Piketty Is Wrong: Rich Families Don't Generally Get Richer

Corporate CEO pay is, however, way out of hand.

French economist Thomas Piketty made a huge splash last year with his Capital in the 21st Century in which he claimed that economic inequality increases as capital accumulates in the hands of the already rich. Piketty's analysis as been comprehensively analyzed and dismissed by other economists. One of the more informative and entertaining takedowns of Piketty is by Northwestern University University of Illinois-Chicago economist Deirdre McCloskey.

Alerted to a new study, "The Rich Get Poorer: The Myth of Dynastic Wealth," by The Economist's Buttonwood column, I thought I would share some that study's conclusions with Reason readers.

From the study:

We believe Piketty's core message is provably flawed on several levels, as a result of fundamental and avoidable errors in his basic assumptions. He begins with the sensible presumption that the return on invested capital, r, exceeds macroeconomic growth, g, as must be true in any healthy economy. But from this near-tautology, he moves on to presume that wealthy families will grow ever richer over future generations, leading to a society dominated by unearned, hereditary wealth. Alas, this logic holds true only if the wealthy never dissipate their wealth through spending, charitable giving, taxation, and splitting bequests among multiple heirs.

As individuals, and as families, the rich generally do not get richer; after a fortune is first built, the rich get relentlessly and inevitably poorer.

The "evidence" Piketty uses in support of his thesis is largely anecdotal, drawn from the novels of Austen and Balzac, and from the current fortunes of Bill Gates and Liliane Bettencourt. If Piketty is right, where are the current hyper-wealthy descendants of past entrepreneurial dynasties—the Astors, Vanderbilts, Carnegies, Rockefellers, Mellons, and Gettys? Almost to a man (or woman) they are absent from the realms of the super-affluent. Our evidence—used to refute Piketty's argument—is empirical, drawn from the rapid rotation of the hyper-wealthy through the ranks of the Forbes 400, and suggests that, at any given time, roughly half of the collective worth of the hyper-wealthy is first-generation earned wealth, not inherited wealth.

The originators of great wealth are one-in-a-million geniuses; their innovation, invention, and single-minded entrepreneurial focus create myriad jobs and productivity enhancements for society at large. They create wealth for society, from which they draw wealth for themselves. In contrast, the descendants of the hyper-wealthy rarely have that same one-in-a-million genius. Bettencourt, cited by Piketty, is a clear exception. Typically, we find that descendants halve their inherited wealth—relative to the growth of per capita GDP—every 20 years or less, without any additional assistance from Piketty's redistribution prescription.

Dynastic wealth accumulation is simply a myth. The reality is that each generation spawns its own entrepreneurs who create vast pools of entirely new wealth, and enjoy their share of it, displacing many of the preceding generations' entrepreneurial wealth creators. Today, the massive fortunes of the 19th century are largely depleted and almost all of the fortunes generated just a half-century ago are also gone. Do we really want to stifle entrepreneurialism, invention, and innovation in an effort to accelerate the already-rapid process of wealth redistribution?

Buttonwood observes:

Indeed, the authors point out that the rapid turnover of the Forbes 400 suggests that inherited wealth is unstable. Three-quarters of the families in the original list no longer appear on it.

Of course, dropping out of the Forbes 400 hardly indicates a descent into penury. But family wealth tends to dissipate over time. The Astors, Vanderbilts and Carnegies were among the wealthiest families of the late 19th century; not one of their descendants makes it onto the modern list. Indeed a Vanderbilt family reunion held in 1973 failed to find a single millionaire among the 120 present.

The study concludes:

When great wealth is achieved through entrepreneurialism, innovation, and invention, society benefits, jobs are created, and life becomes easier and better. For generations, this process has fueled American exceptionalism. When great income is achieved through entrepreneurialism, innovation, and invention, society again benefits for the same reasons. We find it puzzling that Piketty underplayed what even he recognizes as the major driver of growing American income inequality: the massive appropriation of the wealth of corporations by their executives. When it is objectively deserved, terrific; when it is not, it siphons resources out of the macroeconomy and hollows out the opportunity set for the populace at large.

As the researchers note, a significant driver of rising income inequality in the United States has been the increasingly outsized pay packages awarded to corporate CEOs. They do not see much evidence that 9-figure CEO compensation boosts shareholder wealth and argue for corporate governance reforms that more tightly align CEO pay with increased shareholder value.

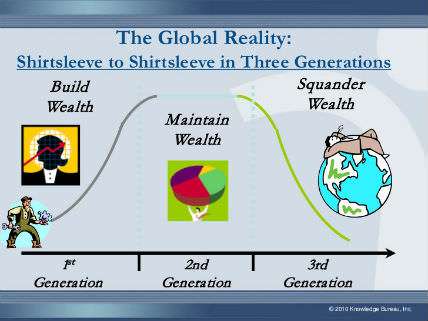

In an case, they find that the proverb "shirt sleeves to shirt sleeves in three generations" has more than a bit of truth behind it.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Piketty is pandering to emotions and nothing more.

How dare you?! I mean, what about the poor children who rely on such pandering.

What about the poor economists who rely on such pandering for their livelihoods? Do you want them to starve in the streets? WHY IS NOBODY THINKING OF THE ECONOMISTS?

