Here Come Big Budget Deficits!

Thanks to more spending, annual deficits will grow faster than expected.

During the George W. Bush years, the rapid increase in annual deficits and national debt worried a lot of people (including many of us at Reason). Persistent deficit spending is an indicator of unserious governance and allows politicians not just to buy votes but to buy votes that will be paid for by future generations. While there is some difference of opinion at what stage a country's public debt starts to reduce economic growth, even ardent Keynesians agree that large and increasing debt ultimately has that effect.

But in the wake of the Great Recession and the Not-So-Great Recovery, discussion of debt and deficits has gone missing, especially as President Obama has been hailing his ability to reduce annual deficits over the past several years (he tends to leave out the part about reduced outlays due to sequestration and the inability of the federal government to agree on budgets until recently).

Now the Committee for a Responsible Budget is back with bad news. Rising deficits are back, baby. With a vengeance (all emphasis in original):

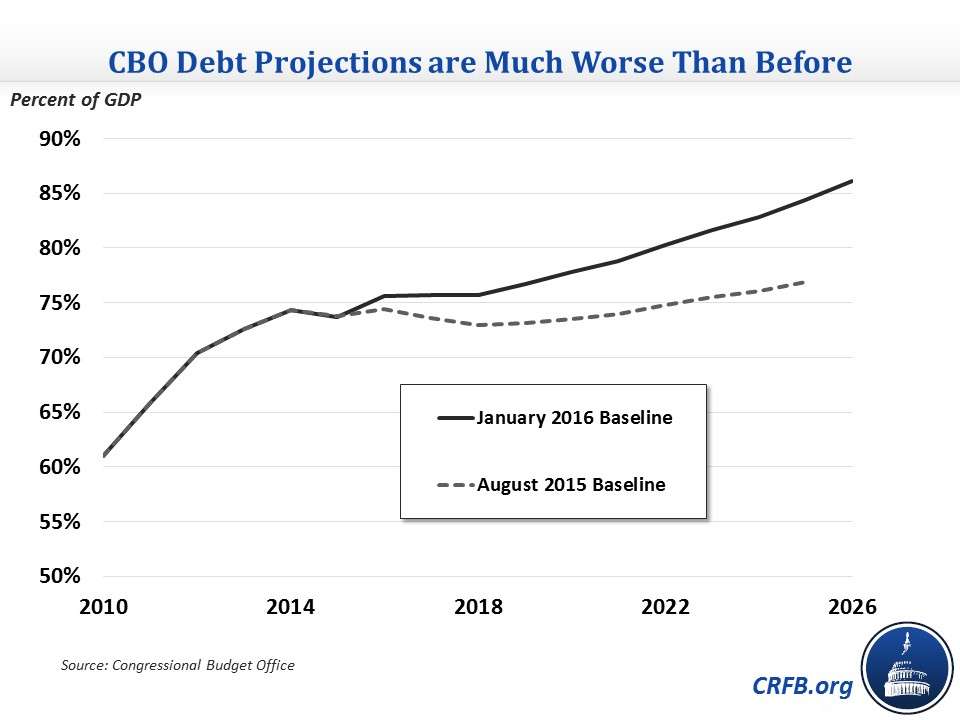

CBO now projects deficits more than tripling, from $439 billion in 2015 to $1.37 trillion by 2026, with trillion dollar deficits returning by 2022 – three years earlier than prior projections.

Debt held by the public, meanwhile, will grow by over $10 trillion from $13.1 trillion at the end of 2015 to $23.8 trillion by 2026. As a share of Gross Domestic Product (GDP), debt will grow from 74 percent of GDP in 2015 – already twice its pre-recession levels – to 86 percent of GDP in 2026. By comparison, August projections showed debt on track to reach roughly 77 percent of GDP, or $21 trillion, by 2025….

The largest driver of this difference is legislation changes, especially the $855 billion tax extenders and omnibus spending package. Total legislative changes appear somewhat lower, driven by gimmicks and baseline quirks surrounding the $70 billion highway bill and the Bipartisan Budget Act. The remaining difference is from a combination of economic and technical factors, especially driven by lower projected economic growth….

CBO shows a worse debt picture than before both because of lawmakers' own doing and other factors. It is clear now that deficits will no longer be in decline as they have been for the past five years, and debt will continue to increase from near-record high levels. The complacency that lawmakers have shown about debt over the past few years must end so they can address the troublesome trajectory of deficits and debt.

