This California City Is Threatening a Family Over Property Fines Sent to a Dead Woman at the Wrong Address

An already awful practice of trying to use code violations as a revenue stream gets truly grotesque.

Not even your death will keep the government of Coachella, California, from trying to nickel-and-dime you out of every last cent. Just ask the family of Marjorie Sansom, who died in 2016 at age 91.

The city levied thousands of dollars in fines on the woman due to code violations on a lot she abandoned. It tried to collect them by mailing bills to an empty house where she hadn't lived for years. Samson, meanwhile, was suffering from dementia and being cared for by her family, which says it never received any of those mailings.

Now the city is demanding that the family cough up $39,000 to cover the back fines and to pay for the cleanup for the empty lot. That's more than the value of the property itself.

Worse still, officials are being dismissive of evidence that the city knew its complaints were not reaching the woman or her family. The government just wants its money.

The whole outrageous story was carefully investigated and reported by Brett Kelman of the Palm Springs Desert Sun. It's a follow-up to a heavily researched piece he published in November, which documented how Coachella and a private legal firm the city had contracted with were abusing code enforcement regulations to extract huge sums from property owners. The city would cite property owners for typical code violations, like having damaged property or for unapproved home upgrades. Months later, the property owners would get massive bills from the legal firm, charging them for the cost of prosecuting them in the first place.

That law firm, Silver & Wright, is in the thick of the Sansom case. It sent the woman invoices (still mailed to the wrong address) demanding thousands of dollars in fines, court fees (even though there were no court hearings), prosecution fees (nobody was prosecuted), and reimbursement to the city for the time spent cleaning up the lot.

In Kelman's story, neither the city nor the law firm shows any signs of worry that they've gone too far. Despite threatening this family with liens of thousands of dollars for fines they didn't even know existed, the city and the firm insist they're doing everything above the board:

When asked to comment on the Sansom's property this month, Coachella officials and a city attorney said that they were unaware of the owner's advanced age, mental state, true address or death at any point during the nuisance property case, but still stood by the actions taken by the city. Luis Lopez, Coachella's development services director, said the city presumed the citations and legal notices it had mailed to Sansom were received—even though they were notified twice by the U.S. Postal Service that the documents were sent to a vacant house.

Lopez also defends holding Sansom's heirs responsible for her debt, saying her legal guardian should have been maintaining her land and that funds collected from the lien would "go towards replenishing the public's money" that was spent to inspect and clean her property. After The Desert Sun noted that a majority of Sansom's debt came from punitive fines, which are not reimbursement of public money, Lopez said the family should still pay because of their negligence.

"The city believes these fines are justified in this case due to the willful, or at least reckless, disregard for the public safety of the community which includes an elementary school as evidenced by the nuisance on the property," Lopez wrote in an email statement.

"Additionally, the fines are justified because there was no 'good faith' effort by the owners or successors in interest to contact the city, pay part of the citations or abate the nuisance."

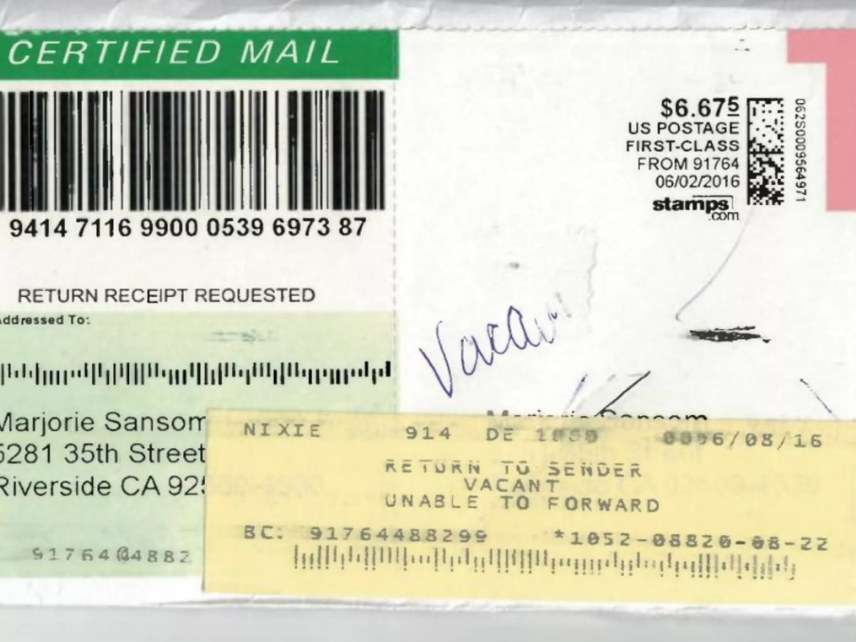

Reminder: The family says they never saw the citations because they were sent to an abandoned house, not to them. Kelman even has a photo of the certified letter that was returned to the city, informing them that the address they were mailing was vacant. The family found what has happening from the Desert Sun itself, which tracked the family down while investigating the city's use of the law firm.

