National Debt Hits a New Record High: $22 Trillion

A new record, but one that won't stand for long.

The national debt hit a new record high of $22 trillion this week, according to figures released by the Treasury Department. That works out to about $66,000 for every man, woman, and child in the country.

It's a record that likely won't stand for long. We're less than a year removed from surpassing the $21 trillion threshold, and just a little over 17 months have passed since the debt climbed above $20 trillion for the first time. The Congressional Budget Office (CBO) expects the federal government to run a $900 billion deficit this year, and by next year, the government will be adding more $1 trillion to the national debt every 12 months.

Hitting the $22 trillion threshold this week is "another sad reminder of the inexcusable tab our nation's leaders continue to run up and will leave for the next generation," said former New Hampshire Gov. Judd Gregg and former Pennsylvania Gov. Edward Rendell, co-chairs of the Campaign To Fix The Debt, a bipartisan group pushing for fiscal responsibility in Washington, D.C.

"The fiscal recklessness over past years has been shocking," the former governors said in a statement.

Look a few more years into the future and things really start to accelerate. Unlike a decade ago, when the so-called Great Recession (and the questionable federal policies crafted in response to it) caused deficits to spike, the current increase is not a short-term problem that will be solved as soon as the economy rights itself. Instead, we're now at the beginning of a long upwards climb that has no end in sight—unless significant policy changes are enacted.

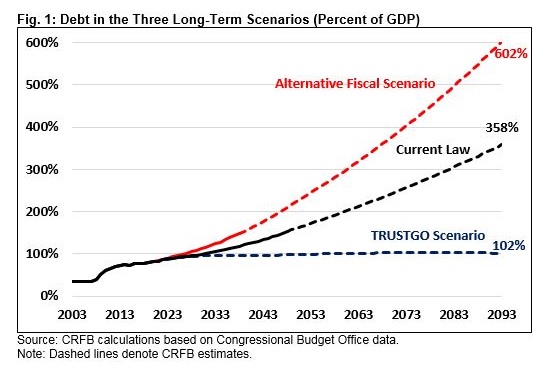

Here's how the CBO projects the national debt to grow, relative to America's gross domestic product—which roughly represents the size of the national economy—over the next few decades.

Under current law—which assumes, among other things, that the 2017 tax cuts will expire in 2025 and not be extended—the national debt will double from 78 percent of gross domestic product (GDP) this year to 160 percent of GDP by 2050. It would hit 360 percent of GDP, and still be climbing, by the end of the CBO's 75-year projection window in 2093.

In the so-called "alternative fiscal scenario," which assumes current policies (such those tax cuts) are kept in place, the debt would hit 225 percent of GDP by 2050 and more than 600 percent of GDP by 2093.

Either way, that sort of trajectory should inspire immediate action. But President Donald Trump completely ignored the national debt issue in last week's State of the Union address, and he's previously shrugged off worries about the national debt because things won't get really bad until he's out of office. Mick Mulvaney, the president's acting chief of staff and a former congressional budget hawk, now says "nobody cares" about the debt.

The thing is, he seems to be right. In Washington, much of the discussion over the past week has focused on Democratic plans to spend untold piles of cash on a "Green New Deal" that would require a mobilization of the entire economy to fight climate change. Republicans, meanwhile, spent the past two years with full control of the federal government and used that opportunity to increase spending and cut taxes, which is not a formula for deficit reduction. Those tax cuts were defensible in many ways—the reduction in the corporate tax rates makes America competitive with the rest of the world—but it is undeniable that they added to the debt.

Indeed, a $22 trillion national debt is not the result of any single bad decision. Entitlement programs—Social Security, Medicare, and Medicaid—are the main drivers of the long-term deficit, but endlessly expensive (and just plain endless) foreign wars, the 2017 tax cuts, and a bipartisan consensus that spending should keep growing faster than revenues have played important roles too.

The other problem is that the national debt isn't just getting bigger—it's getting more expensive too. Already, interest on the national debt consumes about $390 billion annually. That's more than any federal department or agency except the Pentagon, and it is only going to keep getting bigger.

As Brian Riedl, a senior fellow at the Manhattan Institute, told Reason last year:

The danger is that if the debt keeps growing, at a certain point investors will stop lending us money at reasonable interest rates. They will be reasonably concerned that the debt is growing beyond our ability to finance it. They will demand higher interest rates, and every one percentage point increase in interest rates will add $13 trillion in interest costs over 30 years. As interest rates go up, we will have to borrow even more to make the interest payments, which causes the debt to go even higher. At a certain point, the investors will demand that we get our fiscal house in order. It will likely start with low-hanging fruit—tax hikes for the rich, for example—but those won't be enough.

Eventually, you'll be left with two choices. Either significantly raise taxes on the middle class or significantly cut benefits to current seniors. If we do neither, you will have a major financial crisis.

Hitting the $22 trillion threshold is just one step towards that future debt crisis, but it will take a long time to reverse these trends. The time to start is now, while the economy is still growing—because another recession will only make these problems more intractable. Unfortunately, there's little reason to expect Congress or the current president to take meaningful steps to defuse the long-term debt crisis before we hit the next milestone along the road—which won't take long at the rate we're going.

Show Comments (130)