Meh, out of hand is a value statement. Are we not all worth exactly what someone is willing to pay us?

Agreed. This is a matter between shareholders, boards, and executives. They will sort it out (free market and all).

I think the problem (as I say below) is that shareholders don't have enough power when it comes to executive compensation. Boards are often more representative of management than shareholders (yeah, that's ass-backwards), so the kind of controls companies should have in place aren't really there.

That's mostly due to shareholders taking too little interest in the actions of the board and not being willing enough to coordinate their activities.

The board can mostly do what it wants, but if what it wants isn't what the shareholders want they can change the board composition.

And if you can't get enough support from other voting shareholders to get the company on the track you want, you can always sell your interest and put that money elsewhere.

One might say that you should put more trust in the decisions of those with skin in the game. If the shareholders aren't revolting the either they're fine with this (ie, they agree that executive pay is worth what they're getting in return) or the 'researchers' should provide a mechanism by which executives have captured control away from shareholders *and* evidence that that mechanism exist.

*Then* we can talk about what and how much government intervention is appropriate, including *costs* of government intervention in that discussion as well as benefits.

Its entirely possible that shareholders agree that executive pay is getting out of hand but that its not so far out of hand that they are willing to pay the costs of government interference.

I can't find the article now but one of the arguments I read that at least sounded plausible was that CEO's have been given too much (veto) power by federal law with respect to mergers and buyouts (as a result from fears during a period of heavy M&A activity) and that is often why they get these "golden parachute" packages.

The rules and regulations of corporate boards and shareholders are not just the result of voluntary free market activity - there is a lot of federal intervention here.

And as usual, calls for more government regulation either ignore the already existing regulation or (more often) are completely unaware of existing regulations and how things changed to accomodate.

None of them ever think, let's *repeal* what we've been doing and re-think the situation. Its always 'one more reg and we'll be golden'.

I'm in the deregulate the process camp. I do think limited liability and limited control need to go hand in hand, but the courts have sided against shareholders too much in my book. Agreed that part of the problem is shareholder apathy, which, curiously, can even happen with institutional shareholders. For the latter, a lot of them operate quite often on a statistical basis and don't necessarily get into details like compensation in their analyses.

I wonder if their is a strong or even a weak correlation between shareholder apathy/laziness and the total number of shareholders or per capita shareholder ownership. It would seem that the less equity individual shareholders have in a corporation the less likely they are to actually care to learn what is actually going on (not unlike why voters in politics often vote irrationally - because their individual impact is close to zero).

I'm sure most people that may own a couple shares of say, Microsoft or GE, probably just look at the ticker to see if the stock is up or down.

I don't really have any investments yet, but when I do, the board of whatever company I buy stock in is going to hate me.

You have no 401(k)? No money market? No pension DBP plan? No credit union account?

Really?

Small money market savings, but other than that, no.

What I do have is an ok salary, a mountain of student loan debt, a master's degree in architecture, and no license (yay onerous licensing regs and being stupid enough to not switch majors).

So. You are a shareholder. You may not think you are, but you are. And you may not have a lot of shares, but you are a shareholder.

I would think there is a huge correlation between the two.

A lot of stock is of the non-voting type to start with - that portion of the shareholders only get to vote 'keep or sell'.

And for the rest, the voting stock is often diluted with only a few people able to directly control a sizeable voting block - the rest is diluted among tens of thousands.

Much like voting for the president - there's millions that will cast their votes, but only a small handful of those votes have the power to direct the election.

That's mostly due to shareholders taking too little interest in the actions of the board and not being willing enough to coordinate their activities.

Not entirely true, though. And to the extent it is true, it is often more a consequence of their lack of power (if you can't meaningfully challenge the board or management, you dump the stock and move on to a company more to your liking). Laws around corporate governance are very friendly to management and very hostile to activist investors. Even if management is using the company as its own personal piggy bank, it's nearly impossible for investors to remove them (oddly though, people with virtually no stake in the company often have more luck through scandals). Most decide it's not worth the fight and move on.

Yes. This is another of the ways shareholders can punish corporate boards that are not doing what the shareholders want.

You can bet the board is going to sit up and notice when their stock price drops because investors are abandoning ship.

This frees up capital to go to entrepreneurs who show that they are willing to respond to shareholder desires.

But, if shareholders are not willing to take the effort of moving their money - say, because the company is still making them money - the worst you can say is that the salaries have not yet risen to the point of leaving - which is tacitly agreeing that they are worth it.

You can bet the board is going to sit up and notice when their stock price drops because investors are abandoning ship.

That's far from clear. There's plenty of CEOs who underperform their pay packages without significant pushback from their board. That's kind of the whole point of a captured board of directors.

Boards are often more representative of management than shareholders"

Incorrect. They are more representative of institutional shareholders than individual investors

They have the greatest power of all: they can sell their shares and stop being shareholders.

"They have the greatest power of all: they can sell their shares and stop being shareholders."

Sure, but it's rarely economical to do so. If the transaction cost to sell shares and replace them with other shares is 1% or more, then it doesn't make sense to do so in many cases. A corrupt executive with a captured board who is paying his self 0.2% of the companies market value is safe in most cases, because he's effectively not taking enough to be worth replacing the stock.