Speaking of the firm, Kelman tracked down Curtis Wright, one of the firm's partners. Wright insisted that the firm and the city did its due diligence to track the woman down. Then he presented this whopper of a quote:

The city doesn't have funds to do a manhunt for everybody who has a code enforcement case on their property. Cities don't have investigative reporters on payroll to find investment property owners.

He's arguing that the City of Coachella (2017–18 budget: $22 million) and his law firm that bills people for thousands of dollars lacks the investigative resources of a Palm Springs newspaper with a daily circulation of 50,000.

Read the sordid story here. Kelman reports that both the Institute for Justice and the American Civil Liberties Union have denounced Coachella's behavior.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Even if the fines were valid, isn't it moot because the person being fined is dead? If someone commits a crime and is a fugitive, their family members don't become responsible for completing their sentence.

I'm assuming the family inherited the property. Could be wrong. If they did not, then they could just tell the city to go take a long walk off a short pier.

Unless I have misread the article, they did. OTOH, unless I have misread the article, the only recourse the city has for nonpayment is to foreclose on the lot, so if they want to walk away without paying the 39 large, they can.

But then it wouldn't be the first time that a city used code violations and/or tax liens to steal someone's land either.

.

Yes, they inherited it as a real asset. I'm juggling this with my mother's house now. Got slapped with a $1000 tax bill a week after her death (sent to her address, not mine). Yes, I am not responsible for that property, so from a legal standpoint this city is in the clear. It's pretty nasty, though. I have a truckload of stuff to do, all of which requires me to take off 9-5 days to conform to the hours of government/bank/DMV facilities - the courts close at 3pm, for example.

Incidentally, my locality is anxiously clamoring for that tax money, and I haven't even had enough time to perform the legal functions needed to free up some funds from her estate. The power bill has also gone unpaid for possibly three months, and curiously my ever-loathed big, bad power company has not cut my heat off yet, presumably because it's freakishly cold, and they'd get skewered by the media and court of public opinion, even though they have every right to shut it off.

*now responsible for that property. sigh. I made one of the worst possible typos.

As I note below:

"A lien or other encumbrance is a claim on the property, not on the person."

Liens and mortgages survive their original makers.

Also:

"If you inherit real estate it is your responsibility to contact any creditors and arrange for satisfaction of any liens or other encumbrances."

The obligation to satisfy a lien and mortgage lasts until it is satisfied or forgiven and an instrument to that affect is recorded in the public record or the county, parish or other judicial district involved.

"of the county, parish or other judicial district involved."

Sound advice. It's become clear to me that I need to hire a lawyer; the process is fairly complex even for a simple estate. I keep going to do things and being told that I need or don't need something new, so it's a little reassuring that even the folks at the banks and courts don't understand the whole process. My tinfoil hat is telling me that this process is intentionally obfuscated to create jobs.

Your tin foil hat is not screwed down tight enough. The process is intentionally obfuscated to create a fine based income stream for the state. They really don't care if the lawyers have a job.

Obviously the solution is for the family to claim they sent the fines and fees to the wrong address.

Organized crime at its finest

Fire up the logchippers.

If they are her heirs and inherited the property from her they are liable for any liens or other encumbrances on the property.

Whoever owns the property now is liable for any liens or encumbrances.

Whether the liens are legal, reasonable or just is another matter.

This was meant as a reply to Stormy Dragon|1.18.18 @ 1:38PM.

It's epic for a local jurisdiction to claim no knowledge of death notices, or any work their coroners office does for that matter. Time to open up civil liabilities for municipal employees that willfully discard due diligence, but then again... farming out tax collection to third parties is all about providing insulation, isn't it? They can't pop down the hall for a records check, and have to suffer the stonewall of process if they are to do the job the city is supposed to. The question is...Who got the extra money? This company abusing taxpayers in coachella is likely making campaign contributions, so it all deserves a RICO case.

