Why It's So Hard to Figure Out What the Stimulus Did

Five years after the passage of the American Recovery and Reinvestment Act, the biggest fiscal stimulus in the nation's history, the debate over its success hasn't changed very much.

Democrats say it worked, providing a Keynesian jump-start to the economy is a time of great distress. A White House report released on the anniversary of the Act's passage touts millions of jobs created, economic aid to families and individuals, and positive long-term growth effects, among other gains.

Republicans say it was a waste of money with little to no helpful effect. It hasn't helped the middle class, says the GOP's Senate Minority Leader, Mitch McConnell. The stimulus has "clearly failed," says Sen. Marco Rubio (R-Fl.), who calls the law "proof that massive government spending, particularly debt spending, is not the solution to our economic growth problems."

All of this should sound rather familiar to those who've followed the stimulus debate, because it's more or less what the two parties have been saying for years. One reason why I suspect the debate has changed so little is that it's very hard to determine with great certainty what, exactly, the stimulus really did.

That's why I think the best way to judge the stimulus as a whole is to say that we don't really know how well it worked—but that it didn't live up to some of the promises that were made when it was passed.

In theory, fiscal stimulus juices the economy through a multiplier effect, in which one dollar of borrowed government spending produces more than a dollar of overall economic gain. With a multiplier of 1.5, a stimulus of $100 million would produce $150 million in economic activity. A multiplier of 2.0 would result in double the economic jolt of the initial cash infusion. The higher the multiplier, the bigger the boost.

The problem, as I noted in my April 2013 story on the stimulus, is that no one really knows what multiplier effect of fiscal stimulus is. Reputable economists don't even really agree about the possible range for the multiplier. Some economists think it could be in the range of 3.0 or even higher, given the right circumstances. The Congressional Budget Office puts the estimated multiplier for government purchases at somewhere between 0.5 and 2.5. A broad survey of estimates by University of California San Diego economist Valerie Ramey found that the range was usually between 0.8 and 1.5, although the data could support anywhere from 0.5 to 2.0.

Dig a little deeper into the data and it gets more complex. Estimates vary based on the timing, the economic conditions, and the particular way the stimulus funds are spent. And it's practically impossible to verify empirically, because economists can't run controlled experiments on an entire economy. They end up having to tease out the possible effects of stimulus indirectly.

You'll notice that some of those multiplier ranges actually dip below the 1.0 mark. What that means is that the economic activity created by stimulus is less than the original money spent, potentially as low as 50 cents on the dollar. Not much of a boost.

Despite the wide uncertainty surrounding these estimates, they end up playing a major role in estimates of the stimulus' effects. That's because when economists at the White House or the Congressional Budget Office attempted to gauge the results of the stimulus, they relied heavily on measurements of inputs rather than outputs, and then used the multipliers to work from there. In other words, they looked at the amount of money spent on stimulus and then ran that through a model that included an estimated multiplier.

If you build a model that assumes a high multiplier effect, then your results will reveal that stimulus spending has a high multiplier effect. What you won't have done is prove that stimulus spending has a high multiplier. But that's how the government estimates of stimulus effects on jobs and economic growth work: Rather than measure real-world results, they count the spending, assume a multiplier, and then report the output.

And what if the real-world effects were, in reality, radically different? Would that show up in the reported estimates? No. When CBO Director Douglas Elmendorf was asked, "If the stimulus bill did not do what it was originally forecast to do, then that would not have been detected by the subsequent analysis?" his response was: "That's right. That's right."

What we have then are highly uncertain, hard-to-pin-down multiplier estimates being used not to measure the results of stimulus, but to estimate what the results might be if those highly uncertain estimates happen to be correct. That's not a clear failure, but it's hardly proof of the unambiguous success the White House and its allies have claimed.

So, it's hard to say what, exactly, the stimulus did accomplish. But we can say some of what it didn't.

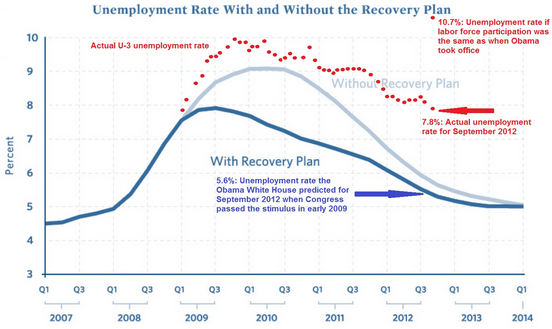

Most notably, it failed to hit the employment targets drawn up by White House economic advisers prior to the Act's passage. In a January 2009 report titled "The Job Impact of the American Recovery and Reinvestment Plan," administration economists projected that with no stimulus in place, unemployment would continue rising through 2010, topping out around 9 percent and holding there for much of the year. With the stimulus, however, unemployment would peak in the third quarter of 2009, then begin to fall, dropping below 6 percent.

The stimulus passed, but unemployment rose higher and faster than the administration's no-stimulus track had projected. Unemployment began to fall by early 2010, but not nearly as rapidly as the administration's estimates suggested.

Via Jim Pethokoukis of the American Enterprise Institute, here's a comparison between what the administration predicted, with and without the stimulus, and what actually happened:

The administration's defenders counter that the estimate was made before the breadth and depth of the recession became clear, and that a bigger stimulus was needed. But that only reveals how hard it is to transform academic theory into practical political reality, and how easily macroeconomic turmoil is misdiagnosed by politicians and their advisers. It's hard to have confidence in their solutions when they admit they did not understand the problem. And as Pethokoukis has noted, when you factor in the dramatic decline in labor force participation, the administration projection looks even rosier.

