The Volokh Conspiracy

Mostly law professors | Sometimes contrarian | Often libertarian | Always independent

Today in Supreme Court History: January 29, 1923

Editor's Note: We invite comments and request that they be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of Reason.com or Reason Foundation. We reserve the right to delete any comment for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Marchetti v. United States, 390 U.S. 39 (decided January 29, 1968): I didn’t know until I read this case that something can be against the law and still be taxed. “Wagering” (handling bets) is (or was) an example. Not only did (do?) “wagerers” have to pay taxes, they were required to register and publicly post their licenses. Defendant here refused to do any of this, citing the Fifth Amendment privilege against self-incrimination. The Court agrees, noting that the information gathered by the statutory scheme is used by prosecutors, and holding that asserting the privilege is a complete defense. (In other words, I admit that I broke the law and therefore you can’t prosecute me.) The Court notes “different” circumstances where “a taxpayer is not confronted by substantial hazards of self-incrimination”, but I can’t imagine how that would ever be true if the taxed activity is illegal.

Haynes v. United States, 390 U.S. 85 (decided January 29, 1968): Decided the same day as Marchetti, with a similar situation. Small firearms, i.e., capable of being concealed, were presumed to be used “principally by persons engaged in unlawful activities”, and therefore were subject to special taxation and registration requirements. Also included were small firearms actually constructed by the owner. Ownership of an unregistered firearm is a criminal offense. (The statutes, 26 U.S.C. §§5841 and 5845, are still in force.) The Court here holds that one cannot register a small firearm without incriminating oneself, because the registration requirements include providing personal information and whether he has ever been convicted of a crime; therefore it reverses a conviction for ownership of an unregistered firearm as defined.

United States ex rel. Lowe v. Fisher, 223 U.S. 95 (decided January 29, 1912): Descendants of former slave of Cherokees had no claim because he did not return to reservation (and get his allotted land) within six-month deadline set by Court of Claims. The opinion has an interesting historical discussion of tribes’ attitudes towards being forced to give up their slaves; whether freed black people should have the same rights as tribesmen; and how Congress dealt with the issue over the years.

Teitel Film Corp. v. Cusack, 390 U.S. 139 (decided January 29, 1968): Chicago “censor” process violated First Amendment because 1) gave the censor too much time to decide whether a film could be shown and 2) did not provide for prompt judicial review (the films, “Rent-a-Girl” and “Body of a Female”, can be found online; they’re what “Carnival of Souls” would look like if filmed by a sex-obsessed 14-year-old boy)

Provident Tradesmens Bank & Trust Co. v. Patterson, 390 U.S. 102 (decided January 29, 1968): Owner of car whose insurer was being sued in connection with accident didn’t have “absolute, substantive right” to be joined as defendant because joining him was “infeasible” due to destroying diversity and therefore he was not an “indispensable party” under FRCP 19. What?? (my Civ Pro professor complimented Harlan’s analysis, but my Complex Litigation prof called this case “incomprehensible”, which made me feel better, because this logic seems circular to me, even 34 years later)

Big day in 1968 lol.

I actually knew about income derived from illegal activities being taxable, it was a big thing in prohibition (when the income tax was still new) so money made by bootlegging was considered taxable income. That's how they got Al Capone.

I imagine the 5th amendment route would be to declare the income without sepcifying the source. Back then it was probably a common thing, today I think any "unspecified" income would automatically raise suspicion, since everything is so closely monitored these days.

My understanding is that there's a way to pay taxes on income without disclosing its source. (It may involve literally saying something like "illegal activity" on the line-item for miscellaneous income on the tax return.) And if you don't do this you can be prosecuted, a la Al Capone, for tax evasion. (Indeed, my understanding is some of Capone's competitors in bootlegging actually did this and paid taxes.)

What I am foggier on is exactly what happens if you get into an audit. I have to imagine you are going to have the right to take the Fifth about details unless the government gives you immunity, but I don't know in practice how that works.

I believe Al Capone was an antique dealer as a cover, and maybe could have avoided tax evasion prosecution by listing his bootlegging income as antique sales. One would expect criminals to maintain a cover of operating a legitimate business, if only to launder criminal proceeds through.

Marijuana tax stamps were a thing for a while, even if they were primarily aimed at raising revenue and mostly sold to collectors. Anonymous purchase could address the self-incrimination issue.

"I believe Al Capone was an antique dealer as a cover, and maybe could have avoided tax evasion prosecution by listing his bootlegging income as antique sales..."

I doubt any of the hootch he sold was old enough to qualify as "anitque"

The point would be to disguise the illegal activity as a legal activity, in order to pay taxes on it.

I don't see the issue. There is no need to declare that income is illegal. Simply say that you are self employed, and then find some creative, legal-sounding description. Like agriculture if you're growing marijuana. Or entertainment if you're a prostitute. Or sales if you're a drug dealer. Or personal services if you're running an illegal numbers racket. I can't think of a single crime from which income would be derived that could not plausibly be described as something that sounds legitimate, and so long as the taxes are being paid, the IRS is not likely to dig any deeper.

Remember that prior to WWII, the exemption was higher than the gross income of most people, only the rich paid the new income tax.

That was Capone's mistake -- he was over the threshold (way over) of where one had to pay.

Capone should have let other gangsters rule Chicago in the late 1920s so he had less income? That would probably have set law enforcement on other targets, but by all reports it doesn't seem to fit Capone's persona.

