Bitcoin is No Substitute for Government Money, But a Refuge From Control

Bitcoin has the ability to bypass capital controls. If you can convert your wealth into Bitcoin, you can get it out of your government's reach.

There are many reasons why Bitcoin is a revolutionary and disruptive invention, and its wider adoption promises many benefits for individuals and the economy. Delivering us from the perceived unfairness of inflation, however, is not one of them.

Bitcoin has no central bank. Its supply is fixed and its growth rate controlled by an immutable algorithm. As a result it is very attractive to those who are suspicious of politically controlled monetary policy.

Among those is my good friend and colleague Jim Harper, global policy counsel at the Bitcoin Foundation, who last week wrote a very interesting post on the Foundation's blog, which concluded: "Fiat-currency-denominated savings do not hold value. Bitcoin will. That is monetary justice, and it will bring greater wealth and security to people who truly, truly deserve it."

Hard money types have been a large contingent of the Bitcoin community since its inception, and I've never had occasion to critique their view. But I think Jim's piece presents a good opportunity to do just that, first and foremost because it is such an excellent articulation of the hard money view, but also because it did not simply appear on Reddit, but on the blog of the Foundation, which is the closest thing Bitcoin has to an official body.

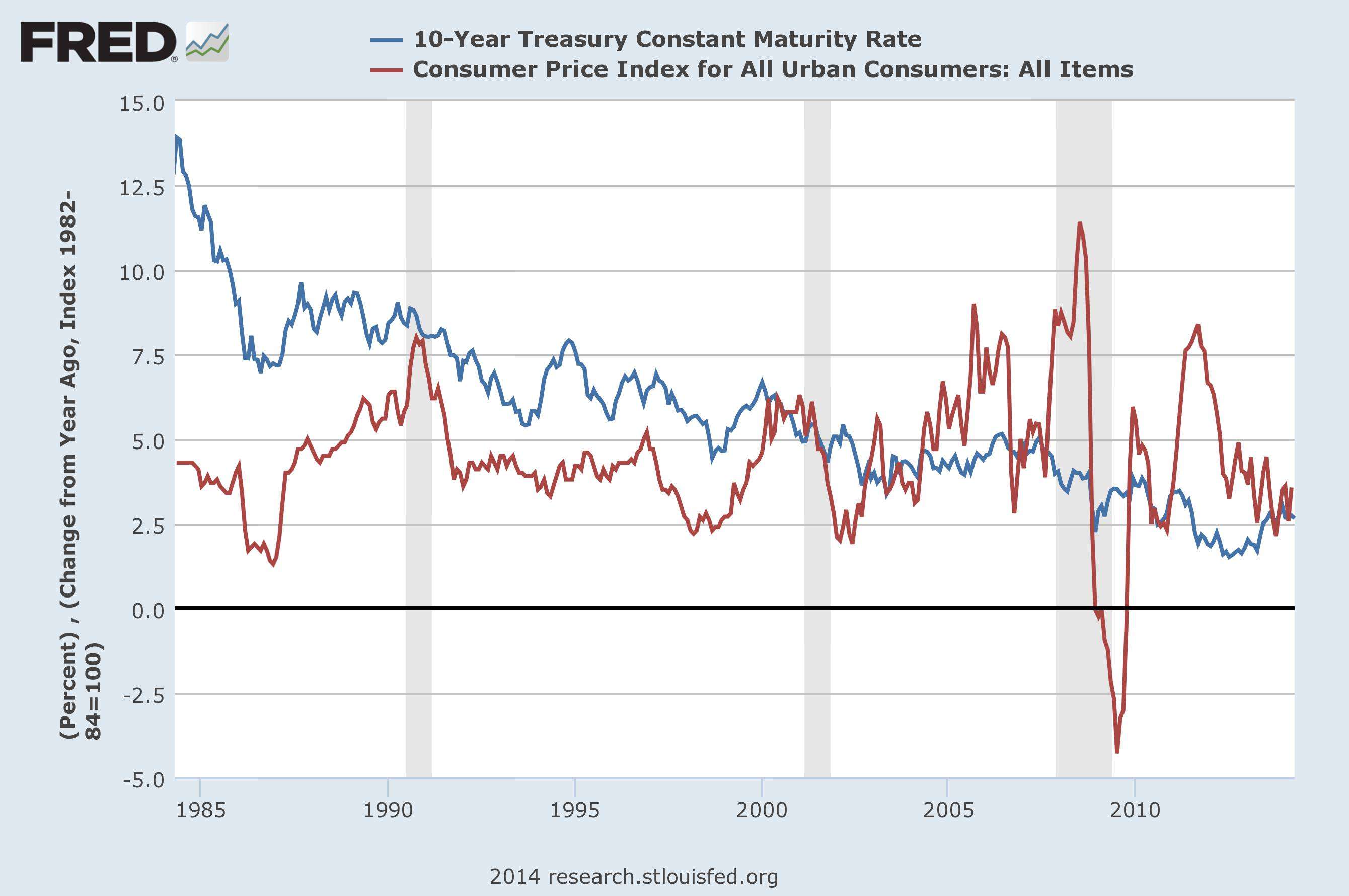

The first claim is that fiat savings don't hold value. This could certainly be the case if one were talking about Zimbabwean currency, but in his piece Jim was referring to U.S. dollar savings. In that case, the facts just don't agree. Looking at the last 30 years, which is a standard long-term investment horizon, we can see that real interest rates are positive. That is, any losses to inflation would have been made up by keeping your money in a savings account.

