Federal Debt to Exceed 100 Percent of GDP by 2040

Do ya think it's time to rein in the spending a tad?

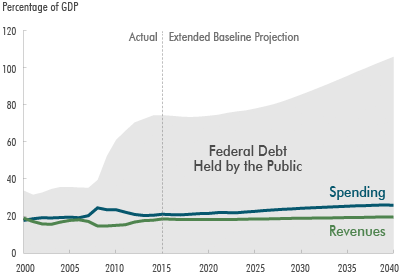

Sen. Rand Paul (R-Ky.) wants to "blow up the tax code and start over," but the bloated government edifice supported by those taxes could use a little demolition too. The Congressional Budget Office's 2015 Long-Term Budget Outlook is out, and the takeaway is "If current laws remained generally unchanged, federal debt held by the public would exceed 100 percent of GDP by 2040 and continue on an upward path relative to the size of the economy—a trend that could not be sustained indefinitely."

The phrase "could not be sustained indefinitely" is a phrase that appears again and again in CBO documents. Translated, it means, roughly: The bill is coming due, assholes.

That's because the soaring national debt is not a new thing, nor are warnings about it and its nasty effects on Americans' prosperity. Those effects include displacing private investment, resulting in lower productivity and reduced income, even as the cost of paying the government's bills soar. That means a poorer, more constrained country.

The federal government has spent more money than it takes in for years. The deficit has shrunk and grown a bit during that time based on specifics of policy and the economy, as have projections of just how much the debt will pile up inthe years to come. But nobody has yet seriously suggested that revenues and spending will match up anytime soon.

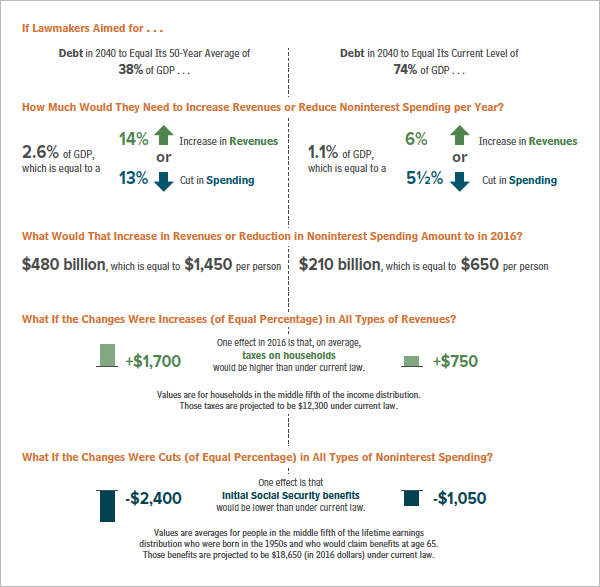

In the latest outlook, the CBO does offer some suggestions for avoiding a mass national drowning in a sea of red ink, just in case politicians are short of ideas. To maintain national debt at the current 74 percent of GDP, the feds would have to "slash" spending by 5.5 percent or increase revenues by 6 percent. To return the national debt to its 50-year average of 38 percent of GDP, the feds would have to actually reduce spending by 13 percent or increase revenues by 14 percent.

Yes, the idea of actually reducing spending causes much rending of garments in Washington, D.C., but it's been less than catastrophic when done in other countries. Canada "slashed total spending 10 percent in just two years and then held it roughly flat for another three years" in the mid-1990s without being reduced to a post-apocalyptic wasteland, points out the Cato Institute's Chris Edwards.

Politicians, by and large, will probably prefer to look at the revenue-raising side of the equation, because there can't possibly be anything to cut in the budget. But there's less wiggle room there. With the occasional surge, revenue has topped out at an average of 18 percent of GDP since the middle of the last century. Maybe thefeds can squeeze more blood from the stone, but that's not what history suggests is going to hapen.

And honestly, there's plenty to cut from the oversized federal government. Let's start with agencies that are lousy at their jobs, or those that can't hold on to sensitive data without handing it to the first hacker who asks…

Note: As commenters have pointed out, some measures of debt have the federal government already exceeding that 100 percent threshold. The St. Louis Federal Reserve Bank puts total public debt at 102.76 percent of GDP in the first quarter of this year.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

No, because austerity.

THIS^^

"This time is different!"

What the politicians hear is "We can kick the can down the road a few more times."

Sometimes, like Greece, you reach the end of the road.

Greece technically defaulted June 5th, but everyone seems to be waiting for when the big payment is due on June 30th.

