Why Presidential Candidates From Both Parties Are Wrong About Community Banks

Plenty of Americans prefer the convenience of banking somewhere large.

Here's a rare presidential campaign issue that Ted Cruz, Jeb Bush, Marco Rubio, Carly Fiorina, Bernie Sanders, and Hillary Clinton all are on the same side of: they claim to prefer cute little "community banks" instead of Wall Street behemoths. And, as can sometimes be the case in those unusual instances when there's a bipartisan consensus on an issue, the politicians are wrong.

The topic came up over the weekend in the Democratic debate. Sen. Bernie Sanders of Vermont promised to break up the big Wall Street banks and instead "support community banks and credit unions. That's the future of banking in America."

Strangely enough, the socialist senator's position had been foreshadowed a few days before by some of the top Republican candidates. Said the former governor of Florida, Jeb Bush: "Imagine America without its community banks. Well, that's what's happening because of Dodd-Frank. That's my worry. My worry is that the real economy has been hurt by the vast overreach of the Obama administration.""

Bush's fellow Floridian, Marco Rubio, concurred. "The big banks, they have an army of lawyers, they have an army of compliance officers. They can deal with all these things. The small banks, like Governor Bush was saying, they can't deal with all these regulations," Senator Rubio said. "This is an outrage. We need to repeal Dodd-Frank as soon as possible."

Sen. Cruz, too, echoed the community bank talking point. "The big banks get bigger and bigger and bigger under Dodd-Frank and community banks are going out of business. And, by the way, the consequence of that is small businesses can't get business loans," Cruz said.

Carly Fiorina also weighed in. "What do we have with Dodd-Frank? The classic of crony capitalism. The big have gotten bigger, 1,590 community banks have gone out of business," she said.

Hillary Clinton, the Democrat, addressed the issue recently while campaigning in New Hampshire. "We have to separate out the big banks from the community banks," she said. "I am open to looking at how we help community banks." She advised the community bankers to "come in with their own package" of proposed reforms, "not in concert with the big banks."

You'd need to look through a magnifying glass into the viewfinder of an electron microscope to detect differences between Messrs. Sanders and Cruz, or between Ms. Fiorina and Mrs. Clinton, on this one. They all basically tout the community banks as somehow more sympathetic and worthy of government lenience than the big "Wall Street" firms.

I'm for repealing Dodd-Frank yesterday, but blaming the financial regulation law that President Obama signed on July 21, 2010, for the failure of community banks is nonsensical. More banks failed in 2009, the year before Dodd-Frank passed, than in 2011, the year after it passed. In 2010 more banks failed before the law passed than afterward. And the number of bank failures has been declining as Dodd-Frank implementation and enforcement has ramped up. It's almost enough to make you think the bank failures weren't the result of the law but of the economic downturn.