That's over the long term, which is usually what one's concerned about when discussing savings. In the short term there can certainly be periods in which interest rates don't make up for inflation, such as the last few years. It's important to keep in mind, though, that inflation has only been between one and two percent over that period. You'll see why that matters in a minute.

Given that interest rates tend to match expected inflation, most economists are not too concerned about inflation. Jim takes such thinking to task, however, for overlooking the plight of people who might not have the wherewithal to put their money in a savings account, not to mention in stocks or Treasury Inflation-Protected Securities. That's a fair point, and one that should concern us deeply if we find that this is a large cohort.

The second claim is that bitcoin will hold value, and that this will help those people who don't know better than to hold cash or who otherwise can't save. That bitcoin will be a good store of value is a claim about the future, and because Bitcoin is so new, we have no good historical data to analyze. However, it shouldn't be controversial to assume that, given its characteristics, Bitcoin will likely behave a lot like gold, which has been a fine long-term store of value. The question, then, is why an instrument with similar properties to gold would help bring about what Jim calls "monetary justice."

For one thing, folks who wouldn't know to put their money in savings or securities–or gold, for that matter–probably won't know to invest in Bitcoin, either. If the problem is that people don't understand the consequences of inflation or how to mitigate it by saving and investing, then simply creating Bitcoin as a new asset class in which they can potentially invest won't help them. Education is probably a better way to address the problem.

So, if it's not simply Bitcoin's availability for investment that hastens "monetary justice," then how can Bitcoin help those folks who keep their wealth exclusively in cash? Well, it must be that Bitcoin displaces the dollar altogether, so that holding cash means holding bitcoins, and as a result inflation can be avoided altogether. As for how we get to there from here, I have not seen anything more than hand-waving.

Bitcoin is a great value transfer system, and it has the potential to usher in many previously impossible financial transactions and decentralized applications, but one thing it won't do is displace the dollar. As William Luther has shown in research for the Mercatus Center at George Mason University, short of monetary catastrophe or government support, it's virtually impossible for a cryptocurrency to overcome the dollar's network effects, especially given the vast switching costs inherent in such a transition.

But even assuming that Bitcoin could displace the dollar, what we would end up with is a currency that likely would behave like gold, and gold doesn't make for good money–certainly not from the perspective of justice.

If there's one thing you want from money, it's a stable short-term rate of return. People, especially those living paycheck to paycheck, want certainty that $100 will be able to buy you pretty much the same stuff a week from now, or a year from now, as it does today. Even at 1 percent or 2 percent inflation, that's certainly the case.

What we don't want in money is large short-term fluctuation, such that a year from now the value of your money could have declined by 25 percent. Even if fluctuations cancel out in the long term, you probably prefer a world where your money lost value at a slow but steady rate. This is what we have with the dollar today. On the other hand, gold, like any fixed-supply commodity, is going to be volatile in the short them. For example, in 2013 the price of gold fell over 25 percent. That's essentially 25 percent inflation, which after all is what's supposed to be the problem.

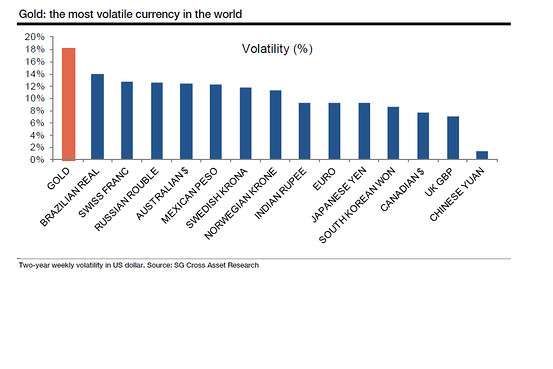

Bitcoin today suffers from extreme volatility. After an incredible run up last year, it's lost half its value from the peak over the last six months. This extreme volatility is driven in large part by the fact that the Bitcoin economy is not very large and the currency is still very thinly traded. Increasing adoption, as well as emerging derivatives, will help subside this extreme volatility. But, as a fixed-supply commodity money, it's never going to be as stable as a currency with a variable monetary policy. Again, gold is the best proxy we have, and gold is much more volatile than many world currencies including the Mexican Peso or the Russian Ruble.

Some have even pointed out that under the gold standard the dollar was much more volatile than under our current regime of quantitative easing, which is of much concern to the hard money camp.

Finally, Bitcoin, like gold-backed money, is inherently deflationary given its fixed supply. This is not a problem for the Bitcoin as a value transfer system or for any of its other myriad uses. But as the monetary unit that displaces the dollar it would be pretty terrible–especially if you're concerned about justice.

For one thing, deflation punishes debtors, many of whom will be among the least fortunate among us, just trying to get by. This is because falling prices increases the real burden of debts. For example, say you buy a car with a 10 bitcoin loan, and then the price of bitcoin doubles. The same car will now cost five bitcoins, but your loan obligation remains at 10. This is what's happening today in Spain and Greece and it's a tragedy for the average person there.

