More Evidence That Government Policy Was Behind the Mortgage Meltdown

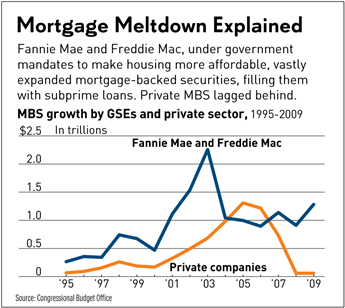

Just two months ago, with regards to the mortgage meltdown that government apologists have been eager to lay at the door of moustache-twirling Wall Street types, a research paper answered the question, "Did the Community Reinvestment Act (CRA) Lead to Risky Lending?" with a resounding, "yes, it did." Now, Investors Business Daily tells us that, as the federal government encouraged ever-riskier loans with fewer and fewer safeguards, the most enthusiastic issuers of the mortgage-backed securities that ultimately crashed in spectacular form were (can you guess?) Fannie Mae and Freddie Mac.

HUD not only encouraged no down payments but also adopted affordable housing mandates for the government-sponsored en terprises that issue mortgage securities, Fannie Mae and Freddie Mac. Beginning in 1996, the [government-sponsored enterprises] had to make 40% of new loans they financed to borrowers with incomes below the national median.

With lower underwriting standards and a mandate to fulfill, Fannie and Freddie's MBS issuance began to take off. It surged more than 116%, from $342 billion in 1997 to $741 billion in 1998.

Hogberg describes how MBS issues soared even as standards for loans were continuously eased, in compliance with the National Homeownership Strategy.

That strategy was a key piece of government policy through two administrations. Of its implementation, then-President Clinton said in 1995 "[t]he goal of this strategy, to boost home ownership to 67.5 percent by the year 2000, would take us to an all-time high."

The "how" of the boost is a big part of what got us into trouble. Businessweek reported in 2008 that the strategy "promoted paper-thin downpayments and pushed for ways to get lenders to give mortgage loans to first-time buyers with shaky financing and incomes."

While the strategy was no secret, and was continued by the Bush administration, it was sufficiently low-profile that the Department of Housing & Urban Development quietly tried to drop the embarrassing thing down the memory hole in 2007. That didn't work.

Hogberg continues:

By 2000, Fannie and Freddie were financing loans with zero down payments. The private market soon followed. By 2006, 30% of all homebuyers made no down payment. …

After those changes, Fannie and Freddie's business skyrocketed. Their MBS issues jumped from about $469 billion in 2000 to $1.1 trillion in 2001. The increase continued, rising to $1.5 trillion in 2002 and $2.2 trillion in 2003. As GSEs' issuance of mortgage securities began to fall in 2004, the private MBS market took up some of the slack. Private issuance rose from $684 billion in 2003 to $980 billion in 2004 to a high of $1.3 trillion in 2005.

Yet private mortgage securities never matched that of the GSEs. From 1995-2009, the private market issued about $6.8 trillion in MBSs vs. $14 trillion for Fannie and Freddie.

I distinctly remember "no-doc" loans being a big deal during those years, too. A friend of mine took out more than one mortgage during the National Homeownership Strategy years without offering a single page of evidence that the income he claimed bore any resemblance to reality. He "self-certified" in the language of the time, in return for a (very) slightly higher rate. He also admitted to me that his claimed income was complete bullshit. He wasn't the only one, as no-doc loans became known as "liar loans" and are now essentially unavailable.

This was a result of federal government policy to promote home ownership as a good in itself without regard to the financial ability to pay for a home. Fannie Mae and Freddie Mac took that policy and turned mortgage-backed securities into the equivalent of torpedoes fired at the U.S. economy.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

More Evidence That Government Policy Was Behind the Mortgage Meltdown

The science is settled!

Shrike assures me this is a teabag lie.

He assures me that it's been massive profits all the way down.

If the government would just turn into a stimulus and bailout machine, we could reduce tax rates to 0%.

Really?

I think I forget his position on the cause of the mortgage meltdown.

It has been awhile....though i am sure Booooooosh is involved.

