Oil Price Super-Cycle Collapse: Party Like It's 1998?

Never bet against human ingenuity operating in free markets.

Crude oil prices continue their collapse, falling to the low $30 per barrel range. How much lower can they go? The world is awash with crude despite the fact that so many exporting countries and their national petroleum companies - Iran, Iraq, Nigeria, Venezuela, Libya - are in turmoil. As it happens, U.S. domestic free market producers can turn the fracking tap on and off pretty much at will which makes them the price setters for the foreseeable future. If other countries choose to frack, oil and natural gas prices will only go lower.

In my book, The End of Doom: Environmental Renewal in the Twenty-first Century, I discuss the theory of commodity super-cycles that describes the boom-bust cycle that has characterized the process of global economic growth for essentially the last two centuries. I suggested the current cycle driven largely by China's blistering economic growth was showing signs of moving toward the downward phase. I noted:

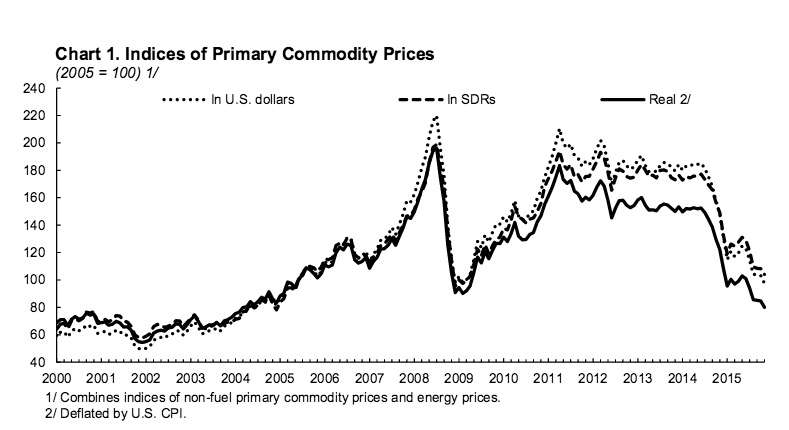

Figuring out when a super-cycle has topped or bottomed out is a fraught exercise. Nevertheless, many researchers believe that the current super-cycle in commodity prices has peaked and will soon move into its downward phase. By February 2015 the International Monetary Fund's commodity index has fallen by about fifty seven percent from its July 2008 peak. If the past is any guide, commodity prices could well fall to levels even lower than the price nadir of the 1990s as the expansionary phase of the current super-cycle begins to fade.

As it happens, by November, 2015 the IMF Commodity Index has continued to drop and is now down from its 2008 peak by more than 65 percent.

Back in 1973, US Foreign Service Officer James Akins dryly observed: "Oil experts, economists, and government ocials who have attempted in recent years to predict the future demand and prices of oil have had only marginally better success than those who foretell the advent of earthquakes or the second coming of the Messiah." Wise words to keep in mind for all commodity price predictions. Nevertheless, betting on human ingenuity operating in free markets is usually a winning strategy.

Oh, just one more thing: Peak oilers please shut up forever!

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Unpossible. When I was in college in the 90s I was confidently informed that we were at Peak Oil. A greenie told me to take that jet flight home for the holidays while I still could.

That's funny, I took a jet flight home for the holidays this time too. Well, scarcity must be around the corner.

It's always when you least expect it!

Nobody expects the Spanish Peak Inquisition!

Just like AGW.

But we haven't yet reached peak progressive, that is for sure

There's so much excess that people bring them up for no reason in totally unrelated threads.

^BUTTHURT PROGRESSIVE^

Have you realized that you are a little more than just a parody of yourself at this point?

I'm actually starting to enjoy the gibbering paranoid partisanship to which so many people around here are succumbing.

IT'S TIME FOR A PURGE!!! COSMO VS YOKEL!!!

You mean libertarian vs conservative?

I don't know what I mean anymore...

*stares into the abyss*

Wait, which is which?

I *knew* you were on TEAM JACOB and not TEAM EDWARD! I knew it!

That's such a prog thing to do, Hugh.

Maybe we have.

People's response might be the marker.

Supply is good, but there's another side to the price equation:

What does demand look like?

RCD: Does that depend on the price? 😉

RCD: Grrr. Doesn't that ....

There were expectations of future demand that aren't likely to materialize as anticipated, and prices had those expectations baked in. In fact, what we're seeing now is those expectations of future demand falling out of prices. China may even consume more in the way of commodities this year than it did last year--just not as much as people expected.

Do you want a serious answer, Ron? I'll have a go at it.

