Extending Last Year's Tax Cuts Without Massive Spending Reductions Would Be a Fiscal Disaster

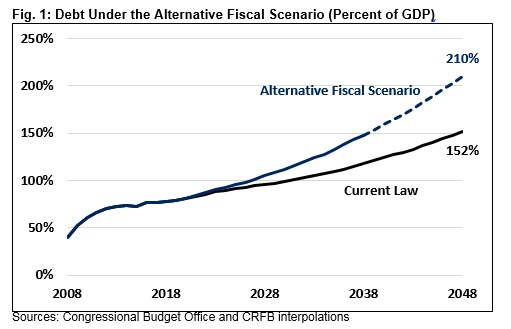

New CBO analysis shows debt could exceed 200 percent (!!!) of GDP by mid-century without changes.

Republicans in Congress are reportedly mulling a proposal to make permanent the tax cuts passed last year, with some members of the House GOP pushing for the passage of what's been called "Tax Reform 2.0" as soon as next month.

Currently, the lower individual and corporate income tax rates established by the Tax Cuts and Jobs Act of 2017 would expire in 2025. Extending them, according to a newly released analysis from the Congressional Budget Office (CBO) would cause the already terrifying trajectory of America's national debt to spike even higher over the coming decades—potentially doubling the size of the entire economy before 2050.

Under this so-called alternative fiscal scenario, current spending plans would remain unaltered but future tax revenues would be reduced by the permanent extension of the tax cuts. With the gap between revenue and spending already on pace to hit $1 trillion annually within a few years, it's not hard to see how reducing future tax revenue—without a commitment to seriously curb spending—could cause the debt to skyrocket.

At present, the national debt is expected to bump up against the record of 106 percent of GDP (a level reached at the height of World War II) sometime in the late-2030s. Extending the tax cuts without cutting spending would see that mark eclipsed by 2029, the CBO says.

"Lawmakers should not accept ever-growing federal debt as a share of the economy, nor make it worse by continuing deficit-increasing policies," advises the Committee for a Responsible Federal Budget, a nonpartisan think tank that favors balanced budgets. "They should take steps to slow and reverse its growth."

Instead, the CBO projections show the exact opposite happening, as the growth of the national debt is set to accelerate over the next decade.

Congressional Republicans never really intended for last year's tax cuts to expire, something that Speaker of the House Paul Ryan (R-Wis.) admitted even as the tax bill was still being debated.

"Those are sunsets that will never occur, we don't believe will ever occur, we don't intend to ever occur," he told the The Washington Examiner last year, adding that the temporary nature of several key elements of the GOP tax plan was meant to satisfy Senate rules that limit the extent to which bills can affect the long-term deficit.

Though Ryan was, in that instance, talking about a handful of tax credits—including one that rewards parents simply for having children—the same general logic applied to other parts of the tax bill, including the rate cuts for individuals and corporations. The lower rates passed by Congress last year are technically scheduled to reset to their previous, higher levels in 2025. Those expiration dates allow projections of the cost of the tax bill to appear lower because they took into account additional revenue from after the expiration dates.

Those gimmicks allowed Republicans to make the tax cuts look less bad for the deficit—though the bill was still projected to add at least $1.5 trillion to the deficit over the next decade.

Even if Congress allows the tax cuts to expire, as the CBO expects in its "current law" projection, the national debt is expected to spiral in future years without a serious effort at cutting spending. Things get really ugly in the alternative scenario, which envisions a future where Congress allows not only the tax cuts to expire, but also extends other planned tax breaks (including the politically popular tax break for parents) and permanently repeals some health care taxes tied to the Affordable Care Act.

This alternative future—one that actually seems more likely in many ways than the "current law" projection that relies on Congress making several sure-to-be-unpopular decisions in the middle of the next decade—would put "increasing pressure on the noninterest portions of the budget, limiting lawmakers' ability to respond to unforeseen events, and increasing the likelihood of a fiscal crisis," the CBO warns. The number-crunching agency concludes that "such a situation would ultimately be unsustainable."

Of course the real problem is Congress' inability to cut spending. After passing the tax cuts last year, Republicans earlier this year approved a two-year spending plan that obliterated Obama-era spending caps once championed by Ryan and other budget hawks. In doing so, the GOP has signaled quite clearly that it does not give a damn about the deficit—despite years of claiming otherwise as Presidents Bush and Obama added to the national debt. And if Republicans don't care about the deficit, why should Democrats?

But even a party that has abandoned fiscal conservatism should take a good, long look at the CBO's latest release before pressing ahead with a plan to put more tax cuts on the national credit card.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

tax cuts good, spending cuts better

This. Why does Eric Boehm take 13 paragraphs to say, "Of course the real problem is Congress' inability to cut spending"? That is the issue here.

The administration did us all a big favor by cutting taxes broadly. This is something you couldn't expect a progressive party to do, ever. Now the onus is on government to get it's spending in line so that it's not blowing through cash. To not do so is to invite the next Democratic majority to dismantle the tax cuts they spent so much effort installing.

Isn't the real problem that a revolutionary army hasn't seized the assets of the ruling political class and sold them off to pay whatever debt instruments we don't simply choose to dishonor? And of course couple it with selling all the family members of the the ruling political/media classes off as indentured servants to various Asian and middle eastern countries?

That's only the 'real problem' if you think protecting the government (from itself, no less) is a higher priority than protecting individual liberty.

Which is Boehm's unstated premise.

This is what happens when a publication mistakes libertines for libertarians.

A government desperate for more money isn't great for individual liberty. What's the end game with lower taxes and an ever-increasing budget? Probably massive destruction of wealth and attempts at confiscation.

I'm for the tax cuts on principle, but if the budget keeps growing, it's not going to be good.

Ok. Just undestand that argument makes you a Utilitarian, not a libertarian.

This is a stupid response.

It is entirely accurate.

Your (non)response is entirely typical.

No it doesn't.

Governments are NOT businesses. For govts, their spending comes first - and those decisions are made directly and controlled through the legislature. Their revenues are entirely a dependent function of that spending. They either get those revenues thru taxes (which can only be anticipatory revenues) or thru bond issuance. Taxes mean - broadly - the people who elect the legislature (the govts current customers) pay for the spending the legislature approves. Bond issuance means a future generation of customers has to pay for the spending but gets no voice in making those spending decisions. All you do when reducing taxes is increase bond issuance.