Maybe they could roll a big wooden horse up to the doors of the Bundesbank.....

Perhaps if we built a giant wooden badger...?

"...then Galahad, Launcelot and I jump OUT of the rabbit..."

Anything wooden is verboten.

They all want cake.

Maybe they could roll a big wooden horse up to the doors of the Bundesbank.....

And what would jump out? Certainly not battle-hardened hoplites. Waiters? Cab drivers? Or just a bunch of lazy fucks with their hands out?

They're not looking to cause damage, but who wants to see a pile of dirty Greeks stacked up at the doors.

Beware of Greeks baring anything.

+1 hairy mediterranean

Wasn't there a book where all the Peoples Republics of Europe were failing, one by one, because their governments promised them moar free shit than they could possibly ever provide...in the name of social justice?

What book was that?

Edited by Adam Smith. Chapters by Bastiat, Hayek, Mises, ...

It will take us much longer to reach the end. Unlike Greece, we can print our own money. Our end will have cool $billion bills. It will okay because we can put the faces of famous feminists on the new denominations we'll be using to buy gum.

I nominate Rachel Dolezal for the billion dollar bill. She's a pioneer of trans-racialism, after all.

she did what Obama could only promise.

Fitting for a $1BB bill that's worth $10 in real money.

A B? Pfft let's go big.

http://www.mikecampbellfoundat.....es/Picture 2 Ben Speach.jpg

Well that link failed. -1

http://www.quickonlinetips.com.....-front.jpg

Wait...Canada isn't a post Apocalyptic wasteland... Who knew?

I think we should change "e pluribus unum" to "no, fuck you, cut spending".

I second your proposal.

"Wait...Canada isn't a post Apocalyptic wasteland... Who knew?"

When the Rightful Heir to the Trudeau dynasty succeeds to the Throne of Canada this fall, the Wasteland Prophecy will be fulfilled.

Visit in the winter, you might change your mind.

It's already over 100% of GDP.

Of course they're going raise revenue. That way they'll have money to spend on all the new projects that are being held down in our current period of austerity.

That way they'll have money to spend on all the new projects that are being held down in our current period of austerity

Orwell would applaud. Sadly this is exactly how they think.

Of course they're going raise revenue.

I don't know that they really can, at least via taxes. There seems to be a hard cap on how much they can extract at around 19% of GDP, and we're pretty much there.

My prediction: they will do a stealth/slow motion confiscation of retirement accounts, by requiring that they be X% invested in Treasuries to keep their tax deferred status. You'll have the choice of losing tax deferred status (and having to pay a big chunk of your retirement as taxes right then and there), or you can give them a big chunk of your retirement in exchange their paper.

Sadly I suspect you're correct. It worked so well for Argentina...

Whichever way they do it, I agree that they are most likely going to go after retirement accounts. There's no way that they will be able to resist so much money "just sitting there".

There is nothing of yours/mine/everyone's that they won't take if they get the opportunity. The only reason they haven't done it yet is that they don't quite have the power to do so without fear of being strung up on lampposts. The instant they feel like they can safely...they will.

I think after the next big stock market dump, when everyone's 401ks take a big hit and people cry about how they didn't know you had to take risk to earn a return, they'll have the crisis they have been waiting for to do this.

Exactly right, RC.

I'm actually very surprised we haven't heard noises in this direction yet. I mean, it's the most obvious thing for them to go after next.

Here's a great piece by the lovely Danielle D'Martino Booth

By the time the Feds get around to figuring out a way to out-right confiscate savings there might not be much left.

I don't think you're giving their evilness enough credit. When the poor mob is on your side, the rich have nowhere to hide their loot.

I thought it already had.

Likely they are not counting the debt that the government owes to itself. For some reason that won't have to be repaid.

If not for the fact that the US Dollar is the reserve currency for the world we'd be staring at an imminent Weimar Germany scenario. I'm not entirely convinced that we aren't in any case.

They're doing it in the weirdest way ever. Pump it through the fed to banks at 0.5% interest WITH THE TERMS THAT the bank turns around and loans it right back to the government at 3% interest. That absolutely blows my fucking mind. I consider myself to be at least marginally intelligent and I can't come close to wrapping my head around that conceptually. Where did the money come from and go? It's giving me object permanency issues.

Japan has had debt of 200 percent of GDP for a while now. Why ain't they tits up, deader than Elvis about now?

Have you seen Japan's economy?

http://www.economist.com/node/13415153

They've had like no growth for 20 years.

