Increasing Top Tax Brackets Is Easier Than Increasing Revenue Over Time

Proponents of jacking top marginal income tax rates such as AOC ignore how hard it is to actually boost revenue over the long haul.

Freshman Rep. Alexandria Ocasio-Cortez (D–N.Y.) has floated the idea of increasing the top marginal income tax bracket to 70 percent to help pay for her "Green New Deal" programs. Ocasio-Cortez said the top rate would kick in on families making $10 million or more, a figure that covers the top 0.5 percent of Americans. The current top income tax bracket is 37 percent and kicks in at $600,000. "People are going to have to start paying their fair share in taxes," Ocasio-Cortez told 60 Minutes (for what it's worth, in 2016, the top 1 percent of income earners paid 44 percent of all income taxes).

Supporters of the hike are quick to point out that in the past, top rates have ranged as high as 92 percent and, in the words of Nobel laureate and New York Times columnist Paul Krugman, the country "did just fine":

What we see is that America used to have very high tax rates on the rich — higher even than those AOC is proposing — and did just fine. Since then tax rates have come way down, and if anything the economy has done less well.

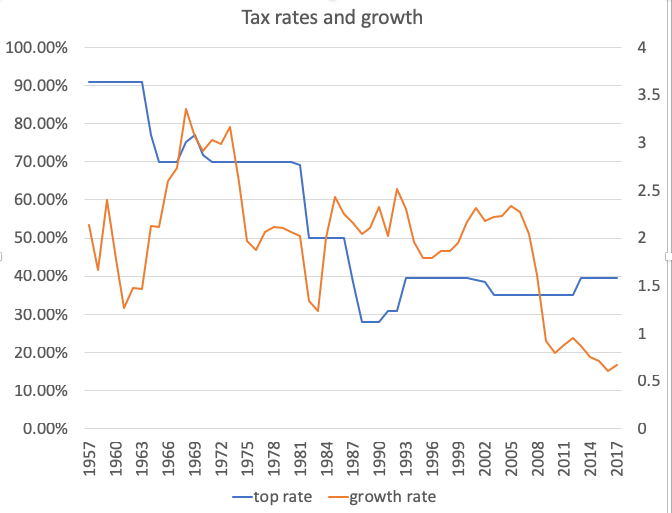

Krugman produces this chart, which plots annual economic growth against top marginal rates:

Accounting for 48 percent of the total, income taxes are the single-biggest source of revenue for the federal government, followed by payroll taxes (35 percent), and corporate taxes (9 percent). The Washington Post estimates that Ocasio-Cortez's proposal might raise about "$72 billion annually — or close to $720 billion over 10 years" while stressing "the real number is probably smaller than that, because wealthy Americans would probably find ways around paying this much-higher tax."