For biz - revenue comes first and controls everything. Costs are entirely dependent on those revenues if the owner wants to make a profit at the end of the day. If they fail to keep that spending in line with their revenues - or issue bonds and pretend that they are revenues; they will go bankrupt quickly.

You are still prioritizing sustained government via increased taxes as the preferable "good" vs. not sustaining the same spendthrift government through those taxes.

Such profligacy being a direct affront to the liberty of every taxpayer.

So yes, that makes your argument utilitarian, not libertarian.

I'm not prioritizing anything. I'm simply saying how the fucking math works. You don't have the right to pick and choose the laws of math that you think are most politically advantageous. The laws of math are beyond the ability of the US government - or any free individual - to alter. They just ARE. Deal with it.

The specifics of WHAT money is spent on (guns or butter so to speak) may well be utilitarian.

But the total AMOUNT of spending is either a)theft from the future if in deficit or b)savings for future if in surplus.

No, making observations about what might happen is not being a utilitarian. I might be wrong, but I'm making predictions, not assigning any value to anything.

The administration did us all a big favor by cutting taxes broadly. This is something you couldn't expect a progressive party to do, ever. Now the onus is on government to get it's spending in line so that it's not blowing through cash.

This is a telling distinction...

No it isn't. Government is not some illegal alien God that wandered in from Mars.

YOU elect Congress. If Congress can't control its budgeted/approved spending, it's because YOU are electing people to Congress who don't think that's important. Likewise with Prez/exec for any discrepancy between approved v actual spending.

If YOU believe Congress is not controllable by you anymore, then its because YOU have let Congress make itself increasingly unaccountable/unrepresentative over time. So it is up to YOU to elect people to Congress who will restore that representation and electoral accountability as the first step to Congress controlling such spending.

This is entirely a problem that rests squarely on every single voter who is playing the 'I'm just a duop partisan sheep' game of evading personal responsibility for what govt does.

Maybe the voters have simply chosen to let the government spend itself into insolvency.

The problem with either option is we really will not know the truth of the matter until after the fact.

No. You know the truth of the matter right now. You choose to say FYTW to all Americans younger than you. And coerce them into paying bills that are your obligation.

Since you know what is actually happening - and refuse to alter your theft, they are completely within their NAP rights to defend themselves from being enslaved by that debt. By killing you. That is the only option they actually have if they want to remain free for their lifetime.

Why intergenerational warfare hasn't broken out yet is probably because - we go to a lot of effort to keep them stupid until they are already shackled in and become part of the problem themselves.

The only endgame that can result in freedom is intergenerational warfare.

?including one that rewards parents simply for having children?

Because that's how it works in practice. A couple has kids, gets a tax credit, and nothing else happens.

I don't disagree that we shouldn't be subsidizing reproduction, but lets not pretend that having a kid is like buying a Tesla.

but lets not pretend that having a kid is like buying a Tesla

Yeah. For starters, I didn't have to give my wife $2,000 in deposits for kids that she wasn't even remotely able to deliver.

That's OK. If you get them they will catch on fire.

If she had been wearing Elon Musk, she would have been more fertile.

"It's like patchouli, but smarter."

That's why God invented printing presses.

Just a note: Paul Ryan's original tax bill was supposed to be revenue neutral, thanks to a "border adjustment tax" that most conservatives, and virtually all libertarians, hated. The network of political pressure groups organized by the Koch brothers labored long and hard to get rid of the "BAT" and did so, but "forgot" to recommend any revenue enhancers to make the package revenue neutral once more. After the bill passed, promising to increase the national debt by $1.5 trillion over ten years at a minimum, Charlie Koch announced "I'm more excited about what we're doing and about the opportunities than I've ever been. We've made more progress in the last 5 years than I had in the previous 50." I wonder if he's still excited.

I won't be excited until I see tumbleweeds rolling down Pennsylvania avenue.

Meh. It'll take heads to get my attention.

Indeed.......

https://m.youtube.com/watch?v=ZwrqI8vK4II

I'm wondering if there's a scenario where our elected leaders would see this disparity in revenue and spending, and cut the latter.

Never. But the good news is that the CBO always underestimates the economic benefits of tax cuts and its revenue projections are always low whenever tax cuts are involved. So, the numbers are likely not as bad as portrayed.

Oh, hell no. I'm not voting for someone who is going to cut the program on which I have become accustomed.

Bwahahahahahahahahaha

HAHAHAHAHAHAHAHAHAHAHA

No.

That isn't the answer Diane. The answer is to increase taxation.

Here we have an article from Reason functionally demanding higher taxation since cutting spending is literally not an option that is on the table. Every single Democrat will vote 'no' to any spending cuts, and so will over half the Republican party.

So, I guess the question we need to ask is what is more important? Keeping more of our own money, or...not keeping more of our own money. The reason, of course, is that the government will always spend more than it 'makes'. Always. So, functionally we should just skip to the end and set taxation at 100% of all income then watch as the government somehow manages to spend 150%

This, to libertarians, is considered 'winning' I suppose.

I'm not sure there is any winning. You can keep more money for a while. Maybe even for most of our lives. But sooner or later you need higher taxes, less spending or to fire up the printing presses. Any option besides the less spending one means we all lose, I think.

I think there's a scenario.

A group called - say - For the Children - kills everyone in the US over age 80.

Issues a manifesto:

We've made the first big round of spending cuts for you. Now it's up to you. Next year, we kill everyone over the age of 79. We will repeat this until SS and Medicare are reformed with no long-term liabilities and govt spending is in rough balance forever. Your choice - you make the spending cuts in your way or we make them in ours. Thank you for your attention.

Reason Magazine: RAISE TAXES NOW

BREAKING NEWS: We're fiscally doomed without entitlement reform either way.

The same Congress that is spending us into bankruptcy can totally be trusted not to spend the extra money they get from raising taxes. This seems to be reason's position.

The only solution to this problem is to require either a balanced annual budget or to have a debt ceiling that can't be moved by Congress (tied to GDP or something). There is no amount of legislation that any Congress can be trusted to come up with that will show any sort of restraint on spending money that they don't have. The people need a check on Congress' power, and that requires a Constitutional amendment.

It's time to schedule an Article V Convention now.

I am not even sure that would fix it, because there would have to be some kind of emergency clause for wars and real national emergencies. And once Congress had a loophole, they would just drive a truck through it.