Some of it does and some of it doesn't. When you have massive central economies investing in infrastructure, much of the demand is immune to price. China building power plants, roads, entire cities, etc. with Monopoly money to keep up with their population growth is still going to happen regardless of the price of oil. Same goes for India to a slightly lesser degree. And developing nations in Africa will continue their public works projects through bond issuances that the IMF will guarantee regardless of cost overruns due to an increase in oil prices.

In the developed western world, price drives demand. In developing economies where a lot of demand comes from public works projects, price doesn't drive demand as much. Another example would be the demand of scrap iron staying high a decade ago with the price increase trailing the demand. The Chinese constructs boom pushed the demand up regardless of the price, especially considering the supply side remained steady and even increased toward the end of the boom.

Partly. But, demand curves themselves are not static. For oil, my biggest guess is that demand at any price would be pretty heavily influenced by the rate of economic growth. The slowdown in China is a pretty significant driver of the current slump in prices.

According to the junk bonds of US frackers, demand does not look good.

I'm not sure demand is as important to the current price as oversupply.

What we're seeing is about reduced expectations for demand in China.

Oil is dropping because the Shanghai and Shenzhen stock exchanges are practically in free fall.

The Chinese stock exchanges are dropping because of expectations for demand are falling.

Other commodities are dropping for the same reason.

It's about reduced expectations for demand. China isn't going to grow as quickly as people expected, and market prices are reflecting that. Production levels of oil and other commodities are dropping in response to falling prices because of lower expectations for demand.

+1 ghost town

The Chinese stock exchanges are partly in turmoil because of the CCP's ham handed efforts to control the trading.

It has prevented short selling.

It has placed restrictions on certain investors selling their shares.

It has initiated trading circuit breakers that resulted in their entire market being shut down for most of a trading day.

And just today, they announced the circuit breakers are being suspended.

Oh and they are also engaged in currency manipulation.

"It has prevented short selling."'

The Emperor has decreed that prices shall only rise!

You may be right. If only there were some economic mechanism we could use to better balance supply and demand. Some way to encourage production and discourage consumption when demand is high and supply is low, discourage production and encourage consumption when supply is high and demand low. I don't currently have a supply of ideas for what that economic mechanism might be, but I'll bet if you paid me $20 I could produce one.

I'm not sure demand is as important to the current price as oversupply.

But its only "over" - supply relative to demand, see?

Sure, lower prices help increase demand, just like higher prices help increase supply. The price is the point at which supply and demand balance. We're only looking at one side of the equation here.

Supply is a misused term here. Storage is a better one.

Supply of oil can be manipulated pretty easily. Storage levels are what drive oil prices. And storage capacities have increased abroad, causing a glut in available, deliverable oil.

Obviously, the government needs to burn some of that oil, like when it confiscates produce only to have it rot in a warehouse to support ag prices.

I'm not sure demand is as important to the current price as oversupply.

Isn't oversupply by definition supply in excess of demand?

I guess so. Supply and demand are really two sides of the same coin, so perhaps they can't be separated.

I was thinking of supply and demand as variables, with demand staying relatively constant while supply has changed more dramatically. But being mutually dependent it's also correct to say that demand simply hasn't kept pace with supply.

Oh, just one more thing: Peak oilers please shut up forever!

Paul Ehrlich has a sad.

"'Peaked,' Dee? Let me tell you something. I haven't even begun to peak. And when I do peak, you'll know. Because I'm going to peak so hard, that everybody in Philadelphia will feel it."

Rocky?

I'll tell you what to do, Hugh. Take her to the zoo. I hear retards like the zoo.

Maybe a Shymalan movie? There aren't that many things set in Philly.

That dude with the hairpiece was Bruce Willis the whole time!

Whoa, whoa whoa. Spoiler alert!

Rocky? A Shymalan movie? Dude, he's quoting from that show all the hip kids are watching now. It's an Archer reference.

Now goddammit, I just a bit ago on the other thread posted that the expert consensus, fundamental facts and the inescapable conclusion in 1996 were that - unless the US started a WWII-style campaign for alternative energy sources - we were screwed by the fact that by 2006 we would be running an unsupportable trade deficit importing 2/3 of our oil at an economy-crippling $24 per barrel. Are you telling me now that that forecast has changed and I'm not going to be sitting in the cold and the dark gnawing my arm off for sustenance in 2006?

The $24 per barrel may be more prescient than expected.

I love the old quote/saying, "They told me that if I voted for Goldwater, there'd be race riots and a war in Southeast Asia, but I voted for him anyway. And you know what, they were right!"

"Peak oilers please shut up forever!"

As if!

Might as well hope that Ehrlich finally admits he's been a dofus for the last couple of decades.

Is it dofus, dufus, or doofus? Is there a consensus on this?

