National Debt Hits a New Record High: $22 Trillion

A new record, but one that won't stand for long.

The national debt hit a new record high of $22 trillion this week, according to figures released by the Treasury Department. That works out to about $66,000 for every man, woman, and child in the country.

It's a record that likely won't stand for long. We're less than a year removed from surpassing the $21 trillion threshold, and just a little over 17 months have passed since the debt climbed above $20 trillion for the first time. The Congressional Budget Office (CBO) expects the federal government to run a $900 billion deficit this year, and by next year, the government will be adding more $1 trillion to the national debt every 12 months.

Hitting the $22 trillion threshold this week is "another sad reminder of the inexcusable tab our nation's leaders continue to run up and will leave for the next generation," said former New Hampshire Gov. Judd Gregg and former Pennsylvania Gov. Edward Rendell, co-chairs of the Campaign To Fix The Debt, a bipartisan group pushing for fiscal responsibility in Washington, D.C.

"The fiscal recklessness over past years has been shocking," the former governors said in a statement.

Look a few more years into the future and things really start to accelerate. Unlike a decade ago, when the so-called Great Recession (and the questionable federal policies crafted in response to it) caused deficits to spike, the current increase is not a short-term problem that will be solved as soon as the economy rights itself. Instead, we're now at the beginning of a long upwards climb that has no end in sight—unless significant policy changes are enacted.

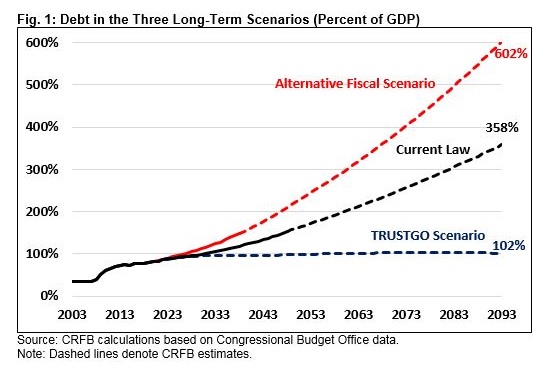

Here's how the CBO projects the national debt to grow, relative to America's gross domestic product—which roughly represents the size of the national economy—over the next few decades.

Under current law—which assumes, among other things, that the 2017 tax cuts will expire in 2025 and not be extended—the national debt will double from 78 percent of gross domestic product (GDP) this year to 160 percent of GDP by 2050. It would hit 360 percent of GDP, and still be climbing, by the end of the CBO's 75-year projection window in 2093.

In the so-called "alternative fiscal scenario," which assumes current policies (such those tax cuts) are kept in place, the debt would hit 225 percent of GDP by 2050 and more than 600 percent of GDP by 2093.

Either way, that sort of trajectory should inspire immediate action. But President Donald Trump completely ignored the national debt issue in last week's State of the Union address, and he's previously shrugged off worries about the national debt because things won't get really bad until he's out of office. Mick Mulvaney, the president's acting chief of staff and a former congressional budget hawk, now says "nobody cares" about the debt.

The thing is, he seems to be right. In Washington, much of the discussion over the past week has focused on Democratic plans to spend untold piles of cash on a "Green New Deal" that would require a mobilization of the entire economy to fight climate change. Republicans, meanwhile, spent the past two years with full control of the federal government and used that opportunity to increase spending and cut taxes, which is not a formula for deficit reduction. Those tax cuts were defensible in many ways—the reduction in the corporate tax rates makes America competitive with the rest of the world—but it is undeniable that they added to the debt.

Indeed, a $22 trillion national debt is not the result of any single bad decision. Entitlement programs—Social Security, Medicare, and Medicaid—are the main drivers of the long-term deficit, but endlessly expensive (and just plain endless) foreign wars, the 2017 tax cuts, and a bipartisan consensus that spending should keep growing faster than revenues have played important roles too.

The other problem is that the national debt isn't just getting bigger—it's getting more expensive too. Already, interest on the national debt consumes about $390 billion annually. That's more than any federal department or agency except the Pentagon, and it is only going to keep getting bigger.

As Brian Riedl, a senior fellow at the Manhattan Institute, told Reason last year:

The danger is that if the debt keeps growing, at a certain point investors will stop lending us money at reasonable interest rates. They will be reasonably concerned that the debt is growing beyond our ability to finance it. They will demand higher interest rates, and every one percentage point increase in interest rates will add $13 trillion in interest costs over 30 years. As interest rates go up, we will have to borrow even more to make the interest payments, which causes the debt to go even higher. At a certain point, the investors will demand that we get our fiscal house in order. It will likely start with low-hanging fruit—tax hikes for the rich, for example—but those won't be enough.

Eventually, you'll be left with two choices. Either significantly raise taxes on the middle class or significantly cut benefits to current seniors. If we do neither, you will have a major financial crisis.

