Proponents of Raising the Debt Ceiling Want To Bankrupt Your Kids

Whether it's long-term or short-term, proposals to hike the debt ceiling are schemes for allowing the federal government to borrow more money so it can continue to spend beyond its means. Politicians want to borrow more money because they have spending plans that consistently exceed the amount of money that the federal government takes in as taxes, and that are projected to continue to outpace revenues into the foreseeable future. Raising the debt ceiling means snowballing debt rolling downhill right toward our children and their children.

In a Cato Institute paper published in February of this year, Jagadeesh Gokhale of the Social Security Advisory Board warns:

Current U.S. fiscal policy, including the recently concluded "fiscal cliff " debt deal, is placing an enormous financial burden on today's children and on future generations in order to deliver government benefits to current middle-aged workers and their elders. Standard government accounting methods hide that intergenerational transfer from the public and make it difficult to calculate how large the transfer is. Intergenerational resource transfers will grow larger as the composition of budget receipts and expenditureschanges with relatively faster growth of age- and gender-related social insurance programs. Intergenerational redistributions through federal government operations could substantially affect different generations' economic expectations and choices and exert powerful long-term effects on economic outcomes.

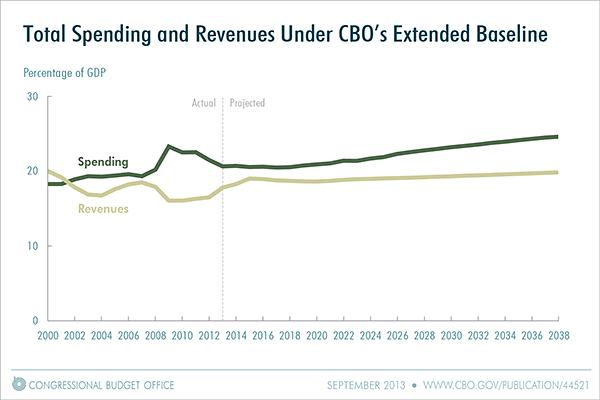

Entitlements are a big part of the problem. In fact, current middle-aged workers are expected to receive such enormous benefits via Social Security and Medicare under existing policies, Gokhale continues, that their lifetime net tax burdens are "almost fully eliminated." With the Congressional Budget Office projecting spending to steadily rise, as a percentage of GDP, over the decades to come, while taxes are expected to remain a bit above their decades-long average share of GDP, that means deficits, year after year, and growing debt, as ceilings get bumped ever-higher until the economy buckles under the pressure.

This is without taking into account the fact that "the increase in debt relative to the size of the economy, combined with an increase in marginal tax rates (the rates that would apply to an additional dollar of income), would reduce output and raise interest rates relative to the benchmark economic projections that CBO used in producing the extended baseline." Taking the resultingly depressed economy into account, "debt under the extended baseline would rise to 108 percent of GDP in 2038."

This means, essentially, that the massive tab for everything else besides entitlements is being passed along to the next generation via borrowing to cover today's bill. And they'll have a lousy economy in which to scare up the payments.

Of course, most of the current flock of politicians—Barack Obama, Harry Reid, John Boehner, and company—expect to have happily sucked up the entitlements that will leave their tax payments "almost fully eliminated" long before the bill comes due. It's tough luck for their kids and grandkids, along with ours—unless they've arranged for them to dodge the consequences (they wouldn't do that, would they?).

That intergenerational passing of the check, with no plan in sight to do otherwise, is the big problem with just raising the debt ceiling like our self-proclaimedly responsible policial class insists. Pay no mind to the debt—it's doom if we don't comply.

But what doom? Economist and Reason columnist Veronique de Rugy has pointed out that "if the debt ceiling is not increased, the Treasury can prioritize interest and debt payment to avoid a default." Now, Moody's Steven Hess agrees, writing, "We believe the government would continue to pay interest and principal on its debt even in the event that the debt limit is not raised, leaving its creditworthiness intact. The debt limit restricts government expenditures to the amount of its incoming revenues; it does not prohibit the government from servicing its debt."

So, the federal government is fully able to pay off its already hefty tab even if we cut up the credit card. Then, maybe, it can finally get its spending under control.

Show Comments (175)