No doubt the political back and forth over the merits of stimulus will continue, and the declarations of success and failure will end up as fodder in fights over possible future fiscal policy boosts. Not much will change. That's too bad. Because if there's anything we should have learned from the fight over the nation's biggest fiscal stimulus, it's that we've been asking the wrong question. It's not whether the stimulus did or did not fail, it's whether we can ever know one way or another—and whether it's worth spending hundreds of billions of dollars on economic interventions whose results are likely to remain uncertain.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

That's why I think the best way to judge the stimulus as a whole is to say that we don't really know how well it worked

Considering that it cost a trillion dollars, isn't it incumbent on its defenders to prove its positive effects? If the best answers they have are "we just don't know" or the always popular and totally un-falsifiable "it would have been worse had we not done it" counter factual, they have lost the argument and should admit they wasted the money.

If you spent a trillion dollars making things worse would you admit to it? Well you might, if you're not a politician fishing for some legacy to leave behind.

Heck, they'd already written that trillion off as a great success before they'd even started wasting another trillion on the ACA, which apparently is just as great a success as the stimulus, leaving many with no insurance and more with insurance they can't afford.

isn't it incumbent on its defenders to prove its positive effects

In something like a just world, yes, this would be true. In this current construct, no; see, instead AlmightyJB's comment below.

Yeah. Here is what I think happened. Reid, Pelosi and Obama are fucking morons who have no idea how the economy works and were taken in by the various crooks on wall street who told them TARP was going to save the economy. So they figured the economy was going to come back on its own. Never wanting to let a crisis go to waste, they took the opportunity of the financial crisis and their freakishly large majority to pass a stimulus bill that did nothing but enrich their supporters figuring when the economy turned around they could take credit for the turn around while enriching their supporters at everyone else' expense.

Of course the economy didn't turn around. So now they are desperately spinning trying to pretend the stimulus either worked or saved us from much worse, facts to the contrary be damned.

Sounds like a good summary to me. Plus, don't forget Bush & Paulson were in on this (although to a lesser extent) as well.

Paulson dragged all those bankers in and compelled them to take bail out money even if they didn't think they needed it.

They were totally in on TARP. But the stimulus came later and was totally the creation of Pelosi, Reid and Obama.

And you told me that the general run of people here know their shit. Well, they certainly know how to throw it around.

If the stimulus worked, that means George Bush was right. George Bush signed the first bailout, you know.

Which makes it even harder to believe that it worked. When was the last time GWB did something good?

Success at what? Being flung at wasteful state budgets? Crony green energy failures? Oddball studies of shrimp sex and such? Cowboy poetry festivals?

How much interest are we going to pay on that debt from borrowing all that?

It was a successful raid on the Treasury by the new Administration. Unions, freeloaders, and cronies were showered with cash. My kids and grandkids will be saddled with the interest and inflation unless they are smart enough to revolt.

It paid back obama campaign contributers which is what it was intended to do. So success.

Plus, it "saved" a bunch of public sector jobs which meant those employees continued to pay union dues and those dues supported Democrat candidates. So, further success.

That's easy. New and exciting opportunities to defraud the taxpayer.

That's not a clear failure, but it's hardly proof of the unambiguous success the White House and its allies have claimed.

That is far too charitable a characterization. There are any number of non-controversial economic theories explaining why it is complete crap. It is inarguable that when the loans the government takes to finance the stimulus are due and money is diverted from the market to retire the notes the multiplier will have at least an equal and opposite effect. Where is that analysis? Since the stimulus funds are distributed politically rather than rationally the probability they are optimally spent is zero. Down the road the money taken from me in the form of higher taxes to retire the debt would most certainly have been spent to maximize my utility. We will all be less well off. To damn a non-falsifiable premise with faint praise gives credit to incompetent and evil men.

^^THIS^^

It also should be noted that the Keynesian models predicted this thing would be an absolute and quantifiable success. The fact that it hasn't been should discredit those models. Of course it won't since believing in those models means a lot more to people than telling the truth or learning from experience means.

Keynesian policy requires that the debt used to fund recovery be promptly paid off once the economy is back up and running. We've been following the borrow part of Keynes and rejecting the pay it back part for about...well, since the borrowing started.

Yes, these people don't even count as Keynesian. Also, they never admit that we have a ton of Keynesian stimulus programs built into the budget in the form of welfare, social security, medicare and our defense complex. There is no way in hell this economy could ever have a liquidity trap. There are too many people on the dole and too many people getting a government paycheck for that to ever happen.

The point of a stimulus is to give people cash and get them spending money to avoid a deflationary spiral. Forgetting for a moment the problems with that theory (namely that it assumes there is no natural boundary to such a spiral), an honest Keynesian answer to the problems of the spring of 2009 should have been "to get through these times is why we have social security and welfare and spend so much money" not "we need more stimulus". There are no more adherents to Keynesian economics left. It is just a name people who want to steal money or set up full on socialism use to justify their actions.

Deficit spending is BY DEFINITION Keynesian stimulus spending.

If it worked, Greece would be the world economic powerhouse of the 21st century.

Yes. and TARP was Keynesian spending. That is my point. Even under Keynesian thinking, the stimulus wasn't necessary.