You might think that deflation wouldn't matter because your wages, say 10 bitcoins a year, are now much more valuable. But, of course, unless you're giving your employer twice as much value for the money, he's not likely to keep paying you what is now effectively double. So you'll have to accept a pay cut or, more likely since nominal wages are sticky, just get laid off instead. Perhaps not coincidentally, unemployment was higher during the period when the U.S. adhered to the gold standard.

None of this is good if you're looking out for the little guy. One or two percent inflation, and eternal vigilance over the Fed, might turn out to be a price worth paying to avoid the alternative.

Now, putting aside the fantasy of Bitcoin supplanting fiat currencies, I must say that Bitcoin could be extremely useful in countries, such as Argentina, Cyprus, or Venezuela, where hyperinflation is a threat or where the government is otherwise abusing its monetary powers. First of all, it may be the case that despite its volatility, bitcoin may be a relatively better store of value than some imploding fiat currency, and therefore preferable to keeping one's money in such a fiat currency. I'm glad that's an option that will hopefully be increasingly available to people everywhere in the world.

But that's not the end of the story. It's likely that if you ask people trying to get money out of Argentina or Venezuela what they'd like to move it to, they'd probably say dollars in the U.S., or Francs in a Swiss bank account, or even gold–not Bitcoin. But what Bitcoin has that no other currency has is censorship-resistance.

Because it is decentralized and relies on no third parties, Bitcoin has the ability to bypass capital controls. If you can convert your wealth into Bitcoin, you can get it out of your government's reach. That is revolutionary. You can then keep that wealth in bitcoins, or convert it to dollars or euros or whatever else you want. This is Bitcoin's true contribution to "monetary justice."

Yes, fiat currencies are susceptible to abuse, and while I personally don't see inflation as the most pressing issue confronting Americans today (especially not from a justice perspective), I can understand that others might. Yet as much as we might want it to be, Bitcoin is not going to be a solution to inflation. Let's focus our energies instead on pursuing Bitcoin's strengths: it can make the world better by fostering financial inclusion and by helping the oppressed escape control and censorship. On this, I hope, we can all agree.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

you probably prefer a world where your money lost value at a slow but steady rate. This is what we have with the dollar today

This is true if you only look at the official measure of "inflation," and not at prices of things people actually buy regularly, like food. The dollar is losing value rapidly relative to a gram of protein.

I prefer deflation. I prefer that my wealth accrue in value as opposed to being stolen to service interest on debts that I never consented to.

As your statement illustrates, deflation encourages hoarding. So good luck getting a loan or finding a job when deflation is guaranteed.

Late 1800s America prospered with deflation. Deflation is prosperity.

There's plenty of reason to spend and even more reason to save for future spending. Is saving a bad thing? (I know you call it "hoarding" but lets avoid the hyperbole.)

Take your Krugman arguments back to the NYTimes commentariat where they belong. You people advocating relentless debt and consumption are destructive.

"Hoarding" is not "saving." Saving implies that the money is then lent out and used for investment purposes, e.g. when you buy stock in a firm, that firm then takes the money and uses it to invest in future production. Hoarding is what happened during the Great Depression, people take their money out of the banks and stash it under their mattresses. Thus, there is no cash to be circulated for loans and investment.

"Hoarding" as you define it is a perfectly reasonable thing a person may do with their own wealth. It's theirs and in the case of the Great Depression, the withdrawal of money from banks was a direct response to fractional reserve banking and the limiting of liability for bank officers which was understandably eroding trust and confidence in the banking industry.

If I want to withdrawal cash from my bank account and then burn it, that's my business because it's my wealth to dispose of how I see fit. None of it justifies a banking cartel to siphon off the value of my worldly existence to facilitate the generational theft of governments.

Who said you shouldn't be able to hoard?

Hoarding is a signal of a sick economy. Hoarding is sometimes good for the economy - like the investment banks are doing now by hoarding residential real estate while they anticipate a rebound in distressed property values.

Inflationist intelligentsia toss the H-word around everytime someone dares criticize central planning of currency. So uhh, Keynes had something to offer on that subject and so does Krugtron.

Hording is rational and a reasonable response to the policies that people like you would casually impose on everyone.

Why do you keep putting words in my mouth. I never said hoarding was irrational or unreasonable. On the contrary, it's perfectly rational which is why people do it. Moreover, I never said you shouldn't be able to hoard, what you do with your money is your own business. I only said that hoarding is bad for economic growth and the standard of living. What is irrational is buying into Bitcoin as an inflation haven.

What is irrational is buying into Bitcoin as an inflation haven.

While volatility today makes that a no-go, that is not irrational in the long run at all. BTC amount is mathematically fixed (although the community might be able to modify it).

You absolutely said hording is a negative thing. It's not. It's a response to a negative thing, like the shit policies pushed by 'spend and consume' supporters like yourself.

Haha, once again, when did I say anything about "spend and consume?" I'm talking about saving and investing. When deflation is guaranteed there is an incentive to hoard which means less of an incentive to invest and slower economic growth. Have you take n Principles of Macro?