The correct spelling is idiot.

Alternatively: Idjit.

+1 for Yosemite Sam reference.

Nevertheless, betting on human ingenuity operating in free markets is usually a winning strategy.

Yet a gigantic chunk of the political class can't seem to understand or appreciate this, despite the evidence smacking them in the face every day.

And those are the idiots we inevitably choose to lead us. We're dumber than they are

"It is difficult to get a man to understand something, when his salary depends on his not understanding it."

Hey, since Reason has wiped the dust and cobwebs off its economics reporting today, I thought I'd throw this one on the pile:

Fed official leaves mouths agape at CNBC by admitting that the fed front-loaded the market and engineered a market rally: "What The Fed did, and I was part of it, was front-loaded an enormous rally market rally in order to create a wealth effect... and an uncomfortable digestive period is likely now." Simply put he concludes, there can't be much more accomodation, "The Fed is a giant weapon that has no ammunition left.".

When CNBC's Simon Hobbs asked if there was an apology forthcoming, the Fed dude says "Hey, I voted against QE3!".

SHRIIIIIIIIIIIIIIIIIIIIIIIIIKE!

http://www.zerohedge.com/news/.....o-ammo-lef

Huh, why would they do something like that on purpose. It doesn't seem like it benefited anybody.

*spits coffee*

Alright, I'm not an economist, so this is my perspective as someone who doesn't fully understand what is going on, but it sounds like their attempts to front load the economy didn't grant any long term benefits to the usual suspects. The economy failed to rally enough to give the Democrats a political boost. The pain was drawn out longer, and the bust is going to cause some cronies to lose their shirts. So I'm left wondering why.

Presidential administrations only last 4 to 8 years. You have to keep your boss happy and in catnip only that long.

it sounds like their attempts to front load the economy didn't grant any long term benefits to the usual suspects

Oh, it did. It fueled a market rally that the usual suspects made billions on.

Right, and propped up the banks that pay lobbyists a lot of money to have access to politicians, who depend on contributions from said lobbyists and their paymasters to stay in power.

I think what Illocust is asking is why would they do that, knowing that it was bound to fail down the road. It's strangely an incredibly easy, and extremely difficult question to answer, all at the same time.

They did it because they had to be seen doing something. That's the bottom line.

Can you imagine the screaming hissy-fits the morons in the press would throw over someone that said,

Well, with every boom comes a cycle of bust. You cannot repeal the economic cycle - which is human nature driven. Yes, the next several quarters will be difficult but the economy will recover more quickly if we let it run its course.

The politician who said that would get my vote.

The politician who said that would get my vote.

I'm .025% of the electorate! AND I VOTE!

Which supports the notion that change comes by changing the minds of the people rather than changing the politician in office.

Which supports the notion that change comes by changing the minds of the people rather than changing the politician in office.

Sure, that's where change comes from, but what about hope?

Illocust asked about long term benefits. A term is 2 years for Congress and 4 years for the White House and that's as long as it gets. Nobody cares what happens after the next election.

In the long term, Mr. Illocust, we're all dead.

+ 1 John Maynard Keynes

And when you're dead, they digging your grave and filling it back up instead of burying you in it.

To stimulate the economy.

There's a just release report by the BIS (bank of international settlements) that indirectly supports Fisher:

The Bank for International Settlements says the entire strategy of stimulus by global central banks is based on a false premise

It will be interesting to see how the Chinese people react to a recession--when they have one.

The Chinese people struck a grand bargain with the CCP that they would tolerate them in power so long as the economy brought lots of opportunity. However, if the CCP can't deliver growth, then that grand bargain may be off.

I think that's why the Chinese were trying to guide the yuan down (looks like they've now lost the handle on the yuan)--they fear the end of growth and what that might mean for the CCP.

I don't think there's ever been a time in the history of the world when more people have been lifted out of abject poverty more quickly than in China in the last 15 years after they joined the WTO, but political volatility and recessions go hand in hand. Even in the U.S., people blame the last downturn in the economic cycle on capitalism--as if capitalism ever promised freedom from cyclical growth.

Fortunately, the CCP owns all the rubber truncheons and riot gear.

But not the guns, right? RIGHT?

*lovingly caresses Remington 1911*

Do yourself a favor friendo and get a rifle.

"A pistol is best used to fight your way to a rifle"

-Ghandi

Sheriff shows up at local party, sidearm strapped on. Lady says "You expecting trouble?" Sheriff replies "If I was expecting trouble I would have brought my rifle."

It will be interesting to see how the Chinese people react to a recession--when they have one.

More than likely, they're in one now, or at least at the beginning of the rollercoaster down-run.

