Driving a Motor City Revival

Detroit can only improve from here, if city officials change a lot of bad habits and policies.

In the wake of officially receiving approval for bankruptcy protection, Detroit's story has become a familiar one. Once the poster child of America's industrial might and middle-class prosperity, decades of economic decline have brought the city to its knees before a bankruptcy court with as much as $20 billion in debt. The decline of an iconic American city has led to a flurry of finger-pointing, both to assign blame for the crisis and to identify the right direction forward.

The facts of today's Detroit are staggering. Businesses and individuals labor under heavy tax burdens, with an income tax set at the maximum level allowed by state law and property taxes ranking highest among America's 50 largest cities. City services range in quality from mediocre to unconscionably bad, such that the average response time to a 911 call is now 58 minutes (PDF) and 40 percent of street lights aren't working (PDF). Residents suffer an unemployment rate that has been at Depression-era levels in recent years, reaching as high as 25 percent and settling at 16 percent today. By most measures, Detroit is the most dangerous city in the nation, registering 20 more murders in 2011 than Philadelphia, despite containing fewer than half as many residents.

The collapse of the city has led to it being placed under the control of an emergency financial manager, attorney Kevyn Orr, who is granted broad unilateral powers to restructure its government and debt without the need for approval from elected officials like the mayor or city council.

Michigan's record of state interventions in local government has been somewhat mixed. Take the on-again, off-again takeover of the Detroit Public School System. Under an emergency manager for all but four of the past 14 years, the system is finally in the black for the second year in a row, but only after years of persistent deficits and strong backlash from Detroiters opposed to restructuring by an unelected official.

On the other hand, the nearby city of Pontiac's finances have been under state supervision since 2009 and the results, from a dollars and cents perspective, are undeniable. Expenditures dropped from about $55 million to $29 million annually and the city is now in spitting distance of true solvency for the first time in years, despite a steep decline in its tax base. Orr now faces the unenviable task of enacting similar reforms in Detroit to better manage its finances while also unifying the city's fractious population to rebuild civic institutions.

Identifying a cure for the Motor City's problems requires an accurate assessment of their causes. A popular conservative narrative has been to point the finger at Democrats and labor unions, both public and private, for driving the city to ruin. Tempting as it might be to lay the blame on one's political rivals, hand-waving about the salutary effects of electing Republicans does not constitute a serious plan. Liberal governance surely did the city no favors in helping create its yawning chasm of debt. But one sees plenty of successful large cities that had equally liberal and corrupt leadership, yet do not face insolvency because they do not suffer from Detroit's unique mix of significant size and radical depopulation.

More than one million people have headed for the Motor City's exits since its size peaked in 1950. Even when compared to other Rust Belt cities that have experienced significant population loss, Detroit stands out. The only city that has dropped farther from its mid-20th century peak is St. Louis, but its population has never been even half as large as Detroit's. In fact, of the eight U.S. cities that have lost more than 50 percent of their population in recent decades, Detroit is far and away the largest. Even in its shrunken state today with just over 713,000 residents, it is larger than Pittsburgh's all-time peak of 677,000.

The Steel City was able to realign its economy around world-class universities and vibrant health and technology sectors, positioning itself as the smaller-but-viable city that it is today. Detroit, meanwhile, lacks any obvious infrastructure to capitalize on growth industries. Though it does boast some world-class medical facilities, the rest of its top 20 employers are an odd grouping of government entities, businesses in the turbulent auto industry, and casinos. As a result, its economy is largely stuck in the same rut it has occupied for decades.

Detroit also suffers from a long and sordid history of racism that has contributed significantly to depopulation and regional division alienating the city from its suburban neighbors. Though many point to the 1967 riot as the spark that lit the fire of racial discord, the truth is that tensions had been smoldering for upwards of 100 years by that point. The city's rapid population growth in the 19th and early 20th century, driven in large part by an influx of African-Americans from the south, ignited countless ugly incidents including significant riots in 1863 and 1943. By the time the civil rights era arrived, Detroit's toxic racial politics meant that so-called "white flight" was already well underway.

The city's epic population loss and poor governance created a debt monster. Job number one for Orr as emergency manager will be working to reduce the city's staggering liabilities, something that is much easier with bankruptcy protection that allows for rewriting many contracts to allocate losses.

The largest share of debt is associated with the Water and Sewerage Department, a major asset for the city which services much of Southeast Michigan. Orr is already working to restructure its debt while exploring ways to spin it off as a regional authority from which Detroit could receive lease payments, a plan that could also help ease ongoing tensions with suburban neighbors that draw from the system.

The next biggest portion of debt is $5.7 billion in unfunded retiree health care liabilities (PDF). Detroit spent so lavishly on these benefits that its per-household liability is higher than every other large city except for Boston and New York, both of which are much wealthier. Fully two-thirds of its annual health care bill goes to retirees, with just one-third for current workers. Reforming these obligations is among the "easiest" things the city can do because, unlike pensions, there is no protection in the Michigan constitution for health care benefits. Though it will be difficult politically, Orr should consider reducing promises made to new employees, increasing deductibles and co-payments, and raising eligibility requirements to receive coverage. Ultimately the city should pre-fund its health care obligations, but aligning costs with ability to pay is step one.

