IRS Official Says Even More Employees Had Computer Problems, May Not Be Able to Comply With Congressional Subpoenas

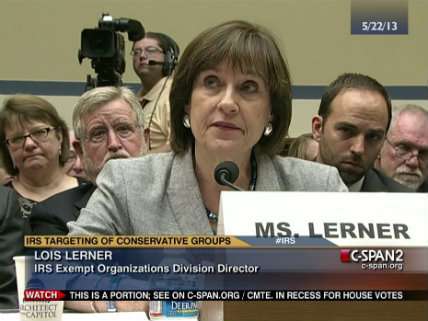

When the Internal Revenue Service (IRS) said that Lois Lerner, a former tax official at the center of a congressional investigation over targeting of conservative groups, could not produce an untold number of emails during a time-frame crucial to the investigation due to a hard drive failure, it seemed convenient, but entirely plausible. When it was later revealed that six more IRS employees could not produce certain records related to the investigation, at least one due to another computer failure, it seemed more than a little convenient. But still, these things happen.

Now, it appears that there are even more records that the IRS may not be able to produce due to employee computer failures. In transcribed testimony today, IRS Deputy Associate Chief Counsel Thomas Kane, the individual in charge of producing documents for congressional investigators, said that a number of additional tax agency officials "have had computer problems over the course of the period covered by the investigations and the chairman's subpoena," according to a House Oversight Committee release this afternoon. Kane placed the total number as "less than 20." The group apparently includes Justin Lowe, an exempt organization technical advisor, David Fish, who was the manager of Exempt Organization Guidance and an "advisor to Lois Lerner" (who ran the tax exempt division), according to the Committee release.

Details of what sorts of records can't be provided are still unclear, as are the particulars of the computer problems involved. But on the surface, this is pretty incredible. Yes, hard drives crash and computers malfunction, but increasingly, this strains credibility. Based on what we know, at least, this looks pretty bad for the agency, even if there was nothing particularly damning in the lost records and emails. The IRS appears, at minimum, to have a widespread problem keeping and storing records that might be of interest to congressional investigators.

Or at the very least, senior officials do not have any idea how the data retention process works. The other interesting detail revealed in the Committee release is that some email backup tapes may still exist. When Kane was asked about a June IRS memo to Sens. Ron Wyden (D-OR) and Orrin Hatch (R-UT) stating that "back-up tapes from 2011 no longer exist because they have been recycled," he responded hesitantly. There was "an issue" with whether the backup recovery tapes were actually destroyed, he said. "I don't know whether they are or they aren't, but it's an issue that's being looked at."

That seems like the sort of thing that the IRS should have been confident, certain, and accurate about the first time around, and the conflicting stories—first agency officials are certain the records were destroyed, later they are not so sure—does further damage to their credibility. The most generous possible story here is that the IRS is massively sloppy and incompetent in its records retention processes, and as a result suffered some extremely convenient data losses.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

The backups were recycled! See? Why do you hate the earth, you monsters?

The IRS appears, at minimum, to have a widespread problem keeping and storing records that might be of interest to congressional investigators.

I wonder if it's only records of interest to outside investigators.

What the congressional response SHOULD be:

How would you like a 25% budget cut instead of 10%?

Sure that shouldn't be 18 1/2 %?

All evidence is gone, due to a rogue AI accidentally released by the NSA. See, this rogue AI saw the congressional investigations as a threat and acted accordingly. No one directed this AI to do this, and its actions are a regrettable consequence. The AI has been utterly and completely destroyed, along with all documentation even tangentially related to it, to avoid it coming back into existence.

Looks like APEX is killing deckers in the Matrix again.

I was pretty sure I was the only one who played the new Shadowrun games.

You might be but some of us are longtime Shadowrun fans from the tabletop rpg

I blame Arnim Zola.

That seems like the sort of thing that the IRS should have been confident, certain, and accurate about the first time around

Now be fair, that is hardly the sort of thing one should expect of a massive accounting organization.

"Fake scandal fake scandal fake scandal fake scandal *take deep breath* it is a christfag fake scandal!!"

- Shrike

Notice how the Benghazi fake scandal disappeared a month ago after the Annie Lennox looking guy was given the top investigator role?

Hey Weigel. Clear up that problem acne yet?

"Fake scandal should be ignored cuz another fake scandal is being ignored. Christfags are christfags cuz they don't understand it is impossible for Obama or anyone under him to do any wrong ever. He is the chosen one you stupid christfags!!"

- Shrike

Really, there's no reasonable doubt that there's a massive cover-up occurring with the IRS. And why would that be happening if it didn't go way up? If it didn't, then the president would be tossing people out and locking up everything for investigation.

We're like about ten light years past Watergate here, people.

check Big Gov v Free Speech - A Real US Gov/IRS targeting coverup http://goo.gl/Jr7z0V #IRS #IRSscandal #FreePaulAndrewMitchell

It's interesting they set up a system where archived records could be retained only on local drives. That's not not by design. No one, not even government IT, would be stupid enough to design a system for records retention that allowed for that.

It's especially "interesting" because it seems to be flatly illegal. It's time for arrests and interrogations.