"If that turns out to be true, Japan's economy will have grown at an average of 0.6% a year since it first stumbled in 1991 (see top chart). Thanks to deflation as well, the value of GDP in nominal terms in the first quarter of this year probably fell back to where it was in 1993. For 16 years the economy has, in effect, gone nowhere."

Since the Japanese are such calm men and women, this total lack of economic growth hasn't been the catastrophe it would have been somewhere where the people are a bit more, uh, rambunctious. If you had no economic growth for 20 years in France, that would mean all the dirt poor Muslim ghettos would remain dirt poor indefinitely and you'd end up with some major problems.

If you strip out whatever "growth" Japan has had that has been funded by debt, I'd bet they are stuck even further back in time.

And their savings rate has been utterly eviscerated thanks to central bank policy. A nation of savers is now a nation of debtors. "MISSION ACCOMPLISHED!", according to central bank clowns.

http://highway6.com/images/9d8.....255484.png

Oh my God, I hadn't realized the savings rate got this bad.

I found an article saying their savings rate actually became NEGATIVE for a few months last year. The exact same thing happened in America right before the housing crisis, so they could be in for some rough times.

Also, isn't it interesting that Japan had a gigantic rise in their fortunes while their savings rate was up, yet their fortunes have declined dramatically as the savings rate has fallen? So much for the 'paradox of thrift' Mr. Keynes.

Economists like Jim Chanos complain about a "savings glut" internationally because China and some other mostly Asian countries have high levels of personal savings, not just government surpluses but individuals saving. This is a problems because if those people spent their savings then we get a demand surge.

Hear that Chinese people? Stop working hard and setting aside money so that you can build a future. SPEND, SPEND, SPEND. All people across the world should be debt slaves.

Eating your seed corn is the best way to more corn in the future. My krugman plushie told me so.

You know what other growth has been on hiatus for 16 years?

What has our (the US) growth been over the last 20 years? Anyone know?

This graph from the Economist gives a suggestion:

http://media.economist.com/ima.....CFN226.gif

And if you strip out the GDP growth funded by debt it wouldn't show anything.

It's funny Krugman holds Japan up as an example of how unlimited debt and spending policies never hurt anybody, at all, ever.

Krugman's opinion about Japan is that they didn't spend enough, they didn't take on enough debt to achieve escape velocity from deflation. Of course, if you're a saver you love deflation even with low yields on bonds because prices are falling, things are getting cheaper, your purchasing power is getting stronger. Debtors hate deflation because their relative purchasing power is decreasing and their debt isn't being eaten away by inflation. Governments are nearly always debtors.

Well Krugman's point was to respond to critics of high debt-to-GDP ratios and he said basically "If high debt is so bad, then how is Japan doing so fantastically well?" (paraphrased) He wasn't using Japan as an example of anything to do with inflation or deflation per se.

They are, but most of their debt is held domestically, and basically the government forces people to save by investing indirectly in government bonds.

As soon as their interest rates tick up a couple of points, they are utterly fucked. And it will happen, because debt is still artificially cheap thanks to central bank clowns.

We can't be broke. We still have checks.

Well, the Greeks elected a lefty liar, and now his common-law wife is threatening to leave if he agrees to the Euro-terms:

http://www.independent.co.uk/n.....27912.html

Seems she's to the left of him and really, really wants him to find those damn unicorns!

What we need to find is a unicorn that eats carbon dioxide and shits money.

He should declare that the family court ruling is illegal and odious.

To maintain national debt at the current 74 percent of GDP, the feds would have to "slash" spending by 5.5 percent or increase revenues by 6 percent.

There are a few problems here:

1) The national debt owed by the public may be 74% of GDP but total national debt is already over 100% of GDP, so the problem is actually much worse.

2) The feds may have to "slash" spending by 5.5% (if the 74% number is correct, which it isn't) but the far more challenging part is the government would not be able to raise spending at all - it would have to maintain the 5.5% "slash" indefinitely. Good fucking luck with that.

3) Sure, you can raise revenue by 6% but the government would have to not raise spending at all indefinitely. Again, good fucking luck with that.

State and local governments are worse off, and we will see more Detroit's. That debt is largely ignored. The left doesn't want any discussion there because the main cause of it nationwide is unfunded benefits given out to the public sector.

Even 'just' 74% of the GDP is far higher than what is considered 'healthy.' That surpasses even the EU's debt-to-GDP limits.