Unfortunately for China, it appears their government is little different from ours-- the first sign of downturn and the government believes it can manipulate itself out of a downturn.

Even in the U.S., people blame the last downturn in the economic cycle on capitalism--as if capitalism ever promised freedom from cyclical growth.

Exactly. Capitalism, when left unfettered provides opportunity. Only socialism promises endless growth and infinite wealth.

Even in the U.S., people blame the last downturn in the economic cycle on capitalism--as if capitalism ever promised freedom from cyclical growth.

We don't have capitalism; we have corporatism. Big difference. Welfare state for the connected.

Capitalism in a nutshell: market dictates prices and private ownership of industry.

Socialism in a nutshell: prices set by regulators and public ownership of industry.

Surely we can use these words descriptively even if in reality there has never been a perfect example of either one.

Probably the way they always have: with mass starvation and political murders.

[tinfoil]Managing the current crisis allows Chinese gummint to expropriate the middle class a bit and nationalize this and that, no? What if the whole stock bubble thing was engineered for this very purpose?[/tinfoil]

I don't quite believe the above but don't know what to think seriously either.

There's not a whole lot of tinfoil required. See my post above, Fed official admitted pretty much that vis-a-vis the American economy.

They were trying to guide the value of the yuan down to boost exports.

They want to boost exports because the Chinese economy is having a hard time, and it certainly must have occurred to someone in the CCP that unemployment caused by decreased demand for exports is a political time bomb.

You know who else wanted to reduce the value of their currency to boost exports?

Pepito, the biggest cat in the whole wide world?

After the fall of the Berlin Wall and the CCCP fell apart, the Russians eagerly looked forward to their new capitalist paradise. The next morning they woke up and saw they were still in Russia and concluded capitalism doesn't work. They seriously did believe that the consumer bounty the West produced was produced by capitalism and not by capital. Like expecting to collect a slot machine jackpot while refusing to put a coin in the slot.

I expect China will be much the same - they're not going to blame their God King masters for the failures of capitalism because they know all about their God King masters but their God King masters have never allowed them to learn about capital. If something goes wrong, blame it on the Mystery Box of Forbidden Knowledge because who the hell knows what sort of demons came out of there when somebody cracked the lid.

I have hope for China because they're quite a complex nation of interesting contradictions.

Communism in China, for instance, doesn't mean the same thing it does in the west/Venezuela etc.

Communism seems to be more about control and authority, and less about an egalitarian Worker's Paradise.

""Peak oilers please shut up forever!""

I'll just forward this to James Howard Kunstler

Is he the McDonald's Painting guy?

He's sort of the "Wine-Sipping-Man's Malthus"

"Another doomer who has made a career from predicting collapse is peak-oil pundit James Howard Kunstler. Well known in the peak oil community for his role in the documentary The End of Suburbia and his 2005 book The Long Emergency, Kunstler is lesser-known, or perhaps forgotten as "one of the most extreme voices in the Y2K fiasco."

< "If nothing else, I expect Y2K to destablize world petroleum markets", Kunstler wrote, and the effects of that wil be as bad as, or worse than, those of the 1973 oil embargo. Industrial agriculture will collapse. "Spectacular dysfunction" will plague car-dependent cities. Supply chains will crumble. "I doubt that the WalMarts and the K-Marts of the land will survive Y2K." That was the minimum-damage outcome. He actually expected things to get much worse?

Failure- even repeated failure over decades- does not seem to be a hindrance for these hedgehogs. "One might think that after Kunstler's Y2K pratfall people wouldn't pay for him to be their tour guide to the future, but The Long Emergency was a best-seller and Kunstler- a wildly entertaining speaker- became a fixture on the lecture circuit, where he is paid significant amounts of money to tell audiences they are doomed"-

He's sort of the "Wine-Sipping-Man's Malthus"

I went to his website. This seems like an apt description. He's all doom and gloom, but with a Masters of Liberal Arts.

It appears he does oil paintings of various subjects, some touching on America's consumerism (I presume that's his point-- I don't fancy myself particularly capable in unwinding the artist's inner thoughts by studying the strokes, juxtaposed subject matter or use of light) in addition to telling us that we're all doomed and swimming in debt. The latter of which is true, but I suspect his prescriptions would differ from mine widely.

One nice thing about Old Testament law was that false prophets were to be stoned to death.

Donald Prothero is cut from a similar cloth. He's really good when he's speaking as a paleontologist and refuting creationists and others. But then he insists on speaking beyond his training.

I was listening to a podcast on which he was a guest c. 2006 when he opined that we were never going to see $2/gallon gasoline again (I was listening to this c. 2013 which made it even funnier). Of course, he made this statement right after declaring that people trained as biologists did not have the expertise to be commenting about dinosaur evolution.