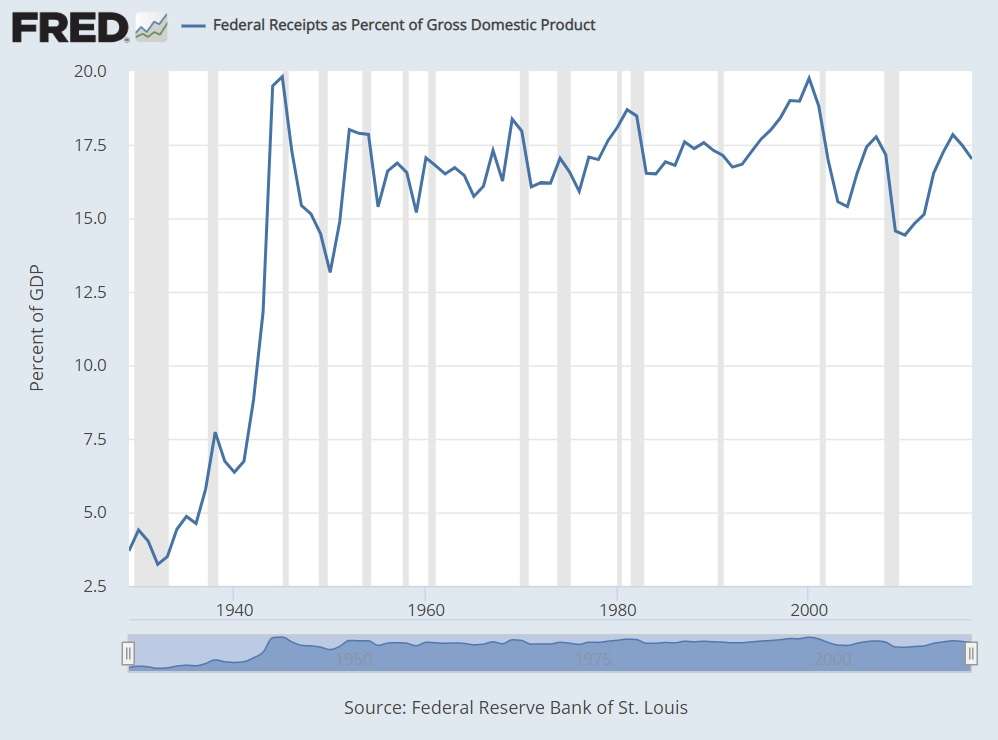

That's not a small point but it's not just rich people who find ways to avoiding tax hikes. For any number of reasons, since the end of World War II, it has proven exceptionally difficult for the federal government to substantially increase overall revenues for any period of time. The entire country, it seems, has an aversion to paying more than about 18 percent of GDP in the form of total government revenues. Despite very different income tax brackets, corporate tax policy, you name it, it's rare when the feds' take tops 18 percent for very long (recall that both Al Gore and George W. Bush campaigned on tax cuts in 2000, after a series of big-revenue years for the federal government).

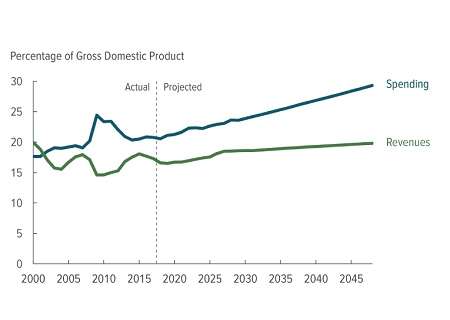

The flip side of the "remarkably stable amount of federal revenue as a percentage of GDP"? Sadly, it's the ability of the federal government to spend much more each year than it takes in via taxes and other fees.

According to the Congressional Budget Office (CBO), the annual deficit will rise from about 4 percent of GDP to 9.5 percent of GDP in 2048. By then, I suspect we'll care less about the top marginal rate, if only because we'll have bigger problems to worry about.

Now that we live in a world where neither Republicans nor Democrats even pay lip service to reducing the national debt, here's a reminder why persistent deficits are so bad for the economy and other living things:

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

If AOC isn't dancing and shaking her naughty bits... I'll just sit here. Quietly.

I like her technique. Pressing the thumbs against the base of the underside of the head of the penis really intensifies the experience.

She looks like someone who is up for some really rough, energetic sex. Like a really good poundig from a standing doggy position.

After a certain age, that position is easier on the knees.

Here's what it sounds like when she gets it on.

Here's what it sounds like when she gets it on.

Here's what it sounds like when she gets it on.

I pushed the button once. I swear.

She did "intern" for Ted Kennedy.

I wonder if he was still functional enough to put her to work the right way. It wouldn't shock me if she blew him to get the job.

Harris 'interned' for Willie Brown

I'm all for raising taxes as long as they balance the budget. Best to combine with spending cuts.

Because then we start getting into questions about the laffer curve, not to mention raising taxes isn't simply about revenue. There will be other effects to the economy beyond the very wealthy taking their ball and moving elsewhere.

And there is the whole class warfare inherent in extreme progressive taxation schemes, which isn't good either.

"Capital goes where it's welcome and stays where it's well treated." Make the country hostile to capital, and even spending cuts won't matter.

2018 Federal revenue from personal and corporate taxes is up substantially in 2018. Everyone knows Laffer is right.

http://www.taxfoundation.org/federal-.....-1934-2018

This might be a good time to point out that the "Laffer Curve" is a curve. Meaning that you do not get a linear response. You can not assume that any tax cut will result in a revenue increase. Rather there is a portion of the curve where this happens. The goal should be to find that sweet spot on the curve where taxes result in the maximum revenue (and no that is not at either 0% or 100%).