Agreed. CA and IL will probably need bailouts sooner rather than later.

Also, the current debt does not include unfunded liabilities. Something like $100 trillion. That doesn't include unfunded state liabilities.

But I'm sure it'll all end well despite the fact that it never has.

I'm not an economist, so please correct me if I'm wrong.

Politicians are spending a shit-ton more than they are taking in, giving the population free shit in exchange for power. They cannot cut spending because they'll be voted out for stopping the gravy train. They cannot raise taxes for the same reason. SO, their plan is to inflate their way out of debt because a) no one who's not an economist will notice and b) they will likely be out of office anyway when TSHTF anyway.

Inflation is essentially a tax. It is an extremely regressive tax as the poor are hit the hardest by a loss of buying power. SO essentially, what's going on here is that politicians get elected by professing to want to help the poor while, in reality, taxing the everloving shit out of them and ensuring their futures will consist of living in permanent squallor.

That about right?

Nailed it.

Oh, and squalor too.

I think that the big elephant in the room is that the interest rates on Treasury Bonds are still unusually low, thanks to the Fed keeping them artificially depressed (by themselves purchasing them) and their perceived stability compared to the market's uncertainty attracting investors. When the bonds, and they will, go back to their historical around 4% average you're talking about going from a quarter trillion in interest payments to about 3/4 of a trillion per year, just from the uptick in interest rates. And it's worth a reminder that in the 1980's we saw 15-18% interest rates on T Bonds. Any significant upset in monetary confidence, any inflationary fear or even just a booming economy with lots of other things to invest in and we could absolutely see a return to that because the Treasury would have to offer high rates just to find someone to purchase bonds.

If we went back to 1980's rates, and it's entirely possible, you're talking about several trillion a year in just interest payments. What would that do to the defect and debt? We're talking about a death spiral at that point. It's mind numbing the gamble that's being waged on our monetary system right now.

federal debt held by the public would exceed 100 percent of GDP by 2040

The solution is obvious. Government spending is part of GDP; if we increase government spending enough, we'll push down the relative size of the debt.

The solution is obvious. Government spending is part of GDP; if we increase government spending enough, we'll push down the relative size of the debt.

There goes the next chief of police Speaker of the House.

Ain't Keynesian economics grand? No matter what the problem is, government spending is the answer!

OT: This is slightly disconcerting:

I'm a front end WordPress developer at a government agency.

I just got a recruitment email for a front end WordPress developer position at my same government agency, in my same bureau.

I'm sure you are fine, they are just under a mandate to reduce unemployment.

You should try out, I'll bet you could get it easy.

Maybe this is your chance to break into the private sector...?

Check with the Chinese and Russian governments. They have your complete digital HR file.

Apply for it!

Under Bush, every leftwinger I knew ranted about the debt being accumulated. Most of the ring wingers didn't care. Under Obama, you have the flip situation. Everyone wants to cut spending on whatever the other team wants to spend on.

Salon and Slate see this report, and if they don't ignore it, they are busy readying more of their brilliant stories that explain in retardese why the federal debt isn't like your credit card bill. This is magical stimulus money.

This might take two or even three trillion-dollar coins to solve!

Politicians are parasites. They are very good at squeezing the maximum amount of take from the host, and at constantly pushing that edge. Their incentives are to get all they can now. The very nature of "democratic" politics changes the incentives for powerful people. They don't think and act like an Augustus or an Elizabeth; because their power is fleeting and finite as based on elections, as opposed to lifetime, they do not plan for the future or care about what happens after they lose their power/office--at least not to anyone else but them.

We need to realize that politicians are behaving differently than they have in the past because the nature of the way they gain power is different. We've changed to a mostly democratically elected system in many countries over the last 200 years or so, and we're seeing the differences in the way the politicians behave. One of those differences is not giving a shit about budgets and the like, because the damage they cause by gaining advantages now is irrelevant to them; they don't care. Kicking the can down the road is the new normal, and along with that will be basically zero incentive to control spending or balance budgets. That doesn't give them political power now.

Always look at the incentives.

Democracy definitely incentivizes kicking the can down the road, but I'd be careful making the argument that monarchs were all that much more farsighted. Plenty of them racked up debt whether it was in the form of spending lavishly on themselves or wars to build their power/legacy. Debt was often part of the reason monarchies and dynasties collapsed.

What's pretty remarkable about democracy, though, is that it has been able to enforce taxation levels that most monarchs never would have attempted. The modernization of the state has also allowed great enforcement of tax policy.

