Study Says Community Reinvestment Act Induced Banks To Take Bad Risks

'twas Wall Street greed what done it, some folks say, when it comes to explaining the spectacular housing meltdown of recent years, which had its roots in a great many astonishingly risky loans. Other folks suggest that the federal government just may have played something of a role in inducing, even strong-arming, banks to take risks they otherwise would have avoided. Specifically, the Community Reinvestment Act and related policy pressures are pointed to as culprits, part of a government effort to extend home-ownership in lower-income neighborhoods. Now comes a new study from the National Bureau of Economic Research that says, quite bluntly. that the CRA played a major role.

In the academic world, mealy-mouthed delivery of even powerful conclusions is the norm, so it's refreshing to see authors Sumit Agarwal, Efraim Benmelech, Nittai Bergman, Amit Seru answer the title's question, "Did the Community Reinvestment Act (CRA) Lead to Risky Lending?," with the clear, "Yes, it did. … We find that adherence to the act led to riskier lending by banks." The full abstract reads:

Yes, it did. We use exogenous variation in banks' incentives to conform to the standards of the Community Reinvestment Act (CRA) around regulatory exam dates to trace out the effect of the CRA on lending activity. Our empirical strategy compares lending behavior of banks undergoing CRA exams within a given census tract in a given month to the behavior of banks operating in the same census tract-month that do not face these exams. We find that adherence to the act led to riskier lending by banks: in the six quarters surrounding the CRA exams lending is elevated on average by about 5 percent every quarter and loans in these quarters default by about 15 percent more often. These patterns are accentuated in CRA-eligible census tracts and are concentrated among large banks. The effects are strongest during the time period when the market for private securitization was booming.

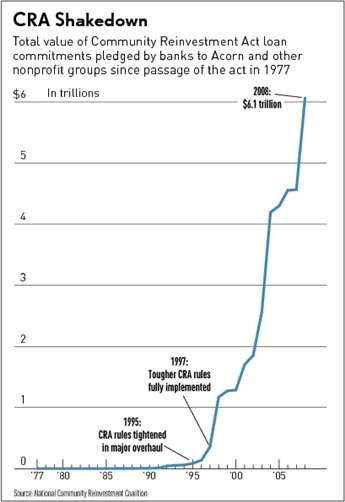

Investors Business Daily does a very nice job of summarizing the nature of the pressure brought on lenders (that's IBD's most excellent graphic, above):

"We want your CRA loans because they help us meet our housing goals," Fannie Vice Chair Jamie Gorelick beseeched lenders gathered at a banking conference in 2000, just after HUD hiked the mortgage giant's affordable housing quotas to 50% and pressed it to buy more CRA-eligible loans to help meet those new targets. "We will buy them from your portfolios or package them into securities."

She described "CRA-friendly products" as mortgages with less than "3% down" and "flexible underwriting."

From 2001-2007, Fannie and Freddie bought roughly half of all CRA home loans, most carrying subprime features.

Note that the authors of the study caution that their work here may actually understate the impact of the CRA. How? Because the study assumes that the major impact of CRA took place when banks were undergoing examination regarding their compliance with CRA goals. If banks found it difficult to shift gears in preparation for such exams, they may have altered their overall behavior to satisfy politicians and regulators. Or, as the authors put it in their conclusion, "If adjustment costs in lending behavior are large and banks can't easily tilt their loan portfolio toward greater CRA compliance, the full impact of the CRA is potentially much greater than that estimated by the change in lending behavior around CRA exams."

The housing meltdown and the Great Recession. Something else for which you can thank the feds.

See other Reason writers on this issue.

Show Comments (110)