The only solution is for Congress to no longer be able to borrow or print a dollar. As long as they can do that, they will continue to spend.

because there would have to be some kind of emergency clause for wars and real national emergencies

I disagree that there would have to be something. If you pegged a debt ceiling to some metric like GDP then you could allow for borrowing during a national emergency or war. If Congress wants to go to war, they better think long and hard about what funding they'll cut to finance it, or have enough support to raise revenues and not get thrown out of office the next go around.

Reducing wars and federal bailouts for "emergencies" is a feature not a bug.

If Congress wants to go to war, they better think long and hard about what funding they'll cut to finance

That sounds great until you realize that our enemies can also decide if we go to war.

That sounds like a reasonable reason to temporarily raise revenues then.

our enemies can also decide if we go to war.

That's why we urgently need to change the focus of our military spending to actual DEFENSE rather than maintaining a fabulously expensive offensive capability.

Yep. Disband the standing army and focus on sea and air defense.

Zero out the defense budget and we still go broke. Stop it with this nonsense. The one and only thing that has to happen is entitlement reform.

Even if entitlement reform could zero out the deficits, it would still be insane to spend trillions of dollars on high-tech offensive weapons systems, offensive wars, and a large standing army. Here in the real world where entitlements are not going away, all wasteful spending needs to be on the table if we want to stop printing money like circus tickets.

So aside from not fixing the problem at all, we should do it because it will fix the problem which it cannot fix.

The logic is irrefutable.

And entitlement reform is the only thing which CAN zero out deficits. The refutation of the rest of your babbling about "offensive" weapons with the implication that somehow weapons can be only defensive is left as an exercise to the reader.

entitlement reform is the only thing which CAN zero out deficits.

Which, as I said, does not mean that it makes sense or is politically feasible to zero out deficits by taking ALL the cuts from entitlements.

weapons can be only defensive

This is a libertarian site. It is a foundational principle of libertarianism that violence must only be used in defense. That's not to mention the practical argument that maintaining a powerful offensive force is insanely expensive.

A defense without offensive capability is no defense at all.

Not to say that there is no waste, or misappropriation, but to note that what you suggest is unrealistic.

A defense without offensive capability is no defense at all.

What we have now is the opposite of that?a capability to project a powerful offense at weak opponents, and no ability to stop attacks or retaliation from the weapons of our powerful adversaries. And we're in this position at a time when advances and proliferation of powerful, threatening weapons against which we have no defense are putting those weapons in the hands of lessor opponents. This is a much bigger problem than "waste" or "misappropriation". It's a complete misalignment of our military posture with our legitimate defense needs in today's world. We are left in great peril of devastating attack in spite of massive military spending.

Vernon, even if we are to stipulate that we should (never mind whether we even could) do what you suggest, I do not think the military/appropriators would accomplish it for less than we are currently spending.

Beyond that, there would be no way to enforce such a provision anyway. Congress could just tell the courts to fuck off and ignore any injunction they issued. What are the courts going to do about that? Nothing. Congress has all of the power if it chooses to use it.

Whoever controls the military has all the power. I suspect that they would be much more sympathetic to the people than Congress in this scenario.

The same could be said of your proposal of not being able to print or borrow money. Who would enforce that? Who would stop them if the Congress said they were going to confiscate everything within our borders?

If the people can't limit Congress' power through a constitutional amendment, then why are we even discussing this? We might as well take up arms and get it over with.

Whoever controls the military has all the power. I suspect that they would be much more sympathetic to the people than Congress in this scenario.

If the people wanted Congress to stop spending money, there wouldn't be a spending problem. And my idea is not to legally prohibit anything. It is just a statement of fact. At some point, they won't be able to borrow any more money and the public will not tolerate them printing any more and they will have to stop spending.

Actually the solution is competitive money - even if the only competition is two semi-govt currencies.

Go back to the Gold Standard where they can no longer print money. That would solve both the budget deficit and the trade deficit overnight. Reason being hacks who know just enough to be dangerous fail to see the connection between fiat money and endless trade deficits. If we couldn't print money, we couldn't finance either of those things.

It's important to recall that fiat currency didn't exist at the time of our founding. That change (thanks, Progressives) gave the government far more power than anyone thought (except the Progressives).

That's a feature, not a bug, of modern government but it's a feature that needs to be curb stomped.

important to recall that fiat currency didn't exist at the time of our founding.

'Fiat currency' has become more of a scarephrase than an actual economic concept. Any currency that doesn't physically contain its intrinsic value is a 'fiat' currency. Gold standard was technically fiat. Deposit physical gold in banks - and they issue you a note and TELL you that its backed by the gold you deposited. Truth is - it's only actually backed by gold after you withdraw the gold and have it in your hands and the bank takes back the note. The note itself is fiat.

Gold standard solves a lot less than people seem to think nowadays. Yeah - it can solve govt debt and trade balance issues. But that comes at the direct cost of brutal depressions that come out of nowhere when all money is drained overnight from the country and markets cease to function and banks call all their loans and refuse to pay their depositors.

The gold standard failed because it is a crappy form of currency to serve as a medium of exchange. Physical gold is damn near useless as a medium of exchange because for most transactions, it's hard to distinguish the gold required from pocket lint. So it all gets deposited into banks - and hey presto you now have a banknote standard and those promissory notes turn fraudulent the day trade flows have to get balanced.

Silver coins can work as a medium of exchange. So can monetized commodities (which mostly stay local because they are too bulky to be shipped to balance trade flows). Both meet the Says Law requirement for a currency that self-corrects production without the intervention of top men (incl bankers). We almost kinda did the latter with the Stockpile Act of 1939 but stopped short of actually monetizing those.

If there's a war, they can ask for donations. If people don't pony up, then they deserve to get invaded or whatever.

Why not take the emergency loophole away from congress, and give it to a certain percentage of state legislatures?

My favorite idea is a rule that the budget cannot exceed the previous year's tax receipts.

And the consequences should be decimation of Congress by lots.

Real decimation, by hand

Agreed.

At the very least, Congress people should face some sort of personal liability for the debt they create.

You weren't supposed to notice that.

Can we just go ahead and have the worldwide monetary collapse and get it over with? Who the hell is prolonging this crisis by buying our worthless paper? What's their motivation?

I keep thinking that is what is going to happen, but it never does. Hell, inflation isn't even rising.

Whatever is going to happen, Congress isn't going to stop spending money. So, reason can go fuck themselves with their desire for the public to give them more.

Hell, inflation isn't even rising.

