Bitcoin is No Substitute for Government Money, But a Refuge From Control

Bitcoin has the ability to bypass capital controls. If you can convert your wealth into Bitcoin, you can get it out of your government's reach.

There are many reasons why Bitcoin is a revolutionary and disruptive invention, and its wider adoption promises many benefits for individuals and the economy. Delivering us from the perceived unfairness of inflation, however, is not one of them.

Bitcoin has no central bank. Its supply is fixed and its growth rate controlled by an immutable algorithm. As a result it is very attractive to those who are suspicious of politically controlled monetary policy.

Among those is my good friend and colleague Jim Harper, global policy counsel at the Bitcoin Foundation, who last week wrote a very interesting post on the Foundation's blog, which concluded: "Fiat-currency-denominated savings do not hold value. Bitcoin will. That is monetary justice, and it will bring greater wealth and security to people who truly, truly deserve it."

Hard money types have been a large contingent of the Bitcoin community since its inception, and I've never had occasion to critique their view. But I think Jim's piece presents a good opportunity to do just that, first and foremost because it is such an excellent articulation of the hard money view, but also because it did not simply appear on Reddit, but on the blog of the Foundation, which is the closest thing Bitcoin has to an official body.

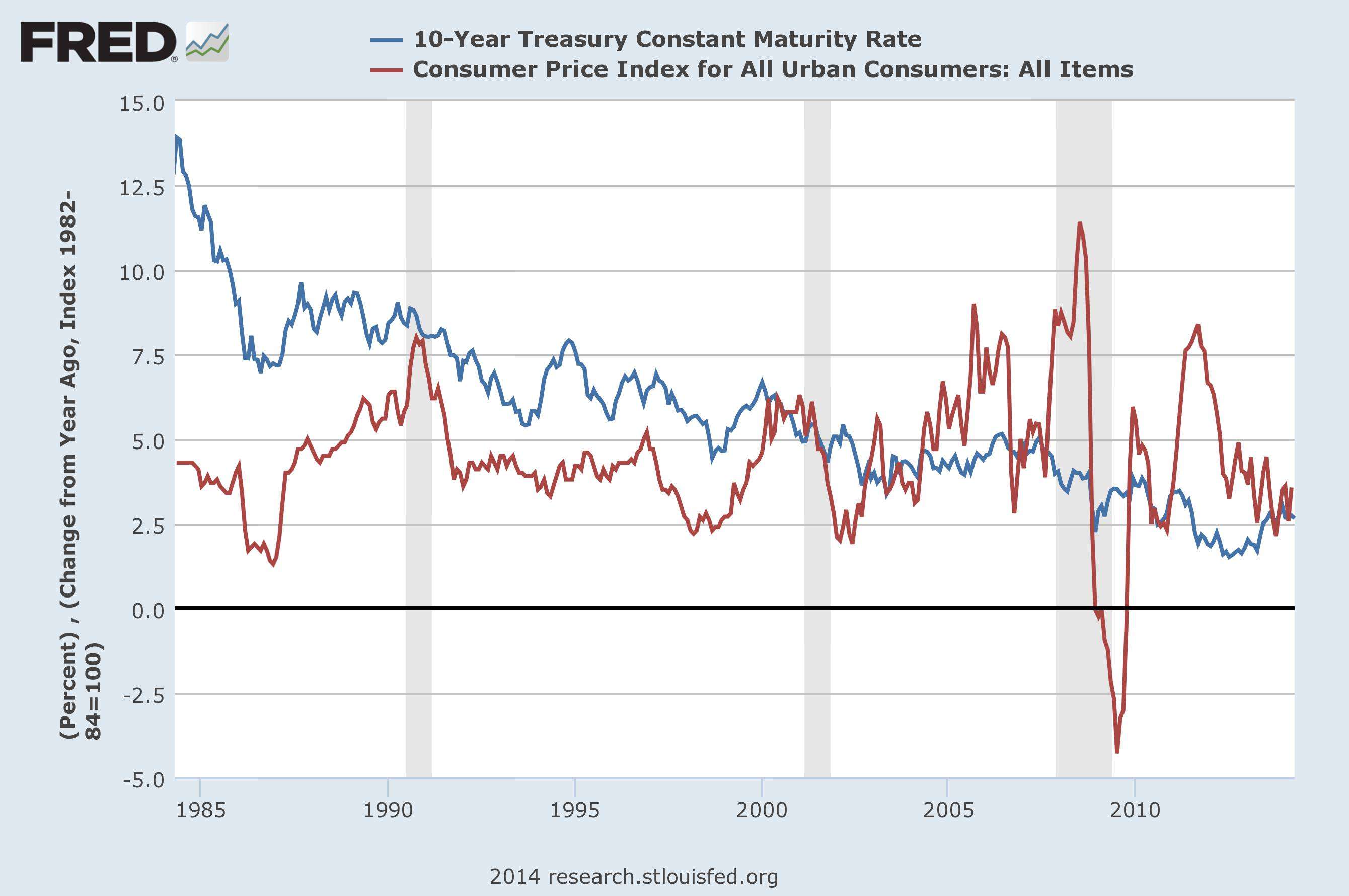

The first claim is that fiat savings don't hold value. This could certainly be the case if one were talking about Zimbabwean currency, but in his piece Jim was referring to U.S. dollar savings. In that case, the facts just don't agree. Looking at the last 30 years, which is a standard long-term investment horizon, we can see that real interest rates are positive. That is, any losses to inflation would have been made up by keeping your money in a savings account.

That's over the long term, which is usually what one's concerned about when discussing savings. In the short term there can certainly be periods in which interest rates don't make up for inflation, such as the last few years. It's important to keep in mind, though, that inflation has only been between one and two percent over that period. You'll see why that matters in a minute.

Given that interest rates tend to match expected inflation, most economists are not too concerned about inflation. Jim takes such thinking to task, however, for overlooking the plight of people who might not have the wherewithal to put their money in a savings account, not to mention in stocks or Treasury Inflation-Protected Securities. That's a fair point, and one that should concern us deeply if we find that this is a large cohort.

