Finding a Cure for Our Fiscal Insanity: Podcast

Peter Suderman, Len Gilroy, and C. Boyden Gray diagnose the country's many fiscal woes, and offer some solutions, at Reason's 50th anniversary celebration.

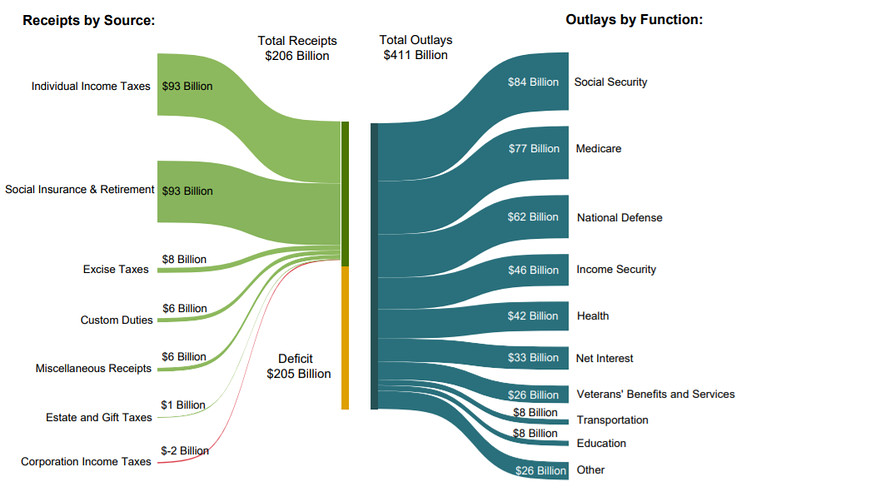

The national debt is north of $21 trillion, the annual deficit is nearing the $1 trillion threshold, the federal government can't afford its old-age social insurance programs, state governments can't afford their public-sector pension promises, and all this fiscal precariousness comes at the end of a near-historically long expansions in both the stock market and the economy writ large. Gee, what could go wrong?

So when Reason celebrated its 50th anniversary in November, we presented much diagnosis of, and some cures for, our fiscal insanity, through the expert testimony of an all-star panel: Former White House counsel and ambassador to the European Union C. Boyden Gray (who also moonlights as an Adam Smith champion and Reason Foundation trustee); the foundation's Pension Integrity Project Managing Director Len Gilroy, and Reason.com Managing Editor Peter Suderman. I moderated.

Subscribe, rate, and review our podcast at iTunes. Listen at SoundCloud below:

Audio production by Ian Keyser.

Photo credit: Michael Brochstein/Sipa USA/Newscom

Don't miss a single Reason Podcast! (Archive here.)

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

I'm going to listen to hear who asserts repealing tax cuts, and then mock them on social media.

Anyone who thinks a tax cut is always a good idea no matter the economic conditions or fiscal circumstances is a fucking idiot.

but government spending more is always rational and "compassionate".

Not when it's tanks and bombs and Clinton investigations, though that seems to be free money to fiscal hawk Republicans.

"Deficits don't matter."

Boris Yeltsin just before the collapse of the Soviet Union.

If you're gonna quote, get it right :

Treasury Secretary Paul O'Neill was skeptical. According to his recounting of the incident in Ron Suskind's book, The Price of Loyalty, O'Neill expressed concern that a trillion dollars worth of tax cuts had already been enacted. O'Neill was no liberal. He liked tax cuts. But with the country rebuilding from the economic slowdown after the 9/11 attacks, and with a war being fought in Afghanistan and another on the horizon in Iraq, O'Neill noted that the budget deficit was increasing. And he argued against Cheney's position, suggesting that another tax cut was unnecessary and unwise.

"You know, Paul, Reagan proved that deficits don't matter," said the vice president. "We won the mid-term elections, this is our due."

O'Neill was, according to Suskind, left speechless.

I do like the notion a country can tax its way out of fiscal irresponsibility. It's a plan so simple you don't have to give it any thought.

That's thoughtless, yes. But consider the bottomless pit of stupid you find on the other side :

Tax cuts pay for themselves.....

Only cut a few more trillion in taxes, and we sweep off to a magic land of limitless prosperity.....

And you know what's really amazing? No one is dumb enough to believe what you said. But post-Reagan supply-side drivel is the very core belief of the Right. A crude lie, developed as a political tactic to promise free stuff to voters, is now enshrined as the first principle of conservatism. Every time the GOP gains power, they trash the nation's finances. Every time their candidates seek presidential nomination, they vie against each other promising multi-trillion tax cuts. Their projection are all lies. Their numbers are all lies. Their "theory" is so absurd even a child couldn't believe it.

This fraud now lies at the heart of conservatism. Could the moral rot of today's Right be partially caused by this? I think that's likely.

Supply side equals free stuff?

Saying you can :

(1) Cut trillions in taxes,

(2) Have no offsetting revenue or spending cuts, and yet....

(3) Magically, there is no adverse effect on the deficit

is indeed "promising free stuff"

Mind you, that's only if you :

(1) Accept words have meaning,

(2) Accept there is such a thing as truth & lies,

(3) Accept 2+2+4.