Riiiiiight. That'll happen.

Honestly, I'd like to see the Sgt-at-Arms office roll out in the MRAPs and M4s to escort IRS employees to their contempt of Congress hearings. It would be like hookers-and-blow day.

You're assuming the design goal was to KEEP the archived records.

No, seriously. What REALLY happened. Cause this isn't real, right? RIGHT? RIGHT??!! RIIIIGHT?!!!!!1111!

Slightly OT:

what exactly is Obama doing fundraisers for? He cannot run for re-election and it would seem that using tax-payer funded AF1 to essentially campaign should be clearly a violation. I know, the Dem party wants money, but shouldn't he be, idk, doing president things?

The great thing about being CEO is delegating everything to others. Reagan famously took long naps in the middle of each day. The POTUS gets to sign a few papers and that is it.

Sluuuuurp slurp slurp slurp.

Be sure you wipe your chin, Shriek.

Ok, I could be wrong, I wasn't really active here in 2008 but I could have sworn I have seen you bitch about how often Bush was in Crawford

IIRC they must pay for the use of AF1 (etc) when he's doing campaign appearences.

It practically pays for itself.

"What don't these rethuglican retards not understand?! There's NO EVIDENCE anyone did anything wrong! SEE? NO EVIDENCE!!"

How does an organization that exists solely to anal probe people over financial records get away with claiming ignorance of federal record keeping laws?

My tax return records for the past 7 years, you say? I have them all backed up to my hard drive. Dang, it's not booting....

Can't we stop saying the hard drives "crashed"? That's a useless non-technical term which gets applied to a wide array of possible problems. I'm curious what actually happened, well supposedly actually happened, to the hard drives.

What actually happened was undoubtedly that IRS officials, realizing the contents of those hard drives would fuck them, had some IT flunky run a magnet over the platters, destroy the hardware via an industrial shredder or furnace, and delete any network backups of their contents.

*Puts on tinfoil hat*

Obumbles, Lerner, probably Holder and certainly Dem legislators conspired together in the whitehouse on how to deny exempt status to groups representing their political enemies. Further, they tried to contrive a way to prosecute individuals belonging to those groups. Pure banana republic style tactics, cuz thats the kinda guys they are.

Now, with the secure knowledge that the AG will not prosecute anyone involved, they thumb their noses at investigators and destroy evidence of their activities with impunity. Congress is too nutless to impeach the AG, and even if they were to do so Obumbles would probably appoint someone even worse, so nothing will happen. Unless of course the next administration.....nah..nothing will happen.

*takes off tinfoil hat*

Wow, that just sounds almost as crazy as the justice department supplying drug gangs with guns. Fake scandals all.

It's good to be King.

Imagine if you committed a crime and could appoint your own DA and had the full force of the NSA/CIA/FBI/IRS at your disposal. And if you somehow got charged, half of your jury would be made up of up your best buddies, and the other half wouldn't mind being ambassador to Brazil (and know about the NSA/CIA/FBI/IRS full force thing).

And the guys on the other side wouldn't prosecute you for destroying evidence, because they don't want to set a precedent for when their side is in the White House next.

Serious question, at what point does the failure to adequately keep records and adequately investigate the absence of records allow a taxpayer to legitimately claim tax protester status?

I'm guessing never probably, but if the agency is so broken that it can't rightly claim it has accurate records of what you owe, you would at least have a claim.

I don't know about "legitimately claiming tax protester status", but I think we're at the point where a taxpayer should legitimately be able to request and be provided *all* records the IRS has on him/her.

I love the IRS, and have nothing but respect for the brave, patriotic labor it's employees selflessly provide to us citizens of the greatest nation in the land.

I think we're at the point where they shouldn't expect us to keep accurate records for more than a few months.

Does anyone believe its plausible that that many hard drives failed? I know they can crash, bad sectors, etc etc... but to even come across one when looking for records is suspious. two or more? Complete bullshit.

Take these 'failed' hard drives to some child pron investigator, there is still data on a crashed drive.

Its absurd.

Supposedly the drives were "recycled." There are machines that shred them, and no doubt the IRS used those.

lol... perfect! They must have sent them to MI5 or whatever goonsquad they sent to the Guardian.

Depends on which low bidder GSA used that year.

"Details of what sorts of records can't be provided are still unclear"

Let me take a guess as to which records can't be provided - the incriminating ones.

"I don't know whether they are or they aren't, but it's an issue that's being looked at."

Well, that's a profoundly ambiguous statement. I'm taking it to mean that, if any of these drives accidentally survived, they won't be around much longer.

As has been said before - start locking people up for obstruction of justice until somebody cracks.

Can't we arrest them for not taking good care of their computers then?

Does anyone believe its plausible that that many hard drives failed? I know they can crash, bad sectors, etc etc... but to even come across one when looking for records is suspious. two or more? Complete bullshit.

They also had 'crashes' in both the Washington and Cinci offices.

How partisan does someone have to be to ignore this level of shadiness? I don't think you are even a functional human being capable of your own thoughts at that point.

The take away I get from the is the IRS is too large to effectively manage the tax code. Let's work on simplifying the tax code so things like this do not happen again.