The second claim is that bitcoin will hold value, and that this will help those people who don't know better than to hold cash or who otherwise can't save. That bitcoin will be a good store of value is a claim about the future, and because Bitcoin is so new, we have no good historical data to analyze. However, it shouldn't be controversial to assume that, given its characteristics, Bitcoin will likely behave a lot like gold, which has been a fine long-term store of value. The question, then, is why an instrument with similar properties to gold would help bring about what Jim calls "monetary justice."

For one thing, folks who wouldn't know to put their money in savings or securities–or gold, for that matter–probably won't know to invest in Bitcoin, either. If the problem is that people don't understand the consequences of inflation or how to mitigate it by saving and investing, then simply creating Bitcoin as a new asset class in which they can potentially invest won't help them. Education is probably a better way to address the problem.

So, if it's not simply Bitcoin's availability for investment that hastens "monetary justice," then how can Bitcoin help those folks who keep their wealth exclusively in cash? Well, it must be that Bitcoin displaces the dollar altogether, so that holding cash means holding bitcoins, and as a result inflation can be avoided altogether. As for how we get to there from here, I have not seen anything more than hand-waving.

Bitcoin is a great value transfer system, and it has the potential to usher in many previously impossible financial transactions and decentralized applications, but one thing it won't do is displace the dollar. As William Luther has shown in research for the Mercatus Center at George Mason University, short of monetary catastrophe or government support, it's virtually impossible for a cryptocurrency to overcome the dollar's network effects, especially given the vast switching costs inherent in such a transition.

But even assuming that Bitcoin could displace the dollar, what we would end up with is a currency that likely would behave like gold, and gold doesn't make for good money–certainly not from the perspective of justice.

If there's one thing you want from money, it's a stable short-term rate of return. People, especially those living paycheck to paycheck, want certainty that $100 will be able to buy you pretty much the same stuff a week from now, or a year from now, as it does today. Even at 1 percent or 2 percent inflation, that's certainly the case.

What we don't want in money is large short-term fluctuation, such that a year from now the value of your money could have declined by 25 percent. Even if fluctuations cancel out in the long term, you probably prefer a world where your money lost value at a slow but steady rate. This is what we have with the dollar today. On the other hand, gold, like any fixed-supply commodity, is going to be volatile in the short them. For example, in 2013 the price of gold fell over 25 percent. That's essentially 25 percent inflation, which after all is what's supposed to be the problem.