If you deny the existence of truth or math, then it probably does not equal "free stuff"

Speaking of moral rot, I glance around the other comments here and what do I see? A lot of people who believe they've absolved from making adult choices as long as they're busy complaining about something safely abstract. But the answer isn't that hard; we saw it not that long ago. Remember, the deficit was under control Pre-GW Bush.

It took :

(1) Deficit reduction packages from both GHW Bush and Bill Clinton.

(2) Broad tax increases, impacting the middle class

(3) Structural spending restraints in Congress, such as paygo

(4) Spending cuts

Re the last point: Under Clinton federal spending fell from 20.7% of GDP in 1993 to 17.6% of GDP in 2000, this being below the historical average (1966 to 2015) of 20.2% GDP. Of course this was real spending reductions, not the comic book variety talked about around these comments - so maybe it doesn't count....

Your points would be more valid if 2017 Federal Tax Revenue had shown any decrease from previous years, or even a slightly lower increase from previous year-over-year increases. That was not the case. Perhaps you would counter that had taxes been increased, the increase in 2017 federal revenue would have been even higher. But it would seem the combination of fewer regulatory barriers and lower taxation has in fact increased business confidence, employment levels and wage gains, resulting in a healthy federal tax take. Now don't get me wrong...I think the only way we make any real progress with spending cuts is to charge (i.e., tax) people for the actual cost of all this government they want, rather than borrowing the money so they get a lot of that government without having to pay for it. Only then will people start to question whether they need government to be so large and expensive.

Morgan44, Please guess how many times in the past fifty years there hasn't been an increase in federal tax revenues?. I'll give you the answer : Four. The only time tax revenues don't increase is after a major economic shock - and even then they just reset lower to grow year by year after. This happens during recessions and expansions (though to different degrees). It happens after tax cuts, tax hikes, and taxes unchanged. When a Right-type tells you Reagan's, or Bush's, or Trump's tax cuts worked because revenue grew, they're just saying water is wet.

Because - as you anticipate - the question is grow by how much? Because government's cost grows with the same certainty as its revenue, even if the scope of government remained unchanged. It grew even while Clinton cut federal spending by 3% per GDP.

I'll give you this : A study of budgets over the past few decades found spending increases common with large tax cuts, spending cuts with tax hikes. When you binge on supply-side scams and fraudulent math, why shouldn't everyone want their share of the con? Ask for sacrifice and you better show sacrifice in return.

Obviously the solution is to tax social media posts.

Put the legislature on commission?

They have to make up deficits from campaign and personal funds; they get to split any surplus. If they cannot make up the deficit, they are considered as resigned without pension.

Fuck you, cut spending?

Simple solution to a simple problem. Give Congress a checkbook to the public's bank account and tell them not to write checks. Like giving an alcoholic a fifth and telling him not to drink it, a fat lady a cake and telling her not to eat it, or LC1789 Trump's ass and telling him not to kiss it.

I still say the only way you're going to get the budget under control is to make it in our elected representative's interest to do so. Apportion government revenues to each Senator and Congressman and allow them to distribute it as they see fit amongst all the budget expenditure categories. Whatever they don't distribute, half of it goes back to the Treasury, the other half they get to stick in their pocket. Whatever they've distributed becomes next year's budget and the cycle repeats. Apportion, distribute, pocket, new budget baseline. The Federal budget will be about 200 bucks within ten years.

ten bucks says Suderman pushes the New Green Deal

why the ignorant focus on debt and debt alone? Seems like spending is the problem but none of the Big Government libertarian representatives like Suderman like to focus on spending, just how government programs can do more to serve people then whine about magically appearing debt numbers.

Significant cuts in spending will require cuts to popular entitlements. W floated a trial balloon of a very modest entitlement reform, and the backlash from the media has scared any from attempting it since.

The elite have a great deal of denial about the debt. Many think Medicare will be fixed by single payer, but that will only exacerbate the problem, and that SS can be easily fixed by taxing the "rich"*, but there are not enough "rich".

"It's the spending stupid"

*everyone that earns more than them are the rich.

I keep wondering what the magic number will be before the US has an economic collapse ala the Soviet Union, and more importantly, what is to be done if and when it happens.

I'm sure the ruling elitist vermin will point fingers at each other and blame the other party for their failures to reign in spending.

But complaining and finger pointing will not solve the problem of indebtedness. For example, it is my understanding that state and local governments cannot file for bankruptcy. If that is so, states like California (who is $1.3 trillion in debt at the moment) are going to have to make some tough decisions on what to do.

I don't have an answer out side of pulling out of the Middle East, stop all foreign aid, no more subsidies, and perhaps raise the interest rates on government bonds so the average American can purchase them tax free as an incentive to reduce this quiet monster called the debt.

However, I am open to suggestions.

Anyone?

Your spending cuts are too small.

Selling more bonds is still increasing debt.

Stop giving "entitlements" to immigrants.

"Stop giving "entitlements" to immigrants."

That would not save enough. Nor will cuts to defense.

It will take serious cuts in SS and Medicare. These programs are demographically unsustainable.

I essentially started three weeks past and that i makes $385 benefit $135 to $a hundred and fifty consistently simply by working at the internet from domestic. I made ina long term! "a great deal obliged to you for giving American explicit this remarkable opportunity to earn more money from domestic. This in addition coins has adjusted my lifestyles in such quite a few manners by which, supply you!". go to this website online domestic media tech tab for extra element thank you .

http://www.geosalary.com