That depends on what you spend your money on. If you're well-off and spend a large portion of your income on information technology and luxury items, you probably aren't noticing any price rises, or are even experiencing the things you buy going down in price. On the other hand, if you're low income and spend all your money on vital things like rent, food, basic clothing, transportation, utilities, and medical care, prices are skyrocketing for you.

And yes, I know that inflation and price increases are not technically the same thing.

^this

Yep. To pretend that the actual price of beef hasn't risen in the last decade is a joke.

Since eating beef is murder, since cow farts are a significant part of carbon emissions, and since raising a pound of hamburger takes about 1980 gallons of water, the rising cost of beef is not a bug.

It's a feature of the vegan, anti-global warming, anti-drought blocs agendas.

Vegans are really easy to beat up. So it should follow that making these people, and their lame ideas go away, should be a simple endeavor.

"Kick the shit out of everyone different from me," Typical rightwing thug.

Must be a Trump worshipper,

You don't have to be poor for the stuff you actually spend money on to be inflating. I'm pretty sure that's the case for people well up into the middle incomes.

The problem with the inflation statistics is that they're rigged: Instead of reporting the inflation numbers based on a constant 'market basket', they started changing the 'market basket' to lower them. The excuse was, "People eat less beef, more chicken now, so we changed the proportions in the market basket to reflect that."

But, of course, they're eating more chicken and less beef because they can't afford the beef! So this reasoning will eventually replace chicken with beans and rice, and still claim there's next to no inflation.

The site "Shadowstats" attempts to calculate government statistics as though there hadn't been these sorts of changes. They figure that, based on the way inflation was calculated in 1980, we're currently at about 10% inflation.

If people aren't buying things, then it's kinda stooopid to count them.

Wingers thrive on lies and hysteria. And this one has no clue what CPI measures. He'd still count horses, and say using gasoline is among the plots financed by the commies in our government.

Brainwashing them can be so very profitable, and not just Fox, Breitbart, WND and infowars.

Who the hell is prolonging this crisis by buying our worthless paper?

And why do we want to reduce the trade deficit when they are trading goods for our worthless paper?

Why do you want to reduce the national debt when most of it is borrowed money we will never pay back?

And why do we want to reduce the trade deficit when they are trading goods for our worthless paper?

Surely they'll wise up sooner or later. What I don't understand is what's in it for them right now? Why haven't they already told us to wipe our asses with our "dollars"?

It has to be the fact that there are so many dollars in circulation coupled with the fact that we export so many dollars through trade... right?

If the dollar collapsed, then everyone would have to rush to some other reserve currency or asset like gold. It would certainly upset the world's power structure, so the powers that be have a vested interest in maintaining the status quo. That's all I can think of.

Yeah, I get that as far as currencies are concerned, the US Dollar is the prettiest horse in the glue factory.

The US dollar is NOT worthless paper. The US dollar is the 'risk-free' collateral at the bottom of the $230+ trillion (excluding derivatives) debt pyramid. It is the basis for determining the cost of interest and capital for EVERYTHING in the world.

If the US dollar didn't perform that function, then something else would need to. And until that something else comes along, the dollar and only the dollar will perform that function. That is, like it or not, valuable. And the morons who buy into 19th century notions of what money is or should be should get off their butts and learn what money and debt ACTUALLY is in today's world.

Yes, something else would. You are right. So maybe neither trade deficits nor budget deficits matter?

They don't matter until they do matter. Once they do matter, it's too late for either brakes or responsibility. You and multiple future generations of Americans will be enslaved to that existing debt at that point.

No, historically you don't end up enslaved to that debt unless you're a small and very powerless country that owes money to a powerful neighbor. You end up repudiating it, and then go through a period where nobody will loan you money.

The Constitution forbids repudiating the debt, but it forbids a lot of things that happen anyway. Likely we'll hyperinflate it away. "Pay" it in nominal terms, but only pennies on the dollar in real terms.

And until that something else comes along, the dollar and only the dollar will perform that function.

I admire your faith. I think it's much more likely that nothing else will come along until AFTER the dollar stops performing that function and we experience a worldwide financial collapse and depression. Sooner or later, the rest of the world will tire of paying a tribute to those who can create dollars that is far out of proportion to the real wealth the dollar-makers are able to create, and catastrophic change will become the more desirable option.

Sooner or later, the rest of the world will tire of paying a tribute to those who can create dollars that is far out of proportion to the real wealth the dollar-makers are able to create

The constraint on the US is smaller and far more specific than that.

The US taxpayer only needs to be willing to keep servicing the US dollar debt - paying the interest forever and keeping the dollar market liquid when principal gets rolled over. And keep paying to be the world's cop/enforcer.

The limit on 'new dollars created' is the amount needed to keep serving as a reserve currency for international trade/capital flows. Idk what that latter number is - but the 'new dollars actually created' is basically the net increase in mortgages. So as long as Americans keep leveraging up and speculating re housing - or keep selling homes/land to foreign buyers; that 'money creation' part will keep working.

Those are both identifiable events. When they stop happening is when we'll see if someone else steps up.

Those two events are also good proxies for - how long is the US willing to transfer its wealth from the non-financial sector to the financial sector. idk the answer - but that's basically the cost we've (those NOT in the financial sector) been incurring for 30+ years since all of those debts/imbalances are zero-sum re wealth creation.

Personally, I don't see much - beyond inchoate anger at nothing/everything in particular - that indicates that's about to stop or has reached its limit.

" So as long as Americans keep leveraging up and speculating re housing - or keep selling homes/land to foreign buyers; that 'money creation' part will keep working."

That certainly explains why banks are still lending for commercial development, even though vacancy rates are through the roof.

At least we haven't gone the route of China and built entire ghost cities that will never be occupied.

Yet.

Alternate, non-progressive (too much to expect from a "libertarian" rag), headline:

If Spending Isn't Reduced, Taxes May Have to be Raised

Fuck you, Boehm (or whoever is responsible for the title).

Fuck you for propping up the progressive narrative that the government owns the citizenry.

Amen

See, when the right applies the left's standards and goes after them with social media mobs, this is what is known as Wrong(tm). Now when the left refuses any entitlement reform (the only mathematical necessity in all of this) and the right stops pushing for it, then it fully justifies when the left goes on its next spending spree, e.g. Medicare for All (one of those bankrupt things already). This is what is known as Right(tm).

Yeah, I have to think it's more like 'Democrats have never cared about a deficit, and Republicans learned no one actually cares about them so they stopped caring too.'