That doesn't matter one whit. Most institutional shares are now owned by either index funds (who keep costs down by deliberately not spending money on corporate governance stuff) or pension funds (who don't want to rock any boats just in case they get blackballed for pension fund management contracts)

Actually, the shareholders are generally very well represented. What you have to keep in mind is that the board and the executives frequently own a controlling share of the stock.

I used to design executive compensation. I can tell you exactly when CEO pay started getting out of whack. In response to the movie Wall St and the LBO shenanigans of Milken/Boesky/etc, poison pills and the other board entrenching stuff became like kudzu. While poison pills/etc had been legal for a couple of years already, they took off once they could be spun as 'Gekko protection' and once the Drexel stuff had eliminated the ability of hostile shareholder groups to get financing for a takeover. From that point on I began to see that 'getting board approval' for the compensation plans was changing. The boards were no longer acting on behalf of shareholders. Rather, they were increasingly dependent on the CEO himself for their job. A classic agent-principal problem.

In 1993, FASB recommended closing an accounting loophole re stock options. It was a mild proposal IMO since it merely required expensing them so that shareholders could see it - not actually valuing them correctly. This would have affected the accounting for all publicly-traded companies. But the reaction was huge. CEO's demanded that Congress express its opinion of the FASB - and Congress voted 88-9 for a non-binding resolution expressing its opposition to FASB. FASB folded. And stock options took off. With shareholders in the dark and diluted. Boards now dependent on CEO's. And CEO's in hog heaven.

So, where does old money come from?

europe.

A buried chest.

Trust funds.

Old money is usually a lot less fabulously wealthy than it was when it was new money. Sorry if that sentence is poorly formed.

Consider this: Every single one of us is descended from old money at some point. So we should be pissed off if we don't have it now.

There are a few branches of my family that were pretty well to do in the past 200 years. All gone.

My family from England actually had a castle. A title. And most of Providence, Rhode Island.

But alot of things change over 400 years.

And no one wants Rhode Island.

Old people.

Graft, corruption, rent-seeking, etc. IOW, government.

Grandma's purse

Grandma's chest? That's one tough titty

There are a few factors that, to my mind, inflate CEO pay a little artificially. One is the investor and general media constantly focusing on CEOs as symbols of the companies they work for. That's somewhat understandable with founder CEOs, like Bill Gates, but it makes almost no sense at all with the so-called hired gun CEO.

Another major factor is the deliberate weakening of shareholder--i.e., owner--control of their businesses. I get isolating them from day-to-day decision-making, since without that isolation, the limited liability concept starts becoming problematic--but shareholders have very little practical ability to stop CEOs from making outrageous amounts of money.

Finally, (and this ties back to the first point) CEOs are given far too much credit (and get too much blame) for a company's performance. Sometimes they deserve credit/blame, but there are a lot of people in companies that contribute to their performance, and, of course, many companies are successfully because of their position in the market, with little real difference presented by who is running the show. Along with this is the constant hiring of people just because they've been CEOs before, regardless of their success in those roles. It's a weird, in-bred community.

and that is why they all have weak chins and thin blood.

Seriously, it's the same answer as to WHY they will keep making shit like Jurrasic World- because people keep paying for it.

If people quit paying them, they would start to accept lower salaries, etc., but no one is their right mind is going to NOT go for highest value deal for themselves. The corporations that hire them are not acting rationally and the CEO is.

Rational actors win out almost every time in those scenarios.

The best takedown of high CEO pay (for the non-founder CEO types) I've ever heard was that they were getting entrepreneurial pay for managerial work.

That's exactly right. There are exceptions where CEOs make a huge difference, but the compensation doesn't reflect that--it's just ginormous because they're CEOs, not because they're effing brilliant.

There is a relationship between pay and responsibility. A CEO is basically responsible for every employee in the company, and to the customers as well. One bad decision could bring down the company, resulting in unemployed workers and customers without goods and services. That's a big-fat-hairy-deal, and they are paid accordingly.

Yeah, well, no. CEOs usually fall into two skill sets--investor relations or administrative/operation experts. They're rarely both. While they have a lot of responsibility, so do other executives. In fact, much of what you're saying they're responsible for is really some other member of management's responsibility. Any halfway decent CEO doesn't attempt to make solo decisions in subject matters they don't understand as well as their subordinates.

Again, I'm talking more about hired-gun CEOs than entrepreneurs--night and day difference between the breeds.

Except there are "hired gun" CEOs who really do deserve ginormous pay packages. While he's not particularly popular anymore, Jack Welch did a remarkable job at GE.

Fuck him for ruining complicating lives with Six Sigma.

His stockholders got a compounded annual return of 23%.

He did?

From their 2000 report:

http://www.ge.com/annual00/letter/

From their 2000 report:

http://www.ge.com/annual00/letter/

Sure, and they deserve compensation for their actual accomplishments. Like everyone else.

Wait, libertarians are criticizing CEO pay?

Somewhere a Salonistas head is exploding.

to be fair, I think they're criticizing the stupidity of the people that agree to pay it.

so, all in all, the monocles are still well in place.

Ron Bailey is criticizing it.

Not me.

