The Volokh Conspiracy

Mostly law professors | Sometimes contrarian | Often libertarian | Always independent

Today in Supreme Court History: November 29, 2004

Editor's Note: We invite comments and request that they be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of Reason.com or Reason Foundation. We reserve the right to delete any comment for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Commissioner v. Kowalski, 434 U.S. 77 (decided November 29, 1977): cash meal allowances to New Jersey police officers are taxable income

Lincoln Property Co. v. Roche, 546 U.S. 81 (decided November 29, 2005): defendant can remove to federal court without having to exclude possibility of non-diverse interested parties (tenants sued out-of-state landlord for mold injuries; did not find any in-state partners of defendants during jurisdictional discovery but Court notes they didn’t try very hard) (I was recently involved in a removed case where the judge made us track down every partner of one defendant and lo and behold, one of the silent partners was in-state; remanded!)

Texas v. Lesage, 528 U.S. 18 (decided November 29, 1999): white applicant to state university can’t argue that affirmative action was Equal Protection violation when he would have been denied entrance even under race-neutral regime

The Lincoln case was not about partnerships per se. It was undisputed (at least by the time the case reached SCOTUS) that Lincoln was a corporation, and thus had no partners. The Fourth Circuit's decision that was reversed was that there could've hypothetically been an affiliate or subsidiary or something of Lincoln's that was the real party in interest and that would've destroyed diversity if joined. (It could've been a partnership, but that wasn't the underlying issue.) SCOTUS said that there was no evidence of any such other party, that the evidence was that Lincoln was the real party in interest, that the defendants did not have to disprove the existence of such a party in order to remove, and that removal was therefore proper.

(The plaintiffs were engaged in obvious gamesmanship. They waited until after they lost on summary judgment to raise this issue.)

thanks

Commissioner v. Kowalski, 434 U.S. 77 (decided November 29, 1977): cash meal allowances to New Jersey police officers are taxable income

Only in NJ...

While eating a substandard hamburger and greasy fries at the Vince Lombardi Service Stop at 3 a.m., the cop thinks, “This is part of my salary??”

What was the justification for a "meal allowance" in the first place?

The State of New Jersey instituted a cash meal allowance for its state police officers in July 1949. Before that, troopers were provided a mid-shift meal at one of several meal stations located throughout the State. The State had decided that this system was unsatisfactory, as it required troopers to leave their patrol areas unattended for extended periods of time. The new system provided troopers with a cash allowance, which troopers could use to purchase a meal at a location within their patrol area, thus making it unnecessary for them to leave the area unmonitored.

The meal allowance was paid bi-weekly in advance and was included, although separately, with a troopers salary. The money was also separately accounted for in the State's accounting system, and funds from the meal allowance account were never mixed with the salary accounts. Troopers were not required to spend the allowance on mid-shift meals, nor were they required to account for the manner in which the money was spent. This meant that troopers were allowed to eat at home if their home was within their patrol area, or to bring a meal with them to eat in or near their patrol cars. (wiki)

I'm told that UMass went from a 40 hour to a 37.5 hour workweek (i.e. a paid lunch) because there were too many physical plant workers opting for a liquid lunch at the VFW hall and coming back to work intoxicated. Some of these men were operating heavy equipment.

The legal distinction was that if they weren't being paid, UM couldn't tell them they couldn't leave campus, but if they were, it could and does.

Capt C; we often stop at the Vince Lombardi Service Stop when driving from northern Virginia to Boston.

They have a Nathan's Hot Dog stand there.

Dog with sauerkraut is my standard.

You know, you might take a 15 minute trip off the NJTPK and go to White Manna on River Road in Hackensack (15 mins from VL rest stop). Worth it.

Nathan's is good!

It's also good that they let you put on your own dressings. (To put the sauerkraut on first, before the mustard, as I've seen it done, is a violation of the laws of Man and God.)

Best get your asses up north to Weiner's Circle in the big city. The verbal abuse from staff pays for itself.

It's a Chicago dog tradition!

Best fast food in NOVA is Taco Bamba. Get the El Beso.