And there's this, from Rep. Mark Sanford (R-S.C.), noted fiscal hawk, writing in The Fiscal Times:

In just ten years, there will only be enough money coming into the federal government to pay for interest and entitlements…and nothing else….

it took two hundred years for our nation to accumulate $5 trillion in debt, yet during just the eight years of the George W. Bush presidency, it doubled and moved from $5 to $10 trillion. Now in the Obama presidency, it is doubling again, moving from $10 to $20 trillion. A freight train is coming at us, and we are not discussing it.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Something something debt doesn't matter something something austerity bad something something tax the rich

Oh, screw it. We're really, really, really fucked, aren't we.

Well, yes. Good news is, everyone gets free gubment lube.

The bad news is the "lube" contains course grain sand and pumice. And we don't anticipate any more good news.

Good news, the masochist lobby is good at getting legislation passed!

Oh, screw it. We're really, really, really fucked, aren't we.

Yes. Yes we are.

Help me out here. I know I've seen this, but I can't recall:

The deficit numbers, especially (it seems) recently, are out of line with the increase in federal debt outstanding.

Federal debt has gone up by about a trillion a year every year since 2008 (it can be hard to tell what's going on some years, as they are gaming the fuck out of their numbers. Seriously, we went for months this year without a single nickel of debt being issued, according to the Treasury).

What explains the difference between the "deficit" and the increase in federal debt?

What explains the difference between the "deficit" and the increase in federal debt?

Accounting tricks, mostly with regard to loans.

IOW, "Why aren't we bankrupt yet?"

Were household economic policy valid on a large scale we should have devolved into bartering at least a decade ago. You'll notice that no major presidential candidate even uses this analogy anymore. Well maybe Rick Santorum did at the kid's table, but it's out of general discourse now, for better or worse.

I have not traded in my car for a mule yet. The government must be sucking on something. But what is it?

I have a hairbrained theory that the government has just grabbed the wealth of the SOHO revolution, not making things worse for those who use it, but taxing the booty for themselves. That wouldn't account for all of it, but it's a healthy chunk.

I have not traded in my car for a mule yet. The government must be sucking on something. But what is it?

Other countries' willingness to buy our debt.

The funny thing about the "household analogy" is that it's not wrong for the reason most often cited. There is an analogue for a large debt, it's called a mortgage.

The household analogy isn't wrong, it's really just scale. For instance, everyone laughed when it was suggested fifteen years ago that cities would be going bankrupt if they didn't get their debt under control. Now it's a common occurrence. The point is, there's always a higher authority that can come to the rescue and bail them out.

The only question left is, does this apply to the Federal Government which has the ability to mint the national coin?

Because the national coin isn't backed by gold, but only the full faith and credit of the Federal Government, I suppose it can sustain itself as long as the faith of the global economy remains high. Anyone who thinks a national government can't go bankrupt, one need only look at Europe. It can, and it will, the only question is when?

I think it's sustainable as long as (a) USA has the least-shitty economy and (b) oil continues to be traded in dollars.

Any economists out there to enlighten?

This has something to do with it.

By the way, d3x / dt3, is your handle a self-deprecating engineering joke? If so, I like it.

"(a) USA has the least-shitty economy"

Several years back, when the dollar sucked vs euro, I mentioned to a friend (who is not a lefty), that it would come back. He asked 'why?', given the government we had/have.

I said 'look at the competition; we don't have to out-run the bear, just the other shitty economies'.

So true.

Depends on what you mean by sustainable. Even if our economy is good (i.e. growing) too much spending can create more debt than we can handle. Yes, we could print money to pay it off, but that would be inflationary (and if that prospect becomes obvious lenders will jack up interest rates on the debt we issue). If we raise taxes to pay it off that screws taxpayers (and eventually tax rates could get so high that economic growth slows even more). So pick your poison. If spending gets out of control we eventually become Greece. The $64,000 question is how much spending and debt is too much for the U.S No one knows. But some politicians act like they'd like to find out.

Yes. Krugman has said all the US needs to do is mint a TRILLION DOLLAR COIN to solve all our problems.

Also, as far as the petro dollar, it isn't widely known but Gadaffi tried to accomplish just that. he had already opened one bank and was opening anoither whose sole purpose to facilitate oil sales and purchases in non dollar demoninated currencies.

It's just my opinion, and I'm no expert, but I think that might be why he's dead since he had already given up his WMD programs after Saddam was pulled from the spider hole.

What do you think. ? The leader of a country is overthrown and killed so there is no trial. Was it because of a spontaneous uprising for freedom from a people he had ruled with a iron fist for decades aand had no tanks or planes to fight him with ? Iran had the same uprising and no Western Powers stepped in .

Or was it because he had taken concrete steps to upset the entire Western World's economy ?