I never said you used the exact words 'spend and consume', I gave those words apostrophes because that's what you do with terms that have a certain meaning within a certain context. It's called 'grammar'. And you know damn well I wasn't quoting you, so put your strawman away.

You said yourself, commerce pretty much breaks down in a deflationary environment.

And again, "hoarding" is saving, it's just not necessarily investment. "Hoarding" occurs when people have lost faith in the ability of certain investment assets to protect and promote their wealth. If my savings account could be trusted to provide a decent yield and reliably store my wealth, I'd have a savings account. In an environment of instability, I will not have a savings account. Hoarding is a means of protecting ones wealth from certain things.

There is incentive to save. The fact you casually toss the word 'hoarding' around indicates that you're a 'spend and consume' advocate. Deflation doesn't deincentivize investment, uncertainty does.

Blow as hard as you want. I'm sure you read every book on economics that ever existed.

Hoarding was a rational response to insane government policy.

Define hoarding. If my refrigerator breaks, I'm not going to wait to buy a new one until I expect the price to stop dropping. Same if my clothes wear out, my car breaks down, etc. I'm not going to stop eating. I'm not going to stop driving. And on and on. The deflationary death spiral is pure distilled derp.

To these people deflation= the end of commerce and all peaceful human interaction. Whereas inflation is the SOLE reason people engage in commerce. Without government, who will force us to trade and improve our material existence? /derp

Furthermore if decreasing prices is so awful, then I guess we better stamp out every new time saving innovation and invention because they bring costs down. What we need is a new dark age, where all the peasants wealth is controlled and appropriately distributed by our noble political overlords.

I never said "deflation= the end of commerce and all peaceful human interaction." You're trying to argue reductio ad absurdum even though I said no such thing. As Jordan points out, while it is true that people will continue to purchase things out of necessity, deflation DOES encourage people to defer purchases longer and drives real interest rates up which makes investing and borrowing harder to do. Deflation and hoarding was a major contributing factor to length and severity of the Great Depression.

So good luck getting a loan or finding a job when deflation is guaranteed.

That's what you said. No one can find a loan and no one can get a job, that's pretty much the end of commerce.

Hoarding is saving. But saving is not always investment. If you see a deficiency in investment, I assure you that it's not because people have an irrational penchant for trying to worsen their material existence. Do people call up the IRS for investment advice?

"Hording" was a response to government policy. Decreasing prices benefits everyone. So what if people defer purchases to the future? I'm not reducing anything to the absurd, you're doing that yourself. We don't need inflationary government policy to entice people to engage in commerce with one another. In fact, commerce is a whole lot more stable and productive when investments aren't being herded into the stock market, or whichever politically favored arena, by policy makers.

The length and severity of the Great Depression was entirely determined by the central planners that had recently seized control of the finance industry and the political leaders bent on nationalizing industries and dictating prices.

Hoarding is saving. But saving is not always investment.

Exactly!

Deflation and hoarding was a major contributing factor to length and severity of the Great Depression.

Really? What did people have to hoard during the depression? They were no longer allowed to own gold. Sure, they held onto their paper money, their silver, and whatever material wealth they had - but only because they didn't know when or if they'd be getting any more of it anytime soon. What you call hoarding is what others would call being careful or frugal with their money - which is what people do when they discover that it isn't as easy to obtain as they have been led to believe by the hype-artists.

The bottom fell out in 1929 when the stock market bubble of that time burst. As in a game of musical chairs when the music stops and some suddenly find themselves without the chairs they had expected to sit in, and the remaining players become much more wary for the next round of play - so too, in an economic downturn do people become much more wary. They aren't quite as likely to fall for the next bunch of feel-good bs that comes along. It gets real difficult to restore the confidence of the marks after you've burned hell out of them; it took ten or more years to do so during the Great Depression.

Deflation and hoarding was a major contributing factor to length and severity of the Great Depression.

You might be some kind of Keynesian court astrologer, but you sure as hell aren't an economist.

-jcr

Well I would have taken more econ classes but they wouldn't let me go higher than PhD. It's funny that whenever someone disagrees around here they're automatically labeled an evil Keynesian. Here's some old-school classical economics from Irving Fisher: r = i - pi. The real interest rate equals the nominal interest rate minus inflation. When inflation is negative (i.e. deflation) the real interest rate is higher than the nominal interest rate which discourages people from borrowing and encourages people to hoard.

But apparently the moral hazard of "hoarding" isn't all that bad, when deflation is the norm (approx 1800-1900), there is much more prosperity when there isn't.

A side note: even the Keynesians at the Fed noted that deflation isn't often related to recessions (I think the stat was that there was 1 time of deflation in 7 recessions they looked at).

Hoarding may indeed be bad for "the economy", though it seems to be a much smaller problem than inflation.

Hoarding is a symptom of other problems. It's not the problem, it's the rational response to a problem. I'd be curious to see Mr Ink would toss all of his worldly wealth into a rapidly collapsing investment for the good of the "macroeconomy".

The natural state of the economy is slight deflation due technical, process, and productivity enhancements.

"Hoarding" is my favorite of all the Keynesian bugaboos.

