Shocker! American Steel Prices Spiked in April.

Hmm, I wonder why....

In the days and weeks after President Donald Trump slapped 25 percent tariffs on imported steel and aluminum, it was widely reported that American steel-consuming companies were bracing for higher prices. Some said they were already seeing those higher prices reflected in contracts to purchase steel from suppliers, but no one was sure how significant those price increases would turn out to be.

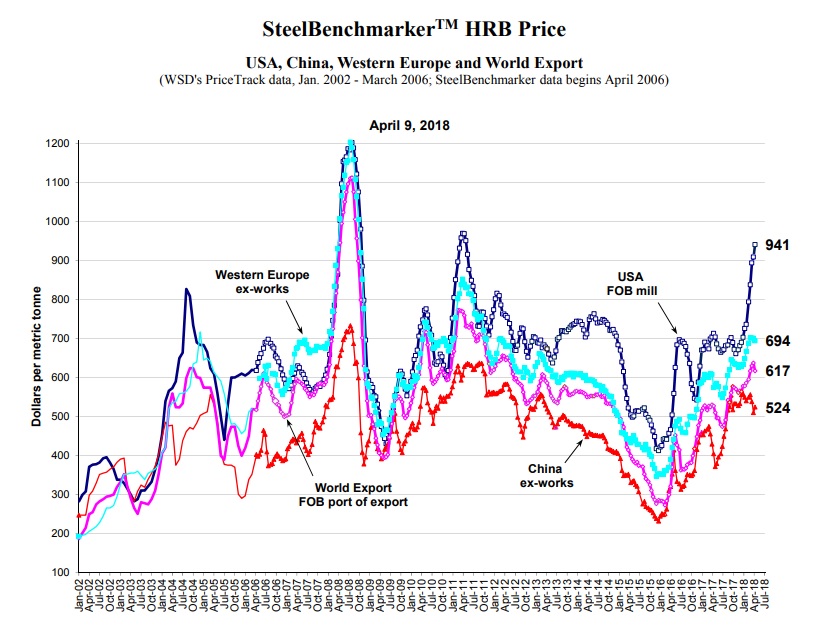

Now, a little more than six weeks since the tariff announcement, we have a better picture of the consequences of Trump's trade policy. It looks like this:

This chart—published by SteelBenchmarker, a firm that tracks the price of the commodity across different markets—shows the average price (in dollars per metric tonne) of hot-rolled band (HRB), one of the most commonly used types of steel. The dark blue line represents the United States' average price, while the light blue represents the price of steel produced in Western Europe, the red line represents China, and the pink line shows what SteelBenchmarker refers to as the "World Export" market: steel produced in other places, including Japan and South Korea.

The chart is notable because it shows how American-made steel has fluctuated in price relative to foreign-made alternative supplies. It's pretty plain that American steel historically has been a bit more expensive than steel made anywhere else in the world, but also that the price of American steel typically follows the same ebbs and flows as other markets. That's because steel is a globally traded commodity and price fluctuations in one place are going to affect pretty much everyone equally.

Until the last few weeks. American HRB steel has skyrocketed in price while steel made in other markets has experienced only a slight uptick.

The same is true for cold rolled coil (CRC), another common form of raw steel. According to SteelBenchmarkers, American CRC steel has seen a dramatic increase in recent weeks and is now priced more than 50 percent higher than Chinese or European options:

Is this good news for American steel manufacturers? Well, they are now able to charge higher prices for their product. But steelmaking is a relatively small part of the American economy. According to 2015 Census data, steel mills employed about 140,000 Americans and added about $36 billion to the economy that year, but steel-consuming industries employed more than 6.5 million Americans and added $1 trillion to the economy.

As a result, a large sector of the American economy—businesses that consume steel to make everything from beer kegs to automobiles—are stuck with a difficult choice. Buy cheaper foreign steel and pay 25 percent import taxes to the federal government, or turn to American suppliers and get stuck with a significantly higher purchase price.

"We see hot rolled steel up on average 30 percent on foreign and domestic pricing. No one is leaving prices 30 percent below an artificial market price," says Mike Schmitt, CEO of The Metalworking Group, an Ohio-based parts manufacturer.