Hitting the $22 trillion threshold is just one step towards that future debt crisis, but it will take a long time to reverse these trends. The time to start is now, while the economy is still growing—because another recession will only make these problems more intractable. Unfortunately, there's little reason to expect Congress or the current president to take meaningful steps to defuse the long-term debt crisis before we hit the next milestone along the road—which won't take long at the rate we're going.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

There's something very telling about the phrase "if we do neither, you'll have..."

I think what's being hinted at here is the enormity of resources being diverted from higher ends by certain manifestations of online "speech" that clearly need to be suppressed. If we don't build a digital wall to keep out the Trolls, then millions of taxpayer dollars are going to keep going into law enforcement efforts such as those required by America's leading criminal "satire" case. See the documentation at:

https://raphaelgolbtrial.wordpress.com/

The DEBT is not the DEFICIT. And the DEFICIT is not the DEBT. They are separate problems.

Government BORROWING drives up the debt, not government SPENDING.

The solution to our debt problem is simple: STOP ISSUING DEBT-BASED MONEY! Begin issuing pure "unbacked" fiat money to fund the deficit, rather than going further into debt. The inflationary impact of unbacked dollars is no worse than the inflationary impact of the same amount of debt-backed dollars. Issuing unbacked dollars will halt the increase in the national debt and its crushing $390 billion in annual interest. Paying off part of the maturing debt each year and rolling over the rest will eventually bring the national debt (and its taxpayer-financed interest payments) down to zero. See http://www.fixourmoney.com .

Barr's "platinum coin" idea was considered and determined to be unconstitutional. The current system is unconstitutional also, but I'm not allowed to tell you why.

You may, however, read the Gold Clause Cases (all three of them) for free. 294 U.S. 240 ff. Then ask yourself all the relevant questions.

Finally, Barr does not answer the ultimate question: What would make his "debt-free" money valuable? As things stand now, what gives a FeRN value is not the use of the FeRN to back debt (it is debt) but the willingness of the IRS to steal it from you (as opposed to, e.g., stealing your car). That does not cure the constitutional objection (for all who can ascertain what the objection is), but it does establish a system that, at least for now, works.

Congress has the power to issue debt-free currency with or without making a "platinum coin". In fact, this type of currency was issued to help finance the Civil War and a small amount is still in circulation today. Its constitutionality was upheld by the Supreme Court in an 8-1 decision in 1884 - see Juilliard v. Greenman. All of our circulating coinage is also debt-free money, issued by the Treasury Department rather than the Federal Reserve.

Although inferior to a gold-based currency, debt-free fiat money does in fact have real value. The U.S. dollar's value derives from the fact that it is the official medium of exchange and unit of account within a large, productive and reasonably stable economy. It does not derive its value from "the willingness of the IRS to steal it from you."

usdebtclock

Evidently we're already $9 billion over that $22 trillion.

We were told that a few billion dollars isn't even worth talking about just a few weeks ago.

"Build the wall!"

Cutting illegal immigration pays for itself. Automatic saving from welfare programs. Easily worth $5.7 billion.

"{Insert name of pet program} pays for itself" is the new opiate of the masses.

Luckily, common defense/repelling invasions/erection of forts, magazines, arsenals, dockyards, and other needful buildings... are all listed in the US Constitution.

Social Security, Medicare, Medicaid, Welfare giveaways are not.

You didn't answer whether it pays for itself, only that you think it's allowed in the Constitution.

You didn't ask a question or questions.

You do what you always do.

Go ahead and show us those citations, baby!

loveconstitution1789|12.3.18 @ 10:20AM|#

Poor alphabet troll. Script is still broken?

Poorly-maintained lc1789 troll hasn't been updated in ages. What happened, did your mom's basement flood out?

Alphabet troll programmer must have gotten an alert to update script.

Well done programmer.

And of course we have the enumerated powers of Congress to regulate immigrants.

Article I, Section 8: To establish a uniform rule of naturalization,

Article I, Section 9: The migration or importation of such persons as any of the states now existing shall think proper to admit, shall not be prohibited by the Congress prior to the year one thousand eight hundred and eight, but a tax or duty may be imposed on such importation, not exceeding ten dollars for each person.

How about you show come citations, some actual legal opinions, where that clause has ever been interpreted as applying to anything other than slavery?

Inclusion of the naturalization clause has nothing to do with immigration and just shows how inept your citations are, when you even bother to pop one out.

As a reminder of how well you keep your citation promises, here goes the alphabet troll again:

loveconstitution1789|12.3.18 @ 10:20AM|#

No response yet, of course. I truly would like to see some good legal citations; maybe my google-fu is too weak, or maybe it needs a legal wiki search.

But the more likely reason is just that lc1789 has nothing to stand on. It wouldn't be the first time's he's dodged his promises:

loveconstitution1789|12.3.18 @ 10:20AM|#

Poor alphabet troll.

Hates Libertarianism and it shows.