Keynes gave leftist all the justification they needed to use money to buy votes. They conveniently ignored the part about running a budget surplus during expansionary times. That don't buy no votes.

AS I said above. There are no adherents to Keynesian economics left. There are just leftist who want to steal.

TARP was designed to prevent the collapse of major financial institutions, not to increase aggregate demand.

Greece is currency constrained, much like California. Greece can't issue euros.

No. Wrong. You don't know Keynes.

Keynes never called for deficit spending all the time.

Now finish the circle. There are dollars piling up abroad. They eventually return to the US to purchase our upscale goods and superior services, or to buy US Treasuries, keeping interest rates low so we can afford the leakage.

You can question the size of the effect; you can't deny that we avoided another Great Depression.

I have a labor participation rate and a stagnant wage rate that says we didn't avoid anything.

And there is nothing that says those "dollars" piling up abroad will return here or even if they do they will return at the same value they left.

If printing money were the way to wealth, we wouldn't have to work. We could just print money and give everyone a free paycheck every month.

Offshoring is one of several factors contributing to lower participation and stagnant wages, not the only one.

Yes, you are pointing to real factors, but writing off the possibility of an effective stimulus because of them asserts the conclusion before the analysis.

Some spending is less susceptible to offshoring than others, as the products and services are produced and invested/consumed here rather than abroad. In my household, imports are limited to consumer electronics, fresh produce out-of-season, and clothing. Maybe 10-15% of the budget?

Your "printing money" angle is a strawman. Yes, there is a small contingent who think we can expand our way to wealth, but that is not the question here.

As others have stated already...

According to every single argument the government used to spend all this stimulus - they failed.

They told us, with charts and everything what to expect from spending said money and what to expect if we didn't.

& in every single case - their predictions failed. IE - they failed.

Look at it this way - if they had said - for 1 trillion dollars we'll buy X number of aircraft and then years later it was determined they spent all the money but has zero aircraft would people really be standing around trying to figure out how the money really did purchase aircraft even though it didn't exist?

Likely not - the only difference between that scenario and the one we face today - is that the promises weren't tangible, but they were measurable.

& by every measure the government gave - they failed. All of their predictions failed.

IE - the stimulus failed.

PS "printing money" is not a strawman - not even sure under what context you make that statement - but it's not. Printing money, IE - "creating" wealth from non-productive activities, such as printing more money, is a bad thing.

Is there something you know that it makes it a good thing?

We real economists see this as nothing more than an iteration of the Broken Window Fallacy.

Indeed, there's no multiplier effect when government borrows to spend. Government has NO incentive - NONE whatsoever - to borrow for profitable, productive efforts. Either the expenditures are wasted on window-shop shinny things (like roads or the military) or they are severely wasted on redistribution schemes.

Those economists are running around like headless chickens because they do not want to face reality: The multiplier effect of governent fiscal stimulus is exactly zero. Let me explain.

First, the nature of money. Money represents previously-produced goods and services. People trade goods or services for money, and then money for goods or services. So there has to be a previous production in order to trade. Government borrowing of money is in reality borrowing from future production. Government taxing of money is taking from already-existing production. Thus, in each case, there is LESS production available at the moment of taxation and borrowing. When government SPENDS, it spends on goods or services provided by some individuals; these expenditures will possibly help a few other individuals. The rest who are not directly benefited from these transactions will not see their production being returned. They are made worse off. Only those that receive the government largess are benefited. This is a ZERO-SUM GAME. Thus, the multiplier effect of government spending is exactly ZERO.

The problem is spending money isn't good enough. If it were, we could throw money out of helicopters or the broken window fallacy wouldn't be a fallacy. The money has to go to a productive use for it to do any good. When government taxes or borrows it takes the money out of the hands of the private sector and spends it where government thinks is best.

Some of the Progs are intellectually honest enough and sentient enough to admit that the government knows better than the private sector how to spend money and thus stimulus works. Of course, they never admit to there being any limit to that. And if the government knows best, why have any private sector? Not wanting to admit to being full on communists, they pretend "well of course there is a limit to that but we are not even close to it". The point at which the government no longer knows best how to spend money is always somewhere beyond the next stimulus package.

Back on planet earth, the government, after it fulfills its essential function of running the courts and defending the nation, quickly and always spends the money in very unproductive ways and any stimulus ends up being a drag on the economy.

I am sorry but your understanding of money is about sophisticated enough for a Monopoly game, and not much else.

Yours doesn't even rise to that. At least a monopoly game doesn't let you print your own and pretend everyone can own every property on the board simultaneously.

Try actually arguing his point, otherwise you are just like a 5 year old sticking his tongue out. If you want to win an argument, the first step is to have one. By the way, "now go away or I will taunt you a second time" is not a valid rejoinder either.

Macroeconomics and monetary policy can't be meaningfully introduced and argued in the comments.

Now, a Monopoly game with a central bank that can expand the money supply - maybe that would both introduce interesting dynamics to a rather static economy and teach players some real-world concepts. Hmm - I declare copyright!

If you can't argue it in the comments, why are you arguing it in the comments? OM seemed to do just fine with his point, whether or not you agree with it.

I can point to discrete omissions and failures in facts and logic. I'm calling flags on the play, not reading from the books of rules and strategy.

Yeah, if only we were smart like you - we wouldn't be so stupid and then we'd know what you know.

That's why you could point out actual facts and logic, but don't, right?

"We real economists"?

Degree? Institution? Career?

I've read lots of economists, including Austrians. You don't sound like any of them.