But in general I agree. People will always vote to tap into the coffers and get out of paying themselves just like the ancients said. I guess that's why Thomas Jefferson is on record that the tree of liberty needs to be fertilized every once in a while with blood...

The Tree of Liberty was fed through a woodchipper years ago.

"I think I'm turning Japanese..."

Everyone wants to cut government spending. Just not on anything that will affect them or someone they care about. So that leaves out Social Security and Medicaid, since most people have family members who depend on that. Can't cut the military. I mean, you gotta support the troops, right? Can't cut any government agencies, since that would put people out of work. Can't cut grants to states, since that would mean higher state taxes. Shit, is there anything left? But yeah, everyone wants to cut spending. Just not that. Or that. And not that either.

Can't cut welfare because poor people dying in the streets.

Everyone wants to cut government spending, but only on their enemies.

As libertarians, everyone is our enemy these days.

See? Fairness!

Everyone CALM DOWN. We'll just print some more money

Obviously Greece is going to pull out or get kicked out of the EU. Then they can go back to printing drachmas to their hearts' content. The economic retards will think it great and not notice the steady inflation and slow economic decline. They really are too stupid to realize that they will pay the bill for government overspending.

Big spending cuts, even more taxes, or worthless currency (or some combination). Choice Your Destroyer.

The economic retards will think it great and not notice the steady inflation and slow economic decline.

Something tells me the decline won't be that slow. The retards will still not learn a fucking thing though.

No, it will be the fault of markets and greedy kkkorporations.

retards are retarded for a reason. Greeks kept electing the Socialist Party to power for the better part of two decades and it's not like the others were hard-core conservatives. There are some cultural habits that are too ingrained to eliminate very quickly. It's going to be a tough slog.

The mummers farce is almost done.

Another thing about this story that irks me. The supposed 'non-partisan' CBO issued it. The Republicans recently got to appoint the head of it. There is nothing non-partisan about anyone in Washington. They are all serving someone and have an agenda. Before, the CBO softened its language on debt and carried water for Obamacare. At BEST, you get bipartisan which doesn't mean honest.

I'm confused.

National debt = $18T

GDP = $17T

2040?

Economist...splain pleez.

The debt keeps rising as well as GDP. By the time GDP catches up, the debt (and GDP) will be much higher.

They're counting debt held by the public, which excludes the various internal debt obligations of the feds (mainly to SocSec).

Whether you should divvy it up that way, I couldn't say for sure. Probably not, though - its too easily gamed.

Well we owe it to ourselves and since the government is us then the government owes it itself.

Except we don't. 48% of the debt is held by foreign countries - some 6+ trillion.

https://www.fas.org/sgp/crs/misc/RS22331.pdf

Rein in spending? That's Crazy Teahadist extremist talk. That makes you a domestic terrorist. Drone dispatched in 3... 2... 1...

that chart is hilarious. according to it, politicians are going to stop borrowing for the next ten years.

Debt clock says debt today is at 18.27 trillion

http://www.usdebtclock.org/

US GDP is at about 13 to 14 trillion...

Last I checked 18 trillion is more then 100% of 14 trillion.

This is like the 3rd or forth time I have seen reason claim debt is less then 100% of GDP. No idea why you guys keep claiming this BS.

No idea why you guys keep claiming this BS.

The Top. Men. at the CBO said so...

Just wait until interest rates rise. That date advances much faster when rates go up.

What the hell? U.S. GDP was $17.4 trillion in 2014 and our national debt on January 2nd 2015 was ~$18.1 trillion. Am I missing something?

Yes, future outlay commitments and interest on debt as compared to future income.....so its worse then that. And that doesn't even count being on the FDIC hook for all the debt large private banks are holding. Get ready to drive your flintstone-car down to government quarries to get your alotted breakfast rocks.

100%? So like an A then? Maybe an A+ even ?

Bbbuuut...NASDAQ eleventy00000!

None of you seem to understand that our money supply is totally dependent on debt to the Federal Reserve. The money supply must have increased in the past 100 years or so to grow with the population and GDP. The only way that is done is for the Federal Reserve to loan it out, automatically generating debt. It is the way the system works. We cannot get out of it. It is how the system works. Reigning in spending may seem good, but it is not the answer to a perceptual problem and the problem that we are totally owned by the bankers. The real answer is to change that system.

DAMNIT!!! are we just NOT spending enough or something!? /sarc

they will never rest, not even when we are all broke....because rich people. haha