Donald Prothero is cut from a similar cloth. He's really good when he's speaking as a paleontologist and refuting creationists and others. But then he insists on speaking beyond his training.

Paul Ehrlich made a major name for himself speaking beyond his training. So has Noam Chomsky.

I just have to throw this out there again. While dipshit here was way off base, it isn't because his premise was wrong. Y2k was a very serious issue that people like me spent the decade before fixing to MAKE shit didn't happen. And some shit DID happen. But the vast majority was tiny and easily fixed. It was because of over 10 years of effort by 100,000s of people that y2k was a big nothing. Not because it wasn't real to begin with. Unlike CAGW.

MAKE SURE

My argument with the Y2K freak out culture was along these lines. I figured there were potential problems but also figured they could be fixed. What I objected to was all these computers were going to crash and there was nothing that could be done about it in advance.

But the vast majority was tiny and easily fixed. It was because of over 10 years of effort by 100,000s of people that y2k was a big nothing.

Oh how I remember those days. Although we didn't spend ten years fixing it. I think we spent about 4 months fixing it.

The fear of Y2K was a classic example of top-down thinking. The idea was this: There were millions... tens of millions of disparate systems around the globe which all had this issue. Who was fixing it? Who's in charge?

What was misunderstood is that the tens of millions of people in charge of those tens of millions of systems were in charge of fixing their system. Amazing how millions of people working towards their own self-interest can solve a global problem all by themselves.

precisely.

Was Kunstler one of those who poo-pooed Harry Browne's contention that Y2K wasn't going to amount to much simply based on the fact that the people who had their money where their mouth was didn't seem to be in as much of a panic as the likes of Kunstler were? Kunstler had all the science - Browne only had common sense. (If it's a good bet that Walmart is going to get hit hard, don't you think Walmart might be aware of that? If Walmart's not panicking, either the people running Walmart are all idiots or there's no reason to panic. Given Walmart's history, which is the smart bet - they're a pack of idiots or they know more than you do?)

When it turned out Browne was right, "well, you just made a lucky guess, you didn't really know". But it's like being shown a perpetual motion machine - if you can't say exactly why and how it's not going to work, would it be fair to say you don't really know that it's not going to work? Just because you can't explain precisely why this particular machine isn't going to work, you know "perpetual motion machines don't work, this is a perpetual motion machine, therefore this machine is not going to work". If everybody can see the shit's about to hit the fan the people in front of the fan will be the most concerned, the people in front of the fan aren't in a panic, therefore the amount of shit hitting the fan is probably not enough to panic over. QED

He's an idiotic one trick pony who never says anything of substance

You can take his Y2K rant here, and replace "Y2K" with any perceived social ill (Global Warming? Price of Oil? ISIS? rednecks with guns?) and it would be exactly the same.

""[PANIC THING] will converge with and amplify other forces already in motion around the world, namely a global economic deflation and the political dissolution of more nation states. Our nation may not be immune to the latter, though in the unlikely event I wouldn't expect it to disintegrate the way that the Soviet Union or Yugoslavia did after the collapse of communism. We really do have more of a common culture, however idiotic it may be in its current state, and more fundamentally sound political institutions. A more likely outcome would be disabled federal and state bureaucracies and the consequent increased importance of local government - especially in terms of competence. This leads to another major aspect of [PANIC THING] . I believe it will deeply affect the economies-of-scale of virtually all activities in the United States, essentially requiring us to downsize and localize everything from government to retail merchandising to farming. Particulars below.""

Someone else noted in 2007 that he deserved a prize for "World's Shittiest Forecaster" His streak remains unbroken.

Everyone knows that we have low oil prices because of the Obamessiah (swt). No one explains how; I guess the economic spirits are rewarding us for having elected him. I do know that it makes perfect sense to praise the Obamessiah for low oil prices and in the next breath condemn the things that actually have made oil prices low.

He actually was trying to push oil prices up and failed.

Peak oilers shut up! Yep, should've kept Gretsky.

The Great One?

Paulina.

Human ingenuity in developing fracking technology has indeed enabled new supply due to the fracking boom and China's economic slowdown does indeed change the demand equation.

But that isn't the whole story.

Saudi Arabia's decision to keep pumping to maintain their market share vs cutting back to support oil prices (which would let other producers free ride off of them) has something to do with it as well.

As does Obama's nuclear deal with Iran. The market is anticipating new Iranian supply coming into the market as well.

So it's not all about human ingenuity. Part of it is about political machinations.