While there are benefits to the economy from lower taxes, there are more benefits from a well thought out tax policy. Most importantly a more equitable distribution of wealth, which in-turn yield a more stable society. Too much wealth in the hands of too few will eventually cause problems. Think France 1798, Russia 1917 and Venezuela 1999.

Finally why is it only class warfare when it affects the rich? What about attacks on the middle class and poor, are those OK?

The goal should be to use the lowest taxes rates possible to fund a small frugal government. Our federal government certainly should not have the most tax revenue it can squeeze out of the economy.

Here's what slavers offer ehen they try to appear 'reasonable':

"While there are benefits to the economy from lower taxes, there are more benefits from a well thought out tax policy. Most importantly a more equitable distribution of wealth, which in-turn yield a more stable society. Too much wealth in the hands of too few will eventually cause problems. Think France 1798, Russia 1917 and Venezuela 1999.

Finally why is it only class warfare when it affects the rich? What about attacks on the middle class and poor, are those OK?"

Fuck off, slaver.

So apparently you find robbing your neighbors to be an acceptable thing for all concerned as long as your take "hits the sweet spot". Theft and violence (state violence that is), the moral foundations of the modern left.

Here's the thing brah: We live in the real world, not AnCap fantasy land.

In the real world, we're going to have taxes. Therefore the intelligent thing to do is come up with a tax system that has the fewest burdens, the fewest downsides for economic growth, and that most people can agree is fair and reasonable.

I am down for going a LOT closer to AnCap fantasy land than we are right now, but that's going to be a gradual process, if at all. I'm all about making as many things as possible privatized, fee for service when it's not private, etc.

But it's a matter of one step at a time. Being an autistic "All taxes are theft!" is fine and well... But it's not going to achieve anything. Convincing people to reduce spending, make things fee for service, and whatever socialized costs there are being reasonably collected from people... That stuff is actually possible, at least in theory.

That's all very true.

But wealth CAN be taxed - with very low income tax rates and with no class warfare or effect on the wealthy.

Just got to break out of the stupid 'income tax is everything'. Income tax is a middle-class thang and only the middle-class gets trapped by punitive marginal rates.

Switzerland is the model. At fed level - a 12% marginal income tax rate at the top (with afaik a $30k exemption). But a 50 basis points (0.5%) tax on wealth. So the Buffetts/Bezos/Koch/Gates crowd would see taxes go from (prob) less than $10 million to several hundred million. Can't protect/leverage 'unrealized gains'. Afaik not one wealthy Swiss has said to hell with this - 50 bp is too expensive for this service. The existence of govt and legal rules for arbitrating conflict and its protection of property is a VERY valuable service for those who actually HAVE property - and those with property know it.

In exchange for being able to eliminate cap gains/losses nonsense and end-of-lifetime-only estate tax (which also will be avoided by the truly wealthy) and the dubious deductions for charity and other stuff. A 12% income tax eliminates the low-end poverty trap and work disincentives at the top and obliterate the electoral politics of class warfare.

Course eliminating those politics would also eliminate the politics - so you can bet that sort of boringly rational change can't happen in the US.

The rich don't move from California to Ireland even with the high taxes.

https://www.theguardian.com/inequality/

2017/nov/20/if-you-tax-the-rich-they-wont-

leave-us-data-contradicts-millionaires-threats

https://tinyurl.com/ycs3s5k7

Ohhh, is that why literally tens of millions of people have migrated from high tax states to lower tax states over the last couple decades? Almost every member of my family has moved out of our native California, and if you asked them why excess taxes and BS nanny state laws are the main reason. We bailed almost 20 years ago for that reason.

And lemme tell you, if a decent European country went hard core free market, I would strongly consider moving there. The only countries in Europe that are generally better than the US on tax stuff are micro nations, and most of them are highly restrictive on who they will let in. Also, all Euro countries on worse on other freedoms I deem important, like gun rights and free speech. But if the UK or Germany became better on taxes, AND they were slightly or greatly improved on free speech and gun rights... I'd bail in a heartbeat. And many others probably would too.