"but I can’t imagine how that would ever be true if the taxed activity is illegal"

Tax stamps for transportation of illegal goods, if available for anonymous purchase. My state does this, but AFAIK hasn't ever prosecuted it. By far most are bought by collectors and souvenir shoppers.

So the Provident Tradesmens Bank & Trust Co. v. Patterson problem is created by SCOTUS (in Strawbridge v. Curtis) and Congress. Essentially, either the Court or Congress could make minimal diversity the standard (this has happened in other contexts). Under minimal diversity, a single non-diverse party does not destroy subject matter jurisdiction over the action.

But since we have a "complete diversity" rule, something has to give. Either we allow joinder and then the case has to be sent to state court, or we deny joinder even if it involves a truly indispensable party.

The Court chose the latter. Is the former a better rule? I don't know.

The Court has pointed out that all Article III requires is minimal diversity. And that is the rule with interpleader and class actions. But in ordinary contexts they don’t want to overrule John Marshall because his interpretation (set forth in an era of simpler litigation) is not quite unworkable. Though it has necessitated a great deal of wasteful time and effort at the beginning of a case to ascertain if there is total diversity or not.

I would say, in addition to the indispensable party situation, I think complete diversity is unworkable with respect to LLC's and large partnerships, where they look at the citizenship of members.

What I would favor is that courts actually deal with reality rather than pretending Marshall was engaging in strict statutory construction and they are bound by 1332's language.

Indeed.

Recently I brought a case in New Jersey District Court on behalf of an LLP. Defendant was fine with the venue but the judge made us compile an exhaustive list of the partners. Lo and behold one silent partner was in New Jersey. Case dismissed!

Re: Marchetti - fwiw in Britain self-incrimination is afforded much less deference. I don't recall all the details, but a cousin of mine unsuccessfully challenged corporate regulations requiring him to make certain statements about the management of his company that were later used in a criminal case against him.

Are UK prosecutors still allowed at trial to reference the fact that the suspect asserted his rights against self-incrimination in refusing to speak with the police?

IIRC if you raise in defence at your trial something that you could have mentioned that would have been exculpatory after you were arrested, your silence after arrest can be mentioned to the jury.

There’s a scene in “Our Mutual Friend” by Dickens (1864) where the inspector advises John Harmon that he can remain silent and anything he says can be used against him. Not clear whether his silence could be used against him.

His silence could also have been used against him, depending on circumstances.

I can do no better than link to the wikipedia page, which is comprehensive.

https://en.wikipedia.org/wiki/Right_to_silence_in_England_and_Wales

I note this change from 1994:

Adverse inferences may be drawn in certain circumstances where before or on being charged, the accused:

fails to mention any fact which he later relies upon and which in the circumstances at the time the accused could reasonably be expected to mention;

fails to give evidence at trial or answer any question;

fails to account on arrest for objects, substances or marks on his person, clothing or footwear, in his possession, or in the place where he is arrested; or

fails to account on arrest for his presence at a place.

Thanks

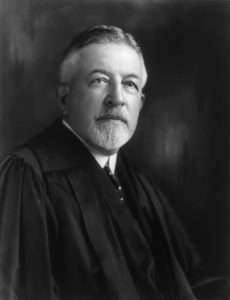

Before joining the Supreme Court, Sanford ran a law firm with his son

Fred Sanford didn’t even graduate junior high — when asked, he said “how about junior low?”

Fred Sanford was supposedly born in St. Louis, Missouri on January 20, 1907 which would have made him 13 in 1920 -- and Junior Highs didn't exist back then -- it was Grades 1-8 and then *maybe* High School which often was a private (parents pay) academy.

The concept of a Junior High School didn't arrive until after WWII and the Baby Boom, and was helped along by the need to build more schools to address overcrowding.

Black education was different -- Black high schools would often admit younger children because there was no place else for them to go, and St. Louis had several Black high schools -- https://www.stlmag.com/history/architecture/forgotten-schools/

But it didn't have a Junior High -- and definitely didn't have a Black one -- not in 1920...

From Wikipedia: "The junior high school concept was introduced in 1909, in Columbus, Ohio.[38]"

From Googling: "In 1913 the first Junior High School opened in St. Louis,"

Is there a single thing about which Dr. Ed won't bullshit?

Also its not like Junior High is additional schooling, its just in reference to when K-8 is split into more than one school location. So Fred Sanford could simply have been referring to him not completing 8th grade (regardless of what other grades were housed in the same building)

It doesn't seem to have a consistent split point either across schools and districts.

When I was a kid K-4 was at the elementary school, and 5-8 were at the junior high. Later they reorganized and now K-3 is at the elementary school, 4-5 is in a different wing of the junior high, and 6-8 is in the same building that used to be 5-8.

Lincoln didn't graduate from junior high either, yet he was a lawyer.

And look what happened to him!

"United States ex rel. Lowe v. Fisher, 223 U.S. 95 (decided January 29, 1912): Descendants of former slave of Cherokees..."

The Cherokee slaves are an overlooked bit of history -- neither the 13th Amendment nor the Emancipation Proclamation applied to them (so forget the myth of Juneteenth) and the treaty was to give them tribal membership (which the tribe never did) and hence they built their own community which became the "Black Wall Street" of Tulsa, Oklahoma, that was destroyed in 1921.

https://www.history.com/news/tulsa-massacre-black-wall-street-before-and-after-photos