The GOP Tax Bill Isn't the End of the World. Far From It.

It's a conventional Republican tax plan with all the predictable problems - and benefits.

Sometime today, both the House and the Senate will hold final votes on the tax legislation that has been working its way through Congress this year. And then, tomorrow, President Trump will sign it into law.

Democrats have treated the bill's passage as an apocalyptic event. Earlier this month, when a previous iteration of the bill passed in the Senate, Nancy Pelosi, the Democratic House Minority Leader, declared that it was literally the apocalypse. "It is the end of the world," she said, singling out the bill's repeal of the individual mandate. "This is Armageddon." How perilous the world must seem to her that this muddled bit of tax cutting could bring it all down.

Pelosi's apoplectic reaction offers, among other things, a reminder of how long it has been since Republicans last passed major legislation, and how unhinged the responses to such an event can be. The Tax Cuts and Jobs Act (TCJA) is not the end of the world, nor anything close. It is not even, unfortunately, the end of the tax code as we know it.

Instead, it is a predictable, conventional piece of Republican tax legislation, one that cuts taxes for corporations and individuals while sharply increasing the deficit. It is the sort of thing you can imagine passing, more or less, under Mitt Romney or John McCain or Jeb Bush. Which means, of course, that it has all the problems, and benefits, of conventional Republican thinking about taxes.

Among those benefits is the bill's centerpiece: a permanent reduction in the corporate tax rate, from 35 percent, the highest in the developed world, down to 21 percent. There is little serious disagreement amongst mainstream economists that America's corporate tax rate is too high. In 2012, President Obama proposed slashing it to 28 percent. Predictably, the Republican plan goes further, but it still leaves America with a rate that is higher than the European average of 18.8 percent. Cutting corporate taxes may not provide the sort of quick boost to job creation or economic growth that some of its more enthusiastic backers claim. But it positions the nation to be more competitive internationally in the long term by permanently reducing the cost of doing business in the United States.

Corporations are not the only beneficiaries of the bill's cuts to tax rates, however. The plan cuts tax rates across all seven tax brackets, doubles the standard deduction (while eliminating the personal exemption), expands the child tax credit, and alters the alternative minimum tax so that it will affect fewer people. According to an analysis the Tax Policy Center, these changes would reduce taxes for every income group. Only about five percent of taxpayers would pay more next year.

The bill is broadly unpopular, and has been widely misunderstood by the public, with one recent poll showing that a majority of the public believes their taxes will go up under the bill. In fact, it will reduce taxes for most Americans. If you are reading this, you will most likely get to keep more of your money as a direct result of this legislation.

At least, that is, for the next several years. The individual tax reductions, including the doubling of the standard deduction, are all set to expire at the end of 2025. This is where the bill's problems become more apparent.

Sunsetting these provisions allows the bill to comply with the Senate's self-imposed requirement that the bill not increase the deficit by more than $1.5 trillion over the next decade. Republicans, however, have argued that the provisions won't really expire, because no future Congress would allow middle-class taxes to rise. "Those are sunsets that will never occur, we don't believe will ever occur, we don't intend to ever occur," House Speaker Paul Ryan said last month at event hosted by The Washington Examiner.

This may well be true. Under President Obama, the vast majority of the temporary tax cuts passed under President George W. Bush were made permanent.

The problem is that if it is true, and the provisions don't expire, then the bill will increase the deficit far more than projected. What Republicans are arguing, essentially, is that the actual text of the legislation should be ignored, because the authors do not intend for the bill to be implemented as written. It is effectively an argument for intentional legislative deceit. At best, it asks for support on the basis of a transparent budget gimmick.

The bill also repeals the individual mandate to maintain health coverage that was part of the Affordable Care Act. This won't repeal Obamacare, as the subsidies, regulations, and Medicaid expansion will be left in place. But it might partially hobble it, sparking political blowback in the process.

The main reason for repealing the individual mandate is that it provides about $340 billion in deficit reduction, helping to offset the budgetary effects of the tax cuts, because, according to the Congressional Budget Office, about 13 million fewer people will choose to obtain government subsidized health coverage. Republicans have credibly argued that the estimated coverage loss is too high; if so, however, that means the deficit reduction is smaller too. It's another budget gimmick — an attempt to have it both ways.