The rich don't move from California to Ireland even with the high taxes.

Yeah, they move to Arizona, New Mexico, Colorado, Oregon, Utah, and Washington, and keep homes in Wyoming and Montana as their primary residence.

I'm starting to question whether people who don't care about the rationality of their policy prescriptions are worthy of our criticism. Her stupid idea was stupid long before she was elected. Why bring her name into the conversation at all? Her tax ideas should be ridiculed, not carefully refuted. She doesn't take rationality itself seriously, so why should we take her seriously? Better to ask her ridiculous questions that she can't answer without making a fool of herself like, "what would you have us do to help the millions of Venezuelan refugees fleeing socialism? " Taking her seriously isn't the solution. Making people laugh at her helps. And we can tear apart her foolish ideas without even mentioning her at all.

"According to U.N. figures, some 2.3 million Venezuelans ? about 7 percent of the population ? have left their homeland over the past couple of years. Other estimates place the number at closer to 4 million.

The exodus is the consequence of severe economic deprivation and mounting desperation among Venezuelans. The country's economy has shrunk by half in just five years, and inflation is nearing a staggering 1 million percent. Shortages of food and medicine have led to a crisis in public health, with once-vanquished diseases such as diphtheria and measles returning and the rate of infant mortality rising sharply. U.N. officials claim that some 1.3 million Venezuelans who left the country were "suffering from malnourishment."

----The Washington Post

http://www.washingtonpost.com/.....misphere/?

What could be more ridiculous than AOC trying to explain that away?

Probably just about anything else she tries to explain. She seems fairly divorced from reality on a wide range of subjects.

You're describing all progressives. And I agree with Ken, it would be nice if the adults could simply ignore her, but there will always be people who treat her with kid gloves because she's willing to call everyone worried about mass migration a racist and because she supports murdering unborn babies on our dollar.

I think the reason a lot of us pay any attention to her is shit like that video of her dancing around with her.boibs bouncing. If she were a fatty uggo, a lot of her celebrity would vanish.

The thing is, you can't ignore people like her... You need to destroy them, because at the end of the day they are trying to destroy sane people.

Now HOPEFULLY you can just ridicule them and marginalize them in the minds of people, and make them a non threat. But sometimes they get all uppity and violent... In those situations stronger methods are sometimes needed. I think the USA is heading towards option 2 being needed, because the progressives control the media and academia, so sane libertarians/conservatives don't have the "social cred" to ridicule these people back into the shadows.

This is the game they play.

Suderman 'critiqued' Obamacare and now Pleather Jacket 'critiques' AOC.

"Krugman produces this chart, which plots annual economic growth against top marginal rates:"

Amazingly enough, you get the same relationship if you plot Krugman's age vs. annual growth.

Best not tell that to AOC or Krugman will be in real trouble with the lefties.

AOC becoming such a star is item #268,918 on the list of things that show just how preposterously inane our political and media culture is. Her "green energy" concept is idiotic both technically and financially. There's really not much more to say.

A fundamental question is: Why should "the price we pay for civilization" be tied to one's "income"? What other "price" is? Highway tolls? (Well, traffic fines in Scandinavia, perhaps.) Groceries? What's magic about government services?

"From each according to his ability, to each according to his need."

Income taxes take care of the first half, spending on Medicaid, SNAP, public schools, public housing, etc. takes care of the second.

Not just a good idea; it's the Law.

Because they can doesn't mean they have to!

. . . and we could repeal that amendment. The income tax has surely caused more unnecessary grief than Prohibition.

The poll tax lead to disenfranchised masses, and the tariffs made it more difficult for corporations to do business overseas. An income tax combined with a standard deduction makes it possible for a destitute person to live. That being said, we need a flat tax with a low rate and some severe spending cuts.

A chart? Well, case closed then.

Jesus these people are dangerous.

"All your doubts and concerns should be addressed by this simple diagram."

[draws Crusty inside a cage]

I threw out the cage, because it pinched the skin and the lock broke after one date.

This is why we need to end the trade war. American forged metals are not as strong.