The CRA, Affordable Housing Rules and unprecedentedly low interest rates clearly incentivized the housing bubble.

HOWEVER, the banks/ratings agencies clearly committed fraud when that packaged shit loans and gave them AAA ratings.

Perp walks for everybody!

"HOWEVER, the banks/ratings agencies clearly committed fraud when that packaged shit loans and gave them AAA ratings."

Not sure.

If the gov't is backing similar instruments, doesn't that justify a AAA rating?

I don't expect any of the companies involved to get huffy and stand on an arbitrary principle; they are there to judge the market and make a profit.

The AAA ratings were based on insurance from AIG. Where the agencies laid down was in not making sure that AIG could actually cover the insurance.

The banks, issuers, etc. for damn sure committed fraud, though, in at least some of the bonds, and maybe a whole crapload. There are some civil cases wending their way, but the mills of justice, etc.

The SEC, of course, is too busy wanking and chasing celebrities who may (or may not!) have engaged in trivial insider trading to bother with multi-billion systemic fraud. I mean, c'mon, how are they going to land phat high-six-figure jobs at those banks tomorrow if they prosecute them today?

A lot of factors contributed to the problem, including lender and borrow fraud and, let us say, over-exuberance, but the government played a major role in creating the conditions for the bubble and later disaster. Part of that were a number of pressures to make loans really easy to get ("Everyone has a right to own a house"), while simultaneously attacking lenders for risk-based pricing and other methodologies designed to require risky borrowers to pay more and jump through more hoops.

Without the government, the bubble never happened. Sure, many are to blame for the damage done when the bubble burst, but the government blew it up in the first place. Like it's done with education and healthcare.

By the way, this isn't all about the federal government. The states did their part, too.

I never understood the need for borrower fraud. I bought a house in 2010, well after the bubble popped and lenders were still willing to give me a loan with monthly payments that were 60% of my monthly income (principal value more than 5x my yearly income). That's just retarded (or brilliant, given the nature of Bailout Nation). I can only assume lending standards were even worse back in 2006, so why did borrowers even need to lie?

Shocked, I am. Shocked.

I knew a guy who did the whole liar loan thing. He paid considerably more in interest, and ended up doing a deed in lieu to get out of the house. He was the first clue I had that something was very wrong, because I wouldn't have loaned him 50 cents for a cup of coffee but finanical institutions were loaning him enough to buy a house. I remember thinking anybody who lent him money had to be stupid.

Apparently, I was right.

How stupid are the bankers who did this? They've cashed big checks, gotten their banks bailed out, and not a single one has gone to jail.

If I'm looking for stupid people, I'm not sure I land on them.

By punishing no one, they'll all do the exact same thing again, given the chance. And they're mostly in the same position to do it, and the government hasn't done anything significant to prevent it.

The Cause of the 2008 Mortgage Crash

...It appears that this aggressive expansion of Fannie Mae and Freddie Mac into subprime lending was a political strategy adopted by their leaders in response to heightened congressional scrutiny and criticism in the wake of the accounting scandals at the agencies that emerged during 2003 to 2004 and which threatened to lead to a revocation of their favored status as government-sponsored enterprises. Fannie and Freddie aggressively restyled their lending operations as the promotion of affordable housing and actively encouraged retail lenders to generate mortgages with those characteristics. As a result, not only did the number of subprime loans explode in the 2005 to 2007 period, but a disproportionate number of these loans were made to the riskiest borrowers or had extremely high risk characteristics, such as negative amortization, interest-only, high-LTV, or very low FICO scores. ...

Above, revised

...Good numbers kept Wall Street happy. They paid the light bills for more than 50 partnership offices that represented Fannie Mae around the country. And they made top executives multimillionaires. Johnson received $21 million in his last year as chief executive and a consulting contract worth $600,000 a year.

But when good numbers -- and the bonuses that came with them -- weren't possible anymore, the executives who came after Johnson allegedly rearranged the math and, even after accounting problems were found, used the company's political clout to fend off closer regulation. That was the conclusion of Fannie Mae's chief regulator, the Office of Federal Housing Enterprise Oversight, in a 340-page report that determined the company's $10.6 billion accounting scandal was rooted in a corporate culture that dates back 20 years....