Schmitt says he's also worried about American steel producers being able to keep up with demand. One large order from a domestic mill has been delayed several times already. "We don't even have a firm date," he says, "but it will be at least 6 weeks late."

It's not easy to bring additional steel production facilities online, so increasing supply (to reduce prices, or at least to ensure everyone is getting the steel they need) is not a immediately available remedy.

It's also worth noting that Trump's steel tariff applies only to steel in a raw or unprocessed form. American businesses that turn raw steel into, say, steel wheels for use on trucks and RVs have to pay higher prices for their supplies, but a foreign competitor that makes steel wheels and ships them to the United States does not. A trade policy that was intended to protect some American businesses from foreign competition ends up giving other foreign businesses a huge advantage over American ones.

That's exactly what's happened to Americana Development, Inc., which employs about 400 people in three states making steel wheels for trucks, RVs, garden equipment, and the like. Jeffrey Pizzola, the company's COO, tells Bloomberg that his company is paying 25 percent more for steel, something that creates "an unfair price advantage for Chinese companies that sell finished steel wheels" into the United States. Unless something changes, Pizzola warns that his company will have to reduce staffing or production.

They likely won't be alone. A projection released by the Trade Partnership, a Washington-based pro-trade think tank, says Trump's steel and aluminum tariffs will cause 146,000 net job losses—five jobs lost for every job gained. Even protectionist think tanks like the Coalition for a Prosperous America project a net decline in American jobs as a result of tariffs. The only point of disagreement seems to be how bad things will get.

Tariffs don't merely misalign economic incentives. They screw with political incentives too. Faced with what it sees as "unfair price competition" from China as a result of American tariffs, Americana Development is one of several companies now petitioning the U.S. Trade Representative to impose more tariffs on imported goods.

"All we're asking is that the table be leveled and the field balanced so the competition is fair," Pizzola tells Bloomberg.

There is an economic cost to protectionism, and it is spelled out plainly in the price of hot-rolled steel. The moral cost is more difficult to calculate.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Like corporate tax cuts, tariffs should only be reduced if there is an equal expenditure reduction. That's how consistency works.

Sure, but neither party supports spending reductions but one party does support corporate tax reductions and they happen to be in control right now.

President Obama did voice support for corporate tax reductions during his administration. This might have been more lip service than anything, but it may be unfair to say that all elected Democrats oppose corporate tax cuts.

President Obama voiced support for the concept of corporate tax cuts during his tenure

Or you could...not enact new tariffs. But that would fuck up your Trump apologism.

Or you could...not make the ridiculous case that tax cuts without expenditure reductions are terrible, while low tariffs without expenditure reductions somehow doesn't make you a hypocrite and your argument sound absolutely stupid.

FYI- I support tax cuts and oppose tariffs. Another fail Rataxes

I've given this some thought, and I'm thinking that the pre 16A revenue model for the feds, tariffs and alcohol taxes, wasn't such a bad idea. You can avoid those taxes if you really want to. Don't drink. Don't buy imports. You don't pay federal taxes. I know it's a pipe dream, but if income taxes and other taxes were abolished, and the feds were limited to tariffs and taxing booze, I think that would be a whole lot better than taxing productive behavior. This is after I just got a raise, and managed to keep only sixty cents of every new dollar added to my paycheck. That shit will piss anyone off.

Corporate taxes are virtually indistinguishable from tariffs. The cost of both are either passed on to consumers, workers, or shareholders, depending on the elasticity of the product.

The politically convenient attempt by others to try to separate the two and suggest that one is somehow more devilish than the other and only one needs to be offset with expenditure reductions is the height of hilarity.

How the federal government gets funded is a different conversation. They should probably just be able to survive off of sin taxes and mineral right payments. Of course that would require a drastic reshaping and reduction of the federal government, which is really what the focus should be on.

Corporate taxes are virtually indistinguishable from tariffs. The cost of both are either passed on to consumers, workers, or shareholders, depending on the elasticity of the product.

All taxes on businesses are passed onto consumers. Businesses don't pay taxes. Their customers do. Customers pay for everything. That's something people on the left cannot comprehend. They think they can stick it to the rich corporations without having an effect on the people who buy their goods and services. Similarly the right seems to think they can stick it to foreign exporters without having an effect on the people who buy stuff.