Poor poor-troll troll, hates citations and doesn't show them.

And is still quoting an obsolete part of the constitution that deals with the slave trade.....which just goes to prove that, indeed, he is a slaver. To which he gets the obvious response.

As Sen Everett Dirksen once said: "A billion here, a billion there, pretty soon we're talking about real money"

I can't get interested in this problem. Ultimately a bout of inflation will take nearly all dollar savings and render the debt moot. It has happened in so many other countries.

I don't see any government getting religion when it says it must tax equal to its expenditures. Or if you prefer, that it must spend just what it has. Just won't happen.

The problem in the discourse about the federal debt is that there's a significant portion of the population believes that deficits truly don't matter. I think the issue should be framed in terms of the federal interest expense outlay instead.

For example, a lot of people think we spend too much on defense spending. I wonder what those people think about CBO projections which put the interest expense surpassing the defense budget by 2025. That is money that is literally going to nothing beneficial to our country that we are obligated to pay.

Interest expense is also the fastest growing area of our budget. Do these people think it's good that interest with take a higher and higher portion of our budgetary spending?

The problem in the discourse about the federal debt is that there's a significant portion of the population believes that deficits truly don't matter.

Much of that is because that's how Americans, on average, live their personal lives as well. How can the ~35% of people who live within their means, as far as credit cards go, influence public policy for the remaining 65%?

We blame politicians for this all of the time, but it's the voters that have to hold them accountable.

True, but that's why I think framing the discussion around the interest expense may resonate with the electorate more.

Expecting most Americans to understand what you're talking about is a really big ask.

Maybe, but I don't necessarily think so. Not all areas of federal spending can be compared to an average household, but interest expense can. Tell people, it's like when you first get a credit card and use it somewhat responsibly, the interest expense is negligible. Then, over time, after that responsbility turns to extravagance, interest owed cuts into household income that would be used for other things like food, for example. It's exactly the same here.

Tell people, it's like when you first get a credit card and use it somewhat responsibly, the interest expense is negligible. Then, over time, after that responsbility turns to extravagance, interest owed cuts into household income that would be used for other things like food, for example. It's exactly the same here.

I'm still willing to bet that that's way more than most people pay attention to.

I hope you're wrong

I agree. People are borderline incompetent.

AOC's new green deal would be funded in part by deficit spending. So the new blood doesn't even want to pretend to care.

I wonder how many times their parents bailed them out of their credit card debt.

AOC believes in "modern monetary theory", although I doubt she really has a deep understanding of all that MMT describes and suggests. The MMT crowd says the government can just print/spend more money. They admit there's some inflation risk, but nothing that we're not smart enough to handle.

What does inflation matter? We just print more more money.

I've been framing the debt issue around the interest payments for a few year now. Seems that people who don't care about 22T in debt also don't care about a 500B interest payment. I love to point out to them that 500B would feed a lot of starving people.

That's depressing...

I think the issue should be framed in terms of the federal interest expense outlay instead.

I wouldn't bet on that being a wise solution either. Americans are basically a stupid entitled people who are hard-pressed to be a role model for even their own child beyond say age 2 or so.

If the issue is phrased as an interest expense problem, the 'solutions' will be:

Well then just print the damn money

Only pay interest to those who paying more than that in taxes

Declare bankruptcy and default on those loans

It wasn't long ago the country made hard choices on accumulating debt & brought it under control. This was under GHW Bush and Bill Clinton & involved very basic steps :

(1) Tax hikes - broad-base, not solely on the wealthy.

(2) Spending Cuts - federal spending fell from 20.7% GDP in 1993 to 17.6% GDP in 2000.

(3) Structural restraints on federal spending such as pay-go, requiring offsetting cuts or revenue for any new spending or tax cuts.

The tough political moves were taken, the public accepted action was needed, the benefits began to accrue. But then all that progress was just thrown away. The problem, as always, was Republicans. Multi-trillions in tax cuts, an unfunded new drug benefit, unfunded wars on top of those tax cuts, and promises given out like candy on Halloween. That was W Bush, who could toss out a multi-trillion dollar pledge on Social Security privatization w/ a casual shoulder shrug. Sixteen years later nothing had changed, with GOP primary candidates offering insane tax cut bids - Trump's ran to 10 trillion - accompanied by massive spending proposals. The candidate last election who promised the least - who treated voters most like an adult - was Hillary Clinton.

But most commentators here vote for the GOP, which blows the deficit to smithereens every time they hold power. The OP excuses massive tax cuts during an expanding economy & debt crisis - even as he decries debt. Why isn't this all just more empty hypocrisy?

Ha. Yeah, ignore that it's a bipartisan issue.

Almost 10T under Obama. Yeah, yeah, yeah, you can talk about outliers when he took office but that ignores the fact the dems held both houses of Congress at the end of Bush's term.

Also, look at the New Green Deal. That's more spending than any republican has ever suggested.

