Erroneous Subsidies for Obamacare Coverage Nothing New for Feds, Who Make $100 Billion in Mistakes Per Year

Yesterday Peter Suderman reported that about 1 million people who have signed up for Obamacare have gotten inaccurate subsidies for their coverage:

The law's subsidies are doled out based annual income, and people who apply for coverage are responsible for submitting income data in order to prove eligibility for the subsidies. The problem is that a million or so people have entered incomes that differ substantially from what the Internal Revenue Service (IRS) has on file.

Normally this would be reconciled through a follow-up auditing process; when the system identifies people whose submitted incomes don't match IRS records, those people are asked to send in further paperwork as proof. But only "a fraction" of those people have responded, according to [The Washington] Post. And even when they have provided additional documentation, it doesn't matter.

It doesn't matter because the government isn't following up on the mismatches. It will be interesting to see how many people mistakenly claim they don't smoke, either (smoking is the one activity—it's not a pre-existing condition precisely—that will increase your premiums).

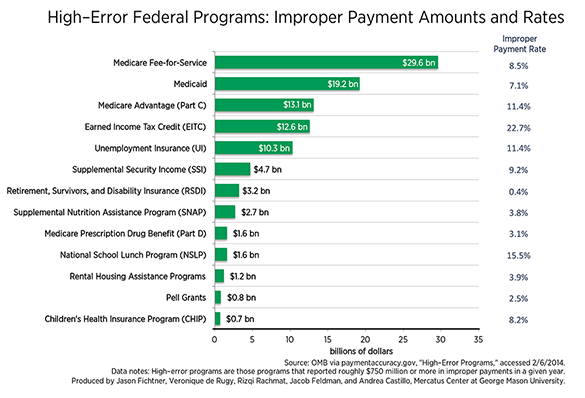

But as Reason columnist and Mercatus Center economist Veronique de Rugy and her Mercatus colleague Jason J. Fichtner have pointed out, erroneous payments by the federal government are nothing new. Programs such as the Earned Income Tax Rate (EITC), the school lunch program, Medicare Advantage, and unemployment insurance all have improper payment rates in the double digits.

Based on data from the Office of Management and Budget (OMB), de Rugy and Fichtner note that "over $100 billion in taxpayer funds were improperly spent in 2012," the latest year for which numbers are fully available. Some programs (such as Social Security) have low error rates but nonetheless fork over huge amounts in mistaken payments. Social Security's Retirement, Survivors, and Disability Insurance (RSDI), explain the Mercatus analysts, has an error rate of just 0.4 percent but still sent out $3.2 billion in improper payments.

Other programs

not only have a high improper payment amount but also a relatively high improper payment rate. The $12.6 billion in misspent EITC outlays represents a substantial portion, 22.7 percent, of total EITC spending—suggesting that the EITC is prone to fraud, waste, and abuse. As the chart displays, Medicare Advantage (Part C), Unemployment Insurance (UI), and Supplemental Security Income (SSI) face problems similar to the EITC, with anywhere approximately from one in nine to one in eleven dollars in these programs being disbursed improperly.

Read more here. Below is a chart showing error rates. We can look forward to future charts that will include Obamacare subsidies, for which most people on the individual insurance market qualify.

Show Comments (10)