We're so educated that we all know that deficits don't matter. Well, unless a disgusting Republican is in office...then...wait...no deficits still don't matter to anyone. You'll note maybe two people in the United States said anything about the deficit when talking about the 'Trump Tax Cut' and the few who did were pretty much instantly shut up.

And the majority of opposition to last year's spending bill came from the GOP. The spending bill earned a higher fraction of sentate dems than it did reps and virtually identical percentages for each in the house. But it's clear that this is all team red's fault because reasons.

Essentially Republican get the blame because Republicans are the only one's who ever even mention the debt. Thus it's only their problem...or at least I guess that the new Progress-itarian talking point.

hear hear

I have an idea for cutting spending, how about we make it impossible for non citizens to get federal welfare? Reason should be all for that since they clearly see the need to cut spending.

No, according to Reason, recognizing the concept of "citizenship" is Nazism.

Like Trump is talking about doing? kevinboyd1984.wordpress.com /2018/08/07 /the-trump-administration- proposes-a-crackdown-on- welfare-using-legal-immigrants/

Sure. And while you're at it, cut foreign aid, and eliminate all the 'waste, fraud and abuse'. That will solve all our problems!

Don't forget Congressional salaries. That's at least half the problem, right?

Wait, wait, wait! Didn't we balance the budget by cutting out the "waste, fraud and abuse" the last nine times we elected a president? I could SWEAR I heard we did that.

Yup that's all we have to do. Get rid of the 'waste, fraud and abuse'. It's so easy! The only reason we haven't is because of all that lobbying money from Big Fraud.

The tax cuts were a good idea, but they will mean little if the damn spending isn't stopped.

Reason is against tax cuts now?

Is that because the illegal immigrants need their services?

America bankrupt, immigrants hardest hit.

"America bankrupt! Not unattractive immigrant women and their doe-eyed children hardest hit!" (see photo feature)

source: Truth In Headlines, Inc.

>>And if Republicans don't care about the deficit, why should Democrats?

Can't write this and expect peeps to take you seriously.

No shit. If the deficit is such a big deal, why does one party not caring about it make it okay for the other not to care about it? Sometimes the reason millennials are a living indictment of our education system.

Well the democrats are honest about not wanting any limits on government spending, so they get a pass.

Something you will never read in a Reason piece on the deficit/debt:

And if Democrats don't care about entitlement reform, why should Republicans?

And if Democrats don't care about entitlement reform, why should Republicans?

^ This. Exactly this. There is no benefit to being the party of 'no' when the other party is promising free pony's and blowjobs. In fact, this was accurately predicted to be the death spiral of any democracy. Coincidence?

So cut things:

Dept of Education 68 - 70 billion

Dept of Transportation 75 - 80 billion

Dept of Health and Human Services 1,000 - 1,100 billion

Are we there yet?

Only if doing that wouldn't affect immigrants.

signed

Reason Staff

Immigrants? What immigrants?

I am going to kick my deadbeat uncle out of my house and stop giving him money regardless of whether he can pay his bookie. Not my problem.

Does your deadbeat uncle have lots more guns than you do?

Obviously I have to pay taxes, but I feel about as much responsibility and respect for our government's spending choices as I would for a deadbeat uncle. Unlike the writer, I'm not going to fret and voluntarily offer them more of my money. It's enabling them.

But you're also not going to participate in representative democracy in a useful way, are you?

OK, you got me, I live in Kansas and I didn't vote in the primary. But you're right, I should've voted....for Kobach, just to annoy you.

More important question:. What does your deadbeat uncle think of the NAP?

Since these tax cuts aren't even popular, perhaps eventually you will see that the Republican party is on a mission to loot the country, has been for a long time, and is evidently in the latter stages of the plan.

Won't it be nice when libertarians stop making it their raison d'etre to defend every one of those looted dollars.

It's a pretty bad mugger who declines to steal your money. On the other hand, your welfare payments sure rattle like a treasure chest.

Not paying so much in taxes, (or anything else), is always popular.

Nobody but the gazillionaires noticed their taxes go down, because they hardly went down for anyone but gazillionaires. This incredibly obvious ploy is finally getting through to the common American voter.

Nobody but the gazillionaires noticed their taxes go down

False. Try again?

Keep telling the big lie. Worked for your fascist role models before, might work again.

The big lie that tax cuts are economically useful in the current economy? That one?

The big lie that says that raising taxes can even theoretically be a solution, idiot. You know, what Democrats spout instead of talking about reduced spending anywhere outside the military?

Raising taxes are theoretically a solution to paying for shit government wants to buy... wtf?

Tony, you deliberately act retarded in these instances. You can do simple math, you know the gulf between revenue and spending so enormous that it would require absurd tax hikes to even begin to bridge that distance. It's been demonstrated than when you tax too much, tax revenues fall. And that is all beside the point.

It is immoral to spend other peoples money on welfare programs and other social engineering tasks. The only moral taxation is that which is required to run the proper functions of government, because a state is necessary to protect the interests of it's citizenry. Anything else is an immoral and unjust taking. Even with the current tax cuts, they still take far too much. Ergo, the only moral (and practical) thing to do is cut spending.

I think everyone can agree on this closed circle of an argument.

(cont.)

So if reason wants to get serious about the deficit versus just scoring cheap political points to fit with their real, libertine narrative, then this (and ONLY this!) is what matters.

In 2013 (the last year IRS list certain stats for on their website), the cumulative AGI of the top 50% of returns was $7.995T. Expenditures in 2013 were $3.45T.

If we're generous and assume the lower 50% of returns will pay 0% in taxes (currently about 41% of all returns have zero or negative effective tax rates), average rates on the income of the top 50% would need to be 43% to cover the spending.

If we taxed the top 5%--cumulative AGI of $3.109T--of returns at 100% and the lower 95% paid nothing at all, we'd be short about $341B.

If we taxed the top 10%--cumulative AGI of $4.143T--of returns at 100% and the lower 90% paid nothing at all, we'd need rates of 83%.

Of course, this assumes no one modified their behavior in any way that affected their income and tax impact...

assume the lower 50% of returns will pay 0% in taxes (currently about 41% of all returns have zero or negative effective tax rates)

If you assume that, you'll be completely wrong. Although 40-some percent of returns have zero or negative effective tax rates, that 40-some percent are NOT the bottom 40-some percent. There's three kinds of taxpayers that end up paying nothing: poor people with dependents on public assistance and/or receiving the Earned Income Tax Credit; extremely low income workers (like under $10,000 or so) receiving the EITC; and middle-income families with dependents who can take lots of itemized deductions. Low-income workers without dependents get soaked on federal taxes, often paying more as a percentage of income than many middle- and upper-middle income taxpayers.