Really? The day of Obama's first inauguration the CBO projected deficit was 1.3 trillion dollars - with the economy in total meltdown. The deficit came down every year thereafter, being well less than half that size by the time he left office. This has been a certainty for about forty years now : The GOP makes the debt situation worse their time in power; the Democrats make it better during their turn.

Look back over the last four decades - when has that not been the case?

Also : Notice you blame Obama for debt despite GOP congressional control, then excuse Bush's debt because of Democratic congressional control. In two adjoining sentences no less. Pretty funny that.

Lastly, as hypnotic as a first-term 29-year-old junior Representative can be, I'm not sure she represents the whole of the Democratic party yet - so ya might wanna hold back your gushing enthusiasm. Less messy.

""Also : Notice you blame Obama for debt despite GOP congressional control, then excuse Bush's debt because of Democratic congressional control. In two adjoining sentences no less. Pretty funny that."'

I'm not excusing anyone. I clearly called this a bipartisan issue. President just sign or veto spending bills, I don't really give them credit or blame either way.

I have no "gushing enthusiasm" for AOC NGD. I'm merely pointing out the fact that is more spending than any republican has suggest.

The first thing the dems in congress did when Obama was elected is pass a single piece of legislation called the ARRA with an almost $1T cost. For one single piece of legislation.

Once the republicans took Congress under Obama, the deficits went down.

Not that republicans are off the hook for what they have contributed.

Fiscal Year Deficit (in billions) Debt Increase (by FY) Deficit /GDP Events Affecting Deficit

2004 $413 $596 3.4% n/a

2005 $318 $554 2.4% Katrina / Bankruptcy Act

2006 $248 $574 1.8% Bernanke chairs Fed

2007 $161 $501 1.1% Iraq War cost

2008 $459 $1,017 3.1% Bank bailout / QE

2009 $1,413 $1,632 9.8% Stimulus Act

2010 $1,294 $1,905 8.6% Obama tax cuts / ACA / Simpson-Bowles

2011 $1,300 $1,229 8.3% Debt crisis

2012 $1,087 $1,276 6.7% Fiscal cliff

2013 $679 $672 4.0% Sequester / Government shutdown

2014 $485 $1,086 2.7% Debt ceiling

2015 $438 $327 2.4% Defense = $736.4 b.

2016 $585 $1,423 3.1% Defense = $767.3 b.

2017 $665 $672 3.4% Defense = $812.3 b.

2018 (est) $833 $1,271 4.0% Defense = $824.7 b.

Don't bother- these "libertarians" are all to ready to excuse debt hikes under Rs and then say "but but but both sides!" as if that's even a thing. 2 trillion more in debt for a tax break for the wealthy who don't need it in a good economy. That's pure foolishness at best but these "libertarians" here will hand wave it away somehow.

Also, how much difference do you think there would be in the debt today if Hillary won the election?

I'm going with zero.

Are you friggin dellusional ?!?

Tax. Cuts. Cost. Revenue.

Less. Revenue. Means. Higher. Deficits.

Please - as a favor - don't respond.

I can only deal with so much Stupid each day.

Are you friggin dellusional ?!?

Tax. Cuts. Cost. Revenue.

Less. Revenue. Means. Higher. Deficits.

Please - as a favor - don't respond.

I can only deal with so much Stupid each day.

""Less. Revenue. Means. Higher. Deficits.""

No shit. More spending means higher deficits too.

CUT SPENDING

I would agree that we are usually better off fiscally when no single party rules both houses of congress and the presidency.

(so gobsmacked by the utter cluelessness I did a double-click-double-post. Apologies)

Tax cuts usually increase revenue, it is just that it isn't enough to offset the increases in spending.

The clueless ones are the ones who only see static accounting, while the dynamic of built-in spending boosts of 8%+ each year are ignored.

You do realize it was Congress that makes the budget right? So the Republican Congress in 1994 is what held firm.

Now, I agree lately both parties stink. But remember democrats had both houses in Congress under Obama for a while. Did spending go down?

The last deficit for "W" - WHEN HE HAD A REPUBLICAN HOUSE - was $161B and trending downward.

What happened was Nasty Pelosi got hold of the purse-strings and it only took two years for her to cause that "meltdown".

Blame "moderate" sounding demoncraps, who immediately sided with Nasty and a media that ignored the reality and told the nation that "Bush and the Republicans are spending like drunken sailors" that switched the House to the big spenders in 2006..

The problem in the discourse about the federal debt is that there's a significant portion of the population believes that deficits truly don't matter. I think the issue should be framed in terms of the federal interest expense outlay instead.

For example, a lot of people think we spend too much on defense spending. I wonder what those people think about CBO projections which put the interest expense surpassing the defense budget by 2025. That is money that is literally going to nothing beneficial to our country that we are obligated to pay.

Interest expense is also the fastest growing area of our budget. Do these people think it's good that interest with take a higher and higher portion of our budgetary spending?

