How I Learned to Stop Worrying and Love the National Debt

From the Ezra Klein-led media outlet whose goal "isn't telling you what just happened, or how we feel about what just happened, it's making sure you understand what just happened," comes this bit of brilliant 'splainin': "Stop freaking out about the debt." Seriously. Because, as narrator Matthew Yglesias explains in a mind-blowing animated video, "the U.S. government can never run out of dollars. Unlike you, or the company you work for, or the town you live in, the federal government prints dollars."

I feel satisfyingly explained to, now.

Besides, there are other big numbers, too. "Stop freaking out about the debt" helpfully points out that debt held by the public may be $12.5 trillion, but Gross Domestic Income is $17 trillion. That's a bigger number. So stop freaking out!

Of course, the U.S. Treasury reports that Total Public Debt Outstanding is actually $17.5 trillion, which is bigger yet, but we can make even more dollars.

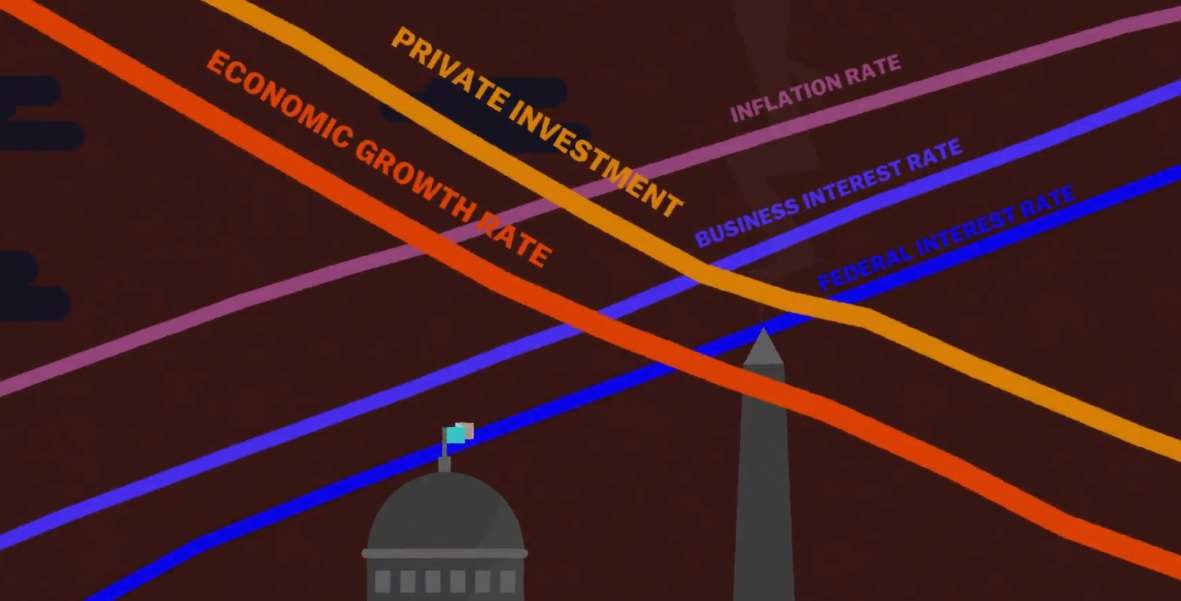

Vox 's video does acknowledge that if you have "too much money chasing a fixed amount of stuff, that means higher prices. And if inflation gets out of control, that will slow down the economy by raising interest rates." This can, Yglesias admits, have bad effects. Those bad effects include an apparent Space Invaders scenario (see below) in which we fight off invading alien inflation, or something, with laser cannons powered by incinerated masses of dollar bills.

The way I see it, the Washington Monument is a goner, whether from Economic Growth Rate bombs or ack-ack from the Federal Interest Rate. Looks like a good game, anyway, for 1983.

But inflation is the lowest it's been in 30 years, Yglesias assures us. And higher taxes or cutting spending "would take money out of people's pockets." So debt it up! Besides, war and hurricanes (seriously—you have to see the video).

For the record, the Congressional Budget Office recently revised projections for Gross Domestic Product downward. That means less wealth against which to compare that soaring federal debt. The CBO also warns about the debt itself:

Such large and growing federal debt could have serious negative consequences, including restraining economic growth in the long term, giving policymakers less flexibility to respond to unexpected challenges, and eventually increasing the risk of a fiscal crisis (in which investors would demand high interest rates to buy the government's debt).

With GDP sputtering and deficits continuing, the CBO warned last year, "federal debt would be growing faster than GDP, a path that would ultimately be unsustainable."

Bluntly, the prosperous country and powerful Federal Reserve that can afford to run up bills and fiddle interest rates to push the day of reckoning into the future is a function of a government perceived to be reasonably fiscally responsible and trustworthy—relative to the alternatives, anyway. If the United States government comes to be perceived as on a hopeless credit-card spree, it will lose financial options, and climbing out of the hole will become difficult and very expensive. The dollars the U.S. government "prints" will be so much toilet paper—worth even less, since it's mostly digital and not two-ply.

The U.S. government's credit rating has already taken a hit, hinting at more expensive future borrowing. The Chinese government gleefully warned the U.S. about debt, and clearly sees some opportunity in our self-inflicted plight.

Stop freaking out about the debt? Fine. How about just resigning ourselves to idiots trying to bankrupt us.

Pour a drink and see the full video here.

Show Comments (227)