Not the pay itself, but the (IMHO broken) system that allows it to be offered. Large corporate boards tend to be a very clubby place, and the board members vote on CEO pay with little (generally *no*) input from the stockholders (you know, the ones that technically own the company). I'm not really sure how to fix this for existing corporations (without violating first principles), but the managers, not the owners, are making high-level strategic decisions and telling the owners to fuck off, which seems...not so libertarian to me.

as a company, corporations aren't libertarian at all. They are paid to do this. Shareholders vote on board members, and on bylaws, etc.

Most shareholders don't care. If they do, they change things.

If they do, they change things.

But, that's the problem. To a large extent supported by law, companies have made changing things very, very, very, difficult. And, actually quite often, they get to change the rules in the middle of the game if someone challenges them in the market for corporate control.

"Very clubby places . . . ". Sour grapes much?

I don't think its entirely sour grapes. Boards are often much more sympathetic to management than the shareholders they're supposed to be representing.

So, like Congress and the Executive branch?

Ad hom much? It's true, corporate boards tend to be hugely incestuous.

So. Sour grapes it is.

Tough titty

Easy there, champ.

Everyone I've talked to who interacts with CEOs and boards says they are incestuous, to varying degrees. Including the libertarian types.

You sound ignorant.

And, since I've do this for a living, I say you're generalizing. Over generalizing. Even with your "to varying degrees" qualifier.

Let the market work, and the problem will largely solve itself. Some dumb Delaware decisions have fucked things up as far as shareholders stopping absurd compensation levels. Who else cares?

To be honest I don't mind at all how much money CEOs make. They probably deserve it. You can argue how much is too much but who cares. If you pay someone a lot more than what they are worth, eventually the market will correct it. I'm glad our country has so much rich people, and knowing that I am also richer because of their wealth creation.

To be honest I don't mind at all how much money CEOs make. They probably deserve it.

This is question-begging, really. Did Ron Johnson deserve all the money he made to run an already ailing Sears further into the ground? Did the myriad examples of CEOs who resigned and left the company worse off than they found it deserve their pay and "golden parachutes"?

CEO pay should really be more like the NFL--non-guaranteed contracts subject to annual renewal, contingent on performance over the past year.

"This is question-begging, really. Did Ron Johnson deserve all the money he made to run an already ailing Sears further into the ground? Did the myriad examples of CEOs who resigned and left the company worse off than they found it deserve their pay and "golden parachutes"?"

Ron Johnson deserved whatever Sears was willing to pay him. Because they made the bad decision to pay him like that, it hastened their destruction and allows better run and better managed companies to supplant Zombie Sears after blowing out its brains.

And that's all well and good...unless you were a shareholder of Sears.

Tough titty...

Tough kitty:

mix96buffalo.com/cat-on-a-plane-video/

Right, and you weren't smart enough to take your money and be a "former" shareholder?

Quit talking like a victim.

Right, and you weren't smart enough to take your money and be a "former" shareholder?

Quit talking like a victim.

Stop with the blankety blank blank "deserve" mumbo jumbo. It is irrelevant.

English, motherfucker, do you speak it?

Me neither. It's something to aspire to, not to shame and demean.

Using the word "deserve" isn't really appropriate. It could mean legally, morally, or something else. Using it to mean "legally deserve" is fine, but the Left tries to sneak in "morally deserve" whenever possible. "Morally deserve " makes no sense unless you think Chairman Mao should set salaries.

Honestly - I'm both pleased and a bit surprised at the tone of the comments here. Most of the time, this sort of article really gets a lot of yawns here on Reason. I still think I'm probably more a monopoly-hating classical liberal than a modern libertarian - but today gives me hope

Pfff....Facts are meaningless. You could use facts to prove anything that's even remotely true.

"One of the more informative and entertaining takedowns of Piketty is by Northwestern University economist Deidre McCloskey."

Deidre McCloskey: A transsexual far more worthy of praise than Caitlyn Jenner. This paragraph of her article is particularly awesome:

"One can line up the later items in the list, and some of the earlier ones revived ? la

Piketty or Krugman, with particular Nobel Memorial Prizes in Economic Science. I will not

name here the men (all men, in sharp contrast to the method of Elinor Ostrom, Nobel 2009), but can reveal their formula: first, discover or rediscover a necessary condition for perfect

competition or a perfect world (in Piketty's case, for example, a more perfect equality of income). Then assert without evidence (here Piketty does a great deal better than the usual practice) but with suitable mathematical ornamentation (thus Jean Tirole, Nobel 2014) that the condition might be imperfectly realized or the world might not develop in a perfect way."

"Then conclude with a flourish (here however Piketty falls in with the usual low scientific standard) that "capitalism" is doomed unless experts intervene with a sweet use of the monopoly of violence

in government to implement anti-trust against malefactors of great wealth or subsidies to

diminishing-returns industries or foreign aid to perfectly honest governments or money for

obviously infant industries or the nudging of sadly childlike consumers or, Piketty says, a tax

on inequality-causing capital worldwide. "

"A feature of this odd history of fault-finding and the proposed statist corrections, is that

seldom does the economic thinker feel it necessary to offer evidence that his (mostly "his")

proposed state intervention will work as it is supposed to, and almost never does he feel it

necessary to offer evidence that the imperfectly attained necessary condition for perfection

before intervention is large enough to have reduced much the performance of the economy in

aggregate."