I essentially started three weeks past and that i makes $385 benefit $135 to $a hundred and fifty consistently simply by working at the internet from domestic. I made ina long term! "a great deal obliged to you for giving American explicit this remarkable opportunity to earn more money from domestic. This in addition coins has adjusted my lifestyles in such quite a few manners by which, supply you!". go to this website online domestic media tech tab for extra element thank you .

http://www.Mesalary.com

Not to mention it completely ignores that you could write off everything, INCLUDING the kitchen sink back in the day. Which made those effective tax rates... Drum roll please... Almost exactly the same as they are today.

Freshman Rep. Alexandria Ocasio-Cortez (D-N.Y.) has floated the idea of increasing the top marginal income tax bracket to 70 percent to help pay for her "Green New Deal" programs.

And if that doesn't work, we'll just take more.

Right?

Look at that photo.

Surely she's power hungry, wanting to grab the johnson and squeeze every last essence of the animal spirit.

Do you think she's ever been spitroasted? Maybe even double or triple penetrated? Surely she's lezzed out in a conventional mff threesome?

Rick James said she's a freak

https://www.youtube.com/watch?v=gT65GFEMQ2s

...not that there's anything wrong with it...I'm not a prude and like to party with the ladies..

If SOC spent her time getting dicked and lezzing out for the viewing okeasure of men, an not trying to Rick our country up, things would be much better.

I'm starting to suspect that she doesn't understand things like money, numbers, taxes, how the government works, the US Constitution, economics, abstract thought, where she is?

I suspect she's like a lot of rich kids who haven't had to work for their living -- they get out into the real world, see people who have to actually work for a living, and because they are young and struggling, they feel guilty for having been born with that silver spoon and want to make other rich people pay for their guilty conscience.

Using envy to make government bigger.

I got a caucus right here for her!

Hah - this was the best.

Nick and commentators here still can't seem to grasp that the income tax is an excise tax on federal privileges. The Koch brothers website says they have no problem with those who make an honest buck, its crony capitalists they dislike. Well, that is exactly what the income tax is for-to punish crony capitalists, while those who make an honest buck are left alone. The definition of a "trade or business" in the income tax code is "the functions of a public office".

Why can't libertarians wake up and start realizing that the classical liberal constitution and the statutes in the code are just what they really, really want-a tax on the exploitation of a federal privilege for private profit. IF you tax something, you get less of it. Start telling the truth about the tax, damnit! Stop the nonsense about a flat tax, or a fair tax. Realize that America is unique, and our federal system does not allow a general tax on all that comes in. "Income" is a narrowly defined subset of that-if you read NFIB v Sebelius Judge Roberts specifically says that the income tax is on "certain occupations". Not all occupations,only federal related, licensed occupations. Stand up for the rule of law! http://www.losthorizons.com

I think the general libertarian belief is that taxation is theft. Why do you think it's ok to tax only federal related, licensed occupations?

I think the general libertarian belief is that taxation is theft. Why do you think it's ok to tax only federal related, licensed occupations?

So I'm a 'crony capitalist' now? The guy working the nightshift at the gas station - he's a crony capitalist too? The nurse working in the hospital is a crony capitalist?

Speaking of the Koch brothers, the Russians want them to stop influencing foreign elections.

That's not a small point but it's not just rich people who find ways to avoiding tax hikes. For any number of reasons, since the end of World War II, it has proven exceptionally difficult for the federal government to substantially increase overall revenues for any period of time. The entire country, it seems, has an aversion to paying more than about 18 percent of GDP in the form of total government revenues. Despite very different income tax brackets, corporate tax policy, you name it, it's rare when the feds' take tops 18 percent for very long (recall that both Al Gore and George W. Bush campaigned on tax cuts in 2000, after a series of big-revenue years for the federal government).

Wow, the federal tax rate really shot up once someone figured out how to shut up the Jeeeeews.

Perhaps it is time for a geolibertarian approach to addressing poverty. A select 2% of Americans earn an income by occupying 51% of American land. New York and New Jersey should tax agricultural land, residential land, and commercial land at the same rate.

There is only so much money in circulation to be taxed. Shifting who pays is not the answer. That's what the Georgeists just can't understand. The problem is not the form of the taxation. The problem is that government spends too much.