IANAL, but I was under the impression that any creditor with a lien on the estate's property have to claim that while the estate is in probate, and that after probate closes, tough noogies.

Not a lien on real estate. A lien or other encumbrance is a claim on the property, not on the person.

What you're talking about is unsecured personal debt. Liens and mortgages live on after death.

If you inherit real estate it is your responsibility to contact any creditors and arrange for satisfaction of any liens or other encumbrances.

The notice the executor of the estate places in newspapers only applies to the personal unsecured debt of the deceased

Incidentally, IANAL either, but this is the kind of thing that should be known to anyone who owns real estate or who acts as the executor of anyone's estate or who is in any kind of business doing, well, just about anything.

My local area does a municipal spam. For about 5 years, the company they outsource tax collection to has sent a certified letter, threatening me with arrest if I don't settle an overdue school tax bill. First time it happened, I assumed me or my wife had been forgetful, wrote another check, and was about to mail it. Thought to ask my wife first. So was sure we'd paid it; and after she drilled into our checks, pulled up the check, cashed, online. Called them the next day. "Oh, we're sorry, must've been a mistake. Ignore the letter."

Couple of years later, the same thing happened. And again. It happened 18 months after we'd moved out of the township.

So presumably, they're dashing off nastygrams to their (government supplied) address list, and since the alternative is men with guns coming to your door, a certain subset of people will just write another check; it's only a couple hundred bucks. They probably net a decent chunk of change off of it. And if they get called on it, "Oops, terrible clerical error." Magically, they never fucked up a property tax bill, which would've had a bank in their face.

Magical, yes? Scamming banks opens federal crimes, and local hacks lose control of their own game when their judges aren't sitting on the bench. Say... why can't the NSA spy on local hacks and make referrals to DOJ, since spying on a presidential campaign appears to be zero problem. Somebody trains local hacks on how to abuse process...

You have a separate school tax on top of the property tax? ugh

Actually, that's pretty common. We have separate city and independent school district property taxes because the boundaries are different. There are people who live in the ISD, but outside the city, and people who live in the city, but outside the ISD.

So, ah, who paid the property taxes all those years? Obviously, that bill went to the right address and got paid. I guess Code Enforcement never checked with Real Property or the City Clerk.

Well, this all looks like an abuse of "process": use some thread of information [knowing it is wrong at the very begining] in the hopes that if things ever go to court they can lie and call it a clerical error, and hope to keep any extra monies created by the malfeasance in the first place. They pick nickel and dime targets knowing that the business of lawyering up and getting the matter into a superior court is so expensive, that people just bend over and pay. In that light, there is a fine line between aggresive administrative action under the law and something needing a RICO case - whatever conspiracy to abuse a certain taxpayer took place, it usually happens before action occurs against a citizen which leaves it largely undiscoverable even for federal agents with wire tap warrants in hand to observe local officials running the scam.

DC does something similar with their speed camera fines and other things. One time I got some summons that I didn't pay enough in some car fee/tax or whatever. They sent it to me in the mail. The "Date sent" on the letter was 2 weeks prior. The postmark was the day before I got the letter. The letter said "we must receive your reply in person or in writing within 2 weeks of this letter being sent," which was the next day. So it was impossible to reply by mail. I dropped what I was doing and went straight to the office to see them in person. When I brought up the bullshit date on the letter and showed them the postmark, they didn't react much. They knew what they were doing, the fucks. They also didn't do shit about it.

I'm pretty sure that most places that have red light or speed camera setups contract them out to private companies.

In general a service is only privatized if the city (or whatever) stops providing that service and leaves it to individuals to deal with.

If they're simply hiring an outside contractor to handle something they formerly had public employees or the police do, it might make for cost savings and efficiency but it isn't really privatization.

Well, the thing I got wasn't a speed camera thing, but I've heard that from others.

Local governments are contracting out all kinds of services now. But it's for efficiency or cost savings (or just plain old cronyism or nepotism) not because of any love for the free market.

Never privatize anything to attorneys.

Because FYTW.

98% of lawyers give the other 2% a bad name.

"Hey, we're all professionals here."

The city is able to presume that the letters sent were received by the addressee in due course because the California Code of Civil Procedure says so.