I have a new hero.

Yes, that is impressive.

Sounds very much in the vein of The Secret Sins of Economics. She's awesome.

I'm the worst

+1

+1. And, of course, there's usually little thought given to the unintended consequences of such actions.

"Deidre McCloskey: A transsexual far more worthy of praise than Caitlyn Jenner."

Is it the same as saying she's a credit to her gender?

Is there any answer to that question that isn't wrong?

...Yes?

Yes. I view successful transsexuals in much the way mid-1800s British colonial magistrates viewed the rare Indian who appeared to appreciate Shakespeare.

Truly it is the cisgendereds' burden. /sarc

A credit to both of them

I read that paper when it first came out -- I think I felt like most middle aged housewives feel when they read gossip in People magazine. A thoroughly satisfying read with just the right amount of academic sass.

Deidre McCloskey: A transsexual far more worthy of praise than Caitlyn Jenner.

Any transsexual who has an accomplishment outside of being a transsexual is far more worthy of praise than Caitlyn Jenner.

Well, I mean, Jenner did win the decathlon olympic gold medal... in 1976...

His political alternative history of the minimum wage was enough for me to realize he shouldn't be taken seriously.

On CEO pay. I think some of it could be attributed to the government requiring that corporations disclose how much their CEOs are paid. When you know how much the competition is being paid, you have leverage to ask for more money.

I recall reading somewhere that the explosion in CEO pay began with just that. I can't find it though...

Also, it's mostly in the form of stock grants and options, which is a transfer of wealth from existing shareholders in the form of dilution.

http://www.huffingtonpost.com/.....39281.html

http://www.law.yale.edu/docume.....olor54.pdf

Trigger warnings...PuffHo and Ivy League...

Here are some other thoughts...

http://www.csuiteinsight.com/2.....f-ceo-pay/

Piketty came off much more reasonably on Econtalk than I had expected. Not right, mind you, but most of the people quoting Piketty are more Pikettiests than Piketty himself.

Also, the proposed remedies to the supposed problem he poses will only exacerbate income inequality.

It's really nothing moonshine and nascar won't fix.

Goddamn, Dierdre McCloskey is awesome:

"Admittedly, such pessimism sells. For reasons I have never understood, people like to

hear that the world is going to hell, and become huffy and scornful when some idiotic optimist

intrudes on their pleasure. Yet pessimism has consistently been a poor guide to the modern

economic world. We are gigantically richer in body and spirit than we were two centuries ago.

In the next half century?if we do not kill the goose that laid the golden eggs by implementing

leftwing schemes of planning and redistribution or rightwing schemes of imperialism and

warfare, as we did on all counts 1914-1989, following the advice of the the clerisy that markets

and democracy are terribly faulted?we can expect the entire world to match Sweden or France."

She was also the subject of one of my favorite quotes. She told a former colleague she was a transsexual who was going to be transitioning to live as a woman, and the colleague said 'Oh, thank God. I thought you were going to say you've converted to socialism.'

Definite MUST to have on the next reason cruise?

For reasons I have never understood, people like to hear that the world is going to hell

Never underestimate the affect of two millennia of Christian apocalyptic theology reinforced by events such as the World Wars.

Meh, this goes even further than 2 millenia. Apocalyptic shit sells. Look at AGW..

Shortly after that Bleeding Heart Libertarians blog started, they held a symposium about one of their bloggers' new books, Free Market Fairness. It basically argues for free markets from Rawlsian and social justice grounds. McCloskey absolutely humiliated the entire project, and particularly the lefty bloggers they were targeting. She is fierce.

Example from here:

God damn that is good reading.

She also brings it in the comments. This is gold:

I'm ashamed to say that I keep pushing her books lower on my reading list. It's time to change that.

I like "if we do not kill the goose that laid the golden eggs by implementing

leftwing schemes of planning and redistribution or rightwing schemes of imperialism and

warfare." That's exactly what the statists are doing, trying to kill the golden goose. To be fair, while some want to kill it, I think many think it can survive anything, even strangulation.

I don't know who they are, but just from reading those quotes I know they won't be in a position of power and influence within the government. Ever.

I just noticed the "chip in" ad for reason. Nice.

Income inequality is simply an excuse to steal.

fool, there need be no excuse for criminal activity. It's a rationalization.

It's not stealing when the government does it. If it was, then the government would help you get justice.

One thing to bear in mind is that if Picketty was correct in his assumptions, the Soviet Union would have been a smashing success economically.

The reason is what von Mises described as the socialist calculation problem.

The more resources a Howard Hughes controls, the more trouble he has coordinating the activities of the various resources under his command. Inevitably this leads to less than optimal production and consumption patterns. The greater the size of the business empire, the more inefficiently it will operate. And, above some threshold of inefficiency, an opportunity forms for an upstart competitor, who despite being relatively poorly capitalized can combine resources and capital goods to do the same job as one of the empire's most inefficient arms does, but to do it more efficiently.

The effect is more dramatic when Howard Hughes retires and turns the decisions over to a commitee.