What you call a "hoarder", I call a good neighbor. If someone produces value and doesn't consume as much as he could, then his money isn't competing with mine for goods and services. The less he spends, the more I can afford.

-jcr

Can you explain why I'd "hoard" if I could get even 1% by loaning my money out? You even said below "deflation DOES encourage people to defer purchases longer and drives real interest rates up": if interest rates are going "up", then surely I can get at least 1% by loaning the money out? Capital is a market quantity, subject to supply and demand like anything else. If deflation encourages "hoarding" it reduces the supply of capital, thus increasing the price I can get for my capital and raising interest rates to the point where hoarding no longer makes sense.

All of these discussions of "hoarding" in the face of deflation always compare "hoarding" to "spending now", but those aren't the only two choices. There's an opportunity cost to hoarding vs loaning.

But when perpetual deflation is guaranteed, the real interest rate tomorrow is always greater than the real interest rate today so there is always an incentive to hoard. I'm not saying lending will grind to a total halt I'm just saying that it will drop off considerably. And as we know from Principles of Economics, investment is key to productivity growth. Look to the Great Depression and the recent Great Recession and you can see the effect hoarding has on the length and severity of the crises.

It's quite telling that you choose the word "hoard" to describe what it is that deflation incentivizes.

People were "hoarding" (i.e. saving outside of the regulated finance industry) because to invest in the smoking ruin of the financial industry was a sure-fire way to lose your investment. You act surprised that people take you for a Keynesian while you use the same hyperbole and make the same misrepresentations that Keynesians are constantly guilty of.

This is just wrong. PCE inflation (inflation in the things average consumers buy) is right about 1% per year. Bitcoin has lost ~60% of its value in 4 months.

Okay, so Shriek is not the only one here who just eats whatever stats the government puts out.

Are you a climate change denier and anti-vaccine crusader as well?

Hilarious! He openly reaches for his TEAM cudgels because he can't argue against a point!

Notice how artfully he lumps anti-vaccinators with climate change denial. Almost as if they were the same propositions. Brilliant!

Are you a climate change denier and anti-vaccine crusader as well?

Most of them are. There are even a few Creationists sprinkled in here.

I'll leave it to you to take mutually exclusive propositions and hitch them onto a consensus bandwagon for the purpose of stealing people's freedom.

1%? Are you fucking joking? I bet you measured the success of TARP by the increased GDP numbers, didn't you?

http://research.stlouisfed.org......png?g=xZE

Yes we know you're citing political numbers. So.....? It's been conclusively proven that those numbers are whitewashed. I don't care to have another one of these discussions where I have to explain politics 101 to you.

But he has TOP MEN on his side! OFFICIAL stats.

For a guy with "economist" in his username, you'd think he'd recognize the faults of using politically derived numbers. He must be an economist in the same way that Paul Krugman is an economist, that is, in the government toady sense of the word.

Those are PCE rate of change numbers. I thought you were arguing inflation. The PCE numbers reflect the economy and don't look so hot compared to other years. Did you really mean to post that to bolster your case?

I'm confused, PCE rate of change IS inflation.

You are certainly confused if you think that inflation is whatever the PCE says it is.

This is just wrong. PCE inflation (inflation in the things average consumers buy) is right about 1% per year. Bitcoin has lost ~60% of its value in 4 months.

Bitcoin is volatile, like any new thing of abstract value is - this includes money, any money which is an abstraction (vs. commodity 'hard' money). BTC might even collapse all the way to zero; such is the nature of pricing a speculative thing, which is why BTC's price trends are so, well, speculative.

However, while Bitcoin has lost 60% of its value in 4 months, BTC has increased its value one hundred times over in the past two years, at least relative to bankster-scrip ('dollars'). This does not mean the dollar is out, anymore than BTC is in. Neither does your four-month cherry-pick prove BTC is doomed.

But cherry-picking date ranges - to make some universal, timeless point - is something straight from the climate clowns and their doomsday Carbontology cult.

Don't succumb to such intellectual slop, there's too much of it already.

inflation in the things average consumers buy) is right about 1% per year.

That's what's known in finance as a bald-faced lie.

Bought any food or fuel lately, sparky?

-jcr

True but on the flip side Americans spend the smallest portion of their income on food that they ever have.

For a long long time the price of food did not increase as fast as wages.

In the 1940's it took about 20 minutes of work at the median income to pay for a gallon of milk and 5 minutes for a loaf of bread. Today that is down to only about 10 minutes for milk but up to 8 minutes for Bread. In the 80's it was 7.5 and 5.5 minutes, by the 90's it was 9 minutes and 6 minutes respectively and in the 2000's it was 8 and 7 minutes.

That illustrates the trend from the 40's through the 80's the price of food relative to incomes in America dropped, leveled off in the 90's and 2000's began to creep up in the 10's.

The obvious reason for this is from the 40's to the 80's productivity gains outpaced inflation by a significant margin but now that the easy productivity gains are achieved inflation is starting to take over and drive prices up

The obvious reason for this is from the 40's to the 80's productivity gains outpaced inflation by a significant margin

I know some liberal types who insist it's because big agricultural companies have filled our food supply with inexpensive toxic chemicals fillers to drive down food prices to satisfy our cheapo selves. They cite the higher price of organic food as the price food should cost.

gold doesn't make for good money?it's too volatile.