ZOMG UR SOOOO RIGHT ITS NOT JIST HUMAN INJENEWITY IT IS ALSO THE INJENEWITY OF BARACK H CHRIST OUR LORD AND SAVIOUR HUZZAH ALL PRAISE BE TO HIM FOR SAVING US FROM OIL SHORTEJEZ!!!!!!

More like Obama getting snookered for the foreign policy rube that he is.

Of course Obama is multi-talented: he is an economic moron as well.

As does Obama's nuclear deal with Iran. The market is anticipating new Iranian supply coming into the market as well everybody in the Middle East is going to start selling as much oil as they can as fast as they can at whatever price they can get because they need lots and lots of military equipment real fast real bad real big.

It's also about demand. When the demand for goods begins to shrink, the engine that moves and creates those goods begins to slow down, causing the fuel for that engine: oil, to back up.

But that's what I'm unsure about. I thought demand hadn't really changed this time round. Instead, monoeconomies like Saudi Arabia and Iran had recently committed to keeping the tap on with the stated goal of driving smaller U.S. producers out of the market. Demand normally drives supply, but global politics and wrong predictions about increasing demand have led to a glut.

In other words, I don't believe there is a collapse in demand like what happened during the 2008 recession. Savings increased dramatically then, which is a good indicator of falling demand. Savings rates have leveled off since then, though they're still higher than they were before 2008.

I think it's both. I think that the Saudi's may be dumping oil on the market to push out small producers, but I also think that demand is shrinking (I'm not going to say "collapsing").

But they can't raise the price of oil buy running the frackers out of business.

The fracking tech is there and will be put back to work the second oil reachest a certain price.

So government deserves credit for not getting in the way, and for getting out of the way? Really?

"Hey government, thanks for not fucking things up. You deserve all the credit."

What a dope.

Where did I say that government gets "credit" for anything?

I was merely pointing out that market prices can also be affected by actions that government's take as those actions can have an affect on supply - and demand as well.

There have been plenty of times in the past when oil prices have spiked on perceived increases in geopolitical instability that could effect supply from the Middle East. To acknowledge this fact is not to give "credit" to anybody for it.

I'd also like to bring up one other aspect of this . . .

The credit cycle and the economic cycle are related. And I've talked about a "regulation cycle" that influences cycles, too. For instance, after the subprime mortgage industry collapsed, we saw a ton of regulation heaped on the lending industry to stop them from offering so many home loans. But once the economy starts growing again, there's no politician in the world principled enough to stand between voters who want home loans and the banks that want to make those loans. At such times, the regulation starts to disappear. That's what I'm talking about with the regulation cycle. The markets are ultimately more powerful than any amount of regulation--even in countries with authoritarian governments--and when the market says it's time to deregulate, that's generally what the politicians do.

That can make politicians look smarter than they really are.

At such times, the regulation starts to disappear.

Regulations rarely disappear.

Financial regulation does.

It goes up after recessions and tends to disappear as the economy rebounds.

Like I said, there's no politician in the world that's brave enough to stand between those who want to join the middle class and the banks that want to lend them money--not while the economy is growing.

Financial regulation expands and contracts with the economy--probably more so in a democracy--and I'm here to tell you that the same market forces work on the regulation of other industries, too.

Like I said, hardly any politicians were arguing to end the export ban on oil for 40 years, but then for 40 years, the United States used more oil than it could produce domestically. Once that was no longer true, . . .

I see the same thing in commercial real estate, although the model is a little different. Circa 2003, before the real estate market took off in SoCal, it would take us about three months to get a 300,000 sf industrial project approved. By 2007, the same project would take at least 18 months in the same municipality and was very expensive. Things crash and any regulations those local cities can get rid of to encourage us to develop in their communities, they do. There's a regulation cycle. Sometimes it moves very slowly, but if you don't conform to that regulation cycle, your local economy can end up looking like Detroit.

Financial regulation does.

It goes up after recessions and tends to disappear as the economy rebounds.

I will agree that there are times when new regulations are heavily piled on, and periods when it's not. But I'm not super-keen on the idea that Congress or the SEC are busily repealing regulations during boom times.

it would take us about three months to get a 300,000 sf industrial project approved. By 2007, the same project would take at least 18 months in the same municipality and was very expensive.

I've seen this too, but it was often due to approval backlog, not so much because there were thousands of rules we no longer had to navigate.

"I will agree that there are times when new regulations are heavily piled on, and periods when it's not. But I'm not super-keen on the idea that Congress or the SEC are busily repealing regulations during boom times."

Think Glass?Steagall.