Just FYI, in the military, Basic Allowance for Housing (BAH) and Basic Allowance for Subsistence (BAS) are both nontaxable income while the Cost of Living Adjustment (COLA) is taxable.

You remember that from your military service do you?

Um, yes.

I spent 16 of my 20 OCONUS.

This might not have been the case, but there was one around then that ruled that the meals that Massachusetts nursing homes provided their employees -- the same lunches and suppers that the patients got -- were taxable. This is the one time that I actually *was* a janitor and memory is that they had to be deducted at fair market value and not merely institutional cost, which was far less.

There was a lot of USDA surplus food (from subsidy programs) that for-profit nursing homes could get for nearly nothing. It was good stuff, the peanut butter was better than the commercial brands. And the then-owner, a local man, realized that his actual cost was only incremental as almost all of his meal costs were fixed regardless of how many meals served.

Totally OT:

https://nypost.com/2023/11/28/news/student-15-killed-by-younger-peer-in-caught-on-camera-brawl-at-north-carolina-high-school/

Sure looks like self-defense

Wickard v. Filburn was the nadir of Commerce Clause jurisprudence. Gonzales v. Raich was just as bad.

I don't get it, we've had plenty of DemoKKKrat POTUS's, Houses, Senates, Speakers over the last 30 years, if they want to take Marriage-a-Juana off the Schedule 1 list all they have to do is pass a law...

Frank

They took a 10 month old baby hostage.

How does Parkinsonian Joe not declare War on Ham-Ass today??

Oh yeah, because his nomination in 2024 depends on fellating the Moos-lum wing of his "Party".

Listened to a little of the NPR (National Palestinian Radio) coverage of Rosalyn Carter's Memorial Service. Funny how they didn't mention the Ham-Ass protestors outside the service.

Frank

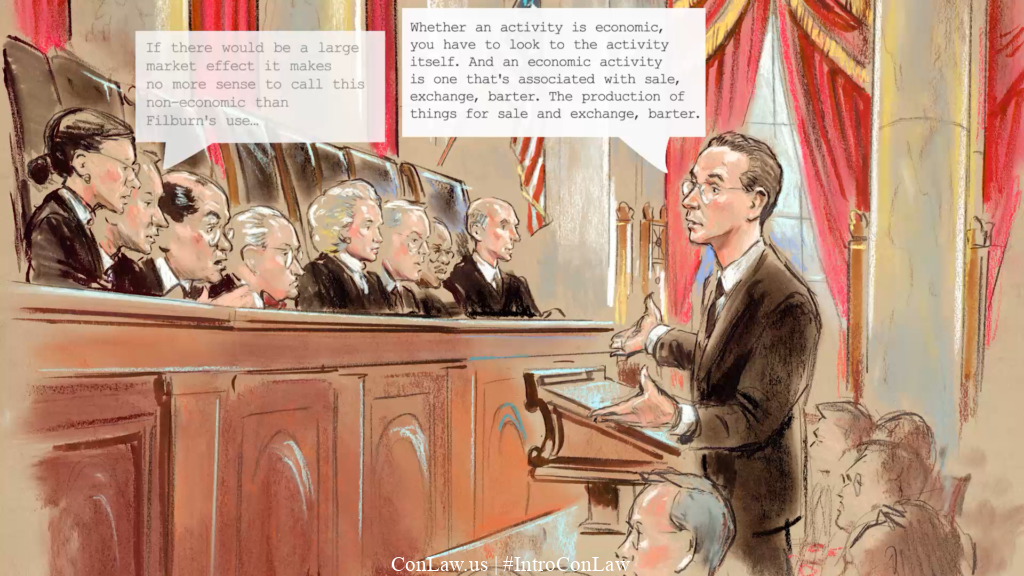

I don't understand the point Barnett is trying to make in the image in the OP. Is the last sentence fragment intended to narrow the scope of "economic activity," or expand it?

Where was Rehnquist? Barnett is arguing in front of only 8 justices.

And everyone in the drawing (except Ginsburg) seems to be 20 pounds lighter than photos taken of them at the time seem to suggest.