Inquiring minds want to know ?

Let's say you're taking out multiple loans with your house as collateral. What are you sucking on?

The collateral for US loans is the American people, their private property, and their ability to pay taxes.

US foreign debt is special in that it is issued in a currency we control. But that doesn't really help much either: if we devalue it to get out of our debt obligations, that still amounts to taking lots of money from people and making everybody a lot poorer.

Interest payments and other debt servicing are not included in the deficit.

Interest rates are at zero, so there are no interest payments.

Oh wait...

Not sure where you got your data. The treasury has issued debt every month for at least two years.

The portion of the federal debt that is subject to a legal limit set by Congress closed Monday, August 10, at $18,112,975,000,000, according to the latest Daily Treasury Statement, which was published at 4:00 p.m. on Tuesday.

That, according to the Treasury's statements, makes 150 straight days the debt subject to the limit has been frozen at $18,112,975,000,000.htThe portion of the federal debt that is subject to a legal limit set by Congress closed Monday, August 10, at $18,112,975,000,000, according to the latest Daily Treasury Statement

http://www.cnsnews.com/news/ar.....2975000000

We may be saying two different, but congruent, things. When you said we've gone months without issuing debt, I thought you meant there were no treasury auctions. But, based on the above reference, it sounds like you meant that the level of debt didn't increase. Even if the level doesn't increase the treasury has to issue more debt to replace maturing debt. That's what I referred to.

This is unfortunate timing because we're going to have to win by bankrupting the Muslims like we did the commies.

With Iran blasting oil into the world market again, the Muslims are doing a fine job bankruptcy themselves.

Let that be a lesson: if you're gonna go bankrupt, be the first to go bankrupt. Whatever you do, don't be the LAST to go bankrupt.

I for one won't sleep until people like Osama Bin Laden are living in a cave.

Last I heard he was sleeping with the fishes, so... You may be up for a while.

Now you know why Bush advertised himself as the COMPASSIONATE CONSERVATIVE.

For as long as the US Dollar is the premier reserve currency of the world and Treasuries are the premier bond of the world, it does not actually matter what America's budget deficits are.... just keep on telling yourselves that and it'll all be okay.

In a way this is true. But only because we're the premier reserve currency only for as long as we're a strong economy with manageable debt. Your point is well taken in that some have the causation backwards - they think that because we're the premier reserve currency our finances will always be manageable.

I like big budgets and I cannot lie

Spending requests I can't deny

OK, I think I'll stop there.

Keith Richards found not dead in San Francisco hotel.

The headlines to these kinds of spoof stories are funny, but then the article beats the joke into the ground.

So I guess people are going to start fleeing TBills and the US Dollar for more stable investments.

A stable investment like this?

http://www.dreamhorse.com/

Let me guess: bestiality pr0n?

Without clicking, I'm guessing it's a Pony... encrusted with Diamonds.

OT: I was discussing taxes with some generally apolitical friends, and I noticed something interesting. When you describe taxes in terms of percentages, people (including me, this ain't some type "those plebs are dumber than me" speech) don't really conceptualize what they mean. For example, one of my friends said that he didn't feel a 60% tax rate was too high. it didn't really seem like he understood what he was saying though, as when I phrased this as "a payment of 60 grand a year" (he makes roughly 100k), or "3 days of charity work during every 5 day work week," he seemed appalled. I actually think this is a way libertarians could help win over more average people, by putting things like tax increases in more practical, more easily relatable terms.

I actually think this is a way libertarians could help win over more average people, by putting things like tax increases in more practical, more easily relatable terms.

I wouldn't get too carried away with this idea. It didn't work out so well for the schools...

People think about taxes they same way they think about public transport: It's a great idea for YOU.

No offense to your friends, but what kind of job pays $100K per year to someone who doesn't understand what "sixty percent" means?

School administrator, police detective...

This is actually part of the point. He is actually very intelligent and when prompted he is able to do the math that 60%=60k, but for whatever reason he does not feel all that compelled to actually do that math. I think this is a pretty common phenomenon, I had a teacher who used to do a similar thing where a question would have something like "a squirrel is traveling 88ft a second" and he would give extra credit to the first person who asked "what the hell kinda squirrel runs 60 miles an hour?" Most of the time no one noticed this, because people often think of things like taxes and units in a math problem in a very abstract way, so it would be more relatable if you put it practically.

88ft a second

Even without doing the math, I knew that was one quick squirrel.

Not really compared to the ones on these boards...

Damn I wanted that to be a double post.

It can be.

a president makes 4X that and none of them seem to comprehend numbers either.