Of course that would require a drastic reshaping and reduction of the federal government, which is really what the focus should be on.

Speaking of pipe dreams.... Barring some significant event, I doubt that will happen. Everyone wants less government, as long as it doesn't affect them. Thing is, any cut in government means someone loses their job or their benefit. And no one wants to lose what affects them. Any cut will affect someone, and that someone will raise a stink. Whoever proposes it will get stuck with the political fallout. Whoever opposes them will be put on a pedestal.

I agree that that is what the focus should be on, but as a practical matter it's pointless.

Realize there is a sizeable population, maybe even a majority of the population at large, that don't want smaller government. They like other people paying for their services.

I've considered the same thing. Of all the bad ways to steal another's productivity, the more voluntary choice built into the process, the better the results ought to be.

Might I suggest an evolution? Crowdfund gov. It's the logical step after tariffs and vice taxes. Let them Kickstarter these social experiments if they think it's so important.

I mean, hey, if we're dreaming pipe dreams, right? I think the point is they don't want us to have a choice in the matter. It's less profitable for those who would rule everything the light touches. But we can dream.

"That's something people on the left cannot comprehend"

And some libertarian publications

Trade isn't productive behavior?

Trade isn't productive behavior?

It is in that it allows comparative advantage to result in creative destruction. However that's not the same as taxing income, as taxing work, as taxing people who produce stuff. I know it's splitting hairs, but trade doesn't produce in the literal sense. That's what I meant.

All taxes stink. That's a fact. But like the guy on the hundred dollar bill (who is not a dead president) said, you can always count on death and taxes. Best to make the taxes as least destructive as possible.

It is EXACTLY the same as taxing income and people who produce stuff.

1. When I, as an importer of steel, artificially pay more for steel I pass it on in my products. Price of product goes up, demand goes down. I adjust suppy to meet demand. My business suffers and less wealth is created. EXACT same effect of a corporate tax.

2. As a consumer of imported steel I can now purchase less of it. My dollars buy less, it may as well be a direct income tax. The only difference is that the payment to the government is hidden so the politicians don't take the heat.

ALL TAXES inhibit productive behavior.

ALL TAXES inhibit productive behavior.

Fair enough. The optimal solution would be no taxes, but that isn't going to happen. The people with the last word in violence will always use that power to steal. After all, who helps you when the people who are supposed to help you steal from you? No one.

So when given a choice between taxes on personal income, corporate income, or imports, I think imports is the least destructive choice. Not only that, but it's almost legitimate. After all, the government polices the borders. The government enforces property rights. Tariffs are almost like a toll on goods crossing the border that the government enforces. Whereas I see no legitimate claim on income, be it personal or corporate, because the government has no role.

First, unless you are an anarchist, there will be taxes. So let's assume that's a given

The problem with taxes is that the government manipulates them such that it buys votes with them. That leads to two problems. One, it divides the citizenry by pitting groups of tax dollar recipients against each other when they should be focused on keeping it away from government. Two, it incentivizes government to spend more dollars to buy more votes. Hiding the taxes benefits government as it insulates politicians from blame.

The correct way to tax is to take the annual budget and divide by the population. THAT is your share. It has the following benefits:

1. It's up front and out in the open. This is the price of your government services. If you don't like it, vote for fewer services.

2. Assuming all citizens have equal access to government services, it is completely fair (provided government is providing only for the legitimate function of protecting the rights of the citizenry).

3. It inhibits the growth of government as any increase in spending impacts the poor first. Suddenly, the poor become the demographic of smaller government.

I figure the Feds could run this country on about a trillion a year if they were only protecting rights. That comes to about, a very affordable, $3250 per person per year.

$3250 a year might be a large burden for people with no access to education, roads, or sanitation.

Now do tax cuts, Tony.

Huh? Someone just seriously argued for not only a flat tax but a lump-sum tax and justified it with "Stuff will probably be cool and stuff, whatever."

Trade absolutely does produce utility and produces resources by making them available. Otherwise nobody would trade.

Or you could...not make the ridiculous case that tax cuts without expenditure reductions are terrible, while low tariffs without expenditure reductions somehow doesn't make you a hypocrite and your argument sound absolutely stupid.