Investigators found that Fannie Mae's reported earnings per share closely tracked the targets set for executives to receive their maximum bonus payouts...

...During the period covered by this report?1998 to mid-2004?Fannie Mae reported extremely smooth profit growth and hit announced targets for earnings per share precisely each quarter. Those achievements were illusions deliberately and systematically created by the Enterprise's senior management with the aid of inappropriate accounting and improper earnings management.

A large number of Fannie Mae's accounting policies and practices did not comply with Generally Accepted Accounting Principles (GAAP). The Enterprise also had serious problems of internal control, financial reporting, and corporate governance. Those errors resulted in Fannie Mae overstating reported income and capital by a currently estimated $10.6 billion.

By deliberately and intentionally manipulating accounting to hit earnings targets, senior management maximized the bonuses and other executive compensation they received, at the expense of shareholders. Earnings management made a significant contribution to the compensation of Fannie Mae Chairman and CEO Franklin Raines, which totaled over $90 million from 1998 through 2003. Of that total, over $52 million was directly tied to achieving earnings per share targets....

HUD not only encouraged no down payments but also adopted affordable housing mandates for the government-sponsored en terprises that issue mortgage securities, Fannie Mae and Freddie Mac.

Mandates, eh? I think a certain someone is going to be conspicuously absent from this thread.

You know who else is absent from this thread?

I'm not, dammit. I live for housing threads.

Le Corbusier?

Walter Gropius?

Frank Lloyd Wright?

Howard Roark?

Joe, Shrike, Tony, Palin's plug?

Calamity Jamie Gorelick?

Tim Cavanaugh

May god rest his soul...

He may not be dead...but he is at national review online where they envy the dead.

Shriek and Dickrider must have gotten called away on important business and thus cant comment on this thread. They will be so disappointed when they find out after the thread is dead. T i n y too apparently. Shame as I came here specifically to see what those mendacious fuckwits had to say.

We can keep posting - a high comment count attracts further comment.

If you anti-intellectuals ever looked outside of your bubble and thought in terms other than right-wing talking points from AM talk radio, you would understand that government was merely seeking to protect our fundamental right to be given shelter. If you have arguments other than appeal to ridicule, let's hear them.

How'm I doing as Tspaceospacenspacey?

They never ask for arguments. They always get them anyway and ignore making any kind of serious refute to the statements that get made.

don't forget Obama's ACORN lawsuit against Citi which proved it's better to make a bad loan with real estate backing it up than paying out millions in judgements for no assets.

ACORN played a big role in the state legislation against so-called predatory lending. Some lenders were doing bad things, but those laws almost always prevented good business practices in lending.

But I thought the meltdown was the result of all that deregulation and laissez-faire craziness from the Bush era that never really happened except in the minds of intellectually-dishonest liberals.

The whole pro-housing movement was a response to the crime wave in the early-to-mid 90s. Basically, crime skyrockets in the inner-cities, and it becomes a hot bed issue in the media due to the racial element Liberals blame failing inner-cities on what they were stigmatizing at the time as "absentee landlords", conservatives respond with a seemingly pro-capitalist argument that "if they owned their homes, they'd take care of their communities", and when the two put their heads together, the "National Homeownership Strategy" was born.

It's a storybook in unintended consequences. People voice concern over crime and governments sets in motion a clusterfuck that will destroy the economy and ruin their children's futures.

conservatives respond with a seemingly pro-capitalist argument that "if they owned their homes, they'd take care of their communities"

This idea wasn't any more valid in the 1990s than it was in the 1940s when the Truman administration was setting up public housing projects.

Just giving irresponsible people something to be responsible for isn't going to solve the problems that made them irresponsible to begin with.

But, but, it's their RIGHT!

cause, you know, it says so in one of those constatution declarasion thingys.

Cargo Cult legislation AGAIN. It's what the FedGov does.

Now that we are disregarding the Constitution, we can squash studies like this, and go back to blaming the mortgage meltdown on the anarchistic deregulation that happened under Bush.