The regulations get watered down, and the regulators get colonized by industry. I can make an excellent argument that the BLM is being run for the benefit of ranchers at the expense of wild horses, that the National Park Service culls the last of the genuinely wild buffalo herd to protect the interests of ranchers grazing on public land surrounding Yellowstone, and that the Fish & Wildlife Service devastated California sea otters--a protected species--in the interests of protecting fishermen who don't want to compete with sea otters to supply the sushi industry with sea urchins (uni).

We live in a pluralistic democracy, and that means that our environmental regulatory agencies aren't just there to protect natural resources and wild animals from industry--the regulators are also there to protect industry from environmentalists.

Yes, regulation is burdensome to capitalism, but as libertarians, we also know that any time you start to regulate a new industry, the regulators and the industry they're regulating become extremely cozy. Yes, Wall Street gives plenty of money to politicians. So does every other regulated industry. The more heavily regulated the industry is, the more they tend to give. And they get a lot of influence for that. That influence becomes apparent as the economy allows.

Regulatory capture as a consequence of pluralism, eh?

While regulatory capture undermines the rule of law (and hence is bad), I have a hard time getting worked up over businesses trying to stop certain agency mandates, like implementing the private-property-forfeiting provisions of the ESA.

Think Glass?Steagall.

I believe that what you're really seeing here is businesses operating in a dark storm of regulations, so when one is removed, everyone rushes towards the single ray of sunshine. It's what I call the regulatory floodwall theory.

Government is a one-way-ratchet. Rules do not go away. If a rule causes a problem, the solution is always more rules for the new problems. Sometimes rules are ignored or overlooked, but they are do not disappear. Getting rid of rules is like admitting to making a mistake, and that is something that people in government simply do not do.

If Obama decides not to raid marijuana dispensaries so long as they conform to the laws of the state they're in, I'm going to call that de facto deregulation.

And I think it's in response to market forces.

So many people wanted to participate in the marijuana market (medical, recreational, legal, and illegal), that the federal government had to bow to what amounts to deregulation.

Someday, maybe they'll do something formal, but you're not going to tell me that marijuana hasn't effectively been deregulated in Colorado, are you?

It's true that they have a whole new set of state regulations for marijuana dispensaries there, and I'm sure the marijuana industry will eventually colonize those regulators. But we're still talking about regulation being defanged at the federal level--and the state level, too. They don't arrest you or try you for simple possession anymore.

I wouldn't call that deregulation. The next president could decide to completely ignore CO state law and bust every "legal" dealer. I also wouldn't use the word deregulation to describe creating a legal market that is so heavily regulated that black market dope is cheaper than the legal stuff.

Deregulation is when they take pages from the Federal Register and throw them in the trash.

Side note to peak oil:

Total number of Chevy Volt sales in the US since 2011: 84,656

Total. By comparison, Ford sells around a million F150's every year.

One Chevy volt saves enough gas to run the economy for 120,000 years.

To be fair that is 120K AGW years. An AGW year is a year on our wonderful planet after all utopia has been achieved and there are no more internal combustion engines allowed anymore, or herds of methane producing livestock, or any other technology above the stone age. Oh, and the human population has been reduced to "sustainable" levels.

Yeah one Chevy Volt could power that economy for 120K years.

In that scenario there would only be the one Chevy Volt, and all 30 of us who have survived will just take turns using it.

30 of us who have survived will just take turns using it.

Episiarch! You're missing an opportunity to make a crack about someone's mom!

Your mom makes crack.

Take the oil export controls. Just recently, they started talking about allowing the export of oil again for the first time in 40 years. This isn't becasue those politicians are ingenious and understand that we can devastate the ability of OPEC countries, Venezuela, Russia, ISIS, et. al. to dictate the price of an economically important commodity and profit from our misery. No, our politicians aren't smart enough to understand the implications of our newfound ability to flood the world's oil markets. Rather, some politicians want to get rid of that regulation because oil producers are lobbying to be able to sell their surplus oil for higher prices internationally than they could get for the stuff here at home.

In other words, markets are so ingenious, they can make politicians seem smart.

"Just recently, they started talking about allowing the export of oil again for the first time in 40 years"

The legislation to allow that has already been passed now.

My point was that they start talking about deregulating things when what I'm calling "the regulation cycle" tells them to do so.

It's one of the essential things I think true environmentalists (not watermelons) misunderstand about carbon regulation. If what they wanted to do through regulation were effective at inhibiting carbon emissions at the expense of economic growth, what I'm calling the regulation cycle would quickly get rid of those regulations.

Some true environmentalists really do understand that, and that's what makes them overtly authoritarian. But even authoritarian governments can be brought low by the same market forces that drive what I'm calling the regulation cycle. Ultimately, they'll either need people who will make the necessary sacrifices willingly, or they'll need to find ways to limit the necessary sacrifices to something negligible.