I've read lots of economists,

Then tell us about them. If you have actually read any of them, you would know the problems of stagflation and the criticisms of Keynes that arose in the 1970s. A hell of a lot more people than just the Austrians understood the limits of government spending.

The conditions leading to the stagflation of the 1970s were fundamentally different from those of 2008 on; the policy of Keynes had become corrupted by apparent prior success, and Friedman and Shwartz appropriately pointed out the problems of building in inflationary expectations.

In short, the details are very important to a real economists; too many policy wonks take away simplistic ideas that ignore the caveats and conditions.

Keynes had become corrupted by apparent prior success

Facts not in evidence - citation on prior success(es) required

"We spent trillions doing what any sane, sensible person could have done for billions. STIMULUS!"

Even Keynes himself said Targeted, Temporary and Timely. The Porkulus is none of those things. The additional damage created by upping the baseline spending makes it even worse.

It isn't that hard to figure out what the stimulus did, if you stick to first principles. It shoveled money to a bunch of political cronies. No surprise there. It bailed out a bunch of institutions that might otherwise have blown up noisily and publicly, with the attendant risk that somebody would speak the unspeakable truth; that the collapse of the mortgage industry had been predicted in advance by scads of people who thought that pressuring the lenders to lend to people who wouldn't pay back was lousy idea. Some classless people have angrily said to me "Why hasn't there been an investigation?!?"And the answer is that the Government knows goddamned well that the government is the problem, and doesn't want that particular dirty laundry spread abroad.

*spit*

CRA was definitely part of the problem, and the agencies responsible hid massive liabilities to skewer the blame, and succeeded in doing just that as the narrative it had nothing to with the problem was advanced in the MSM. Johnny Longtorso has a good resource on his website outlining the scheme.

The even greater problem causing the recession was in how the artificially low interest rates skewered what everyone else in the market for a home thought was affordable for them. This is where the assumption of risk really fell through the floor, as millions were in higher risk categories than they otherwise would have been. In the aggregate, the banking sector was holding much more in risk than they otherwise would if the moral hazard was in line with the underlying unskewered reality.

Some of that though is just the nature of markets. Markets do occasionally boom and bust and bubbles do happen. No question, the Fed did everything it could to create this bubble. But that wasn't the only thing that was going on. First, the bubble becomes self reinforcing. A lot of people in finance believed that real estate prices would rise forever and that no real estate investment ever came with any risk. The other problem is that while the bubble is inflating, the best course of action is to buy in hoping you can sell out just before it bursts.

Once the boom starts, these two phenomena become self re-enforcing. The more the market rises, the more people are convinced there is no down side. So the more they invest and the more the market rises. The more the market rises, the more people who haven't gotten in on the action feel like chumps and jump in further inflating the bubble. This is how booms happen.

Where the Fed and the federal government bear the responsibility is taking what should have been a garden variety real estate boom and correction and making it the worse crisis since 1929. Take away cheap credit and the various intervention in the markets by the Federal Government and the bubble probably never starts. But even if it did start, it would have corrected long before it did had the federal government not kept stepping in to keep anyone from losing any money.

At this point, ABCT should be considered empirically undeniable, as interventionist have certainly created enough laboratories of the greater economy to test it for falsifiability. I would thank them for the research but for the diminished opportunities for others, especially those of the younger generation, caused by it.

Pretty much. What infuriates me about the critics of it is that they admit that too much spending and liquidity is the cause of inflation. Yet, they can't seem to understand that artificially low interest rates cause people to spend more and save less.

The whole point of pump priming via monetary policy is to lower interest rates to get people spending. So how the hell can they deny that sustained periods of that will produce bubbles and busts?

The stimulus spent a trillion dollars, and we still can't afford alt-text...

To add to the criticisms above: any tax money comes with a certain price, beyond the amount. The taxpayer who pays $100 isn't just out his $100, but has to take the time and expense to pay that $100. I seem to recall figures as high as $1.60 for every $1 paid in taxes.

Then, of course, there's the bureacracy. They collect the $100, but it costs money to handle and dispense the money.

Add all that up, and you need a multiplier effect of much more than 1.0 to even break even.

That is a good point. What these people can never understand is that we are only as rich as the total amount of goods and services we produce. So the cost of collecting taxes isn't just the cost of paying someone to do that. It is also the cost of the productive things that person would have otherwise done had you not hired him to collect taxes.

The contribution to overall wealth of a "tax collector" is entirely dependent on the usefulness of the taxes he is collecting. If I am collecting taxes and those taxes are going to pay for things like running the courts and defending the country and other core government functions, then I am contributing to total wealth, albeit in directly. But I am still contributing since someone has to collect the taxes and those taxes are then used by the government to set the table for other people to produce goods and services.

But if I am just collecting taxes to redistribute the wealth to someone else based on whatever criteria the government thinks best, I am no longer productive. The fact that I spend my paycheck in the economy doesn't make me productive. These idiots just can't accept that.

Definitely, the bureaucracy consumes fees on every dollar that runs through an agency.

Yes. It costs money to collect money and it costs money to spend it. You can't just magically collect taxes or magically ensure that the money you spend isn't just stolen.