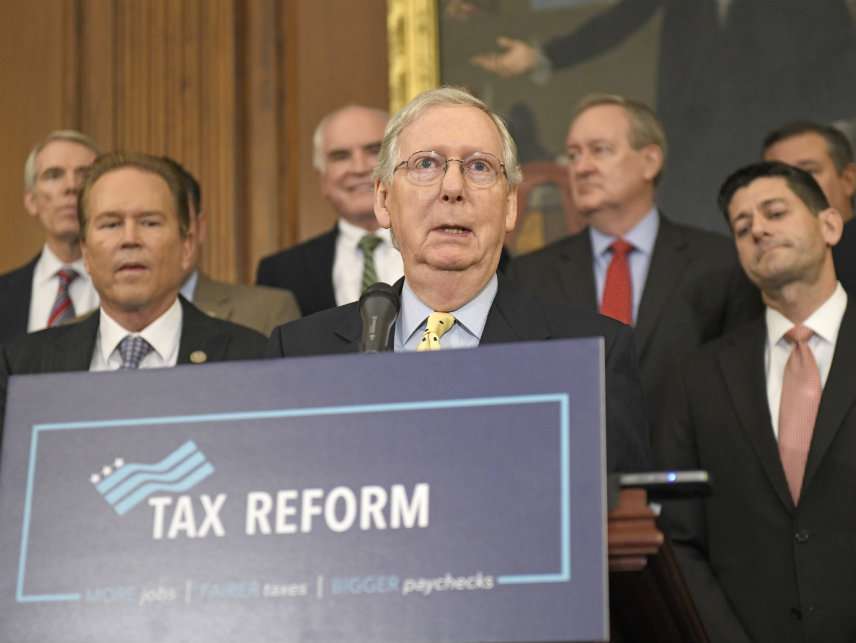

Indeed, Republicans are also promising that the bill won't raise the deficit at all. Although static estimates suggest that it would raise the deficit by a little more than $1.4 trillion, Republican leadership maintains that this will be made up via new revenue from increased economic growth. The bill, Treasury Secretary Steve Mnuchin said earlier this year, would "pay for itself." On the night the bill passed in the Senate, Majority Leader Mitch McConnell even went so far as to declare that it would result in an increase in government revenue.

Not a single independent analysis backs up this claim. The most favorable estimates, which assume large dynamic effects stemming mostly from the corporate tax cut, project that growth will make up for about $1 trillion in lost tax revenue. An analysis by the Committee for a Responsible Federal Budget found that the total hit to the deficit could amount to $2.2 trillion. That this comes after eight years of blistering GOP criticism about debt and deficit increases under Obama is more than a little telling.

Republicans did produce one short document outlining their argument for growth. It provided no detailed analysis, yet concluded that the bill would pay for itself via "a combination of regulatory reform, infrastructure development, and welfare reform as proposed in the Administration's Fiscal Year 2018 budget." In other words, the bill, on its own, won't actually pay for itself.

It is an admission that even under the most generous assumptions, GOP claims about the bill's likely effects have no realistic basis. Republicans may not exactly be lying about the bill, but they are certainly bullshitting.

There are other problems with the legislation as well: It provides a tax break for pass-through corporations, which pay at the individual rate, in a way that is nearly certain to encourage accounting gimmicks and other types of tax arbitrage. When Republican lawmakers in Kansas set up a similar provision, it encouraged tax avoidance but not economic growth, according to an analysis by the Tax Foundation. Republicans sold tax reform on the notion that it would simplify the tax code, reducing opportunities for gaming the system. Instead they have produced a bill that provides an incentive for complex tax-avoidance schemes.

Meanwhile, Republicans won over holdout votes with sketchy side-deals, at least one of which appears to directly benefit a number of Republican legislators. Republican leaders haven't even bothered to pretend that these add-ons have a purpose beyond buying votes.

And even backers agree that the text of the legislation, which was hastily written and rushed through the legislative process, has numerous errors and glitches in need of correction. Rep. Kevin Brady (R-Texas), who helped design the legislation, has already said that he anticipates a follow-up bill with technical corrections. Republicans are passing this bill into law despite knowing that it is a shoddily constructed mess.

This is not the first piece of partisan legislation to be passed with apparent gimmicks, glitches, and handouts. When Democrats wrote the health care law that became Obamacare, they structured it with gimmicks intended to make it score as reducing the deficit. The major spending provisions were phased in after four years to give it a lower total cost in the 10 year budget window, because some Democrats lawmakers felt it was important for the price tag to come in under $1 trillion. The CLASS Act, a long-term care program that was never going to be fiscally sound, and was eventually cancelled, was attached in order to bolster its on-paper deficit reduction. But the law's backers at least felt an obligation to provide the appearance of fiscally responsible legislation.

The Republican bill, and the GOP's evidence-free assertions about its likely budgetary effects, have all but ensured a future in which politicians do not feel obligated to even engage in the pretense of fiscal responsibility. Republicans complained endlessly about the opaque process by which Obamacare was passed. But now they have escalated the gimmick wars, and there may be no going back.

On its own, then, the Tax Cuts and Jobs Act is a fairly typical Republican plan to cut taxes without reducing spending, making some productive changes to the tax code while intensifying the nation's long-term problems. Yet understood more broadly, through the lens of politics as well as policy, the effect of the GOP's duplicity, opacity, haste, and carelessness is not only to produce bad legislation, but bad precedent — another excuse, going forward, for politicians of both parties to disregard even the imperfect norms of transparency that have often governed the policymaking process whenever it is convenient. So no, it is not the end of the world. Far from it. But neither, I suspect, is it a pathway to a better one.

Show Comments (184)