A trillion here a trillion there pretty soon you're talking real money... until you reach gazillions, then you've reached mythical numbers and everyone knows you don't have to repay mythical amounts.

When it gets to gazillions, the IMF will bail us out.

I think there are a couple of big things we can do about our national debt.

For one, we should have Medicare for all. You may think that maximizing profit means private companies do what they can to keep costs down and, thereby, maximize the difference between revenue and cost, but I happen to know that Medicare for all would be a big money saver because . . . well . . . um Bernie Sanders said so, and he really cares about people.

The second thing we can do to lower our national debt is embrace the Green New Deal, which will create millions of new jobs, soften your hands while you do the dishes, and lower the amount of money we spend on energy, making our economy more competitive and creating more jobs while at the same times creating more jobs. I know this is true because Alexandria Occasio-Cortez said so, and she makes heart hands and dances, so we know we can believe her.

P.S. The Green New Deal will create more jobs.

Needs more hashtags, Ken, in order to be effective.

And a "to be sure"

We need some serious changes to our healthcare financing.

Benefits managers actually have a perverse incentive to let costs rise because they get paid a percentage. Sure they get paid to hold down costs this year, but next year they want a larger pool of money to skim.

Another way to fix the issues of health care spending affecting public debt is to stop spending public money on health care. It might... just... work!

That unpossible. It's obviously the government's job to provide for "the general welfare" aka guaranteed access to any health care up to and including genital mutilation, because that's the point of government after all. To pay for shit.

I can't figure out how people come to the conclusion that a right equals getting something for free instead of meaning the government cannot interfere with you getting it on your own.

Why are we creating jobs when I would get money even if I am unwilling to work?

Yes, I've worked with many people who got money even though they were unwilling to work.

But your forgot the best fix of all. We should build a wall, a big, big wall from sea to shining sea along our southern border. It will be a big, big wall, not small but bigly big. Larger than others, and I mean Huge! This wall will logically pay for itself because that's what walls do. They pay money. To us! Bigly!!!

"P.S. The Green New Deal will create more jobs."

Yeah, but unless it will wash my car for me I'm not interested

The absolutely fucking ludicrous official position of the fugazi "libertarians" of Reason magazine:

"The republicans bear of all the blame and responsibility for the entire national debt, regardless of which party is in control of which branches of government at any given time. The democrats, and ESPECIALLY our venerated hero Block Insane Yomomma, aren't responsible for one single penny of any of it."

You're nutty

Fuck off. You just showed up like yesterday and I've been hanging around here for many years, and this is exactly how they talk about it.

It's either Tulpa or Shrike.

Poor delusional Ken, living in lala land.

I've been around on and off for a few years now. I read more than I post.

Try to keep it that way.

Good thing I don't give a shit about some randos on the interwebz. I'll continue doing as I please thank you very much.

I think you care a little bit, or you wouldn't have responded.

I don't, but it's flattering that you want me to care what you think.

I love it when all the hit n run-publicans get all internet tuff gai.

Mithrandir's been around a while.

Maybe you don't fully understand how quotes work? They're not intended to convey your biased, partisan paraphrase of language that didn't say anything that you purport it to say.

LEFTIIIIEEEEEESSSSSSS!!!!!!!!!!!

WTF are you rambling about? If you had been around here for ages, as you claim, you'd know how much Reason was bashing Obama, and Bush 43, and so on, over their increased spending. Clinton got some kudos for more-or-less balanced budgets, but didn't get no free pass.

They didn't bash Obama once on the spending, debt, and deficit. They put all the blame on Paul Ryan and the republicans like they always do. You are completely and totally full of shit.

The Reason staff socks are out to get you WCR.

that sort of trajectory should inspire immediate action.

"MINT THAT COIN! MINT THAT COIN!"

$66,000 for every man, woman, and child in the country.

"Here's $65K for your 'Treasury'. Now leave me alone."

Wouldn't that be great!

Oops! *$70K*

*** gets coffee ***

75K when you get back with your coffee.

You must not have any kids. My bill would be much higher to be left alone.

I demand government money to help me pay back my portion of the government debt! Because fairness.

No one who matters cares.

Private debt - mortgages, credit card balances, etc. - eventually gets paid off (for the most part - some gets wiped out in defaults). Public debt just gets kicked down the road and the voters know it. My grandfather said I'd be paying off FDR's and Eisenhower's debt, yet my generation kicked it down the road, and the millienials will kick it down the road and our grandchildren will kick it down the road too. Today's pols will be long out of office when the "road" runs out and today's voters, of any age, still believe in Santa Claus and his magic toy bag.

I've seen graphs of national debt over time, and memory says it was continuously decreasing until Ronnie Raygun decided to triple it from $1T to $3T to scare the Soviets into bankruptcy.