I think Sunderman should learn more about the Kalecki equation. I agree that the Obama administration is wrong to brag about how many jobs its stimulus programs created and I would say that federal spending (including deficit spending) is often done poorly and inefficiently, the following article, which includes an important chart, shows how federal spending stepped in and helped boost corporate profits. The private sector collapsed in the financial crisis, so government spending was needed. The multiplier effect is largely a myth, and widely misunderstood -- but those dollars spent by the government did create profits in the private sector. Take a look:

http://pragcap.com/budget-defi.....tter-right

The private sector collapsed in the financial crisis

First, that is untrue. Second, even if it were true, we already had massive Keynesian spending in the form of the existing budget deficit and the recently enacted TARP. People point to those equations and then assume that the stimulus exists in a vacuum. Even if you believe in the value of Keynesian spending, that doesn't justify this set of spending.

And the private sector is never going to "collapse", absent invasion or some kind of mass societal breakdown like a pandemic.

That is what these idiotic equations never take into account. Prices will never fall to zero. Unemployment will never reach 100%. Eventually prices get so low even people who are hoarding money decide that can't go any lower and begin spending again. Eventually unemployment gets so high that the remaining employers can no longer resist the temptation of hiring from the now huge available pool of workers. Eventually enough firms go bankrupt that the remaining ones expand to take up their no unserved customers.

The thinking you describe assumes the world works like a math equation and you can obtain any result by just feeding in the right numbers and any self sustaining regression continues to zero. Well, the world isn't a math equation. And the economy and people have built in self correcting mechanisms that ensure all of these things have a natural bound greater than zero and that every down cycle eventually corrects itself with a corresponding up cycle.

Another good point re: "the private sector does not collapse", the private sector just reallocates and adjusts (but not down to zero). Down turns are generally good (or at least necessary) in the long run, cause they correct for inefficiencies that inevitably build up during economic boom. Random thought: I bet there is some thermodynamics-like equations in cyclical economic theory.

There are. To get heavily into the equations, create them as opposed to just draw them based on some ideal, you have to know how to do linear equations. The sensitivity to price in a demand curve is mathematically no different than describing the flow of a fluid. The inputs are just different and have different names.

"Collapse" does not have to be "disappear". Along the path, we get the deflationary spiral, driving wages and prices lower and lower. There is simply too much damage done along the way to let the market and it's psychology take its course.

Along the path, we get the deflationary spiral, driving wages and prices lower and lower. There is simply too much damage done along the way to let the market and it's psychology take its course.

And the entire history of the American economy in the 19th Century, which had two depressions 1830s and another in 1873, that were much worse than the 1929 one shows that to be completely untrue. The only depression ever known to last as long as the one in the 1930s was the one in the 1930s. The ones before were deeper and they ended quicker. What you are saying was completely disproven by the monetarists' work in the early 1960s. Every professional in the field stopped believing it by the 1980s.

It is only come back into vogue now because people like you who don't know any better read Pauli Krugnuts and believe him.

Ok, I don't have all the details on this to hand. I will note that the merest search shows the 1873 crash lasted 6 years, and produced 2 decades of stagflation in England. So perhaps these weren't as innocuous or quickly overcome as you believe?

And are you telling me that Friedman, who advocated Fed intervention to spare the economy, was not a monetarist?

Okay, "collapse" was not accurate -- but it was the worst financial recession since the Great Depression. Consumers/households hunkered down and began deleveraging -- they had to. This affected the economy, clearly. Private sector credit expansion, when done prudently, is how the money supply grows and how the economy grows best. Loans create deposits. Private sector credit expansion has been increasing a bit in recent months, but primarily on the corporate side. When you say the world isn't a math equation, I agree in a sense. Economics involves behavior. Having said that, the math (or better, the accounting identities) of how the U.S. monetary system actually works is important. The operational realities of our monetary system don't seem to be widely understood by our politicians, journalists (not just at Reason), or even by college professors teaching economics these days.

There was a time when one could make a plausible argument that Keynesian economics might work. When there was little international trade if the government gave someone in Michigan $100 and he buys a table from a producer in Michigan and the table maker takes that $100 and buys a carpet from someone in Alabama, and the carpet maker takes that $100 and buys some new needles made in Pittsburgh, etc. Plausible, might not be best, but it isn't unreasonable. However, now give someone $100 and they go right out and buy a new pair of runners made in Taiwan. Nothing was made, nothing produced, the money left the country immediately. This isn't an exaggeration. Money flows now internationally. The stimulus might very well work, if it is large enough, but I doubt very much it would help America. It might help Viet Nam, China, India, and the Philippines, because that is where the money comes to rest.

That is a very good point. I hadn't thought about it that way.

You know that will just encourage them. Their response to that will be "well yeah, we need a world stimulus".

Ooops...sorry about that. You're right. Krugman thinks like this, the UN thinks like this, and we could be in real trouble.

Money is made, when something is made and sold to someone who wants it at that price. A recovery happens when more productive activity happens, or the same activity happens, but at a lower price, ie a more competitive price, which will then result in more activity. Bureaucracies don't create anything. Money given to bureaucracies slows down recoveries because it is unproductive, and because bureaucracies always slows activity of others. Even if they don't say 'no', which they often do, it is an unproductive step in the production process - ie going to City Hall to get a permit and a half day is wasted and costs are incurred, even if City Hall gives you the permit. Money given to prop up high prices slows down recoveries because a recession is when nobody will pay the price to get something new. Propping up prices does nothing as the recovery can't occur until the prices drop enough to make people want to start buying again.

If I had to guess what a stimulus does, it is more or less nothing. But, it might keep some activity going, false as it is, and build enough inflation, ie dollars in the system, such that the old price, which had been too high, now is sort of okay. That would be a best case scenario.