It doesn't, because, again, they're not calling for lowering tariffs.

What?

That doesn't follow at all. It's not like Trump lowered tariffs without cutting spending. He increased tariffs!

Yes, he did. What I am saying is that every time corporate tax cuts were discussed the fact that it would increase the deficit was also the main crux of the article. I haven't seen one mention about revenue increases from tariffs. If fiscal responsibility is really more important than reducing taxes then why the disconnect between tariffs and corporate tax cuts?

For the record, once again, I am not defending the tariffs. I'm opposing the notion of treating tariffs differently from corporate taxes.

Let me pose this question to you, then. Which hurts the economy more, corporate taxes or tariffs?

Both. They are essentially the exact same thing. Both taxes (tariffs are literally a tax) are paid for either by consumers, workers, or shareholders depending on the elasticity of the product. Is this even up for debate? These are basic economic principles

The Trump administration almost completely canceled out the benefits of corporate tax cuts by imposing tariffs.

THIS!!!111tenplusone111!!

I disagree. Tariffs are worse. They hurt all would-be purchasers of the good in the country, while corporate taxes hurt only customers of the corporation, or the workers, depending on how the cost is passed on. Furthermore, tariffs often result in trade wars, which have further damaging effects on other goods. Of course, both are terrible for the economy.

I don't deny that the threat of a tariff war is a possible argument for tariffs being worse, but only because of its effects on foreign relations. However, the damage done to the economy for both is the same.

Corporate income tax is at least supposed to be applied equally to all producers. Granted, various tax distortions can alter that, but tariffs by their very nature distort not just by taxing, but by taxing selectively to achieve specific market outcomes. Their very purpose here is to alter the competitive balance in certain industries.

Do you not realize that we still have tariffs for certain industries?

Try as you might a tariff is a tax. And a tax is a tariff. You can't get around opposing one while being disinterested in reducing the other.

Yeah, what is your point? How is that relevant to what anyone was arguing?

The way we are using the word tariff, a tax is not not necessarily a tariff even if all tariffs are taxes. Rectangles and squares and all. Not every tax has the same economic impact, and economists recognize this. Apparently, you think it's ghastly that some people asses different taxes with different impacts on the budget and the economy differently and that this gives you some sort of purity advantage and moral high ground.

If you want a guess at an answer that's more likely than "cocktail partiez!" then it's probably because of the differences in scale of deficit impact and marginal economic benefit.

As of a few years ago, the entirety of tariffs brought in about $35 billion in revenue. Even before adding in the impact of lost revenue from lower trade, Trump's tariffs would presumably bring in a small fraction of that since they are applied to only a few select items. So we're talking a total drop in the bucket in terms of impact on the deficit for a move that hurts foreign trade and risks trade war escalation.

The tax plan added about $150 billion a year on average for 10 years to the deficit. Some of that would be offset from growth, but even conservative and libertarian think tanks didn't predict most or all of it would be. Additionally, that number was biased downward by some gimmicks like sunsetting most of the cuts near the end of that period while promising they would be extended. $150 billion isn't a majority of the deficit by any means, but it's a substantial portion. Actually looking at the details involved here can provide better explanations than tired rhetoric about how everyone who supposedly isn't as libertarian as you is in it for the cocktail parties.

Also, there were plenty of articles addressing positive aspects of tax reform. De Rugy alone must have written a half dozen at least.

"As of a few years ago, the entirety of tariffs brought in about $35 billion in revenue"

You invalidated your own point. Our corporate tax rate was above average, in comparison to the rest of the industrialized world, while our tariffs were below average, in comparison to the rest of the industrialized world. So, of course tariffs would bring in less revenues. Obviously, we could bring in enough revenues from tariffs to compensate for having no corporate income tax (we use to do it that way).

What I am arguing, again, is that deficit concerns are only ever brought up when it came to corporate taxes. I didn't hear of any deficit concerns with regards to TPP or NAFTA or any free trade agreement ever.

Could we? In the days when tariffs were the primary source of federal revenue, outlays were less than 5% of GDP. Today that number is around 20%. Also, what's your source for tariffs being lower than the rest of the industrialized world?

