CBO vs. OMB on the President's Budget Plan

Each year the president releases a budget plan, and each year we get two different sets of projections about what the effects of the budget plan would be if it were enacted.

First, accompanying the budget plan, we get the White House's outlook—the projections from the Office of Management and Budget (OMB). A little while later, we get a different set of projections from the Congressional Budget Office (CBO).

The CBO report, which was released this morning, compares the president's budget against the current baseline—what the CBO expects from the budget should all current legislation stay in place. It's revealing, however, to also compare the CBO's estimates to those produced by OMB. Inevitably, some of the estimates that come from within the White House are much rosier.

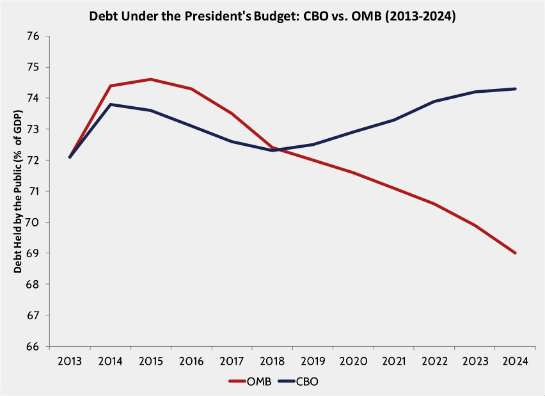

For example, via Gordon Gray at the American Action Forum, a conservative think tank, here's how the White House's projections of debt held by the public as a percentage of GDP stack up against the CBO's projections of the same.

That's a pretty big difference. There are numerous reasons for the difference, many of which are fairly technical. But in general, the CBO and the OMB use somewhat different baselines, meaning the projections have different starting points. The OMB also tends to rely on brighter assessments of the economy's future, which in turn makes its overall outlook sunnier.

It's a good thing that we have these competing estimates. For one thing, each one provides a check on the other. Both scorekeepers know that their estimates will be checked against the other, so neither wants to go too far out on a limb. This is especially useful for helping check OMB's natural political incentives for optimism. As part of the White House, there are obvious reasons why OMB tends to see brighter economic futures; CBO's follow-up score helps make sure that optimism doesn't get too far out of hand.

For another thing, the competition serves as a reminder that these estimates are just that—estimates, subject to all sorts of uncertainties and prediction problems. Official Washington has a tendency to treat these projections as something approaching gospel truth, but no forecaster has a crystal ball. These best experts often disagree, which means that someone, and possibly everyone, is wrong. These projections offer generally helpful expert guides to the possible effects of policy making, but they don't tell us what will happen, only what might.

Granted, there's an added wrinkle when it comes to President Obama's consistently dead-on-arrival budget frameworks. We can't be exactly sure of what would happen if we implemented the administration's budget blueprint, but we can be fairly certain that it doesn't matter much either way, because that's not going to happen.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

How bizarre, how bizarre.

That's OMC, not OMB. Get it right or pay the price!

If you leave, don't leave now.

I'm going to guess that their track record for projection going back to their opening days will show a constant over-estimation of economic outcomes from both groups.

A bet a set of overlays of their annual predictions on a graph of the actual historical performance would show a lot of lines branching off up from fact and few if any branching down.

Any debt projections that extend past the next major election date are completely irrelevant.

Any debt projections that extend past the next major election date are completely irrelevant are almost guaranteed to be wrong.

fixed!

C'est vrai, mon ami.

the projections have different starting points.

With all due respect, Peter, behold your graph.

There are numerous reasons for the difference, many of which are fairly technical.

Probably just the weather.

When economic data is bad in winter, it's because of cold weather.

When economic data is bad in spring, it's because of rainy weather.

When economic data is bad in summer, it's because of hot weather.

When economic data is bad in fall, it's because of unseasonably cold weather.

It's actually because BOOSH!!1!

How about the baseline is the last budget before the current president came into office?

There are not just two, but three methods of accounting: cash, accrual, and government.

If you are running an ordinary business you have to pick one of the first two.

The basic difference between cash and accrual accounting is that your invoices are posted as assets before they are payed by the customer in the latter.

Can you imagine if government had to use GAAP?

the competition serves as a reminder that these estimates are just that?estimates, subject to all sorts of uncertainties and prediction problems.

Would that it were "competition". How about: The organization that proves to have the poorer prediction in, say, a year is abolished.

What if neither organization's projections were near the target?

Come, we are men of faction. Lies do become us.

Well spoken, sir.

Let's go torture some minions.

The technical differences boil down to this: the OMB uses assumptions and inputs supplied by the White House; the CBO uses assumptions and inputs from Congress, the House, as far as I know.

There's your discrepancy.

You know who else had a plan?

Yes. The man who built the Panama canal.

Why measure as percent of GDP? I guess because showing it in absolute amounts would just produce two hard-to-distinguish, scary lines heading up at a steep angle.

OMB is practicing Keynes-think, of course. The debt is absorbed in nominal growth. That, as a Macy's sales clerk told me yesterday, nothing is made a good as it used to be, is entirely irrelevant to them. It's a Ponzi scheme, of course, but how long it can go on is anyone's guess. The more chaotic things become, the more money flows in to bankroll our military, in a sort of protection racket.

You think this is all to bankroll the military?? Ha. It's all to buy votes via entitlement spending.

Agreed that there is a CBO v OMB difference...Matter of fact, from the same CBO v OMB comparison for George W. Bush's last Budget (FY2009):

CBO estimates of deficits under the President's budget exceed those anticipated by the Administration by $2.3 trillion over the 2010-2019 period. The differences arise largely because of differing projections of baseline revenues and outlays.

CBO's projection of baseline deficits exceeds the Administration's estimate (prepared on a comparable basis) by $1.6 trillion.

Do find it interesting that the OMB (Administration) was much more pessimistic about near term debt than the CBO.

It's when we get to 2019 that the difference...Does it stay basically static, as the CBO says, or go down as OMB states.

Also find it interesting that the American Action Forum, and the writer, choose to have such large Y axis representation for each percentage point...

With this visual, a 2 percentage point difference appears HUGE. On a 1 - 100 scale, the difference would be barely discernible.