And, that process can take years. Let the prices drop and as soon as they do, boom, the recession is over.

All we have to fear... is Obama himself.

Did anyone figure in "paying the stimulus BACK!!" Where's the multiplier on that??

We have fiat currency system, the federal government never has to pay off the debt. In fact, the federal government has been in debt throughout our entire history, except for a brief time under President Jackson, when the entire federal debt was retired and we had a true surplus. Interestingly, the country experienced its worst financial depression (to that point) within a couple years.

Not sure the last sentence has anything to do with the rest of it.

Suderman comes down on the side of indeterminacy leaning towards ineffectiveness by pretending that the calculations of the multiplier effect are so variable as to be meaningless. This is not the actual case. It is true that there are enough contingencies and complexities in the real economy that we can never determine the multiplier with accuracy, but this doesn't mean that we have no idea whether it was positive or not.

Just to remind you, Krugman predicted this all back in 2009: The stimulus plan was too small to replace lost consumption, thereby restoring production and employment, and that anti-Keynisan ideologues would use the weak recovery to attack Keynsian economics.

Peter, Paul's got your number.

That's not Keynsian economics. Not how I learned it anyway.

Since you coyly avoid telling us what you learned as Keynsian economics, it is difficult to correct you.

, but this doesn't mean that we have no idea whether it was positive or not.

Accept that there is not a shred of evidence that it was. Even if you can't quantify it, there should be some evidence and there is not.

And of course Kruginuts said it was too small. He has never once found a stimulus that wasn't. This allows him to always claim the resulting failure was predicted and any success just proves how great Keynesianism is. Sorry, non falsifiable counterfactuals are just as unpersuasive as they always have been.

In the end you have no argument beyond "sure we can't quantify its effects and sure we can't point to any evidence of it being effective, but we know it was".

Sorry son, stupid and economically illiterate is no way to go through life. Lay off the Kruginuts or if you just can't help yourself, go read the books he wrote before he became professional lunatic on the pages of the Times. Try reading Peddling Prosperity. He wrote it before he went nuts and it presents a pretty good explanation of why everything you just wrote is completely wrong.

"Kruginuts" did win a Nobel - what do you have to certify your superior knowledge?

I quantify things all the time that I can't determine with accuracy; I use error bars to quantify the uncertainty. It's called, you know, statistics?

If you don't get that simple concept, I'm not too worried about who is calling who "stupid", simply noting that you dashed into the muck with haste and aplomb.

Kruginuts" did win a Nobel - what do you have to certify your superior knowledge?

He won it for his work regarding trade that has nothing to do with this subject. Moreover, I don't have to have superior knowledge. I just have to read what Krugman himself wrote before he started getting paid to troll stupid people in the Times.

I encourage you to actually read Krugman's work that he did before he started writing for the Times. Krugman always admitted the limitations and fallacies of Keynesian thinking. And he was upfront that his advocacy for them was due to his personal moral and political bias towards bigger government and higher taxes. For some reason he forgot all of that in the last ten years because he likes writing for the Times I guess.

Sorry dude, you came to the wrong board to troll. The people on this board generally know their shit and are not bluffed by appeals to authority or canned talking points.

You fail to distingush between serious discussion and trolling; you toss out insults, you say people on this board generally know their shit while 2/3rds of the comments disprove it and GregMax can't tell the difference between his excrement and mine.

Part of rescuing Keynsian thinking from the disapprobation of the many is cleansing it of the misinterpretations and yes, admitting the limitations and fallacies - which is how scholars point out where work is needed.

Wikipedia says of "Peddling Prosperity":

"Krugman argues the rise of the supply-side economics is produced by the inability of opposing economists to convincingly explain certain economic phenomenon, such as the US productivity slowdown.[2] He criticizes monetarism, rational expectations theory, and conservative economists' views on taxes and regulation, arguing for greater government intervention into the market-economy via increased deficit spending and higher taxes."

This hardly seems an endorsement of conservative economic commitments or a rejection of Keynes. If you wish to explain it to me, I'll follow respectfully as long as you rein in the "son" and "stupid".

Wikipedia? Really? That's a source now? I think by "actually read Krugman's work", John meant "actually read Krugman's work", not the Wikipedia article.

Look, Keynes never advocated continual deficit spending regardless of economic circumstance, which is what we have been doing since the 1980s. He advocated a burst of spending in economic hard times to get the market going again. Also, if you look at the stimulus, it wasn't spent on things that were likely to produce increased economic activity. Instead it reads like a valentine to Democratic special interests. We are about as far from being Keynesian as we can possibly be.

Krugman continually predicts doom for any proposal that doesn't involve increasing the hell out of government spending. If the spending doesn't work, he claims its because there wasn't enough of it. He essentially puts himself in a position where he can never be wrong. "The stimulus saved us from the worst depression ever!" Unprovable. "The stimulus would have worked if we had spent more!" Ditto. "Cutting spending is the worst thing ever!" Hold your breath while waiting for Congress to do it.

Yeah, methinks he was pretty aware of the limits of his theory.

He was no slough or idiot. It's just that stupid people apply his theory.

My impression anyway.

Discredit the source because you can't dispute the review? Wikipedia entries are gone over by people of all stripes so egregious biases are unlikely to survive. Point me to the reviews that disprove the Wikipedia assessment.