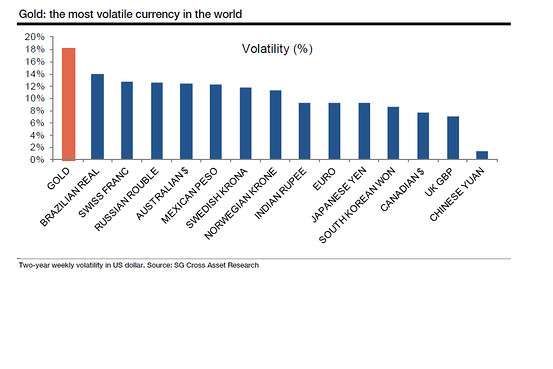

Bitcoin today suffers from extreme volatility. After an incredible run up last year, it's lost half its value from the peak over the last six months. This extreme volatility is driven in large part by the fact that the Bitcoin economy is not very large and the currency is still very thinly traded. Increasing adoption, as well as emerging derivatives, will help subside this extreme volatility. But, as a fixed-supply commodity money, it's never going to be as stable as a currency with a variable monetary policy. Again, gold is the best proxy we have, and gold is much more volatile than many world currencies including the Mexican Peso or the Russian Ruble.

Some have even pointed out that under the gold standard the dollar was much more volatile than under our current regime of quantitative easing, which is of much concern to the hard money camp.

Finally, Bitcoin, like gold-backed money, is inherently deflationary given its fixed supply. This is not a problem for the Bitcoin as a value transfer system or for any of its other myriad uses. But as the monetary unit that displaces the dollar it would be pretty terrible–especially if you're concerned about justice.

For one thing, deflation punishes debtors, many of whom will be among the least fortunate among us, just trying to get by. This is because falling prices increases the real burden of debts. For example, say you buy a car with a 10 bitcoin loan, and then the price of bitcoin doubles. The same car will now cost five bitcoins, but your loan obligation remains at 10. This is what's happening today in Spain and Greece and it's a tragedy for the average person there.

You might think that deflation wouldn't matter because your wages, say 10 bitcoins a year, are now much more valuable. But, of course, unless you're giving your employer twice as much value for the money, he's not likely to keep paying you what is now effectively double. So you'll have to accept a pay cut or, more likely since nominal wages are sticky, just get laid off instead. Perhaps not coincidentally, unemployment was higher during the period when the U.S. adhered to the gold standard.

None of this is good if you're looking out for the little guy. One or two percent inflation, and eternal vigilance over the Fed, might turn out to be a price worth paying to avoid the alternative.

Now, putting aside the fantasy of Bitcoin supplanting fiat currencies, I must say that Bitcoin could be extremely useful in countries, such as Argentina, Cyprus, or Venezuela, where hyperinflation is a threat or where the government is otherwise abusing its monetary powers. First of all, it may be the case that despite its volatility, bitcoin may be a relatively better store of value than some imploding fiat currency, and therefore preferable to keeping one's money in such a fiat currency. I'm glad that's an option that will hopefully be increasingly available to people everywhere in the world.

But that's not the end of the story. It's likely that if you ask people trying to get money out of Argentina or Venezuela what they'd like to move it to, they'd probably say dollars in the U.S., or Francs in a Swiss bank account, or even gold–not Bitcoin. But what Bitcoin has that no other currency has is censorship-resistance.

Because it is decentralized and relies on no third parties, Bitcoin has the ability to bypass capital controls. If you can convert your wealth into Bitcoin, you can get it out of your government's reach. That is revolutionary. You can then keep that wealth in bitcoins, or convert it to dollars or euros or whatever else you want. This is Bitcoin's true contribution to "monetary justice."

Yes, fiat currencies are susceptible to abuse, and while I personally don't see inflation as the most pressing issue confronting Americans today (especially not from a justice perspective), I can understand that others might. Yet as much as we might want it to be, Bitcoin is not going to be a solution to inflation. Let's focus our energies instead on pursuing Bitcoin's strengths: it can make the world better by fostering financial inclusion and by helping the oppressed escape control and censorship. On this, I hope, we can all agree.

Show Comments (123)