I'm a simple person. It became clear that F&F were the main culprits when they received the biggest bailouts and have zero chance of actually paying them back.

From the study:

Government housing promoting policy contributed to the crisis, along with many other factors (at least eight possibilities cited by Wikipedia). The most important thing to remember about this debate is that, as with the Great Depression, the matrix of causes is complex. (Complexity itself was a factor here!) Nobody is innocent and everyone is guilty. I've said countless times that government was the major problem (because it didn't have the right policies).

Re: Tony,

Ah, so much for the "Greed did it!" boilerplate towards which economics-ignorant liberals fell back always.

I never have. I see greed as a natural human compulsion. If there are too many negative consequences from greed, then the incentives and capabilities of greedy people need to be altered by public policy.

Except what you see as "negative consequences" actually serve a purpose, and public policy doesn't eliminate the incentives for greed, it merely shifts them in ways we can't predict.

Re: Tony,

It is public policy which enables greater risk-taking, because fools think the government will be there to bail them out or to "protect" them.

Greed is always balanced by risk aversion. Reduce the risk artificially - through regulations, subsidies, tariffs or bailouts - and what you end up is moral hazard. Place rubber ground below the monkey bars, and you will see kids doing really crazy stunts, until they break their necks. If they know beforehand they would hit harder ground, kids will be more prudent. Same thing with protective, paternalistic government: people take the most incredible of risks if they feel they can socialize the loses but keep the profits. Take government away, and people become much more prudent.

Greed is always balanced by risk aversion.

Always?

Always?

Nope.

Just better balanced then government planning can achieve.

I see greed as a natural human compulsion.

Yet somehow government bureaucrats and progressive politicians are immune to this...

right?

RIGHT?!?!

the matrix of causes is complex.

Tony translation:

"umm looks like I am wrong...better hide that fact by using the word "Complex" to cover myself."

Among those policies would have been to discourage the private market from going hog wild in the easy-credit reality. And major players like Countrywide engaged in behavior far beyond the risk levels tolerated by CRA-related rules.

Government subsidizing a sector of the economy doesn't necessarily lead to a crash (see: military-industrial complex). The CRA may (or may not) be good policy, and if it's deemed that subsidizing housing is desirable, we have to make sure, with regulation, it doesn't lead to out-of-control speculation by large banks (something having nothing inherently to do with housing)--which was the proximate cause of the crash if not the only one.

Re: Tony,

They went wild because Countrywide was encouraged by the underwriting by Freddie and Fannie.

That is correct. What does lead to a crash is the malinvestment driven by a cheap credit policy as pursued by the Fed. People shifted their money from stocks (after the dot.com crash) to housing, driven by cheap money and the encouragement from government. You would probably have default and a bust in housing if only the subsidies were offered except not as great as the country suffered because of the speculation due to the increasingly lower underwriting standards and cheap credit.

In all, the fault resides squarely in the Fed. Without the pusher, the addict cannot get his fix.

They went wild because Countrywide was encouraged by the underwriting by Freddie and Fannie.

So i am a hypothetical Countrywide employee.

I see all the other employees buying up loans, I see the government buying up loans to the tune of $3 trillion swamping the tiny amount of loans being sold before the government went big on it, I see my competition buying up loans and shovelfuls of money keeps pouring in.

My boss tells me to buy loans or i am fired cuz I am not making as much as everyone else.

Everyone including and especially my own government is telling me to buy loans.

Yup Tony is right it is all private greed here. Move along no government manipulation of the market to see here. No dumping of trillions into a market that hardly existed prior.

That is only because we are not particular about who we bomb the shit out of so there is no glut of bombs, missiles on the market and we have very handy secondary markets for all non-consumables.

All of the things you cite are unintended consequences of government policy.

From which does not follow "therefore government should be disallowed from creating policy." The market always operates in a particular regulatory environment, among other various constricting (or permissive) environments, and there is no reason to believe that minimizing regulation will somehow make it work better. Even a laissez-faire environment comes with risks and wouldn't eliminate innovative speculation methods and bubbles. Good policy is the only solution.