Now, consider if Picketty was right, and the rich get richer while the poor stay in stasis. In that case, one man with X amount of capital could service Y customers better than 10 men with X/10 capitalization could service those same Y customers. And the larger the firm, the more pronounced this effect would be. The biggest, most capitalized company would slowly push its smaller competitors to bankruptcy, acquiring their assets at fire sale prices, until one day you either worked for the Company, or starved. And the commies, where the entire production system was under the control of one group of persons, would have completely outpaced the growth of equally rich free market economies.

If Piketty were right, the top 10 richest people on Earth would all be Rockefellers. If you adjust for inflation, John D. Rockefeller was worth well over $100 billion dollars at the time of his death. By the 1970's, when Nelson Rockefeller became vice president, it was disclosed that the whole FAMILY was worth 1.3 billion.

Now you can say 'that's a shitload of money' and you'd be right. But their fortunes had fallen tremendously in less than 100 years. 100 years from now, I'd be shocked if a single descendant of Rockefeller was what we consider to be truly 'rich.'

CEOs are given far too much credit (and get too much blame) for a company's performance.

I don't believe they are sufficiently punished for poor performance.

The mechanism by which CEO pay is determined is definitely broken.

And your excellent distinction between founders and hired guns cannot be overemphasized.

It's good to be rich.

So this

Lead me to this

http://www.tweaker.org/crystal101/weights.html

Somebody should tell the druggies that we've got this thing called *the metric system* for a reason. If they can't handle the 'Standard' system.

Quarter, half, teener, 8 ball. Reinventing the fething wheel here.

All I know is t was not uncommon to watch an immigrant parent work like a dog amassing some coin while the lazy, douche son drove around in an NSX.

Better the lazy douche son than the venal and detestable government.

Exactly,. At least the lazy son is investing capital in other entrepreneurial ventures through the division of labor: car, gas, strippers, booze, drugs, anything women want, et al.

the constant hiring of people just because they've been CEOs before, regardless of their success in those roles.

"Nobody ever got fired for buying from IBM."

Part of the reason: Regression to the mean.

The obvious response to McCloskey's evidence will be that our environment has changed since the robber baron era and thus fortunes accumulated now are more likely to preserve themselves and cause economic distortions.

This in turn reminds me of the current global warming rhetoric and other economic Armageddon scenarios. Bjorn Lomborg killed Lester Brown for continually projecting harvest failures by extending 1992 (fall of Soviet Union) trends, and of course everyone mocks Michael Mann's famous hockey stick. Watch for this.

A book harkening back to Marx's Capital shares many of the same errors? Interesting.

So the concentration of wealth we've seen isn't due to 10+% return vs. 3% growth since 1982, but some other factor? I read this and all it seems to say is that growth is actually greater than return because hey look over there!

I want to eat the rich too. The successful investment returns over the past few decades surely is a vehicle for wealth. But it is hardly limited to just the top earners. I get more upset at those who's wealth comes from taxes than from generating value.

The rich are stringy and not very good eating. Especially those 3rd generation layabouts.

No way, dude. Third-gen one-percenters are tender and well-marbled like veal, as long as they haven't been spending too much time with personal trainers.

If two people invest in the same product two different amounts the returns won't be the same. For example, Tony invests $10 (remember he's a lefty he naturally has less because he'd rather it be redistributed to him expropriated from someone else) and you invest $100. Say, the investment renders 5%. Tony made .50 cents you made $5. But in the lefty world view, this is not basic financial math. No, no. It has little to do with you having the tenacity to save more in order to improve your wealth. No, siree. It just means it's unfair ergo someone has to 'make equal' the difference; in this case $4.50.

I've never seen anyone explain why concentration of wealth, even if it really has gone up, would be so horrible. Just about everyone is richer today than they were in 1982. The Tony's of the world sit here on a computer in a room that probably has a TV, the latest generation of video game console, and god knows what else that didn't even exist in 1982 and whines about growing income inequality.

If you listened to the modern left in the West, your average poor American is standing in bread lines and congregating around garbage fires to stay warm while the heathens at the top get richer.

In order for inequality to actually matter, the wealth needs to stay concentrated. And it doesn't.

Does too, does too.

/Tony

I might add, in my example, the reverse is true. People who invest more of their income lose more of their net worth when markets fall. That often gets overlooked. So, if the market falls 5% Tony loses less in total dollars. But now we're getting into 'it's all relative' territory. After all, a loss is a loss regardless of what class you're in.

Brochettaward|6.24.15 @ 1:43PM|#

"I've never seen anyone explain why concentration of wealth, even if it really has gone up, would be so horrible. Just about everyone is richer today than they were in 1982."

Tony would be very pleased if everyone were as poor as the average Euro-trashian, but it would have to be everyone.

If *you* got that additional $4.50, proggy assholes like Tony would still froth at the mouth. Envy, baby! Envy all the way down!

Don't he look great in green?

Frankly, the difference between what Tony thinks he wants and what he actually ends up with is vast. Tony is all talk and no think.

And now, he has backed himself into a corner so much so he has to maintain the pretense of the "compassionate progressive" or he will lose face.

He actually thinks redistribution increases liberty, despite all evidence to the contrary. I almost wished I had the power to snap my fingers and say "wish granted"- just to prove to him how hellish his existence would be. He'd be howling for me to "please, change it back".

The Pope says it is bad and hates it.