Depends on what you take as your baseline. If you take fiat money as your baseline, gold is volatile. If you take gold as your baseline, fiat money is volatile.

How's it goin, R C? I actually thought this would be a pretty lively comment section, given the number of unsupported assumptions in the article.

This extreme volatility is driven in large part by the fact that the Bitcoin economy is not very large and the currency is still very thinly traded.

Don't forget the implicit (and explicit) government threats against Bitcoin and its users every time it is mentioned in the media. That probably contributes to the volatility.

It absolutely contributes to it's volatility. Government power is the only real threat to Bitcoin's longterm survival. The technical short-comings are rapidly overcome with additional code user practices.

Bullshit. BTC advocates (read the article above) love to brag/hype about the invincibility of bitcoin to regulation.

And, by far, bitcoin's own early adopters have been far more detrimental to it's uptake and value than any gov't disapproval.

It's almost like if you want to start a stable currency, you need policies to prevent drug dealers and currency manipulators from co-opting it.

It's almost like if you want to start a stable currency, you need policies to prevent drug dealers and currency manipulators from co-opting it.

WTF does that even mean? The USD is used by drug dealers and speculated on all the time. Doesn't stop it from being a reserve currency.

BTC advocates (read the article above) love to brag/hype about the invincibility of bitcoin to regulation.

Stramannish.

bitcoin's own early adopters have been far more detrimental to it's uptake and value than any gov't disapproval.

Oh fuck off. You have no way to substantiate that claim.

I'm in no way interjecting into your discussion with mad.casual but you definitely sound as though you are a BitCoin owner.

Bullshit? I literally just said that regulation is the biggest threat to bitcoin's success and you claim I said the opposite.

So a currency is only valuable if people don't use it to engage in commerce that you find distasteful? Like how every stable currency in human history prevented people from using it to trade for things that Mad.Casual dislikes. Oh wait, that's fucking absurd. But that's an interesting opinion. You'll have to forgive reality if it treats that opinion as worthless.

mad.casual you seem very intelligent, skeptical. Do you mind if I ask what is you do?

Thought I saw some life sciences/engineering on some perl forum.

Lots of respect,

Dan

And despite those threats, BTC has recovered from its lows and is stable at around $500. Not diminishing the evil of the government actions I'm just pointing BTC's remarkable durability.

This article is giving the Inflationista crowd heartburn.

More like a belly laugh.

I don't know how you can say:

"That bitcoin will be a good store of value is a claim about the future, and because Bitcoin is so new, we have no good historical data to analyze. However, it shouldn't be controversial to assume that, given its characteristics, Bitcoin will likely behave a lot like gold, which has been a fine long-term store of value."

Then turn around and say:

"Bitcoin today suffers from extreme volatility. After an incredible run up last year, it's lost half its value from the peak over the last six months."

Bitcoin is a terrible store of value, especially if you're trying to shield yourself from inflation (as you point out.) Where Bitcoin does have a real advantage is in the way it processes transactions. Being able to send an unlimited amount of money anywhere in the world in a matter of minutes and essentially for free is something very powerful.

Let's be clear, this is a potential rather than an advantage. As the author indicates, those unable to avail themselves of inflation resistant financial tools are probably unable to sufficiently avail themselves of bitcoin as well. Similarly, those parts of the world without access to V.me, Vodafone or similar networks aren't going to have internet and bandwidth access like BTC and the BTC network require.

Aren't you forgetting the most basic of investment caveats? Namely, past performance, by itself, is no guarantee of future results. It works whether past performance was positive or negative.

The volatility of gold is driven by the boom and bust cycle of central banks and fiat currency. How is a gold backed currency more unjust than fiat currency?

I am very interested in hearing a reasonable answer to that question. You have to have a deficient sense of morality to think central banking and fiat currency contains more justice than commodity backed assets.

I am very interested in hearing a reasonable answer to that question.

Yes, so am I - but I won't hold my breath.

This article is one unsupported assumption after the next bad economics assumption. First, nobody here but Shriek is dumb enough to swallow government inflation stats uncritically. Second, deflation is good, period. Any argument otherwise is wrong. America in the late 1800s had a steady rate of deflation and prospered immensely, unemployment regardless. Third, gold isn't necessarily volatile, it is everything else that is volatile. BTC's volatility today will decrease as its economy grows.

The long-term threat to BTC is other cryptocurrencies. SafeCoin, the token that the MaidSafe project will dispense for contributing to its revolutionary network. I urge you all to read the linked article and then some about MaidSafe.

http://www.marketwatch.com/sto.....2014-04-21

Bingo. We may not all be Keynesians, but we're certainly living in a world economy that is routinely assaulted by Keynesians. If I'm not mistaken, every single government in the world relies on political banking cartels to centrally plan interest and exchange rates.

It's getting harder though. The interests of governments don't always line up. When someone steps out of line and raises rates it can upset things for others. That and technology is eroding their power.

I hope I live long enough to see the obsolescence of political government.

I'd settle for living long enough to see the end of political banking.

That would be the beginning of the end.