Not to mention senators. Or Nobel prize winners. Or.......... Okay, point taken.

I don't support a 60% tax rate in any form, but a 60% marginal rate isn't the same as a 60% effective rate. If someone is paying 60% of income in taxes, the marginal rate is going to be much higher.

If someone is paying 60% of income in taxes, the marginal rate is going to be much higher.

Not if most of their income falls in the largest bracket. That's not going to be the case for someone making $100k/year (the highest bracket now is north of $400k), though.

But if the rate is up for discussion, then surely the bracket can move, too...

Granted, but that applies to a very small number of people. Even with the top marginal rate around 40%, the effective rate for the top 1% is only a little above 20% (just counting federal income tax, not including other federal taxes, or state and local taxes).

The top 1% is presently delineated at $428,713, which is in the highest tax bracket (currently 39.6% for all income over $413,200). Without any deductions, that amount of income has an effective tax rate of 29.4%. The rate will only go up as income increases.

If we're taking tax deductions into account, then the entire picture gets much more complicated.

To uncomplicated it a little, at those levels of income the AMT is likely to kick in and 80% of most deductions aren't usable anyway.

I'm pretty sure he meant just an overall 60% rate. He used it in the context of talking about how wonderful Denmark is, and I'm pretty sure you get basically a 60% effective rate really damn quickly (after something like the equivalent of $25,000 US). His exact words were something like "why can't everyone just pay 60% taxes, I don't see why that's too high," so I don't think he meant marginal rates either.

Ok, got it. Usually when people talk about these sort of rates, it's marginal rates that get discussed, so that's why I made that assumption.

Rubbish - I have been assured that Teh Lightworker was going through the budget line by line to find spending reductions and savings!

Not to mention the GOP majorities in both houses of Congress that are bravely standing athwart the river of deficit spending, yelling, "stop!"

What America needs is a kinder, gentler deficit.

Wait, America needs a deficit that feels your pain.

Wait, America needs a more compassionate deficit.

Wait, America needs a new, hopeful, reformed deficit.

Wait, America needs the rich fatcats to contribute their fair share of deficit.

Wait, America needs a stronger, more forceful deficit.

As far as I can tell, there are only two good things about being my age. Number one, I'm retired. Number two, I won't have to cope with a U.S. that goes kablooey.

I have some bad news for you: reincarnation.

Hopefully, the next home for my soul will be in a Scandinavian socialist paradise.

With blondes, right?

Oh crap. Just realized that Sweden will be full of Mooslems by the time my soul is transported and I reach my teenaged Scandinavian years. Perhaps I should hope for the libertarian paradise of Somalia instead?

And,it is a very good reason to drink all the good beer you can NOW. There'll just be swill after the fall.I have all ready started

This would be a good story if the data supported it. The real increase in debt as a percent of GDP has been under Obama... and is projected to continue for a long time based on the programs that have been implemented during his administration.

Clinton got the debt % GDP down. Bush kept the debt % GDP down... okay, a very slight bump up.

http://www.aei.org/publication.....ng-to-get/

Wait 'til we get President Sanders at the levers to power.

debt will continue to increase from near-record high levels.

Under what metric has our debt not been at record-high levels for a very long time now?

As a percentage of GDP, it has been higher recently (2009) and not so recently (WWII).

In terms of gross dollars, it is indeed the highest it has ever been.

Why would we discuss it, smart guy, when we can talk about the five ''most read" stories from Politico's website:

The One Weird Trait That Predicts Whether You're a Trump Supporter

How Donald Trump defeats Hillary Clinton

Why the GOP Primary Could Be Even Crazier Than You Think

Michelle Obama turns 52! A dance party of photos for her birthday

Palin tweets: 'Is THIS Why People Don't like Cruz?'

That is what matters, not your silly, little deficit.

Hey, coinkidink.

Speaking of unsustainable budgets:

You know who else is a big noise in Atlantic City?

The same guy as did in Winnetka?

Burt Lancaster and Susan Sarandon?

Now the Committee for a Responsible Budget is back with bad news. Rising deficits are back, baby. With a vengeance (all emphasis in original):

Hey, I don't mean to be the Negative Nelly 'round these parts, but it seems there's a lot of focus on deficits, while totally ignoring the Debt.

Sure, for the last three months I lived within my means, but I still have $190,000 in credit card debt... was everything great for the last three months?

Re: the alt-text.

During the Reagan years, a common complaint among liberals was in fact the runaway budgets and profligate spending of the federal government. They've come a long way baby... just like them slim-assed cigarettes... from Virginia.

The deficits will continue until solvency improves.