 1700s/1800s style free trade theory no longer covers all the variables in the world today though. Back in the day if one ran a deficit for too long you LITERALLY ran out of cash, gold or silver, and HAD to rebalance your trade or go broke. With fiat currencies we instead can run in the red forever. This has resulted in prolonged deficits that would have been impossible in 1800 or 1900. We're now at the point of trading our nations net worth in the form of real estate, equities, and government debt for trinkets of short term value. It's not a wise road long haul.

It's almost as if tariffs are a bad idea and always have been but when Trump imposes them they become magically good -- genius even. Don't believe what you are reading about higher costs. The Never Trumpers won't be happy till our Savior is nailed to a cross. With gold spikes of course.

Trump taxes / tariffs the shit out of us, but that's OK, because His motives are GOOD, and because He's playing 11-dimensional quantum-gravity chess which is beyond us mere mortals, and ALL will all be revealed to us VERY soon now... When the Heathen Chinee and the brown-skinned ones will all bow to us and create our goods and services for us for FREE, due to our inherently superior innate born-on-the-right-side -of -the-border attributes! Have FAITH, oh ye of little faith!

Damn that Trump. It was a free, efficient, open, competitive market until he came along and invented tariffs. Curse the day he was elected.

I noticed this with some work I was getting done on my back yard. I had scoped out a very expensive dual-fuel grill for my back yard. Then we had delays getting started on the work, and Trump raised steel tariffs. When I went to buy the grill, the prices were almost $2000 more! Even though the manufacturer only sourced american steel anyways, the american suppliers had jacked up prices too.

Luckily I was able to find a dealer on the Amazon marketplace who had not updated his price sheets, so I was able to get the grill for the original price, otherwise Daddy Overt would have had to make due with a 34" grill instead of 54". Bleh.

I was just thinking about this sort of thing this morning.

If we are to speak in nationalistic terms about trade and tariffs, we would WANT China to be an unfree economy that taxes and punishes its own citizens in order to send cheap shit to the US. Can you imagine what China would be like if they actually had a free economy? They have over 3 times as many people as the US. If China had a free economy, how long would it take until China had over 3 times larger GDP as the US?

Their unfree economy works to our benefit. Continue to let them tax and punish their own citizens to "dump" goods here. We will be laughing to the bank.

Well Jeff, the truth is they will have a larger economy anyway.

One thing that few people like to mention is that fascist economies actually work OKAY. Not as well as fully free market ones, but well enough to kick ass and take names. And China is now a fascist country in terms of actual policies and how they run their shit. So either way it's just a matter of time.

And the truth is that SOME of their policies probably do "hurt" them in ways, but others do in fact help. People ALSO don't like to admit that tariffs tend to have their exact intended effect, namely to force production of goods inside the country with the tariff barriers.

If China were importing hundreds of billions more in foreign made goods, they'd have dramatically less manufacturing capacity most likely. They're operating on a long term plan which doesn't prioritize immediate gratification goals, and they're not doing too badly.

If China were totally free market would their economy be better off? I'm sure. But it's doing fine as is, and their meddling in their economy has achieved goals they find desirable, like taking over entire industries by crushing all foreign competition with subsidies. Whether or not some of these plays work out in the long run we'll see...

[…] Source: Reason […]