The Derp and Fall of Inflation Fearmongers

Charlatans. It's been a bull market for fake populists the past few years. With wages stagnant, households feel like inflation is higher than it is, and they keep hearing that it is from fact-challenged fraudsters. If it's not pop historian Niall Ferguson putting on his tinfoil hat and saying inflation is "really" 10 percent, it's pop pundit Erick Erickson bemoaning rising milk and bread prices that he knows aren't rising. But the truth is catching up. After playing the "it's-always-1980" game where stagflation is always and everywhere the problem, Erickson has had to admit that it's just that -- a game. And he had to admit it, because Krugman called him on it. In other words, nerds bearing charts beat demagogues bearing derp. (For the uninitiated, "derp", as Noah Smith defines it, means loudly repeating things you believe in the face of contrary evidence).

http://www.theatlantic.com/bus.....rs/277347/

Oh look an Atlantic writer is being a puerile douche and using the troll tactic of claiming victory on no basis, and Shriek loves it! Yeah tell yourselves you won. It'll make the nutpunch of reality hit you even harder and your tears sweeter.

I've been saying the Inflationista crowd is wrong here at H&R since early 2009.

I predicted the gold bubble (based on simple fear and myth) and am right about that.

I predicted gold will fall to $700 when the Fed tightens and GDP gains pass 3%.

Let's see your track record.

I predicted the gold bubble (based on simple fear and myth) and am right about that.

No you were fucking wrong. Gold fell, and it's rising again.

I predicted gold will fall to $700 when the Fed tightens and GDP gains pass 3%.

You may as well predict $700 gold on the basis of unicorns.

Like all central bank acolytes, you failed to spot the housing bubble, and you've failed to spot the current stock market bubble.

And junk debt bubble, which is proven by the fact that any investor is interested in Greek debt. The next cycle finishes off a lot of garbage.

The central planners could save us all if only we give them more power and more wealth.

I predicted gold will fall to $700 when the Fed tightens and GDP gains pass 3%.

That would still be about twice as high as it was in the 1990's. And more than seven times as high as it was in the late 60's - early 70's.

I'm not so sure that Krugman has the standing to call anyone on anything, ever.

Krugman got bested by Joe Scarborough (which should have ended his career that day) but Erik Erickson is about as ignorant as one can be.

Notice I am not playing TEAM - Joe is a conservative (or so he says).

Eventually even charlatans, cranks, and economists notice when the world isn't cooperating with their grand pronouncements. Eventually reality wins.

Starts with the projection early.

Maybe try something a little more timely than a 9 month old opinion piece:

http://www.wgem.com/story/2526.....ecord-high

I know it's hard to have to have to change your mind about things based on actual results, but come on, this is pathetic even for you.

I think it is fair to say that both gold and fiat currencies are volatile. Gold's volatility has a lot to do with the existence of fiat currencies, but prices for most things expressed in gold are hardly more stable than in dollars.

Cryptocurrency is no substitute for government money...yet, in the same sense that automobiles were no substitute for horses in the 1880s.

ha

The biggest problem with bitcoin is that each coin contains documentation of everyone who has ever owned it, and if one of those owners used the coin for an illegal purpose/purchase, then the govt has the right (as defined by the govt, of course), to seize the bitcoin. And you, the current holder of the coin, have no say whatsoever in recovering the value you paid for it.

So, do you feel lucky about the provenance of your bitcoins?

And how is the government going to seize it? Unless they have my wallet passphrase, they cant get it.

Zerocoin and DarkWallet and other technologies should at least ameliorate that. BTW the government would get the IP address out of the blockchain but nothing else.

Due to the way splitting/merging amounts works, the provenance of a particular coin becomes extremely fuzzy after a few dozen transactions.

Inflation is monetary. It is not measured by prices.

That is all. Back to pointless arguing.

So if prices rose 80% on everything but the money supply remained constant that would be 0% inflation?

i can't measure it by any measure, but i know it to be true. rob, quick question, have you considered Jesus.

BITCOIN 10 BILLION!!! its coming... yep, right around the corner. how much has it dropped since its peak?

the chart i'd like to see is the rate of inflation as predicted by various right-wingers, conservatives, libertarians and ron paul devotees. that would be one high-flying chart, fer sure.

It would be high-flying-just like the actual rate of monetary inflation, which is massive.

If BTC doesn't get to multiples of where it is now it will be because of other cryptos. The events from China knocked BTC's price down and it has already recovered much of that and stabilized.

"the chart i'd like to see is the rate of inflation as predicted by various right-wingers, conservatives, libertarians and ron paul devotees. that would be one high-flying chart, fer sure."

Inflation is hiding deep in the ocean along with man made global warming.

BTC is not really similar to gold. Gold is a physical item that has intrinsic value in some industrial, electronic, and aesthetic applications. BTC has no intrinsic value, so it's actually more fiat than fiat currency. At least dollars can be burned for a few seconds of heat.

The value of BTC is that it's easily stored and transferred without prying eyes, something neither gold nor dollars can easily match. And that its quantity is dictated in advance. But since the value is what other people will pay for it, and there are no inherent properties to anchor it to an industry or a physical usage, it's not necessarily easy to say BTC will be nonvolatile.

"Fiat-currency-denominated savings do not hold value. Bitcoin will.