I'll go over this once again and see if you can actually grasp my argument this time. Regardless of how we got revenue 100 years ago or what the raw amount of revenue brought in by what source, the impact of the deficit brought on by the changes you list (Trump's tariffs, NAFTA, TPP) are a drop in the bucket compared to the recent tax plan (which wasn't strictly about corporate tax cuts anyhow). Thus, do you not see how one could feel the marginal budget impact of the tariff changes you cite does not outweigh its economic costs, but that the opposite could be true of the tax plan that had a much larger impact on the deficit?

And if they feel that all else equal the corporate income tax is a preferable way to raise revenue compared to tariffs, so what? Plenty of economists would agree with that argument.

To sum-up the nonsense that I am saying: Let's divorce the topic of tax reduction (and tariff reductions) from the topic of expenditure reductions.

Reducing taxes is not creating a deficit. Spending is creating a deficit. The old saying holds: "we don't have a revenue problem- we have an expenditure problem". And trying to appease our betters by reflexively opposing something done by an unpopular administration (even though we should be supportive on principle) by confusing the topics of deficits and revenues is counter productive and statist.

FIN

(please insert ad hominems below)

You cannot separate revenue from deficit entirely. It is true that you can have avoid a deficit at any level of revenue, which is not true for spending, but the two are nonetheless related. Ceteris paribus, reducing revenue will increase the deficit. It's entirely fair to question how much people who claim to care deeply about the debt actually care when they reduce revenue by hundreds of billions a year while making no attempt to reduce spending at all. In fact, this Congress has increased spending significantly. If we could assume that there would be separate action on the spending side to offset any impact on the deficit from revenue-reducing policies, then your point would hold more weight. But any serious observer knows that isn't being considered at all, and that as such the end result of a bill like the tax plan will inevitably be higher debt.

People are allowed to make judgments about the relative costs and benefits of adding to the deficit and reducing taxes, and obviously the numbers involved and the type of tax will play into that calculation. Your argument seems to be that if you felt the benefits of the tax plan were outweighted by the cost of adding $1.5 trillion to the debt in the next ten years, then you must support any tax increase regardless of what the tax is, how big it is, how much revenue it will bring in, etc.

Going off that point, I would also argue that tax increases and tax cuts should not be seen the same way when it comes to predicting how it will alter Congressional behavior. Tax increases provide politicians with easy justification for increasing spending, thus wiping out any potential benefit from deficit reduction. I think it's pretty clear at this point that tax cuts don't give Congress motivation to cut spending. I think the spending trajectory under JFK/LBJ, Reagan, Bush, and Trump in the wake of tax cuts shows that.

What tariffs have been reduced?

How much revenue is the government pulling in from these new tariffs, and what programs is that money going to fund? I'm not sure revenue is the actual point of them.

"How much revenue is the government pulling in from these new tariffs, and what programs is that money going to fund?"

Does the federal government have specific expenditures funded by corporate income taxes? No. So, what is the difference that you are trying to draw here other than it's politically convenient to oppose corporate tax cuts with a nonsensical caveat that expenditure reductions must be coupled with cuts in the tax rate, while no such justification is made for reducing tariffs.

Let me just say that obviously Trump's tariffs have nothing to do with fiscal responsibility, but neither do the arguments against corporate tax cuts.

While I'm waiting for you to actually address my question, I'll add another one: who is arguing against corporate tax cuts?

Your previous question made no sense. Please rephrase. And this question is ludicrous unless you haven't read any of the articles concerning the reduction in corporate tax cuts

How much revenue are Trump's tariffs generating for the federal government?

Who's arguing against corporate tax cuts? I'm pretty sure there were some Reason writers complaining about Trump's exploding deficits from the angle of decreased revenues rather than increased spending. I'm also pretty sure there were a few of the commentariat here who pointed it out. I'm also also pretty sure that this is exactly what Just Say'n is just say'n - it's pretty hypocritical of a publication that criticized Trump for irresponsibly cutting revenues to now be complaining when he's raising revenues.

Yes.

This is entirely wrong. The complaint by Boehm and Suderman (not Reason itself, as the other writers were pretty cool with it) was that because there was no spending cut the government would just end up increasing taxes again by borrowing from the future. They weren't against the tax cut or decreased revenues; they were against the accompanied increased spending and inevitable tax increases.