Ok, so you're saying we will need taxes to be collected from the lower 50%?

I was trying to give them a break and focus on getting taxes out of only the top earners. But, hey, if we need to get taxes from the lower 50%, so be it. It's a feature!

No. I'm pointing out that plenty of people in the lower 50% ARE paying federal income tax, contrary to myth. Read this again slowly: Although 40-some percent of returns have zero or negative effective tax rates, that 40-some percent are NOT the bottom 40-some percent.

Also: " Low-income workers without dependents get soaked on federal taxes, often paying more as a percentage of income than many middle- and upper-middle income taxpayers.

Then they're NOT included in the set of returns with zero or negative tax liabilities, are they? I can only assume that they constitute the 9% or so of all tax returns that are in the lower 50% but not in the 41% with zero or negative taxes...

Then they're NOT included in the set of returns with zero or negative tax liabilities, are they?

No. That was my point. The bottom 40-some percent of taxpayers by income are NOT the same group as the 40-some percent who pay zero or negative income tax. It is also true that some tax filers whose income is ABOVE that 40-some percent do NOT pay federal income tax because of tax breaks and deductions available to families with dependents.

The big lie that tax cuts only went to the "rich." Just like the big lie that you would "bend the cost curve down" and "if you like your plan you can keep your plan."

Nobody says that, ever.

But you people specialise in lies. The tribal mentality.

Actually, I know a bunch of working middle class people who all noticed the increase in take home pay. I guess the people who are indifferent are welfare recipients like Tony.

The Republican party reduced the amount of my money that the government could confiscate from me at the point of a gun. How does that make them looters?

Spending won't be cut. People like socialism.

Trump won because he promised health care that would cover everybody.

Trump won because he promised not to cut Social Security, Medicare, or Medicaid.

Trump won because he promised to raise taxes on the rich.

He won because he married the traditional Republican racism with the more-popular tax the rich and spend rhetoric from Democrats. The tax bill is unpopular because it wasn't what was promised. The average worker doesn't even see the ~$10-20 increase in their paycheck because most of it is eaten up with the increase in other costs, especially health insurance.

Another hot Vox take.

But of course workers would see the benefits from increased taxes like the doubling in health care premiums in 4 years and the lackluster economic growth.

Come for the socialism, stay for the gulag.

Chandler, none of those things are why Trumo won. None of them.

Do you really believe all the discredited shit you write?

It's what separated him from your typical Republican.

He promised to govern basically like a Dixiecrat. Segregation Now, Segregation Forever!

Remember, all republicans are racists. This coming from the part of Byrd and Johnson.

Happy is just a Vox bot, not a human typing.

Progressive algorithms spouting dogma without thought.

Well, it's about time Reason put up an article demanding higher taxation.

It was really only a matter of time.

"The Fire is too hot"!

"Shovel in more coal!"

Um, this is not the first I've seen here

I keep wishing for a basic modification to our Congress and how we elect them:

A lower House that can pass lots of policy and feel-good laws, elected on the basis of one man (person, or whatever), one vote.

An upper House that deals with the federal budget, elected on the basis of one tax dollar paid, one vote.

Would people be allowed to buy more votes by voluntarily contributing more to the treasury?

Presumably: You pay money in, you get to decide what it's spent on.

Man, really, this isn't hard.

Just cut the federal government by 98% and abolish the IRS.

See, not hard.

If we, the current consumers of all this spending, don't pay for it, who will?

I of course like having more money in my pocket. But I don't know if I like it as much if it means that having more money my pocket now means that future generations will have proportionately less in theirs.

Feel free to contribute to the Treasury.

As of right now (and for years) my taxes more than pay for what my extended family consumes and my savings will cover my needs in retirement regardless of when this bubble bursts, so you'll forgive me if I don't share your concerns about future generations of grasshoppers who could not be bothered to plan for their future.

As of right now (and for years) my taxes more than pay for what my extended family consumes

Curious, how did you perform this calculation?

That you think is statement inconceivable says more about you than anything else.

There's a reason they call it the calculation problem, y'know.

Well I don't think it is *inconceivable*.

I do think it's difficult to calculate with any sort of accuracy all of the government services consumed by any particular individual, even the legitimate government services.

Well, one way is to look at per-capita spending. E.g. 2013 federal expenditures were $3.149T, or about $9,961 in per-capita spending.

On that basis, me and the Mrs. paid close to 5x in federal taxes relative to our per-capita "receipts".

I can't wait until the dollar collapses and we descend into civil war.

If your libertarian moment necessitates a massive government spending well in excess of it's means just how libertarian is it?

I would rather they go in and do a more proper tax reform from scratch really. The whole killing loopholes, and keeping revenue about the same thing has a lot of appeal.

That said, IMO, if they were smart they WOULDN'T make these permanent. Why? Because 2025 will be here before too long. If Trump wins in 2020, it will give them a reason to tell people to vote for whoever his replacement is. If a Dem does win in 2020, same thing. Either way it will enable them to say in 2024 "Vote Republican, or your taxes are going up next year!"

Obviously it goes without saying that cutting spending is what really needs to happen. But I won't hold my breath for that. As far as things go, as long as we don't go full Venezuela style with spending/debt, jacking up the deficit is really just a shadow tax on people who don't understand how fiat currencies work. I'd rather just cut spending, but if it isn't going to happen anyway, it might be better to just pile on the debt and let the devaluation of the currency do its thing... As disgusting as that sounds.

Reads like a Bernie Sander's screed, albeit with a late hat tip to the addiction to spending.

Tax revenues are at historic highs, even after the tax cuts--some might say because of the tax cuts stimulative effect on the economy.

It's the spending, stupid!

"The federal government this January ran a surplus while collecting record total tax revenues for that month of the year, according to the Monthly Treasury Statement released today.

January was the first month under the new tax law that President Donald Trump signed in December.

During January, the Treasury collected approximately $361.038B in total tax revenues and spent a total of approximately $311.802B to run a surplus of approximately $49.236B

The Treasury not only collected record taxes in the month of January itself, but has now collected record tax revenues for the first four months of a fiscal year (October through January).