It's like what happened in Australia. A popular carbon tax was implemented--well, it was popular until it was implemented. But as soon as it was implemented, it became incredibly unpopular, so unpopular that they voted the lady who implemented it, and the party should rode in on, out of power--and then they scrapped the carbon tax. That's like the regulation cycle in a nutshell.

Yeah, no shit.

Ok you maestros of economics: Nothing sophisticated here, I just want to interrupt your spirited repartee--one of the main "reasons"--yuk yuk-- visit this site] to ask a practical question.

I know that the price of oil accounts for about 45% of the cost of a gallon of gas. Other significant costs include refining, distribution, and of course taxes.

The price of oil has continued its slide now below $34 a barrel, and yet the retail cost of a gallon of gas has stubborn remained sticky [yes I understand that prices generally go up much quicker than they go down] at or just below $2 a gallon; this does not seem to coincide with the drop in the cost of oil keeping other variables constant [in terms of percentages]. And of course demand plays a role...and that generally increases when prices go down and may serve to offset a drop in price...

A concise and comprehensive explanation would be appreciate. Hold the sarcasm, if you can.

The cost of your mom is one of the LEAST sticky things about her.

I'm going to pipe up that prices aren't just a function of cost, and their profit margins aren't static. When prices are slashed, they're typically slashed in response to market competition. Someone down the street has to capitulate on price first, but no one is going to drop their prices more than they have to until their competitors do.

Prices do seem to go up faster when they're rising (faster than they fall when they're falling), and I think that's because of the natural inclination of the supply curve. In other words, sellers are already eager to raise prices because that tends to mean they'll be making more profit and/or more easily covering their costs. But they only cut prices reluctantly--even when they have to cut them to maximize profit in response to competition, it's something they'd rather not do.

P.S. There's also the psychological impact of selling something you bought for less than you paid for it.

If you paid $3.00 a gallon to fill your gas tanks last week, and now the market price is $2.50, you can only sell that gas for $2.50. Things are worth what they can be replaced for--not how much you paid for them. But I think there's a certain psychological reluctance to sell things for less than you paid for them. And that may contribute to price lag on the down slope.

I paid $159.9 yesterday in South Houston.

But it always falls slower than it rises and one reason is that when oil at the pump head falls the gas in the pump was made from more expensive oil.

It goes up as quick as competitors can encourage each other .

"A concise and comprehensive explanation"

Gas prices have fallen. However, prices tend to be localized and high demand can keep some locations relatively inelastic.

There's also very-large inventories, and a long cycle before flow-through of costs reduces retail prices. Declines in oil prices often precede changes in gas prices by 6-9 months, and can start rising again before retailers see cost reduction.

Thank you all, except for "Citizen X" who seems to have a strong Oedipal urge about him that he just can't keep it out of an otherwise thoughtful and considerate discourse on the economics of oil.

I am thinking that due to multiple variables [as the rest of you pointed out] that .there is a virtual [non government mandated] price floor of around $1.75-$1.90 per gallon. In my area [North MI] price has been holding steady at $1.95/ gallon and showing no fluctuation in response to drop in oil prices.

Ron = last year ... or 2014 rather, there seemed to be a lot of articles on "the colossal failure of the German Energiewende"

Trying to find anything newer, it seems like the topic fell off the face of the earth in 2015.

Might be good topic to provide a brief update to people on how "Green Energy" policies are faring in the age of cheap-oil. If not your own gloss, at least a link to something you think provides a good one.

Meanwhile, CA continues its fetish with all things tax related, especially the gas tax. I paid $2.90 the other day, and this was in a...not nice area.

Maybe I'm just dumb but peak oil Armageddon made sense to me until I sat there and thought about supply and demand. Granted that doesn't take a lot of thinking but I don't think I'm unique in that of the millions of issues I could think about, I only really think about and research a few that I care about.

The logic of:

Oil is a finite resource

Oil will at some point run out

When it runs out disaster if we don't have nuclear solar wind-powered fission.

That intuitively made sense to me until I realized that whenever oil began to run out (and at this point that looks like a really long time) it would just go up in price causing more people to invest in alternatives and the problem would solve itself.

the problem would solve itself.

That is simply not possible. We need Top. Men.

It's technically possible that all of the oil production could suddenly dry up at a moment's notice, faster than anyone can adapt to. It's also technically possible that the sun could go nova tomorrow.

The incentives to deal with depletion of a natural resource are built into market economics, as you indicate. But a sizable contingent of people appear to be incapable of doing anything but running around like chickens with their heads cut off, and thus assume everyone else will do the same. Naturally, we have to write legislation to punish the sane people in order to placate the crazies.