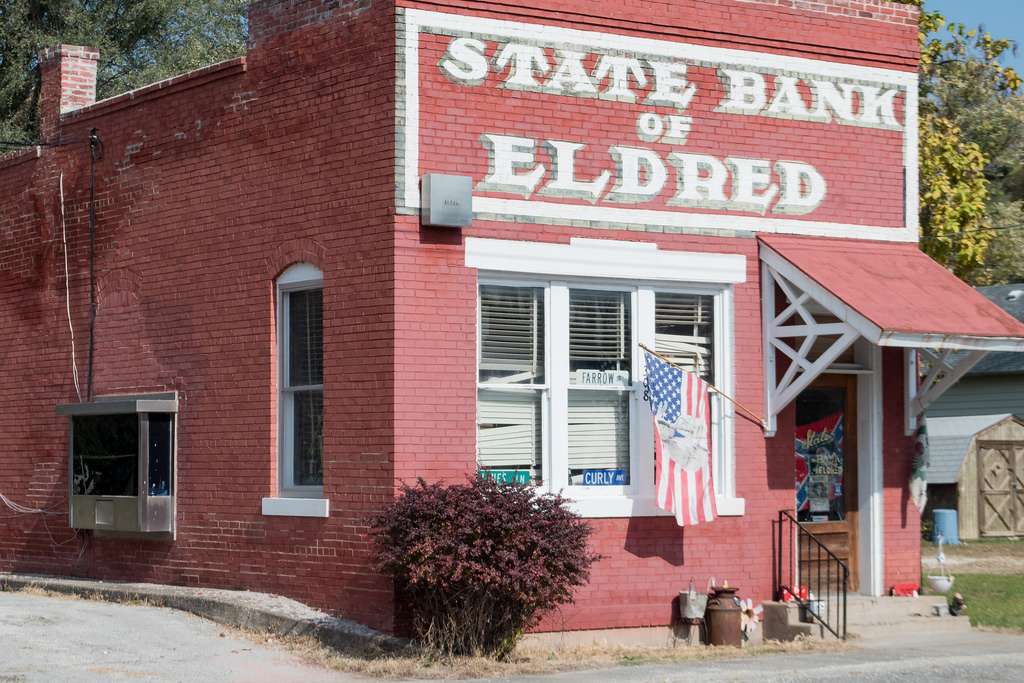

The decline of community banking long preceded Dodd-Frank. A December 2012 report from the Federal Deposit Insurance Corp. called it "a multi-decade trend" that reduced the number of federally insured banks to 7,357 in 2011 from 17,901 in 1984, and the share of U.S. banking assets held by community banks to 14 percent from 38 percent over the same period.

Bank failures are a part of the reason; small, local banks tend to be highly exposed to commercial real estate loans in one concentrated area and can have a hard time weathering a regional economic slump. But consolidation also happens via mergers and acquisitions. The owners of a community bank make money when their little bank is purchased by a larger regional bank. And the big regional banks get bigger by buying up smaller players, applying economies of scale. The FDIC also blames the relatively poor performance of community banks on low interest rates set by the Federal Reserve.

If customers prefer a personal touch, nothing is stopping them from moving their money to a smaller operator, or starting their own small bank to compete. But plenty of Americans prefer the convenience of banking somewhere large enough to operate a slick website and mobile app and to maintain automatic teller machines, or even branches, not just in their home town but also at their vacation destination or the city where their children are in college.

The presidential candidates seem to understand this at the level of their own behavior. According to personal financial disclosure documents, Hillary Clinton banks at JP Morgan, Jeb Bush at SunTrust, Ted Cruz at Bank of America, JP Morgan, and Capital One, Marco Rubio at Citibank and TD Americatrade. Carly Fiorina's money is invested at Goldman Sachs. Even Senator Sanders banks not at some mom-and-pop operation but at a subsidiary of a large regional bank.

The presidential candidates aren't on the campaign trail talking about the need to break up Lowe's and Home Depot and bring back local neighborhood independent hardware stores. They aren't out there talking about the need to break up Staples and OfficeMax and bring back local independent office supply stores. They aren't talking about the need to get rid of CVS or Target drug stores and replace them with local independent neighborhood pharmacists. So what's with the obsession over small banks?

A cynic—or maybe even Sen. Sanders—might suspect that money has something to do with it. The same personal financial disclosure form that shows Fiorina investing with Goldman Sachs also shows that the Independent Community Bankers of America, a trade association, paid her $48,000 for a speech on March 3, 2015, in Orlando, Fla. Federal Election Commission records show that the Independent Community Bankers of America Political Action Committee donated $2,500 to Ted Cruz's Senate campaign in August 2012 and another $1,000, which was later returned, in November 2012. Hillary Clinton's Senate campaign received $1,000 from this same community bankers' political action committee in 2000 and another $1,000 in 2006. Community bankers are just another special interest group, complete with their own campaign contributions and highly paid revolving-door lobbyists.

But that analysis is probably a little too neat. There's something else at work here, a kind of nostalgia and sentimentalism about the past combined with wishful thinking—hubris, really—about the government's power to turn back the clock. The Republicans and Democrats are both happy to use the big banks as political punching bags. A little humility would go a long way here. Maybe the politicians should just let customers and bankers decide the composition of the banking market rather than trying to push in the direction of small banks against large ones.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

People prefer the services a large bank can provide. They might say they want to support the little guy, but they want the latest features that are sometimes cost prohibitive to CU's and Community Banks. Also, many want the assurance they can walk into a branch if needed: The largest banks have branches everywhere.

