Obamacare's Hidden Tax on Your Health Insurance

On November 29, as most Americans staggered through a tryptophan-induced haze, the federal government published final rules (PDF) for the Health Insurance Providers Fee—or Health Insurance Tax, to be more honest. It's a strange fee; one for which the amount to be collected is predetermined, and then parceled out among each "covered entity" that charges premiums for health coverage, proportionate to the insurer's share of net premiums. Which is to say, it's a tax that hits individuals, and small-to-medium-sized businesses that have to pool risks, but explicitly excludes the sort of "self-insured plan" offered by large employers. Unless you work for a large company that self-insures, you can expect the fee to be passed on and to add a couple of percent to the cost of your health coverage.

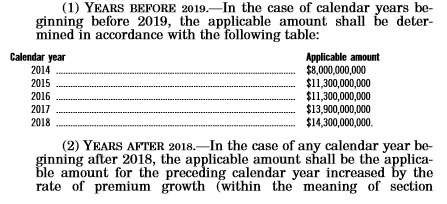

How much the tax will add to your bill is a bit of a guessing game, since the government has already decided how much it will collect, but the size of the market is a bit up in the air in the age of crashing government Websites and legally required policy cancellations. Buried on page 832 (yes, really) of the Patient Protection and Affordable Care Act (PDF) is Section 9010(e), which announces, bluntly, that the IRS will collect:

- $8 billion in 2014

- $11.3 billion in 2015

- $11.3 billion in 2016

- $13.9 billion in 2017

- $14.3 billion in 2018

After that, "the applicable amount shall be the applicable amount for the preceding calendar year increased by the rate of premium growth."

It's good to have confidence in how much revenue you'll collect, isn't it? I'll bet the health insurance providers who will be passing this tax on to their customers wish they had the same confidence.

In fact, the new tax is enough of a concern that insurers, like Aetna, are distributing brochures (PDF) explaining why premiums are subject to a somewhat unpredictable new levy. "Because the new federal fee will impact the cost of plans going forward," cautions Aetna, "we feel it's important for you to understand this fee. By doing so, you can better anticipate and plan for the expected impacts."

How much will the new tax add to the average health coverage bill? The Heritage Foundation's David R. Burton says it "will increase individual and small group health insurance premiums by an additional 2–3 percent."

Douglas Holtz-Eakin, president of the American Action Forum and former director of the Congressional Budget Office, performed detailed calculations of the costs Obamacare is likely to inflict on health care, and predicts the "anticipated impact is as much as 3 percent or nearly $5,000 per family over a decade."

When the Obama administration promised us cost control on health care, we should have realized that meant upwards.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

They passed and now we get to see what's in it, rather like a stool sample.

If you think this is bad, just wait until 2018, when the 40% excise tax on so-called Cadillac tax plans hits.