"The complaint by Boehm and Suderman (not Reason itself, as the other writers were pretty cool with it) was that because there was no spending cut the government would just end up increasing taxes again by borrowing from the future."

Because if there was no spending cuts with free trade agreements then the government would just end up increasing taxes again by borrowing from the future.

This is a bad attempt to justify the illogical position of tax cuts problematic, but tariff reductions totes fine.

They didn't say that the tax cuts themselves were problematic; the refusal to decrease spending is the problem.

Dude, I think you should just stop defending Trump's tariffs before you dig yourself an even bigger hole.

You clearly haven't read anything I wrote at all

Ok, you made it clear above you are not defending the tariffs. My apologies.

I don't accept that. You must respond with an ad hominem otherwise you are lying. Bastard

Revenue?

It's about protectionism and buying votes.

Yes. And arguing against corporate tax cuts is about cocktail party invitations

Just Say'n,

What would your response be to the argument that a tax cut without a spending cut is not really a tax cut, just a tax deferral (with interest)?

I'd say that's a point that could also be used against tariff reductions.

In that case, you must acknowledge that it would be a consistent argument to be opposed to both tax cuts and tariff repeals without reductions in spending, but to be in favor of repealing tariffs alone for non-financial reasons, such as the deleterious effects that tariffs specifically have on trade, or the manner that Trump is using tariffs to conduct foreign policy. No?

If anyone would want to do a point/ counter point on this topic with me we could probably get the argument printed at Glibs (they'll print anything).

I guess the argument would be: "The Logic Behind Demanding Tax Cuts Be Coupled with Expenditure Reductions Versus Reducing Tariffs without Accompanying Expenditure Reductions"

...but nobody demanded that...

Start winning $90/hourly to work online from your home for couple of hours consistently... Get standard portion on seven days after week start... All you require is a PC, web affiliation and a litte additional time...

Read more here........ http://www.profit70.com

Let's stick with math. Start mixing up math with "right and wrong, good versus evil" and everyone gets all distracted and upset.

Politics is a jobs program for very self-confident people too stupid to grasp basic economics and too unattractive to go into show business.

"The first lesson of economics is scarcity: There is never enough of anything to fully satisfy all those who want it. The first lesson of politics is to disregard the first lesson of economics."

-Thomas Sowell

Being unattractive didn't stop the President from going into show business.

True

Even though he did eventually end up in the Hollywood For The Ugly.

No, THIS is a shocker: | | ? \

That doesn't look like anything to me.

It's clearly a cow angled and titled such that its front legs in the foreground but the back legs are splayed.

That's "The Shocker"...

I'm coming around now to the whole point of it being 5d chess to squeeze the Norks into peace talks.

Based upon where we get our steel, I gather that we are trying to force the.....Brazilians to the bargaining table. We should just kidnap Pele and really stick it to them

Was there also an imaginary gas tariff?

Maybe higher prices will cause producers to increase the supply, thus reducing the price? Or is this like the labor market and the laws of supply and demand no longer apply because PRINCIPLES!!

Are they currently failing to meet existing demand?

So we shouldn't have been worried about price spikes in fuel for the later Bush years and early Obama years? Or healthcare or university tuition for the last twenty years? Housing in 2008? Price spikes caused by government action are perfectly okay in your world, since the market will do its best to smooth it over.

of course an improving economy with higher demand has nothing to do with it.

Has the economy improved so much in the last few months that it produced an unprecedented sudden massive spike in the price that totally diverged from foreign steel?

addd the two together nothing exist alone

I think what you mean to say here is that with a stroke of his pen (and it's a yuge pen, just fantastic, a world-class pen, everybody has said it's the best pen they've ever seen, believe me) Trump has just increased the value of American steel. A ton of steel that used to be worth $580 is now worth twice that much. YOU'RE WELCOME!!!

We're talking about tariffs that were actually implemented, right?

As opposed to soybean tariffs and a tariff on Boeing's aircraft--which have not been implemented?

Right?

Someone correct me if I'm wrong!