People love the features but they hate the costs. Right before the recession hit, everyone was up-at-arms about the overdraft fees. Chase even went as high as $67 a transaction.

When this happens, they want to be able to move their assets to another bank. But when you only have six mega-banks that all handle things the same way (with a generous dose of "Oh, we don't consider that overdraft. It's [insert shifting marketing name here], so we didn't like to you when we said we only charge $5 for overdrafts!") they want an alternative.

That's why this sort of comment, "Lurve the leetal banks!" is always on politicians' lips. It appeals to people to "have an option."

I'm making $86 an hour working from home. I was shocked when my neighbour told me she was averaging $95 but I see how it works now.I feel so much freedom now that I'm my own boss.go to this site home tab for more detai....

http://www.4cyberworks.com

I love my credit union. Unfortunately the nearest branch is 86 miles away. It was convenient when I lived closer and worked in a building with a branch. I survive using online banking and affiliated ATMs.

Sorry, the difference is Republicans are using the argument to push for the repeal Dodd-Frank whereas the Democrats are using it to advocate reinstituting Glass-Steagall. Regardless of the merits (or lack thereof) of their stated reasonings, I don't think lumping them all together is helpful. Both sides may be sentimental and wrong on the facts but the conclusions drawn are radically different. This "they're all wrong!" schtick causes more problems than it serves. When Republicans advocate deregulation we should encourage it not tell everyone there's no difference between them and Dems. There is a substantive difference in this instance.

If the Republicans and Democrats had not joined together in 2008 to bail out the big banks there would have been more smaller banks, that is after the big banks had gone bankrupt and their assets sold off

Or banking as we know it would have ceased to exist in the US, and we'd all have died, and then the world would have died, and then the entire planet would have exploded. Whew, guess we dodged a bullet!

That's why we need to end big banks, today! They have drilled too deeply and have tapped the earth's core!

/humor

Completely absent is any discussion of how the US ban on interstate banking directly led to several panics from the Civil War on, including making the Great Depression worse.

Government, as usual, fucks something up, then passes new regulations to cover up their part in the fuckup while setting the stage for the next fuckup which will create the perceived need for more government regulation.

I compare legislators as drunk drivers who have hit a wall.

"Why am I not moving? I don't understand this. Why don't I just press harder on the gas pedal......Why am I not moving? I don't understand this. Why don't I just press harder on the gas pedal.....Why isn't this working?!?! COME ON GAS PEDAL! I WILL PUSH YOU THROUGH THE FLOOR!"

And don't forget the charter laws which forced banks to hold X amount of their reserves in state bonds (iow, they were forced to give a large portion of their gold to state governments). The charter laws are rarely discussed in the context of 19th century bank panics, nevertheless they were instrumental in causing them; in order to comply with them, banks would often be short on gold reserves, and that's how the panics caught on like wildfire once word got out that they were short.

I think you're wrong here, Mr. Stoll. The recession took out a lot of unhealthy banks; Dodd Frank, CFPB, and other regulations are taking out healthy banks that simply can't cover the excessive costs of regulation or the big dick of their regulatory agencies. If we're stuck in an age of crony capitalism and distorted markets, I'll support an agenda that is at least keeping the door open for additional competition. The government forcing smaller competitors out will only artificially make the behemoth banks bigger and therefore easier to control. And under that scenario we're all worse off.

Prior to Dodd Frank, community banks were fairly well regulated and not very dangerous. Frankly, one of the most effective forms of regulation is when the FDIC comes in on a Friday afternoon, fires all the officers and shuts the bank down. The fact that it happens with some frequency, and without serious ripple effects is a testament to how well it works.

Big banks, however are problematic - there is a belief, founded or otherwise, that you can't shut one down without triggering nuclear winter. As such, you get nonsense like TARP. You get idiots like Neil Cavuto asking the Republican candidates whether they would stand by while BofA failed, pauperizing its depositors, conveniently ignoring the fact FDIC insurance protected every depositor under 250K, and the bank's assets weren't worthless, so even the 250K crowd would get a significant portion of their money back (actually, considering this was a liquidity issue, not a solvency issue, they probably would have gotten back all their money)...and nobody called him on it.