In what universe does paying 70 cents out of every dollar earned fall under the definition of "fair share"? AOC is simply an a front for extortion.

Except six anomalous years, growth rates under the high tax schemes does not seem to have produced favorable results. Growth generally seems to be higher under lower taxes, but would also seem there are other factors influencing growth nota covered by the chart.

I essentially started three weeks past and that i makes $385 benefit $135 to $a hundred and fifty consistently simply by working at the internet from domestic. I made ina long term! "a great deal obliged to you for giving American explicit this remarkable opportunity to earn more money from domestic. This in addition coins has adjusted my lifestyles in such quite a few manners by which, supply you!". go to this website online domestic media tech tab for extra element thank you .

http://www.Mesalary.com

Do you understand marginal tax rates? The 70 cents is not for "every dollar earned". It's for the dollars over 10 million. And it's for income only, not capital gains, which are still at 15%. The rich don't have income, just capital gains. Ask Warren Buffet.

And it's for income only, not capital gains, which are still at 15%. The rich don't have income, just capital gains.

So you're admitting that her claims that such a tax will raise money for her "green New Deal" are bullshit?

I essentially started three weeks past and that i makes $385 benefit $135 to $a hundred and fifty consistently simply by working at the internet from domestic. I made ina long term! "a great deal obliged to you for giving American explicit this remarkable opportunity to earn more money from domestic. This in addition coins has adjusted my lifestyles in such quite a few manners by which, supply you!". go to this website online domestic media tech tab for extra element thank you .

http://www.Mesalary.com

I essentially started three weeks past and that i makes $385 benefit $135 to $a hundred and fifty consistently simply by working at the internet from domestic. I made ina long term! "a great deal obliged to you for giving American explicit this remarkable opportunity to earn more money from domestic. This in addition coins has adjusted my lifestyles in such quite a few manners by which, supply you!". go to this website online domestic media tech tab for extra element thank you .

http://www.Mesalary.com

AOC is the embodiment of that clueless young progressive we all carry around in our heads. She's a caricature.

Human nature: the socialist's downfall.

Central planning's fundamental flaw isn't human nature. The animal kingdom is subject to the same real-world pressures of economic forces, and other species would fail to thrive using the strategies of socialism--even without a human nature. Without a human nature, they thrive by adapting to constraints using the strategies of free markets.

Darwin was trying to reconcile how Adam Smith's observations triumphed over Malthusian pressures when he had his epiphanies. Economies without central planning are like species and ecosystems evolving without a creator God--and for all the same reasons.

The reason 536 people making choices for the rest of us from the top will always underperform 350 million individuals, each pursuing their own best interests as they see fit, isn't because of human nature. The problem of a limited perspective is separate from human nature.

The impossibility of 536 people accounting for the qualitative preferences of 350 million individuals better than those 350 million individuals can account for their own qualitative preferences is another reason why socialism fails--and it has nothing to do with human nature. If individual ants could only do what the Queen said, the colony would fail. In order to thrive, individual ants must be free to follow their instincts from their own individual perspective. Isn't it that way with everything?

"Darwin was trying to reconcile how Adam Smith's observations triumphed over Malthusian pressures..."

I think that's a little out of order. His conundrum was trying to figure out what sorts of environmental pressures would result in the selection processes he saw as driving changes over time, and it was only then that he happened upon Malthus as the solution to his problem.

It doesn't matter whether the super-rich get mad at high taxes and leave. Even if they don't, even if they just sit and suffer the higher taxes (and they probably will), it's still a big problem, because it means the economy will have less investment and more consumption.

Which is the same effect as spending-and-borrowing. Which is why Milton Friedman said that it's the govt spending level that matters, not whether they tax or borrow.

Taxes are lowered and investment doesn't increase, just stock buy-backs. Stock buy-backs can increase stock prices but it's usually a temporary impact. Long term 401Kers and the regular-guy investers don't usually catch the short-term gains from stock buy-backs. Consumption increases employment which boosts the economy. Consumption is a driver of investment.

https://www.forbes.com/sites/eriksherman/

2018/06/16/

tax-cuts-arent-delivering

-what-was-promised-investment/

https://tinyurl.com/yaka7pwp

https://www.fool.com/knowledge-center/

does-a-stock-buyback-affect-the-price.aspx

Small problems:

The little guy DOES benefit from stock buybacks, because they own stocks in their 401k, and if they have a traditional pension their company owns stocks to fund it.