So far in fiscal 2018, the federal government has collected a record $1130.550B in total taxes.

https://www.cnsnews.com/ news/article/terence-p-jeffrey/ feds-collect-record-taxes-first -month-under-tax-cut-run-surplus

I've said this before, will doubtless say it again:

When somebody gets too deep into debt, to the point where they can't get out, they're paying the minimum on their credit cards with other credit cards, (This is about where the US has been for at least a decade.) there are two paths they can go down:

They can treat the debt as a moral obligation, and opt for austerity so as to minimize the degree to which they short their creditors when the bill comes due.

Or, they can decide to take their creditors for all they're worth before they wise up: Take nice vacations, stuff cash into jars, buy stuff that can't be taken in bankruptcy. Get as much from them as possible before the card is declined.

Governments fact the same choice, except that in a democracy option #1 is politically impossible, so it's #2 by default.

We're in that awkward phase where we know that default is inevitable, but our creditors have still not figured it out. And Reason is complaining that we're running up the card. Well, duh!

Should be complaining that we're running it up for the wrong stuff...

I don't know that I would say it is politically impossible. Half the country has voted to cut spending in EVERY SINGLE ELECTION since forever. The problem has been the RINOs refuse to actually follow through.

If we just froze spending for a few years, and then took the axe to completely useless things government does that most people never even interact with, I don't think anybody would even notice. I mean the media and leftists would be screaming about the world coming to an end... But then when nothing bad happened, the half of the country that has ALWAYS wanted this would be stoked.

It's really about getting politicians with spines in office. Unfortunately I don't know how to do that...

I have observed that the federal government has usually taken in revenue that equals what it spent about 5 years prior.

E.g.:

2004 revenues $1.880T 1999 spending $1.701T

2005 revenues $2.153T 2000 spending $1.789T

2006 revenues $2.406T 2001 spending $1.862T

2007 revenues $2.568T 2002 spending $2.010T

2008 revenues $2.524T 2003 spending $2.159T

2009 revenues $2.105T 2004 spending $2.292T

2010 revenues $2.162T 2005 spending $2.472T

2011 revenues $2.303T 2006 spending $2.655T

2012 revenues $2.450T 2007 spending $2.728T

2013 revenues $2.775T 2008 spending $2.982T

2014 revenues $3.021T 2009 spending $3.517T

2015 revenues $3.249T 2010 spending $3.457T

2016 revenues $3.335T 2011 spending $3.603T

So all it would take to get back in the black (or fairly close to it), so to speak, is to assume that right now we have a big enough government spending enough money--if we don't have a big enough government now, we never will--and say "freeze it". Don't allocate another penny in budget for next over this year, not even for inflation. Hold that course for a mere five years and let revenues catch up.

No big cuts needed, no new taxes needed. Just the fortitude to say enough is enough.

Yes, and if we had that fortitude, we wouldn't be here in the first place.

Once borrowing contributes significantly to spending levels in a democracy, outside of an existential threat like a war, it appears to me that it's politically impossible to rein it in. I think we only delayed things as long as we did due to the political power of the generation who came through the Great Depression, and were fanatically hostile to borrowing.

I only mean that the fortitude to "not spend more" should reasonably be less difficult to muster than the fortitude to make actual cuts.

Isn't $4T of government enough?

Not for Alexandria Ocasio Cortez.or Bernie Sanders. I think they're looking to spend around $10 trillion per year.

In the last year for which data is available, 2011, the highest marginal tax rate was 35%. This rate was paid on AGI above $379,150. Certainly someone with AGI over that value is in the well-to-do category, but may not be "millionaires and billionaires" (OTOH Pres. Obama seemed to think income of $250,000 equates to "millionaire", but this is immaterial to my point). According to the IRS, the number of returns that were in this highest marginal rate was 922,346. So there's nearly a million households in this country that are, at least by the IRS bracket definition, "rich".

According to the IRS, the cumulative amount of AGI subjected to this highest rate was $554,356,113,000, so let's round up to $555B. The taxes generated on this money is therefore $194B. The overall effective rate for these returns (taxes paid / income) was 29.2%.

Let's assume for a moment (no matter how unrealistic the assumption is) that no one affected would change a lick of their income-generating behavior as a result even if we raised the top marginal rate to 100% and confiscated all monies above the $379,150 bracket threshold. How much revenue would that generate? Why, all of $555B, if no one modified their behavior in any way that affected their income and tax impact. That is, it would generate an additional $361B in revenue relative to the 35% bracket.

If you added that $361B to the 2013 revenue pot, the deficit for 2013 would STILL have been $319B (2013 deficit was $680B).

Not sure why I used 2013 deficit instead of 2011 (the year for which the tax data applies).

The 2011 deficit was $1.3T. So the last sentence above should be

If you added that $361B to the 2011 revenue pot, the deficit for 2011 would STILL have been $939B (2011 deficit was $1.3T).

"Gosh, I guess they just won't cut spending, so they better raise taxes" -- that's a terrible attitude.

"Both parties are committing fiscal suicide, but before then let's get one of those parties to commit political suicide."

Because once the (R)s are out of power the (D)s are darn sure going to get fiscal religion...

Yep.

Totally logical.

Well, it IS logical, if your only goal is to kill off the Rs, and put the Ds back in power.

The question is why a supposedly Libertarian publication would have that as a goal.

Political reality is that spending cuts will happen one day after financial collapse and our creditors cut us off. Not one day sooner.

Eric Boehm provides no evidence that he understands how our monetary system works, from an operational standpoint. I don't mean to suggest that the federal debt won't ever harm our living standards - but living standards are really what it comes down to. The federal government cannot run out of money in our fiat currency system. The risk is inflation, not solvency. Will we find ourselves in a painful cycle of hyper-inflation if/when the federal debt reaches 200% of GDP? Perhaps - but it hasn't happened in Japan - a country with a monetary system much like our own. Japan's federal debt-to-GDP ratio is around 250% - and hyper-inflation is no where to be seen. I appreciate the Libertarian views on the many reasons the federal government should be smaller - and Libertarians certainly continue to do a better job than Republican "conservatives" when making articulate cases for why the private sector would do a better job at meeting so many public needs compared to the dozens and dozens of ineffective federal programs. The federal debt by itself does not tell us much. How the money is spent, what level of economic growth is occurring, and whether or not living standards are improving or at least stable (not just for the upper classes) tell us much more.