Which is why I love greedy CEOs. The greedier, the better.

It's truly an absurd notion. These people will get all pissy if you call them socialists (and I'll admit, that term is overused by the Fox News crowd) but when you are essentially arguing that two people having different incomes is inherently bad and requires government force to correct... That's socialism.

My view on CEO salaries is: let them be, unless you can prove that they got them through fraud or force. Just because some guy is being paid millions per year does not mean that that money is being extracted from the pockets of the poor.

Picketty is basically postulating (giving him the benefit of the doubt here) changes in the *current* economic climate that create a positive feedback loop for capital. And he's postulating that this positive feedback loop will continue into the indefinite future.

1. This is contrary to all previous data - someway, somehow, in the last 40 years there would have to have been a sea-shift in how the economy works to create this positive feedback. The mechanism of this change is something Picketty does not describe, nor does he provide any evidence to support his charge that this change (if it exists) will continue for the indefinite future.

2. In general, positive feedback loops are vanishingly rare and those that exists tend to find a new stasis plateau, rather than continue.

No, Picketty pretty explicit claims it is an inexorable historical trend.

Even calling it "concentration of wealth" gets it very wrong. Wealth is not concentrated through investment, it is created. Calling it a concentration of wealth is the same old zero-sum fallacy that leftists can't seem to shake.

I wonder how much of that is a result of most of them not being entrepreneurs, or owning properties etc. That is, having had a chance to stand on the other side of the aisle if you will.

A person with a billion dollars will spend substantially more in the economy than a person with $30 thousand. But the former will also stash substantially more. That is not productive except of interest. Creating wealth is more efficiently done when not only are the superrich investing, but when there is a large so-called middle class that is spending.

Or you can manufacture a scenario in which wealth is simply hoarded at the top, making plenty off itself, realizing that a vigorous market isn't really all that necessary since you'll get bailed out during crises anyway, and deal with the problem of the agitation of the 99% by convincing enough of them that your wealth is their virtue.

HAHAHA. Funny. And endearing.

You're so dang cute when you're dumb. Precious, precious boy.

But the former will also stash substantially more. That is not productive except of interest

Stash. I don't think that's what they are doing. If they were, they wouldn't be earning interest.

The money to pay interest comes from the productive use of the money that went into an investment. My bank doesn't pay me interest just because, and the money doesn't come out of thin air. The bank uses my money productively and then gives some of the return.

Yeah, sure, without a healthy economy that invested money isn't going to produce much of a return. Which would give me an incentive to spend instead of save. Which presumably would help make the economy healthier.

Or you can manufacture a scenario in which wealth is simply hoarded at the top, making plenty off itself, realizing that a vigorous market isn't really all that necessary since you'll get bailed out during crises anyway, and deal with the problem of the agitation of the 99% by convincing enough of them that your wealth is their virtue.

I'm not aware of anyone here that would like to manufacture such a scenario. Bailouts aren't exactly part of free market libertarianism.

wealth is simply hoarded at the top, making plenty off itself

Tony- Honest quesiton: how do you think that money makes "plenty"?

A complete economic imbecil.

That money is invested which creates more wealth. The company that rich guy invests his money in uses that money to buy raw materials and labor which turns $20 worth of silicon plastic and metal into a computer or a TV worth $690. Yielding a return to the investor, a profit for the company, a job for the laborer and a new TV for the consumer. Something that didn't exist now exists and has value.

Christ, you are stupid.

Tony thinks that rich people keep a lot of their wealth like Scrooge McDuck, and swimming pools filled with gold coins are just not helpful to the economy as a whole.

Of course, even if they did that, it would simply increase the value of everybody else's money; it would be like giving their wealth away.

Tony thinks that rich people keep a lot of their wealth like Scrooge McDuck, and swimming pools filled with gold coins are just not helpful to the economy as a whole.

And yet even if that were so, it would not be so bad. Setting aside specie (wherein the metal itself may have uses other than as money), stuffing literal money into a literal mattress harms no one. It falls out of the money supply which allows the rest of us to squeeze a little bit more out of each dollar. The only potential risk is that the (foolhardy) rich guy (or one of his descendants) digs it out and spends it all in one place, creating a money shock. But in today's economy, thanks to much-maligned things like high-frequency trading, big changes in the money supply are noticed pretty much immediately. Nobody could get away with dumping money because it would be losing value as they were dumping it.

Lefties really don't understand economics, at all.

AND he's a complete economic imbecile too.

Creating wealth is more efficiently done when not only are the superrich investing, but when there is a large so-called middle class that is spending.

What nonsense. The average savings rate is far lower, and personal debt far higher, than it was 50 years ago. The savings rate hasn't been above 10% since 1984. We just had a housing bubble as recently as 8 years ago where people not only out-leveraged themselves to get nicer homes, but used the wealth value of their existing house to buy cool shit for themselves. Based on the level of the DOW, the superrich appear to have no problem with investing, while personal savings are once again at levels completely opposite of where they were 50 years ago and personal debt has once again begun its largely 35-year exponential climb.

The problem, Tony, is that none of your prog bullshit squares in any way with empirical reality.

