What Causes Government Spending to Go Down: Circumstance or Ideology?

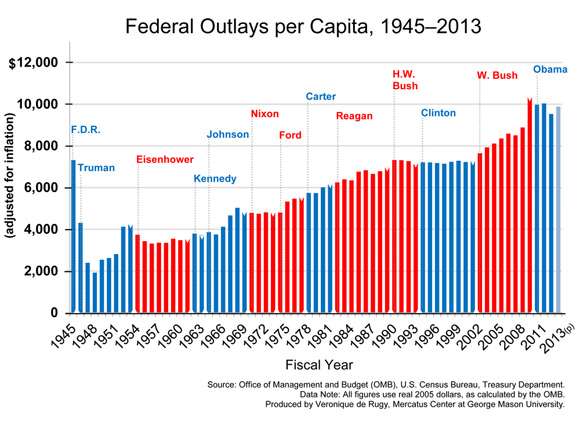

Above is a chart prepared by Reason columnist, Mercatus Center economist, and my frequent co-author Veronique de Rugy. Using constant 2005 dollars, it shows annual spending per capita between 1945 and 2012. Inflation-adjusted, per-capita spending is arguably the single-most accurate way to account for government spending because it takes into account both inflation and population growth. De Rugy writes,

The first Truman budget spent $4,312 per person. Government spending per person decreased for the next two years and in 1948 hit a historic low of $1,918—a low that has not been matched in six decades. Today's spending per person is more than five times this amount.

By the end of the Truman administration per-capita spending had risen back almost to the levels of Truman's first budget, and it continued to increase under the next few presidents. Kennedy began his term by raising per-person spending to $3,790. Carter, Reagan, George H. W. Bush, and Clinton all began their presidencies with higher per-person spending than their predecessors had ended with.

George H. W. Bush oversaw a decline in per-capita spending, which fell from $7,326 to $7,147 over four years. He is the only president since Kennedy whose last budget spent less per capita than his first budget.

Read and view more charts here.

This is an interesting chart for a lot of reasons (it also an extended and updated version of an earlier chart). Certainly, it challenges any notion that one party is better on spending issues. It also challenges any general understanding of presidents past and present. Who knew Nixon was such a tightwad (he managed generally flat spending by cutting defense heavily), that Reagan was so egregiously an overspender, and that H.W. Bush really gave back what used to be called "the peace dividend"?

The biggest surprise of all, of course, is that real, per-capita spending has not just flattened under Barack Obama but has actually declined. Let's get the qualifications out of the way: Part of 2009 spending, which was George W. Bush's final budget year, is rightly recognized as belonging to Obama; spending is likely to boost up this year from last year; and all of Obama's years are among the very highest in terms of real outlays.

Yet it's absolutely the case that spending has flatlined under Obama just as it did under Eisenhower, Nixon, H.W. Bush, and Clinton.

The question is: Why does spending flatten at some times and not others?

Part of the reason has to do with war. When wars end, spending goes down. 1945 wasn't just FDR's last budget year (due to his death) but marked the conclusion of World War II, an unprecendented effort in terms of mobilizing all national economic resources via the government. Truman was able to radically cut spending during his first years in office - and then cranked outlays up as the Korean conflict got under way (though it doesn't loom large in our collective imagination, the Korean War was a big deal in terms of troop size, money, and casualities). With Korea's cessation, Eisenhower was able to trim spending. Nixon may not have accomplished "peace with honor" in Vietnam, but he dialed back the U.S. presence and locked in our eventual withdrawal. As noted above, George H.W. Bush rebated the "peace dividend" that came with the end of the Cold War.

Part of the reason for spending restraint may have to do with divided government. Truman, Eisenhower, Nixon, and eventually Clinton all faced Congresses run in whole or part by the opposing party. Cato scholars William Niskanen and Peter Van Doren concluded in a 2004 study that "the rate of increase in real federal spending since World War II was lower during administrations in which at least one house of Congress was controlled by the other party." Noting that the biggest fluctuations in annual spending are related to defense, they further argued

We find it hard to dismiss the implications of a nearly 200 year old pattern in which the American participation in every war involving more than a few days of ground combat was initiated by a unified government. Divided government may have the lowest rate of growth of real federal spending per capita, in part, because it has been an important constraint on American participation in a war.