I'm confused. Am I still on Reason, or did a non-libertarian take over this website? Are we suddenly opposing the tax cuts because we oppose Trump and anything he would do?

How are the impacts of higher growth rate thanks to tax cuts being calculated? Some people are saying it's nearly a wash ? we have 4% growth instead of 2%, and that might pay for the cuts, or very nearly so.

The solution is clear - the recent tax cuts must be rescinded!

It seems that both parties like to refer to Kennedy's tax cuts as examples of how cutting taxes will spur economic growth and reduce unemployment, while also actually increasing tax revenue.

Problem is, they keep cutting rates from the previously cut rates. When Kennedy proposed a tax cut, the highest marginal individual tax rate was 91%! He cut that rate to 70%. Then Reagan cut it to 39.6%. See? You can't just keep cutting the tax rates and not cut spending also.

I agree with Trump trying to get illegal immigration and stupid legal immigration under control. However, cutting taxes again--especially the estate tax (when studies have proven that high estate tax increases personal spending by the rich), while increasing government spending, can only lead to economic disaster. Now he follows up with proposing a new branch of the military? Just what we need: Another huge military bureaucracy with an unlimited budget. At least Reagan's SDI was mostly smoke and mirrors. A Space Force? Oh craaaaaaap!

You do understand that the Reagan amd Kennedy tax cuts cannot be directly compare in this manner, right? Given that the available tax deductions were vastly different in each situation, and that the nominal rates laid weren't anywhere near 90% for anyone during the Kennedy period.

Apparently, you don't earn enough to pay the federal income tax. "Nominal" tax rates are bullshit for the uneducated. The MARGINAL tax rate was 91% until Kennedy's cuts. That means the tax bracket, or the highest rate paid by that taxpayer. Even Bill Gates pays the very lowest tax rate on his first dollars of taxable income, and goes through each bracket on additional dollars.

He SAID what you "corrected" about the Kennedy and Reagan tax cuts, You display the pomposity and ignorance of Trump defenders, by lying about tax cuts that were actually effective. Are you even aware that you've essentially defended that Trump's tax cuts will be a dead loss to the Treasury, and our debt?

Or your an Alex Jones sock.

If I'm reading you correctly, I'm getting that you have no idea what an effective tax rate is... If you take a 50% rate, but allow say 50 different deductions, that gets your effective rate down to 25%... Versus having a 25% tax rate with zero deductions allowed... IT'S THE SAME FUCKING DIFFERENCE.

Kennedy and Reagan both got rid of a ton of deductions. So while the stated maximum rate came down a ton, the effective rate people paid didn't come down nearly as much. It DID come down, but it wasn't cut in half or whatever.

If you think that's how it works, you're showing your ignorance. Trump did the same thing, but to a lesser degree. He lowered/eliminated some deductions, while lowering the stated rate, but the cut isn't nearly as big as just comparing the rates without considering that many deductions were reduced/eliminated.

I never mentioned effective tax rates.

And nobody said it was cut in half. which would be stupid.

The entire concept of a flat tax is zero deductions for the the lowest possible rate. That means eliminating deductions and lowering the tax rate. duh.

Now, stop your damn progressive babbling and tell us WTF a "nominal" income tax rate is.

It's Shitlords who confused the two. Pay attention.

I never mentioned effective tax ares, so you're as big a fool as your other sock.

It's the Shiotlord who confused the two.

Or are you full of shit, too, that ANYONE ever said effective tax rates were 90%???

Are you both Alex Jones socks?

It's also called equal taxation, proggie.

You and Last of the Shiheads can defend your love for progressive tax rates, but it's still bullshit.

The reporter is evidently unaware that CBO by legislative fiat is prevented from dynamically scoring budget forecasts...

Yeah, but the puppets believe that tax revenues "skyrocketed" after the Reagan tax cuts, which is a lie.

Plus, he copied Kennedy's exactly. "Across the board, top to bottom, business and corporate," Kennedy.

Nah, that isn't right. In fact, it's the kind of bullshit some crackpot might spout. A real loser. With no sense of reality, and absolutely no libertarian bona fides. Like that Michael Hihn asswipe.

I quoted Kennedy. Reagan ran on an across the board cut of 30%. They each had a special incentive for new investment, Kennedy's was was 7% Investment Tax Credit (ITC) on top of depreciation. Reagan's was accelerated depreciation (ACS) and kept Kennedy's ITC.

After WWII all our trade competitors had been bombed into rubble, so they repealed their New-Deal type taxes for pro-investment tax codes. We stayed with FDR's shit, and our industrial base got smothered. Five back-to-back recessions in only 13 years, 1945-1958. Kennedy first SOTU described the damage. We had fallen from the only industrial base on earth to "near the bottom" in economic growth. Unemployment was the highest since the 1930s (in 1961) and employment had not reached the pre-1958 levels. We were flat on our back.

Reagan's was worse, with a 21% prime rate and a 70% stock market crash. The two tax cuts, Kennedy's and Reagan's launched the only postwar booms,

Just like Bush2, they're re borrowing trillions to buy vote, because they are "entitled" to steal from their own children and grandchildren.

They control Congress and the White House, no excuse for not cutting spending.

Democrats borrow trillions to pay for free stuff.

Republicans borrow trillions to pay for free tax cuts.

Both loot the Treasury to buy votes,

"Democracies prosper, until the majority learns how to vote itself ever-larger subsidies, paid for by taxes on others."

The DEBT is not the DEFICIT. And the DEFICIT is not the DEBT.

Government BORROWING drives up the debt, not government SPENDING.

The solution to our debt problem is simple: STOP ISSUING DEBT-BASED MONEY! Begin issuing pure "unbacked" fiat money to fund the deficit, rather than going further into debt. The inflationary impact of unbacked dollars is no worse than the inflationary impact of the same amount of debt-backed dollars. Issuing unbacked dollars will halt the increase in the national debt and its crushing $430 billion in annual interest. Paying off part of the maturing debt each year and rolling over the rest will eventually bring the national debt (and its taxpayer-financed interest payments) down to zero. See http://www.fixourmoney.com .

But spending wasn't cut to offset your little handout.

As always, paying less tax = handout.

The crazy right says "my money" = trillions of debt forced on their own children and grandchildren. Conservatives were never so stoopid.

When he's a geezer, he'll steal THINGS from his grandkids, also claiming they are "my things."

Conservatives were never so stoopid.

Or so crazy.