What utter nonsense. Money has value because when you need it you can get something for it, not because at some time somebody MAY trade you something of value for it. The first gold coins were supposedly minted on Crete but it wasn't the gold that gave the coin the value. It was the promise by the king that if nobody else would trade a sheep for that coin, the king would take one from the flock maintained for the king and give it to you.

Something of real value made that coin money. Just try to get something for your bitcoin during the next economic lock up.

The gold standard gave the USD value for decades, not sheep.

before I saw the check that said $6940 , I did not believe that my brothers friend was like truley bringing in money in there spare time from there labtop. . there great aunt had bean doing this 4 only about and as of now cleard the mortgage on there house and bourt a gorgeous Citro?n 2CV . visit this page......

http://www.Works23.us

Looking at the last 30 years, which is a standard long-term investment horizon, we can see that real interest rates are positive. That is, any losses to inflation would have been made up by keeping your money in a savings account.

Um yeah. No.

Most of the source links he uses to back up his assertions are from the federal reserve or IMF hacks. Gold had a 25% inflation in 2013? What did it do before that? In 2003 it was 350 us dollars, it is currently 1300. Just a little bit of digging would reveal that speculators jumped on the bandwagon during the meteoric rise to nearly 1800, then got cold feet and now the price is settling to the real value without the speculators involved. I thought this was a forum of libertarian thought, not mainstream Keynesian ideologues.

Of course, you really don't need Bitcoin for most of those properties, you can simply buy physical gold or ETF gold, or any of a number of other commodities or property.

I completely reject the hypothesis that the volatility of gold in the current setting is predictive of the volatility of gold were it society's money: it's apples vs oranges. For one, you are *measuring* gold in terms of fiat dollars, which begs the question: which one is really "volatile" just because their *relative* price moves around a lot? More importantly: gold is *not* currently society's money, and the economic forces at work on a commodity are infinitely different when it is "money" vs when it is mostly used for jewelry and an investment vehicle.

In short: if gold were society's money, it would be much more stable with respect to other resources *because* it is "money".

It's kind of like trying to predict that what the price of green pieces of paper with president's faces would be if they were no longer money *by* what their value was when they were money... or what the price of sandstone pebbles would be if we discovered that they made the world's most beautiful, lasting jewelry by their current value. You can't make the assumption "the market value for something varies wildly from the current situation" and then make the prediction based on the current situation.

Bitcoin is really interesting and controversial thing. Countries get many benefits from controlling the financial system and they will not change it to uncontrolled currency. Anyway this is great option to deal with many and may be as helpful as pay day loans in Toronto.

I loved what you've done here. The design is elegant, your content classy. Appreciate this post. I'm interested in your article..!!

Vashikaran mantra in Hindi | Vashikaran specialist babaji

Good post. It is really help to us. Its give us lots of interest and pleasure. Its opportunity are so fantastic and working style so speedy. Its really a good article. It gives me lots of pleasure and interest..!!

Mohabbat ki shadi ke liye Sifli Amal | Evil Spirit Protection Spells

Nice and effective blog post. The content is too short but effective. I love the information you share here. Its an well written blog post by you. This is awesome blog post.

Black magic for girlfriend-boyfriend | How to do black magic tricks

The post is written in very a good manner and it contains many useful information for me

Islamic Jadu Tona

Muslim Totke For Love

Nice post. I learn some thing tougher on distinct blogs everyday. Most commonly it is stimulating to learn to read content from other writers and exercise a specific thing there.

_____________

Kala jadu

Girl Vashikaran

You have really shared a Informative and interesting blog post with people..

_____________________

Husband Wife Problem Solution by Vashikaran

Love Marriage Solution by Vashikaran

Thank you so much And I hope that other readers will also experience how I feel after reading your article

_________________________

black magic for attraction

world famous astrologer molvi ji

Simply wanted to inform you that you have people like me who appreciate your work. Definitely a great post

____________

free indian astrologer services

free astrology consultancy advice online

I was checking constantly this blog and I'm impressed!

________________

How to Get Love Back In Islam

Muslim Vashikaran Specialist

I am very curious about all of this and want to learn more?

Top Best SMO services Provider Company

Best Branding Logo designing company

I agree that Increasing adoption, as well as emerging derivatives, will help subside this extreme volatility.

Needs to lead business outside of the workplace, and it begins with the PIXMA Printing Solutions (PPS) app.3 PPS makes it simple to print photographs or archives specifically from your cell phone from pretty much anyplace. With the Cloud printing capacity you can print specifically from select online Cloud administrations, for example, Facebook?, Twitter?, Dropbox?, One Drive?, Google Drive?, and that's just the beginning, from your cell phone utilizing the free PPS application. With Google Cloud Print features from Canon PIXMA Printer you can print from wherever you are, from applications you utilize each day with canon printer drivers. Also, for Apple cell phone how to install canon mx922 driver for unix?

canon mx922 driver

Prevoir Infotech is one of the leading software companies in India with over 5+ years of experience in IT industry and provide you 100% Satisfied results.

this is one of the best articles about bitcoin really good info you have the share.

Get my love back by black magic

top astrologer and trustable astrologer in gurgaon.

http://topastrologergurgaon.com/