The most annoying aspect of which was his contempt for his own professed beliefs in capitalism; if he had actually believed that communism was incompetent and doomed to fail, he should have paid off the debt and gotten government out of the way of free markets, and let communism fail on its own.

And somehow people treat Reagan as the great savior who killed communism. He might have pushed it a little harder, but he screwed the US economy in the process.

Big debt is a symptom of big spending. Milton Friedman said it's the spending that matters -- the debt-vs-taxes question is not so important.

Growth of real GDP per capita is way down this century, compared to the previous 50 years. Huge federal/state/local spending has already been having a big effect. The future is already here.

"Big debt is a symptom of big spending. Milton Friedman said it's the spending that matters -- the debt-vs-taxes question is not so important."

Fucking THIS. Reason used to understand this, when I started reading the rag almost 10 (!) years ago. It's always the fucking spending. STOP DEMONIZING TAX CUTS. A tax cut is in every way a celebratory thing. What needs to happen is spending needs to be massively reduced, to a point where we are budget-neutral with revenue where it's at now. Then the spending needs to be further reduced, to pay for the debt.

When my erstwhile colleagues explained to me emphatically how Obama would have saved America "billions of dollars" at "state and federal" levels because they lapped up enjoyed his delivery of a Favreau-penned speech and the subsequent commentary on NYT/MSNBC/Guardian etc, they made it heck of awkward to live in a world where water is still wet and the Sun goes down every night. I suppose I could move to the North Pole where water is all frozen solid and the sun never sets for 6 months. Perhaps that lind of bizarro anti-economics works up there, too.

And, as if I have to put this fucking disclaimer on everything critical of Team Blue and Saint O-Bomber (as I do for my reflexively whataboutist "friends"), this does not automatically mean I absolutely suck R dick and refuse to recognize that they are by and large just another flavor of giganto-spend big government wastage.

Fuck it all *fires up the chipper*

Nominal GDP is just under 21T, so aren't we already over 100%?

Yes we are. The game of defining the debt as 'owed to the public' is to exclude the debt that is in the SS 'lockbox' that is owed to the govt before it is owed to the public'. Cuz the latter is a trust fund and therefore an asset not a debt and therefore a liability.

I'd explain it in more detail but then I'd have to kill you.

I regularly try to get people to understand that SS and MC have no real assets and that they're all part of the debt. Thus, there have to be benefit cuts in the future.

They either lack the ability to understand or they just refuse to.

It's worth noting that Japan's debt-to-GDP ratio is around 236% - and they have not experienced hyperinflation or a collapse in their currency yet. I'm not saying our system won't feel some pain from the federal debt one day, but Japan's currency system is similar to ours.

Hyperinflation only occurs when you repudiate the debt. That repudiation eliminates the currency as valid money - so the result is that everyone desperately tries to convert the entirety of everything denominated in that currency to the older form of money (something that is in surplus). It's not about 'money printing'. It's about the panicked attempt to convert everything that was previously money (currency and debt) into eggs/chickens/wheelbarrows/cigarettes/silver/etc so that you're not the last one holding it.

Japan is not repudiating their debt and that is our scenario too - as long as we continue to service and maintain (honor) the debt. At their debt level, every time their economy grows in ways that would normally require an interest rate increase to reallocate capital, the increase in interest rate strangles the change. It can continue forever as long as the economy gradually stops even trying to grow. Japan also never had much household debt (70% of GDP in 1990 - 58% now) - and much of the increase in public debt is the govt taking on private financial sector debt (was 350% of GDP in 1990 and 230% now). Basically, the Japanese govt is increasingly becoming Japan's landlord now too.

the big difference is that they have an asset now to back up their debt. We simply spent too much on elderly consumption. And their debt is owned by them. Ours is only partly owned by us. So financial crises are more likely here.

Those aren't the only options. There's the "fuck you, cut spending" across the board option. And then there's all the land, mineral rights, and other assets the feds own.

They could sell and/or lease a lot of that. Of course if they do, I'd bet dollars to donuts that the government wouldn't use the money to actually pay down the debt but instead spend it on any and all boondoggles they're dreaming of, whether that be Green New Deal horseshit, "free" college and healthcare, or more defense spending, whatever.

You're right. Any new revenue is simply spent right away. But I suppose that helps grow the debt less since less needs to be borrowed? But no, spending is increasing so it seems the only way out is reducing spending.

But I have a practical (maybe dumb) question. How is the debt actually paid down?

Basically government can only issue bonds as a way of accruing debt. They can pay off older bonds that come due by issuing new bonds, monetizing the debt (printing money), or using excess revenue.

Spending any new revenues doesn't help the debt, because the debt is bonds that have already been issued and must be paid off when they mature. It doesn't even really help the deficit, which is the rate at which new debt accrues.

Ok that's what I thought. So in the end it's pretty simple accounting. There are different kinds.of bonds, like bonds held by foreign governments. Those could be tricky I think.

If new revenue decreases the deficit for that year it could be said to grow the debt less than it otherwise would have been.