That money also has to go somewhere, which means it DOES go straight back into the economy and into investments.

Consumption isn't BAD for the economy, provided it isn't financed with debt... But capital investment is what GROWS and economy. If you start taxing all the people that actually invest capital, AKA rich people, and shift that entirely towards consumption... You're going to end up with more Nikes being sold, and fewer new apartment buildings being built, fewer factories, fewer new programmers being hired for start ups, etc.

The fact that we don't produce most consumer goods in the US anymore is one reason that increasing consumption no longer juices the economy the way it used to also. When half that consumption spending goes straight overseas into Chinese hands, instead of staying here supporting jobs, it just don't perk things up like it did in 1985.

The plain and simple truth: to get much higher than that 18%, you have to soak the ever-loving shit out of the working peasants through things like VATs and extortionary fuel taxes, like they do in much of Europe. And even the working peasants in Europe are now starting to get sick and tired of it (see France).

The problem for the democrat party leftards that they can't get around is that they would very much love to do this, but they know damn well there's no way they can ever pull that shit off in America and still maintain power. And given a choice, most of them would rather have the power.

Whenever democratic socialists like AOC disagree with us Koch / Reason libertarians on economic issues, it's important to keep in mind they agree with us on the really important stuff like #AbolishICE. AOC's presence in Congress is clearly a net win for liberty as long as she opposes Orange Hitler's draconian immigration policies.

That's true! Because if we import as many impoverished, uneducated, brown people who like socialism as possible... This will somehow lead us to a libertarian paradise down the road! IT IS KNOWN!

Hahaha

Alexandria Ocasio-Cortez has a Socialist plan that will fail like the Nazis tried and the USSR tried and the Commies in China tried...

Hahaha

AOC is not really a socialist. Why are you so worried about her? She has not indicated she wants to do much that would affect you with your unearned wealth.

The only thing scarier than AOC's proposals is checking out the articles in the Washington Post about them, and seeing how many commenters think they're wonderful (and some who think they don't go far enough).

Those people should get booted out of the US with a one way ticket to Venezuela.

Send them to Scandinavia. It's about as Socialist as any of her proposals.

Send them to Scandinavia.

True, progressives do prefer to live around white people.

Frankly, I outright tell people they should move to Canada/Sweden etc all the time if talking politics. I'm somehow pretty good about saying how I'm completely against all this shit, without pissing most people off. It's probably because I'm for legal weed, and don't care if people are teh gay? I dunno.

But I straight up say "If you like that stuff so much, why don't you just move to where it is already like that? America was founded to be different, and most of the country prefers it the way it is. If a country became exactly what I wanted politically, I'd sure as hell move there... So why don't you just do that???"

I've got a range of answers from they may well do it eventually, to they feel the need to fight to ruin America too because it's the right thing to do... But I really don't get why more people aren't down. If you're worried about cultural stuff, just move to Canada. It's basically the US with more socialism. Same language and everything, basically nothing to adjust to, other than the dumb laws they would like anyway.

Isn't the USA the "land of the free"? Clearly, you prefer the kind of society they had in the USSR. Perhaps you should move to China or the DPRK. Or perhaps Saudi Arabia, which, like the USA, has a tiny proportion of super-rich people, a love for fossil fuels and no freedoms.

I essentially started three weeks past and that i makes $385 benefit $135 to $a hundred and fifty consistently simply by working at the internet from domestic. I made ina long term! "a great deal obliged to you for giving American explicit this remarkable opportunity to earn more money from domestic. This in addition coins has adjusted my lifestyles in such quite a few manners by which, supply you!". go to this website online domestic media tech tab for extra element thank you.....

http://www.geosalary.com

The thing no one ever wants to talk about it is how when the tax rates were 92% there were so many loopholes that no one paid anywhere near that rate anyway. When the rates were lowered we also eliminated a lot of the complicated loopholes so that the effective tax rates that the people actually paid stayed roughly the same

Yup. I said the same above. It is 100% true.

