Sen. Feinstein's Office Objects to 'Nanny of the Month' Depiction

Questions over how burdensome new regulations would be for small soap makers.

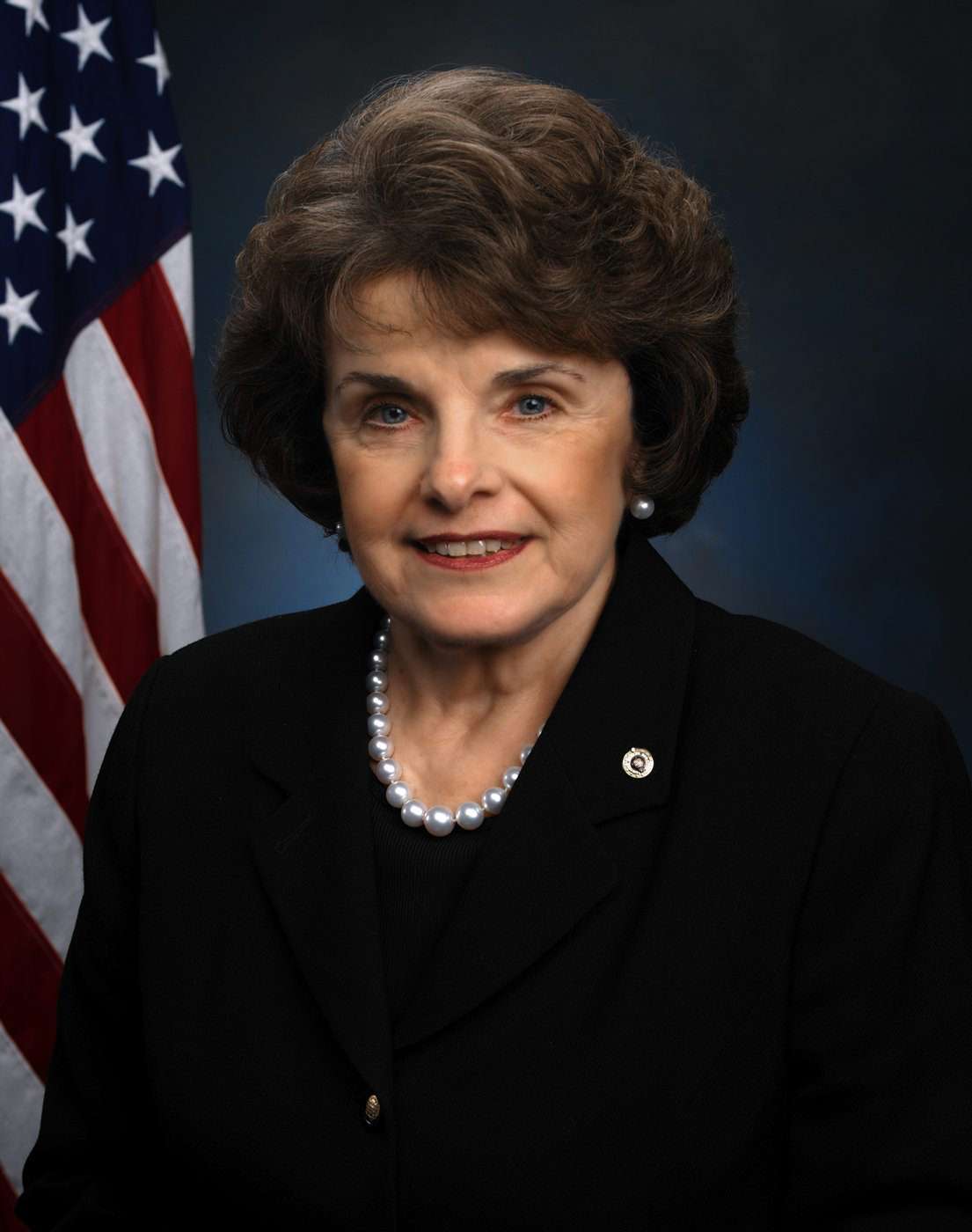

The Nanny of the Month episode for May (above) highlighted the Personal Care Products Safety Act, a bill introduced by Sen. Dianne Feinstein (D-Calif.) and Sen. Susan Collins (R-Maine).

Sen. Feinstein's office explains that bill is designed to "to protect consumers and streamline industry compliance by strengthening the Food and Drug Administration's (FDA) authority to regulate the ingredients in personal care products."