The other big chunk of debt is associated with unfunded pension liabilities, totaling $3.5 billion. Like many city and state pension systems that are in trouble, Detroit has been systematically overstating the health of its fund by assuming unreasonably high investment returns and playing games with "smoothing" of investment losses such that the stock market crash of 2008-2009 still hasn't been fully factored into its estimates.

The challenge with pension benefits is their unique protection in Michigan's constitution, which says that they "shall not be diminished or impaired." The legal boundaries of reform are disputed, but it's likely that Orr will freeze the current pension systems and create a defined-contribution 401(k)-style plan for new employees. If the law allows, (the judge overseeing Detroit's bankruptcy last week ruled that pension cuts are on the table), he should also consider transitioning all current employees into such a system while restructuring benefits for current retirees.

Additional federal or state funding to soften the bankruptcy blow is unlikely (and probably unwise), but Washington and Lansing could focus instead on altering existing funding streams. Detroit gets substantial aid already, far more than any other Michigan city on both a gross and per-resident basis. But it is unable to process these dollars effectively or quickly enough and many of the funds are targeted at things that could fairly be characterized as "wants" rather than "needs" for a city in such distress.

For example, the city forfeited $9 million in federal weatherization assistance last year due to mismanagement and faces a similar threat with Community Development Block Grant funds this year. Instead of disparate funding streams earmarked for very specific purposes (which require complicated application and implementation processes), lawmakers could instead unify existing dollars into one single payment for Detroit to use to address its highest priorities, like tearing down some of the 78,000 vacant structures in the city, bolstering police protection or addressing legitimate human needs in the form of hunger, homelessness, and unemployment. Any of these would be better uses for federal tax dollars than buying energy-efficient windows.

The city should also pursue potential sale of some of its other assets. The Detroit Institute of the Arts, for example, has in its possession an estimated $2.5 billion worth of art that could be auctioned in order to help ease the debt load. After all, that represents more than 12 percent of the city's obligations. The prospect of art sales has rankled many in the press corps, but the simple fact is that cultural pursuits fall well below things like police protection on any reasonable hierarchy of a city's needs.

Once the process of addressing Detroit's debt has begun, repopulating the city will be the order of the day because what it needs more than anything else is human capital. It needs more density, more vibrant neighborhoods, more businesses, and more economic activity. To address that goal, some have discussed redrawing Detroit's physical borders by unincorporating sparsely-populated portions. After all, at 139 square miles, the city is larger than Boston, San Francisco, and Manhattan combined. However, such geographic shrinkage is basically unprecedented for large cities and it's not clear where the new borders would be drawn. A more innovative and less obtrusive policy would be imposing variable pricing for municipal services based on distance from densely-populated areas, some iteration of which the city is sure to pursue despite the likely pushback from residents.

In order to attract more people, the city will need to do a much better job of attracting and maintaining businesses. Unfortunately, the ability to reduce high tax burdens is relatively limited due to the sheer size of the city's ongoing deficit problems. Reforming taxes in a revenue-neutral manner, however, might be possible as a way to better orient the code toward growth.

For example, Michigan currently has a uniform sales tax statewide, but the state legislature could consider allowing Detroit a local add-on that would increase its sales tax in exchange for elimination of its city income tax. While income and property taxes are very high, its sales tax of six percent is actually quite low when compared to other large cities. There is widespread agreement among economists that consumption-based taxes are less damaging to growth than income-based taxes, so this kind of tax swap could improve the city's economic prospects.

Detroit could also improve the business climate in other ways, such as completely eliminating (or at least, making much less restrictive) zoning and land use restrictions that stand in the way of development. The city already has moved (although belatedly and haltingly) to legalize urban farming operations, which have been putting Detroit's vast open spaces to productive use. Loosening regulations in other areas could make building a business easier and cheaper.

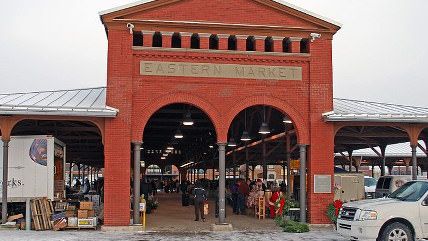

Likewise, it could wipe away senseless licensing restrictions which place barriers to entry before entrepreneurs. Detroit has myriad foolish licensing laws and fees that are tremendously costly for businesses. The Eastern Market Corp., a business association for Detroit's iconic outdoor market, conducted a survey of licensing and inspection fees for food businesses in the city, compared to similar operations in several other cities. The costs imposed by New York City, for example, were less than one quarter as much as Detroit's. This anti-business posture has, among other things, hindered a flourishing food truck industry, which has been a bright spot in many other cities across the country.

None of these changes will be easy. Reshaping a broken city with strong traditions of insularity and distrust of authority would be difficult in any event, but the nature of Detroit's problems puts it in essentially uncharted territory.

The city's motto in Latin, "Speramus meliora; resurget cineribus," translates to "We hope for better things; it shall rise from the ashes." And rise it will. Not through hope alone or simply electing Republicans and cutting taxes, but by starting the hard and necessary work of repopulating and rebuilding a once great American city from the ground up.

Show Comments (148)