And when those bubbles burst, the people who invested in them go broke and things go back to normal. It requires government intervention for a bubble to blow up to the stratospheric heights of our housing bubble.

Unicorns are the only solution.

Yep, and in a laissez-faire environment risks are entered without coercion.

for the record: I am not saying never have a government policy but I am damned suspicious of any government policy. Government is the first choice of folks like you. Be happy, you are winning, as most Americans are passive progressives, but you won't win much.

What is good policy BTW?

So is it about the best form of economy, or is it about your faulty moral preoccupation with coercion (as if there were no coercion in a laissez-faire market!)?

Your moral preoccupations and a well-functioning reality don't necessarily align.

and, Americans wouldn't know a free market if it gave us a lap dance..

Re: Tony,

No, it follows from this: Nobody has that power to give, you moron!

So? We live among disease, that does not mean it is not preferable to be healthy. What kind of argument is that, anyway? If you had head lice and wanted to get rid of them, would you accept the argument that you should operate with lice in your head?

Why would you say that? If I tied a hand behind your back and you asked me to let you go, would you accept that you would not improve your mobility if I did?

Life comes with risks. People learn from mistakes. Shielding people from their foolhardy actions ends up with populating the world with fools.

Top. Men.

*Slow clap*

Excellent pivoting, Tony. From "It was all the greedy bankers and deregulation" to "it's complicated, you wouldn't understand" all the way back around to "But it was the greedy bankers and deregulation" in the space of two comments. You really can talk yourself into anything, can't you?

This might be the dumbest thing I've ever seen you write. What happens when defense spending gets cut?

And major players like Countrywide

...Lenders not subject to the CRA, such as subprime giant Countrywide Financial, still fell under its spell. Regulated by HUD, Countrywide and other lenders agreed to sign contracts with the government supporting such lending under threat of being brought under CRA rules.

"Countrywide can potentially help you meet your CRA goals by offering both whole loan and mortgage-backed securities that are eligible for CRA credit," the lender advertised to banks.... ...

According to Cato's Mark Calabria, by "2005, one out of every four loans purchased by Fannie Mae was from Countrywide" and "one of out every 10 for Freddie Mac was also from Countrywide", the end result being that "close to 90 percent of Countrywide's loan originations were bought or guaranteed by some arm of the federal government". How was this achieved? (warning, link is a PDF)

...In 1999, Fannie Mae CEO Jim Johnson and Countrywide CEO Angelo Mozilo reached a strategic agreement giving Fannie Mae exclusive access to many of the loans originated by Countrywide in exchange for a discount on fees Fannie charged when buying loans. The agreement linked the growth and success of Countrywide to Fannie Mae's continued desire to acquire a large volume of loans....

...Because the growth and success of Countrywide was tied directly to Fannie Mae's continued hunger for acquiring and holding loans and Wall Street's continued investment in mortgage-backed securities composed of subprime mortgages, Countrywide CEO Angelo Mozilo offered a key group of VIPs preferential treatment through a special loan division. Countrywide gave preferential treatment to legislators, Congressional staff, cabinet members, Fannie Mae executives, lobbyists, and others well connected in Washington. Countrywide also gave preferential treatment to business partners, local politicians, homebuilders, entertainers and law enforcement officials....

Government policy was the only thing that matters. Government should not have regulated or manipulated the housing market, and sure as shit should not have bailed out the banks. The only thing that should be regulated is actual fraud, which was committed by people in government, the banks, and even many borrowers. Those people should have been prosecuted, but they won't. If banks go bankrupt and some dickheads need to be evicted from property they do not own, I don't give a fuck.

THIS. And this is what T O N Y doesn't understand. Government shouldn't be putting money in the hands of little guys or big guys.

Even if I grant his premise--and I don't:

1) How does one identify "good policy" ahead of time?

2) How does one insure that politicians produce only good policy?

I know he accuses libertarians of living in fantasy land, but his idea that only good politicians will get elected and only good policy will result is the largest fantasy of all. Evidence: today's world.

The only way to prevent abuse of power is to not grant power.