I wish you wouldn't tantalize us by putting up a graphic w that "TRUSTGO Scenario" w/o explaining it & how it can be achieved.

I am getting $100 to $130 consistently by wearing down facebook. i was jobless 2 years earlier , however now i have a really extraordinary occupation with which i make my own specific pay and that is adequate for me to meet my expences. I am really appreciative to God and my director. In case you have to make your life straightforward with this pay like me , you just mark on facebook and Click on big button thank you?

c?h?e?c?k t?h?i?s l?i?n-k >>>>>>>>>> http://www.Geosalary.com

22 TRILLION is how much?

If you stacked up thousand-dollar bills:

One million dollars would reach four inches high.

One billion dollars would reach 333 feet high.

One trillion dollars would reach 64 MILES high.

The national debt of over 22 Trillion dollars would reach over 1,408 miles high.

The International Space Station orbits at an average of 250 miles high.

I'm still betting on us never doing shit about any of it until our currency collapses.

No politician has any incentive to do a blessed thing about it...

Unless somebody wants to be the hero that saves the nation... Of course HALF the nation, the half that doesn't pay taxes, will eternally despise you for it... But the other half, they will love that politician more than almost any other president in American history.

Democracy was despised by the founders because of the EXACT situation we're in now... It was inevitable. They limited who could vote to people who would be better educated and wealthier, because those people make better choices. If we had a modern version of their "white male landowner" it might be "Can pass this history/civics test, and is a net positive tax payer" or something... With such a restriction the nation WOULD NOT be in this situation. Universal suffrage is the WORST idea in the history of the world. Even worse than monarchy IMO, many founders agreed on that point actually.

We really are at the point where we're going to need our Sulla or whatever. The system is doomed unless somebody comes along and probably FORCIBLY straightens things out in an undemocratic manner.

"Those tax cuts were defensible in many ways?the reduction in the corporate tax rates makes America competitive with the rest of the world?but it is undeniable that they added to the debt."

It's completely deniable. In fact no tax cut EVER added a $1 to any deficit or debt. Allowing property owners to keep more of their own property never generated a single dollar of deficit or debt.

Spending more than you get in revenue has caused every $ of the national debt; the problem as always is spending too much, not taxing too little.

Slash spending by 1/3 across the board and the debt will be manageable in 10 years. Cut it by 1/2 and it will be even sooner...

Start working at home with Google. It's the most-financially rewarding I've ever done. On tuesday I got a gorgeous BMW after having earned $8699 this last month. I actually started five monthsago and practically Text. profitvid.com

Great! Say, can you cover this debt for us?

The video is the best. And direct. More Americans need to watch it. It is at the appropriate level for everyone. I am amazed at how both Democrats and Republicans can defend never doing anything about the debt and just plan on spending more! President George Senior Bush got gutted in the polls for promising no new taxes, and then helping to raise them, after we overspent. President Clinton along with a Republican congress balanced the budget and the 90s were a prosperous time. Few view those as successes, though I feel they were. In quick succession Bush Jr, Obama, and now Trump are just blowing money on their own partisan agendas, and not fixing the problem, because the public doesn't care. And when I look into my crystal ball, I see politicians promising more! As the Narrater in the video says, we are f#$k3d!!

The budget was never balanced under Clinton. The debt grew every year.

That's because of the SS and MC "trust funds". Those are shams and part of the debt.

""I am amazed at how both Democrats and Republicans can defend never doing anything about the debt and just plan on spending more!""

I'm not really. Consider what it might take, and it's easy to see why they ignore it.

Think of it like getting out of credit card debt. First you have to acknowledge you must pay a lot more than just the interest so you can pay down the principle. So for the example let's go with the interest on our debt being $500B. If we paid interest and $1T towards the debt ($1.5T per year) it would take us about 20 years. So we would have to pay almost half of what our current spending amount is for about 20 years just to get out of debt. Yes, that's not exact due to being simple with the math.

I bet government doesn't have the guts to do it on a 100 year payment plan.

You're correct, but not at the same time.

For instance, we could cut probably 1/3 of federal spending over a few years with phase outs of stuff they shouldn't be doing at all. Literally NOBODY would even notice these entire agencies didn't exist anymore. For some services people actually want, the lefty states would probably pick up the slack and raise their taxes, in right leaning states such wasteful things would likely just disappear.

As far as paying down the debt... You really only need to balance the budget, and it deals with itself. With "normal" inflation the TRUE value of the debt is reduced by about 1/4-1/3 every decade. So if you just keep a balanced budget, it gets cut by that amount every decade without repaying a dime. That excludes that there will ALSO be real economic growth in there, making the debt less of an actual issue. In just a couple decades it is manageable and not THAT big a deal.

Paying off modest amounts while it's true value is ever shrinking from inflation, it could just evaporate into being a non issue in just a few decades. All you have to do is maintain a BALANCED budget every year, and never deficit spend.