I agree that Keynes didn't advocate continual deficit spending. Your characterization of the targets of the stimulus is informed by your own politics as much as the any objective assessment.

And your assessment of Krugman seems to contradict John's new and old Krugman.

And by the by - if my arguments are merely 'canned talking points', show me where I stole them from.

Also, there is a difference between appeals to authority and appeals to expertise. We should have fewer of the former (e.g., citing Ayn Rand), more of the latter.

Also, there is a difference between appeals to authority and appeals to expertise

Sorry, but there isn't a difference as both falsely rely only on "authority" to answer the question instead of arguing the points directly.

Whether that authority is by appointment (Fed Chair), by election (President, Congress, et al), by secular education, by religious instruction, by prizes won (Nobel, etc), or by any other arbitrary measure of authority matters not.

In simple terms: You're are full of shit.

Thanks for making it clear that you have nothing to contribute but a foul "mouth" and the foul mind behind it.

If'd you'd try harder to improve yourself, you wouldn't suffer from such an inferiority complex.

You can't possibly know the effect. The answer as to why is right there in the article - no one can agree on what the multiplier is. Right off the bat any attempt at measuring it is compromised.

But there's an even more corrosive problem: Corruption. As in the money going into places it shouldn't be going to in the first place.

Relying on stimulus as a means to an end is stupid. As part of an overall, well thought out scheme, then maybe less so.

But look at the people handing out the money and where it's going and let me know how it works out.

Corruption - well it neither begins nor ends with the stimulus.

Whether "Relying on stimulus as a means to an end is stupid" depends on whether stimulus helps produce the end; you are asserting your conclusion as your argument.

Disagreements over the size of the multiplier are not exactly innocent of attempts to sow confusion and doubt. It's similar to the reason that we can't agree on anthropogenic global climate change.

No, but it is in this case. Handing cash over to the unions is plain corruption and won't do squat for the economy.

Rufus, you're all over the place. Point out where cash was handed to the unions, please?

Did 80% of Federal Stimulus Funds Go To Public Unions?

Using Rush Limbaugh as your authority is a real fail.

Even at that, we have at best in one state of 50, 80% of discretionary funds went to public employees. What are dues, 1%? 1% of 80% is 0.8%. Characterizing the payment of dues by represented employees 'handing cash' to the unions is a rather, well - corrupt way of putting it.

(I support agency fees but not mandatory membership and dues.)

First off - whether Rush said it or not is irrelevant to whether it's true.

But since you don't seem to know - just search for how Obama directly intervened in the GM bankruptcy to ensure the unions, illegally, had their pensions paid off, while other debtors, who legally and historically, should've been paid first got nothing.

Here's a compare and contrast if you wish - but google works just a well.

Giving money to employ government union members is pretty much the equivalent of giving money to unions, smartass.

I don't have time to track down a source more acceptable to you right now, but you are welcome to come up with something that disproves what Rush said.

It's how I see it.

I find it amusing he asked for a citation.

Where there are exemptions and money to give away, the unions are not too far behind.

And to be honest, it's no better when banks or sports teams or any other private enterprise get tax dollars to bail them out either.

I think the reason we can't agree on climate change is because the models fail to predict reality. You know, kind of like the economists models when it comes to stimulus spending.

They get details wrong as we still have much to learn. They are improving over time.

I've done a bit of actuarial work. Yes, prediction is not reality - but extensive research shows it works better than not predicting or ignoring them.

Advocating drastic changes to our economy to combat global climate change requires a bit more accuracy with modeling than just "probably".

Head in the sand. What do you say if the models say that the probability is between 92 and 96% and insurance companies say that weather-related damages are increasing their payout by 5% annually? Is the bigger risk reducing carbon emissions, or not reducing carbon emissions?

What do you say if the models say that the probability is between 92 and 96% and insurance companies say that weather-related damages are increasing their payout by 5% annually?

So what? This could easily be based only upon wealthier and more expensive houses in areas more prone to weather damages - such as beach front property.

There is certainly nothing in your hypothetical that would then lead one to be able to answer this:

Is the bigger risk reducing carbon emissions, or not reducing carbon emissions?

As there's nothing in your hypothetical to prove doing either would have any impact on insurance claims.

& note - even if it did - most rational adults don't care. It's up to insurance companies, private companies, to take care of themselves.

If they see this and it's true - they certainly need to do something about it.

& if I work for one of them, or invest in them, or use one as my insurance company, then I it may matter.

But when arguing when people can put you in jail for not obeying, maybe more is required than "we're pretty sure" especially give not one single model has predicted anything the "sky is falling" lobby claimed would happen.

Though maybe that's just me - maybe you watched Refer Madness and thought "My g-d! If we don't stop this now, we're doomed for sure!"

Weather is not climate. And the models are not accurate. Neither of your points are valid.

Something I have always wondered about Keynsian economics is why they are assuming the effects are linear? For example if deficit spending of $100 billion is good then $1 trillion is 10 times better. I would think there should be some point where the deficit spending hurts the economy more than it helps.

I have never heard anybody talk about this.

Keynes never assumed that. Keynes admitted in his lifetime that there were limits to his thinking and that not every downturn creates the danger of a deflationary spiral.

The problem is that no one pays any attention to Keynes anymore. His name is just a brand for a particularly barbaric and simple form of Leftism.

Good comment.

No pays attention anymore - except the neo-Keynsians, who are trying to clean the theory of the barnacles that have attached themselves to it over the ages.

Why do you assume that they assume the effects are linear?

