Did Soda Tax Proposals Cause a Decline in Soda Consumption That Started Years Earlier?

Probably not, but The New York Times is eager to credit politicians.

New York Times health reporter Margot Sanger-Katz celebrates declining consumption of sugar-sweetened soda, which she calls "the single largest change in the American diet in the last decade." As someone who never drinks full-calorie soda or buys it for my family, I tend to agree that's a positive trend. But as someone who subscribes to the old-fashioned notion that causes precede their effects, I find Sanger-Katz's explanation of this trend—public awareness raised by soda tax supporters such as Philadelphia Mayor Michael Nutter—more than a little implausible.

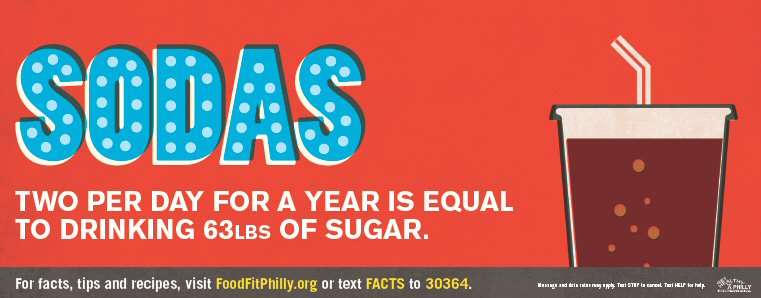

Sanger-Katz's thesis is that even when anti-soda agitators fail to win approval of special levies on sugary drinks (as Nutter did), "they have accomplished something larger" because "in the course of the fight, they have reminded people that soda is not a very healthy product" and "fundamentally changed the way Americans think about soda." But the data she cites do not really support that theory.

"Over the last 20 years," Sanger-Katz reports, "sales of full-calorie soda in the United States have plummeted by more than 25 percent." In other words, the downward trend began more than a decade before the soda tax debates in New York state (2009), Washington state (2010), and Philadelphia (2010). Americans began drinking less soda nearly two decades before Berkeley approved a soda tax and San Francisco rejected one, both of which happened last year.

Sanger-Katz presents data from Philadelphia as the strongest evidence that politicians should get credit for reductions in soda consumption:

The change is happening faster in Philadelphia than in the country as a whole. Daily soda consumption among teenagers, a group closely tracked by federal researchers, dropped sharply—by 24 percent—from 2007 to 2013, compared with about 20 percent for the country. Last month, the city Department of Public Health reported a sustained decline in childhood obesity over the last seven years.

Those reductions are not accidents. The soda tax didn't pass. But the debate about it, along with a series of related city policies, helped discourage people from drinking soda.

That assertion seems overconfident to me, since the downward trends in soda drinking and obesity cited by Sanger-Katz began before Nutter first proposed a soda tax and before the city launched an ad campaign that she also credits with reducing consumption of sugary drinks. Although it's possible that Nutter's efforts accelerated a pre-existing trend, it does not look that way. The prevalence of daily soda consumption by Philadelphia teenagers, as measured by the CDC's National Youth Risk Behavior Survey (which is conducted every two years), fell by 10 percent between 2007 and 2009, by 11 percent between 2009 and 2011, and by 5 percent between 2011 and 2013. If Nutter gets credit for the slightly bigger drop between 2009 and 2011 (a period that includes his two soda tax proposals), does he also get the blame for the much smaller drop between 2011 and 2013 (a period that includes the ad campaign)?

This is not the first time that Sanger-Katz has jumped to conclusions about the impact of government interventions on dietary trends. Last July she suggested that a national decline in calorie consumption that began in 2003 could be explained by policies adopted years later, including Berkeley's 2014 soda tax and federal menu labeling requirements that have not taken effect yet. Maybe Nutter and like-minded politicians reached back in time to the late 1990s and persuaded Americans to drink less soda. But given what we know about causality, it seems more likely that politicians' anti-soda activism and the drop in consumption of sugar-sweetened beverages both reflect broader social trends.

Show Comments (44)