However, the Nanny of the Month video I produced argued that, if passed, the bill would hurt small-time makers of personal care products like cosmetics and soaps by burdening them with fees and reporting requirements. These entrepreneurs are mostly women who operate their businesses out of their homes or farms, and use ingredients like honey, oatmeal, and coconut oil in their products.

After the episode aired I received the following email from Sen. Feinstein's deputy press secretary:

Hi, Ted

I saw your video on my boss' Personal Care Products Safety Act—it completely ignores the bill's small business protections and does not fairly represent what it would do.

* Companies selling less than $100,000 per year do not have to do anything—they do not have to register with FDA.

* Companies selling less than $500,000 per year do not have to pay ANY fee.

* The fee will be no more than $250 for small businesses selling between $500,000 and $2.5 million per year.

Additional information is available here.

If you have any additional questions, I'm happy to answer them.

(Emphasis in original.)

Viewers can decide for themselves if Sen. Feinstein deserves to be named "Nanny of the Month."

I thought that the exemptions carved out for small-time producers obscured the extent of the bill's reach because the were framed in terms of annual sales as opposed to annual income (one may enjoy big sales, but still earn a relatively small income).

I contacted the Handmade Cosmetic Alliance (HCA), which describes itself as "an organization that advocates on behalf of nearly 300,000 primarily woman-owned small handmade cosmetic businesses." The HCA opposes the Feinstein-Collins bill, and HCA spokeswoman Mary Anne Walsh provided me with greater context as to why her organization regards the bill as a threat.

Walsh explained that the HCA had engaged in rather extensive dialogue with Sen. Feinstein's office about the bill, and was left frustrated by the experience. Much of the disagreement seems to boil down to the difference between sales and income.

According to Walsh, the exemption from fees and reporting requirements was originally set at companies making less than $50,000 in annual sales. Why that figure? The Small Business Administration places the average annual income of a small business at approximately $48,000. The authors of the bill took that figure and (in a move they regarded as generous) rounded up to $50,000.

"But sales does not translate to income," Walsh notes, "and that was our challenge to them. At $50,000 in sales you talking about maybe $10,000 in income. It was just crazy."

Eventually the threshold was raised to $100,000, but the HCA was far from satisfied.

"At $100,000 in sales, your income is no more than $15,000 or $20,000," says Walsh. "I was just stunned that we could not reach them."

What about fees? Feinstein's office notes that companies making less than $500,000 in sales are not subject to fees, and that fees would be no more than $250 for businesses that fall between $500,000 and $2,500,000 in annual sales.

Again, Walsh pointed to the difference between sales and income and illustrated the issue with a woman she met at a Maryland farmers market. Although the Maryland woman's annual sales of homemade personal care products exceeded $500,000, her income stood at $62,000. The woman's husband and two teenage daughters both work for the business, and the business is the family's only source of income. A fee of $250 may not sound like much to some people, but Walsh contends that it's a different story when you're a family of four living on a modest income in an expensive region and paying tuition for your daughters.

However, the costliest aspect of the bill may be the reporting requirements.

Walsh notes that whenever an entrepreneur changes ingredients—adds a little more honey or makes soap with almond oil instead of coconut oil—the bill would require her to log onto the FDA website to fill out a product ingredient statement.

Walsh says the FDA website is often very slow, but even if you caught it on a good day and spent only, say, 10 minutes completing the statement, the cumulative effect could be crushing for small entrepreneurs who might have to fill out hundreds of statements per week.

"Look at the time," says Walsh. "Ten minutes times 100. You're now at 1,000 minutes. One person is going to spend one or two days per week just doing product ingredient statements? How is that going to impact that family making $62,000?"

According to Walsh, the bill aims to solve a problem that does not exist. She notes that HCA members are not splitting atoms. They're using safe ingredients that are available at grocery stores, and they provide ingredient labels on their products.

This brings up a point that can't be addressed via cost-benefit analyses: Why exactly should anyone, including business owners, have to report so much information to the government in the first place? It's not as if the people subjected to filing requirements have run afoul of their customers.

Walsh does see a silver lining. Since the Personal Care Product Safety Act was introduced, HCA membership has swelled from 6,500 to more than 10,000. And she says these days she sees independent cosmetics makers and their customers circulating HCA's petition at farmers markets.

Walsh says she used to think that the woman she saw at farmers markets were hobbyists, but now she knows she was wrong. "The reality is this is their livelihood," she says.

"They take such pride in the products they make. They want to be independent. This is truly the American entrepreneurial spirit in its finest form."

(For additional context, watch or read congressional testimony from HCA Founder Debbie May as she addresses a similar 2012 bill.)

Show Comments (64)