We're talking about the market anticipating the effects of the proposed tariffs. Obviously, a lot of people haven't yet figured out that Trump lies like a motherfucker and you can't trust a single word that falls out of his fat face.

People here are giving Trump a lot of latitude because he lies that we didn't (and shouldn't) give Obama because he lied. When Obama threatened to go after guns, corporate profits, reparations, and a host of other issues that never materialized we didn't bother pretending that it was some ploy and proceed to look smugly at the people who were concerned.

Even if Trump were doing this as some ploy he wouldn't hesitate to actually implement these tariffs if he felt it would be popular. The only way to prevent these tariffs is by showing it as and making it unpopular; not by pulling a Ken and writing 15 paragraphs about why we're not worried.

People here are giving Trump a lot of latitude because he lies that we didn't (and shouldn't) give Obama because he lied. When Obama threatened to go after guns, corporate profits, reparations, and a host of other issues that never materialized we didn't bother pretending that it was some ploy and proceed to look smugly at the people who were concerned.

Even if Trump were doing this as some ploy he wouldn't hesitate to actually implement these tariffs if he felt it would be popular. The only way to prevent these tariffs is by showing it as and making it unpopular; not by pulling a Ken and writing 15 paragraphs about why we're not worried.

"We're talking about the market anticipating the effects of the proposed tariffs."

You mean except for the fact that Boeing and soybeans were both trading higher than they were before Xi announced the tariffs against them?

That's different from tariffs that are actually in place--because there's little uncertainty about tariffs that actually in place being implemented but obvious uncertainty regarding the likelihood of Xi retaliating against soybeans and Boeing aircraft. That's what you meant, right?

Yes, steel prices spiked in April. That's the tariffs working as intended. That's the price signal to producers to invest in new production capacity. It's a cost that the proponents of tariffs believe to be balanced by long term benefits.

Now, whether you believe that the arguments for tariffs are valid or not, if you want to disprove them with numbers, you need to show the right numbers and look at the right time scale.

Steel producers are not investing in new production capacity due to a tariff. As always, there will be lip service, but that is to get a few extra months of artificially inflated prices. Steel mills are multi-decade investments. Time scales are indeed important. You seem to be ignoring the lead time necessary to build new production capabilities.

That is certainly my assumption. But...

Which is exactly why you can't look at April's data and say "see, the tariffs didn't work".

So far, the data agrees with what both proponents and opponents of tariffs agree should happen, which means that the data is irrelevant to the question of whether the tariffs work as intended or not.

context from the report

USA ? $955 per metric tonne ($866 per net ton), FOB the mill ? up $14 per tonne from $941

($854 nt) two weeks ago, up $543 from the recent low of $412 ($374 nt) on Dec. 14, 2015 and

up $526 from the low of $429 per tonne ($390 nt) on May 25, 2009. It is down $15 per tonne

from the recent high of $970 ($880/nt) on Mar. 28, 2011 and down $248 (20.6%) from the

record peak of $1,203 per tonne ($1,091 nt) on July 28, 2008.

So, the deal is steel users can still buy imported steel at lower cost. which makes this article a NOTHINGBURGER.

This is a very bad application of tariffs IMO. If tariffs are going to come into the equation they should be small and across the board IMO. Basically revenue tariffs. If you're not going to do it across the board, putting it on finished goods also makes a lot more sense than raw materials like steel. Oh well. At least the price of Chinese steel has gone down according to that chart! LOL

So how is the tariff supposed to help? $524/ton*125% is only $655/ton, which is $286/ton cheaper. Current prices? $961/ton for American HRB, $534 for Chinese HRB. 25% tariff leaves China at $667.5/ton. Chinese steel is still much cheaper than American, meaning that price incentive is still there. The US mills raising their prices for extra profit is just screwing over Americans who have to foot the bill for the higher prices. Glad to see Trump screwing over Americans yet again.

I essentially started three weeks past and that i makes $385 benefit $135 to $a hundred and fifty

consistently simply by working at the internet from domestic. I made ina long term! "a great deal obliged to

you for giving American explicit this remarkable opportunity to earn more money from domestic. This in

addition coins has adjusted my lifestyles in such quite a few manners by which, supply you!". go to this

website online domestic media tech tab for extra element thank you .

http://www.geosalary.com