On second thought, maybe we should just game the lib tards. Since they can't comprehend basic math anyway, if we just gave them a 90% tax rate at the top, and brought back a shit ton of massive deductions like they used to have... Perhaps they'd be placated? LOL

Still, a VAT would raise an awful lot of revenue.

We have 20% VAT in the UK. It is a regressive tax that affects poorer people far more than the wealthy. Land Value Taxation is a much fairer alternative.

Democrats get into office and they can't think of anything else to do but tax and spend. Republicans get into office and they can't think of anything else to do but borrow/deficit and spend. And by "spend" I mean "increase the rate at which spending increases".

Taxable income is not same as income. At least give lip service to the standard deduction.

Gillespie raises no fundamental moral objection to stepped-up looting of persons who have more money than others. Does he have any objection?

Over the past several decades, the top marginal rate has been cut from in the high 70 percent to 37.5 percent. Justification for this has been that the higher rates discourage persons from becoming high earners. Few bother to note that many of those high earners were not especially discouraged by the high rates in the past. We have been told on several occasions that cutting taxes would be a revenue positive action due to increased productivity. Three times this has proven to not be the case. One wonders how many more times and how low taxes will need to be driven before we recognize that cutting revenue results in less revenue.

My own recommendation is that high marginal rates should kick in at five to ten million and that they should be in the 70 percent rate. The first five to ten million of earnings would remain at the lower 37.5 percent so I doubt that many of the affected individuals would have difficulty paying their mortgages or buying food. At the same time, I believe corporations should not be allowed to deduct payments over ten million a year to individuals. Again, they can pay them as much as they wish, but only the first ten million would be deductible. Numerous real capitalists who have their own capital invested in their companies (Warren Buffett being a prime example) do not take massive payments out of their companies preferring to have that capital remain in place helping the company to grow and helping to employ the best available personnel.

You ignore that there were tons of deductions when the rates were that high... The effective rates were comparable to what we have now.

You also ignore that total taxes taken in HAVE gone up every time we've cut taxes. Maybe not as much as they would have without cuts, but revenue is up over 100 billion a year after Trumps tax cuts.

The rest I won't even bother to address.

Why is the total tax take of any importance? The purpose of taxing the wealthy on their income as well as their assets is to reduce inequality. It has little or no other function. The US federal government does not use tax income for spending, as any economist and US president has known for many decades.

Franklin Delano Roosevelt understood all of this. When his administration passed the original Social Security legislation, it included a new payroll tax ? a paycheck deduction working people are all too familiar with today. But when FDR was challenged by advisor Luther Gulick as to the necessity for the tax, he had this to say,

"I guess you're right on the economics. They are politics all the way through. We put those pay roll contributions there so as to give the contributors a legal, moral, and political right to collect their pensions and their unemployment benefits. With those taxes in there, no damn politician can ever scrap my social security program. Those taxes aren't a matter of economics, they're straight politics."

Roosevelt is admitting that the payroll tax isn't needed to pay for Social Security. Tying it to the bill was a purely political maneuver.

This article reaches depths of economic absurdity I've not seen even in a Trump tweet. Why would the US government, which creates its own money for all its federal spending, need to think about tax revenue for that purpose? Money doesn't come to the government from taxes; citizens of the US and the UK receive every cent or penny they own from their government - or, in one of many financial scams, as loaned money created by private banks who receive fees for doing nothing apart from pressing keys. Republican governments, as with the Tories here in the UK, know that the deficit is of little importance, which is how and why they spend so much on the military without the slightest care for the origin of the funds.

Reason readers' hatred and fear of Sanders and AOC are misguided. Those two people are not even socialists, merely on the soft Left. As members of the white, wealthy capitalist class, you need fear and hate those true socialists who expose your grifting and rent-seeking behaviour.

"John Kenneth Galbraith put it this way,

"The study of money, above all other fields in economics, is one in which complexity is used to disguise truth or to evade truth, not to reveal it. The process by which banks create money is so simple the mind is repelled. With something so important, a deeper mystery seems only decent.""

From Money Is No Object by Bruce Lesnick, Counterpunch 11 Jan 2019