Exactly wrong. Whether I invest $1 million in the stock market (or give it to a bank or whatever) in order to get a return, it isn't "stashed", it is spent just as surely as if I had used the $1 million and bought cars and furs and homes. The difference is that when I invest it, it is spent on machinery, roads, houses, etc. that people use to do something productive and useful; that is why they are able to pay me interest on my money.

Anyone who is that rich doesn't have their money in a bank account collecting interest. Even assuming that just collecting interest isn't productive (which it is), rich people's money is for the most part invested in productive companies, creating wealth, jobs and stuff people want or need. Almost no money is just sitting there.

Here is another way to look at it. Say I am worth $1 billion and my wealth is in various investments. There is no way I could come up with $1 billion in cash. As soon as I tried to liquify my assets, their values would drop. A high net worth doesn't mean someone is sitting on a pile of cash. Only the guy with $30k ever does that.

Unlike the middle class, the wealthy disproportionately have their cash invested in private businesses and in stocks and bonds directly.

I meant to include "You are correct" at the beginning in case it wasn't clear.

Just make saving and investing illegal. You will create infinite wealth and won't be confused with someone who is really just envious of wealth.

"But the former will also stash substantially more. That is not productive except of interest."

And again Tony reveals that he sees the world through Duck Tales. Tony, rich people don't "stash" their money in their pools. They invest it, and the institutions it is invested in (i.e. banks, businesses, real estate firms, etc.) then spend that money. Invested money is not lost to the economy.

God, you're stupid.

Hey: how about we just mandate that rich people are required to spend and invest a minimum % of their money. You happy now?

This was written by a 10 year old.

Personally, I stash all my wealth in woodchippers.

I LOVE YOU TONY YOU ARE SUPERSMARTEST COMMENTER #1 AND DONT LET ANYONE TELL YOU OTHERWISE!!!1!!!1!!1!

Dear Tony,

Let's do an experiment. Take all the money (Federal Reserve Notes) out of your wallet, and cut them in half. You now have twice as many pieces of paper; does that mean you are twice as rich?

Go have a lie-down, and ponder.

XOXO

Dear The Late P Brooks,

Thank you for your suggestion. Now give all of your money to David Koch. Let me know when your investment starts producing a return.

DEAR TONY

YOU ARE SPECIAL DONT LET PPL HURT YOURE FEELINGS

Since you can't cut 0 in half, you're stumped, aren't you?

Why do you like David and hate Charles?

He likes peter and paul - he just has no idea what a scam it is.

Damn you to HELL for figuring that out (tee hee)

I assumed Tony would like the gay Koch.

The originators of great wealth are one-in-a-million geniuses; their innovation, invention, and single-minded entrepreneurial focus create myriad jobs and productivity enhancements for society at large.

Luck does play a role, too. And that's fine. Chance is part of life. It's neither practical nor desirable to eliminate that.

That's the wrong premise, and comes from a Marxist or fascist "value based" view of compensation.

In fact, CEO compensation is primarily based on risk and cost to the CEO, not CEO performance.

A failing, underperforming company will have to pay a premium to hire even a half-decent CEO, because anybody they hire will have their reputation stained by the experience, will have to deal with a lot of unpleasant shit, and will probably still be out of a job in a couple of years. And the company is willing to pay huge amounts of money even for mediocre candidates because they desperately need a CEO.

A highly successful, well-performing company doesn't need to pay their CEO much because many people would do the job just for the benefit to their reputation and the fun they can have in such a company.

Tony- in fifty words or less, explain to the class the difference between an "investment" and an "expense".

I'll give you Tony's answers:

Investments are when the government spends money. Expenses are people who used to be Penses, but are no longer.

Taxes are ourselves investing in paying the future of civilization's price.

There, hope you learned something.

There are a number of problems with the "obscene CEO pay that results from captured boards has led to high income inequality" story.

First, there just aren't that many public company CEOs that are making these huge pay packages. If you look at the Fortune 500 lists, there are less than 180 public company CEOs making over $10M. At around 480 on the list, you start getting to below $1M. There is simply no way that these few people can explain increased levels of income inequality in a nation of 320,000,000 people. The "1%" consists of 3.2M people. 480 is irrelevant.

Second, the pay for the CEOs of private companies is every bit as high as in public companies. There is no serious argument that private company boards are captured by CEOs.

Third, individual income inequality actually hasn't increased. What has increased is household income inequality. The CEO story can't explain that.

+100

Thanks for the link to the McCloskey review. It is brilliant.

The wealth concentration claim is interesting considering that even back in 1934 a casual reference to the wealthy losing everything* was assumed to be known to the public.

*"And that gent today

You gave a cent today

Once had several chateaux.

When folks who still can ride in jitneys

Find out Vanderbilts and Whitneys

Lack baby clothes,

Anything goes."

BEST STRAINS OF BUD AVAILABLE FOR SALE

Hi mate if you need the best buds to get high contact us for more info

Medicated Marijuana

Green Crack

Purple kush

Granddaddy purple

Sour diesel

White widow

Afghan kush

GDP per gram

OG Kush

Black widow

White Widow

Hawaii-Skunk

Hindu Kush

Super Silver Haze

Real OG

Super Skunk

Lemon kush

Bubba kush

Blueberry

AK 47

contact us now at;Chicinat@gmail.com

Text;5174923178