So perhaps the war and divided-government constraints are mutually reinforcing. That would help to explain spending under Obama: Not only is he facing a divided Congress but he's overseeing the winding-down of military adventures.

Yet it's clear that there's some limits to the divided-government thesis. The Democrats controlled both houses of Congress when Bill Clinton took office and yet his first two budget years were basically as lean as any that came later when the "Republican revolution" kicked in. The divided goverment facing Gerald Ford didn't stop government spending during his tenure. And then there's George W. Bush, who managed to reduce spending in just one of his eight long and terrible years in office. He had a full GOP Congress for budget years 2002 through 2006 and he spent like you'd expect. But in his last two budget years, he managed to massively drive up spending despite facing a Democratic Senate. The bipartisan panic related to the financial crisis clearly overrode any partisan antagonism.

The one thing that seems clear to me is that the role political ideology doesn't seem to explain much at all when it comes to spending. Ronald Reagan ran as a small-government guy but increased spending - even beyond military spending - massively. Ditto George W. Bush, whose small government rhetoric masked a Texas-sized spending habit. On the flip side, Bill Clinton ran as a liberal and so did Barack Obama; despite serious differences, both were willing to spend tax dollars. Yet their spending patterns betray no increase in spending year over year. Perhaps any given president's desires are simply overwhelmed by other factors well beyond anyone's control. Clinton burned a lot of time and energy in his first two years trying to pass a massive health-care overhaul that proved so contentious and unpopular that it led to the unthinkable: Republican majorities in the House and the Senate. Was the Clintoncare debacle so distracting the goverment simply forgot to ratchet up spending levels?

Obama succeeded where Clinton failed in terms of health care and he passed a massive stimulus bill upon taking the throne. But surely the inability of the government to pass a budget for coming up on four years has made it next to impossible to actually increase spending levels. Continuing resolutions, bless them, make it virtually impossible to raise spending levels. Add to that Obama's willingness to follow the Bush administration's timetable to bow out of Iraq and it all starts to add up to flat or even slightly reduced spending. The fascinating thing about the current moment, really, is that the president, Democrats, and Republicans all openly want to spend more money than we currently are dishing out (yes, even the Republicans). And yet they can't seem to make that happen, despite their best/worst efforts. Government, it turns out, really is incompetent even at wasting money.

Unfortunately for those of us who argue that large amounts of government spending and debt smother economic recovery and growth, the simple flattening of government spending over the past few years doesn't really add up to a true pro-growth austerity package. There is a massive amount of regulatory uncertainty in the air (Obamacare, Dodd-Frank) and no clarity on fiscal or monetary policy either. While January's fiscal cliff deal settled most Bush-era tax rates, Obama is already asking for more hikes, the world economy is in the shitter, and we've got yet another debt limit right around the corner.

As de Rugy has definitively shown, austerity packages work best when they are heavy on spending cuts, not a mix of small trims and tax increases. Attempts to reduce the debt-to-GDP ratio - the U.S. is currently above 100 percent with regard to gross debt - work best when spending cuts are not only explicitly undertaken but are deeper than anything we've seen. Such measures help spur economic growth by reducing expectations of future tax increases and currency meltdowns. As de Rugy and I wrote for Bloomberg View, the most successful austerity programs - including recent experiences in Canada, Sweden, and Great Britain during the 1990s and America's own post World War II boom - were more substantial and conscious than the drift we've seen over recent years in D.C.

Even if the sequester goes through as written, we're still way, way off from a true pro-growth debt consolidation package. But who knows? Obama is already late (again) with his 2014 budget plan, there's no reason to think the Senate Democrats will ever cough one up, and the GOP plan stinks on ice. Maybe we'll get to meaningful levels of spending cuts not because D.C. wants to but because everyone involved in bankrupting the country is either too lazy or incompetent to start spending your taxes.

Show Comments (95)