$22 trillion?

I only want one percent of that.

I'm not asking for much.

Just a little.

You 1%ers are scum

Both parties suck at this. It's not that hard, spend less than you take in.

Some on here just want to tot the liberal line "it's the Republican fault". True, they aren't fiscal by any means anymore.

But if you want to see a total Democrat agenda - look at NY and CA budget/deficits. The unfunded pensions and everything. And guess what - they tax the hell out of you yet it's never enough.

Time to buy a wheel barrow. When inflation hits one load of dollars should be able to get me a loaf of bread

Republicans will always sleep comfortably knowing that no matter how hard they fuck things up, there will be a pundit class and internet commenters who say "both sides" to absolve them of their specific culpability. And then when that imperceptibly creeps into "Democrats are worse" despite all the evidence in the world, they won't mind, will they?

But the Democrats ARE worse...

One could argue the gap was a lot smaller between the two in terms of horribleness in the past... But especially nowadays, the Dems are just shittier across the board. Sorry bro.

Until Congress stops spending beyond our means, every year will bring a new record.

If only deficit spending, absent a crucial national emergency, were a Capital Offense of the Shoot On Sight variety.

Take a single $1 FeRN.

Now take another and tape it lengthwise to the first.

Take a third and do the same thing.

Do that 20 trillion times.

The ribbon of dollar bills will reach from where you are standing to the orbit of Uranus.

And remember: That FeRN is a NOTE -- an IOU.

I can recall when I could go to Bank of America, put one of those IOUs on the counter, and get a brand new silver dollar.

That's right: A Morgan cartwheel!

However, there is not enough gold or silver in the surface of the earth to pay off $20 trillion.

The only thing the government could do would be to pay what gold or silver it has to those first in line, tax them 100 per cent, then take the gold and silver and pay it to the next group in line, then tax them 100 per cent, etc., until the debt is paid.

So, who wants to be first in line?

Because the ONLY thing that gives that IOU any value is the willingness of the pigs to steal it from you.

Without institutionalized theft on a massive scale, the money is worth NOTHING beyond the value of the paper.

Only in America would we issue a commemorative half dollar with P.T. Barnum on it.

Maybe it's time to bring that one back!

The problem with republicans is that, as they lower taxes, they do nothing to reduce the budget. The problem with democrats is that they increase taxes and then find a way of increasing federal spending even more. Don't get me wrong, taxes should be cut, drastically, but the first step to actually doing that has to be toward eliminating spending. Both parties are fiscally irresponsible, but only one party is evil.

Why is the media focusing on that Russian collusion fairy tale instead of this?

Is it worth listening to some bullshit I'd scan and bypass?

Transcript or STFU.

You $2 donation is falling fast.

CLICK HERE...?????? http://www.Aprocoin.com

Neither side of the aisle seems to remotely care about this subject. The only person in the news that cares is Shultz and even though I don't like a lot of his politics you have to admit he is the only one talking about the country's debt. The debt should be a bipartisan issue since it will eventually eat the government.

The problem is the Federal reserve.

Here is a private organisation which lends the dollar to the American government charging interest to do so. This instantly puts the government into debt before it has spent a single cent.

This is an organisation which unilaterally decided to spend billions of dollars to bail out the banks in 2008 thereby devaluing the dollar

The Fed must be dismantled and no more fiat currency.

The world must go back to the gold reserve.

Take a minute and just scroll through the comments. Seemingly every other commenter has a different idea about what the problem is ("it's revenue", "it's spending", "it's federal interest expense", and on and on). The fact is, to a greater or lesser extent it is all of these, and right now we're all sitting at the foot of Mt Everest trying to figure out how we might attack the summit without any climbing gear.

And let's face it: I doubt anybody here knows anybody who can really wrap his or her mind around even the concept of

$22 trillion. I've seen the visuals of stacks of bills filling a warehouse and all that, but like it or not, to most it's just funny money. Nobody really understands how we got there, who our creditors are or what difference any of it makes. Most of all, nobody at any level has any real idea of what if anything can be done about it or whether they would support any real solution even if someone could propose one (eg, cutting spending; it's fine so long as it doesn't affect something of any importance to them).

The solutions are simple... People just don't have the balls to do them.

Cut much of the federal government. Keep the budget balanced, and let inflation reduce the "real" value of the debt over a decade or two. Done.

State governments could opt to jack THEIR taxes if they want to cover some of the stuff the Feds stop doing, but many states would choose to have less government and lower taxes overall.

People are just too big of cowards to cut programs that 90% of the population didn't even know existed, because all those useless programs have small groups that champion them.

Start working at home with Google. It's the most-financially rewarding I've ever done. On tuesday I got a gorgeous BMW after having earned $8699 this last month. I actually started five months/ago and practically straight away was bringin in at least $96, per-hour. visit this site right here>>>>>>> http://www.2citypays.com