As I recall, the levels of various economic indicies is one of the considerations in determining the multiplier - the effect is expected to change with context.

The multiplier is a member of {i}.

After looking at the chart, my guesstimate is the stimulus did absolutely dick. The reason for unemployment to have lowered over time may be because workers dropped out of the workforce and the economy fixed itself. But, what do I know?

Congratulations - you read the chart precisely as the propaganda machine otherwise know as the AEI wanted to read the chart. Good for you!

Please instruct us on how we are supposed to read the chart.

Please forgive us that the predictions of the proponents of the stimulus turned out to be completely wrong, so we question why we spent so much in order to get none of the promised results.

Please continue to appeal to authority rather than posit substantive argument.

There were two comments to the prediction - predicting the baseline without stimulus, and predicting the effects of stimulus. It is obvious that the prediction was too low. You have to go beyond the chart to arise at the conclusion the stimulus didn't work.

Suderman says, shading his conclusion, that we can't know that the stimulus worked. Most responses take that to the less careful claim that we know the stimulus didn't work. Sorry, the totality of evidence doesn't support that. If you wish to avail yourself of Suderman's argument based on irreducible uncertainty, you can't suddenly drop the logical chain of argument at the end.

You have to go beyond the chart to arise at the conclusion the stimulus didn't work.

Why? The administration pitch was clear: If we don't spend $XXX millions, unemployment will go higher than curve Y. If we do spend the money, we will get lower curve Z.

Well, we spent the millions, and unemployment was (and still is) higher than curve Y. Thus, by their own standards, the stimulus was a failure.

Showing that you either didn't read my response, didn't understand it, or chose to ignore it. This resistance to acknowledging the shortcomings of your learning process is why some say that reality has a liberal bias. It doesn't really; but by denying reality the right (I won't call them conservatives) leave liberals in the position of being better guides to reality. When the right again embraces reality, the perceived bias will fade.

I understood your response to be exactly what it is: Jesuitical weasel-wording and hair-splitting in defense of an obvious failure. And anyone who repeats the hilarious "reality has a liberal bias" blather is a guaranteed partisan hack. Begone, troll.

What's 'totality of evidence?'

And to be clear, I don't think there should have been a bail out for any business.

If what I'm going through is "success" I'd hate to experience what the Keynesian dipshits would consider to be a failure.

"Why It's So Hard to Figure Out What the Stimulus Did."

It can't be that difficult to figure out nothing.

Oh come on, let's be fair.

The stimulus massively enriched a bunch of Obama cronies donors. And in my state, which rejected Obama at the polls, it financed a lot of very expensive tools and over-time pay for the militarized police statists.

That hardly amounts to "nothing."

Yay!

And, of course, we know the unemployment numbers have been rigged in the administration's favor.

Trouble is that without principles it isn't possible to establish whether the stimulus was right or wrong, even successful. From a purely empirical standpoint the dispute cannot be concluded--some benefit might have come from it, for some of the citizenry--and unless it is in principle wrong to redistribute wealth in line with the objectives of those who champion the stimulus approach (e.g., Paul Krugman), any evidence against it will be inconclusive. It is easily conceivable that the bit of benefit from it was significant enough to satisfy those who believe in it. That is the problem with the empiricist approach; that is why nearly all experiments in public policy fail to establish whether the policy is sound--the next time it might succeed. It cannot be ruled out empirically!

What never seems to cross the minds of the so-called Keynesians is if Keynes were alive today, and Keynesian economics had not yet been written, but we had much the same system, that is bloated bureaucracies, welfare, corporate subsidies, transfer payments, food stamps, unemployment benefits, and so on, would he have had the same idea? Would he have said, 'Hey, I've got an idea, let's run more deficits. That'll solve the problem!'

And, if the answer is no to that. Then why do people think that is the solution.

We have no flow problem. Cash is flowing always.

We have some structural problems. They are not being dealt with. Keynes solves none of them. Keynes makes most of them worse.

1. An education system that sucks. We take the best and brightest of the sheep and immobilize them with a poor and expensive education. I'm not nuts about sheep, but they're needed to be middle managers in productive jobs. We take that whole middle manager strata of society and turn them into art historians.

2. We are over-regulated. A person can't put a sundeck rail at the height that works for him. Everything is regulated. There is no aspect of our lives not regulated now. It is killing our spirit, and our economy.

3. We have gotten away from the idea that making things is what makes us wealthy. We think we can push paper around and stay wealthy. We can't.

I could go on and on. Keynes, or what passes for Keynes, makes all the real issues we face worse.

History is tough and what might have happened instead of what did is even tougher.

Michael,

I thought your post was very interesting and eye-opening, so I dug around a little. According to http://www.wikihow.com/Calculate-GDP, there's different ways to calculate GDP, one of which uses the method that you described. Then I wondered which one that the gov't uses. According to http://www.europac.net/comment.....versation, they do indeed use the above method, but the article explains the reasoning behind why they measure it that way:

"Unlike most private sector compensation, wages, salaries, and pension contributions paid to government workers are added directly to GDP. This distinction makes sense and eliminates potentially double accounting. Profits generated by private companies add to GDP when they are ultimately spent or invested by the company. Wages reduce profits, and therefore reduce GDP. But that reduction is cancelled out by the consumption of the employee receiving the wages. Governments do not generate profits, so salaries are the only way that public spending adds back to GDP."

The entire article is pretty good and seems to tell of another way that the public is being misled.

-cheers