The answer in this case is to exempt smaller banks (anybody below the 20th largest US bank) from big bank regulation such as Dodd Frank. To the extent that DF is flawed law, which it certainly is, this at least limits the impact to banks that can afford to hire thousands of compliance folks, and limits the negative impact on competition in financial services.

If you have more than $250k and you leave it in a BofA account, you are so stupid that you don't deserve to be bailed out.

Or you are wealthy enough that the $250k+ account counts as your petty cash fund.

$250K is not a significant amount for many businesses - liquidity is necessary for payroll, tax payments (to the nth degree), general operation, and accounts payable.

But all of those payments are periodic - typically weekly or monthly - so a business that needs more than 250K at any one time is probably a fairly good size. This is not to say that lots of businesses don't keep their entire retained earnings in their bank account...

In that case, they aren't "leaving" it there, and it's only a tiny part of their overall cash reserves and they should be able to absorb the loss without requiring a bailout. If it's really a big issue, they can always spread things over multiple banks to reduce risk.

Politicians are simply spouting what they think voters want to hear. Lots of people dislike the big banks (the "banksters") because they think they're responsible for a lot of our financial and economic problems, without realizing how big a role government intervention plays in our economic problems.

Still, it ought to be disturbing enough that the politicians *aren't* interested a 'level playing field', but, as always, want to favor some businesses over others, no matter which businesses it is that they want to favor. We already know how much they "helped" family farms and other small businesses. They shouldn't be out to give the same kind of unwanted help to community banks.

Agreed that the government shouldn't be playing favorites. However, the government is already balls deep in banks thanks to the FDIC, Fed, OCC, state banking departments, plus a myriad of regulations. Outside of the highly unlikely event that the government gets out of regulating financial markets, I think regulatory relief in any shape or form is greatly welcomed. Essentially they've created such a bureaucracy that they're artificially taking players out of the market. Banking reform of any kind at any level would come as a relief to consumers and financial institutions.

That's utterly naive. Due to federal regulations, starting banks has become next to impossible, and the paperwork kills smaller operators. And the federal regulations are no accident: they are often the result of rent seeking and regulatory capture by big banks.

Until most of the current banking regulations are thrown out, we have no idea whether consumers are better served by small banks or by large banks.

There are good reasons to prefer "community banks" from a libertarian point of view: they have far less resources to engage in rent seeking or get government handouts. And when they do, they at least have to band together. That is the main "sentimentalism" at work here: a sentimentalism for a time when banks were less regulated and behaved accordingly.

I much prefer medium sized banks. Those banks with more than five and less than 15 branches. They are large enough to be stable and offer a variety of programs and small enough to care about the small investors.

Same here. In the past I've been with a hayseed bank, a credit union, and a large national. Since I went to a regional bank, I've never looked back.

Im making over $9k a month working part time. I kept hearing other people tell me how much money they can make online so I decided to look into it. Well, it was all true and has totally changed my life. This is what I do,

---------- http://www.onlinejobs100.com

Google pay 97$ per hour my last pay check was $8500 working 1o hours a week online. My younger brother friend has been averaging 12k for months now and he works about 22 hours a week. I cant believe how easy it was once I tried it out.

This is wha- I do...... ?????? http://www.buzznews99.com

I believe the discussion of community banking is part of a larger debate over the essential functions of a financial system and financial reform. It is part of a response to "too big to fail". The interest is in developing a network of community development banks (CDBs) to provide a full range of services to consumers and to prudently invest in local businesses. The conventional wisdom is that small-to-medium banks are more relationship-oriented, know their customers better and are therefore capable of better loan underwriting. (In addition, some people suggest allowing these CDBs to provide a greater range of services in order to compete with shadow banks.) A key support for the notion of better underwriting is keeping loan originators exposed to the longer-term risks of the underlying projects. These lenders would not be permitted to package a number of loans to sell, or "securitize". Hence, they would exhibit more skepticism and diligence in determining creditworthiness. In short, I believe the interest in small-to-medium community development banks is to decentralize finance, keep lenders exposed to the risks of the projects they underwrite, restore relationship banking and prudently lend to small- and medium-sized businesses.